Rewards Plan

Sign up Bonus

Our Rating

0% Intro

Annual Fee

APR

- 5% Rewards on Best Buy

- No Foreign Transaction Fee

- Expiry of Reward Certificates

- Redemption Restrictions

Rewards Plan

Sign up Bonus

20% back in rewards on your first day of purchases.

Our Rating

PROS

- 5% Rewards on Best Buy

- No Foreign Transaction Fee

CONS

- Expiry of Reward Certificates

- Redemption Restrictions

APR

15.24% – 31.74% variable

Annual Fee

$0

0% Intro

N/A

Credit Requirements

Good - Excellent Credit

- Our Verdict

- FAQ

The Best Buy Visa Card, issued by Citibank, is a great choice for frequent Best Buy shoppers.

Cardholders earn 5% back in rewards on shopping at BestBuy, 3% back in rewards on gas purchases, 2% back in rewards on dining, takeout and grocery purchases, 1% back in rewards on everyday purchases. Plus, you'll get 20% back in rewards on your first day of purchases. .

The rewards structure is intricate, with points valued at $0.02 each. The redemption process involves earning 250 points for a $5 reward certificate, redeemable for Best Buy purchases. Rewards can expire, and there are exclusions and limitations on redemption.

However, the application process is complex, considering you for up to four different cards. The rewards rates may be misleading, as the advertised percentages include points from the free My Best Buy rewards program.

The Best Buy Visa Card can be a great option for frequent Best Buy shoppers and big spenders. However, it's important to carefully review the fees, rewards structure, and any limitations before choosing this card over others. If you don’t frequently shop at Best Buy, you might want to consider other rewards cards that offer more versatile benefits.

How’s The Card Customer Service Availability?

This card is part of the Citi product line, so you can access the Citi customer service team 24/7 if you have any queries or questions. You can also access support via the website and app.

How Hard Is It To Get This Card?

You do need a good to excellent credit rating to qualify for this card. Citi will assess your income and employment status as part of the application approval.

So, if you’re unsure if you have a good enough credit rating, you may be better suited to a card that is available to those with fair credit.

When You Shouldn't Consider It?

Since the card rewards are so weighted towards Best Buy purchases, if you’re only a casual shopper with the brand or you tend to have a wide variety of spending habits, you may find other reward cards offer better incentives and perks.

What Purchases Don't Earn Cashback?

The tiered reward structure for the Best Buy Citi card allows for you to earn points on practically any purchase.

However, there are some exclusions including commercial purchases, payments made on your Best Buy card, purchases paid with a gift card or reward certificate, certain fees and charges, Thermador products and Apple and Beats products not purchased on standard credit.

In This Review

Pros & Cons

Let’s take a look at the pros and cons of the My Best Buy Visa card and see if it’s the right one for your wallet or not.

Pros | Cons |

|---|---|

Signup Bonus | Annual Fee |

Generous Rewards for Travel and Dining | 0% Intro Only on Balance Transfers |

No Foreign Transaction Fee | Rewards Are Not Transferable |

0% Intro APR on Balance Transfers | Minimum Redemption Requirement |

Rental Car Coverage | Restricted Availability |

- High Rewards on Best Buy

Best Buy Visa Card cardholders receive 5% back in rewards on shopping at BestBuy, 3% back in rewards on gas purchases, 2% back in rewards on dining, takeout and grocery purchases, 1% back in rewards on everyday purchases

Every 1,000 points is equal to a $20 certificate to be spent at Best Buy.

- No Foreign Transaction Fee

Best Buy Visa Card does not have a foreign transaction fee.

This is unusual for a non-travel rewards card. This is a great perk because you can earn Best Buy rewards on your travel spending.

- First Day Bonus

A noteworthy perk is the 10% back on the first day of Best Buy purchases within 14 days of opening the account, providing an attractive incentive for new cardholders.

- Flexible Financing Options

Cardholders have the option to choose standard financing on Best Buy purchases, allowing for flexibility in payment terms, especially for significant purchases.

- Redemption Restrictions

Best Buy Visa Card rewards can only be redeemed or spent at Best Buy.

Also, there are various exclusions on purchases eligible for rewards, and reward certificates cannot be used for certain products and services, limiting redemption options.

- Confusing Application Process

The application process is confusing, considering applicants for up to four different cards, potentially leading to uncertainty for those applying.

- Expiry of Reward Certificates

Reward certificates earned through the points system expire 60 days after issuance, imposing a time constraint on redeeming earned rewards.

- High APR

The APR for the Best Buy Visa Card is a 15.24% – 31.74% variable variable rate for all who are approved which is high for a card that requires borrowers with excellent credit histories.

Top Offers

Top Offers From Our Partners

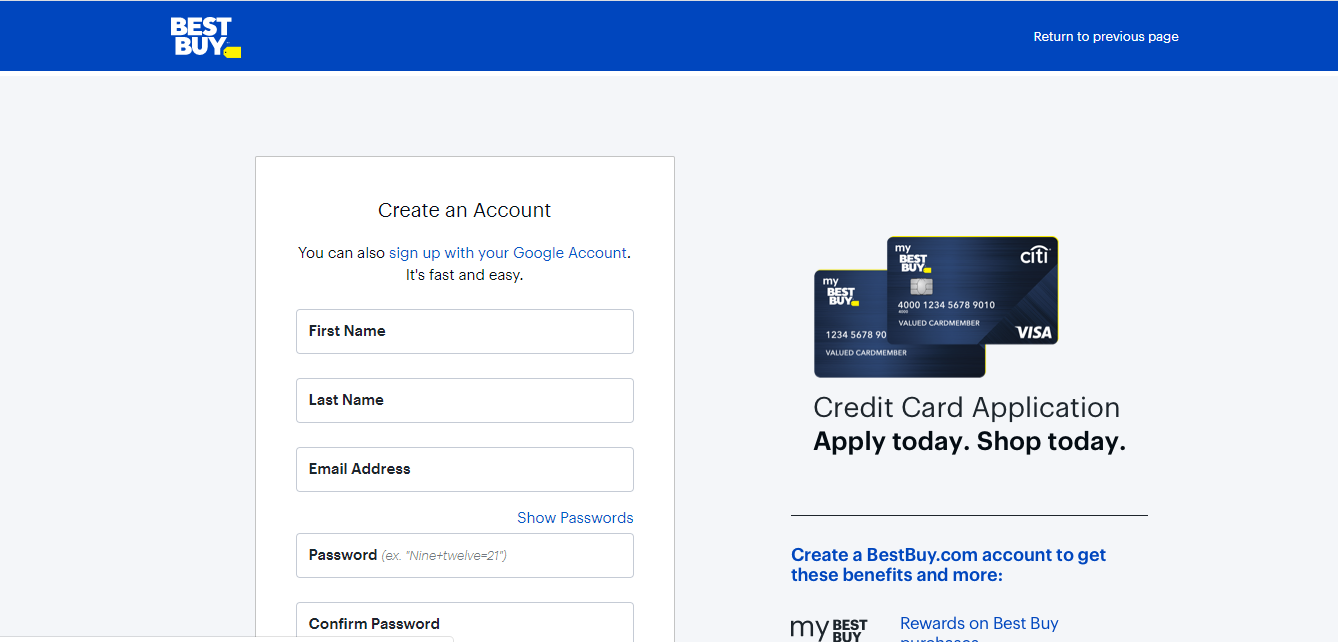

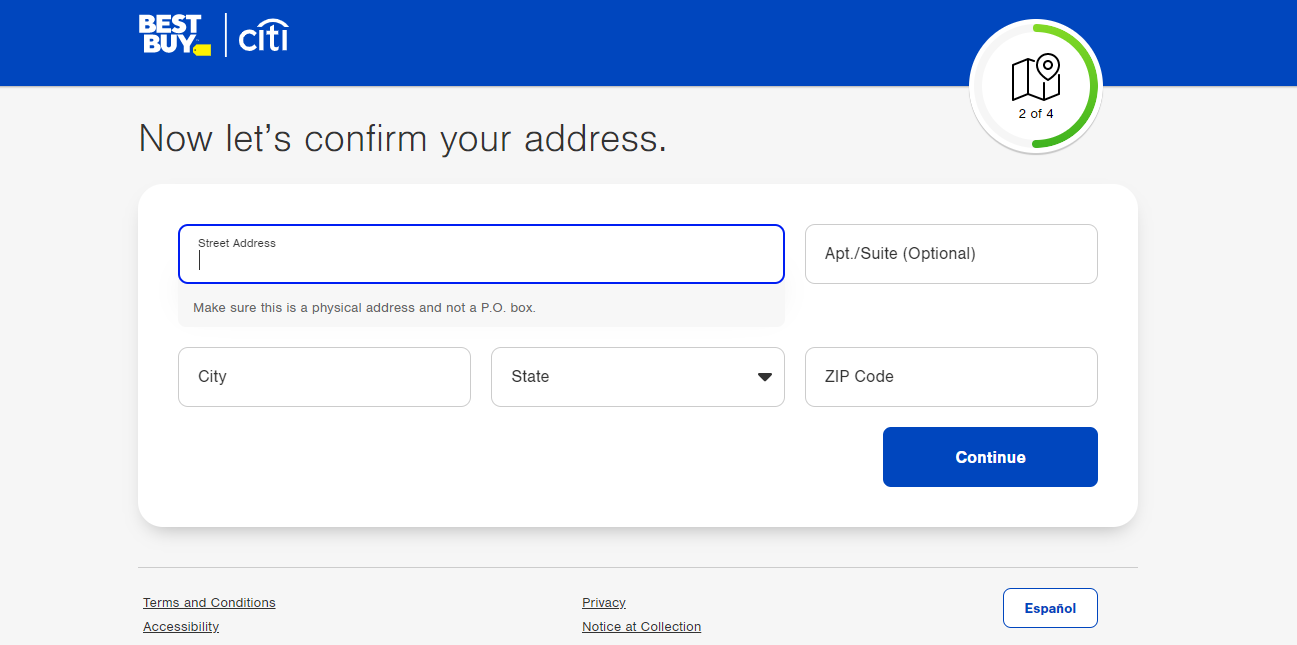

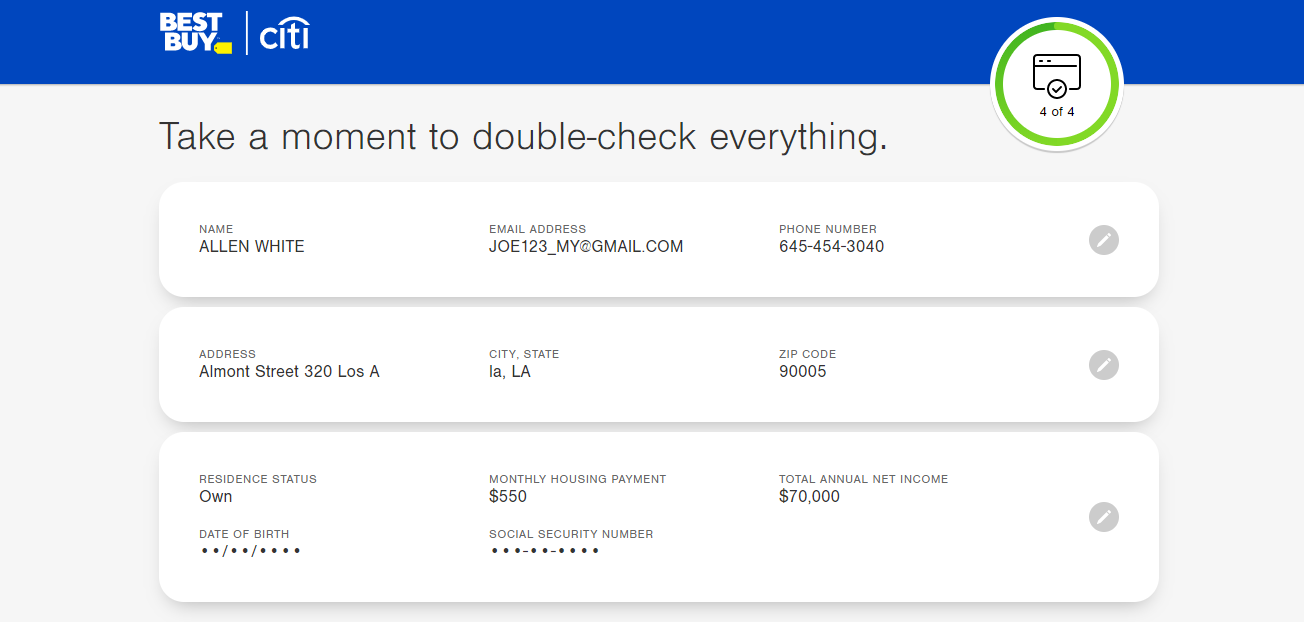

How To Apply For Best Buy Credit Card?

- 1.

Visit the Barclaycard Ring Mastercard Credit Card homepage and click “Apply Now.”

- 2.

This takes you to the next page, where you should fill in your “Personal Information” such as your Names, date of birth, etc.

- 3.

Next is your contact and financial information, such as income and social security number.

- 4.

Lastly, ensure you read through the important disclosure page to know your eligibility, fees, costs, rates, etc.

- 5.

Then click on “Continue” to complete the process.

Is the Best Buy Card Right for You?

Best Buy Visa Card is best for consumers who are frequent customers at Best Buy or are planning to make large purchases at Best Buy. The Best Buy Visa Platinum card offers a variety of benefits for those who are loyal Best Buy shoppers.

Best Buy Visa Card offers rewards outside of Best Buy, but those rewards must be spent within Best Buy. The rewards offered outside of Best Buy can be recreated with other cards that are more competitive.

A potential consumer looking at making a large purchase for appliances or a new home theater system and who wants to pay that overtime may want to consider the Best Buy Visa Card . They can defer interest for a time and pay off the balance of that large purchase. Always be cautious on deferred-interest financing because if you do not pay off the balance, the balance will be charged to your credit card.

Compare The Alternatives

There are more online shopping credit cards worth mentioning as alternatives to the Best Buy card:

|

|

| |

|---|---|---|---|

Capital One® Walmart Rewards® Card | Amazon Prime Visa Card | Chase Freedom Unlimited® card | |

Annual Fee | $0

| $0 ($139 Amazon Prime subscription required)

| $0

|

Rewards |

1-5%

5% cash back at Walmart.com (including pickup and delivery), 2% cash back in Walmart stores and gas stations, at restaurants and on travel plus 1% cash back everywhere else Mastercard is accepted

|

1-5%

5% back on Amazon.com, Amazon Fresh, Whole Foods Market, and Chase Travel purchases. Plus, you’ll get 2% back at gas stations, restaurants, and on local transit, and 1% on all other purchases

|

1.5% – 5%

5% cash back on travel booked through Chase Ultimate Rewards, 3% on dining (including takeout and eligible delivery), 3% on drugstore purchases, and 1.5% on all other purchases

|

Welcome bonus |

5%

5% cash back for the first 12 months when you use your card with Walmart Pay for in-store purchases, upon approval

|

$150

Get a $150 Amazon Gift Card instantly upon approval exclusively for Prime members

|

$200

Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening.

|

Foreign Transaction Fee | Unknown

| $0

| 3%

|

Purchase APR | 17.99% – 28.99% (Variable)

| 19.49% – 28.24% Variable

| 18.74%–28.24% variable

|

FAQ

Citi does not state what credit limit you can expect with this card, but there are reports of initial credit limits of $2,000 to $7,500 from previous and current customers. Your credit limit will be determined by a number of factors during the application process including your creditworthiness and income.

Since this is a Best Buy branded card, you’ll get the most rewards on your Best Buy purchases. So, think outside the box and explore all the store aisles and online categories.

Even if you’re a keen Best Buy fan, you may be unaware of the sheer volume of available products. You may find products that you typically buy from another retailer at Best Buy and you can earn more points.

Best Buy is a fairly large chain with a store network with almost 1,000 locations throughout the United States. There are also Best Buy stores and outlets around the country. While this is not as large a network as Walmart or Target, it is still fairly easy to find a store in most areas of the country.

Obviously, this is a Best Buy branded card, so it is a good idea for those who are particularly loyal to Best Buy. Since the card is also heavily weighted towards rewards for Best Buy purchases, you should consider it if you tend to spend a large amount in Best Buy each month or year.

Compare My Best Buy Visa Card

The Apple Card offers high cashback on Apple products, while the Best Buy card wins when it comes to gas and BestBuy purchases. Let's compare.

My Best Buy Visa Card is cheaper than the Amazon card, which requires a membership. But, it doesn't mean Amazon wins – here's why.

Costco is a clear winner when it comes to rewards for everyday spending, but the Best Buy Card wins for gadget lovers. Here's our comparison.

My Best Buy Visa vs Costco Anywhere Visa Card: How They Compare?