Unless you have a credit card that offers reimbursement for Global Entry or TSA PreCheck application fees, you’ll need to consider whether these programs are worth the cost.

Even if your fee is covered, the process is quite involved. So, when should you consider either of these programs?

TSA PreCheck is an excellent option to speed through airport security measures. Whether you’re a frequent traveler or find the need to take off your shoes or pull your laptop out of its case extremely frustrating, you should appreciate this program.

Essentially, you’ll be able to speed past the regular security lines.

Global Entry is more beneficial if you usually fly back to U.S airports included in the program. In addition to having TSA PreCheck, Global Entry also helps you to avoid customs processing lines. You won’t need to provide paperwork on arrival, and where applicable, you may be able to clear customs before you arrive in the U.S.

If you're looking for a credit card that includes Global Entry or TSA PreCheck reimbursement, here are our suggestions for 2025:

Capital One Venture X Rewards Credit Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- TSA Precheck & Additional Rewards

- Pros & Cons

The Capital One Venture X Rewards Credit Card is a premium travel card that can be a good fit for travelers who want extra travel perks like airport lounge access, travel insurance protection, and special rental car privileges, in addition to better rewards rates. It has quite high annual fee ($395)

The Venture X earns 10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases.

In addition, new applicants can earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening, and there is no foreign transaction fee.

In addition to its travel benefits and rewards, the Capital One Venture X also offers up to $100 to reimburse you for your Global Entry or TSA PreCheck application fee.

- Statement Credit For Travel

- Better Rewards Rate, Sign-Up Bonus

- Capital One Travel Portal

- No Foreign Transaction Fee

- $395 Annual Fee

- No Upgrading or Elite Status

- Smaller Network

Capital One Venture Rewards Credit Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- TSA Precheck & Additional Rewards

- Pros & Cons

The Capital One Venture Rewards is a low-cost travel card that worth’s its value. It allows you to earn rewards and bonus points while traveling for business, leisure, or pleasure.

If you have a Capital One Venture Rewards card, you can get up to $100 in statement credit to cover your application fee for either Global Entry or TSA PreCheck. The only thing you need to do is ensure that you pay your fee using your Venture Rewards card.

The rewards plan includes 2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel . The card attracts no annual fees, and you can get a sign up bonus of 75,000 miles once they spend $4,000 on purchases within 3 months from account opening.

However, it requires holders to have a credit score of between 680 and 850.

- Flexible Rewards Redemption

- Great Sign-Up Bonus

- No Blackout/Expiration Dates

- No Accumulation Limit on Miles

- High Variable APR

- Airline Partners Limitations

- $95 Annual Fee

- Redeem Points for a Statement Credit

The Platinum Card® from American Express

The Platinum Card® from American Express

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- TSA Precheck & Additional Rewards

- Pros & Cons

The Platinum Card® from American Express provides a $100 statement credit when you pay for Global Entry with your card, or up to $85 for TSA PreCheck. You can use this credit every 4 years for Global Entry and every 4.5 years for TSA PreCheck.

You can also earn a $189 statement credit each year when you pay for a CLEAR® Plus membership, which helps speed up your travel through U.S. airports and stadiums. Terms apply.

In addition to high rewards rates, the Amex Platinum card offers a range of premium benefits, including exclusive perks at luxury hotels and baggage insurance covering up to $500 for checked bags and $1,250 for carry-ons.

- Welcome Bonus + Premium Point Rewards Rate (Terms Apply)

- No Foreign Transaction Fees

- Special Premium Status Perks

- High Annual Fee

- High Requirements

Chase Sapphire Reserve®

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- TSA Precheck & Additional Rewards

- Pros & Cons

With the Chase Sapphire Reserve, you can receive a statement credit for up to $100 as reimbursement for Global Entry or TSA PreCheck application fees charged to your card.

In addition, you earn 5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

However, due to the high annual fee ($550) – you should make sure your regular spending habits fits to this card and you'll be able to cover the high annual cost. If that's not the case – the Chase Sapphire Preferred is a good alternative.

- Points Rewards

- Sign Up Bonus

- More Ultimate Chase Rewards

- No Foreign Transaction Fee

- Airport Lounge Access

- Annual Fee

- No 0% Introductory APR

- Balance Transfer Fee

- Chase Restrictions

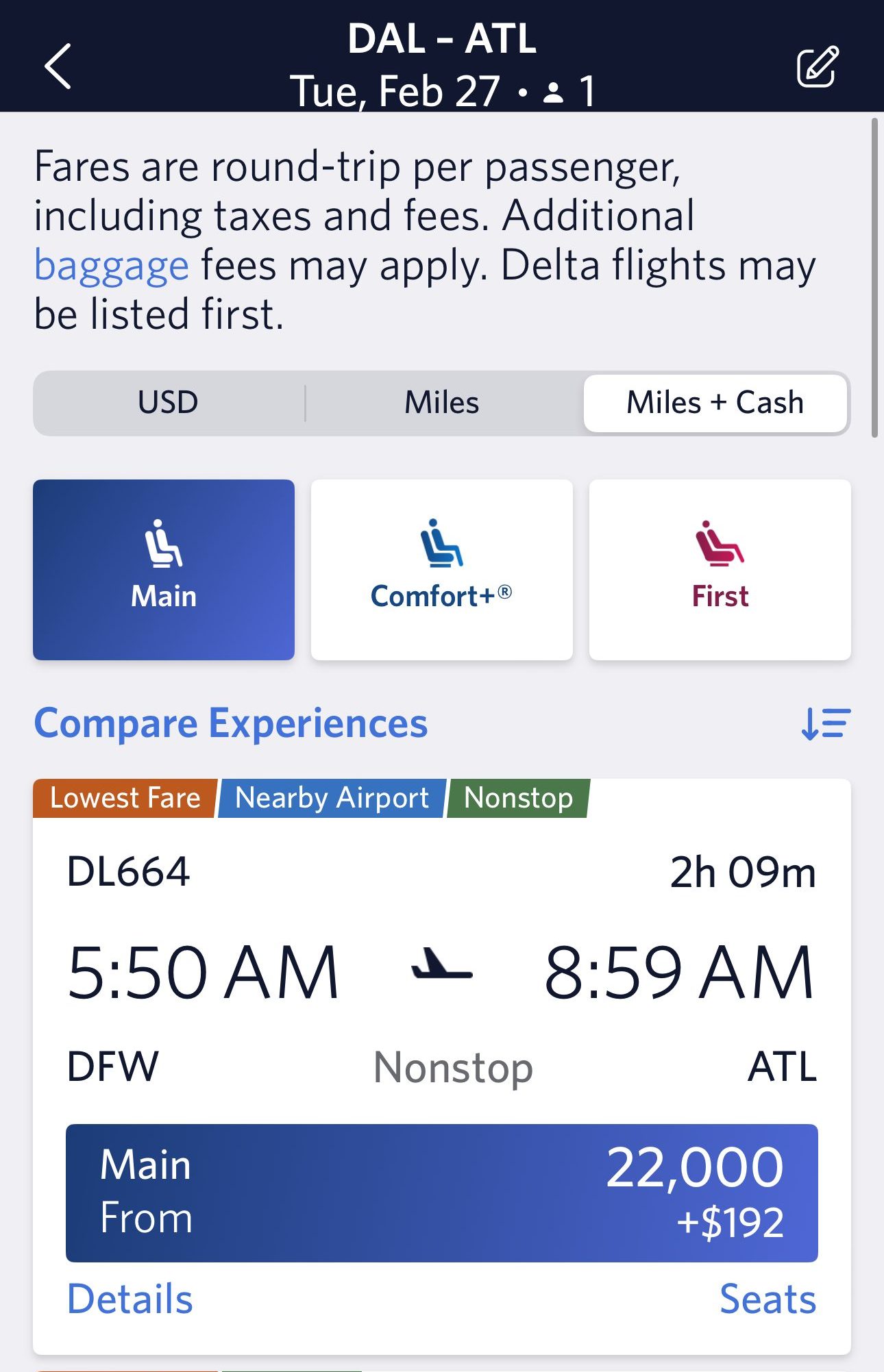

Delta SkyMiles® Platinum American Express Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- TSA Precheck & Additional Rewards

- Pros & Cons

The Delta SkyMiles® Platinum American Express Card offers one credit per four or 4.5 year period for either Global Entry or TSA PreCheck respectively. You’ll need to pay for your enrollment fee using your Delta SkyMiles Platinum card, and the credit will be automatically applied to your statement.

If you're looking to improve your Delta Medallion status, the card offers a welcome bonus of 60,000 Bonus Miles after you spend $3,000 in eligible purchases on your new Card in your first 6 months of Card Membership.

The card also provides a status boost if you hit the annual spending requirement; there is a first checked bag free for you and up to eight travel companions, priority boarding, and a companion certificate on your account anniversary.

- First Class, Comfort+® or Main Cabin

- Free Global Entry or TSA PreCheck

- Upgrades

- No Foreign Transaction Fee

- Trip Delay Insurance

- Medallion Status Boost

- The Centurion® Lounge

- Free First Checked Bag

- Car Rental Damage and Loss Insurance

- $350 Annual Fee

- Rewards Rate Could Be Better

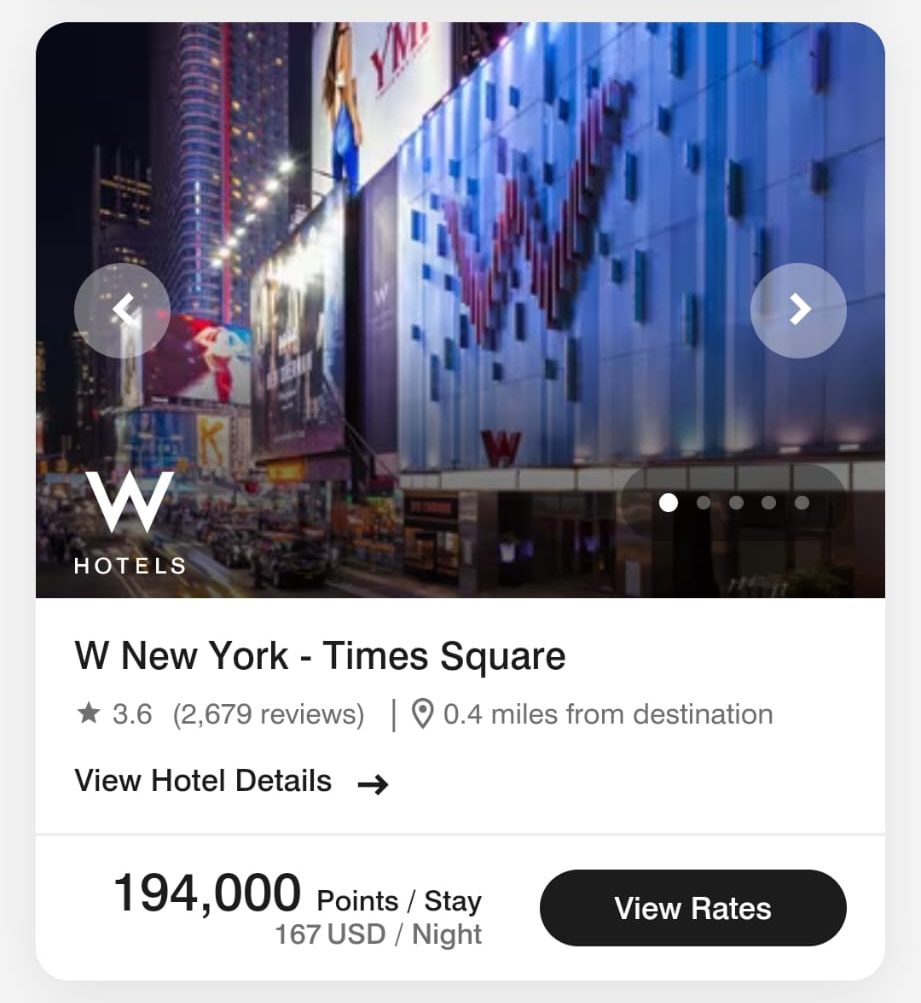

Marriott Bonvoy Brilliant® American Express® Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

Rates & Fees, Terms Apply

- TSA Precheck & Additional Rewards

- Pros & Cons

If you use your Marriott Bonvoy Brilliant American Express card to pay for your application fee for Global Entry, you can receive a $100 statement credit every 4 years, or $85 every 4.5 years if you pay for TSA PreCheck.

In terms of rewards rate, the Amex Bonvoy Brilliant card offers 6 Marriott Bonvoy points for each dollar of eligible purchases at hotels participating in the Marriott Bonvoy™ program, 3 points at Worldwide restaurants and on flights booked directly with airlines and 2 points on all other eligible purchases.

The card is ideal for frequent Marriott Bonvoy visitors, particularly those who like dining out, as there is statement credit per year for eligible restaurant purchases from around the world. It can also help you to get a boost with the Marriott Bonvoy loyalty program.

- Annual Marriott Bonvoy Credit

- 50% More Points on Eligible Purchases

- Gold Elite Status

- Free Night Award

- Airport Lounge Access

- Purchase and Travel Protections

- Limited Elite Status

- $650 Annual Fee

- Co Branded Benefits

United Explorer Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- TSA Precheck & Additional Rewards

- Pros & Cons

One of the perks of the United Explorer card is that you can get a statement credit for up to $100 every four years. This is reimbursement when you pay for either Global Entry or TSA PreCheck with your United Explorer card.

With the United Explorer card, you can earn 2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases. Miles accumulated through use of this card do not expire as long as the account is active. The card has an annual fee of $95 ($0 first year).

- Free Checked Bag & Priority Boarding

- Annual United Club Passes

- No Foreign Transaction Fee

- Mileage Rewards & Sign-Up Bonus

- Annual Fee

- Balance Transfer Fee

- High APR for purchases

U.S Bank Altitude Reserve Visa Infinite Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

- TSA Precheck & Additional Rewards

- Pros & Cons

The U.S. Bank Altitude Reserve Visa Infinite Card offers competitive rewards for travel spending categories.

The cards earns 5 points per dollar on prepaid hotels and car rentals booked directly in the Altitude Rewards Center, 3 points per dollar on eligible travel purchases and mobile wallet spending and 1 point per dollar on all other eligible net purchases.

With a $325 annual travel credit, cardholders can offset travel expenses such as flights, hotels, and car rentals. Additional perks include Priority Pass Select membership, car rental discounts, and a 30% discount on Silvercar rentals.

However, despite its $400 annual fee, the card lacks travel transfer partners, has limited airport lounge access (four visits per year), and imposes a minimum redemption amount for hotels and rental cars.

- Generous Rewards

- Annual Travel Credit

- Priority Pass Select

- Luxurious Features

- High Annual Fee

- Limited Lounge Access

- Redemption Limitations

Bank of America® Premium Rewards® credit card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- TSA Precheck & Additional Rewards

- Pros & Cons

With the Bank of America® Premium Rewards® Credit Card, you can get up to $100 in Airport Security Statement Credits towards TSA PreCheck® or Global Entry Application fees, every four years.

Cardholders earn unlimited 1.5% cash back on all purchases. You'll also earn a sign up bonus of $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening..

Like most of Bank of America credit cards, the card offers a generous 0% intro APR for new cardholders.

- 0% intro APR

- No Foreign transaction fee

- Rewards & Sign up Bonus

- There are better rewards cards

- Balance transfer fee

- Annual fee

Sign Up for

Our Newsletter

and special member-only perks.

Sign Up for

Our Newsletter

and special member-only perks.

How to Compare Card For TSA PreCheck

What Are Global Entry and TSA PreCheck?

Global Entry and TSA PreCheck are federal trusted traveler programs that allow you to access special airport security lanes. This means that you can enjoy the less intrusive and faster screening. However, although they may appear similar, the two programs have some key differences.

TSA PreCheck speeds up your security screenings when you depart from U.S Airports. This program is operated by the U.S Transport Security Administration (TSA). Global Entry provides the benefits of a TSA PreCheck membership, but you can also enjoy faster U.S customs screening for international travelers. This program is operated by the U.S Customs and Border Protection and is more comprehensive, but there are more stringent program requirements.

Either program requires that you pass a background check to be approved. However, Global Entry also requires an interview. You’ll get a Known Traveler Number (KTN) which you need to include when you make any airline reservations. You can also add it to your frequent flyer account, so your TSA PreCheck status automatically applies to all your reservations with that airline.

When you use your KTN, you’re not guaranteed to get PreCheck status, but it is very likely. You will see an indicator on your boarding pass, which provides you access to lighter screening security lanes. This means that you can leave your shoes and belt on, you can leave gels and liquids in your carry on and your laptop can stay in its bag.

What Are the Main Differences Between Global Entry and TSA PreCheck?

The main difference between these two programs is that TSA PreCheck is included with Global Entry. Additionally, the benefits package for Global Entry is more advantageous if you leave the U.S.

You don’t need to be a U.S citizen, but you need to be a U.S lawful permanent resident. You need to not only have a valid passport, but for either program you need to visit an enrollment center for an ID check and fingerprinting.

However, Global Entry also requires that you participate in an interview and there are fewer enrollment locations for Global Entry applications. TSA has over 380 locations where you can schedule an appointment to apply for PreCheck or simply walk in during business hours. By contrast, the locations for Global Entry are limited to Customs and Border Protection offices, some designated centers and select major airports.

How to Choose a Global Entry and TSA PreCheck Card?

If you’re now considering that Global Entry or TSA PreCheck would be a great option, you may want to consider a credit card that provides reimbursement for your program application fees.

As discussed above, many credit cards offer this perk, so how do you choose between them? The things to consider before you choose a card include:

- Card Rewards: Your ideal card should offer rewards for your typical spending patterns. The card should have a reward structure that allows you to maximize your cash back easily, points, or miles. It is also important that the card offers the type of rewards you prefer.

- Other Benefits: The top tier of travel cards offers additional benefits, not just Global Entry or TSA PreCheck. Look at what perks and benefits are included with the specific cards and ensure that they appeal to you. There is no point in getting a card that offers a free night in a Hilton hotel if you rarely visit a location with a venue.

- Introductory Bonuses: Most cards offer some introductory bonuses, but you need to check that you can comfortably meet any qualification requirements. If you sign up for a card with a high introductory bonus, but you can’t meet the spend requirement, this is a massive waste. It is far better to go for a more modest bonus with easier to attain spending requirements.

- Annual Fee: Generally, the more generous rewards offered by a card, the larger the annual fee. You will need to make sure that the rewards you can earn with your typical spending patterns will more than offset the annual fee.

- Intro Rates: If you’re looking to transfer a balance to your new card, look for a card that has an introductory rate and no balance transfer penalties or fees.

- Fees: Finally, be sure to check the fees that will apply to your new credit card account. This includes late fees, foreign transaction fees and other charges you could incur with day-to-day use of the card.

- Luxury Perks: in case you're willing to pay high annual fee and get more, you may want to look at the best cards for luxury travel . All of them include TSA Precheck as part of the luxury benefits they offer.

How to Maximize Your Global Entry and TSA PreCheck Card?

If you want to maximize the benefits and rewards of your Global Entry or TSA PreCheck credit card, you will need to look carefully at the terms and conditions for your specific card.

- Check for Reward Maximums: If you have a tiered reward structure with your credit card, there may be maximums applied to certain categories. So, if you want to maximize your rewards, prioritize the higher-rate reward categories until you reach the maximum cap.

- Pay for All Travel Purchases With Your Card: Whether you’re hiring a rental car or taking a flight, be sure to pay for your purchases with your card. If you have any additional insurance, such as flight delay cover, damage waiver insurance, or lost baggage protection, they will only kick in if you paid for your fare or expense with your credit card.

- Check for lounge access: since these cards are mainly relevant for frequent travelers, you may want to find a card that combines lounge access and TSA Precheck.

- Use the Card’s Travel Portal: If you want to get the best deals on your airfares and other travel purchases, be sure to check the travel portal from your card issuer. You can often get discounted rates even if you don’t pay with your rewards.

- Evaluate the Redemption Methods: If you want to maximize your card rewards, evaluate which redemption methods offer the best rates. For example, getting a statement credit tends to have a lower redemption rate than using points or miles to purchase flights. So, don’t assume that the most flexible redemption method will give you the best deal for your miles or points.

Related Posts

Top Offers

Top Offers

Top Offers From Our Partners

Ranking Methodology

To identify the best credit cards for Global Entry and TSA PreCheck, our team meticulously researched offerings from various issuers, focusing on major banks and financial institutions. We rated these cards based on four key categories tailored for travelers seeking expedited security screening:

Global Entry and TSA PreCheck Reimbursement (10%): We assess the card's reimbursement policy for Global Entry and TSA PreCheck application fees, including the coverage amount and frequency of reimbursement. Cards offering full reimbursement for both Global Entry and TSA PreCheck application fees, with no annual limit, score higher in this category.

Travel Rewards & Benefits (50%): This category evaluates the card's travel rewards program and additional benefits that enhance the overall travel experience, such as points or miles earned per dollar spent on travel purchases, airport lounge access, travel insurance coverage, and complimentary elite status with airlines or hotels. Cards offering a comprehensive range of travel rewards and benefits tailored for frequent travelers earn higher scores.

Additional Travel Perks (20%): We examine other travel perks and amenities provided by the card, such as priority boarding, free checked bags, in-flight purchase credits, and concierge services. Cards offering a wide array of additional travel perks and amenities beyond Global Entry and TSA PreCheck reimbursement earn higher ratings in this category.

Customer Experience and Issuer Reputation (20%): We scrutinize each issuer's reputation, considering customer feedback, financial stability, and regulatory standing. Issuers with positive reviews from cardholders and a history of providing excellent travel rewards products and customer service receive higher ratings in this category.

This comprehensive evaluation ensures that the best credit cards for Global Entry and TSA PreCheck offer full reimbursement for application fees, attractive travel rewards and benefits, additional travel perks