If you're a Texas resident in search of the perfect bank to meet your needs, you're likely aware of the vast array of options available. From community banks and regional institutions to national and online banks, the choices can be overwhelming.

To simplify your decision-making process, we present our carefully curated list of the best banks in Texas for 2023. Our selection criteria encompass factors such as the number of branches, product variety, deposit rates, digital banking capabilities, and customer service.

Whether you prefer a local community bank or a nationwide institution, our list offers options to suit every banking preference.

Best Texas Regional Banks

You can find hundreds of regional and community banks in Texas, here are some of the best of them:

Prosperity Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

Prosperity Bank has established itself as a reputable financial institution, with a strong presence that spans over 250 branches across 150 cities in Texas.

At Prosperity Bank, customers can access a diverse range of banking services, including checking, savings, money market accounts, and CDs (but low rate on deposits). To cater to different needs and preferences, the bank offers seven different types of checking account options.

Prosperity Bank provides various individual retirement account (IRA) options for those planning their retirement. Additionally, the bank extends its services to encompass lending and mortgage products.

However, if you prioritize bank accounts with low opening deposits or minimal fees or seek a higher savings rate, exploring other alternatives better suited to your preferences may be worthwhile.

Comerica Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

Comerica delivers a wide range of banking services, including deposits, loans, credit options, investments, and insurance products.

As a traditional brick-and-mortar bank, certain services may require customers to visit branch locations for account openings. Presently, Comerica operates over 120 branches across 40 cities in Texas. The bank's mobile app has garnered high praise from both iOS and Android users.

However, it's important to be aware that, like other physical banks, Comerica offers low-interest rates on savings and charges various fees to cover expenses. While some fees may be waived, customers might encounter charges eventually. Additionally, opening CD accounts online is currently unavailable, but digital options exist for opening savings and checking accounts.

Despite operating during regular business hours, Comerica extends its services to customers beyond closing time. They offer a 24/7 interactive voice-response service, catering to different time zones, and live agents are available during weekdays' office hours.

Frost Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

Frost Bank, with its presence in over 150 branches across 60 cities in Texas, stands out as a notable banking option. The bank offers multiple types of account choices, including interest-bearing checking accounts, and has a highly rated mobile app, ensuring convenient and efficient banking services for customers.

Frost Bank is recognized for striking a balance between being large enough to compete on service while remaining small enough to provide a personal touch, fostering a community-focused approach.

One of Frost Bank's strengths lies in its competitive CD interest rates, making it an attractive option for those interested in investing in certificates of deposit. However, it's worth noting that to access the highest CD rates, customers may need to meet relatively high minimum deposit requirements.

While the bank offers waivable monthly fees, they could reduce potential earnings for some account holders. Additionally, the interest rates on some accounts, particularly interest-bearing checking accounts, might not be significant enough to make them worthwhile for certain customers.

Best Texas National Banks

In our selection of preferred national banks in Texas, we conducted a thorough assessment based on various factors.

These factors included the accessibility and abundance of branches, the range of products offered, as well as opportunities to obtain high rates on deposits, primarily through CDs rather than savings accounts.

PNC Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

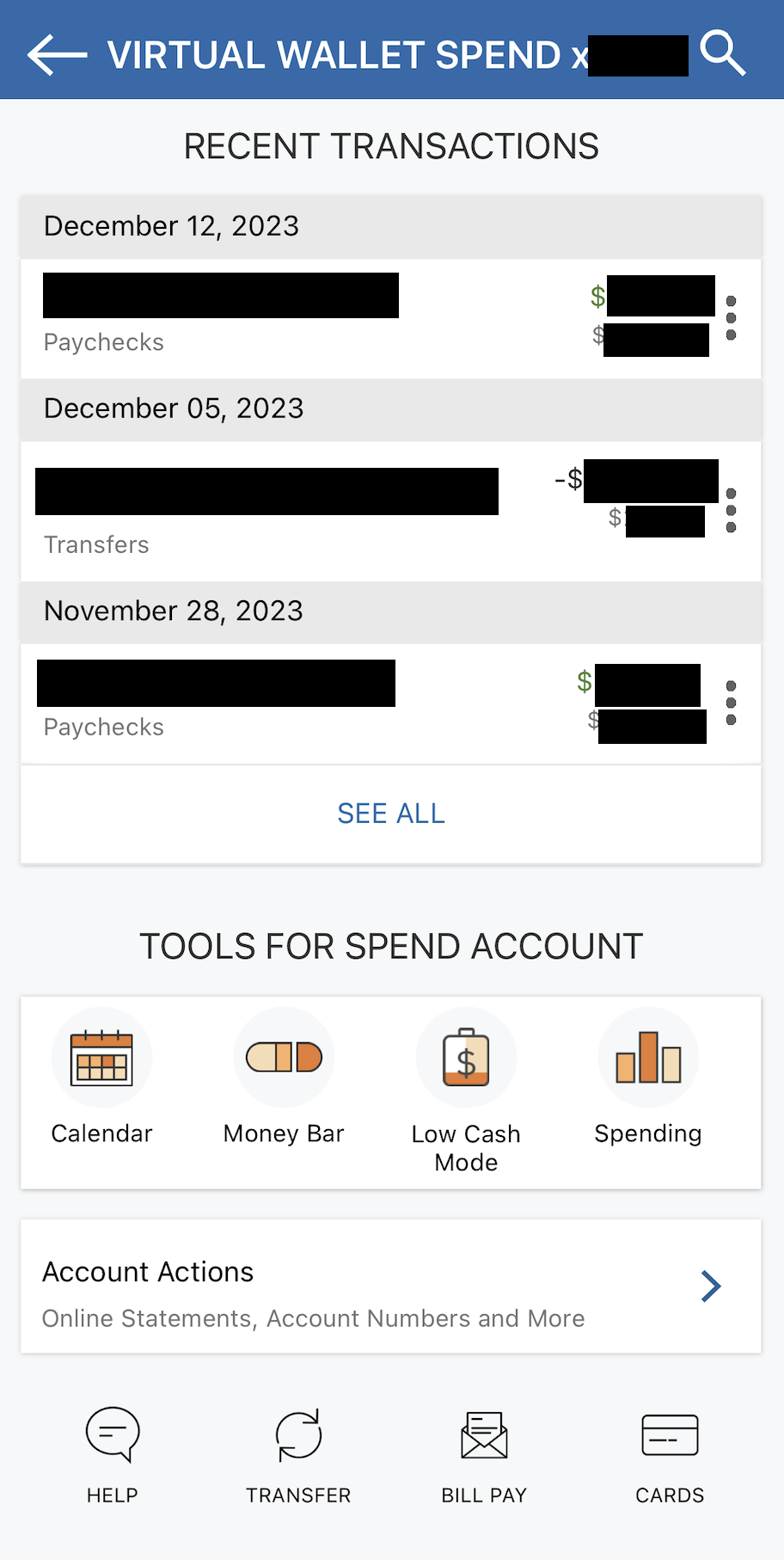

PNC Bank is a top banking option in Texas, boasting over 300 branches across 140 cities in the state. One of their basic checking accounts, Virtual Wallet Spend, offers free mobile banking and online bill pay. PNC also reimburses some ATM usage fees for non-PNC ATMs, although the machine owner may still charge a separate fee.

The bank has several advantages, including a competitive APY on its online-only savings account (available in specific states), access to around 60,000 fee-free ATMs, and above-average digital banking features.

However, there are some drawbacks to consider. PNC has a higher-than-average overdraft fee at $36, one of the highest in the nation. Additionally, most CDs can only be opened in person at a branch, and some accounts may have monthly fees, though they can be avoided.

For Texas customers seeking a high-yield savings account and a wide range of banking products, PNC Bank offers a good balance between a high yield and a large branch network.

Wells Fargo Bank

Checking Fees

Promotion

Savings APY

CDs APY

Wells Fargo is one of the largest banks in the US, with a significant presence across Texas through 480 branches spread across 150 cities. The bank offers numerous ATMs and a diverse range of financial products. While basic bank account monthly fees can be waived easily, the savings rates are generally low.

Also, Wells Fargo's checking account is highly rated, especially due to the elimination of non-sufficient funds (NSF) fees, 24/7 customer service availability by phone, a large, free, nationwide ATM network, and the convenience of early direct deposit.

Despite these strengths, Wells Fargo has faced intense regulatory scrutiny in recent years for various issues, including the opening of fake accounts.

Additionally, the bank's savings account yields are not very attractive, and some accounts may still have monthly fees that can be avoided. Customers should also be aware of the relatively high overdraft fee charged by the bank.

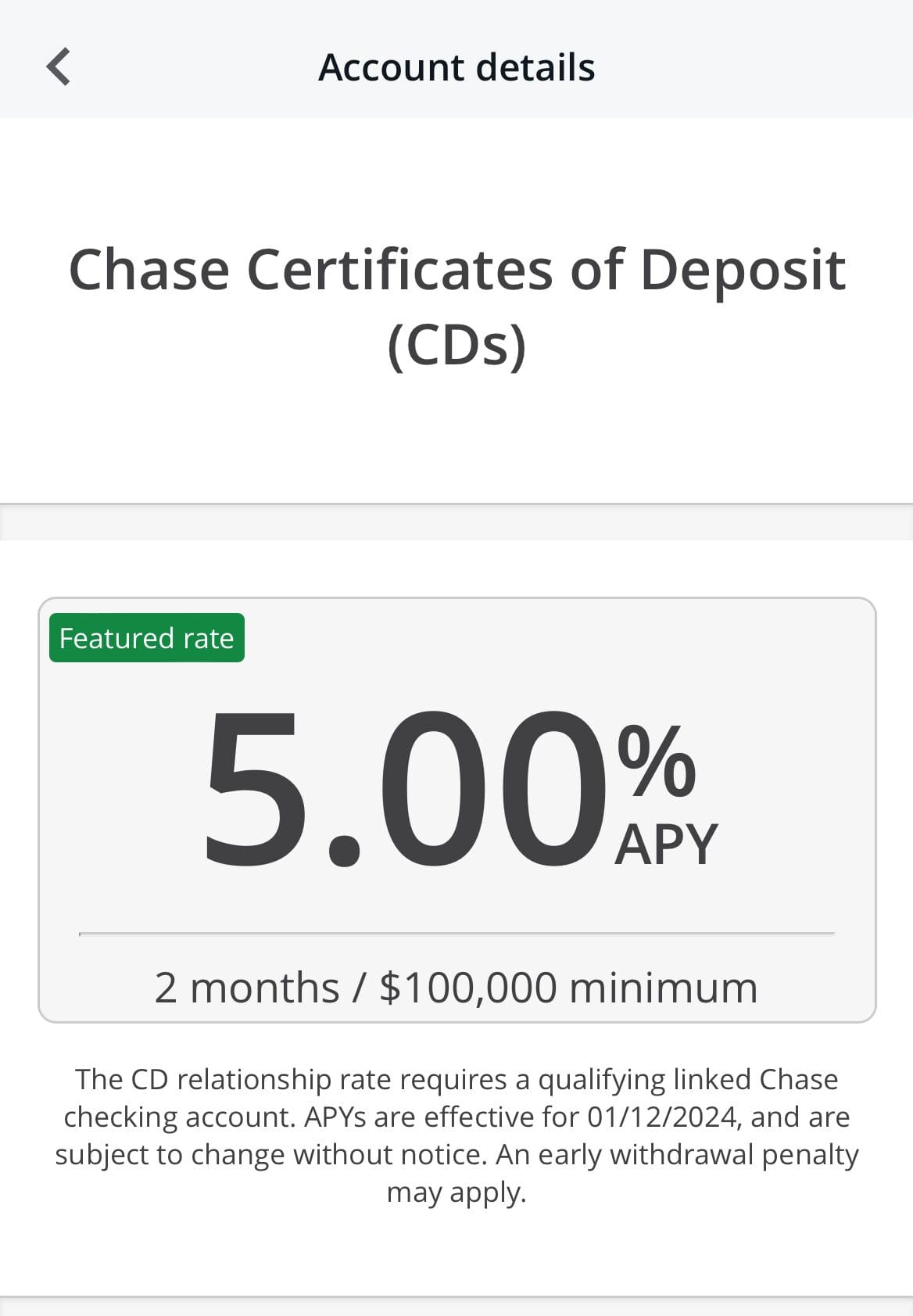

Chase Bank

Checking Fees

Checking Promotion

Savings APY

CDs APY

Chase Bank has many different services for your banking needs, like checking and savings accounts, credit cards, mortgages, personal and auto loans, investment services, and small business banking. They have over 450 branches in Texas, spread across 110 cities, making it easy to find a branch nearby.

Here are some good things about Chase Bank: they have lots of branches and ATMs so you can access your money easily, they offer a wide range of financial products, their online and mobile banking is user-friendly and strong, they have competitive interest rates for specific CDs.

But, there are some not-so-great things to consider too: some accounts have high monthly fees, their savings account rates aren't as high as some other banks, and if you use ATMs outside their network with their basic accounts, they charge fees.

Best Texas Online Banks

Our primary focus when selecting the online banks available in Texas was on their savings and CD rates, as well as their capacity to offer a diverse range of financial products. This includes checking accounts, loans, credit cards, and even mortgages.

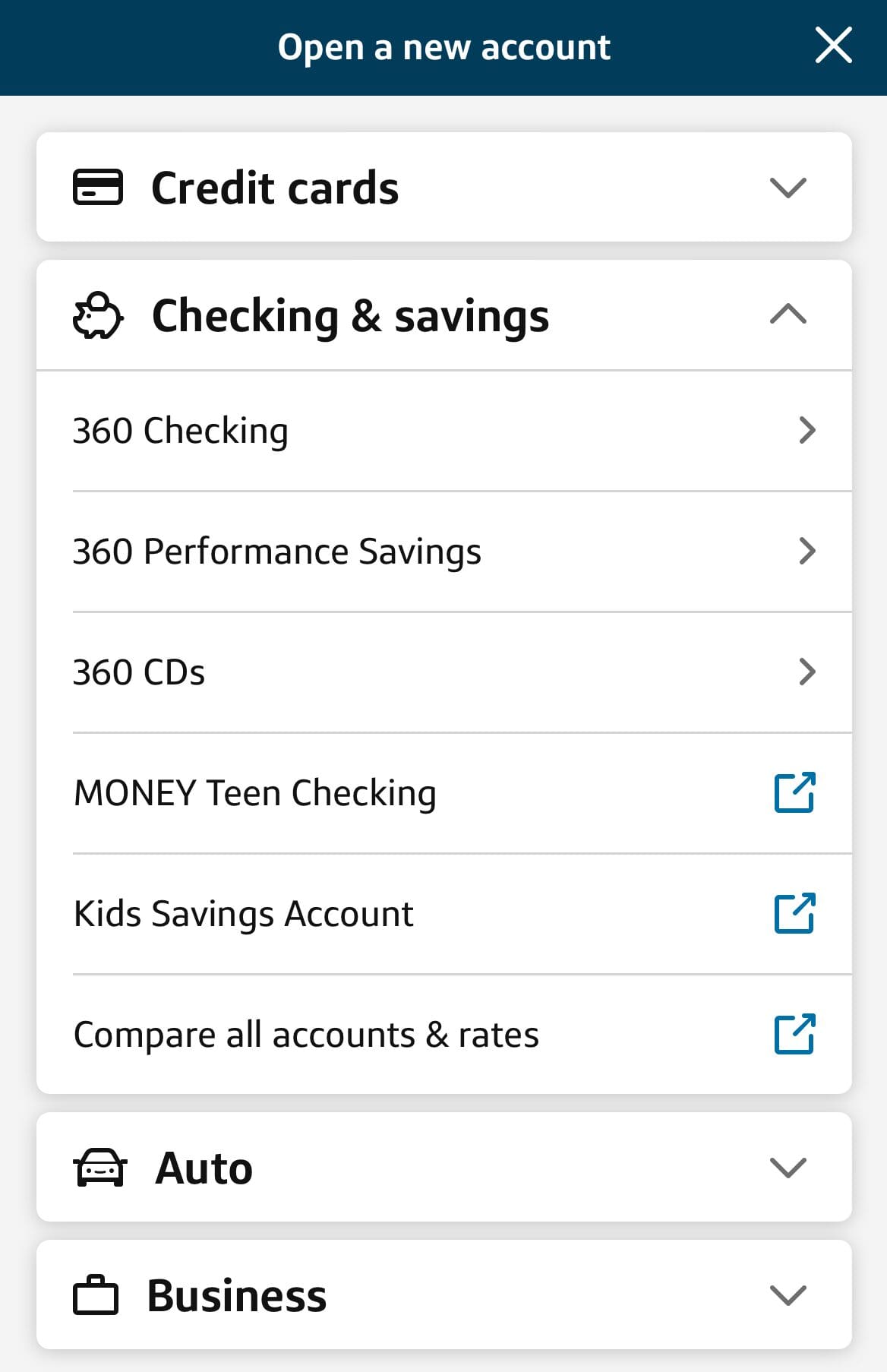

Capital One Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

Capital One is a recommended choice for consumers seeking competitive rates and a full-service banking experience without monthly fees. The bank provides access to an extensive network of no-fee ATMs and branch locations in specific states. However, even without a local branch, customers can conveniently manage their accounts online from anywhere.

One of Capital One's strengths lies in its attractive rates for savings and CD accounts, as well as a free checking account that earns interest. The absence of balance minimums, monthly fees, and overdraft charges further adds to its appeal. Additionally, the mobile app has received high praise from iPhone and Android users.

On the downside, there are limitations such as no cash deposits at partner ATMs and the absence of money market accounts. Despite these drawbacks, Capital One remains a top choice for those seeking a well-rounded banking experience with favorable rates and flexibility in managing their finances.

SoFi Bank

Checking Fees

Checking Promotion

Savings APY

CDs APY

SoFi offers a combined Checking and Savings account with distinct interest rates for each balance.

The account stands out with its advantages, including the absence of monthly fees and a robust free overdraft coverage program for eligible customers. Additionally, customers can benefit from a competitive rate on their savings account and gain access to a vast and free nationwide ATM network. Direct deposit users also have the perk of getting paid up to two days earlier.

However, there are some drawbacks to consider. SoFi lacks physical branch access, which may not be ideal for those who prefer in-person banking services.

Moreover, cash deposits come with fees, making it less convenient for individuals who frequently deposit cash. Another limitation is the absence of CDs or money market accounts, which could deter those seeking more specialized savings options.

FAQs

What are the banks with the highest number of branches in Texas?

As of 2025, Chase Bank, Wells Fargo Bank and Bank of America are the banks with the most branches in Texas, with over 300 branches each bank.

What's Texas's finest bank?

The top Texas bank varies according to what you want, like if you prefer in-person help, high deposit rates, or no-fee checking accounts. Check out our suggested banks above, each with its unique strengths.

Which Texas bank has the best CD interest rates?

The top CD rates in Texas can vary with different terms. One bank might have the best rates for 1 year, while another offers the best rates for 6 months. Check out our recommended banks in Texas for high CD rates and compare them with credit unions.

What's the bank with the most competitive savings rates in Texas?

Finding high savings rates can be challenging, but Texas has some top-notch options. Discover some of the best performers among banks and credit unions in 2025.

How We Picked The Best Bank In Texas: Methodology

The Smart Investor team conducted an extensive review to identify the best banks in Texas. We assessed them based on four main categories, each with specific features:

- Financial Products and Services (40%): We evaluated the range and quality of financial products and services offered by each bank, including checking accounts, savings accounts, CDs, loans, credit cards, and investment options. Banks offering a diverse array of financial products with competitive rates and terms received higher ratings in this category.

- Banking Features and Tools (30%): This category assessed the availability and functionality of banking features and tools, such as transfer options, the ability to set savings goals, account linking capabilities, mobile app usability, check deposit options, and other features important for banks. Banks offering a comprehensive suite of features and user-friendly tools earned higher scores.

- Customer Experience (20%): We closely examined the overall customer experience, including the ease of account opening, communication with customer service representatives, the usability of online banking platforms and mobile apps, and the responsiveness of customer support. Banks with user-friendly interfaces, efficient digital banking tools, and responsive customer service received higher ratings.

- Bank Reputation (10%): Our team analyzed each bank's reputation based on factors such as customer satisfaction ratings, JD Power scores, TrustPilot reviews, and any notable awards or recognitions received. Banks with positive reputations and a history of providing excellent service to customers in Texas received higher ratings.

Within each category, we assigned weights to various features and qualities to ensure a comprehensive evaluation of each bank.