The Citi/AAdvantage Executive World Elite Mastercard and the Chase Sapphire Reserve® are both premium travel rewards credit cards that offer a variety of benefits to frequent travelers.

However, there are some key differences between them – let's compare them side by side, including features, benefits, drawbacks, and target audience.

General Comparison

The Citi/AAdvantage Executive card is associated with American Airlines' AAdvantage program, making it an ideal choice for those who frequently fly with American Airlines. Cardholders receive Admirals Club membership, providing access to premium airport lounges, enhancing the overall travel experience.

On the other hand, the Chase Sapphire Reserve stands out as an excellent option for travelers seeking a flexible travel rewards card, applicable to a diverse range of travel expenditures such as flights, accommodations, car rentals, and dining.

Here's a side by side comparison of the card's main features:

Citi/AAdvantage Executive World Elite | Chase Sapphire Reserve | |

Annual Fee | $525 | $550 |

Rewards | 10X AAdvantage® miles on eligible rental cars/hotels through aa.com, 4X miles on eligible American Airlines purchases and 1X on all other purchases

| 5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases. |

Welcome bonus | 70,000 American Airlines AAdvantage® bonus miles after spending $7,000 in purchases within the first 3 months of account opening | 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening |

0% Intro APR | N/A | N/A |

Foreign Transaction Fee | $0 | $0 |

Purchase APR | 21.24% – 29.99% (Variable) | 22.49%–29.49% variable |

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Compare Point Rewards: Which Card Wins?

Based on our analysis, there is no clear winner here as both cards offer a high points rewards ratio. Therefore, which card is better depends heavily on your spending habits.

Spend Per Category | Citi/AAdvantage Executive World Elite | Chase Sapphire Reserve |

$10,000 – U.S Supermarkets | 10,000 miles | 10,000 points |

$5,000 – Restaurants | 5,000 miles | 15,000 points |

$6,000 – Hotels | 60,000 miles | 60,000 points |

$8,000 – Airline

| 32,000 miles | 40,000 points |

$4,000 – Gas | 4,000 miles | 4,000 points |

Total Points | 111,000 miles | 129,000 points |

Estimated Redemption Value | 1 mile ~1.5 cents | 1 point ~ 1 – 1.5 cent |

Estimated Annual Value | $1,665 | $1,290 – $1,935 |

Can I Transfer Chase Reserve Points To American Airlines?

No, the Chase Sapphire Reserve is part of the Chase Ultimate Rewards program, which has several airline and hotel transfer partners, and American Airlines is not one of them.

However, they can be transferred to other Oneworld alliance partners such as British Airways and Iberia. By transferring your Chase points to one of these airlines, you can indirectly use them to book flights with American Airlines.

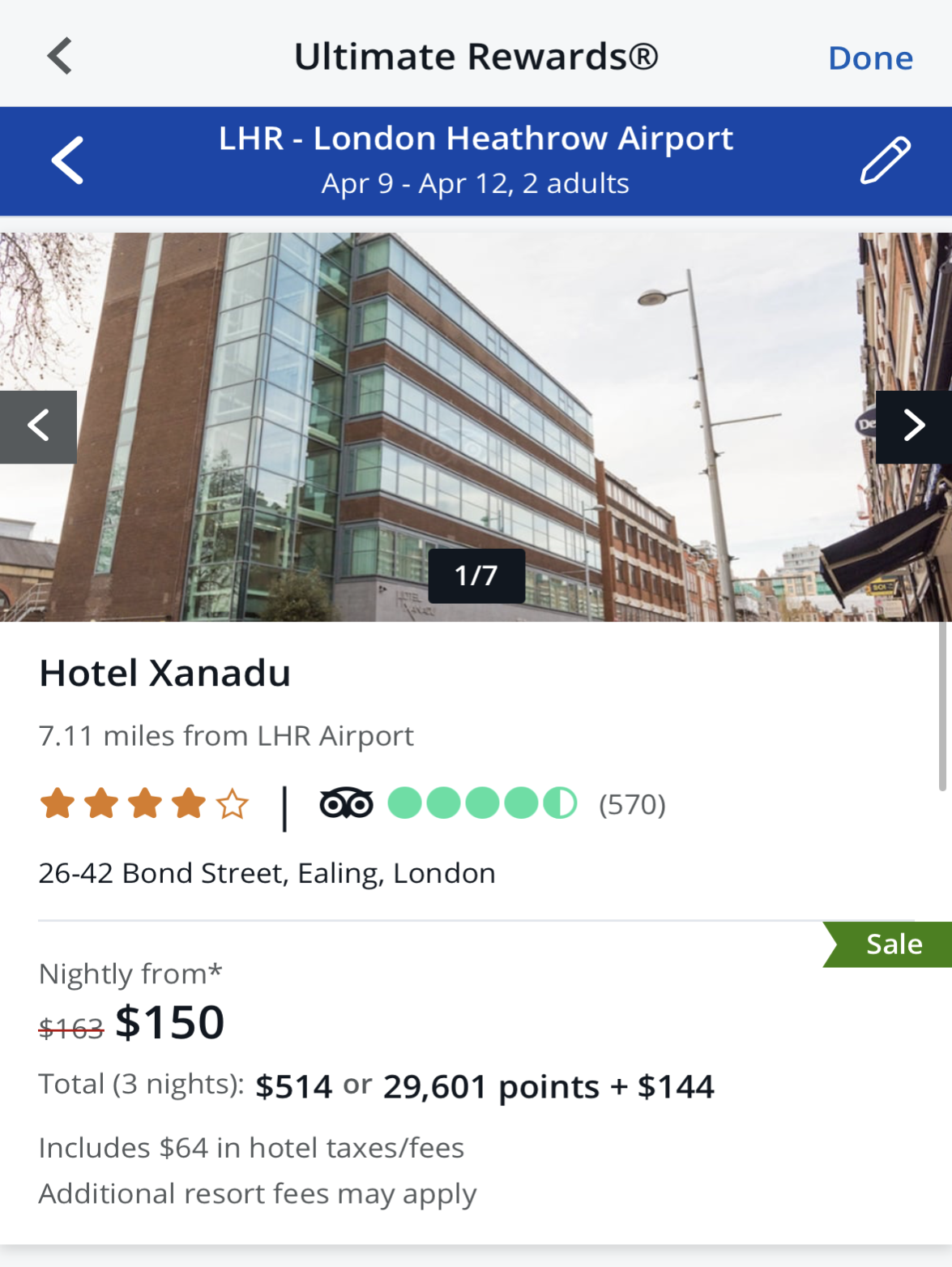

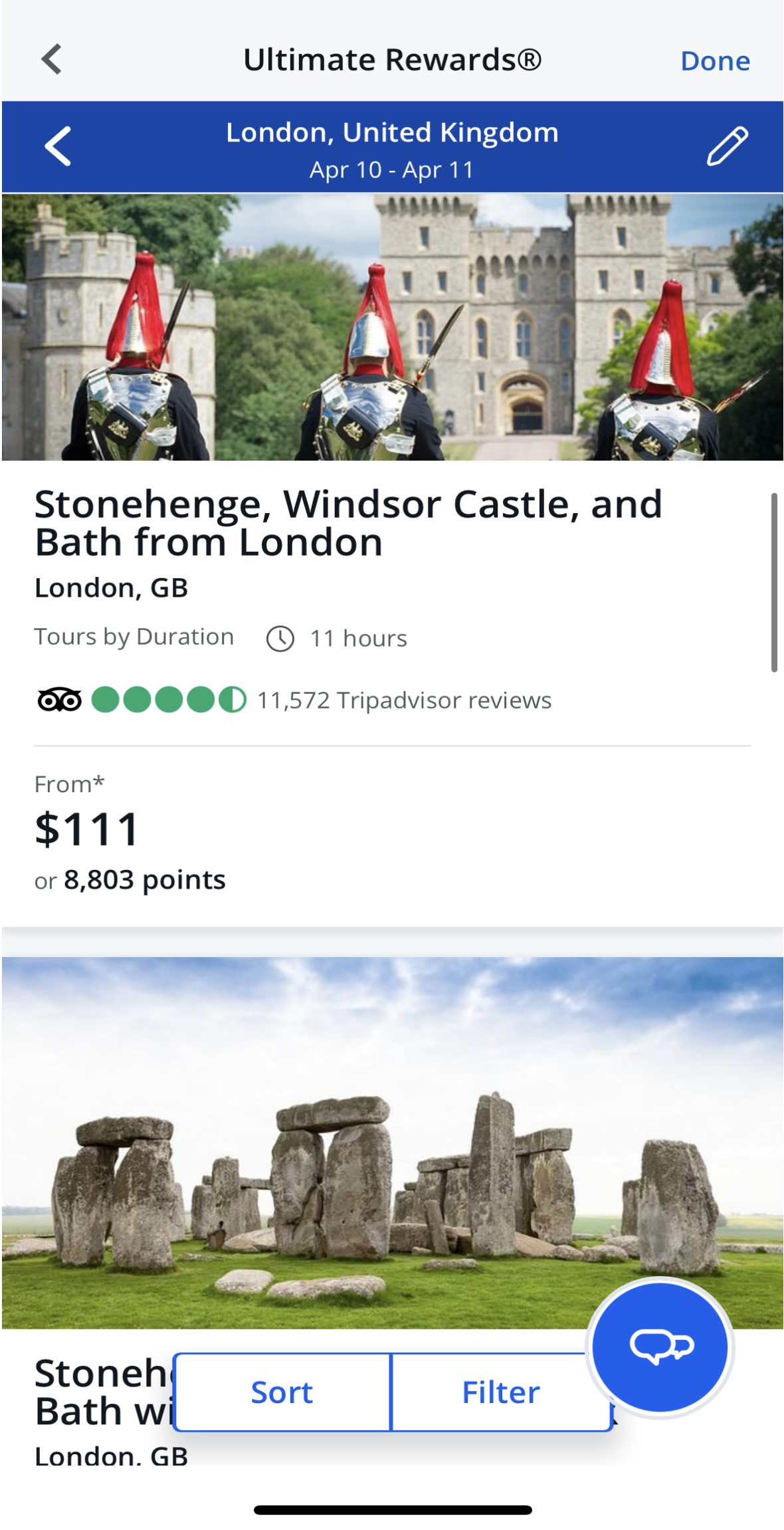

To transfer Chase Ultimate Rewards points to British Airways or any other partner, you typically log in to your Chase account, navigate to the Ultimate Rewards portal, select the transfer option, and follow the instructions to complete the transfer. Here's an example:

Travel And Airline Benefits: Comparison

When it comes to extra travel perks and benefits, there is no clear winner, as both cards offer great (but sometimes different) benefits.

It includes lounge access, statement credits, and global TSA PreCheck reimbursement. Naturally, Citi Executive card benefits are more relevant for airlines, while the Chase Sapphire Reserve offers more general travel perks.

Here are the travel perks for each card:

Citi/AAdvantage Executive World Elite

- First Checked Bag Free: Enjoy the benefit of a complimentary first checked bag on domestic American Airline itineraries for yourself and up to 8 companions traveling with you on the same reservation.

- Enhanced Airport Experience: Receive priority check-in, screening, and boarding privileges for you and up to eight travel companions on the same reservation, enhancing your overall airport experience.

- Admirals Club® Membership: Gain access to nearly 100 Admirals Club® and partner lounges worldwide, with the flexibility to bring immediate family or up to 2 guests.

- Dedicated Concierge: Access a dedicated concierge service for expert assistance with foreign and domestic travel, shopping, dining, household, and entertainment needs.

- TSA PreCheck® or Global Entry Application Fee Credit: Get a statement credit, up to $100 every 4 years, as reimbursement for your application fee for Global Entry or TSA PreCheck®.

- 25% Savings on Inflight Food and Beverage: Receive a 25% savings on food and beverage purchases when using your card on American Airlines flights.

- Up to $120 in Lyft Credits: Earn a $10 Lyft credit after taking 3 eligible rides in a calendar month, for a total of up to $120 Lyft credits annually.

- Up to $120 Back on Eligible Avis® and Budget Car Rentals: Earn $1 statement credit per $1 spent on eligible Avis® and Budget car rental purchases, up to $120 every calendar year.

- Up to $120 Back on Eligible Grubhub Purchases: Earn a statement credit of up to $10 per monthly billing statement on eligible Grubhub purchases, totaling up to $120 every 12 billing statements.

- Loyalty Points Bonuses: Earn a 10,000 Loyalty Points bonus after reaching 50,000 Loyalty Points in a status qualification year, and an additional 10,000 Loyalty Points bonus after reaching 90,000 Loyalty Points in the same status qualification year.

Chase Sapphire Reserve

- $300 Annual Travel Credit: Receive up to $300 in statement credit each year for various travel purchases.

- 50% More Value for Travel Redemption: Redeem points for travel and get 50% more value, e.g., 60,000 points are worth $900.

- Complimentary Airport Lounge Access: Enjoy free access to over 1,300 airport lounges worldwide for you and up to two guests.

- Global Entry/TSA PreCheck/NEXUS Fee Credit: Receive up to $100 in statement credit every four years for application fees.

- 24/7 Customer Service: Access dedicated customer service specialists around the clock.

- Lyft Pink Membership: Get 2 complimentary years of Lyft Pink All Access, including discounts and rewards.

- DoorDash DashPass Subscription: Enjoy a year of $0 delivery fees and lower service fees on eligible orders.

- Monthly DoorDash Credit: Receive $5 in DoorDash credits each month through Dec 31, 2024.

- Instacart Membership: Get 1 year of complimentary Instacart+ for grocery delivery.

- Monthly Instacart Credit: Instacart+ members earn up to $15 in statement credits each month through July 2024.

- Priority Pass Select Membership: Access 1,300+ VIP airport lounges worldwide.

- Luxury Hotel & Resort Collection: Receive room upgrades, daily breakfast, late checkout, and other benefits at select hotels and resorts.

- 10x on Peloton Purchases: Earn 10x total points on Peloton equipment and accessories over $150 through March 31, 2025.

When it comes to travel insurance and protections, Chase Sapphire Reserve card coverage is better than Citi Executive card coverage. Here are the protections for both cards:

$0 Liability On Unauthorized Charges: ensuring you are not held responsible for charges you did not authorize.

Car Rental Loss and Damage Insurance: When you reserve and pay for a rental vehicle with your Card, declining the rental counter's collision damage waiver, you can be protected against damage or theft in specific regions, subject to certain exclusions and limitations

Trip Delay Insurance: If your trip faces a delay of more than 6 hours due to a covered reason and you paid for the round-trip with your Eligible Card.

Baggage Insurance Plan: When you purchase a common carrier vehicle ticket with your Eligible Card, you can receive coverage for lost, damaged, or stolen baggage.

Trip Cancellation and Interruption Insurance: Buying a round-trip with your Card can assist in the event of trip cancellation or interruption, following the specified terms and conditions.

Travel Insurance And Protections: Comparison

However, some protections are available only for the Chase Sapphire Reserve card:

Travel Accident Insurance: Pay for air, bus, train, or cruise transportation with your card and get accidental death or dismemberment coverage of up to $1,000,000.

Travel and Emergency Assistance Services: Benefit from legal and medical referrals or other emergency assistance away from home, with coverage for incurred costs (excluding goods or services obtained).

- Travel and Emergency Assistance Services: Offers access to legal and medical referrals and other travel emergency assistance when you encounter problems away from home.

- Emergency Evacuation and Transportation: Provides coverage for medical services and transportation in case of an emergency evacuation during a trip far from home.

- Roadside Assistance: Offers roadside services like towing, jumpstarts, tire changes, locksmith, or gas.

- Emergency Medical and Dental Benefit: Provides reimbursement of up to $2,500 for medical expenses if you or an immediate family member become sick or injured while 100 miles or more from home on a trip.

- Purchase Protection: Covers new purchases against damage or theft for 120 days.

- Return Protection: Reimburses eligible items that the store won't accept returns for within 90 days of purchase.

- Extended Warranty Protection: Extends the time period of U.S. manufacturer's warranties by an additional year on eligible warranties of three years or less.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Want The Citi/AAdvantage Executive?

You might prefer the Citi/AAdvantage Executive card over the Chase Sapphire Reserve card in the following situations:

Dedicated American Airlines Traveler: Opt for the Citi/AAdvantage Executive World Elite if you frequently fly with American Airlines, as it offers exclusive perks like Admirals Club membership, priority check-in, and free first checked bags, enhancing your overall travel experience.

Looking To Earn Miles For Flights: based on our analysis, both cards offer great points/miles rewards ratio. Therefore, if you're mainly focused on earning miles to redeem for flights, the Citi Executive card may be a better option.

When You Might Want The Chase Sapphire Reserve?

You might prefer the Chase Sapphire Reserve card over the Citi/AAdvantage Executive card in the following situations:

You Want Many Redemption Options: The Chase Sapphire Reserve® offers more flexibility with its redemption options. You can redeem your points for travel through Chase Ultimate Rewards®, transfer them to airline and hotel partners, or use them to pay for cash back. This flexibility is a major advantage over the Citi card, which primarily restricts redemption to American Airlines-related rewards.

You Want Comprehensive Travel Insurance: If travel insurance is a priority, the Chase Sapphire Reserve provides extensive coverage, including trip cancellation insurance, trip interruption insurance, and primary car rental insurance. This makes it a preferable option for travelers seeking comprehensive protection during their journeys.

Compare The Alternatives

If you're looking for a travel rewards credit card– there are some excellent alternatives you may want to consider:

Marriott Bonvoy Brilliant® American Express® Card

| The Platinum Card® from American Express | Delta SkyMiles® Reserve American Express | |

Annual Fee | $650. See Rates & Fees | $695. See Rates & Fees | $650. See Rates & Fees |

Rewards | 2X – 6X

6 Marriott Bonvoy points for each dollar of eligible purchases at hotels participating in the Marriott Bonvoy™ program, 3 points at Worldwide restaurants and on flights booked directly with airlines and 2 points on all other eligible purchases

|

1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

| 1X – 3X

3X miles per dollar on eligible Delta flights and Delta Vacations® with 1X miles on all other purchases

|

Welcome bonus | 95,000 points

95,000 Marriott Bonvoy bonus points after you use your new Card to make $6,000 in purchases within the first 6 months of Card Membership

|

80,000 points

80,000 Membership Rewards® points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership

| 60,000 miles

Earn 60,000 bonus miles after you spend $5,000 in purchases on your new card in your first six months

|

Foreign Transaction Fee | $0 | $0. See Rates & Fees | $0

|

Purchase APR | 20.99% – 29.99% Variable

| 21.24% – 29.24% APR Variable | 20.99%-29.99% Variable |

Compare Citi/AAdvantage Executive World Elite

The Citi/AAdvantage Executive offers better cashback value and perks than the Platinum Select, but usually it doesn't worth the annual fee.

Citi/AAdvantage Executive World Elite vs. Citi/AAdvantage Platinum Select

When it comes to premium travel cards, these two offer nice perks and benefits. But who is the winner between the two?

Here's our analysis: United Club Infinite vs AAdvantage Executive Elite Mastercard

The AAdvantage Executive card offers higher cashback value, but when it comes to premium travel perks, the Amex Platinum is the winner.

Citi/AAdvantage Executive World Elite vs. Amex Platinum Card: Compare Cards

The AAdvantage Executive is a clear winner when it comes to cashback value. But the Delta SkyMiles Reserve wins at premium airline perks.

Citi/AAdvantage Executive World Elite vs. Delta SkyMiles Reserve: Compare Cards

Compare Chase Sapphire Reserve Card

When it comes to the annual fee, there is a clear winner. But is it worth the exclusive travel rewards you'll get? Here's our analysis.

While Chase Sapphire Reserve offers better protections and redemption options, Venture X is cheaper and offers premium travel benefits.

Chase Sapphire Reserve vs. Capital One Venture X: Comparison

If you're looking for travel rewards, there is a clear winner. But what about if you're looking for rewards on everyday spending?

American Express Gold Card vs Chase Sapphire Reserve: Which Card Is Best?

When it comes to premium travel rewards, both may be the best cards in the market. But who is the winner between the two? Here's our analysis.

American Express Platinum vs Chase Sapphire Reserve: Which Is Better?

The Chase Sapphire Reserve offers more versatile travel rewards and redemption options. But if you need airline perks, the Delta Reserve wins.

Chase Sapphire Reserve vs. Delta SkyMiles Reserve: Comparison

While the Brilliant card focuses on benefits tailored to Marriott enthusiasts, the Chase Reserve focuses on general, luxury travel perks.

Marriott Bonvoy Brilliant vs. Chase Sapphire Reserve: How They Compare?

While both cards offer premium travel perks, the Chase Reserve is the winner as it provides better travel perks and more redemption options.

Bank of America Premium Rewards Elite vs. Chase Sapphire Reserve: Which Card Is Best?

The Chase Reserve wins on cashback rates, travel perks, and insurance. Is it worth the annual fee difference? We think it does – here's why.

Chase Sapphire Reserve vs. Delta SkyMiles Platinum: Side By Side Comparison

The Hilton Amex Aspire offers excellent value for hotel perks, while the Chase Reserve card is best for flexibility and redemption options.

Chase Sapphire Reserve vs. Hilton Amex Aspire: Side By Side Comparison

While having higher annual fee, the Chase Sapphire Reserve is a clear winner with much higher total cashback and better premium travel perks.

The Chase Sapphire Reserve card stands out as the superior choice, delivering greater annual cashback value and luxurious travel benefits.

Chase Sapphire Reserve vs. Emirates Skywards Premium World Elite Mastercard: Which Card Is Best?

Despite being a pricier card, the Chase Sapphire Reserve is our top choice because of its generous cashback system and luxury travel perks.

U.S. Bank Altitude Reserve Visa Infinite vs. Chase Sapphire Reserve: How They Compare?