Table Of Content

Trying to decide between a Capital One and a Citi credit card? You've hit the jackpot! We're about to take a deep dive into what each bank has to offer, covering everything from travel perks to reward points, cashback benefits, and even those swanky luxury cards.

Whether you're gearing up for a globe-trotting adventure, hunting for the best deals to maximize your points, or just want the most bang for your buck with cashback, we've got you covered.

Capital One vs. Citibank: Which Offers Better Cashback Card?

When it comes to cashback cards, both Citi and Capital One offer more than a single option.

For those who are looking for a cashback card with no annual fee, Citi offers the custom cash card as well as the Citi double cash card. All of them offer rewards and also 0% intro APR.

- The Citi Custom Cash Card stands out for its adaptability, offering the highest cash back between the three, but with a low cap – making it ideal for those with variable and low spending habits.

- The Citi Double Cash Card is perfect for those who prefer a simple, flat-rate rewards system, offering 2% cash back on all purchases.

- Lastly, the Capital One Quicksilver Card provides a straightforward 1.5% cash back on every purchase (lower than Citi's cards). It is particularly advantageous for travelers due to its lack of foreign transaction fees.

If you're willing to pay an annual fee, the Savor card may be the best option in terms of rewards, as it offers 1% – 4% , depending on the category – with no limit, and the highest welcome offers between all cards.

|

|

|  | |

|---|---|---|---|---|

Capital One Quicksilver Cash Rewards Credit Card | Capital One Savor | Citi® Double Cash Card | Citi Custom Cash℠ Card | |

Annual Fee | $0 | $95 | $0 | $0 |

Rewards | 1.5% – 5%

5% percent cash back on hotels and rental cars booked through Capital One Travel and 1.5% cash back on all purchases everyday.

|

1% – 4%

unlimited 4% cash back on dining, entertainment, and popular streaming services, 3% at grocery stores and 1% on all other purchases.

| 1% – 2%

2% cash back rewards rate – 1% every time you swipe and another 1% upon payment.

| 1-5%

5% cash back on your highest eligible spend category each billing cycle up to the first $500 spent and 1% cash back thereafter

|

Welcome bonus | Earn $300 in welcome bonuses. Enjoy a $100 credit to use towards flights, stays and rental cars booked through Capital One Travel during your first cardholder year. Plus, earn a $200 cash bonus once you spend $500 on purchases within the first 3 months from account opening.

Earn $300 in welcome bonuses. Enjoy a $100 credit to use towards flights, stays and rental cars booked through Capital One Travel during your first cardholder year. Plus, earn a $200 cash bonus once you spend $500 on purchases within the first 3 months from account opening.

| $300

$300 cash bonus once you spend $3,000 on purchases within 3 months from account opening

| N/A

$200 cash back after spending $1,500 on purchases in the first 6 months

| $200

$200 cash back after you spend $1,500 on purchases in the first 6 months of account opening (20,000 ThankYou® Points, which can be redeemed for $200 cash back)

|

0% Intro APR | 15 months on balance transfers and purchases | None | 18 months on balance transfers | 15 months on purchases and balance transfers |

Foreign Transaction Fee | $0 | $0 | 3% | 3% |

Purchase APR | 18.99% – 28.99% (Variable)

| N/A

| 17.99% – 27.99% (Variable)

| 17.99% – 27.99% (Variable)

|

Read Review | Read Review | Read Review | Read Review |

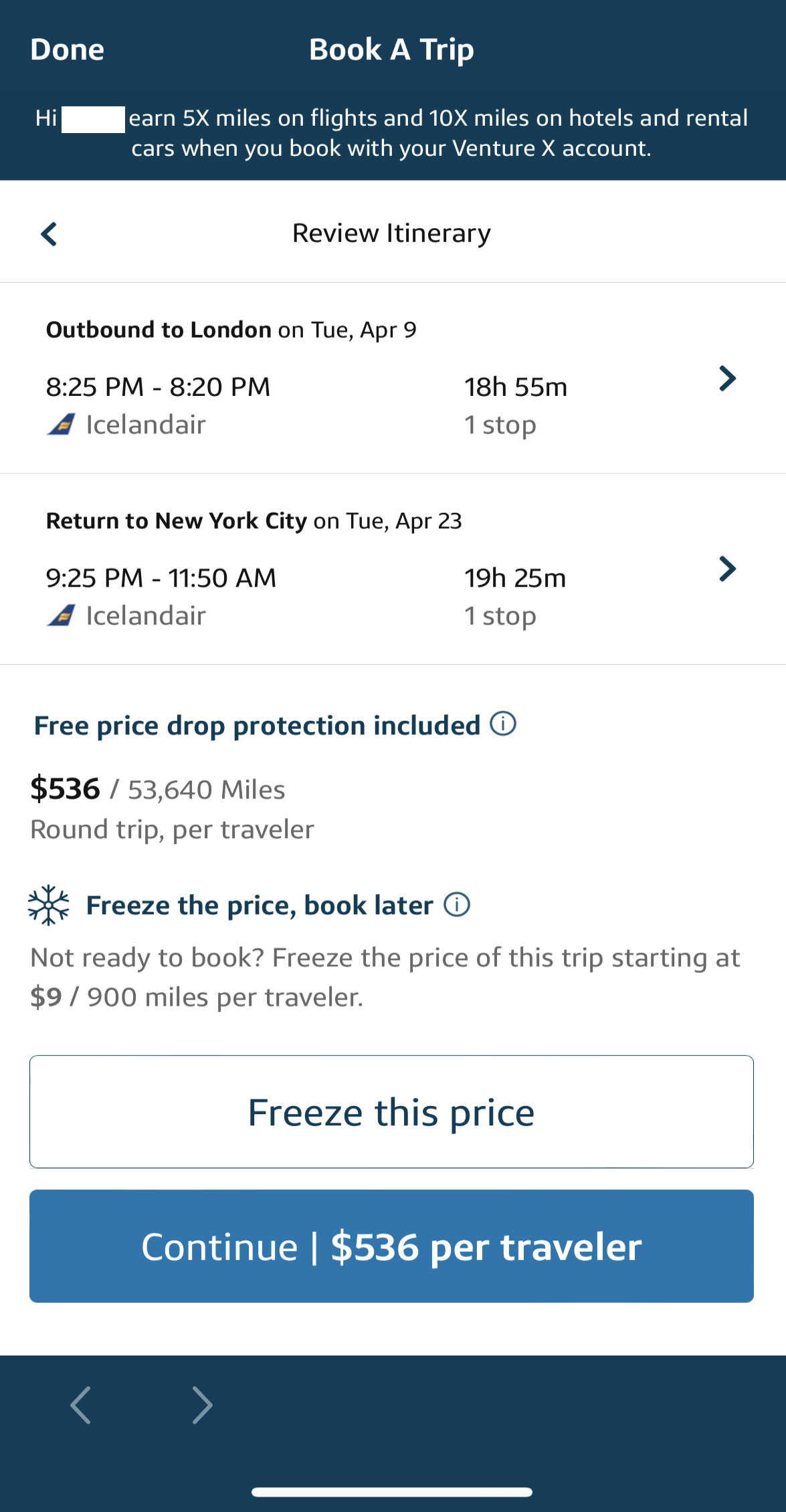

Venture Card or Citi Premier: Which Travel Card Wins?

When it comes to travel cards, there is an interesting battle between the quite new Citi Strata Premier card to the Capital One Venture card. Both cards carry similar annual fees, but their rewards structures and additional benefits cater to different types of spenders and travel habits.

The Citi Strata Premier Card excels with higher rewards on specific travel, supermarkets, and dining categories and also offers a $100 annual hotel benefit on a stay of $500 or more when booked through CitiTravel.com.

The Venture Card stands out for its lounge access benefits (twice a year), making it a great choice for international travelers. Additional travel perks include price drop protection through Capital One Travel, up to a $100 credit for Global Entry or TSA PreCheck®, and Hertz® Five Star status, which lets you skip the rental counter and choose from a larger selection of cars.

|

| |

|---|---|---|

Citi Strata Premier Credit Card | Capital One Venture | |

Annual Fee | $95 | $95 |

Rewards | 1X – 10X

10X per dollar on hotel, car rentals and attractions booked through CitiTravel.com, 3X points on restaurant, supermarket, gas station, and air travel and other hotels purchases, and 1X points per dollar on all other purchases

| 2X – 5X

2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel

|

Welcome bonus | 75,000 points

60,000 bonus ThankYou® points after spending $4,000 in purchases within the first three months of account opening

| 75,000 miles

75,000 miles once they spend $4,000 on purchases within 3 months from account opening

|

Membership Club | Citi ThankYou® Rewards | Capital One Travel |

Foreign Transaction Fee | $0 | $0 |

Purchase APR | 21.24% – 29.24% (Variable) | 19.99% – 28.99% (Variable)

|

Read Review | Read Review |

0% Intro APR: Citi Simplcity vs. Diamond vs. QuicksilverOne

Unless you need a very lengthy 0% intro APR, Capital One SavorOne is the winner when it comes to 0% intro APR. Not only does it offers 0% intro APR for 15 months on purchases and balance transfers, it also has an appealing cashback rewards structure of 1% – 8% , welcome bonus and no foreign transaction fees.

However, if you're looking for the longest 0% intro APR available, Citi Simplicity and Citi Diamond Preferred can be good options. All cards have no annual fees.

|

|

| |

|---|---|---|---|

Citi Simplicity® Card | Citi® Diamond Preferred® Card | Capital One SavorOne Cash Rewards | |

Annual Fee | $0 | $0 | $0 |

Rewards | None |

None |

1% – 8%

unlimited 3% cash back on dining, entertainment, popular streaming services, and grocery store purchases (excluding superstores like Walmart® and Target®). You’ll also earn 1% on all other purchases. Plus, you get 10% cash back on purchases through Uber and Uber Eats, 8% on Capital One Entertainment purchases, and 5% on hotels and rental cars booked through Capital One Travel

|

0% Intro APR | 12 months on purchases and 21 months on balance transfers | 21 months on balance transfers and 12 months on purchases | 15 months on purchases and balance transfers |

Balance Transfer Fee | $5 or 5% (whichever is greater) | $5 or 5% (the greater) | 3% |

Foreign Transaction Fee | 3% | 3% | $0 |

Purchase APR | 17.99% – 28.74% (Variable)

| 16.99% – 27.74% (Variable)

| 18.99% – 28.99% (Variable)

|

Read Review | Read Review | Read Review |

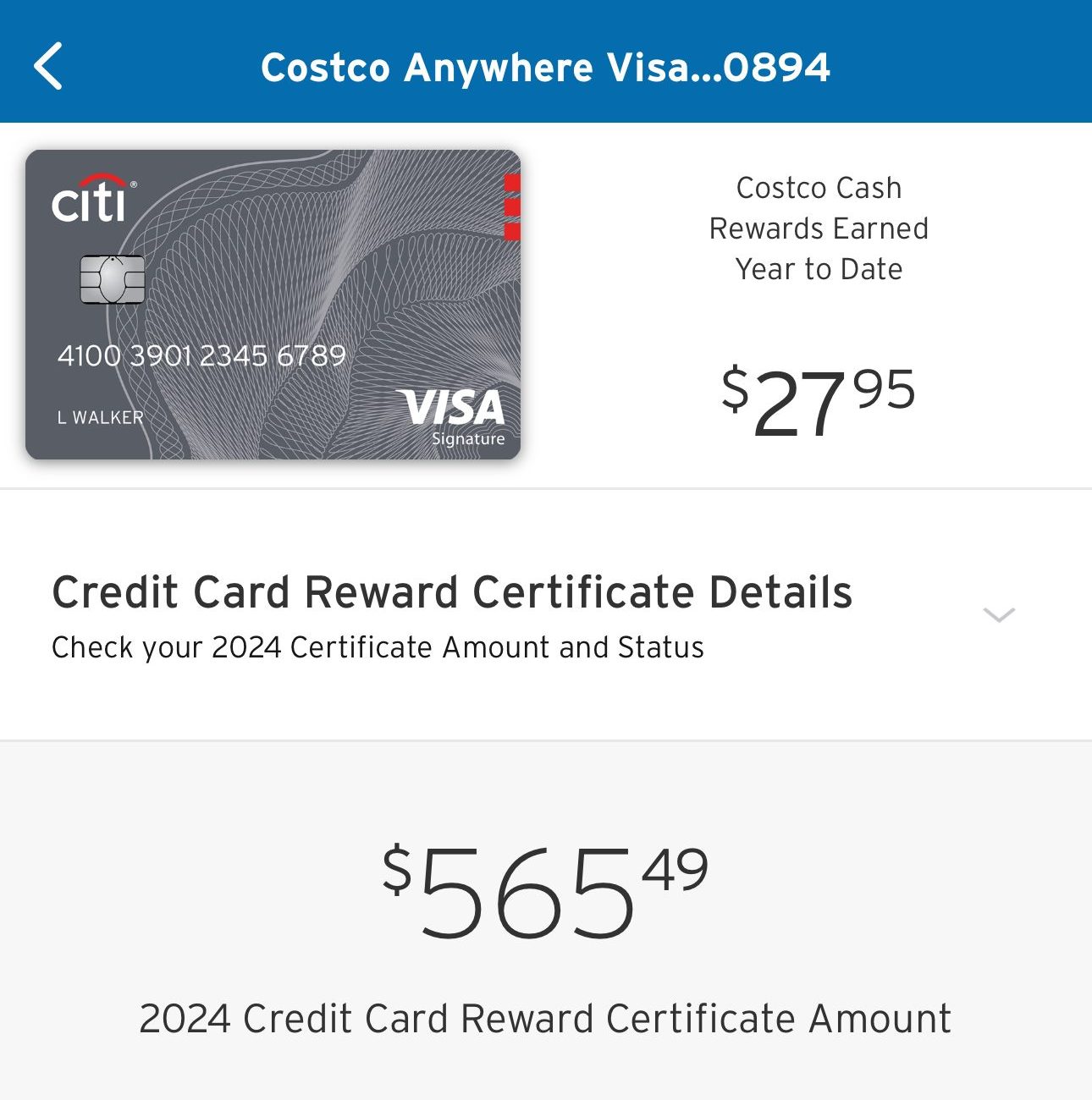

Shopping Cards: Costco By Citi vs. Walmart By Capital One

Citi and Capital One both have partnerships with two major shopping clubs: Costco and Walmart. If your focus is cashback on groceries, Walmart offers a higher rate, making it a stronger option for supermarket purchases.

However, Costco stands out with higher cashback on gas. Ultimately, the better choice depends on your spending habits and preferences.

|

| |

|---|---|---|

Costco Anywhere Visa Card | Capital One Walmart Rewards | |

Annual Fee | $0 ($60 Costco membership fee required) | $0 |

Rewards | 1-4%

4% cash back on on eligible gas and EV charging purchases for the first $7,000 per year and then 1% thereafter, 3% cash back on restaurants and most travel purchases, 2% cash back at Costco and Costco.com, 1% cash back on all other purchases

| 1-5%

5% cash back at Walmart.com (including pickup and delivery), 2% cash back in Walmart stores and gas stations, at restaurants and on travel plus 1% cash back everywhere else Mastercard is accepted

|

Welcome bonus | None

| 5%

5% cash back for the first 12 months when you use your card with Walmart Pay for in-store purchases, upon approval

|

0% Intro APR | N/A | N/A |

Foreign Transaction Fee | $0 | Unknown |

Purchase APR | 19.24% – 27.24% (Variable)

| 17.99% – 28.99% (Variable) |

Read Review | Read Review |

Bottom Line

Overall, both companies offer a diverse set of credit cards. However, we think that Capital One offer some better option for most categories .

While Citi excels with cards for those who are looking to avoid annual fees, such as the Custom Cash card and the Double Cash card, Capital One offers more appealing travel cards, such as the Venture and Venture X cards. In addition, it offers the Savor/SavorOne and Quicksilver/QuicksilverOne cards, which provide a good solution for almost most consumer types.