Table Of Content

What is a Monthly Service Fee?

Customers of financial institutions such as banks or credit unions have typically assessed a fee for using a savings or checking account. However, they can only do this if they fulfill specific requirements.

Every month, banks and other financial institutions automatically deduct the fee from their customers' eligible accounts. When consumers comply with the bank's standards, banks may discontinue charging monthly service fees.

One of these obligations is keeping a minimum or average monthly balance and receiving payments regularlying from multiple accounts at the same institution can both affeur bank balance. In rare circumstances, banks also waive some fees for senior persons. For instance, if you don't maintain a daily balance of $500, you must pay $5 monthly.

TD Checking Accounts Fee

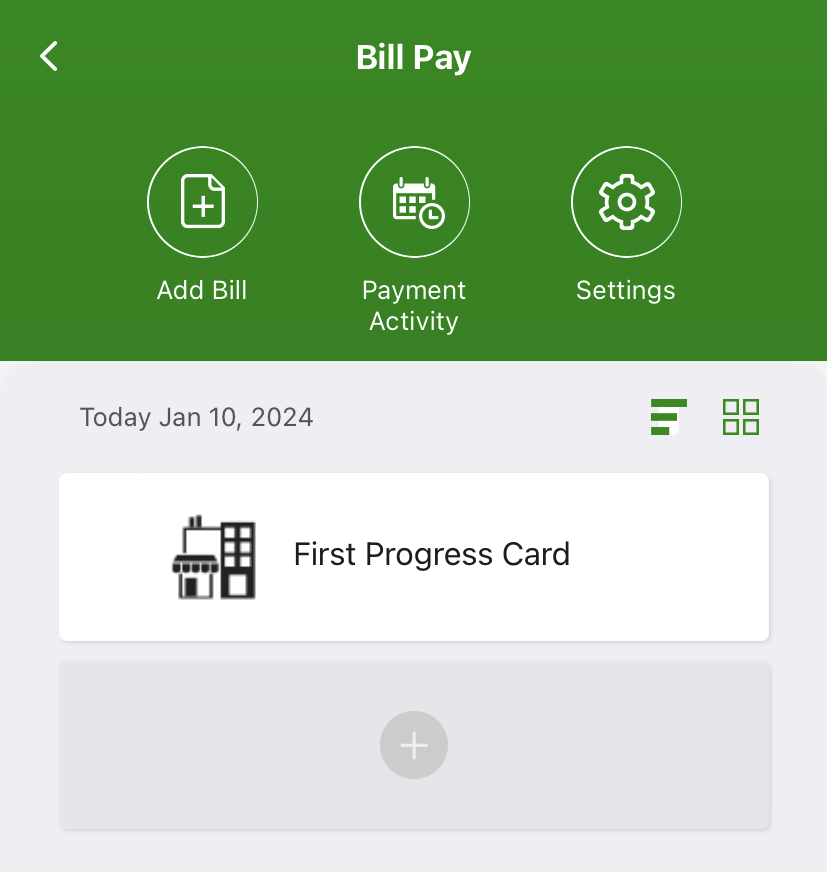

Consumers and companies utilize checking accounts as deposits to pay their bills and withdraw cash. They often come with monthly fees, use fees, or both and pay little to no interest. In addition, paychecks and other recurring payments are usually deposited automatically into the customer’s accounts.

TD offers various checking accounts catering to the different needs of consumers. Every account type has its fee structure. However, the bank offers a flexible fee structure that can be reduced or waived upon meeting specific requirements.

Let’s check the fee structure of each account below:

TD Checking Account | Monthly Fee | Average Day Balance To Waive |

|---|---|---|

TD Convenience Checking Account | $15 | $100 |

TD Beyond Checking Account | $25 | $2,500 |

TD Simple Checking Account | $5.99 | Can't be waived |

TD Essential Banking | $4.95 | Can't be waived |

TD 60 Plus Checking Account | $10 | $250 |

Student Checking Account | $0 | N/A |

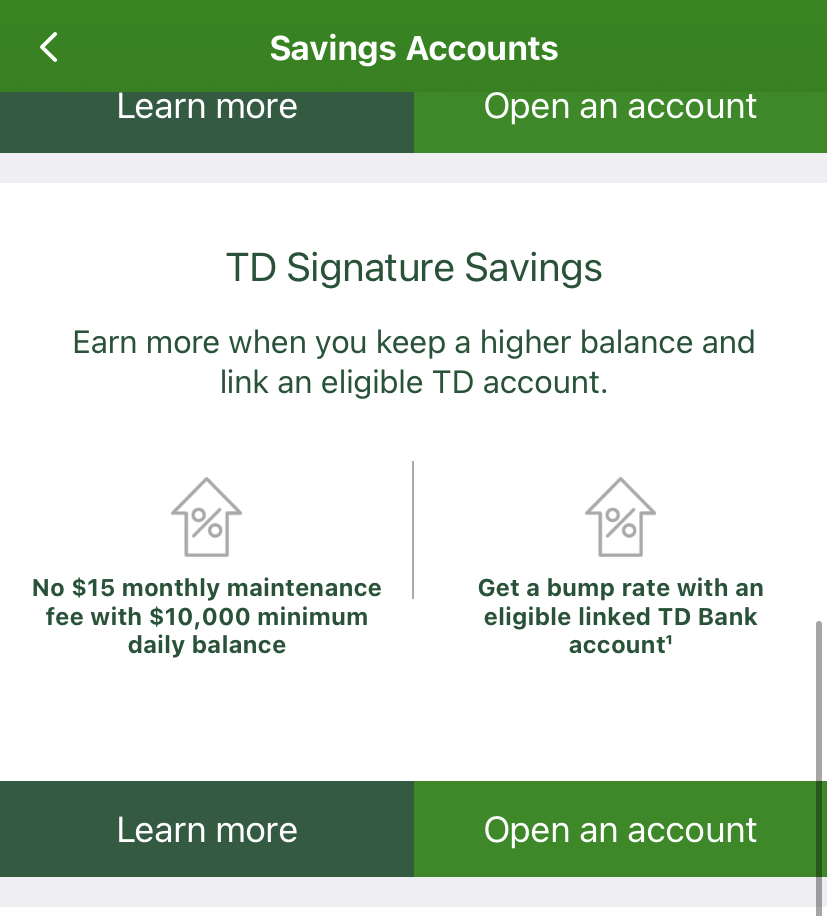

TD Saving Accounts Fee

To help cater to the needs of consumers related to savings and earning interest on deposits, TD offers Personal Savings accounts.

The TD Simple Savings and TD Beyond Savings accounts are the two options offered by TD Bank. These accounts charge a $5 monthly maintenance fee but it can be waived by keeping a $300 minimum daily balance. The banks also waive this fee if the account holder is under 24 or over 62.

There are another 3 savings account with no monthly fee.

Savings Account Type | Monthly Service Charges |

|---|---|

TD Simple Savings | $5.00 |

TD Beyond Savings | $5.00 |

TD ePremium Savings Account | $0 |

TD Everyday Savings Account | $0 |

TD High-Interest Savings Account | $0 |

How to Avoid TD Monthly Service Fee for Checking Accounts?

The ways of avoiding the monthly fees depend on the type of account you are using as they have different fee structures and cater to different banking needs.

Some account types don't charge maintenance fees for customers who are 62 years of age or younger and students.

Here's how to get your fees on eligible accounts waived:

- Keep A Minimum Balance In Your Account

Customers who maintain the below-mentioned minimum daily balances in their qualified accounts are exempted from monthly maintenance fees by the bank.

TD Checking Account | Monthly Fee | Average Day Balance To Waive |

|---|---|---|

TD Convenience Checking Account | $15 | $100 |

TD Beyond Checking Account | $25 | $2,500 |

TD Simple Checking Account | $5.99 | Can't be waived |

TD Essential Banking | $4.95 | Can't be waived |

TD 60 Plus Checking Account | $10 | $250 |

Student Checking Account | $0 | N/A |

- Track How You Earn Cashback

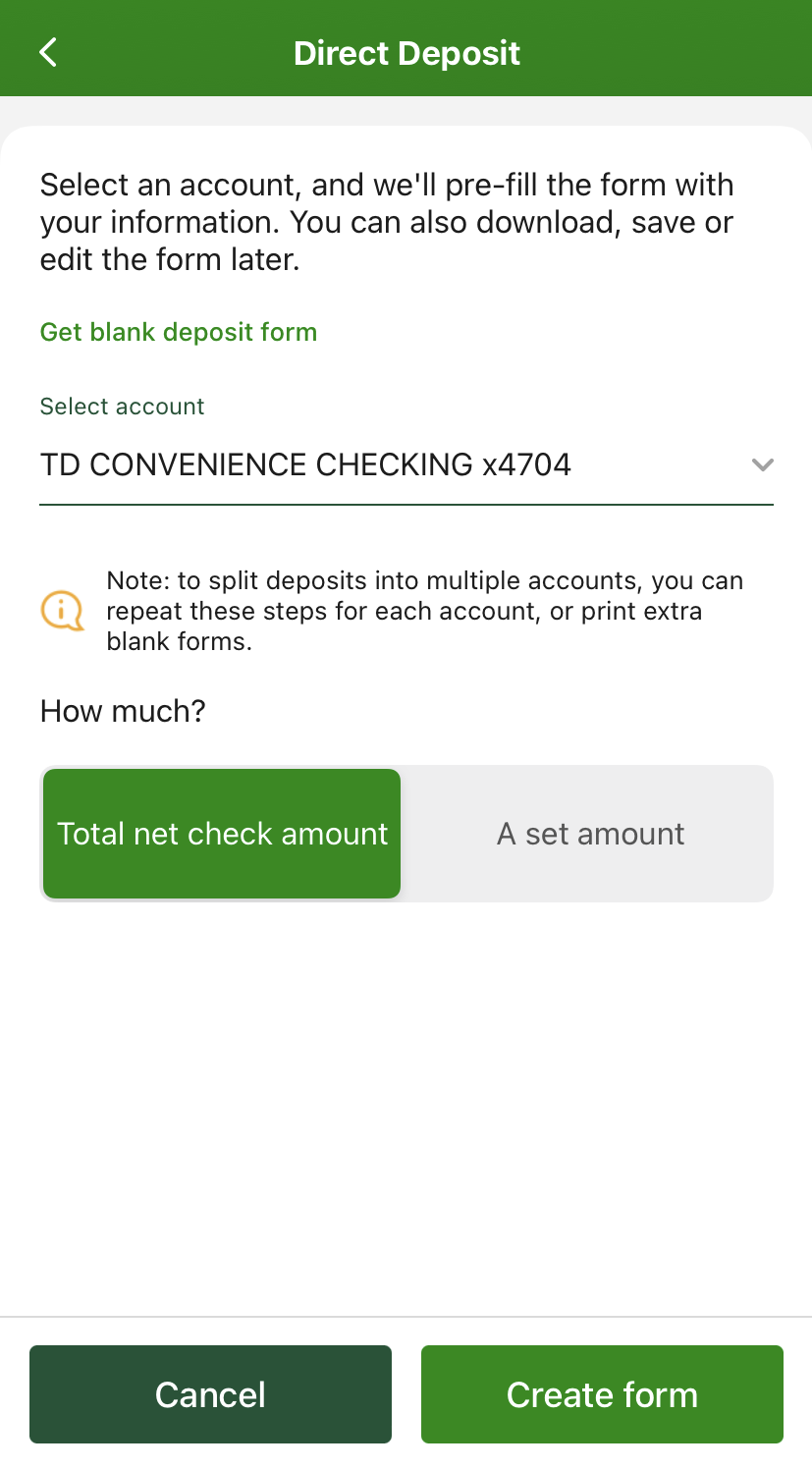

By setting up direct payments into your account, you may avoid monthly maintenance costs with just one TD Bank account.

You must deposit $5,000 in direct deposits each month to be eligible for the fee waiver in your TD Beyond Checking account.

- Eligible Direct Deposits

If your card offers rotating cashback bonus categories, don’t forget to activate or opt into the categories every quarter. This would entitle you to get 5% cashback on featured categories such as restaurants, gas stations, wholesale clubs, groceries, and more.

- Integrate Your TD Bank Accounts

Connecting your eligible TD Bank accounts and setting up regular payments can reduce the amount you pay in monthly maintenance costs.

For example, When young adults between the ages of 17 and 23 link a Simple Savings account to their TD Student Checking account, there is no monthly maintenance cost at all.

- Utilize The Senior And Student Waivers

For eligible customers, including seniors and students, TD Bank will not charge monthly maintenance costs. Even if they are not currently enrolled in school, young adults under the age of 24 are eligible for student discounts.

- For users aged 17 to 23, TD Convenience Checking has no monthly maintenance costs.

- TD Student Checking clients between the ages of 17 and 23 pay no maintenance fees on TD Savings Accounts

How to Avoid TD Monthly Service Fee for Savings Accounts?

Savings Account Type | Monthly Service Charges |

|---|---|

TD Simple Savings | $300 |

TD Beyond Savings | $300 |

While there are many savings accounts with no monthly fees, TD Bank charges monthly fees for savings accounts that vary from $5 to $15. You can reduce the cost in the following ways:

- Keeping a minimum balance in your account

- Joining TD Simple Savings with other TD Bank accounts: Your TD Simple Savings monthly fee will be eliminated for the first year if you set up a $25 regular transfer from your connected TD Bank checking account.

- Take Advantage of Student and Senior Waivers

Does TD Bank Offer an Account with No Monthly Fees?

Yes! Certain accounts at TD charge no monthly fee.

- TD Unlimited Checking Account

With limitless transactions using offered under this account, you can do as much banking as you want. It comes with:

- No monthly cost if you keep $4000 or more in your account at the end of each month.

- You may withdraw money from any ATM in Canada with no TD ATM charge.

- TD Student Chequing Account

Besides offering you an Amazon gift card upon signing up and other cashback programs at major retail outlets across America, it also offers:

- No monthly cost

- 25 free transactions each month (extra $1.25 per transaction)

- Free and unlimited Interac e-Transfers

- Available to individuals under the age of 23 and all full-time students

How to Avoid PNC Overdraft Fees?

The easiest approach to prevent TD Bank overdraft penalties is to spend wisely and keep track of your account balances on a frequent basis using the TD Bank mobile banking app. However, if your account is somehow hit by an overdraft fee you can get it waived by following these steps:

- Sign up for personalized email alerts when your balance falls below a certain threshold.

- Open a TD Private Tiered Checking account and connect it to your savings account to avoid overdraft fees.

- Sign up for a TD Beyond Checking account. Overdraft Payback is a feature of this account that automatically reimburses you for the first two overdraft fees you incur every calendar year.

Account | Fees & Limits | Cost |

|---|---|---|

All TD Bank Checking | Overdraft, up to three per day | $35 |

TD Beyond Savings | Overdraft protection transfer, one charge per day | $3 |

TD 60 Plus Checking | Overdraft protection transfer, one charge per day | $3 |

TD Convenience Checking | Overdraft protection transfer, one charge per day | $3, waived for 17-23 year old |

How to Avoid TD Bank ATM Fees?

When you use an ATM outside of your bank's network, transaction fees can quickly mount up.

However, this extra expense can be completely avoided with a little planning that can be done while you are starting your day or by choosing a bank that’s branches are available in the areas of your daily commute

Consider where your daily routine takes you and select a bank with branches on your way to and from work, near the gym, and other areas you travel frequently.

If you know you'll be using ATMs outside of your bank's network, seek accounts that repay these fees.

You can also save money by utilizing your bank's mobile app. Check your balance, deposit checks, and locate the nearest business or ATM while on the move.

FAQs

With customer satisfaction and a variety of banking solutions, TD can be a good choice to manage your banking needs.

However, from the savings point of view, it doesn’t offer lucrative returns to hedge your life savings against inflation.

At TD bank, all the electronic deposits related to your paychecks and pension from your employer and other government benefits like social security amounting to at least $250 are considered Qualifying deposits.

A daily balance is referred to as the available amount that the user has access to in his account. Banks often set a limit for a minimum daily balance to avoid the maintenance fee.

The combined balance is referred to the collective balance of all your connected accounts.

Yes, TD does offer signup bonuses to new consumers. In TD’s Beyond Checking account, a new customer is entitled to receive a bonus for making a direct deposit within 60 calendar days of opening the account.

TD also offers other signup bonuses on different types of accounts.

TD’s savings account rates are not that good compared to other available options. The bank offers variable saving rates based on the minimum account balance and savings account types. As of November 2025, PNC offers 0.01% – 0.03% APY on savings, while with other banks you can get more than 3% APY.