American Express and Bank Of America are two of the best credit card companies out there. Amex cards are usually seen as more high-end, but Bank Of America has some great choices too, especially if you already have a bank account with them.

Let's compare what each company offers, looking at different types of cards like cashback, points rewards, cards with 0% introductory rates, and travel cards.

Amex vs BofA Cashback Card Battle: Which Card Wins?

For those who need a cashback card, there are a variety of options – all of those cards offer a generous welcome bonus and 0% intro APR. But, their reward structure is the main thing to look for – and here are the main differences.

The Blue Cash Everyday® and Blue Cash Preferred® cards from American Express cater to those who spend heavily on groceries. While the Blue Cash Preferred card offering higher rewards, it charges an annual fee of $95 ($0 intro for the first year).

The Bank of America® Customized Cash Rewards card stands out for its flexibility, letting cardholders choose their 3% cash back category each month. This makes it a great option for those with changing spending habits. On the other hand, the Bank of America Unlimited Cash Rewards card offers a straightforward 1.5% cash back on all purchases, making it ideal for those who prefer simplicity and consistent rewards.

|

|

|

| |

|---|---|---|---|---|

Blue Cash Everyday® Card from American Express | Blue Cash Preferred® Card from American Express | Bank of America® Customized Cash Rewards credit card

| Bank of America Unlimited Cash Rewards credit card | |

Annual Fee | $0 | $95 ($0 intro for the first year) | $0 | $0 |

Rewards | 1-3%

3% Cash Back at U.S. supermarkets / U.S. online retail purchases/ U.S. gas stations on up to $6,000 per year in purchases, then 1%

| 1-6%

6% cash back at U.S. supermarkets (up to $6,000 per year in purchases, then 1%) and selected U.S. streaming subscriptions, 3% cash back on transit

and U.S. gas stations, 1% cash back on other purchases

| 1-3%

3% cash back in the category of your choice: gas, online shopping, dining, travel, drug stores, or home improvement/furnishings, 2% cash back at grocery stores and wholesale clubs and 1% cash back on all other purchases. The 3% and 2% cash back available on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter (then 1%)

| 1.5%

unlimited 1.5% cash back on all purchases

|

Welcome bonus | $200

$200 statement credit after you spend $2,000 in purchases on your new Card within the first 6 months.

| $250

$250 statement credit after you spend $3,000 in purchases on your new Card within the first 6 months

| $200

$200 cash rewards bonus after making at least $1,000 in purchases in the first 90 days of your account opening

|

$200

$200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

|

0% Intro APR | 15 months on purchases and balance transfers from the date of account opening | 12 months on purchases and balance transfers

| 15 billing cycles on purchases | 18 billing cycles for purchases, 60 days on balance transfers |

Foreign Transaction Fee | 2.7% | 2.70% | 3% | 3% |

Purchase APR | 19.99%-28.99% Variable

| 19.99%-28.99% Variable

| 17.99% – 27.99% Variable APR on purchases and balance transfers

| 17.99% – 27.99% Variable

|

Read Review | Read Review | Read Review | Read Review |

Points Rewards: Amex Gold or BofA Premium Rewards?

Despite the higher annual fee, the Amex Gold may be the most attractive options according to our opinion. It offers a higher rewards structure than the Premium Rewards card and additional benefits such as baggage insurance covering up to $500 for checked bags and $1,250 for carry-on bags, $100 experience credit, $120 in annual Uber and dining credits ($10/month each).

In contrast, the Bank of America® Premium Rewards® credit card offers a more balanced approach with its travel and dining rewards, coupled with a lower annual fee. The $200 annual travel credit effectively reduces the net cost of the card, making it appealing to travelers who can utilize these credits.

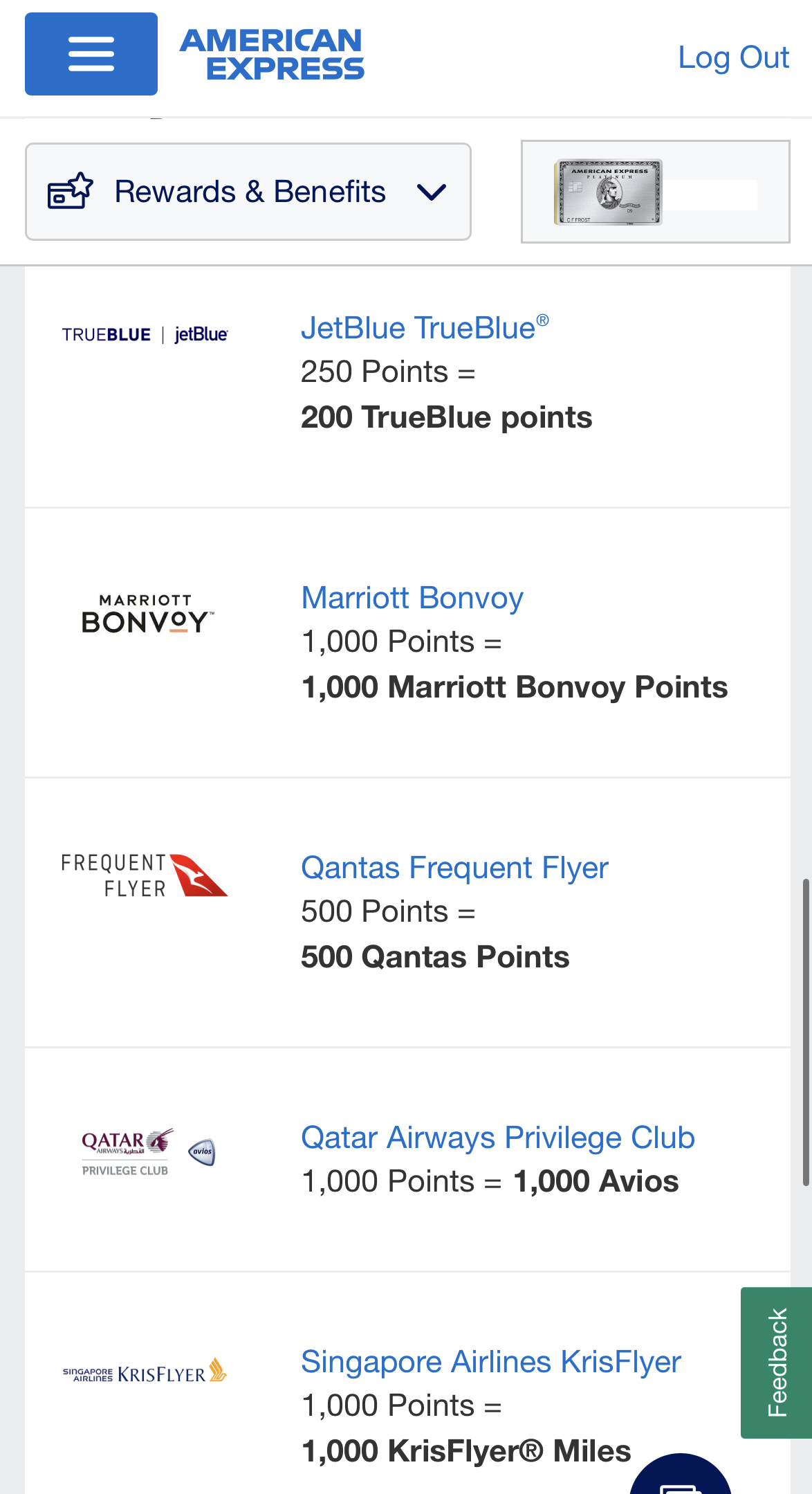

You can redeem points from both cards for travel, cashback, and gift cards. While the BofA Premium Rewards card doesn’t have as many airline and hotel transfer partners as the Amex Gold Card, its connection to Bank of America’s Preferred Rewards program can boost your points value by earning an additional 25% to 75% on every purchase.

|

| |

|---|---|---|

American Express® Gold Card | Bank of America® Premium Rewards credit card

| |

Annual Fee | $325 | $95 |

Rewards | 1X – 4X

4X points at restaurants (including Uber Eats purchases in the U.S.) and U.S. supermarkets (up to $25,000 per year in purchases, then 1X points), 3X points on flights booked directly with airlines or on amextravel.com, 2X points on rental cars through amextravel.com and 1X points on all other purchases

| 1.5X – 2X

Unlimited 2X points on travel and dining purchases. Unlimited 1.5X points on all other purchases

|

Welcome bonus | 100,000 points

100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership

| 60,000 points

60,000 online bonus points after spending $4,000 on purchases in the first 90 days. |

Foreign Transaction Fee | None | 3% |

Purchase APR | See Pay Over Time APR | 19.99% – 27.99% Variable

|

Membership Club | Amex Membership Rewards | Bank of America Preferred Rewards |

Read Review | Read Review |

Which Bank Has the Edge in Travel Cards?

When it comes to premium travel credit cards, we think that there is a clear winner in the category – the Amex Platinum card.

The BofA travel rewards card is a low-tier travel card with no annual fee and limited beenfis, especially for those who travel rarely.

The Bank Of America Elite card is a more interesting option, but we think the high annual fee is simply not worth it, as the rewards structure is less appealing compared to the Amex Platinum card.

Cardholders of the Platinum Card enjoy numerous exclusive benefits. These include Marriott Bonvoy Gold Elite status for hotel perks and a complimentary Priority Pass Select membership for access to over 1,400 lounges worldwide.

Additional perks include preferred event seating, a $100 experience credit for The Hotel Collection booking, up to $200 in annual hotel credits, $240 in digital entertainment credits, $155 in Walmart+ credits, $200 in airline fee credits, and $189 for CLEAR® Plus memberships.

Conversely, the Bank of America Premium Rewards Elite card provides several valuable statement credits: $300 annually for airline incidentals such as seat upgrades and baggage fees, $150 annually for lifestyle services like streaming and food delivery, and $100 every four years for Global Entry or TSA PreCheck® application fees.

|

|

| |

|---|---|---|---|

Bank Of America Travel Rewards | Bank of America® Premium Rewards® Elite | The Platinum Card® from American Express | |

Annual Fee | $0 | $550 | $695 |

Rewards | 1.5X

1.5 points for every $1 you spend on all purchases everywhere, every time and no expiration on points

| 1.5x – 2x

2 points for every dollar you spend on travel or dining purchases, with 1.5 points per dollar on all your other purchases | 1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

|

Welcome bonus | 25,000 points

25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening – which can be redeemed for a $250 statement credit toward travel purchases

| 75,000 points

75,000 bonus points if you spend $5,000 or more within 90 days of opening your account

| 175,000 points

175,000 Membership Rewards® Points after spending $8,000 in eligible purchases on your new Card in your first 6 months of Membership

|

0% Intro APR | 15 billing cycles on purchases and balance transfers, then 17.99% – 27.99% Variable

APR | N/A | N/A |

Foreign Transaction Fee | $0 | $0 | $0 |

Purchase APR | 17.99% – 27.99% Variable

| 19.99% – 27.99% variable

| See Pay Over Time APR |

Read Review | Read Review | Read Review |

0% Intro APR Cards: Bank Americard vs. Amex Everyday

When it comes to balance transfer cards with a 0% introductory APR, the Bank Americard and the Amex Everyday card are both excellent options without annual fees.

For those willing to compromise on the length of the introductory APR, the Amex Everyday stands out due to its appealing rewards structure. However, if you require an extended 0% introductory APR period, the Bank Americard offers one of the longest durations available in the market.

|

| |

|---|---|---|

BankAmericard | American Express EveryDay® Card | |

Annual Fee | $0 | $0 |

Rewards | N/A | 1X – 2X

2X points at U.S. supermarkets (up to $6,000 per year, then 1X), 2X points on prepaid rental cars booked through American Express Travel and 1X points on all other purchases

|

0% Intro APR | 21 billing cycles on purchases and balance transfers made within the first 60 days, then 14.99% to 24.99% Variable

APR | 15 months on purchases and balance transfers |

Balance Transfer Fee | 3% or $10, whichever is greater | $5 or 3%, whichever is greater |

Foreign Transaction Fee | 3% | 2.7% |

Purchase APR | 14.99% to 24.99% Variable

| 17.74% – 28.74% Variable |

Read Review | Read Review |

Amex And BofA Co-Branded Cards: Additional Options

While we covered the main credit cards Amex and BofA offer, both banks have partnerships with airline and travel companies so they offer great co-branded credit cards (and it's just part of them).

For example, the Delta SkyMiles® Gold Amex Card and the Hilton Honors Amex Surpass® Card are best for those loyal to Delta Airlines and Hilton hotels, respectively. The Delta card offers airline-related perks like free checked bags and priority boarding, while the Hilton card provides hotel benefits like complimentary Gold status and Priority Pass lounge visits.

On the other hand, the Alaska Airlines Visa Signature® Card is perfect for those who frequently fly with Alaska Airlines, offering a unique Companion Fare benefit and in-flight savings. The Royal Caribbean Visa Signature® Credit Card is ideal for cruise enthusiasts, offering rewards and benefits that enhance the cruising experience.

|

|

|

| |

|---|---|---|---|---|

Delta SkyMiles® Gold American Express Card | Hilton Honors American Express Surpass® Card | Alaska Airlines Visa Signature® Credit Card | Royal Caribbean Visa Signature Credit Card | |

Annual Fee | $150, $0 intro first year | $150 | $95 | $0 |

Rewards | 1X – 2X

2X miles on delta purchases, at restaurants worldwide (including take-out and delivery in the U.S) and at U.S. supermarkets, and 1x miles on all other eligible purchases

| 3X – 12X

Earn 12x Points on hotels & resorts at eligible purchases at hotels and resorts in the Hilton portfolio. Earn 6x Points on dining at U.S. restaurants , and for takeout and delivery in the U.S, on groceries at U.S. supermarkets and at U.S. gas stations. Earn 4X Points for each dollar on U.S. Online Retail Purchases and 3X Points on all other purchases

| 1X – 3X

unlimited 3 miles for every $1 spent on eligible Alaska Airlines purchases, 2X on eligible gas, EV charging station, cable, streaming services and local transit (including ride share) purchases and unlimited 1 mile for every $1 spent on all other purchases

| 1x – 2x

2x on Royal Caribbean and Celebrity Cruises and 1x on all other purchases

|

Welcome bonus | 80,000 Bonus Miles

Earn 80,000 Bonus Miles after you spend $3,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Offer Ends 10/29/2025.

| 155,000 points

155,000 Hilton Honors Bonus Points with the Hilton Honors American Express Surpass® Card after you spend $3,000 in purchases on the Card within your first 6 months of Card Membership.

| 80,000 Bonus Points + $99 Companion Fare

80,000 bonus points and a $99 Companion Fare (plus taxes and fees from $23) with this offer. To qualify, make $4,000 or more in purchases within the first 120 days of opening your account.

| 30,000 points

30,000 bonus points, worth $300 in onboard credit after you make at least $1,000 in purchases in the first 90 days of account opening

|

Foreign Transaction Fee | $0 | $0 | $0 | $0 |

Read Review | Read Review | Read Review | Read Review |

Bottom Line

Both Amex and Bank Of America offer a variety of cards for almost any purpose. Despite BofA has launched some new and exciting cards, Amex is a clear leader in practically every category, especially when it comes to travel credit cards and luxury benefits for cardholders.