When choosing a bank, factors such as a variety of products, account features, fees, and customer service play a crucial role. Two prominent contenders in the banking industry are Truist Bank and Wells Fargo.

In this article, we will compare these banks to help you make an informed decision about which bank aligns better with your financial needs.

Checking Accounts

Wells Fargo is our winner for checking accounts as it offers more options for personal customers than Truist Bank. While Truist fees are lower, Wells Fargo offers premium accounts such as Prime and Premier checking.

-

Account Types

Wells Fargo offers four types of personal checking accounts for individuals. The basic account with lower fees is called Clear Access Banking, the Everyday Checking is the classic checking account, and the Prime Checking and Premier Checking target customers who want more features and benefits.

While all of them charge monthly fees, customers can waive them in various ways:

Wells Fargo Checking Account | Monthly Fee | Average Balance To Waive Fees |

|---|---|---|

Clear Access Banking | $5 | Only if you're under 24 |

Everyday Checking | $10 | $500 |

Prime Checking

| $25 | $20,000 (Combined with deposits) |

Premier Checking | $35 | $250,000 (Combined with deposits) |

Truist bank offers personal checking accounts with many features and easily waived monthly fees. However, there is no wide selection of accounts as you have with Wells Fargo:

Truist Bank Account | Monthly Fee | Average Day Balance To Waive |

|---|---|---|

Truist One Checking account | $12 | $500 |

Truist Confidence Account | $5 | $500 |

-

Features

Wells Fargo's basic account offers several key features to enhance the banking experience. The Early Pay Day feature allows account holders to access their funds ahead of traditional payday schedules, promoting financial convenience. The online and mobile banking help customers make almost any financial move online.

For those seeking enhanced banking privileges, Wells Fargo's premium accounts offer a range of attractive features. These include interest-bearing accounts, providing the opportunity for account holders to earn on their balances.

Additional perks encompass free check orders and non-Wells Fargo ATM withdrawals, priority customer service and fee waivers on money orders, cashier checks, and international debit card purchase.

Wells Fargo Account | Main Features |

|---|---|

Clear Access Banking | No overdraft fees, Early Pay Day |

Everyday Checking | Overdraft Services, check writing, Early Pay Day |

Prime Checking

| Interest-bearing, free check orders, free Non-Wells Fargo ATM withdrawals |

Premier Checking | priority customer service, No fees on money orders/cashier checks/International debit card purchase |

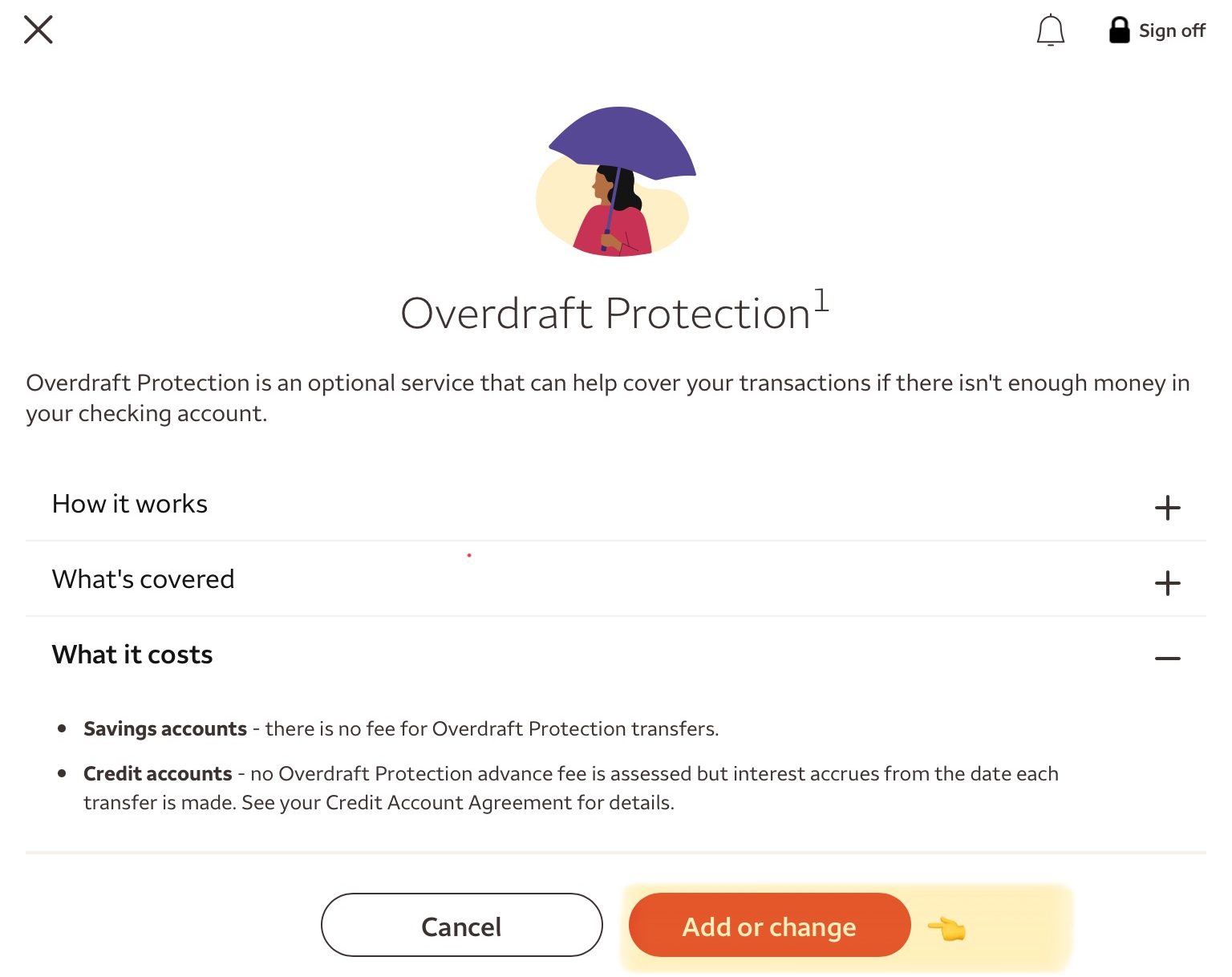

For example, customers can add or change overdraft protection to their account:

The Truist bank checking account offers a range of features designed to meet the diverse needs of customers. Also, Truist offers a range of personal debit cards, combining convenience, security, and ease of use.

These cards provide control over spending with features like setting limits and purchase tracking. Users can earn cash back through exclusive deals, lock and unlock cards via Truist Mobile for security, and benefit from contactless checkout.

Truist Bank Account | Main Features |

|---|---|

Truist One Checking account | Loyalty Bonus on Truist credit cards, Free first order 10-pack checks |

Truist Confidence Account | mobile bill pay, No overdraft fees, No check cashing fees |

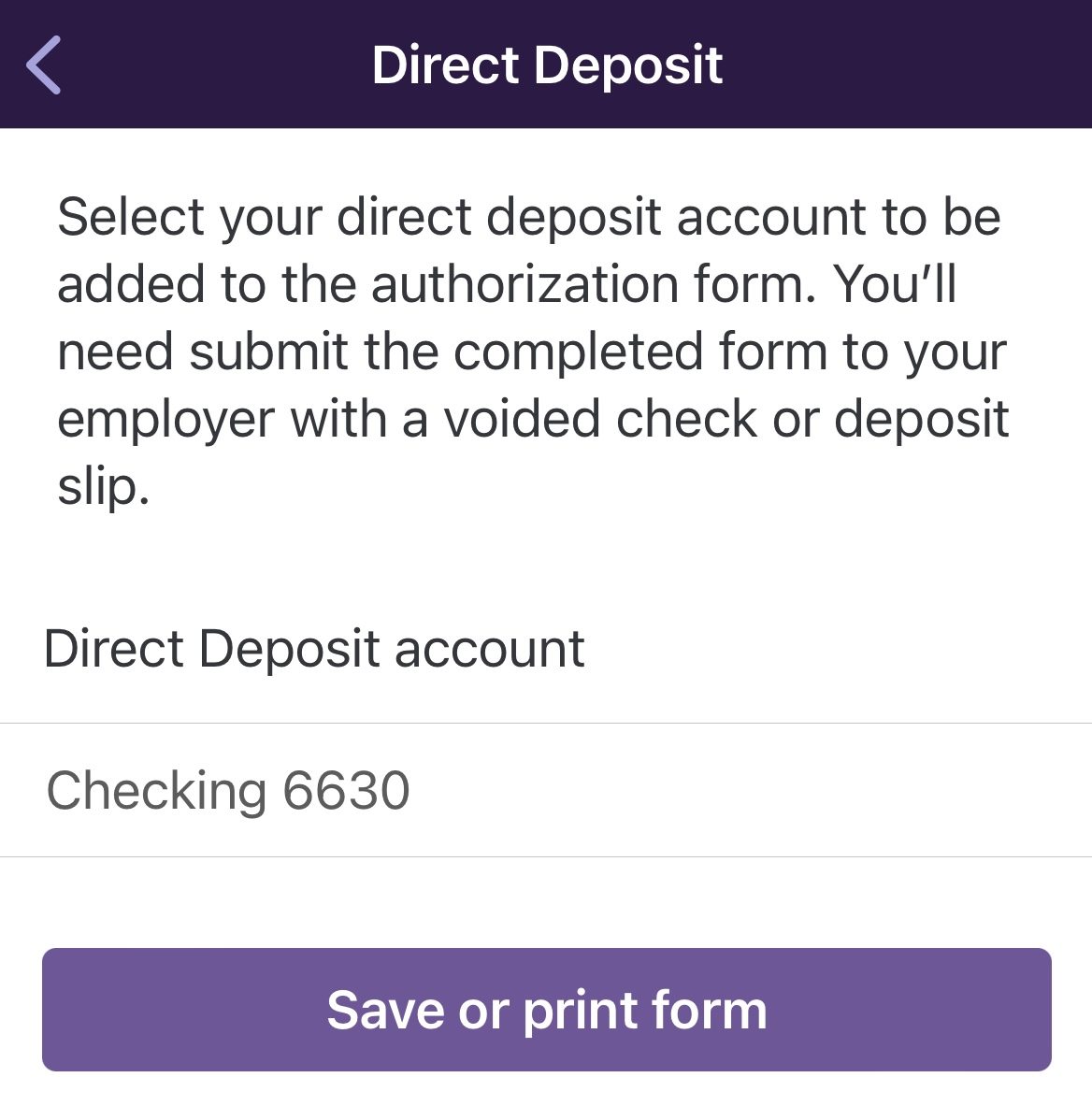

The Truist app allows users to effortlessly select the desired account for direct deposit and provides the option to save or print the authorization form.

Savings Accounts

Wells Fargo is our top pick for savings accounts because it provides better rates than Truist Bank and offers more choices for savers.

Wells Fargo has two main savings account options – Way2Save Savings and Platinum Savings, along with a kids' savings account. Although Way2Save Savings has a low Annual Percentage Yield (APY), the Platinum Savings plan offers a higher rate. However, to access the highest rate, you'll need to have more than $1 million in your account.

Truist Bank, a result of the merger between BB&T and SunTrust, offers savings accounts with different features. The Truist One Savings account provides benefits like no overdraft fees with Truist One Checking and the chance to earn interest. It's a helpful tool for building an emergency fund or working towards specific financial goals.

Truist also has a money market account that you won't find with Wells Fargo, but the rates are comparatively low.

Truist One Savings | Wells Fargo Platinum Savings | |

|---|---|---|

Savings Rate | 0.01% | 0.01% – 2.51% |

Minimum Deposit | $50 | $25 |

Fees | $5

The monthly maintenance fee can be waived by maintain a minimum daily ledger balance of $300 OR

schedule a recurring preauthorized internal transfer of $25 or more per statement cycle into the Truist One Savings account OR

waived for a minor under the age of 18 OR

waived with ANY related Truist checking product

| $5

can be waived by maintaining a $300 minimum daily balance, one qualified automatic transfer, one or more Save as You Go transfers from your Wells Fargo checking account. Primary account owners age 24 or younger are exempt from the fees

|

Certificate Of Deposits (CDs)

When it comes to CDs, Wells Fargo Bank is a better choice for us.

Truist Bank and Wells Fargo both have high CD rates, but they're only available for specific promotional terms.

Keep in mind that Truist Bank doesn't show CD rates on its website, and you can only open Truist CDs in person at a branch, not online.

-

Wells Fargo CD Rates

CD Term | APY | Early Withdrawal Penalty |

|---|---|---|

7 Months | 3.64% – 3.90%

| 3 months interest |

11 Months | 4.50% – 4.76% | 3 months interest |

3 Months | 1.50% – 1.51% | 1 month interest |

6 Months | 1.50% – 1.51% | 3 months interest |

12 Months | 2.00% – 2.01% | 6 months interest |

Credit Cards

When it comes to credit cards, Wells Fargo is our winner due to a bit better credit card features and more importantly – better redemption options than Truist Bank. However, both Truist and Wells Fargo don't offer luxury cards with premium benefits.

Wells Fargo has different credit cards for different needs. If you like getting cash back, the Wells Fargo Cash Wise Visa Card is great for you. It gives you unlimited cash back on what you buy, plus a cash rewards bonus. For those who spend on daily stuff and travel, there's the Wells Fargo Autograph Card. The Reflect card is best for 0% intro APR.

They also have the Choice Privileges Mastercard. With this one, you earn points for staying at certain Choice Hotels. But that's not all – you also get points for buying gas, groceries, home improvement stuff, and phone plans.

Card | Rewards | Bonus | Annual Fee |

| Wells Fargo Active Cash Card

| 2%

2% cash rewards on purchases (unlimited)

| $200

$200 cash rewards bonus when you spend $500 in purchases in the first 3 months

| $0 |

|---|---|---|---|---|

| Wells Fargo Autograph Card | 1X – 3X

3X points on restaurants, travel, gas stations, transit, popular streaming services, and phone plans. Also, earn 1X points on other purchases

| 20,000 Points

20,000 bonus points when you spend $1,000 in purchases in the first 3 months – that's a $200 cash redemption value.

| $0 |

| Wells Fargo Reflect Card | N/A | 0% Intro APR: 21 months on purchases and balance transfers | $0 |

| Wells Fargo Bilt Mastercard | 1x – 3x

3X points on dining, 2X points on travel and 1X points on rent payments without the transaction fees and other purchases

| N/A | $0 |

| Wells Fargo Choice Privileges Mastercard | 1x – 5x

5X points on stays at participating Choice Hotels plus on choice privileges point purchases properties, 3X points on purchases at gas stations, grocery stores, home improvement stores and phone plan services and 1X points on other purchases | 40,000 points

40,000 bonus points when you spend $1,000 in purchases in the first 3 months – enough to redeem for up to 5 reward nights at select Choice Hotels® properties.

| $0 |

| Wells Fargo Choice Privileges Select Mastercard | 1x – 10x

10X points on stays at participating Choice Hotels® properties plus on Choice Privileges point purchases, 5X points on purchases at gas stations, grocery stores, home improvement stores and phone plan services and 1X points on other purchases | N/A | $95 |

Truist Bank also offers a selection of credit cards, with options that cater to various needs, but with fewer redemption options compared to Wells Fargo.

Card | Rewards | Bonus | Annual Fee |

| Truist Enjoy Cash credit card | 1% – 3%

3% cash back on gas and EV charging, 2% on utilities and groceries (up to the $1,000 monthly spend cap) and 1% on all other eligible purchases

OR 1.5% cash back on all eligible purchases | 0% Intro APR 12 months on purchases | $0 |

|---|---|---|---|---|

| Truist Enjoy Travel credit card | 1x – 2x

2x miles per $1 spent on airfare, hotels, and car rentals, 1x on all other eligible purchases | 20,000 miles

20,000 bonus miles when you spend $1,500 in first 90 days after account opening | $0 |

| Truist Future credit card | N/A | 0% Intro APR 15 months on balance transfers and purchases | $0 |

| Truist Enjoy Beyond credit card | 1x – 3x

3x points per $1 spent on airfare, hotels, and car rentals, 2x on dining and 1x on all other eligible purchases | 30,000 points

30,000 bonus points when you spend $1,500 in first 90 days after account opening | $195 |

| Truist Enjoy Cash Secured credit card | 1% – 3%

3% cash back on gas, 2% on utilities and groceries (up to the $1,000 monthly spend cap) and 1% on all other eligible purchase | N/A | $19 |

Lending Options For Borrowers

When it comes to lending products, there is no clear winner as both banks offer more or less the same products, but if we have to choose one – Truist Bank is winning.

Both banks offer various options for home buyers through different types of mortgage programs and options for those who need personal loans or auto loans. Truist also offers special loans such as boat loans and RV loans and, more importantly – home equity lines of credit which are not available through Wells Fargo

None of these banks will have a solution for customers who need student loans, including refinancing.

Which Bank Is Our Winner?

Wells Fargo is our winner in this competition. It offers better savings rates than Truist, more selection for checking accounts, including options for premium accounts and better credit card redemption options compared to Truist Bank.

However, it is crucial to assess various factors, with a primary focus on those that are significant for your specific needs. This could include considerations such as banking services, overdraft assistance, frequent ATM usage, proximity to bank locations, and other elements that vary from person to person.

Compare Truist Versus Other Banks

While Truist is a full-service bank where you can find almost any financial product, Chase is our winner. Here's why – and what else to know: Chase vs. Truist Bank

There is no clear winner as to whether Truist Bank or Bank of America is a better choice, but we prefer the latter. Here's why.

Citibank is our winner due to its checking account options, various credit cards, and better savings account rates than Truist Bank.

Overall, we like Fifth Third a bit more than Truist bank, mainly due to the various checking options. Truist is better in credit cards.

Each bank excels in different categories, but our winner is M&T Bank over Truist. There are some reasons for that, here's our comparison: Truist Bank vs. M&T Bank

Our winner is PNC Bank as it offers more options for checking and higher savings rates than Truist bank. Here's our comparison: Truist Bank vs. PNC Bank

Both Truist and TD Bank are active in a variety of states, such as Florida, Georgia, North And South Carolina, and more. Here's our winner: Truist Bank vs. TD Bank

There is no clear-cut answer to which bank is better, but Regions Bank is better than Truist if we have to choose one. Here's why: Truist Bank vs. Regions Bank

Our preferred choice is American Express, which provides a comprehensive banking package that outshines Truist Bank. Here's how they compare: Truist Bank vs. American Express Bank

Understanding Our Banking Comparison Methodology

In our thorough banking comparison, The Smart Investor team carefully reviewed and compared banks across five key categories:

Checking Accounts (30%): We examined features like direct deposit, debit card availability, monthly fees, ATM and branch access, check deposit, bill pay options, and account alerts. We also considered any special offers available to customers.

Savings Accounts and CDs (20%): Our focus was on important factors such as the Annual Percentage Yield (APY), minimum deposit requirements, account flexibility, FDIC insurance coverage, special savings offers, variety of CDs, automatic renewal options, and early withdrawal penalties.

Credit Cards (15%): We analyzed rewards programs, annual fees, introductory bonuses, travel benefits, APR, and balance transfer options offered by each bank's credit cards to provide a comprehensive comparison of available features.

Lending Options (15%): We assessed the variety of loan options provided, including personal loans, student loans, mortgages, secured loans, HELOCs, and Home Equity Loans, offering insights into the banks' lending capabilities.

Customer Experience and Bank Reputation (20%): Our evaluation included an analysis of online banking and mobile app usability and ratings, accessibility of customer support, online reviews, JD Power research, Trustpilot ratings, and overall financial stability, providing a holistic view of customer experience and reputation.

Compare Wells Fargo With Other Banks

Capital One began as a credit card company, but has expanded its line of banking products to rival a traditional bank. Aside from checking and savings accounts, you can also get loan refinancing, auto finance, and children's accounts.

Wells Fargo offers an even broader range of products. There are several checking accounts available, as well as two savings accounts and investment options such as IRAs and 401ks. You can also get loans and mortgages, as well as wealth management services. Wells Fargo is thus a highly comparable alternative to the traditional high street bank.

Read Full Comparison: Capital One vs Wells Fargo: Which Bank Wins?

Wells Fargo offers a diverse range of products, including checking accounts, savings accounts, loans, mortgages, and investments such as 401ks, IRAs, and wealth management options.

US Bank offers an even more impressive range of banking services. Savings and checking account options, investments, personal loans, mortgage products, and wealth management are all available.

Read Full Comparison: Wells Fargo vs US Bank: Which Bank Account Is Better?

Both Ally and Wells Fargo have a fairly impressive banking product lineup that would make switching from a traditional high street bank simple.

Ally offers CDs, auto loans, mortgages, investments, and retirement products in addition to checking and savings. The only glaring omission in the lineup is the absence of a credit card.

Wells Fargo's product lineup is even more impressive. Checking and savings accounts, mortgages, loans, and a variety of investment options such as IRAs, 401ks, and wealth management services are all available.

Read Full Comparison: Ally vs Wells Fargo: Which Bank Account Is Better For You?

Both banks offer a good selection of banking products, making it easier to switch from your current bank.

Citi offers CDs, personal loans, mortgages, IRAs, investment options, wealth management plans, and a variety of credit card options in addition to checking and savings accounts.

Wells Fargo provides savings and checking accounts, but it also provides mortgages, loans, and investment options such as IRAs, 401ks, and wealth management products.

Read Full Comparison: Citi vs Wells Fargo: Which Bank Account Is Better?

The Wells Fargo service is even more extensive. Checking accounts, various savings accounts, mortgages, loans, and investment options such as IRAs, 401ks, and wealth management solutions are all available.

PNC offers checking and savings accounts, home loans, mortgages, investments, student loan refinancing, and a variety of credit cards.

Read full comparison: Wells Fargo vs PNC: Which Bank Account Wins?

Chase and Wells Fargo appear to offer very similar products at first glance, so we need to dig a little deeper. There is little to distinguish the savings accounts, and both banks provide a variety of checking accounts.

While Chase's account maintenance fee is slightly higher, it does have some more interesting features. Chase also has an advantage in terms of CDs, but Wells Fargo is a better option for loans and mortgages.

Read Full Comparison: Chase vs Wells Fargo: Where to Save Your Money?

Wells Fargo offers a diverse range of banking services. Checking accounts, savings accounts, loans, mortgages, wealth management solutions, and investment options such as 401ks and IRAs are all available. Flagstar also offers a diverse product portfolio that includes a variety of checking and savings accounts, investments, home loans, and loans and investments.

It is important to note, however, that Flagstar does not operate in all states. This bank only operates in Michigan, California, Ohio, Indiana, and Wisconsin, where it has 150 branches. As a result, if you live outside of these areas, you may be unable to use Flagstar's banking services.

Read Full Comparison: Wells Fargo vs Flagstar: Which Bank Is Better For You?

Wells Fargo's product offering is even more extensive. This bank offers checking accounts, a variety of savings accounts, mortgages, loans, and investment options such as IRAs, 401ks, and wealth management services. This makes switching from another bank even easier because you'll have access to all of your favorite banking products.

Bank of America offers a diverse range of banking services. Checking and savings accounts, auto loans, home loans, credit cards, and investment options are all available.

Read Full Comparison: Bank of America vs Wells Fargo: Which Bank Is Better?

There is no clear winner when comparing Wells Fargo and TD bank, but if we have to pick, TD comes out ahead. Here's why.

While Wells Fargo Bank and Citizens Bank offer a range of banking services, Wells Fargo is our winner in this competition. Here's why.

Wells Fargo Bank vs. Citizens Bank : Which Bank Account Is Better?

Fifth Bank may be better than Wells Fargo when it comes to checking accounts, but is it enough? See our complete comparison, and our winner: Wells Fargo Bank vs. Fifth Third Bank

Let's compare savings accounts, checking accounts, CDs, credit cards, and lending products offered by Wells Fargo and M&T Bank.

Wells Fargo Bank vs. M&T Bank: Which Bank Account Is Better?

BMO has great options for checking accounts, and outshines Wells Fargo with higher savings rates. But is it our winner? See our comparison: Wells Fargo vs. BMO Bank

We'll explore Wells Fargo and Regions Bank savings accounts, checking accounts, CDs, credit cards, and lending products. Here's our winner: Wells Fargo vs. Regions Bank

There is no clear winner between SoFi and Wells Fargo as each bank excels in different areas – but Wells Fargo is our winner. Here's why.