Table Of Content

How Monthly Maintenance Fees Work?

The monthly service fee, also known as the monthly maintenance fee, is the amount the bank charges in return for the banking services they provide for you. In most cases, the monthly fee is automatically deducted from your checking account by the end of each statement period and is considered one of the most common bank fees.

The is no standard monthly service fee banks charge. The exact amount depends on the financial institution itself, as well as on the type of account in question.

Generally speaking, basic checking accounts and savings accounts have lower monthly fees. On the other hand, we have premier checking accounts. This includes some rewards and benefits. However, the monthly maintenance fees are higher as well.

Fortunately, banks waive monthly service fees with most accounts if you meet specific requirements. In most cases, this has to do with arranging for electronic payments to be made to the account or maintaining a certain amount of minimum balance at all times.

Citibank Checking Account vs. Savings Account Fees

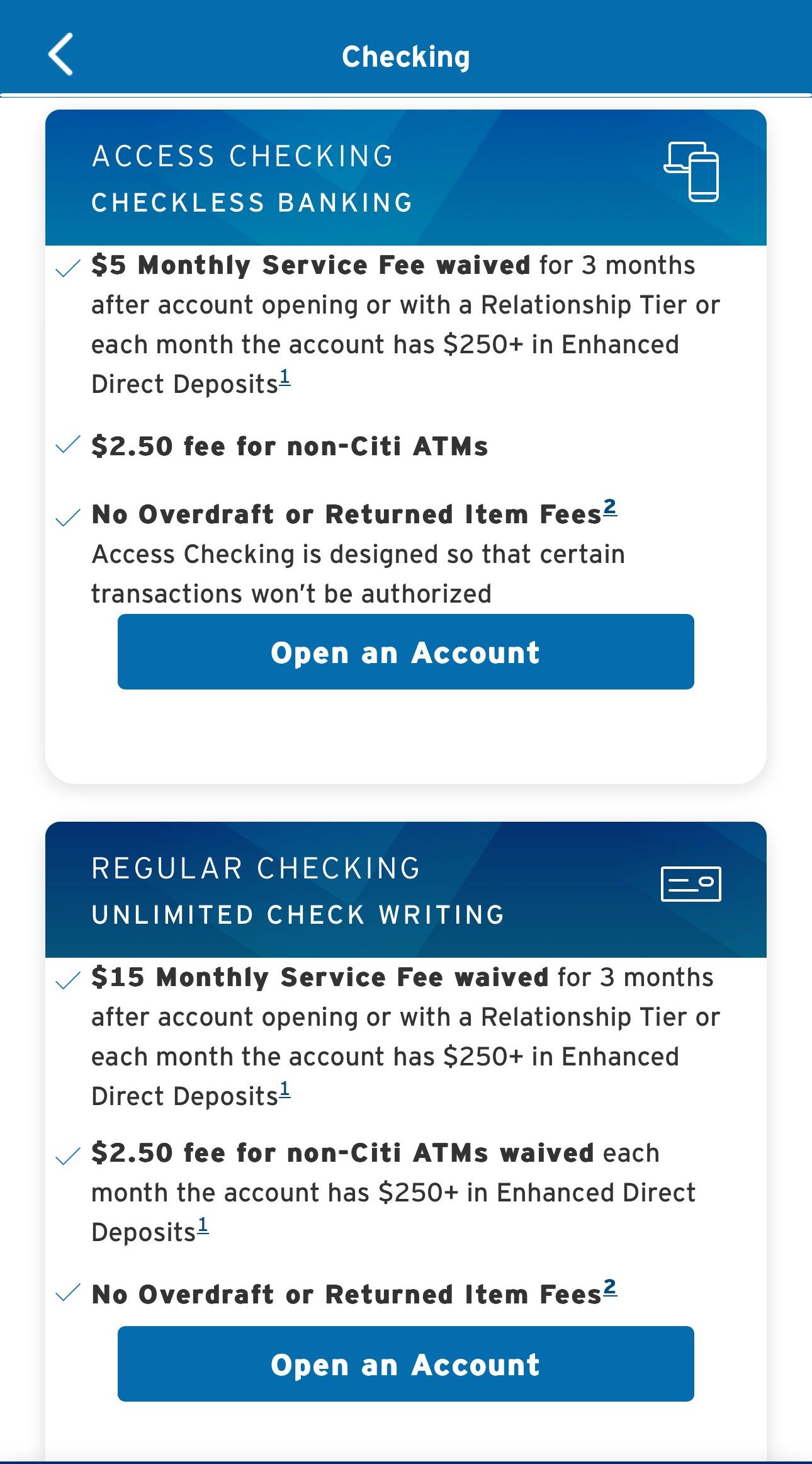

Citibank offers several checking account types to choose from. One thing to keep in mind here is that the exact rates might vary depending on your state and location.

Citi Account | Monthly Fee | Avg Day Balance To Waive Fee |

|---|---|---|

Citi Access Checking | $5 | $30,000 |

Citi Regular Checking | $15 | $30,000 |

Citi Priority Account Package | $0 | $30,000 |

Citigold Account Package | $0

| $200,000 |

Citigold Private Client | $0 | $1,000,000 |

Here is the complete list of those six checking packages with some details:

- Citi Access Checking – This includes the most basic Citi checking account, which allows you to deposit, pay bills, and send money to family and friends. At the same time, you will have 24/7 access to online banking. This package costs $5 per month. The downside is that you cannot use paper checks with this account.

- Citi Regular Checking – You can do all the things mentioned above. In addition to that, you can write an unlimited number of checks. Another upside to this account is that you get free access to all Citibank ATMs. With this package, you can also have a linked savings account. The cost of this package is $15 per month.

- Citi Priority Account Package – Besides all the benefits listed above, you get preferred pricing and interest rates on some products and Citibank priority advisors. There is no monthly fees but you should have a combined average balance of at least $30,000.

- Citigold Account Package – The previous four packages are available for any Citibank client and new clients. However, the Citigold Account Package requires the average monthly minimum balance of $200,000 in deposit, investment and retirement accounts. So this package is not available for everyone, but one advantage here is that there are no monthly service fees. You also get an unlimited reimbursement of non-Citi ATM fees and access to Citibank’s wealth management platform.

- Citigold Private Client – With this package, you get all of the benefits from the previous package, plus premier banking services and access to premium benefits from MasterCard Travel and lifestyle services. This package also does not have any monthly fees. However, you must maintain an average monthly minimum balance of $1,000,000 in deposit, investment and retirement accounts

How to Avoid Citibank Checking Account Fees?

One good thing with Citibank’s account packages is that you can avoid paying any monthly service fees with all of them. However, the average balance needed for Citi Access and Citi Regular checking is a bit high.

Citi Account | Monthly Fee | Avg Day Balance To Waive Fee |

|---|---|---|

Citi Access Checking | $5 | $30,000 |

Citi Regular Checking | $15 | $30,000 |

Citi Priority Account Package | $0 | $30,000 |

Citigold Account Package | $0

| $200,000 |

Citigold Private Client | $0 | $1,000,000 |

Here are the details for each package:

- Access Account Package – In order to avoid monthly service fees here, you need to make one direct deposit and 1 bill payment per statement period. Alternatively, Citibank will waive the maintenance fee if you keep a combined average monthly balance of $1,500 or higher.

- Basic Banking Package – Here, the requirements to avoid monthly service fees are identical to the Access Account Package.

- The Citibank Account Package – In this case, there are no requirements to make direct deposits or bill payments. On the other hand, you need to maintain a combined average monthly balance of $10,000 or higher. This includes deposit, investment, and retirement accounts.

- Citi Priority Account Package – The terms are similar to the previous case. The only difference here is that in here you need to maintain a combined average monthly balance of $30,000 or higher.

- Citigold Account Package – If you hold an average combined monthly balance of $200,000 or higher on deposit, investment and retirement accounts, you qualify for this account package. You do not need to do anything else to avoid fees since there are no monthly fees.

- Citigold Private Client – The conditions are the same as those of the previous package. The only difference is that you need an average combined monthly balance of $1,000,000 or higher.

How are Citibank's Monthly Fees Compared to Other Traditional Banks?

When we compare checking accounts, Citibank’s monthly fees are roughly in line or even higher than other major US banks charge.

However, one way Citibank differs from some of the others is that Citibank charges its fees on the package of checking and deposit accounts, which makes the process much simpler. It also makes it easier for clients to meet the requirements for waiving the monthly service fee.

Another important thing to note here is that Citibank allows its clients to waive fees with its account packages. This is not the case with some other significant banks.

For example, Chase bank’s Secure Banking checking account, you have to keep paying a $4.95 fixed monthly service fee, regardless of the size of your balances. Overall, PNC and US Bank monthly maintenance fees are the lowest among traditional banks.

Bank/institution | Monthly Fee | |

|---|---|---|

| $12

Can be waived if you maintain a $1,500 minimum daily balance, making direct deposits or Associated SnapDeposits of $500 or more per statement cycle, or holding $5,000 in combined deposit accounts with the same statement cycle date or having a Health Savings Account or investment account

| |

| $12

can be waived by maintaining an account balance of $1,500, qualifying deposit of $250+ per month or enrol in Preferred Rewards

| |

$12

Can be waived if you make one qualifying direct deposit and one qualifying bill payment per statement period, maintain a combined balance of $1,500 per month across your eligible accounts or if you’re aged 62

| ||

| $7 – $25 per month

can be waived if you maintain $500+/$2,000/$5,000 direct deposit per month, $500+/$2,000/$5,000 monthly balance in savings or age 62+/$10,000 in all PNC consumer deposit accounts/$25,000 in all PNC consumer deposit accounts/

| |

| $6.95

Can be waived by maintaining an average account balance of $1,500, have $1,000+ in direct deposits per month or be aged 65+

| |

| $10

Related to Wells Fargo Everyday Checking. The fee can be waived if you maintain a minimum daily balance of $500 or receive at least $500 in qualifying direct deposits per month. The fee is also waived if you’re 17 to 24 and have a linked Wells Fargo Campus Debit Card or Campus ATM card linked to the checking account

|

When it comes to traditional banks, Citibank's fees are higher than most banks. If you compare Citi account fees to Chase, we can see they both charge the same fee. Also when comparing Bank of America with Citibank, we can see the differences are minor – and they both offer multiple ways to waive it.

How to Avoid Citibank Savings Account Fees?

With some other banks, there are two separate service fees for checking and savings accounts. So you need to meet the requirements of both of those accounts to avoid paying fees.

However, with Citibank, the process is simplified. This is because checking and savings accounts are included within a single package. So, for example, if you have Citibank Account Package, held a $10,000 balance, and avoided service fees, then that benefit will also extend to your savings account.

So, in this case, you do not need to maintain any additional balances on your savings account to avoid any extra monthly fees.

Does Citi Offer a Fee-Free Checking Account?

As of April 2025, Citibank only offers three account packages with no fees: Citi Priority checking, Citigold Account Package and Citigold Private Client.

The only obstacle here is that to qualify for those packages; you need to hold large balances on deposit, investment, and retirement accounts, as described above.

How to Avoid Citibank Overdraft Fees?

One of the critical benefits of Citibank’s Basic Banking Package is that you do not pay any fees for withdrawing money from Citibank’s ATMs or making ATM cash deposit.

So if you have a more basic Access Account Package and avoiding ATM fees is essential, it might be worthwhile to consider upgrading to Basic Banking Package.

The cost differential between those two is relatively small, just $2 a month. It is also helpful to remember that you can avoid paying monthly service fees with this package if you maintain an average monthly balance of $1,500.

So you can avoid paying any ATM fees if you have Citibank’s basic banking package and only use ATMs belonging to Citibank.

One thing to mention here is that, with Citigold Account Package and the Citigold Private Client package, you get full reimbursement for non-Citibank ATM fees.

How are Citibank's Monthly Fees Compared to Other Online Banks?

Generally speaking, online banks do offer lower fees compared to Citibank. For example, Capital One bank, Sofi bank, Marcus, and other online banks have no monthly maintenance fees associated with checking or savings accounts.

This is not surprising since online banks do not have to pay for the upkeep of hundreds of branches. As a result, many online banks pass some of those savings to the customer.

Bank/institution | Monthly Fee | |

|---|---|---|

| CIT Bank | $0 |

Capital One 360 Checking | $0 | |

| Amex Rewards Checking | $0 |

Axos Bank | $0 | |

| Chime Banking | $0 |

Discover Bank | $0 | |

SoFi Bank | $0 | |

| Marcus | $0 |

FAQs

Every bank has its advantages and disadvantages. Citibank offers its clients account packages, which simplifies choosing banking products. This bank also allows avoiding paying monthly service fees.

Bank fees themselves are mostly in line with other major banks. On the other hand, most online banks might offer lower fees compared to Citibank.

Qualifying deposits represent an unrestricted balance held at instant access savings and money market accounts. The bank pays a certain amount of interest on those deposits.

Some banks require qualifying deposits to equal a certain amount to waive monthly service fees.

Daily balance measures the balance held at the specific account at the start or end of each day. The combined balance measures the total balance amount across different accounts, such as savings, retirement, and investment accounts.

When setting the criteria for waving monthly service fees, banks look at the daily balance on checking or savings account with some accounts. At the same time, in the case of some accounts, it is the combined balance that is taken into account.

As a new Citibank customer, you can earn $325 bonus; the exact amount of the bonus depends on the size of your deposit. You need to open the account, deposit the money and maintain it for at least 80 days.

One thing to remember here is that you must not have had a checking account with Citibank within the last six months to qualify for this bonus.

With the cheapest account packages available at Citibank, the interest rate on savings accounts stands at 3.70%. However, upgrading to premium packages might earn higher rates on savings accounts, but it's still far below what you can get with the best savings accounts.

In contrast, some online banks offer savers around 2% to 3% interest rates on instant access savings accounts. If you compare Citi with Bank of America or Chase, most of them offer more or less the same rates as of April 2025.

While some Citi credit cards require an annual fee, there are many Citi cards with no annual fee.

For example, the Citi® Double Cash Card has no annual fee with nice rewards – 2% cash back rewards rate – 1% every time you swipe and another 1% upon payment.. The Citi Custom Cash℠ Card annual fee is $0 and customers can earn 5% cash back on your highest eligible spend category each billing cycle up to the first $500 spent and 1% cash back thereafter.