Table Of Content

When Wells Fargo Bank Wins?

Wells Fargo has an impressive selection of banking products. You’ll find a few different checking accounts, savings accounts, loans, mortgages, wealth management solutions and investment options including 401ks and IRAs.

Wells Fargo can be a better choice than Flagstar Bank if:

You’re interested in low deposit mortgages

You want access to larger loan options

You want access to 24/7 customer service

You live in any state in the US

When Flagstar Bank Wins?

Flagstar also has a comprehensive product line with multiple checking and saving accounts, investments, home loans, loans and investments.

However, it is important to note that Flagstar does not operate in all states. This bank only offers services in Michigan, California, Ohio, Indiana and Wisconsin, with 150 branches across these states. So, if you are outside of these areas, you may not be able to access the Flagstar banking services.

Flagstar Bank can be a better choice than Wells Fargo if:

You want better CD rates

You want the best savings rates

You live in the Flagstar operating states.

Wells Fargo | Flagstar Bank | |

|---|---|---|

Savings Accounts | ||

Checking Accounts | ||

CDs | ||

Money Market Account | ||

Debit Card | ||

Credit Cards | ||

Personal Loans | ||

Mortgage | ||

Government Mortgage | ||

Business Loans | ||

Investing Capabilities |

Savings Account

Both banks have a savings account with a monthly maintenance fee, but while Flagstar’s fee is lower, the waiver criteria is similar. Flagstar also offers a higher interest rate with its basic savings account. Overall, both banks offer quite low APYs compared to national average.

Wells Fargo offers savings accounts upgrades to allow you to access higher rates and more features, but this typically requires a higher account balance. Like Wells Fargo, Flagstar has several savings accounts options, including a high yield savings account that has a tiered interest rate according to your balance.

Wells Fargo | Flagstar Bank | |

|---|---|---|

APY | 0.26% – 2.51% | 4.20% |

Fees | $5

can be waived by maintaining a $300 minimum daily balance, one qualified automatic transfer, one or more Save as You Go transfers from your Wells Fargo checking account. Primary account owners age 24 or younger are exempt from the fees

| $3 |

Minimum Deposit | $25 | $0 (Branch) $1 (Online) |

Checking Needed? | No | No |

Main Benefits |

|

|

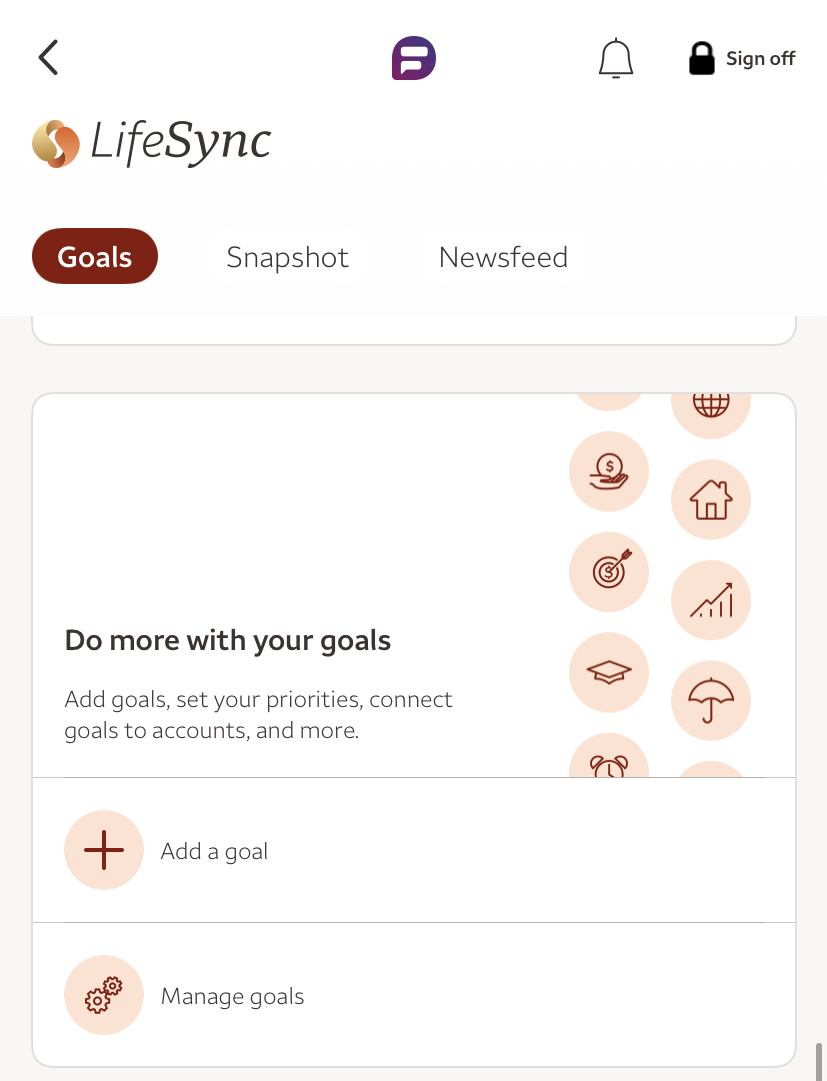

LifeSync is a valuable resource within the Wells Fargo app that helps users stay on top of their financial goals:

Checking Account

Neither the basic Wells Fargo or Flagstar checking accounts are interest bearing and you will need to consider the monthly maintenance fee. Both accounts have a $10 fee, but the Wells Fargo waiver criteria is more lenient. Additionally, Wells Fargo requires a $25 minimum deposit, while Flagstar requires $50.

One nice touch of the Wells Fargo account is that you have check writing capabilities. This is becoming less and less common, as other payment methods become more popular. However, it is nice to be able to write a check if you don’t want to share your debit card details.

Both banks also have upgrade and downgrade options. For example, Flagstar has the SimplySelect checking account that is interest bearing, but the account maintenance fee is higher and the waiver criteria is more stringent.

Wells Fargo | Flagstar Bank | |

|---|---|---|

APY | 0.05% – 0.10% | 0% |

Fees | $10

Related to Wells Fargo Everyday Checking. The fee can be waived if you maintain a minimum daily balance of $500 or receive at least $500 in qualifying direct deposits per month. The fee is also waived if you’re 17 to 24 and have a linked Wells Fargo Campus Debit Card or Campus ATM card linked to the checking account

| $10 per month

Can be waived if you aintain an average daily balance of $1k, receive $2,500 in deposits, 10+ debit card or ATM transactions

|

Minimum Deposit | $25 | $50 |

Main Benefits |

|

|

CDs

In the CD comparison, Flagstar certainly has the edge. While Wells Fargo has a $2,500 minimum deposit, Flagstar’s is just $500.

There is no major difference when it comes to interest rate. The longer you lock your money – the higher rate you'll earn.

Wells Fargo | Flagstar Bank | |

|---|---|---|

Minimum Deposit | $2,500 | $500 |

APY Range | 1.50% – 4.00% | Earn up to 4.40% |

Credit Cards

Wells Fargo offers a diverse selection of credit cards to meet various financial needs:

Card | Rewards | Bonus | Annual Fee | Wells Fargo Active Cash Card

| 2%

2% cash rewards on purchases (unlimited)

| $200

$200 cash rewards bonus when you spend $500 in purchases in the first 3 months

| $0 |

|---|---|---|---|---|

Wells Fargo Autograph Card | 1X – 3X

3X points on restaurants, travel, gas stations, transit, popular streaming services, and phone plans. Also, earn 1X points on other purchases

| 20,000 Points

20,000 bonus points when you spend $1,000 in purchases in the first 3 months | $0 | |

Wells Fargo Reflect Card | N/A | 0% Intro APR: 21 months on purchases and balance transfers | $0 | |

Wells Fargo Bilt Mastercard | 1x – 3x

3X points on dining, 2X points on travel and 1X points on rent payments without the transaction fees and other purchases

| N/A | $0 | |

Wells Fargo Choice Privileges Mastercard | 1x – 5x

5X points on stays at participating Choice Hotels plus on choice privileges point purchases properties, 3X points on purchases at gas stations, grocery stores, home improvement stores and phone plan services and 1X points on other purchases | 40,000 points

40,000 bonus points when you spend $1,000 in purchases in the first three months – enough to redeem up to five Rewards nights at select Choice Hotel® properties.

| $0 | |

Wells Fargo Choice Privileges Select Mastercard | 1x – 10x

10X points on stays at participating Choice Hotels® properties plus on Choice Privileges point purchases, 5X points on purchases at gas stations, grocery stores, home improvement stores and phone plan services and 1X points on other purchases | N/A | $95 |

Each card includes benefits like cell phone protection and access to FICO® Credit Scores. Wells Fargo's credit card offerings cater to a range of preferences, from cash back and rewards to balance transfer options.

Flagstar Bank offers a selection of Visa® credit cards to suit various financial needs:

Maximum Rewards® Visa Signature® Card: Earn unlimited 1.5% cash back on all purchases, with a $100 cash bonus after spending $1,000 within the first three billing cycles.

Platinum Edition® Visa® Card: Provides a low introductory APR on purchases and balance transfers, plus a $100 statement credit after spending $1,000 within the first three billing cycles.

Secured Visa® Card: Designed to help build or improve credit, this card requires a security deposit and reports to major credit bureaus.

Mortgage

Both of the banks offer mortgage and home loan products. Wells Fargo has FHA and VA loans along with fixed rate mortgages.

However, what is nice about Wells Fargo mortgages is the potential for a low down payment. You’ll only need 3% or more for a fixed rate mortgage, while the FHA loans need 3.5% or higher.

Wells Fargo also has home equity finance where you can borrow up to $500k. Your loan amount will be determined by your property value. You can borrow up to 80% less mortgages, liens, or loans secured on the property.

Flagstar also has a variety of mortgage products including fixed rate for up to 30 years, FHA, Jumbo, and VA loans. Flagstar aims to make the process easier, whether you’re a first time buyer or have purchased a home before.

You can apply online and the Flagstar bankers will guide you through the process and advise you on loan terms and their most competitive rates.

Loans

Wells Fargo also has a variety of loans including auto loans, student loans and personal loans for up to 100k. The Wells Fargo personal loans have no closing fees, prepayment penalties or origination fees, you may even qualify for a discount on the fixed rates. The loans have a maximum term of 84 months.

Flagstar also offers various loans including auto, boat, and motorcycle loans. However, while the terms are flexible, for example, qualified customers can borrow up to 110% of the vehicle’s value, there is no conventional personal loan option. One plus point for Flagstar loans is that the bank offers rate discounts for new customers and those who link their loan to a Flagstar checking account.

Customer Service

Wells Fargo has a 24/7 general banking helpline if you want to speak to a customer service agent, but if you have a query, you may be able to find answers on the website support page.

Flagstar also has a comprehensive support section on its website with FAQs and stock forms. However, if you want to speak to an agent, there is only a 24 hour voice banking line. The other customer service lines are typically open 7.30 am to 9 pm on weekdays and 8.30 am to 6 pm on Saturdays.

Unfortunately, neither bank has a great rating on the consumer review sites. Wells Fargo has an average 2.3 out of 5 on Trustpilot, while Flagstar has a marginally better 2.6/5.

Online/Digital Experience

Both banks have an app available for iOS and Android devices. Wells Fargo’s app is rated 4.8/5 on both the Apple Store and Google Play. Flagstar’s app has 4.6/5 on the Apple Store and 4.1/5 on Google Play.

Both sites have a clean design and are easy to use that offers a great user experience. You can explore and compare the products and access support materials.

Which Bank is The Winner?

Both these banks have a fairly comprehensive product line, but there are some key differences which will impact which one is best for you.

Both banks have a choice of checking and saving accounts, so you can choose the tier that best suits your needs. Both banks also offer mortgages, but Wells Fargo is the only one of the two offering genuine personal loans. However, Flagstar does offer better rates for savings and CDs. So, which bank is best will depend on what you are looking for.

FAQs

Does Wells Fargo offer promotion for new customers?

Yes, Wells Fargo promotions are viable for both banking and credit card products. As of October 2025 , you can get up to $300 for opening a new personal checking account.

Can you invest in Crypto via Wells Fargo?

Wells Fargo does allow buying cryptocurrencies, but this investment strategy is only available to the bank’s wealthier customers.

Although the bank does not disclose the details to meet this criteria, it is easy to assume that you must use the Wells Fargo dedicated financial investor program which requires at least $100,000 as a minimum investment.

What Does Wells Fargo offer for Millenials?

As a large bank with lots of branches and a great online platform, Wells Fargo certainly offers convenience and functionality. You can pick and choose the products that appeal to you and apply for them by phone, in person or online.

Once you open your account, you can manage it online or via the Wells Fargo app. This allows you to do your banking at your own convenience.

Can I open a Flagstar checking account online?

Can I open a Flagstar checking account online?

Flagstar offers a variety of checking accounts, but they tend to require that you call the Flagstar customer support line to open one. While this may not be as convenient as an online application, you will have a member of the Flagstar team to guide you through the account opening procedure.

Can you invest in gold via Flagstar ?

Flagstar does have an investment arm with a team of financial consultants who can assist you. The investment side of the bank does allow you to buy, sell and trade a variety of products including stocks. This makes it possible to buy gold stocks via Flagstar. The fees and charges for each of these transactions can vary depending on what items you purchase, but the website does not detail these charges upfront.

You need to find a financial consultant and then you can go through the terms and conditions before you sign up. This may be a little frustrating for those who are unsure whether getting into investing is financially viable, as you will need to discuss your plans to find out the applicable charges.

Is Flagstar worth it for Joint Accounts?

Flagstar supports account co-ownership, so it is possible to have joint ownership with a variety of the Flagstar products. This means that you can have a joint checking or savings account. Of course, you will need to verify the ID of both parties and when you go into the branch to open the account, both of you will need to be there.

This is less convenient than many other banks that offer joint accounts, but it does give the assurance that Flagstar takes account security very seriously.

The Smart Investor Banking Comparison Methodology

In our detailed comparison, The Smart Investor team thoroughly looked in five main areas:

Checking Accounts (30%): We checked things like direct deposit, debit card availability, monthly fees, ATM and branch access, check deposit, bill pay options, and account alerts. We also considered any special offers for customers.

Savings Accounts including CDs (20%): We focused on important stuff like how much interest you can earn (APY), the smallest amount you need to open an account, how flexible the accounts are, and if they're insured by FDIC. We also looked at special savings offers, different types of CDs, and any fees for taking money out early.

Credit Cards (15%): We looked at what rewards you get, how much the card costs each year, any bonuses you get for signing up, perks for traveling, how much interest you pay on balances, and if you can transfer balances from other cards.

Lending Options (15%): We checked out the different kinds of loans they offer, like personal loans, student loans, mortgages, and loans where you use your home as collateral.

Customer Experience And Bank Reputation (20%): We looked into how easy it is to use their online and mobile banking, how helpful their customer support is, what people say about them online, any awards they've won, and how stable they are financially. This gave us a good idea of what it's like to be a customer and how much people trust them.

Compare Wells Fargo With Other Banks

Capital One began as a credit card company, but has expanded its line of banking products to rival a traditional bank. Aside from checking and savings accounts, you can also get loan refinancing, auto finance, and children's accounts.

Wells Fargo offers an even broader range of products. There are several checking accounts available, as well as two savings accounts and investment options such as IRAs and 401ks. You can also get loans and mortgages, as well as wealth management services. Wells Fargo is thus a highly comparable alternative to the traditional high street bank.

Read Full Comparison: Capital One vs Wells Fargo: Which Bank Wins?

Wells Fargo offers a diverse range of products, including checking accounts, savings accounts, loans, mortgages, and investments such as 401ks, IRAs, and wealth management options.

US Bank offers an even more impressive range of banking services. Savings and checking account options, investments, personal loans, mortgage products, and wealth management are all available.

Read Full Comparison: Wells Fargo vs US Bank: Which Bank Account Is Better?

Both Ally and Wells Fargo have a fairly impressive banking product lineup that would make switching from a traditional high street bank simple.

Ally offers CDs, auto loans, mortgages, investments, and retirement products in addition to checking and savings. The only glaring omission in the lineup is the absence of a credit card.

Wells Fargo's product lineup is even more impressive. Checking and savings accounts, mortgages, loans, and a variety of investment options such as IRAs, 401ks, and wealth management services are all available.

Read Full Comparison: Ally vs Wells Fargo: Which Bank Account Is Better For You?

Both banks offer a good selection of banking products, making it easier to switch from your current bank.

Citi offers CDs, personal loans, mortgages, IRAs, investment options, wealth management plans, and a variety of credit card options in addition to checking and savings accounts.

Wells Fargo provides savings and checking accounts, but it also provides mortgages, loans, and investment options such as IRAs, 401ks, and wealth management products.

Read Full Comparison: Citi vs Wells Fargo: Which Bank Account Is Better?

The Wells Fargo service is even more extensive. Checking accounts, various savings accounts, mortgages, loans, and investment options such as IRAs, 401ks, and wealth management solutions are all available.

PNC offers checking and savings accounts, home loans, mortgages, investments, student loan refinancing, and a variety of credit cards.

Read full comparison: Wells Fargo vs PNC: Which Bank Account Wins?

Chase and Wells Fargo appear to offer very similar products at first glance, so we need to dig a little deeper. There is little to distinguish the savings accounts, and both banks provide a variety of checking accounts.

While Chase's account maintenance fee is slightly higher, it does have some more interesting features. Chase also has an advantage in terms of CDs, but Wells Fargo is a better option for loans and mortgages.

Read Full Comparison: Chase vs Wells Fargo: Where to Save Your Money?

Wells Fargo's product offering is even more extensive. This bank offers checking accounts, a variety of savings accounts, mortgages, loans, and investment options such as IRAs, 401ks, and wealth management services. This makes switching from another bank even easier because you'll have access to all of your favorite banking products.

Bank of America offers a diverse range of banking services. Checking and savings accounts, auto loans, home loans, credit cards, and investment options are all available.

Read Full Comparison: Bank of America vs Wells Fargo: Which Bank Is Better?

There is no clear winner when comparing Wells Fargo and TD bank, but if we have to pick, TD comes out ahead. Here's why.

Wells Fargo offers better savings rates than Truist Bank, more selection for checking accounts and better credit cards. Here's our comparison: Truist Bank vs. Wells Fargo Bank

While Wells Fargo Bank and Citizens Bank offer a range of banking services, Wells Fargo is our winner in this competition. Here's why.

Wells Fargo Bank vs. Citizens Bank : Which Bank Account Is Better?

Fifth Bank may be better than Wells Fargo when it comes to checking accounts, but is it enough? See our complete comparison, and our winner: Wells Fargo Bank vs. Fifth Third Bank

Let's compare savings accounts, checking accounts, CDs, credit cards, and lending products offered by Wells Fargo and M&T Bank.

Wells Fargo Bank vs. M&T Bank: Which Bank Account Is Better?

BMO has great options for checking accounts, and outshines Wells Fargo with higher savings rates. But is it our winner? See our comparison: Wells Fargo vs. BMO Bank

We'll explore Wells Fargo and Regions Bank savings accounts, checking accounts, CDs, credit cards, and lending products. Here's our winner: Wells Fargo vs. Regions Bank

There is no clear winner between SoFi and Wells Fargo as each bank excels in different areas – but Wells Fargo is our winner. Here's why.

Banking Reviews

Aspiration Review

Alliant Credit Union Review