Rewards Plan

Sign up Bonus

Our Rating

0% Intro

Annual Fee

APR

- Membership benefits

- Fraud protection

- No Rewards & Sign Up Bonus

- Non-transferable debts

Rewards Plan

Sign up Bonus

Our Rating

PROS

- Membership benefits

- Fraud protection

CONS

- No Rewards & Sign Up Bonus

- Non-transferable debts

APR

16.49% - 25.24% Variable

Annual Fee

$0

0% Intro

18 month on purchases and balance transfer

Credit Requirements

Good - Excellent

- Our Verdict

- FAQ

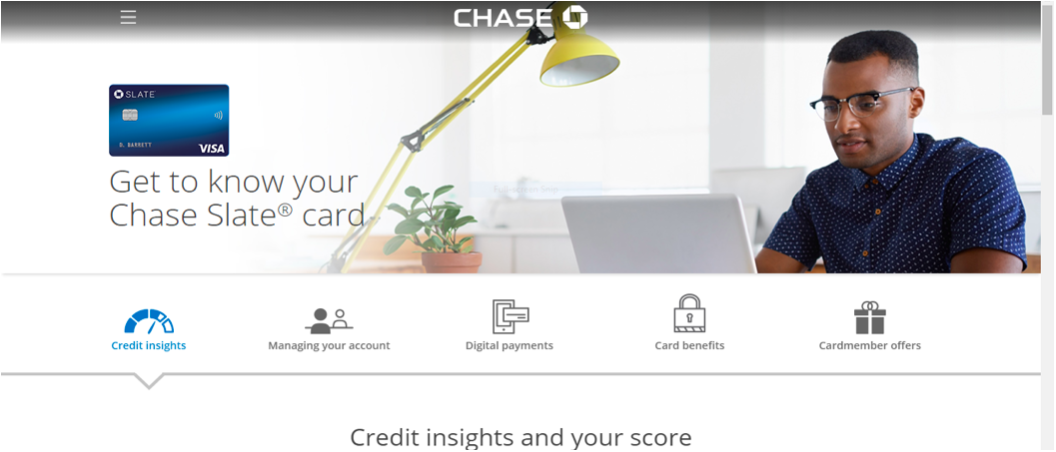

The Chase Slate Edge℠ card is a solid choice for those with an average to good credit score who are looking to transfer balances. Its main perk is the long 0% intro APR, with no annual fee, making it ideal for funding a big purchase or paying down debt over time. Plus, you can earn an annual 2% reduction in your interest rate by making timely payments and managing your spending responsibly.

The card lacks a welcome bonus and doesn't earn rewards, making it best suited for those focused on consolidating debt rather than earning rewards on purchases. Additionally, a 3% foreign transaction fee may deter international use.

Chase Slate Edge℠ users can benefit from features such as the My Chase Plan, allowing fixed monthly payments for large purchases, potentially saving on interest costs. Automatic credit limit reviews are triggered after spending $500 in the first six months with timely payments.

While the card lacks traditional rewards, it offers travel benefits such as a secondary auto rental collision damage waiver and roadside dispatch. It also provides protections like a zero liability policy for purchases and purchase protection.

How does the My Chase Plan work?

My Chase Plan allows you to pay for purchases over time with a fixed monthly fee instead of accruing interest.

What are the advantages of the automatic credit limit review?

It helps you access higher credit limits based on your spending and payment history.

What is the variable APR after the introductory period?

The variable APR on balance transfers and purchases ranges from 16.49% – 25.24% Variable after the 0% introductory period.

Table of Contents

Pros & Cons

Let’s take a closer look at the pros and cons of the Chase Slate Card – and whether or not it’s suitable for your wallet.

Pros | Cons |

|---|---|

No Annual Fee

| No Rewards & Sign Up Bonus |

0% Intro APR | Foreign Transaction Fee |

Interest Rate Reduction | Non-Transferable Debts |

My Chase Plan | Balance Transfer Fee |

Automatic Credit Limit Review | |

Travel Protections | |

Credit Building Tools |

- No Annual Fee

The Chase Slate Edge℠ does not charge an annual fee, making it a cost-effective option.

- 0% Intro APR

It offers a 0% introductory APR for 18 month on purchases and balance transfer , providing a significant window for debt management.

- Interest Rate Reduction

Cardholders can lower their interest rate by 2% annually by making timely payments and spending at least $1,000 per year.

- My Chase Plan

The card features My Chase Plan, allowing users to pay for purchases over time with a fixed monthly fee, offering flexibility in managing expenses.

- Automatic Credit Limit Review

After spending $500 in the first six months with timely payments, an automatic credit limit review is triggered, potentially increasing your credit limit.

- Travel Protections

While not a rewards card, it offers travel benefits such as a secondary auto rental collision damage waiver and roadside dispatch.

- Credit Building Tools

The card provides tools for credit monitoring and an automatic credit limit review, helping users build and monitor their credit.

- No Rewards & Sign Up Bonus

The Chase Slate Edge℠ doesn't offer rewards or sign up bonus for new customers.

- Foreign Transaction Fee

A 3% foreign transaction fee is applied to purchases made abroad in U.S. dollars, making it less suitable for international travelers.

- Balance Transfer Fee

While the introductory APR for balance transfers is 0%, there is a balance transfer fee of 3% or $5 (whichever is greater) on transfers made within 60 days, increasing to $5 or 5% after 60 days.

- Non-Transferable Debts

Clients aren't permitted to transfer debts from other chase accounts. This exclusion is a significant drawback of this card because if debts were transferrable, the 0% introductory rate helps stop interests from accruing on other high-rate debts.

Top Offers

Top Offers

Top Offers From Our Partners

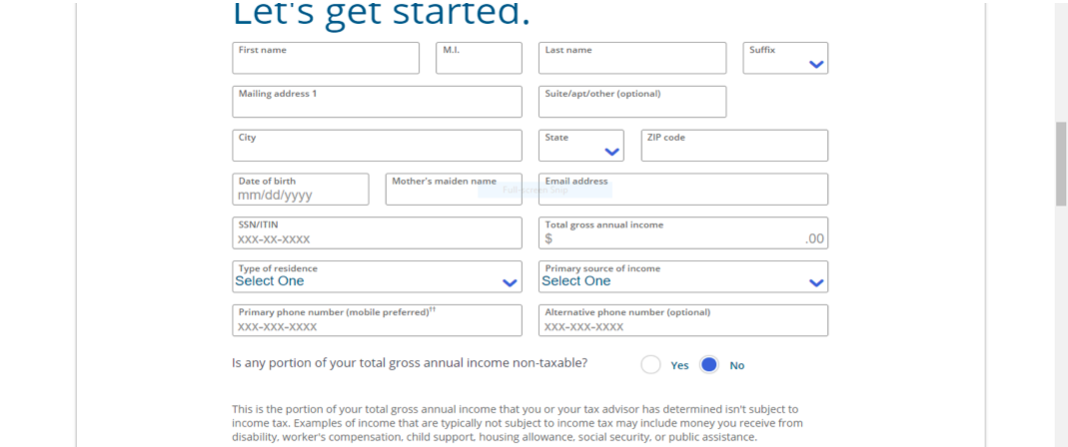

How To Apply For Chase Slate Edge℠ Card?

- 1.

Visit the website at chase.com to apply.

- 2.

Fill in your personal and financial details such as name, address, social security number, date of birth, mother’s maiden name, annual income, housing details, and phone number.

- 3.

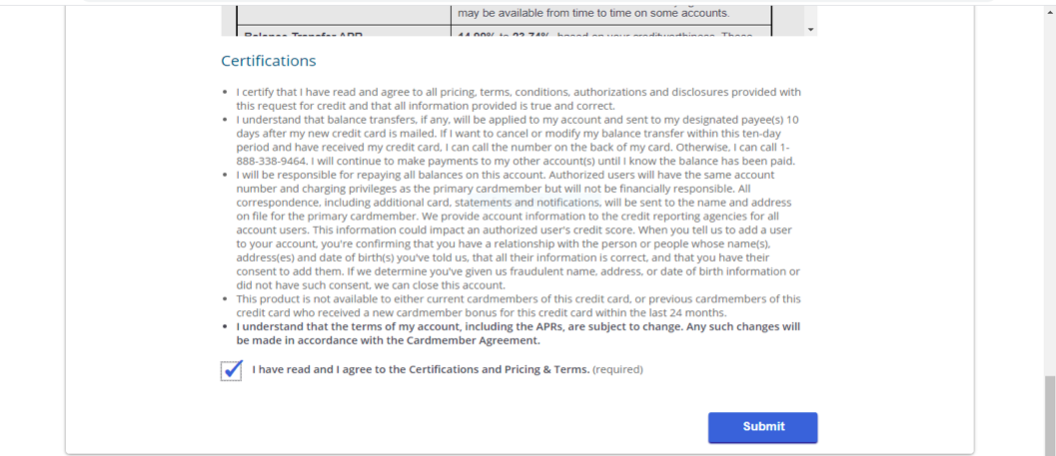

Scroll down to choose your communication delivery preference and read the e-sign disclosure agreement, pricing, and terms. Then tick the box to consent to the provisions and select ‘Submit' to proceed.

- 4.

You have successfully completed your application and your request is now under review.

How It Compared To Other Balance Transfer Cards?

The Chase Slate Edge℠ stands out among balance transfer cards with its unique features, but its comparison with other options reveals a mix of advantages and limitations.

If you're looking for balance transfer cards with longer introductory APR periods, alternatives like the Wells Fargo Reflect® Card and the Citi Simplicity® Card are worth considering. Other great options include the U.S. Bank Platinum Card and the BankAmericard, both offering 0% intro APR. However, keep in mind that none of these cards come with rewards.

However, some cards offer shorter 0% intro but still give you rewards and a welcome bonus. For example, the Chase Freedom Unlimited® card offers a 0% intro APR on purchases and rewards on everyday spending, providing a more comprehensive package for those seeking ongoing benefits.

The Capital One SavorOne Cash Rewards Credit Card stands out for its combination of no annual fee, no foreign transaction fees, and cash back rewards.

Compare The Alternatives

There are more Chase cards with worth mentioning as alternatives to the Chase Slate card:

|

|

| |

|---|---|---|---|

Chase Freedom Unlimited® Card | Chase Sapphire Preferred® Card | Chase Sapphire Reserve® Card | |

Annual Fee | $0

| $95

| $550

|

Rewards |

1.5% – 5%

5% cash back on travel booked through Chase Ultimate Rewards, 3% on dining (including takeout and eligible delivery), 3% on drugstore purchases, and 1.5% on all other purchases

|

2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

|

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

|

Welcome bonus |

$200

Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening.

|

75,000 points

75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening

|

Earn 125,000 points after you spend $6,000 in purchases in the first 3 months from account opening

Earn 125,000 points after you spend $6,000 in purchases in the first 3 months from account opening

|

Foreign Transaction Fee | 3%

| $0

| $0

|

0% Intro APR | 15 months on purchases and balance transfers

| N/A

| N/A

|