What Do You Need To Set Up A Chime Direct Deposit?

The process of establishing a direct deposit is not overly complicated. Here is the list of the following things you need to set up Chime's direct deposit:

- Routing number: A routing number is a nine-digit code that banks and other financial institutions use to find each other. When put together with your account number, it lets institutions find your account.

- Account number: To set up chime direct deposit, you must provide a bank account where your money will be deposited. You can choose to have all the funds go into one account, or some of it go into a savings account.

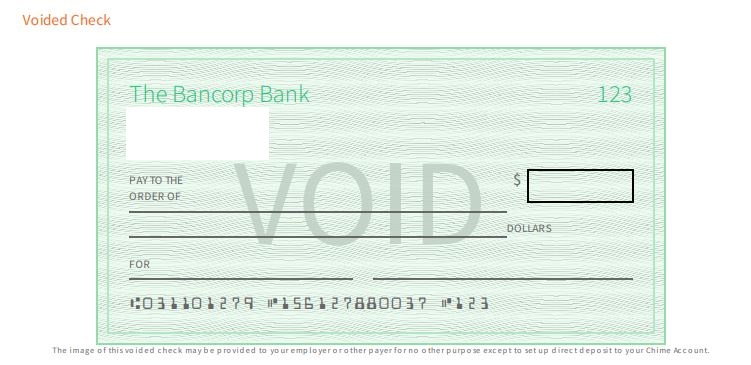

- Banks address and voided check: The direct deposit setting process may require your bank's address and a voided check for verification. Attach them while submitting the form offline or in email while submitting online.

4 Steps For Setting Up A Chime Deposit

Signing up for a direct deposit is essential if you want to steer clear of paper checks and ensure you receive your payment as soon as possible. The process of enrolling in direct deposit is often the same regardless of whether you do so through your workplace, a vendor, or another company.

You will need information such as a routing number and an account number to set up direct deposit. You will quickly get this information. Here are the easy steps to set up Chime direct deposit:

Step 1: Get A Direct Deposit Form

Start with the direct deposit form, which you can get from the Chime app:

Settings > Account Information > Set Up Direct Deposit > Get Direct Deposit Form

The direct deposit form lets your employer know they can send money to your bank account using your routing and bank account numbers. This is a crucial step because you cannot go on without it.

Step 2: Provide Information And Divide Between Accounts

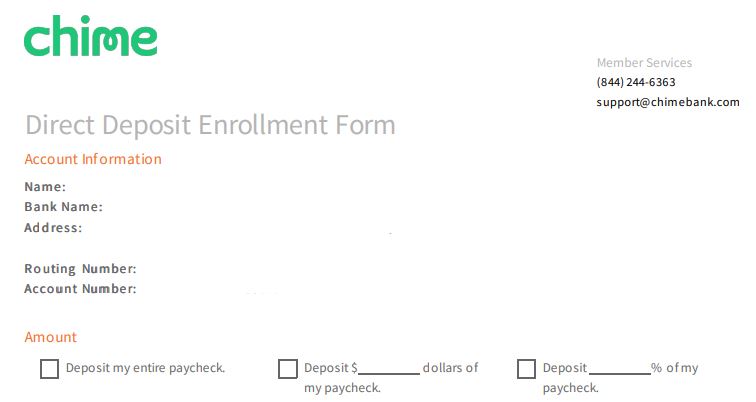

When you download the Chime direct deposit form, it has your name, bank name, routing number, and account number.

When you apply with the Chime direct deposit form, you do not have to manually fill in any of the above information.

How much do you want to deposit to your checking and savings accounts.

Chime's direct deposit form comes with three options regarding this: “deposit my entire paycheck,” “deposit $___dollars of my paycheck,” and “deposit ___% of my paycheck.”

You must fill out the option according to your needs.

3. Attach A Voided Check

A void check cannot be used to pay for something but can be used to find important bank account information.

Even though you already put this information on the direct deposit form, check everything with a void check to ensure your paycheck goes to the correct account.

4. Submit The Form To Your Employer

After filling out all the information and attaching the void check, you must give it to your employer so they can process and set up your direct deposit.

If your application is accepted, you should check your bank account after you get paid.

How To Fill Chime’s Direct Deposit Authorization Form

You must complete the direct deposit form on Chime to process your direct deposit setup.

- Download direct deposit form: Forms are available for direct deposit and may be downloaded easily from Chime's website or mobile app. Chime's direct deposit form comes filled with the necessary information required.

- Fill in the required part and attach voided check: you must fill in the required part, like how much you want to deposit to your primary account and another account. For account verification purposes, you may attach a voided check.

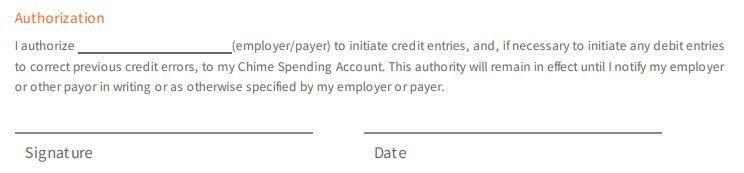

- Fill out the authorization section: Chime's direct deposit form has an authorization section where you must fill in your name, date, and signature. Afterward, you can submit the form to the employer for further procedure.

How Long Does Chime Direct Deposit Take

Direct deposits are one of the quickest ways to transfer money. In general, it takes 2 to 5 working days for a direct deposit to become effective. The hold will take effect the following business day for deposits made on weekends because money is regarded to have been made on Monday (the first working day) (Tuesday).

Although the procedure is rapid, depending on when the issuer makes the payment, it may take longer for the money to show up in your account.

How Long to Set Up Chime Direct Deposit?

If you want your payroll department to start processing your direct deposit payments, you will need to give them the paperwork you need to set up direct deposits.

The direct transfer of funds is a convenient option; however, the timing of these deposits can vary depending on your company. When starting new employment, you should know that it can take anywhere from one to two pay cycles until the direct deposit system is fully set up.

Because of this, you may have to continue using physical checks for a little longer, at least until everything is set up.

What Time Does Chime Direct Deposit Hit

As Chime does not engage in holding deposits, there is no predetermined time during which your Chime direct deposit will arrive in your account.

It could occur in the morning, during lunch, or late afternoon, among other times. As soon as the money is deposited, you will have access to them in your account.

Depending on several variables, including the kind of payroll software your business uses and when payroll is processed, you may not receive your cash precisely when you expect them to once direct deposit is ready.

FAQs

Yes, Chime allows customers to get early direct deposit like many other online banking services.

Employers send paychecks to banks a few days before payday to allow for transfer time. Instead of waiting until payday, the bank will release the money after the transaction clears.

When your direct deposit is late, it may take a few extra days to process. The money will likely arrive the next day due to holidays or after-hours money transfers.

The direct deposit form for Chime can be found on its website or app. You can follow these steps: Go to Settings > Account Information > Set Up Direct Deposit > Get Chime's direct deposit form.

Direct deposit employees can print their pay stubs. You can print or save an electronic copy.

Since most employers don't provide paper pay stubs with direct deposit, you can request them through payroll software or a staff person.

No, one of the benefits of Chime is that it does not charge any of the standard costs associated with traditional banking, nor does it have any hidden expenses. This includes deposits made directly through Chime.

You should make a direct deposit to your Chime checking account. and then move the money to Chime credit Builder secured account.

The money on the Chime credit Builder secured account is the amount you can spend on your Chime card.