If you live in New York and need a good bank that fits your requirements, you likely know there are many choices available.

You can pick from smaller local banks, bigger regional banks, large national banks, or even online banks. With so many options, it can be challenging to determine which one is best for you.

Here's a summary of our best New York banks:

Bank/Institution | Monthly Fees | Our Rating |

|---|---|---|

Key Bank | $0 – $25 |

(3.8/5) |

PNC Bank | $7 – $25 per month

can be waived if you maintain $500+/$2,000/$5,000 direct deposit per month, $500+/$2,000/$5,000 monthly balance in savings or age 62+/$10,000 in all PNC consumer deposit accounts/$25,000 in all PNC consumer deposit accounts/

|

(4.2/5) |

Santander Bank | $0 – $25 |

(3.9/5) |

M&T Bank | $0 – $24.95 |

(4.1/5) |

Citibank | $0 – $30

|

(4.2/5) |

Chase Bank | $0 – $35 |

(4.2/5) |

TD Bank | $0 – $25 |

(4/5) |

Capital One | $0 |

(4.5/5) |

LendingClub Bank | $0 |

(4.4/5) |

To make things easier, we've done the hard work and picked out the top banks in New York.

We considered various factors like how many branches they have, the range of products they offer, the interest rates they offer on deposits, the quality of their online banking services, and how well they treat their customers.

Best New York National Banks

We thoroughly assessed a selection of preferred national banks in New York by conducting a comprehensive evaluation that considered several vital factors.

Our analysis encompassed factors such as the availability and distribution of branches, the variety of products offered, and the potential to obtain competitive deposit rates, with a specific emphasis on CDs in comparison to traditional savings accounts.

PNC Bank

Fees

Our Rating

Current Promotion

APY Savings

-

Our Verdict

- Features

- Pros & Cons

PNC Bank’s Virtual Wallet offers a smart, streamlined solution for New York residents looking to manage all their finances in one place.

With its Spend, Reserve, and Growth structure, the account helps organize daily expenses, build short-term savings, and earn interest on longer-term funds.

Features like the Money Bar and calendar make budgeting easier and help avoid overdrafts. While the account has monthly fees, they’re easily waived with direct deposits or qualifying balances.

However, limited ATM access in parts of New York could be a drawback. Still, it’s a strong option for those who value digital banking convenience.

- Hybrid setup: Spend, Reserve & Growth

- Large ATM network with fee-free access

- Bill pay and check writing tools

- Overdraft protection via Reserve feature

- Debit card with mobile wallet support

- Calendar and Money Bar budgeting tools

- Tiered monthly fees with waiver options

- Welcome bonus up to $400

- All-in-One Financial Management

- Smart Budgeting & Planning Tools

- ATM Fee Reimbursements on Tiers

- Overdraft Buffer with Reserve

- Bonus for New Account Holders

- Monthly Fees Unless Waived

- Requirements for Higher APY

- Out-of-Network ATM Fees

- Numerous Additional Service Charges

- Mixed Customer Service Reputation

Citibank

Checking Fees

Checking Promotion

Savings APY

Our Rating

-

Our Verdict

- Features

- Pros & Cons

Citibank, a global financial institution, offers a diverse array of banking and financial services. With a significant presence in New York, the bank operates over 190 branches across 80 cities.

Citibank CD rates are pretty high for a traditional bank, and you can also put money in their Accelerate savings account, which offers a decent APY.

They also offer robust online and mobile banking platforms, ensuring convenience and choice. Their credit card selection, featuring rewards and travel cards, is particularly appealing.

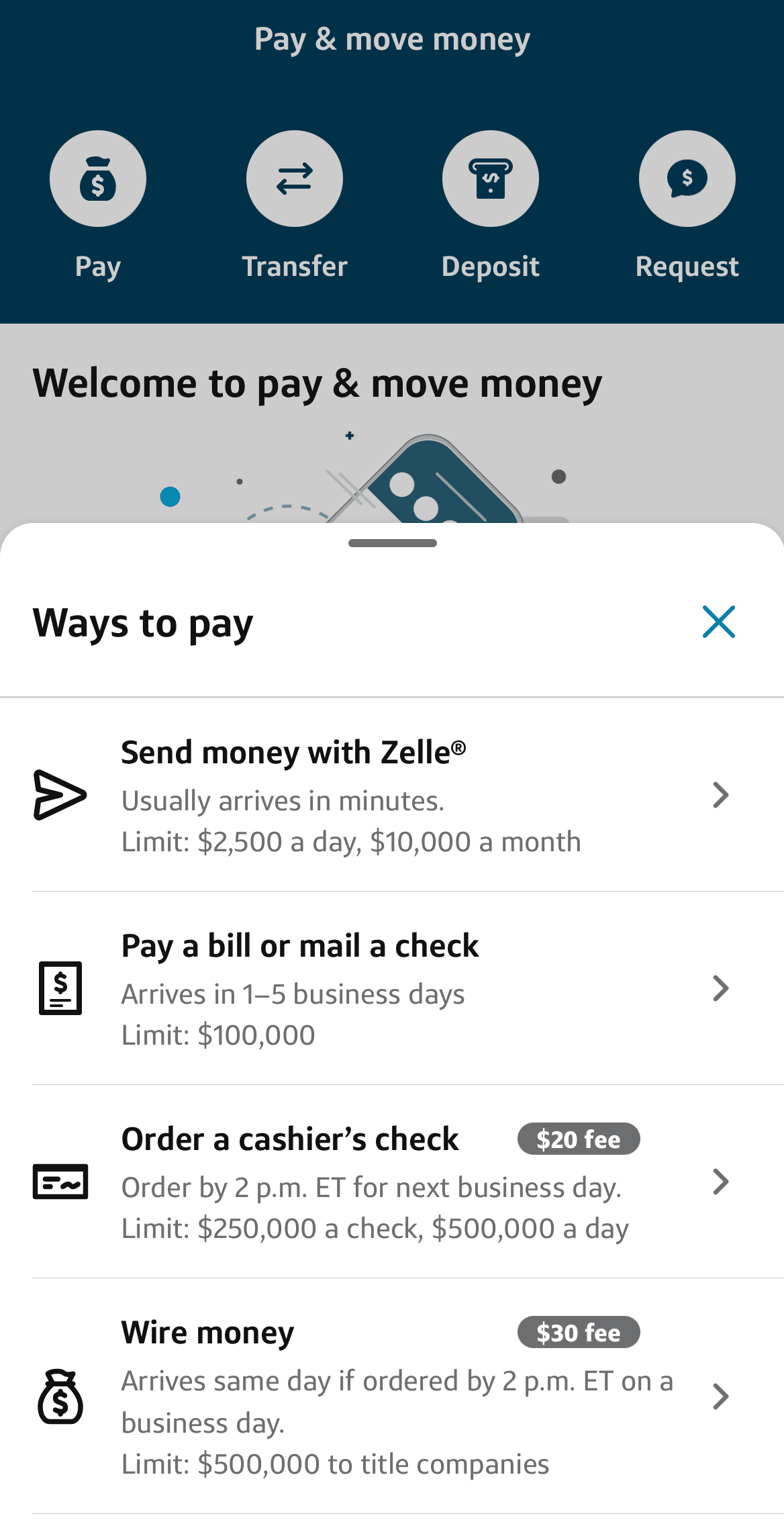

- Access to 4,700+ branches nationwide

- 15,000+ Chase ATMs across the U.S.

- Multiple checking account options

- Secure mobile banking with bill pay

- Custom alerts and spending insights

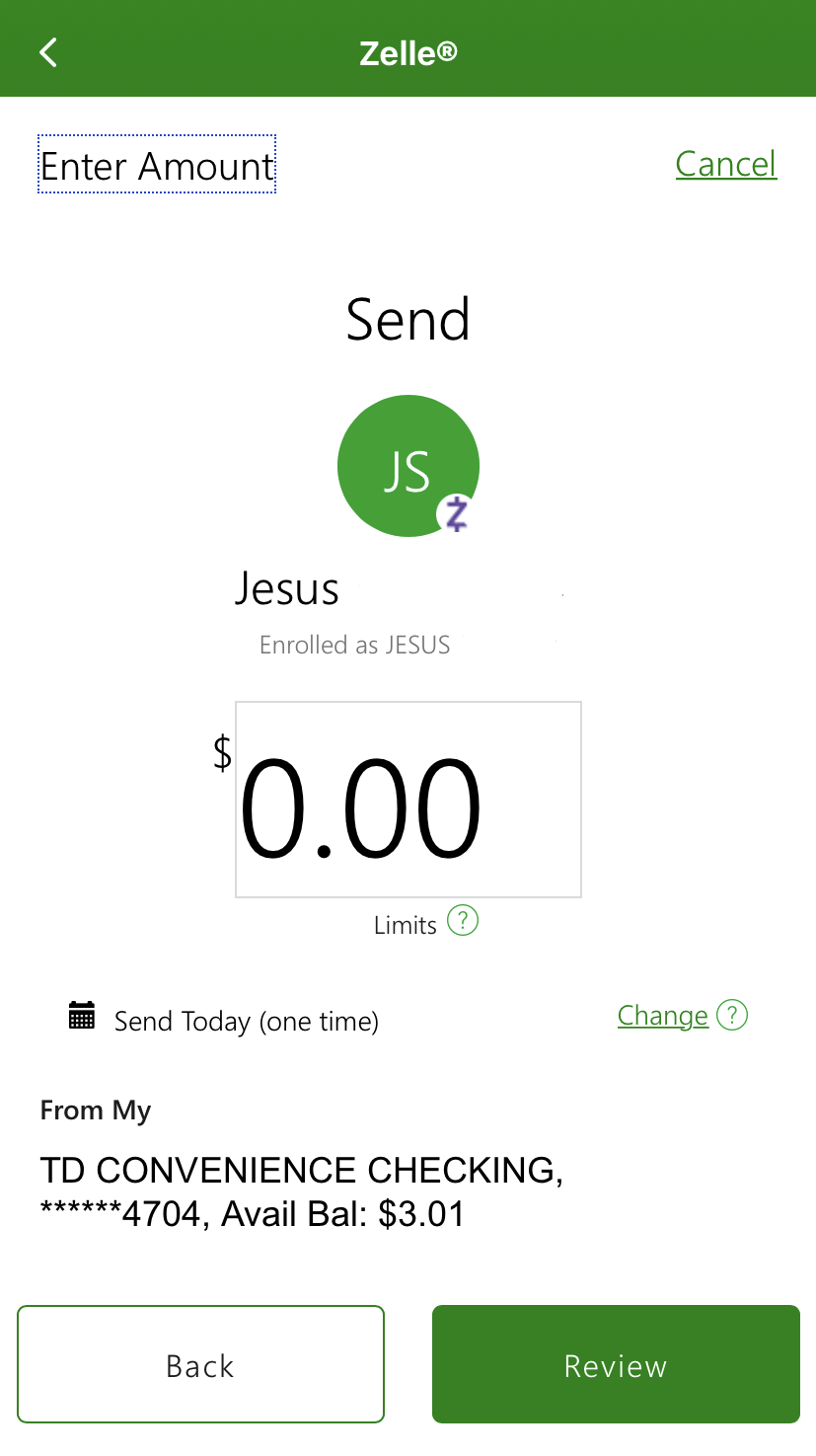

- Zelle integration for instant payments

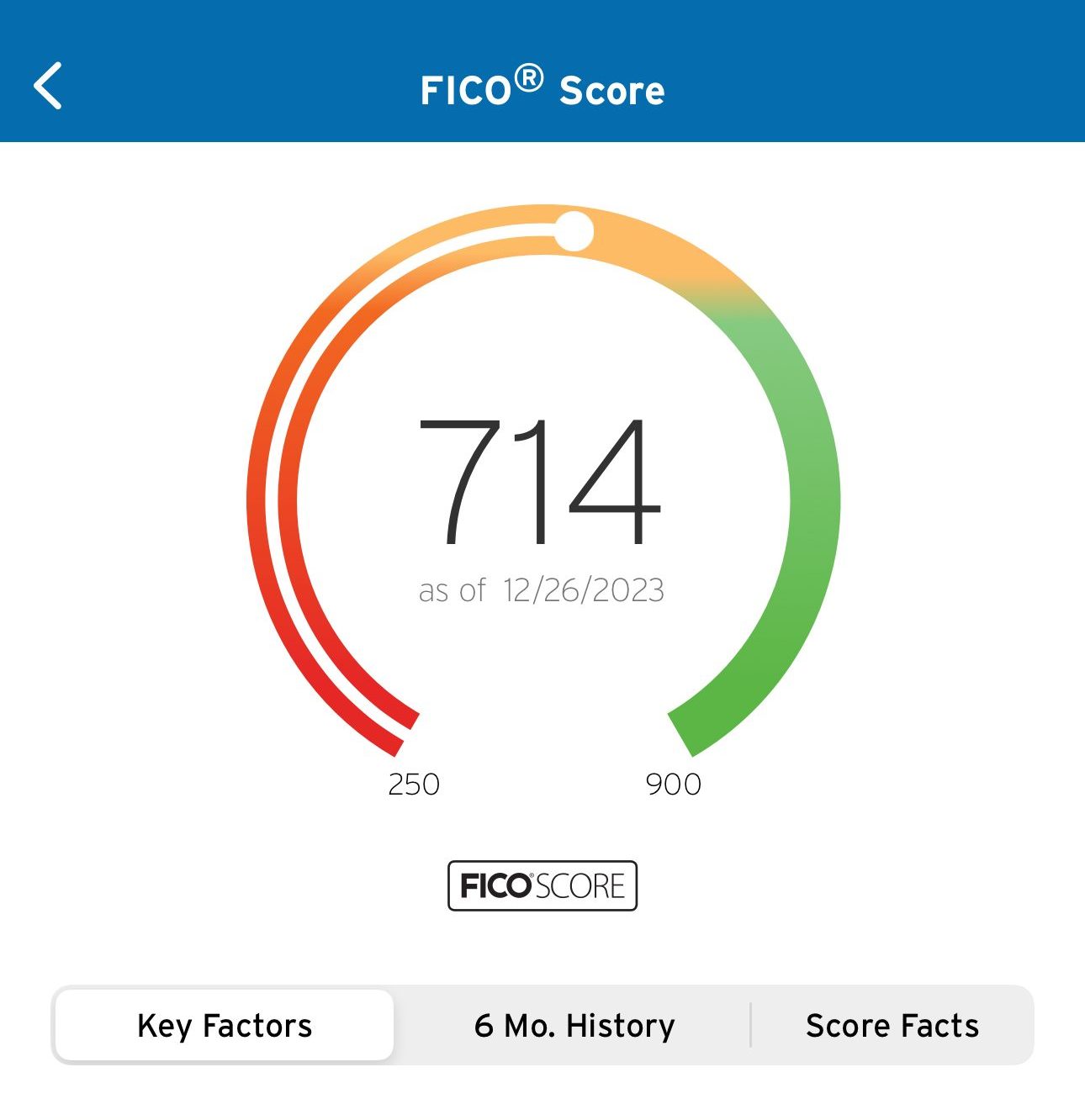

- Built-in credit monitoring tools

- In-app customer service assistant

- Large Nationwide ATM and Branch Access

- Highly Rated Mobile Banking App

- Robust Payment and Transfer Options

- Strong Security and Account Alerts

- Wide Range of Checking Account Types

- Monthly Fees on Most Checking Options

- High Overdraft Fees if Not Managed

- No Free International ATM Access

- Sapphire Account Fee Not Waivable

- Limited Interest-Earning Checking Options

However, there are some drawbacks to consider. Certain services come with high fees, some accounts have minimum balance requirements, and the customer service experiences have been mixed, with occasional reports of delays and communication issues.

Chase Bank

Checking Fees

Checking Promotion

Savings APY

Our Rating

-

Our Verdict

- Features

- Pros & Cons

Chase Bank offers a wide array of banking services to cater to various needs, including checking and savings accounts, credit cards, mortgages, personal and auto loans, investment services, and small business banking.

The bank's strengths lie in its extensive branch and ATM network, ensuring easy access to funds when needed. Additionally, Chase credit cards selection is huge , providing customers with numerous choices.

With over 540 branches and a presence in 220 cities across New York, their accessibility is highly convenient.

However, there are certain drawbacks to consider. Some of their accounts come with high monthly fees, requiring careful attention.

Furthermore, their savings account and CD rates might not be as competitive as those offered by other banks.

- Over 4,700 physical branches nationwide

- Access to 15,000+ Chase ATMs

- Highly rated mobile app for account management

- Bill pay, transfers, and mobile check deposit

- Multiple checking account options to choose from

- No ATM fees with Sapphire Checking

- Integrated credit monitoring via Credit Journey

- Digital assistant for quick support and alerts

- Large Nationwide Branch & ATM Network

- User-Friendly and Highly Rated App

- Multiple Checking Accounts for Different Needs

- Built-In Credit Score Monitoring Tool

- Digital Assistant Helps with Daily Tasks

- Monthly Fees on Most Checking Accounts

- Out-of-Network ATM Fees (Except Sapphire)

- High Overdraft Fees for Some Users

- Some Features Only for High-Balance Accounts

- No Free Money Market or Investment Checking

TD Bank

Checking Fees

Money Market APY

TD Bank offers a welcome bonus for new account – you can get $300 bonus if you open a new checking account, and another $200 if you open a savings account. There is a minimum deposit required of $500 or $2,500, depending on account, within 60 days.

. Expired on 11/30/2024Savings APY

Our Rating

-

Our Verdict

- Features

- Pros & Cons

TD Bank boasts a strong presence in New York, with an extensive network of 230 branches spanning across 120 cities. Additionally, the bank provides convenient access to nearly 2,700 ATMs.

Several advantages of checking accounts with TD Bank include no foreign transaction fees on debit cards, round-the-clock customer service via phone, highly rated mobile apps, and extended operating hours with many branches open seven days a week.

Customers can also benefit from various digital banking features such as Zelle, remote check deposit, and online bill pay.

However, there are certain drawbacks to consider. Customers will be charged a $3 fee for using non-TD Bank ATMs, and the overdraft fee is notably high at $35 per transaction and can be applied up to three times a day.

Moreover, TD Bank applies monthly fees to some accounts, and their savings accounts yield a low APY.

- Contactless debit card with all accounts

- Zelle integration for quick transfers

- ATM fee reimbursements on premium accounts

- Mobile check deposit via TD Bank app

- Free paper checks with select accounts

- 24/7 live customer service support

- Overdraft fee refunds with Beyond Checking

- Wide physical presence with 1,200+ branches

- Wide Branch and ATM Network

- Strong Mobile and Online Access

- Free Checks with Premium Account

- Zelle and Direct Deposit Options

- Overdraft Protection and Refund Features

- Monthly Fees on Most Accounts

- ATM Fees Without Reimbursement

- Few Perks on Basic Accounts

- Limited Free Services in Entry Plans

- Check Discounts Only on Select Tiers

Best New York Online Banks

While researching the online banks in New York, our primary emphasis revolved around their savings and CD rates. Additionally, we sought to ascertain the availability of a diverse range of financial products, including checking accounts, loans, credit cards, and mortgages.

Capital One Bank

Checking Fees

Money Market APY

Savings APY

Our Rating

-

Our Verdict

- Features

- Pros & Cons

Capital One stands out as an excellent option for consumers seeking competitive rates and a comprehensive banking experience, free from monthly fees.

With a vast network of no-fee ATMs and over 70 branches in New York, customers have easy access to their finances. Even without a local branch, managing accounts online from anywhere is a convenient option.

One of Capital One's notable strengths is its appealing rates for savings and CD accounts, complemented by a free checking account that earns interest.

The bank's attractiveness is further enhanced by the absence of balance minimums, monthly fees, and overdraft charges.

Users have also praised the mobile app, which has garnered high acclaim from both iPhone and Android users.

- No monthly maintenance fees on checking

- Free MasterCard debit card included

- Access to 70,000+ fee-free ATMs

- Mobile check deposit via app

- Real-time alerts and transaction tracking

- Bill pay and funds transfer tools

- Overdraft options: auto-decline, free transfer

- 24/7 customer support and virtual assistant

- No Monthly Checking Account Fees

- Widespread ATM Access Nationwide

- Flexible Overdraft Protection Options

- User-Friendly Mobile App Tools

- Instant Alerts and Spending Insights

- No In-Person Branch Services

- No ATM Fee Reimbursements

- Support Requires Correct Contact Channel

- No Dedicated Personal Bankers

- Limited Cash Deposit Options

LendingClub Bank

Checking Fees

Money Market APY

Savings APY

Our Rating

-

Our Verdict

- Features

- Pros & Cons

LendingClub's acquisition of Radius Bank has allowed the company to expand its product line, offering customers a more comprehensive banking experience.

While it previously had a limited banking product line, LendingClub now offers online personal loans, checking accounts, savings accounts, and CDs.

The bank aims to simplify money management through its online platform and mobile app, offering tools to track spending habits, debt, and net worth.

LendingClub savings account rates are competitive, ATM fee rebates, and no monthly fees on many of its products. Customers with direct deposit can receive their paychecks up to two days early, and the Rewards Checking account avoids NSF and overdraft fees.

However, LendingClub's lack of physical branches may deter some customers who prefer in-person banking interactions. Additionally, the range of lending and investing products remains somewhat limited.

- No monthly maintenance or overdraft fees

- Unlimited ATM fee reimbursements nationwide

- 1% cashback on eligible debit purchases

- Early direct deposit up to 2 days early

- Integrated budgeting and spending tools

- 24/7 account access via mobile app

- Free incoming wire transfers

- FDIC insured up to $250,000

- No Fees on Basic Banking Services

- Unlimited ATM Fee Refunds

- Cashback Debit Rewards Available

- Early Paycheck Direct Deposit

- Modern Mobile and Online Banking

- Online-Only, No Physical Branches

- No Multiple Checking Account Options

- Cashback Requires High Balance or Deposit

- No Live Chat or Email Support

- Limited Wire Transfer Capabilities

Best New York Regional Banks

There are loads of local and community banks in New York, and I'll tell you about some of the top ones

key Bank

Checking Fees

Money Market APY

Savings APY

Our Rating

-

Our Verdict

- Features

- Pros & Cons

KeyBank has over 200 branches across New York and thousands of ATMs that you can use for free.

KeyBank provides checking accounts that don't charge you a fee every month, and a variety of financial products including credit cards, lines of credit, personal loans and mortgage.

However, their savings account rates are quite low, and to get a promotional rate on the money market account you'll need to carry at least $25,000.

This medium-sized bank offers great customer service, including 24/7 phone assistance, Twitter support, chat support with extended hours, and in-person help at their branches.

Similar to many traditional banks with physical branches, KeyBank provides additional benefits to customers who open multiple accounts with them.

- Three checking account options

- No-fee account options available

- Free access to 40,000+ ATMs

- In-person banking at 1,000+ branches

- Online and mobile banking tools

- 24/7 live phone support

- Account alerts and budgeting tools

- Debit card and bill pay included

- No-fee checking account options

- Strong branch and ATM presence

- Feature-rich mobile banking app

- Premium benefits for Select Checking

- Helpful 24/7 customer service

- Premium account requires high balance

- Limited perks with basic account

- No interest on standard checking

- Some accounts lack check-writing

- Out-of-network ATM fees may apply

Santander Bank

Checking Fees

Money Market APY

Savings APY

Our Rating

-

Our Verdict

- Features

- Pros & Cons

Santander Bank offers a variety of financial banking products, with some accounts available online and others requiring in-person visits to a branch. While New York is not Santander's central location, it still has over 60 branches in the state.

The bank's offerings include three checking accounts with free overdraft protection, two savings accounts, and CDs available in a wide range of terms.

Additionally, customers can easily waive monthly fees, and they have the convenience of booking appointments for account openings and other banking needs through the bank's website.

On the downside, Santander Bank has a lower interest rate on savings accounts, which might be unappealing to those seeking higher returns on their savings.

Also, the ATM network is relatively restricted, potentially causing inconvenience for some customers.

- Three checking account options available

- Easy monthly fee waivers on most accounts

- Student account with no monthly fees

- 24/7 phone customer service

- Online and mobile banking access

- Select Checking includes financial advisor access

- No international transaction fees (Select Checking)

- Over 2,000 ATMs and 480 branches on East Coast

- Wide East Coast Branch Network

- Student Checking with No Fees

- Select Checking Offers Premium Perks

- Low Effort to Waive Fees

- 24/7 Phone Support Available

- Limited Availability Outside Northeast

- High Overdraft Fees

- No Free Non-Santander ATM Access (Basic)

- Paper Statement Fees Apply

- Some Accounts Must Be Opened In-Branch

M&T Bank

Checking Fees

Money Market APY

Savings APY

Our Rating

-

Our Verdict

- Features

- Pros & Cons

M&T Bank offers a diverse range of financial services for individuals and businesses. Headquartered in Buffalo, New York, the bank operates over 250 branches across 180 cities, ensuring broad accessibility.

The bank's services include checking accounts, savings accounts, CDs, credit cards, and various lending products.

They provide competitive CD rates on specific terms, four types of checking accounts, and have earned an A+ ranking from the Better Business Bureau. Additionally, customers praise their highly-rated iOS mobile app.

However, M&T Bank has some drawbacks. The interest rates on their savings accounts are low, and there are better credit card options available elsewhere.

Moreover, certain CD terms require opening at an M&T branch, and most accounts have monthly maintenance fees.

- Four unique checking account options

- No overdraft fees on select accounts

- ATM fee refunds on premium accounts

- Checkless account option for safer spending

- Online and mobile banking access

- Branch and ATM access across 13 states

- Accounts can be opened online or in-branch

- Bundled benefits with select account packages

- Multiple Checking Accounts for Different Needs

- No Overdraft Fees on MyWay Account

- ATM Fee Rebates with Premium Account

- Strong Regional Branch Network

- Mobile and Online Banking Tools

- Some Accounts Have High Monthly Fees

- Limited Nationwide ATM Fee Coverage

- Premium Features Require Account Upgrades

- Inconsistent Benefits Across Regions

- Few Credit Card Options Compared to Competitors

FAQs

What are the banks with the highest number of branches in New York?

As of 2025, Florida's banking landscape is dominated by Chase Bank, M&T Bank and Bank Of America, each boasting an extensive network of over 400 branches. These three banks stand out as the ones with the most branch locations in the state.

What is the best bank in New York?

Finding the ideal New York bank depends on what you value most – in-person service, high deposit rates, or bank with many branches. Review our recommended banks above, each catering to specific needs

Which bank in New York has the best rates for CDs?

New York's CD rates differ between terms. One bank may offer the best 3 month rates, while another provides the best 6-month rates.

Which bank offers the highest savings rates in New York?

It's not easy to find the best savings rates, but in New York, a few banks and credit unions stand out. Discover some of the top banks for high savings rates in New York for 2025.

How We Picked The Best Bank In New York: Methodology

The Smart Investor team conducted an extensive review to identify the best banks in New York. We assessed them based on four main categories, each with specific features:

- Financial Products and Services (40%): We evaluated the range and quality of financial products and services offered by each bank, including checking accounts, savings accounts, CDs, loans, credit cards, and investment options. Banks offering a diverse array of financial products with competitive rates and terms received higher ratings in this category.

- Banking Features and Tools (30%): This category assessed the availability and functionality of banking features and tools, such as transfer options, the ability to set savings goals, account linking capabilities, mobile app usability, check deposit options, and other features important for banks. Banks offering a comprehensive suite of features and user-friendly tools earned higher scores.

- Customer Experience (20%): We closely examined the overall customer experience, including the ease of account opening, communication with customer service representatives, the usability of online banking platforms and mobile apps, and the responsiveness of customer support. Banks with user-friendly interfaces, efficient digital banking tools, and responsive customer service received higher ratings.

- Bank Reputation (10%): Our team analyzed each bank's reputation based on factors such as customer satisfaction ratings, JD Power scores, TrustPilot reviews, and any notable awards or recognitions received. Banks with positive reputations and a history of providing excellent service to customers in New York received higher ratings.

Within each category, we assigned weights to various features and qualities to ensure a comprehensive evaluation of each bank.