Table Of Content

Synchrony Bank and Marcus are two noteworthy online banks that provide CDs with competitive rates and varying terms. Whether you seek a brief or extended investment option, Synchrony Bank and Marcus provide a broad spectrum of CD terms to select from.

This article will analyze and compare the CD rates presented by Synchrony Bank and Marcus, alongside other essential factors such as minimum deposit requirements, how their CDs work, and early withdrawal penalties.

Synchrony | Marcus | |

|---|---|---|

CD Range | Up to 4.15% | 3.85% – 4.25%

|

Minimum Deposit | $0 | $500 |

Early Withdrawal penalty | 90 – 365 days of interest | 90 – 270 days of of interest |

Terms | 3 months – 5 year | 6 – 72 months |

CD Rates Comparison

Based on the table provided below, we can observe that the CD rates offered by Marcus and Synchrony Bank are quite comparable.

Synchrony offers slightly better rates on most of the terms, but the differences are minor. Also, Synchrony doesn't have a minimum deposit while Marcus does.

However, if you're looking for a 3-month CD, you may want to look elsewhere since any of them offer a competitive rate.

CD Term | Synchrony APY | Marcus APY |

|---|---|---|

3 Months | 0.25% | N/A |

6 Months | 3.70% | 4.25%

|

9 Months | 3.90% | 4.15%

|

12 Months | 4.00% | 4.10%

|

18 Months | 3.80% | 4.00% |

24 Months | 3.50% | 3.95% |

36 Months | 4.00% | 3.90% |

48 Months | 3.50% | 3.85% |

60 Months | 4.15% | 3.90% |

72 Months | N/A | 3.90% |

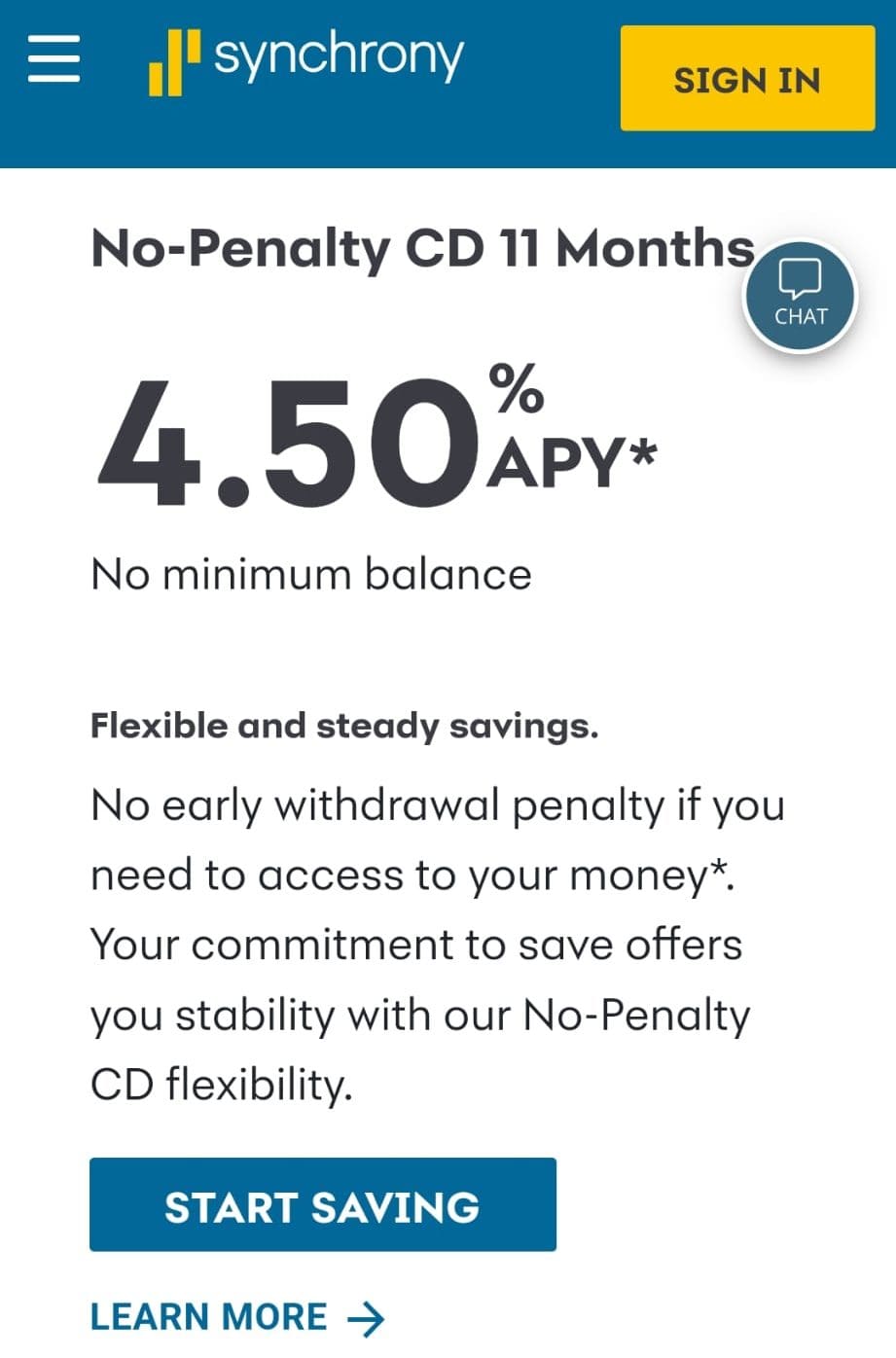

Both Synchrony And Marcus Offer No Penalty CD

When comparing no penalty CDs, the Synchrony CD rate is higher. Not only do they offer better rates, but the term is also shorter compared to Marcus.

However, no-penalty CDs at such rates are quite rare, so while Synchrony is the winner – Marcus's option is also decent and competitive compared to the industry.

Marcus | Synchrony Bank | |

|---|---|---|

11 Months | N/A | N/A

|

13 Months | N/A |

Top Offers From Our Partners

![]()

CD Early Withdrawal Penalty: How They Compare?

While the differences are minor also here, Synchrony penalty charges in case of an early withdrawal are higher than Marcus, especially for the longer CD terms.

CD Term | Synchrony Bank | Marcus |

|---|---|---|

3 Months | 90 days of interest | N/A

|

6 Months | 90 days of interest | 90 days of interest |

9 Months | 90 days of interest | 90 days of interest

|

12 Months | 90 days of interest | 180 days of interest |

18 Months | 180 days of interest | 180 days of interest |

24 Months | 180 days of interest | 180 days of interest |

36 Months | 180 days of interest | 180 days of interest |

48 Months | 365 days of interest | 180 days of interest |

60 Months | 365 days of interest | 180 days of interest |

72 Months | N/A | 270 days of interest |

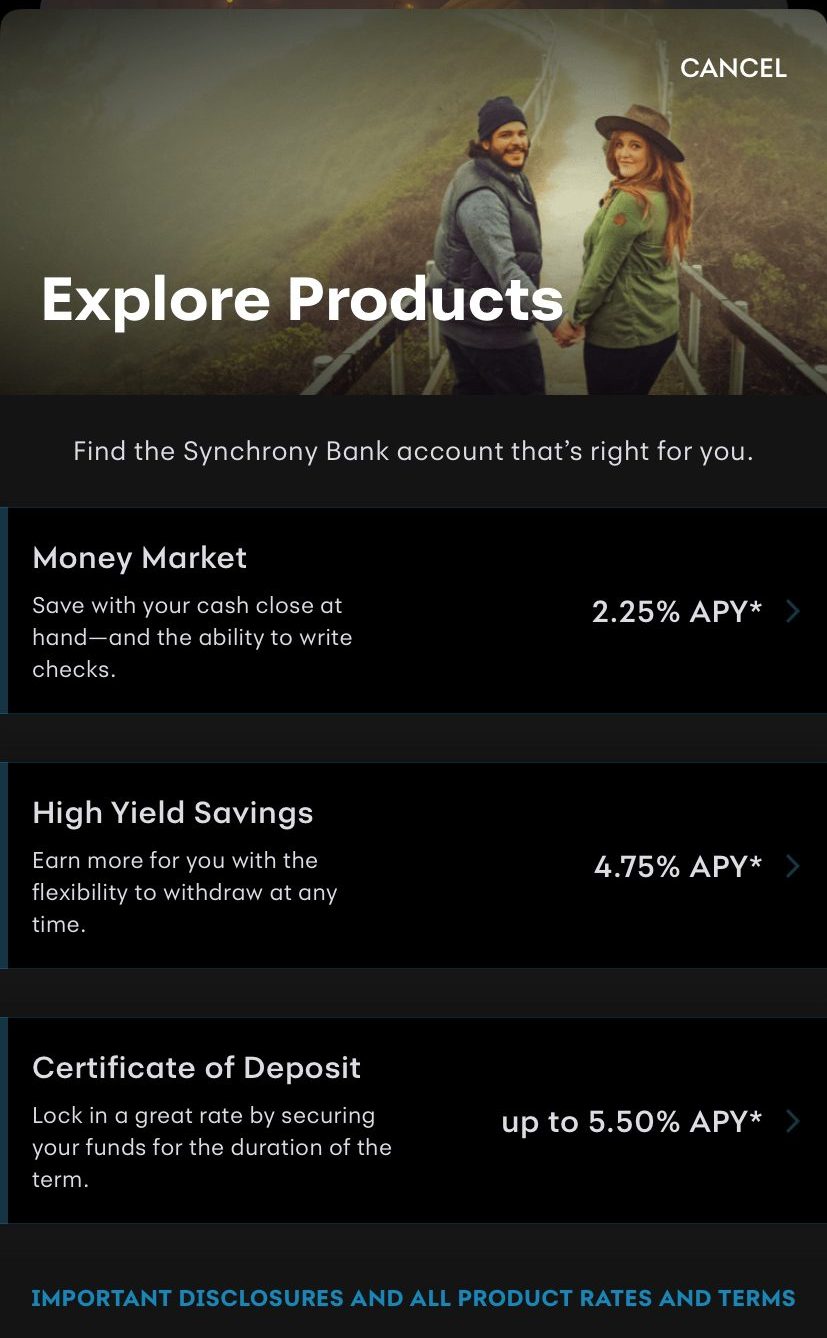

About Synchrony Bank

Synchrony Bank is an online bank established in 2003 that provides various financial products and services to its customers. The bank offers savings accounts, certificates of deposit (CDs), money market accounts, and credit cards with attractive interest rates.

As an online bank, Synchrony Bank has no physical branches, but it provides access to over 2 million ATMs worldwide. It also offers a mobile app and online banking tools that make banking more convenient for customers.

In terms of customer service, Synchrony Bank has a reputation for being responsive and helpful, with a customer service team available 24/7 to assist customers with their banking needs.

About Marcus

Marcus by Goldman Sachs is an online bank founded in 2016 that offers a variety of financial products and services. The bank provides savings accounts, certificates of deposit (CDs), personal loans, and home improvement loans.

Marcus savings accounts offer competitive interest rates with no account fees, minimum deposit requirements, or withdrawal penalties. Marcus personal loans are another popular product that allows borrowers to consolidate high-interest debt, finance home improvements, or fund other major expenses. The bank offers fixed-rate loans with no origination fees, prepayment penalties, or hidden fees.

How We Compare CDs: Methodology

In our comprehensive certificate of deposit (CD) comparison, The Smart Investor team meticulously evaluated various CDs across four key categories to assist you in selecting the most suitable option for your savings goals.

- CD Rates: We thoroughly examined the interest rates offered by each CD, considering their competitiveness in the market. Higher rates typically translate to greater returns on your investment over the CD's term. Additionally, we scrutinized any special promotional rates or conditions that might affect the overall value of the CD.

- CD Features: This category focuses on the unique features and terms associated with each CD. We assessed factors such as minimum deposit requirements, early withdrawal penalties, and the availability of flexible terms. Additionally, we considered any additional perks like interest compounding frequency or options for automatic renewal.

- Customer Experience: A positive customer experience is crucial in banking, and we evaluated each institution's performance in this regard. We looked into aspects such as the ease of opening a CD, the quality of customer service, and the availability of support channels. Reviews from reputable sources such as Trustpilot and JD Power rankings were also considered to gauge overall user satisfaction.

- Bank Reputation: The reputation of the bank is a significant factor in the decision-making process. We examined the bank's financial stability, regulatory compliance, and public perception to assess its overall trustworthiness and reliability as a CD provider.

Compare Synchrony CDs

Synchrony Bank offers higher CD rates than Citibank on most terms. Compare CD rates, minimum deposit and early withdrawal fees.

Synchrony Bank and Ally CDs offer competitive rates, including no penalty CDs. Which one is the winner? Check out our full comparison.

Synchrony Bank offers better CD rates than Discover for most terms. Compare CD rates, minimum deposit, and early withdrawal fees.

Compare Marcus Certificate Of Deposit (CDs)

Discover the best CD rates Marcus and Discover offers with our comprehensive comparison, including early withdrawal penalty.

Marcus offers higher CD rates than Capital One on most terms but not all of them. Compare CD rates, min deposit, and early withdrawal fees.