Rewards Plan

Sign up Bonus

Our Rating

0% Intro

Annual Fee

APR

- Cash Back for Select Spending Categories

- 0% Intro APR

- Limit on Cash Back Spending Per Quarter

- Balance Transfer Fee

Rewards Plan

Sign up Bonus

Our Rating

PROS

- Cash Back for Select Spending Categories

- 0% Intro APR

CONS

- Limit on Cash Back Spending Per Quarter

- Balance Transfer Fee

APR

17.99% - 26.99% Variable

Annual Fee

$0

0% Intro

15 months on purchases and balance transfers

Credit Requirements

Good - Excellent

- Our Verdict

- FAQ

The Discover it® Chrome credit card is positioned as a suitable choice for road trips, emphasizing decent cashback on gas and restaurants in addition to a long 0% intro APR

You can earn 2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter and 1% cash back on all your other purchases. Plus, Discover Discover matches all cash back you earn at the end of your first year. While the rewards structure is fairly straightforward compared to other cash-back cards, the standout feature is the Cashback Match™, which doubles all the cash back you've earned in your first year.

The card, with a $0 annual fee, also promotes other benefits such as no foreign transaction fees, a freeze feature for added security, and Discover's assistance in removing personal information from select people-search sites.

However, the card's appeal is contingent on individual preferences, with a warning that other cards for individuals with good credit may offer more rewarding options, given the Discover it® Chrome's limited rewards and quarterly spending cap.

What is the initial credit limit?

The credit limit that you get with Discover it Chrome Card will at the very lowest be $300. It can be much higher and will depend on your personal financial situation.

How do I redeem cash back?

You can get the rewards in the form of cash, statement credit, or gift cards when you are looking to redeem the rewards that you have earned through the Discover it Chrome Card.

How to maximize rewards on Chrome Card?

If you want to maximize the rewards that you can get through the Discover it Chrome Card, make the most of the quarterly cap on the 2% cashback for gas and dining, as well as the signup offer.

What are the top Reasons NOT to get the Chrome Card?

If you want bigger cashback rates then you might want to look outside of the Discover it Chrome Card and focus on cards that might have special bonus categories.

In This Review..

Pros & Cons

Let’s take a look at the benefits of the Discover it® Chrome Gas & Restaurants Card and see if it’s the right one for your wallet or not.

Pros | Cons |

|---|---|

Cashback Rewards | Balance Transfer Fee |

No Annual Fee | Low Rewards Ratio |

0% Intro APR | Limit on Cash Back Spending Per Quarter |

Discover Matches Cash Back | Few Additional Perks |

No Foreign Transaction Fee |

- Cashback Rewards

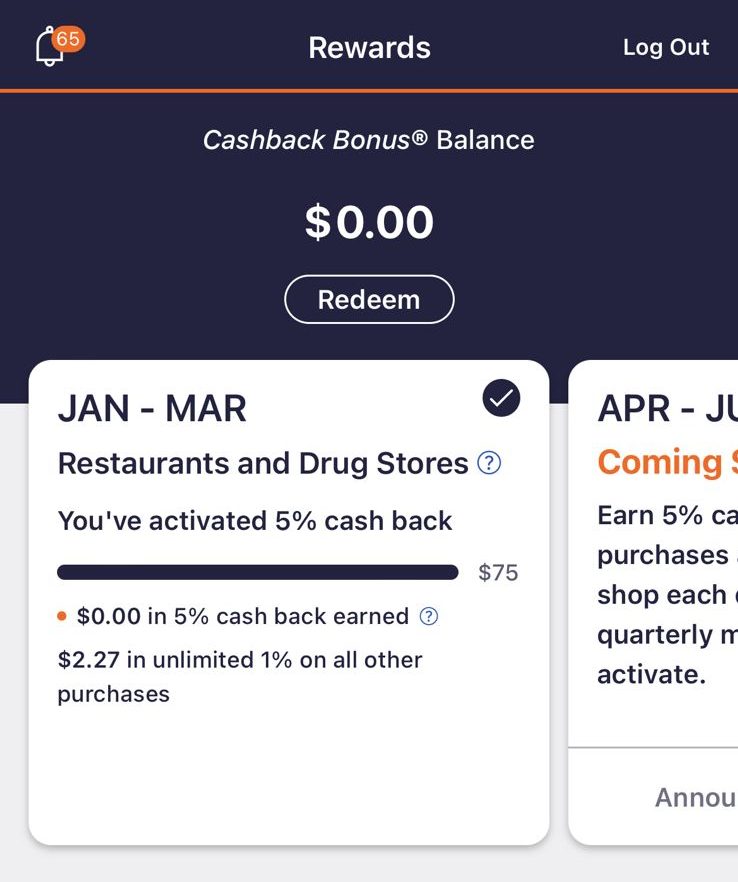

The card offers 2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter and 1% cash back on all your other purchases.

- No Annual Fee

As with all Discover credit cards, you won’t have to pay an annual fee. You also don’t have to pay foreign transaction fees when using your card while traveling.

The fees you will have to pay, however, are a balance transfer fee of 5% if you’re bringing over a balance from a previous credit card.

- 0% Intro APR

Discover incentivizes you to switch to the Discover It Chrome credit card by offering a very attractive intro offer which includes 0% APR for 15 months on purchases and balance transfers.

This means you can take your time paying off new purchases, interest-free.

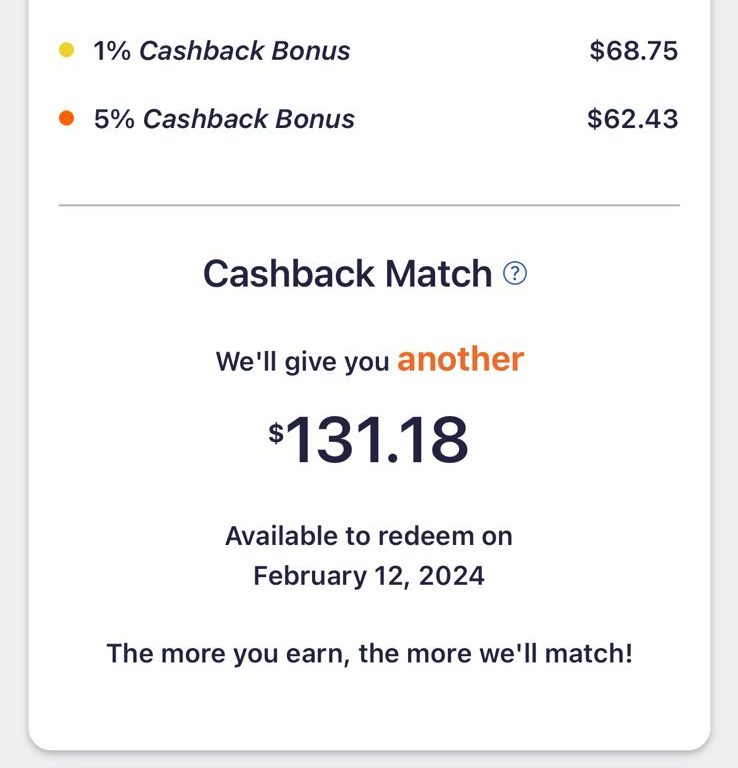

- Discover Matches Cash Back

One of the key benefits of the Discover It Balance Transfer credit card is that Discover will match ALL of the cash back you’ve earned at the end of your first year having the credit card.

This applies to all purchases that earn 1% cash back as well as all purchases that earn 5% cash back so the potential to earn a lot in cash back rewards is high.

- No Foreign Transaction Fee

Whenever you are traveling outside of the country, you won’t have to worry about using your credit card and incurring fees.

Discover is offering you no foreign transaction fees so swipe away and enjoy buying things on credit while traveling other countries!.

- Balance Transfer Fee

The Discover It Balance Transfer card does have a balance transfer fee of 3% which could be a drawback for some consumers.

If you have a high balance you’re transferring over, this 3% fee could add up to a lot of money as compared to a credit card that offers 0% transfer fee.

- Low Rewards Ratio

There are many cashback cards for good credit with much higher reward ratios, including additional categories.

- Limit on Cash Back Spending Per Quarter

While the 5% cash back is a benefit of this credit card, the drawback is that Discover limits this reward to the first $1,500 spending per quarter.

If you easily achieve $1,500 in spending every quarter, then you may be disappointed that all the additional spending is no longer earning the hefty 5% cash back rate.

- Few Additional Perks

Discover it® Chrome lacks some of the additional perks and benefits offered by competing rewards cards, potentially making it less appealing for users seeking a comprehensive rewards package.

What Are The Redemption Options?

The Discover it® Chrome credit card offers flexible redemption options for the cash back earned. Cardholders can redeem their cash back in the following ways:

Statement Credits: Cardholders can apply their cash back as a statement credit, reducing the outstanding balance on their credit card account.

Direct Deposits: Cash back can be redeemed by direct deposit into the cardholder's bank account, providing a straightforward way to access the earned rewards.

Gift Cards: Discover it® Chrome allows users to redeem cash back for gift cards. The available gift card options typically range from $5 to $200, with increments of $5.

“Pay with Cashback Bonus” at Eligible Merchants: Cardholders have the option to use their cash back directly at eligible merchant checkouts, including platforms like PayPal. This provides a convenient way to offset purchases with accumulated cash back.

Charitable Donations: Discover it® Chrome allows users to contribute their cash back to charitable organizations. Cardholders can choose to make a donation starting at 1 cent.

How It Compared To Other Discover Credit Cards?

When comparing the Discover it® Chrome to other Discover credit cards, Discover it® Chrome has benefits but also limitations.

For example, the Discover it® Cash Back card is another popular choice. It offers 5% cash back on rotating bonus categories that change every quarter, plus 1% on all other purchases. While the Discover it® Chrome focuses on gas stations and restaurants, which might be a great fit for some, the Discover it® Cash Back offers a wider range of rotating categories, making it a better option for users who prefer variety.

The Discover it® Miles card, on the other hand, offers unlimited 1.5x miles on all purchases, with the added benefit of miles matching at the end of the first year. The simplicity may be preferable for those prioritizing travel rewards over cash back.

Additionally, the Discover it® Secured card caters to individuals looking to build or rebuild their credit. It requires a security deposit but offers cash back rewards, helping users improve their credit while earning rewards.

Is the Discover it Chrome Card Right for You?

If you want a long time to pay down a credit card balance while still earning cash back on new purchases, the Discover it® Chrome Gas & Restaurants Card is a great option and tough to beat. While it does have a balance transfer fee, it is still comparatively low to other credit cards. The major benefit of this card is if you plan to take advantage of the first 12 months cash back matching reward by Discover.

This card is not for you if you are more focused on transferring your debt balance and paying it down rather than additional spending. Instead, you can find a credit card with an even longer intro balance transfer period to give you more time to pay off the balance. Just watch out for the balance transfer fee.

Compare The Alternatives

There are more cards with cashback on everyday purchases such as gas & restaurants – here are some good alternatives to the Chime card:

|

|

| |

|---|---|---|---|

Chase Freedom Flex℠ Card | Capital One Venture Rewards Credit Card | American Express EveryDay® Card | |

Annual Fee | $0

| $95

| $0

|

Rewards |

1-5%

|

2X – 5X

2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel

|

1X – 2X

2X points at U.S. supermarkets (up to $6,000 per year, then 1X), 2X points on prepaid rental cars booked through American Express Travel and 1X points on all other purchases

|

Welcome bonus |

$200

|

75,000 miles

75,000 miles once they spend $4,000 on purchases within 3 months from account opening

|

10,000 points

10,000 points after spending $2,000 on purchases within the first three months

|

Foreign Transaction Fee | 3%

| $0

| 2.7%

|

Purchase APR | 18.74% – 28.24% variable

| 19.99% – 28.99% (Variable)

| 17.74% – 28.74% Variable

|

FAQ

There is a $1,000 cap on purchases each quarter that allows you to get the bonus cashback rates when you are making purchases with the Discover it Cash Back card.

You are not able to get car rental insurance when you have the Discover it Chrome card. This is something that is offered by other types of credit cards.

When you are applying to get a Discover it Chrome Card, there is no out and out request for proof of income and no transparent income requirements.

Yes, pre-approval is possible when you are looking to get the Discover it Chrome Card. This means that a hard credit check can initially be avoided.

Compare Discover It Chrome Gas & Restaurant

While the Discover it Cashback offers higher rewards on rotating categories, the Chrome card offers flat rate on gas & restaurants. Which is better?

Here's our comparison: Discover it Cash Back vs Discover it Chrome

The Discover it Miles and Chrome Gas & Restaurant offer a different rewards structure and basic benefits.

Here's a side-by-side comparison: Discover it Miles vs. Chrome Gas & Restaurant

Top Offers

Top Offers