Table Of Content

In today's fast-paced world, managing your finances has become easier than ever.

With multiple options available to keep track of your spending and manage your money, two of the most popular choices are checking accounts and debit cards. Although they may seem similar at first glance, there are key differences between the two that can impact your financial management and spending habits.

In this article, we will explore the differences between checking accounts and debit cards, their pros and cons, and help you make an informed decision on which option is the best fit for your financial needs.

How Checking Accounts Work?

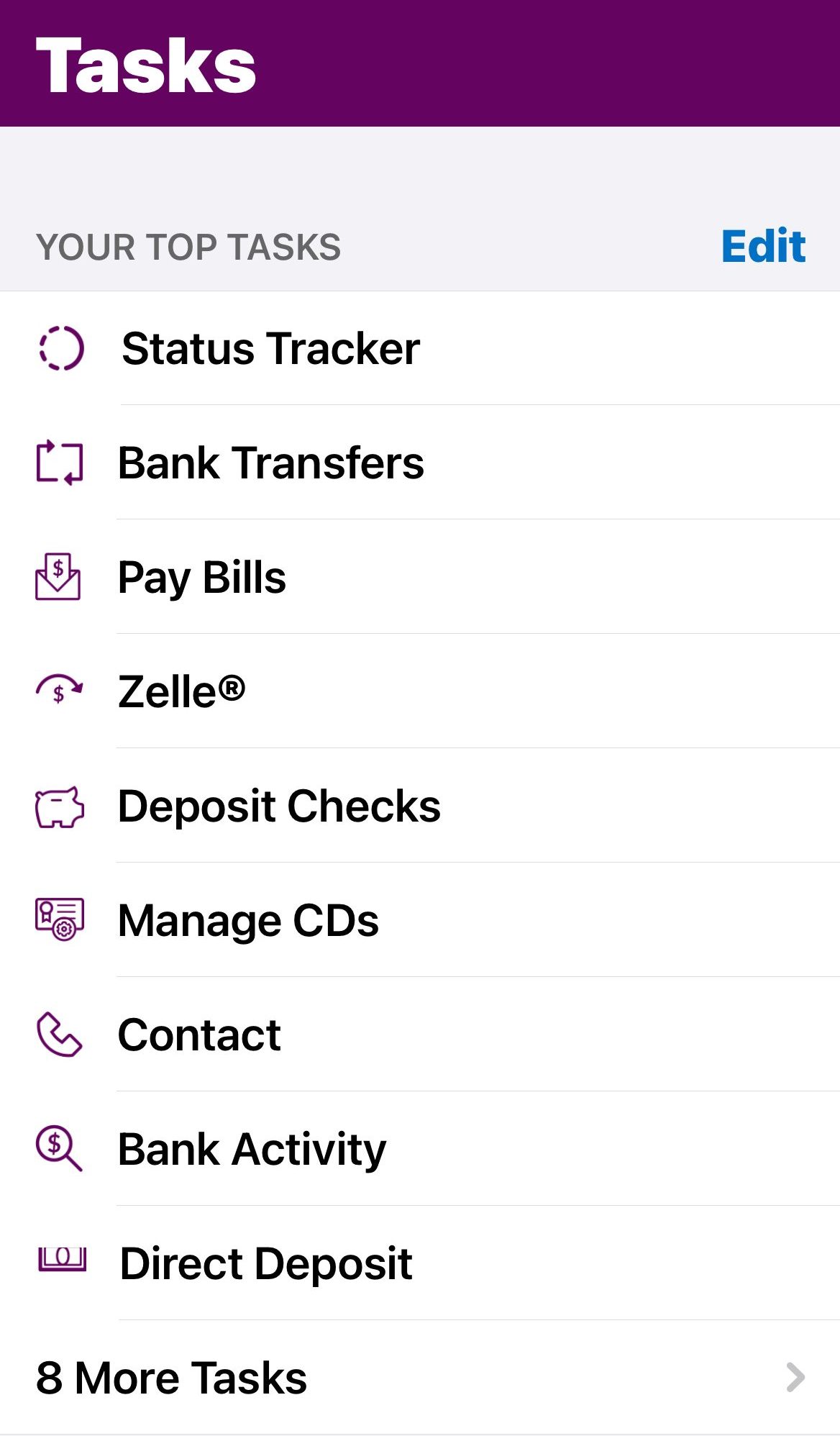

A checking account is a bank account that allows you to deposit and withdraw money, pay bills, and make purchases using checks, debit cards, or online banking.

Checking accounts typically offer several features to help you manage your money. For example, you may be able to set up direct deposit, which allows your paycheck to be automatically deposited into your account. You may also be able to set up automatic bill payments, which can help you avoid late fees and keep track of your expenses.

However, there may be fees associated with using a checking account, such as monthly maintenance fees, overdraft fees, and ATM fees.

How Debit Cards Work?

A debit card is a payment card that allows you to make purchases or withdraw cash from ATMs. When you use a debit card to make a purchase, the funds are automatically deducted from your checking account, so it's important to have enough money in your account to cover your transactions.

Debit cards offer several benefits over other payment methods and even compared to credit cards. For example, they are widely accepted and can be used to make purchases online, in stores, or over the phone. They are also more secure than carrying cash, as you can report any unauthorized transactions to your bank or credit union.

Checking Accounts vs. Debit Cards: Comparison

Although checking accounts and debit cards are often used together, they are not the same thing. Here are some key differences between the two:

Feature | Checking Account | Debit Card |

|---|---|---|

Purpose | Deposit and withdraw money, write checks, and make online payments. | Access your money in a checking account. |

Fees | May have monthly fees, ATM fees, and overdraft fees. | May have ATM fees and overdraft fees. |

Interest | May earn interest on your balance. | Does not earn interest. |

Security | FDIC or NCUA insured up to $250,000. | Not FDIC or NCUA insured. |

Convenience | Deposit and withdraw money, use your checks to pay bills, and make online payments. | Make purchases at stores and online, and withdraw money from ATMs. |

Flexibility | Write checks, set up direct deposit, and have access to money 24/7. | Make purchases anywhere that accepts debit cards. |

Eligibility | Meet certain requirements such as a minimum deposit. | Apply for a debit card with no credit check. |

- Purpose: A checking account is a bank account that you use to deposit and withdraw money, whereas a debit card is a payment card that you use to make purchases or withdraw cash.

- Access: With a checking account, you can access your funds through checks, ATM withdrawals, or online banking. With a debit card, you can access your funds through purchases or ATM withdrawals.

- Fees & Interest: Checking accounts may have fees associated with them, such as monthly maintenance fees, overdraft fees, and ATM fees. They can also earn interest on balance. Debit cards may also have fees, such as foreign transaction fees or ATM fees, but they are typically lower than those associated with checking accounts, and it doesn't earn interest.

When You May Need A Checking Account?

While a debit card can be a convenient way to make purchases and manage your money, there are several reasons why you may need a checking account in addition to or instead of a debit card:

Writing checks: If you need to make payments to individuals or businesses that do not accept debit cards, a checking account may be necessary. Writing checks is a traditional method of payment that is still widely used today, particularly for larger transactions like rent or mortgage payments.

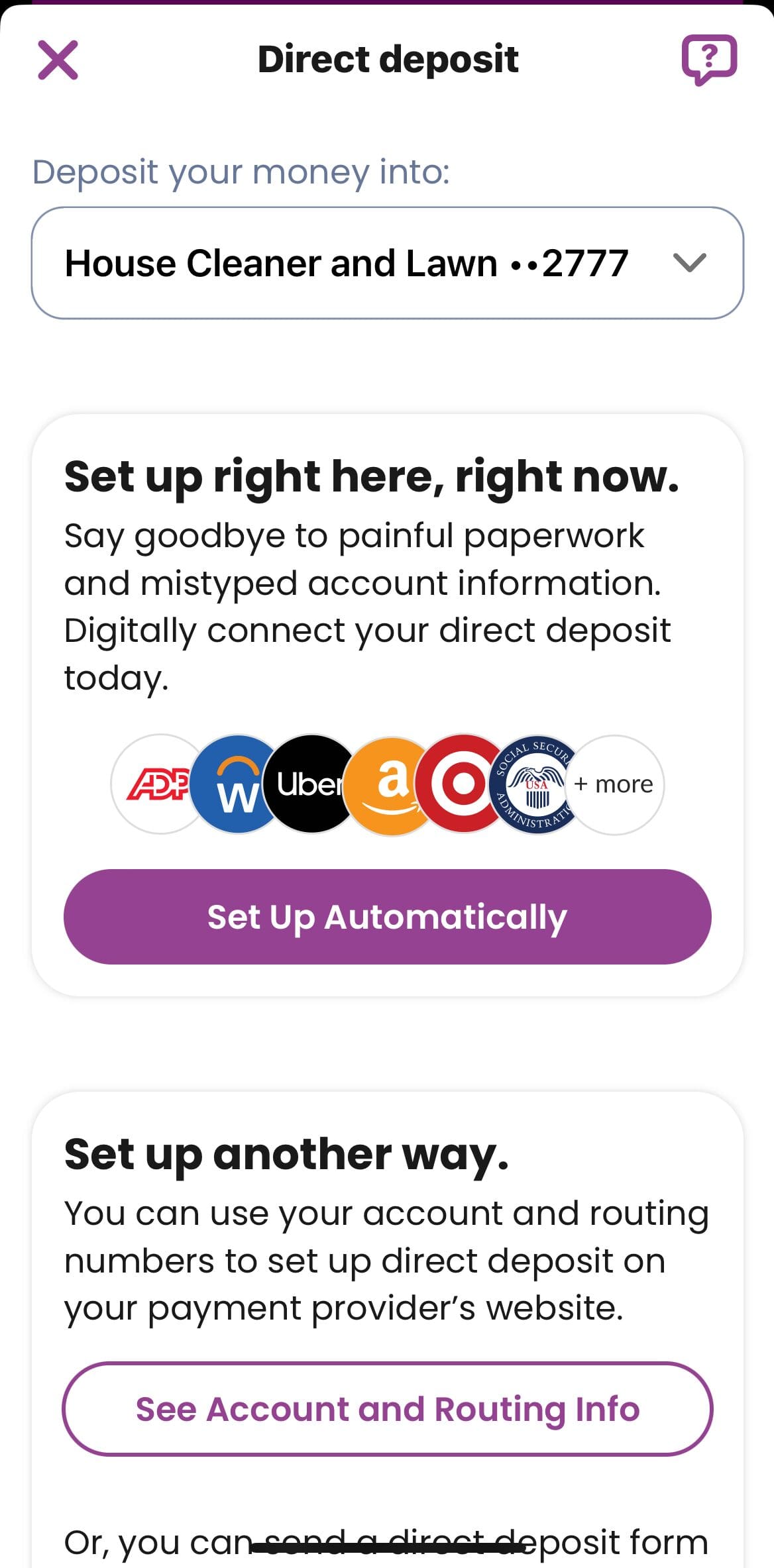

Direct deposit: Many employers offer direct deposit, which allows your paycheck to be automatically deposited into your checking account. This can save you time and hassle compared to depositing a physical check, and may also help you avoid fees associated with cashing a check.

- Bill payments: While you can use a debit card to make one-time payments for bills, a checking account can be more convenient for setting up recurring payments. Many banks offer online bill pay services, which allow you to schedule payments in advance and avoid late fees.

Access to more banking services: In addition to checking and savings accounts, many banks offer other financial services like loans, credit cards, and investment accounts. Having a checking account with a bank can give you access to these services and other great banking features and help you manage your finances more effectively.

Higher transaction limits: Checking accounts typically have higher transaction limits than debit cards, which can be useful if you need to make large purchases or withdraw a significant amount of cash.

Overall, a checking account can be a useful tool for managing your finances

When A Debit Card May Be Sufficient For Your Needs?

A debit card may be sufficient for your needs if you have relatively simple financial needs and do not require the additional features and services offered by a checking account. Here are some situations in which a debit card may be sufficient:

Everyday spending: If you mainly use your card for everyday purchases like groceries, gas, or dining out, a debit card can be a convenient and secure payment option.

Online shopping: Many online retailers accept debit cards, so if you primarily shop online, a debit card may be all you need.

Budgeting: A debit card can be a useful tool for sticking to a budget, as you can only spend what you have in your account. This can help you avoid overspending and accumulating debt.

ATM withdrawals: If you primarily use your card to withdraw cash from ATMs, a debit card may be sufficient for your needs.

Travel: Debit cards are widely accepted internationally and may offer lower fees than credit cards for foreign transactions.

Checking Account | Debit Card |

|---|---|

Writing checks | Everyday spending |

Direct deposit | Online shopping |

Bill payments | Budgeting |

Access to more banking services | ATM withdrawals |

Higher transaction limits | Travel |

Alternatives To Checking Account And Debit Crad

While checking accounts and debit cards are popular financial tools, there are several alternatives that you may consider depending on your financial needs and preferences. Here are some of the main alternatives to checking accounts and debit cards:

Cash: Cash is a universally accepted payment method that does not require a bank account or payment card. However, carrying large amounts of cash can be risky and inconvenient.

- Credit cards: Credit cards allow you to make purchases and borrow money up to a certain credit limit. Unlike a debit card, which draws funds from your checking account, a credit card allows you to borrow money that you must pay back with interest. Also, credit cards offers rewards such as cash back or travel perks.

Prepaid cards: Prepaid cards are payment cards that are loaded with a specific amount of money. They can be used like debit cards to make purchases or withdraw cash, but once the balance is depleted, the card must be reloaded with more funds.

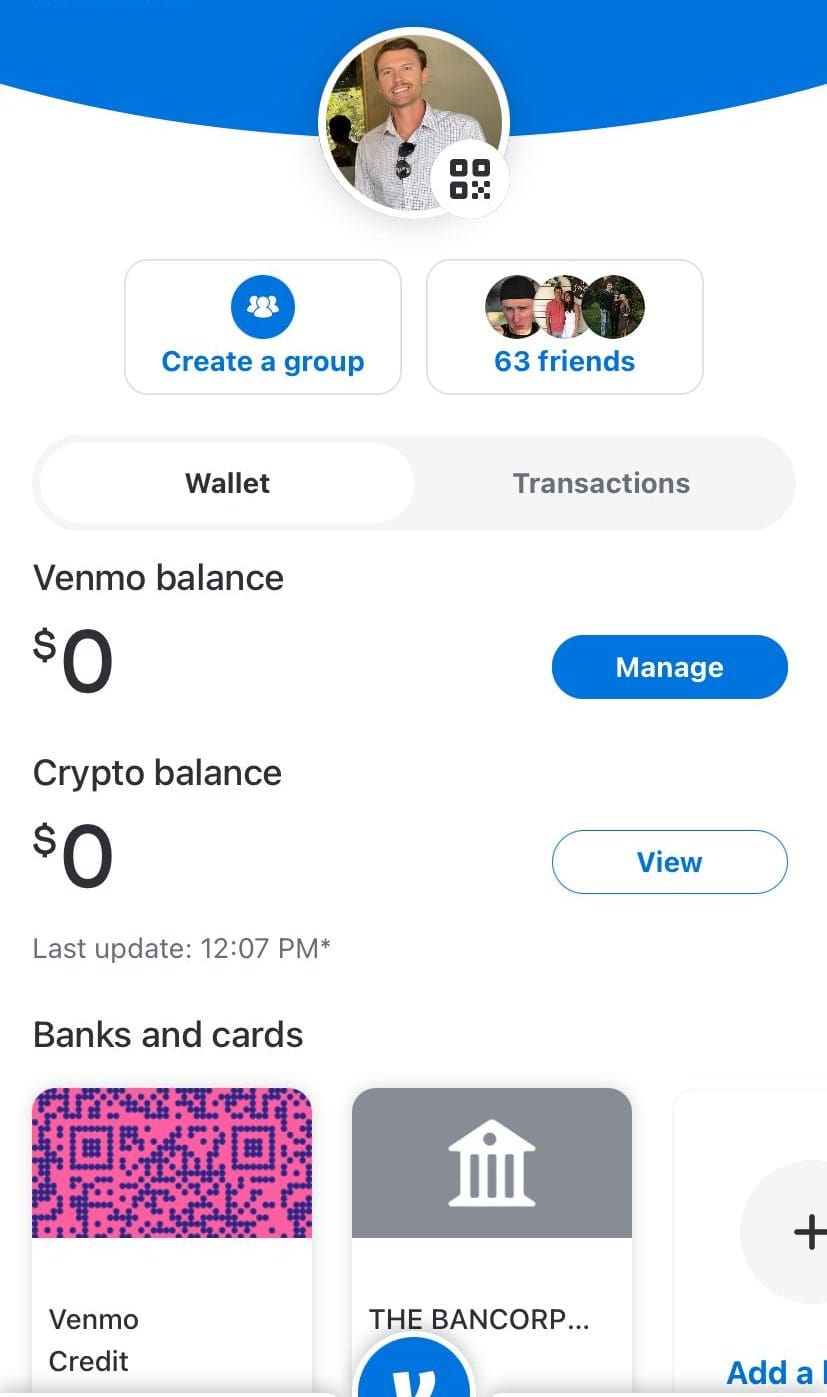

Online payment services: Online payment services like PayPal and Venmo allow you to send and receive money electronically. They can be linked to your bank account or payment card, and are often used for peer-to-peer payments.

- Cryptocurrency: Cryptocurrency is a digital currency that is decentralized and operates independently of traditional financial institutions. While still a relatively new technology, cryptocurrency can be used for online purchases and as a speculative investment.