Discover Bank offers a variety of products, including CDs. When it comes to CD rates, Discover is considered to have some of the most competitive rates in the market.

Opening a CD account with Discover is a quick and easy process that takes only a few minutes. In this guide, we'll walk you through the steps of opening a Discover CD account, and we'll include helpful screenshots to make it easier for you to follow along.

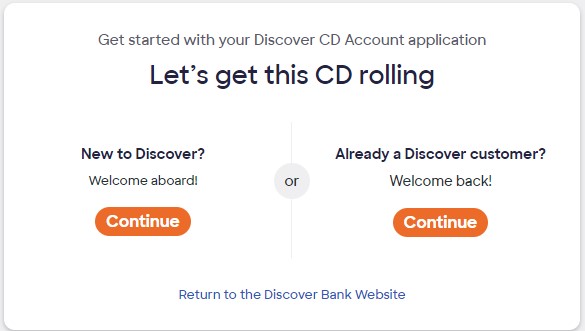

1. Get Started With Your Discover CD Account Application

This step is about starting your application process for a Discover CD account. It gives you two options depending on whether you are already a Discover customer or not.

If you're new to Discover, they welcome you aboard and provide you with a button that says, “Continue with a new account.” By clicking this button, you can open a new CD account.

On the other hand, if you're already a Discover customer and have an existing account with them, you have the option to log in to your account an start the process/

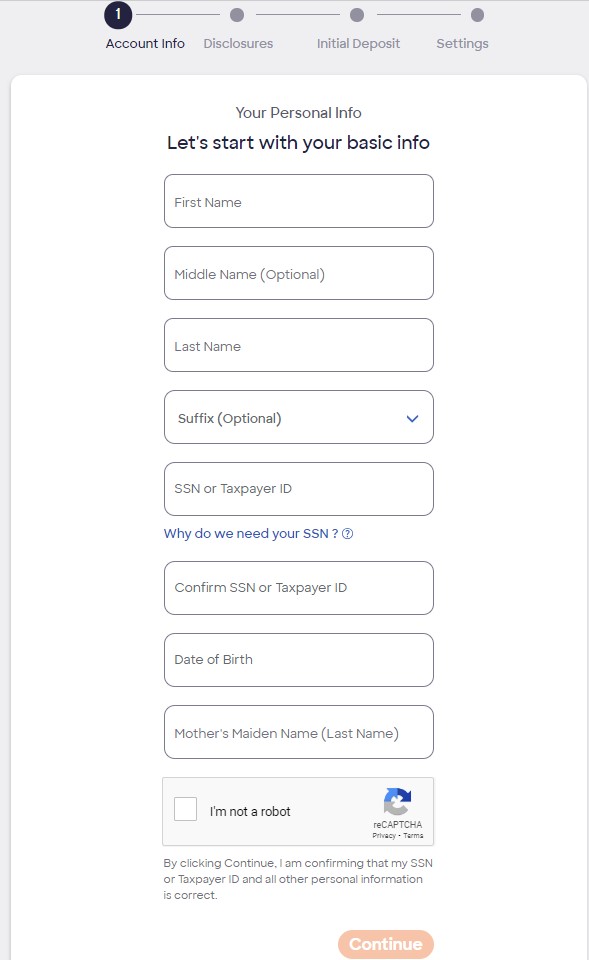

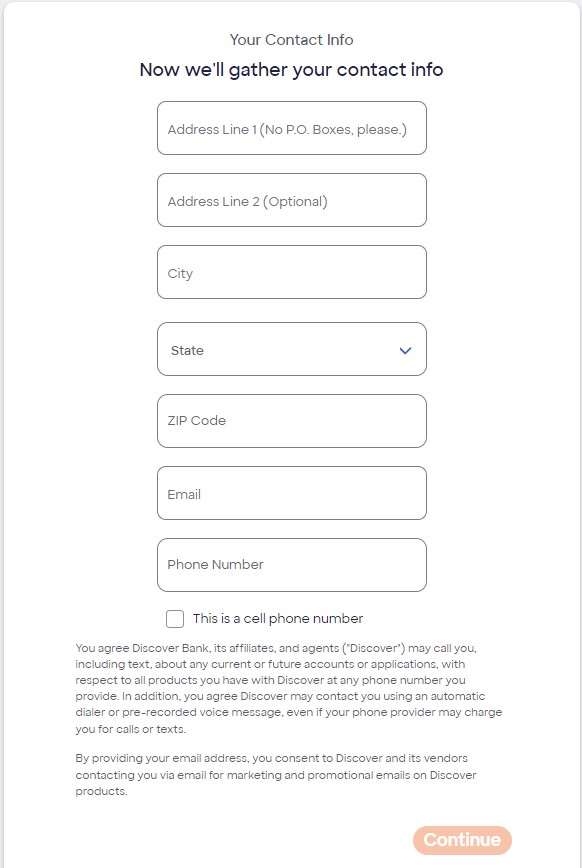

2. Personal And Contact Information

In the next step of opening a Discover CD account, you need to provide the following personal information: your first name, optional middle name, last name, Social Security Number (SSN) or Taxpayer Identification Number (TIN), confirmation of your SSN or TIN, date of birth, and mother's maiden name (last name before marriage).

To complete the information section, you need to provide the contact information such as your address (with no P.O. Boxes), optional address line 2, city, state, ZIP code, email address, and phone number.

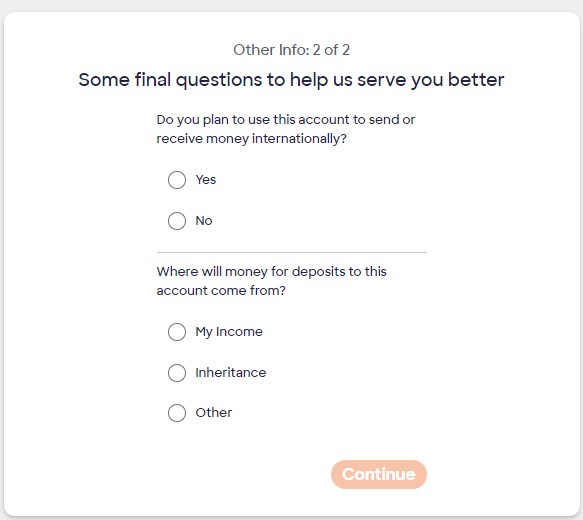

3. Answer Questions On Account Use

In this step, you are required to provide additional information about yourself to complete the application process for a Discover CD account.

Do you plan to use this account to send or receive money internationally? You have the option to select either “Yes” or “No” to indicate whether you intend to conduct international money transfers using this account.

Where will money for deposits to this account come from? You will need to choose one of the provided options: “My Income,” “Inheritance,” or “Other.” This question aims to understand the source of funds that you plan to deposit into the account.

These additional details assist Discover in better understanding your banking needs and complying with relevant regulations.

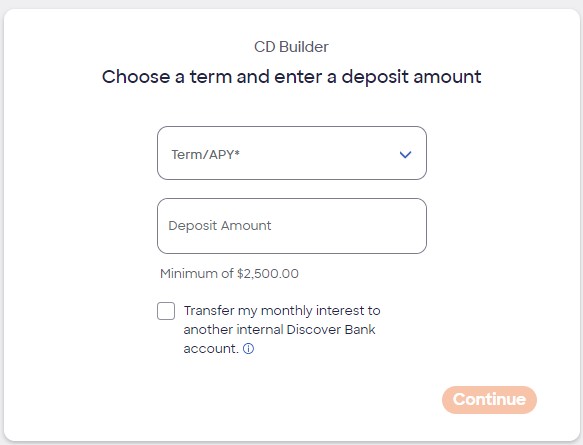

4. Choose CD Terms And Deposits

During this step, you have the opportunity to personalize your Discover CD account using the “CD Builder” feature. Here's what you need to do:

First, you will choose a term (such as 6 months, 1 year, 2 years, etc.) for your CD. After selecting the term, you'll enter the desired deposit amount. The “Term/APY” section will display the Annual Percentage Yield (APY), representing the interest rate you will earn on your CD investment over a year.

It's important to note that a minimum deposit of $2,500.00 is required by Discover for opening a CD account.

Discover provides you with the option to add additional CDs to your account. This feature allows you to spread your total deposit across multiple CDs, creating what is known as a CD ladder.

By having multiple CDs with staggered maturity dates, you can potentially take advantage of different interest rates and have more flexibility in managing your funds.

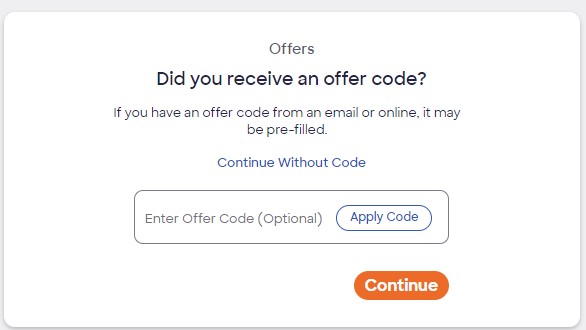

5. Enter A Promo Code (Optional)

In this step, Discover gives you the option to enter an offer code if you have received one through email or online. The offer code may provide special benefits or promotions specifically for you.

Remember, entering an offer code is optional. Discover doesn't offer promo code on CDs on a regular basis. You can choose to continue without one if you don't have it or prefer not to use it.

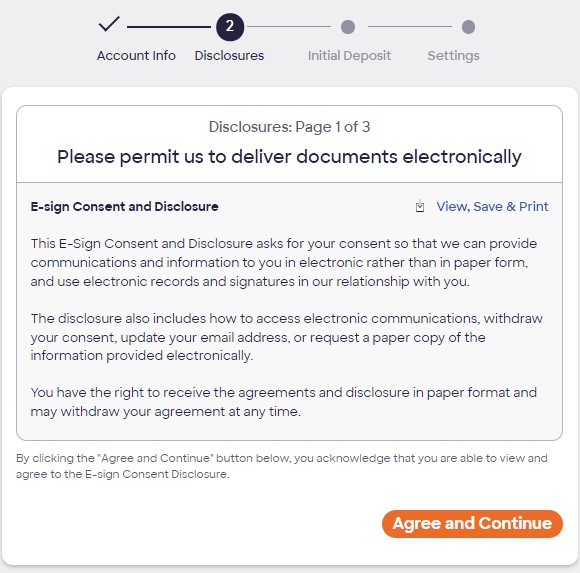

6. Approve E-sign Consent and Disclosure

In this step, Discover asks for your permission to send you documents and information electronically instead of in paper form. They want to use electronic records and signatures in their communication with you.

By giving your consent, you agree to receive electronic communications and understand that you can access them online. The disclosure provides instructions on how to view, save, and print these electronic documents. It also explains how you can withdraw your consent, update your email address, or request a paper copy of the information if needed.

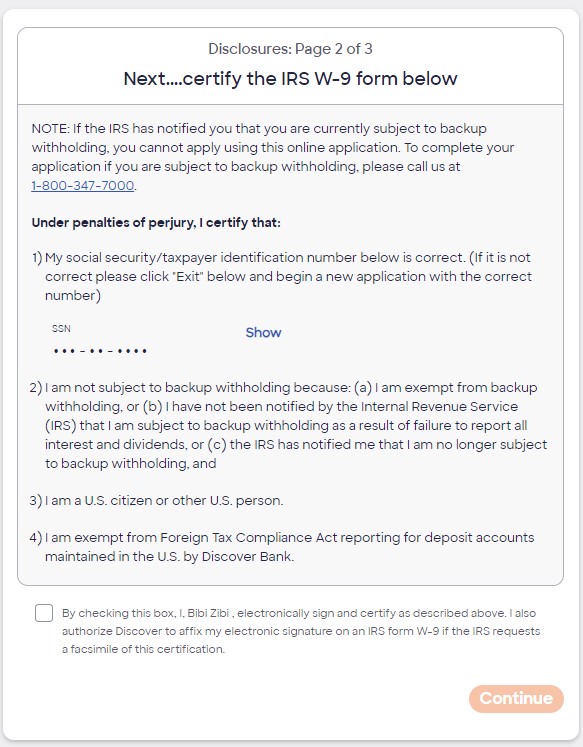

7. Certify The IRS W-9 Form

In this step, you will need to certify the IRS W-9 form. If the IRS has informed you that you are subject to backup withholding, you can't use the online application and should call Discover instead. To certify the form, you need to confirm that your social security number or taxpayer identification number is correct.

You should also state that you are not subject to backup withholding and that you are a U.S. citizen or resident. Lastly, you need to confirm that you are exempt from Foreign Tax Compliance Act reporting for deposit accounts held in the U.S. by Discover Bank.

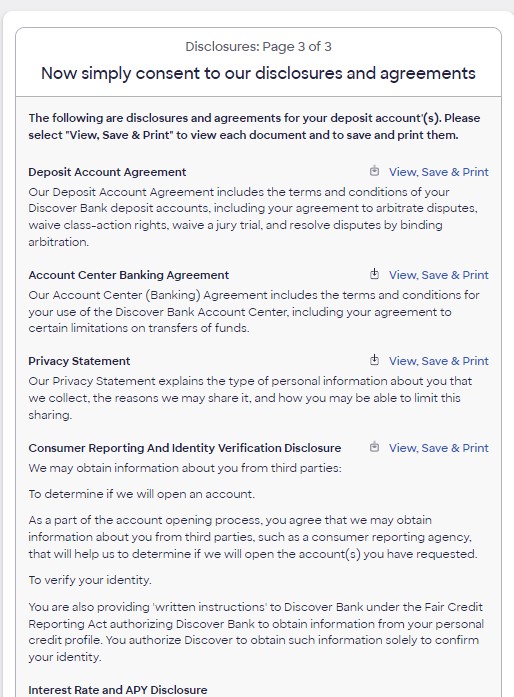

8. Disclosure And Agreement

In this step, you will be asked to consent to various disclosures and agreements related to your deposit account(s). Here's a summary of each document:

Deposit Account Agreement: This document outlines the terms and conditions of your Discover Bank deposit accounts, including arbitration agreements, class-action waivers, and binding arbitration for dispute resolution.

Account Center Banking Agreement: This agreement covers the terms and conditions for using the Discover Bank Account Center, including limitations on fund transfers.

Privacy Statement: The Privacy Statement explains how your personal information is collected, shared, and how you can limit this sharing.

Consumer Reporting and Identity Verification Disclosure: Discover may obtain information from third parties to determine if they will open an account for you and to verify your identity.

Interest Rate and APY Disclosure: The specific interest rate, APY, and maturity date for your CD account will be confirmed in the Welcome Kit.

By selecting “View, Save & Print,” you can access and review each document before proceeding. It's important to read and understand these disclosures and agreements before consenting to them.

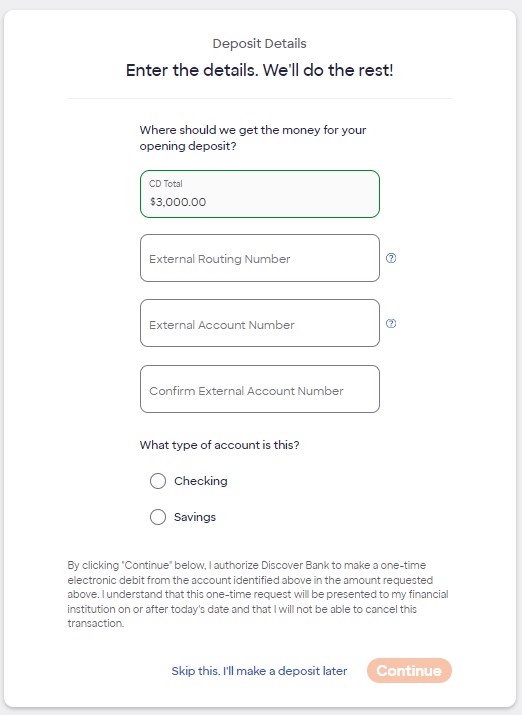

8. Fund Your CD Account

In the final step, you have the choice to make a deposit to your Discover CD account. It's not mandatory, and you can also do it later if you prefer.

To deposit money into your Discover CD account, you'll need to provide some important information. Here's a breakdown of what they need:

Deposit Amount: Specify the amount you want to deposit into your Discover savings account. This can be your initial deposit or an additional contribution.

External Routing Number: Enter the routing number of the bank account from which you'll transfer the funds. It's a nine-digit code that identifies the bank.

External Account Number: Provide the account number of the bank account you're transferring the funds from. This number uniquely identifies your account at that bank.

Confirm External Account Number: Re-enter the account number to make sure it's accurate and avoid any errors.

Account Type: Indicate whether the external account is a checking or savings account. This helps Discover process the deposit correctly.

Once you've provided these details, Discover will take care of transferring the funds from the specified bank account to your Discover CD account.

Should I Open Discover CD Account?

When compared to traditional and online banks, Discover CDs are highly competitive. They offer attractive options across different terms. However, the downside is that the minimum deposit requirement is a bit high at $2,500. If you want to compare Discover against other online banks, here are some examples:

- Ally vs Discover: Which Offers Better CD Rates?

- Marcus vs Discover: Which Offers Better CD Rates?

- CD Rates Full Comparison: Synchrony vs. Discover

- Comparing CD Rates: Capital One vs. Discover Side By Side

One thing to note is that Discover does not provide a no penalty CD. So, if you need to access your funds before your CD matures, you will face a penalty.

The early withdrawal fee varies based on your CD term. For terms less than one year, you'll pay three months of simple interest as a penalty. For CD terms of one to four years, the penalty increases to six months of simple interest.

If your CD term is four to five years, the penalty is nine months of simple interest. For CD terms of five to seven years, the penalty is 18 months of simple interest. The maximum penalty is 24 months of simple interest for CD terms of seven to ten years.

FAQs

What happens when my CD matures?

You will receive a notification 30 days before your CD matures. During the grace period, which lasts for 9 days after the maturity date, you have the flexibility to make deposits, withdrawals, and even change the term of your CD.

If you don't take any action during the grace period, your CD will automatically renew. It's important to note that any interest withdrawn from the account will not affect the grace period.

How is interest on my CD calculated?

Interest on your CD is calculated on a daily basis and compounded. It is then credited to your account on a monthly basis.

Can I open a CD as a Trust or Custodial account?

Yes. Discover allows various types of account ownership, including Trust, Custodial (UTMA), Guardianship, and Estate accounts.