Table Of Content

In this article, we will compare savings account of these two banks in detail to help you decide which one is the best fit for your financial goals. We will examine their savings account rates, account perks, and any potential drawbacks or limitations and evaluate any promotions or offers that each bank may be running for new customers.

Whether you're saving for a down payment on a house or want to maximize your savings, this comparison will help you find the best savings account for your needs.

Compare Savings Rates And Deposit Requirements

Marcus | SoFi | |

|---|---|---|

Savings Rate | 3.65% | up to 3.80% |

Minimum Deposit | $0 | $0 |

Fees | $0 | $0 |

Promotion | None | $50 – $300

New customers should deposit $1,000 – $5,000 to get the promotion. Expired on 12/31/2024

|

Based on the data provided in the table, SoFi Bank Savings appears to offer a slightly better savings rate at up to 3.80% compared to Marcus Savings Account's rate of 3.65%. Comparing other banks, these rates are very competitive.

Additionally, both banks offer a $0 minimum deposit and $0 fees, making them both accessible and affordable for customers.

However, SoFi Bank Savings has the advantage of offering a promotional offer for new customers, with potential rewards ranging from $50 to $250.

SoFi vs Marcus: Saving Account Features And Benefits

Marcus | SoFi |

|---|---|

Detailed Overview Of Expenses | Attractive APY |

Prioritize Spending | Spending Tracker |

Achieve Long-Term Goals | Automatic Savings Roundups |

Automatic Savings Roundups | No fees |

Monitor credit score |

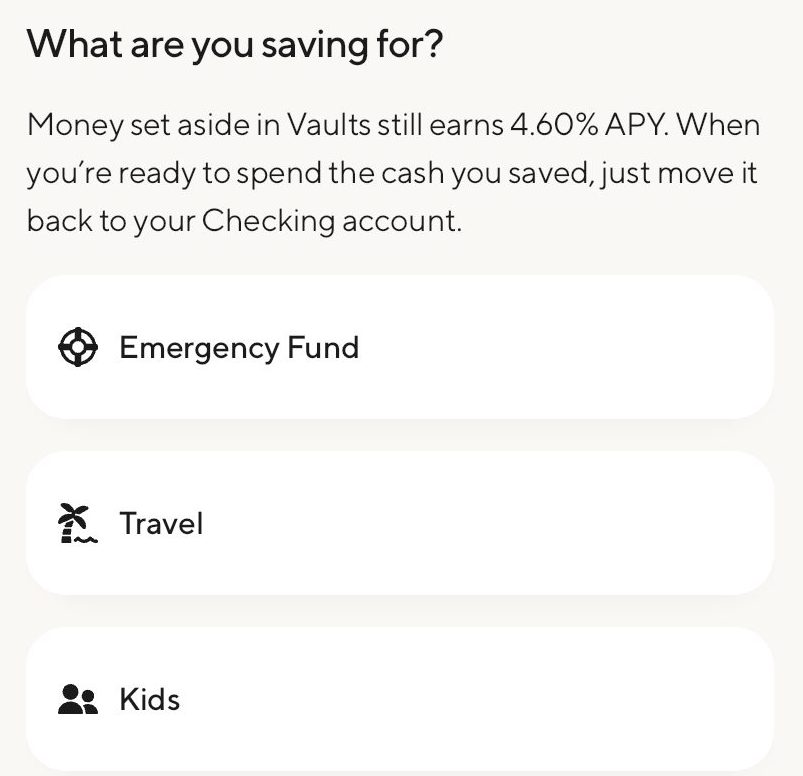

Another notable feature is the Automatic Savings Roundups, which rounds up purchases to the nearest whole number and automatically transfers the difference to a specified vault. Customers can also obtain unlimited free paper checks for making payments when required.

Marcus savings account also has no account maintenance fees. There is also no minimum deposit required, and you can transfer up to $100,000 to other banks on the same day. Additionally, the account comes with a savings calculator, which is a useful tool to determine how much you can earn by saving with Marcus.

SoFi Bank Savings offers a variety of features and benefits that make it a great option for individuals looking to combine savings and checking for a convenient and low-cost banking solution.

Firstly, the bank has no fees for account maintenance, overdraft, account inactivity, foreign transactions, or ATM usage. With over 55,000 free Allpoint Network ATMs worldwide, SoFi Bank Savings also offers $0 ATM fees to its users.

Where They Can Improve?

Marcus | SoFi |

|---|---|

Online Only | No Cash Deposits |

No Mobile Check Deposit | Withdrawal Limits |

No Promotions | No Physical Branches |

No Checking Account | Third-Party ATM Fees |

- Online Only

Marcus is an online-only bank, which means that customers who prefer physical branches may need to look for alternatives.

- No Mobile Check Deposit

Although Marcus has iOS and Android apps, they do not allow check deposits, and customers must either send in a check by mail or link their checking account to the Marcus account.

- No Promotions

Marcus does not offer promotions to new customers, unlike SoFi, that offer bonuses for opening new accounts.

- No Checking Account

Marcus does not offer checking account options, so customers will need to link their Marcus account to a third-party bank for transactions such as deposits and withdrawals.

- No Cash Deposits

Unlike traditional banks, you cannot deposit cash into SoFi directly.

- Withdrawal Limits

SoFi has withdrawal limits, including a $1,000 limit for ATM withdrawals, a $150 limit for over-the-counter withdrawals, and a $6,000 limit for point of sale purchases.

- No Physical Branches

SoFi Bank is an online-only bank, so there are no physical branches available for users.

- Third-Party ATM Fees

Only transactions on Allpoint Network ATMs are fee-free.

SoFi Vs. Marcus: How To Open A Savings Account?

When it comes to online banking, SoFi, and Marcus's account opening procedure is quite similar. Here are the steps for each:

-

SoFi Savings And Checking

Here's a summary of the steps to open a SoFi Bank Savings in 3-4 points:

- Provide basic information: Provide your name, email, and password to create a SoFi Money account.

- Verify identity and confirm account type: Confirm your identity and citizenship status, and choose between an individual or joint account.

- Complete additional questions: Answer additional questions related to your role in a brokerage firm or security exchange, your directorship or role in a publicly-traded company, or adding a trusted person to help manage the account.

- Link your bank account: Link your bank account to add funds to your SoFi Money account.

-

Marcus Savings Account

Opening a Marcus Savings Account is a straightforward process that can be completed either on the Marcus website or through the mobile app.

You simply need to click the “Open an Account” button, fill out an online form with your personal and contact details, and link your bank account to fund your savings account if you wish.

Alternatively, you can download the Marcus app and complete the process there. You will need to provide your occupation, yearly income, and social security number to set up your account.

Compare Marcus Savings

American Express and Marcus offer competitive rates on savings with no monthly fees. However, a mobile check deposit is not available.

Ally and Marcus Savings account offer competitive rates on savings with no monthly fees. Compare account features, benefits and drawbacks.

Ally Bank Savings Account vs Marcus Online Savings Account: Which Is Better?

While Citi is a traditional bank, its savings rates are very competitive. How's the rates, features and tools compare – and who is the winner?

Marcus Online Savings Account vs Citi Accelerate Savings: Compare Side By Side

Related Posts

The Smart Investor Savings Accounts Comparison Methodology

The Smart Investor team has conducted a comprehensive comparison of savings accounts, analyzing each based on these critical categories to help you decide where to entrust your savings.

- Savings Rates: The savings rates category delves into the interest rates offered by each account, assessing their competitiveness in the market. Higher interest rates mean greater returns on your savings over time, providing a crucial incentive for account holders to choose one account over another. Additionally, we explore any promotional rates or conditions that may affect the account's overall value.

- Savings Features: We examine the features and benefits accompanying each savings account. From account minimums and fees to accessibility through online and mobile banking platforms, these features can significantly impact the convenience and utility of the account for account holders. We also consider perks like overdraft protection, automatic savings plans, and rewards programs.

- Customer Experience: A positive customer experience is paramount in banking, and we evaluate each institution's performance in this area. This includes aspects such as the ease of account opening, quality of customer service, availability of support channels, and overall user satisfaction on platforms such as Trust Pilot and JD Power ranking.

- Bank Reputation: The bank's reputation carries weight in the decision-making process. Factors such as financial stability, regulatory compliance, and public perception contribute to the overall trustworthiness and reliability of the institution.