Rewards Plan

Welcome Bonus

Credit Rating

0% Intro

Annual Fee

APR

- Introductory APR

- Preferred Rewards Rates

- No Bonus Categories

- Low Rewards Ratio

Rewards Plan

Welcome Bonus

0% Intro

PROS

- Introductory APR

- Preferred Rewards Rates

CONS

- No Bonus Categories

- Low Rewards Ratio

APR

17.99% - 27.99% Variable

Annual Fee

$0

Balance Transfer Fee

3% or $10 (the greater)

Credit Requirements

Good - Excellent

- Our Verdict

- Pros & Cons

- FAQ

The Bank of America Unlimited Cash Rewards is a solid card for those who don’t want the hassle of dealing with spending categories and limits, you can simply earn a flat rate of cash back on all your purchases. The card also offers a generous 0% APR introductory offer

However, the card is geared towards Bank of America customers, as you can only redeem your cash back to Bank of America accounts. This is not a requirement with similar cards, such as the Chase Freedom Unlimited or Discover It Cash Back.

So, if you’re not already a Bank of America customer, you may find this a little restrictive. But, if you can qualify for BoFa Preferred Rewards status, you can receive a boost to the cash back rate, which makes it far more competitive.

- Introductory APR

- Preferred Rewards Rates

- Option for Paperless Statements

- Flat Cash Back On All Categories

- Overdraft Protection

- Account Alerts

- No Bonus Categories

- Foreign Transaction Fees

- Low Rewards Ratio

- No Third Party Credits

- Preferred Rewards Status Requirements

Does the card provide car rental insurance?

Although the card does not have a specific car rental cover, as a Visa Signature card, you can benefit from collision damage waiver insurance. You will need to book and pay for the entire rental with your card and decline the renal counter additional cover to activate the coverage.

What are card income requirements?

There are no specific income requirements for the Unlimited Cash Rewards card, but you do need to have good to excellent credit. While Bank of America will evaluate your income to ensure that you have sufficient disposable income to manage the card, it is not the only factor to determine if you qualify for the card.

Can I get pre-approved?

There is no option to get pre approval for the Unlimited Cash Rewards on the Bank of America website, but you may receive a mailer or other promotion offering pre approval.

In this Review

Estimating Your Rewards: A Practical Simulation

This table is a rewards simulation that shows how the Bank of America Unlimited Cash Rewards card could work to your advantage. It breaks down the potential rewards you might earn based on your typical spending habits across different categories.

Keep in mind that these figures are just estimates, and your actual rewards may vary depending on your personal spending and other factors. Still, this table can give you a good idea of the card’s potential benefits.

| |

|---|---|

Spend Per Category | Bank of America Unlimited Cash Rewards

|

$10,000 – U.S Supermarkets | $150 |

$3,000 – Restaurants

| $45 |

$4,000 – Airline | $60 |

$4,000 – Hotels | $60 |

$4,000 – Gas | $60 |

Estimated Annual Cash Back | $375 |

Pros and Cons

Just like any other credit card, the Unlimited Cash Rewards Card has some advantages and disadvantages:

Pros | Cons |

|---|---|

Introductory APR | No Bonus Categories |

Preferred Rewards Rates | Foreign Transaction Fees |

Option for Paperless Statements | Low Rewards Ratio |

Flat Cash Back On All Categories | No Third Party Credits |

Overdraft Protection | Preferred Rewards Status Requirements |

Account Alerts |

- Introductory APR

The Bank of America Unlimited Cash Rewards offers a 0% APR for the first 18 billing cycles for purchases, 60 days on balance transfers. This is one of the longest 0% intro offers available.

Just bear in mind that if you do transfer a balance to this card, a 3% or $10 (the greater) balance transfer fee will apply. After the initial billing cycles, the variable rate will apply.

- Flat Cash Back On All Categories

While the cashback rate is not among the highest in the market, it's simple and easy to calculate and it applies to all categories, unlike many other cards. Also, the number of exclusions is very low.

- Preferred Rewards Rates

If you’re a Preferred Rewards member, you can earn up to 25% – 75% more cash back on your purchases. This increases the amount of potential cash back to 1.87% – 2.62%.

- Overdraft Protection

This is an optional service, but it can help to prevent declined purchases or returned checks. You can link your eligible B of A checking account to your card and if you are close to an overdraft situation, funds will be automatically transferred to cover the transaction with no transfer fees.

- Account Alerts

The card offers several types of SMS or email alerts, so you can stay on top of your card due dates and balances. You can receive an alert to let you know when your payments are due and when funds have been paid to your account.

- Option for Paperless Statements

You can opt for paperless statements for your Unlimited Cash Rewards credit card. This not only reduces paper consumption to reduce your environmental impact, but it can also increase your account security.

- Free Access to FICO Scores

You can opt in to access your FICO score with no charge. FICO scores are updated each month and you can access them via the mobile banking app or online banking platform. This feature is essential for those who are working on building or rebuilding their credit.

- No Bonus Categories

While the unlimited cash back is great, there are no bonus categories or unique benefits, which would help this card to distinguish itself from other flat rate cash back cards.

- Foreign Transaction Fees

If you want to use your card outside of the U.S, you will incur a 3% foreign transaction fee. This is a fairly standard rate, but the fees can add up significantly on a vacation or trip. For this reason, there are a number of cards which waive this fee.

- Low Rewards Ratio

While the cash back applies to all categories, it's quite low compared to other cards – only 1.5% . You can find higher rewards ratio on other BoFa cards.

- No Third Party Credits

Although you can accumulate cash back, it cannot be credited to a third party bank. This means that if you want the cash back as actual cash, you will need to credit it into a Bank of America account.

- Preferred Rewards Status Requirements

Although it is possible to get a higher rate of cash back with Preferred Rewards member status, this is difficult to achieve. Depending on the specific criteria, you would need to carry up to $100,000 across qualifying Bank of America accounts to qualify.

Who is the BoFa Unlimited Cash Rewards Card Best For?

The Unlimited Cash Rewards card is a solid choice for anyone who values simplicity. While you might be able to earn higher rewards with tiered category cards, those require some planning before you make purchases. If you prefer earning cash back on all your purchases without worrying about spending categories, this card is perfect for you.

This card is also best for those who already have or can qualify for Preferred Rewards member status. This increases the amount of potential cash by up to 75%, which is highly competitive compared to many other flat rate cash back cards on the market.

You may also want to consider this card if you’re planning a large purchase or you’re carrying a card balance. Since you’ll have 0% APR, it will provide some breathing space to pay down your balance without incurring interest charges.

If you would like to check more options for cards that offer 0% intro and rewards, here are some options:

Card | 0% Intro | Rewards | Annual Fee |

| 15 months on purchases and balance transfers

Go to APR after that will be 18.74%–28.24% variable

| 1.5% – 5%

5% cash back on travel booked through Chase Ultimate Rewards, 3% on dining (including takeout and eligible delivery), 3% on drugstore purchases, and 1.5% on all other purchases

| $0 |

|---|---|---|---|---|

| 15 months on purchases and balance transfers

G o to APR after that will be 17.99% – 26.99% Variable

| 1-5%

5% cashback on up to $1,500 in rotating category purchases each quarter when you activate the bonus category (then 1%), as well 1% percent cash back on all other purchases

| $0 | |

| 15 months on purchases and balance transfers

G o to APR after that will be 17.99% – 27.99% (Variable)

| 1-5%

5% cash back on your highest eligible spend category each billing cycle up to the first $500 spent and 1% cash back thereafter

| $0 | |

| 15 months on purchases and qualifying balance transfers

G o to APR after that will be 18.99%, 23.99%, or 28.99% Variable

| 2%

2% cash rewards on purchases (unlimited)

| $0 | |

| 15 months on purchases and balance transfers

Go to APR after that will be 18.74% – 28.24% variable

| 1-5%

| $0 | |

| 15 months on purchases and balance transfers from the date of account opening

Go to APR after that will be 19.99%-28.99% Variable

| 1-3%

3% Cash Back at U.S. supermarkets / U.S. online retail purchases/ U.S. gas stations on up to $6,000 per year in purchases, then 1%

|

$0 (Rates & Fees) | |

| 15 billing cycles on purchases

Go to APR after that will be 17.99% – 27.99% Variable APR on purchases and balance transfers

| 1-3%

3% cash back in the category of your choice: gas, online shopping, dining, travel, drug stores, or home improvement/furnishings, 2% cash back at grocery stores and wholesale clubs and 1% cash back on all other purchases. The 3% and 2% cash back available on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter (then 1%)

| $0 |

How To Maximize Card Benefits: Tips

Since this card is quite straightforward, there are not very many ways to maximize the benefits of your card. However, there are a couple of things that you can do. These include:

-

Assess the Reward Redemptions

The Unlimited Cash Rewards card does have flexible reward redemptions, so it is important to assess which is the best one for you.

You can have your cash back deposited into a Bank of America bank account, receive statement credit or have a credit to Merrill accounts including a 529 account. So, you can pick which redemption method offers the best value for you.

-

Explore the Visa Signature Benefits

Since the Unlimited Cash Rewards is a Visa Signature card, it offers the full suite of Visa Signature benefits.

These include travel and emergency assistance, extended warranty coverage and pay per use 24/7 Roadside Dispatch.

-

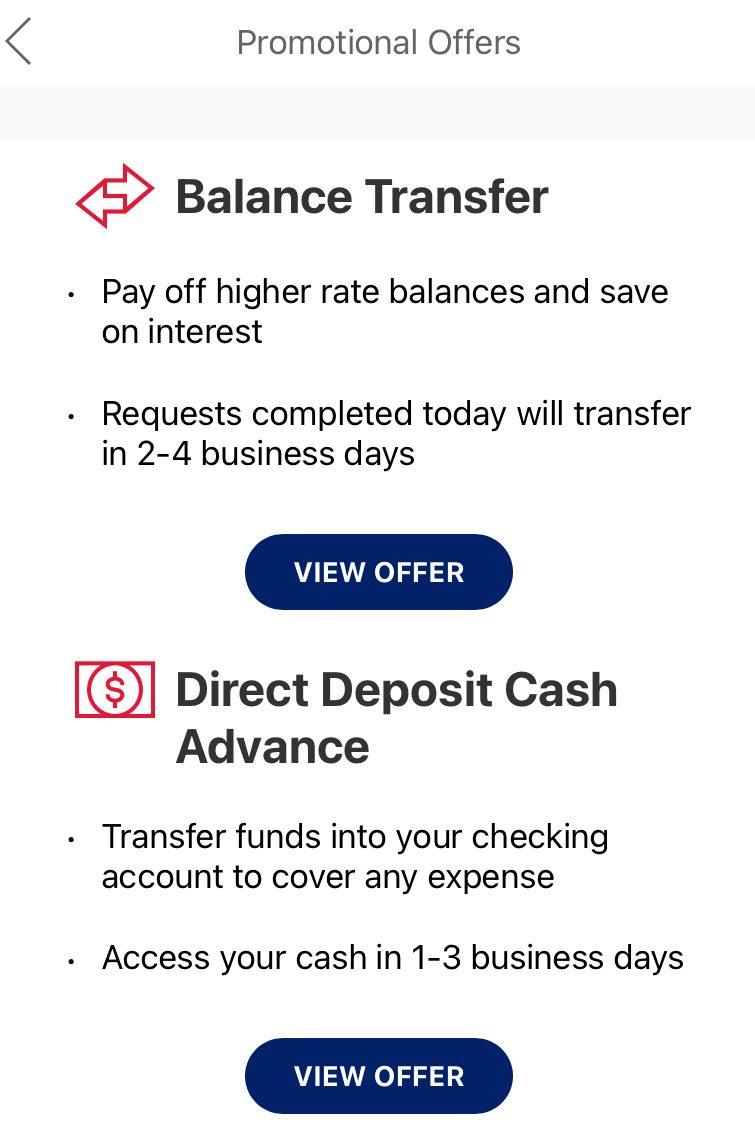

Promotional Offers

Another way to maximize your card is to leverage promotional offers as long as you need them. In every card, customers can see their promotional offers within the app:

FAQs

How do I redeem rewards?

There are several redemption options including statement credit or a deposit into a qualifying Bank of America account. You can log into your account and you’ll see all the available redemption options.

How hard is it to get a Bank of America Unlimited Cash Rewards card?

You do need to have good to excellent credit to qualify for the Unlimited Cash Rewards card, but there are not typically any complicated requirements, so those with decent credit shouldn’t have any difficulty.

When it may not be a good idea?

This card is not a good idea for those who are good at strategically planning their purchases. For that type of person, a tiered reward structure card would offer far higher reward potential. In some cases, it may be possible to earn up to 6% cash back, depending on the spending category.

Compare BofA Unlimited Cash Rewards Card

The BofA Unlimited Cash rewards is the clear winner when comparing it with Bank Americard – here's our side by side comparison