Rewards Plan

Sign up Bonus

Our Rating

0% Intro

Annual Fee

APR

- Automatic Silver Elite Status

- No Annual Fee

- Limited Travel Benefits

- Limited Bonus Categories

Rewards Plan

Sign up Bonus

Our Rating

PROS

- Automatic Silver Elite Status

- No Annual Fee

CONS

- Limited Travel Benefits

- Limited Bonus Categories

APR

21.49%–28.49% variable

Annual Fee

$0

0% Intro

N/A

Credit Requirements

Good - Excellent

- Our Verdict

- FAQ

The Marriott Bonvoy Bold® Credit Card is a rewards credit card designed for people who frequently stay at Marriott hotels and want to earn rewards for their spending. The card offers a range of benefits and doesn't charge an annual fee or foreign transaction fee.

Cardholders can earn 3X Bonvoy points per $1 spent at over 7,000 hotels participating in Marriott Bonvoy. Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy® member. Plus, earn up to 1X point from Marriott with Silver Elite Status. 2X Bonvoy points for every $1 spent on other travel purchases (from airfare to taxis and trains). 1X point for every $1 spent on all other purchases.. Points can be redeemed for hotel stays, transferring to various airline partners, car rentals, and more.

The card comes with benefits like automatic Silver Elite status, which gives you perks such as a 10% points bonus on eligible hotel purchases and priority late checkout. It also includes travel and purchase protections, plus a one-year DashPass membership for DoorDash.

On top of that, you’ll enjoy a range of travel-related benefits, including Visa Signature® concierge service, lost luggage reimbursement, baggage delay insurance, and trip delay reimbursement.

However, there are a few downsides. For instance, the card doesn’t offer rewards on everyday spending, and its travel perks are more limited compared to other travel cards.

What benefits come with the automatic Silver Elite Status?

Silver Elite Status provides perks such as a 10% points bonus on eligible hotel purchases and priority late checkout.

Can points be redeemed for anything other than hotel stays?

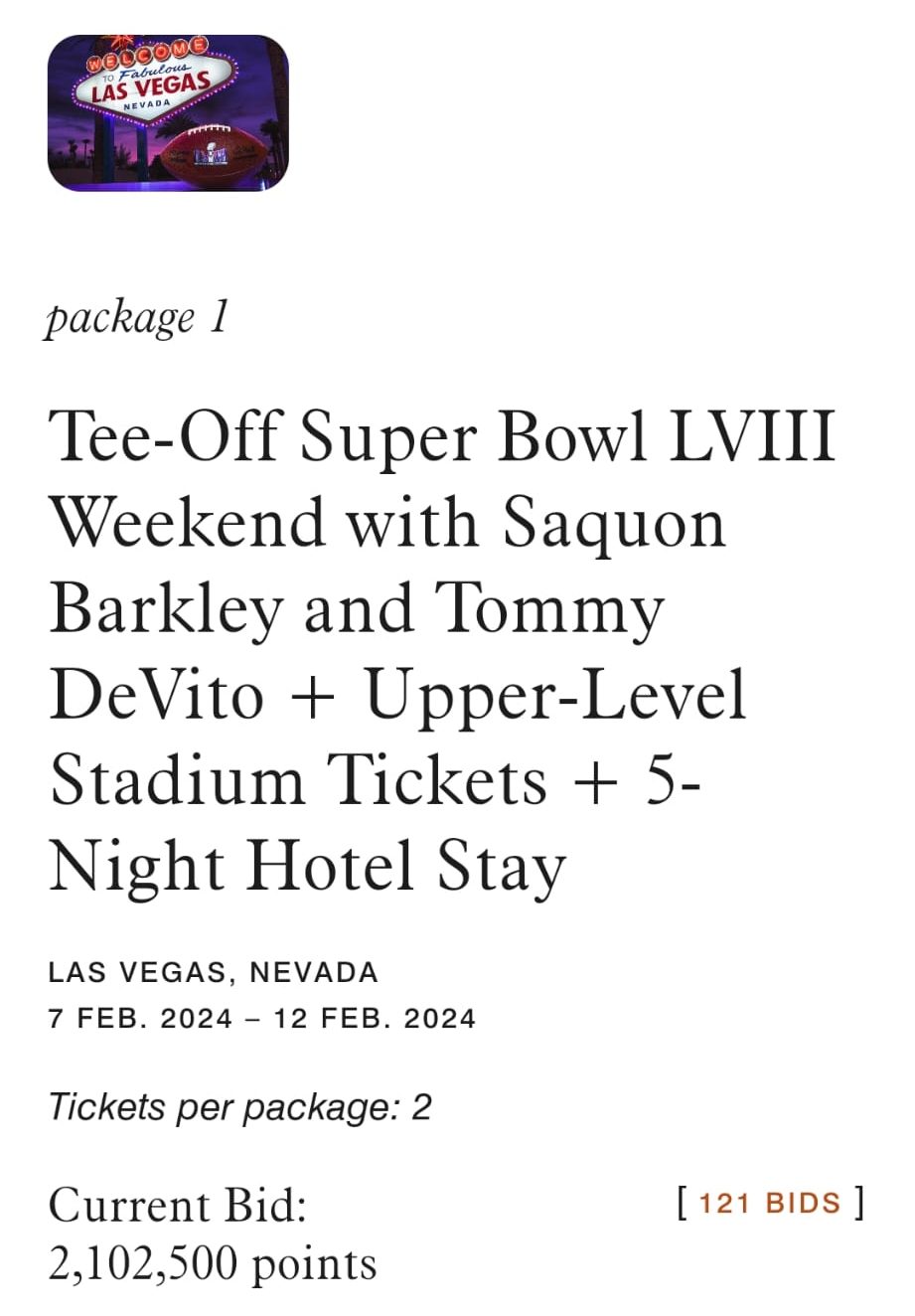

Yes, points can be redeemed for various options, including travel, transfer to airline partners, bidding on Marriott Bonvoy Moments, and even for shopping and gift cards.

Can I use Marriott Bonvoy points for non-travel redemptions?

Yes, points can be redeemed for shopping and gift cards, but hotel stays typically offer the best value.

Is there a Free Night Award available with the Marriott Bonvoy Bold® Credit Card?

No, the card does not offer a Free Night Award.

How much are Marriott Bonvoy points worth?

On average, Marriott points are valued at 0.8 cent cents each, according to our valuations.

In this Review

The Potential Rewards: A Comprehensive Analysis

The table below presents a rewards simulation that offers an overview of the potential benefits of using the Marriott Bonvoy Bold® credit card, based on both general usage and spending across different categories.

This simulation can provide you with valuable insights into the rewards you could earn from using this card.

However, it's important to keep in mind that the figures shown in the table are estimates and your actual rewards may differ depending on your unique spending habits and other factors.

Spend Per Category | Marriott Bonvoy Bold® Credit Card |

$10,000 – U.S Supermarkets | 10,000 points |

$4,000 – Restaurants

| 4,000 points |

$3,000 – Airline | 6,000 points |

$4,000 – Hotels | 56,000 points |

$4,000 – Gas | 4,000 points |

Estimated Total Annual Points | 80,000 Points |

Redemption Value (Estimated) | 1 point = ~0.8 cent |

Estimated Annual Value | $640 |

Pros and Cons

Just like any other credit card, the Marriott Bonvoy Bold® has some advantages and disadvantages:

Pros | Cons |

|---|---|

No Annual Fee | Limited Travel Benefits |

Travel and Purchase Protections | Co-branded Card |

Sign-up Bonus | Limited Bonus Categories |

Automatic Silver Elite Status | Poor Transfer Rates to Airlines |

No Foreign Transaction Fee |

- No Annual Fee

Unlike most Marriot credit cards, the card has no annual fee, making it a good option for those who want to earn rewards without paying a fee.

- Travel and Purchase Protections

Cardholders enjoy travel and purchase protections, including baggage delay insurance, lost luggage reimbursement, trip delay reimbursement, and purchase protection, enhancing the overall value of the card.

- Sign-up Bonus

New cardholders can earn 1 Free Night Award (valued up to 50,000 points) after you spend $1,000 on purchases in your first 3 months from your account opening.

- Automatic Silver Elite Status

Cardholders receive automatic Silver Elite status, which offers perks such as priority late check-out, a 10% points bonus on Marriott stays, and access to exclusive events.

- No Foreign Transaction Fee

When using your card for purchases made outside the United States, you won't be charged any foreign transaction fees.

- Limited Travel Benefits

The card offers some travel benefits, such baggage delay insurance, lost luggage reimbursement and purchase protection.

However, it doesn't offer the same level of travel perks as some premium hotel cards.

- Co-branded Card

Points can only be redeemed for hotel stays, merchandise, or experiences, which may not be as flexible as cash back or other redemption options.

- Limited Bonus Categories

While the card offers bonus points for Marriott stays and travel purchases, it doesn't offer bonus points for other popular spending categories, such as everyday spending, dining or entertainment, which may be a drawback for some cardholders.

- Poor Transfer Rates to Airlines

While the card allows points transfer to airline loyalty programs, the transfer rates are typically poor at 3 Marriott points for every 1 airline point or mile, limiting the value of this redemption option.

Top Offers

Top Offers From Our Partners

Top Offers

Redeeming Points: Options for Cardholders

The Marriott Bonvoy Bold® Credit Card allows cardholders to redeem points for a variety of rewards, including hotel stays, flights, rental cars, and more. Here's a look at the different redemption options and whether they are competitive:

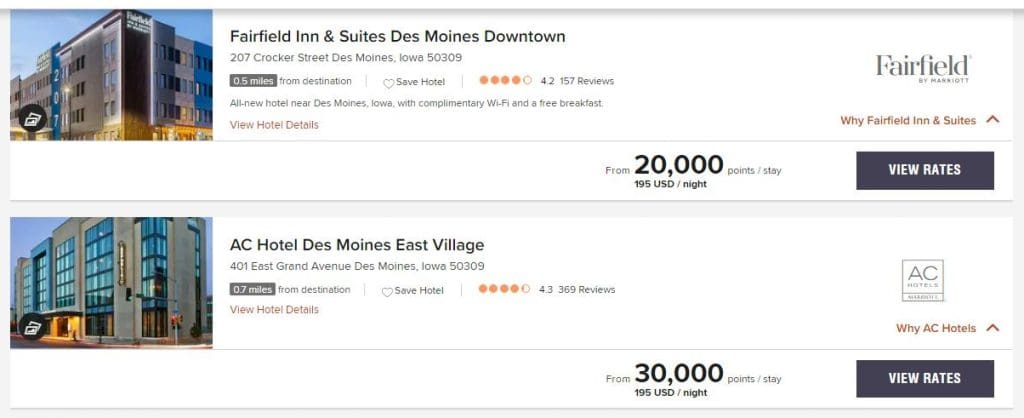

Hotel stays: Cardholders can use their points to book free hotel stays at participating Marriott Bonvoy hotels. The redemption value varies depending on the property and time of year. This redemption option is competitive and can offer a solid value for points.

You can use the search tool on the Marriott website to find Hotel and Air packages, which typically include a seven-night hotel stay and 50,000 or 100,000 airline miles with your preferred airline program. These packages start at around 250,000 points and offer the chance to enjoy a complete vacation experience with your points.

Convert to Airline Miles: Points can be redeemed for miles through participating airlines. Marriott Bonvoy boasts the most extensive list of airline partners among hotel programs, with 38 airline partners. In comparison, Hilton points can be redeemed on 26 airline transfer partners, while Hyatt loyalty program points can be redeemed on 25 airline transfer partners.

- Shop with Points: Marriott Bonvoy provides a “Shop with Points” feature that allows you to use your points for various items such as tech and fashion via the shopping portal. However, there is no fixed point value for each item, and you'll need to check the prices for each specific item to make sure you're getting the best deal.

Rental cars: Points can be redeemed for rental cars through participating rental car companies.

- Pool points: If you have friends or family who are also Marriott Bonvoy members, you can combine your points to help each other out. You can transfer up to 100,000 points per calendar year and receive up to 500,000 points from others. There are no fees for this, and to initiate a transfer, simply reach out to a Marriott representative.

Overall, the redemption options for the Marriott Bonvoy Bold® Credit Card are competitive, particularly for hotel stays and flights.

Is this Credit Card Your Perfect Match?

The Marriott Bonvoy Bold® Credit Card is a good choice for people who frequently stay at Marriott hotels and want to earn rewards for their spending. Here are some specific situations when you may want to consider this card:

You stay at Marriott hotels often: If you frequently stay at Marriott hotels, the Bonvoy Bold Card can be a great way to earn rewards for your spending. With Up to 14X points per dollar spent at participating Marriott Bonvoy hotels, you can earn a significant amount of rewards.

You want a hotel rewards credit card with no annual fee: The card has no annual fee, which can make it a more accessible option for those who don't want to pay an annual fee for a hotel credit card.

You want to earn free hotel stays: The card's rewards program allows you to earn points that can be redeemed for hotel stays, flights, car rentals, and more. If you're looking to earn free hotel stays, this card can be a good option.

You have another card for everyday spending: If you carry a primary card for everyday spending and use this card specifically for travel and especially paying for hotel stay, that may be a good idea.

Card | Rewards | Bonus | Annual Fee | |

|---|---|---|---|---|

1x – 6X

6X points for every $1 spent at over 7,000 hotels participating in Marriott Bonvoy® with the Marriott Bonvoy Boundless® credit card. Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy® member. Plus, earn up to 1X point from Marriott with Silver Elite Status. Earn 3X points for every $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining. Earn 2X points for every $1 you spend on all other purchases.

| 125,000 points

Earn 125,000 Bonus Points after you spend $5,000 on purchases in your first 3 months from your account opening.

| $95 | ||

2X – 6X

6 Marriott Bonvoy points for each dollar of eligible purchases at hotels participating in the Marriott Bonvoy™ program, 3 points at Worldwide restaurants and on flights booked directly with airlines and 2 points on all other eligible purchases

| 95,000 points

95,000 Marriott Bonvoy points after spending $6,000 within the first 6 months of card membership.

| $650 | ||

Marriott Bonvoy Bold Credit Card | Up to 14X

3X Bonvoy points per $1 spent at over 7,000 hotels participating in Marriott Bonvoy. Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy® member. Plus, earn up to 1X point from Marriott with Silver Elite Status. 2X Bonvoy points for every $1 spent on other travel purchases (from airfare to taxis and trains). 1X point for every $1 spent on all other purchases.

| 50,000 points

1 Free Night Award (valued up to 50,000 points) after you spend $1,000 on purchases in your first 3 months from your account opening

|

$0 | |

2x – 6x

6X points on purchases at hotels participating in Marriott Bonvoy, 4X points at restaurants worldwide (including takeout and delivery in the U.S.) and U.S. supermarkets (up to $15,000 in combined purchases per year, then 2X points), 2X points on all other purchases

| 85,000 points

Earn 85,000 Marriott Bonvoy bonus points after you use your new card to make $5,000 in purchases within the first six months of card membership.

| $250 |

Sign Up for

Our Newsletter

and special member-only perks.

Sign Up for

Our Newsletter

and special member-only perks.

Compare Marriott Bonvoy Bold Card

The Hilton Honors Amex is our winner with higher cashback value and great overall rating for a hotel card with no annual fee.

Hilton Honors American Express vs. Marriott Bonvoy Bold: Which Hotel Card Is Best?