Table Of Content

Chase and American Express are undoubtedly the top credit card issuers in the nation. Therefore, there is strong competition across the board, including cashback, travel, luxury, and rewards cards.

Let's explore each category and see what Amex and Chase offer, side by side – and which card wins in every category.

Cashback Battle: Chase Is Best For Travel, Amex For Families

Overall, Chase cashback cards are better for those who use it for travel as well, while Amex cards are great for families and those who need it to buy on supermarkets.

Chase cards are ideal for those who want to maximize travel redemptions through Chase Ultimate Rewards. Both cards offer robust travel and purchase protections with no annual fee. The Freedom Flex card has rotating categories that can yield higher cash back, while the Freedom Unlimited card provides consistent cashback rates on all purchases.

On the other hand, the Blue Cash Everyday® and Blue Cash Preferred® cards from American Express are perfect for those who spend heavily on groceries. The Blue Cash Preferred card offers higher rewards but comes with an annual fee, whereas the Blue Cash Everyday card has no annual fee.

|  |

|  | |

|---|---|---|---|---|

Chase Freedom Unlimited | Chase Freedom Flex Card | Blue Cash Preferred® Card from American Express | Blue Cash Everyday® Card from American Express | |

Annual Fee | $0 | $0 | $95 ($0 intro for the first year) | $0 |

Rewards | 1.5% – 5%

5% cash back on travel booked through Chase Ultimate Rewards, 3% on dining (including takeout and eligible delivery), 3% on drugstore purchases, and 1.5% on all other purchases

| 1-5%

5% cash back on up to $1,500 in combined purchases on selected categories each quarter and 5% cash back on travel purchased through Chase Ultimate Rewards®. Also, you can earn 3% cash back on dining at restaurants (including takeout and eligible delivery services), drugstore purchases , and 1% on all other purchases

| 1-6%

6% cash back at U.S. supermarkets (up to $6,000 per year in purchases, then 1%) and selected U.S. streaming subscriptions, 3% cash back on transit

and U.S. gas stations, 1% cash back on other purchases

| 1-3%

3% Cash Back at U.S. supermarkets / U.S. online retail purchases/ U.S. gas stations on up to $6,000 per year in purchases, then 1%

|

Welcome bonus | $250

Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening.

| $200

$200 bonus after you spend $500 on purchases in the first 3 months from account opening

| $250

$250 statement credit after you spend $3,000 in purchases on your new Card within the first 6 months

| $200

$200 statement credit after you spend $2,000 in purchases on your new Card within the first 6 months

|

0% Intro APR | 15 months on purchases and balance transfers | 15 months on purchases and balance transfers | 12 months on purchases and balance transfers

| 15 months on purchases and balance transfers from the date of account opening |

Foreign Transaction Fee | 3% | 3% | 2.70% | 2.7% |

Purchase APR | 19.99 – 28.74% variable | 19.99% – 28.74% variable | 20.24%-29.24% Variable | 18.49% – 29.49% Variable |

Read Review | Read Review | Read Review | Read Review |

Low-Mid-Tier Travel Cards: Amex Gold Or Chase Preferred?

When it comes to low and mid tier travel cards, we have two main options: Chase Sapphire Preferred and the Amex Gold card.

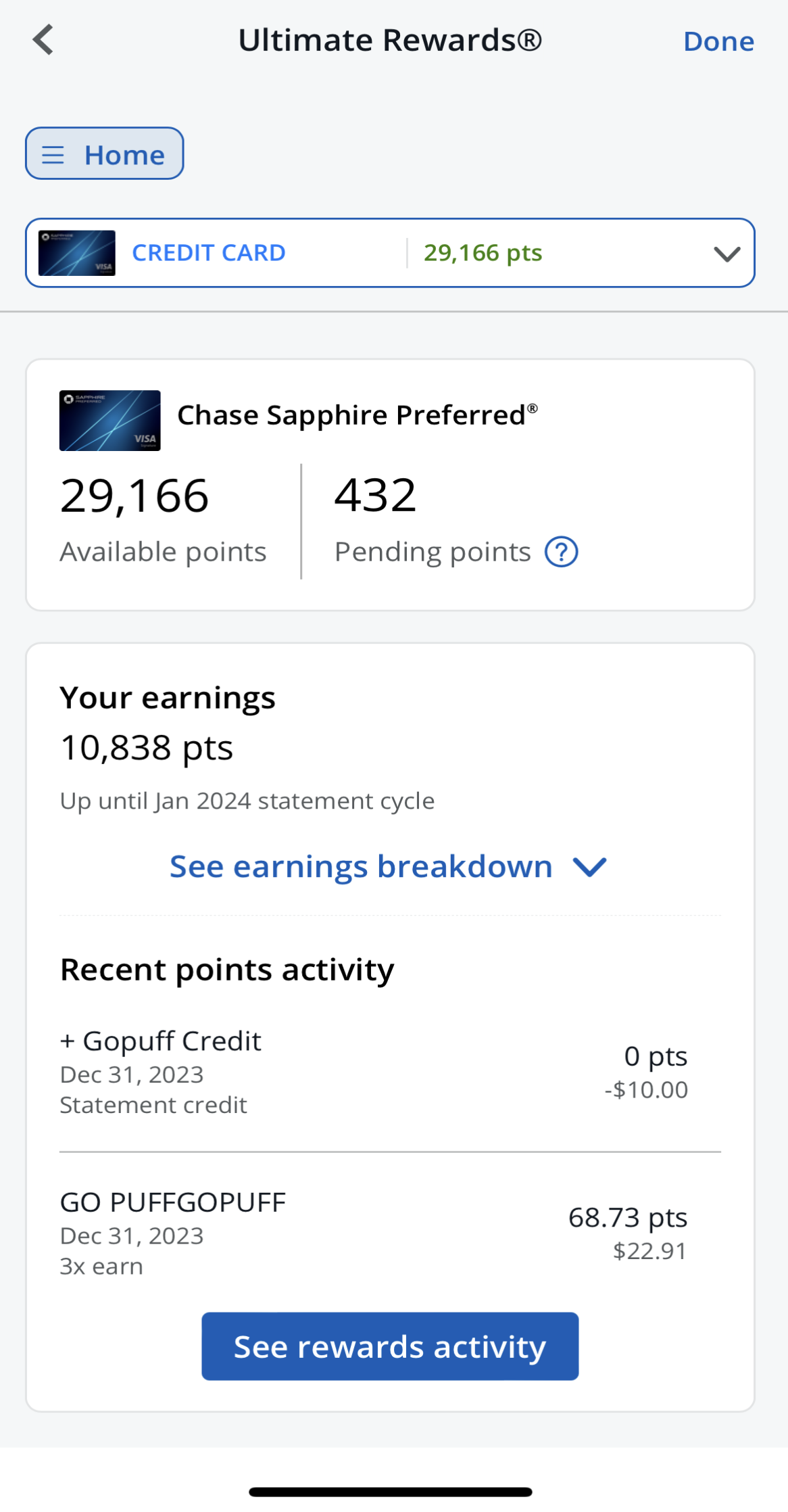

The Chase Sapphire Preferred card is a great choice thanks to its solid points system and travel perks. Along with earning rewards and a generous sign-up bonus, it offers solid travel insurance, purchase protection, and no foreign transaction fees. Plus, you can redeem your points through the Chase Ultimate Rewards program, where they’re worth 25% more when used for travel.

Conversely, the Amex Gold card offers a higher rewards structure than the Premium Rewards card and includes additional benefits such as baggage insurance covering up to $500 for checked bags and $1,250 for carry-on bags, a $100 experience credit, and $120 in annual Uber and dining credits ($10 per month each).

Overall, the Chase Preferred card may be better if you tend to use mostly for travel. The Amex Gold card is good for travel and more important – it's very generous card for families and those who shop in U.S. supermarkets. But, its annual fee is higher.

Chase Sapphire Preferred | American Express® Gold Card | |

Annual Fee | $95

| $325 |

Rewards | 2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

| 1X – 4X

4X points at restaurants (including Uber Eats purchases in the U.S.) and U.S. supermarkets (up to $25,000 per year in purchases, then 1X points), 3X points on flights booked directly with airlines or on amextravel.com, 2X points on rental cars through amextravel.com and 1X points on all other purchases

|

Welcome bonus | 75,000 points

75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening

| 100,000 points

100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership

|

Membership Club | Chase Ultimate Rewards | Amex Club Membership |

Foreign Transaction Fee | $0 | None |

Read Review | Read Review |

Luxury Travel Cards: Amex Platinum or Sapphire Reserve?

There is no doubt that these two are among the top luxury cards in the nation. Both offer high rewards rates, welcome bonuses and various luxury benefits.

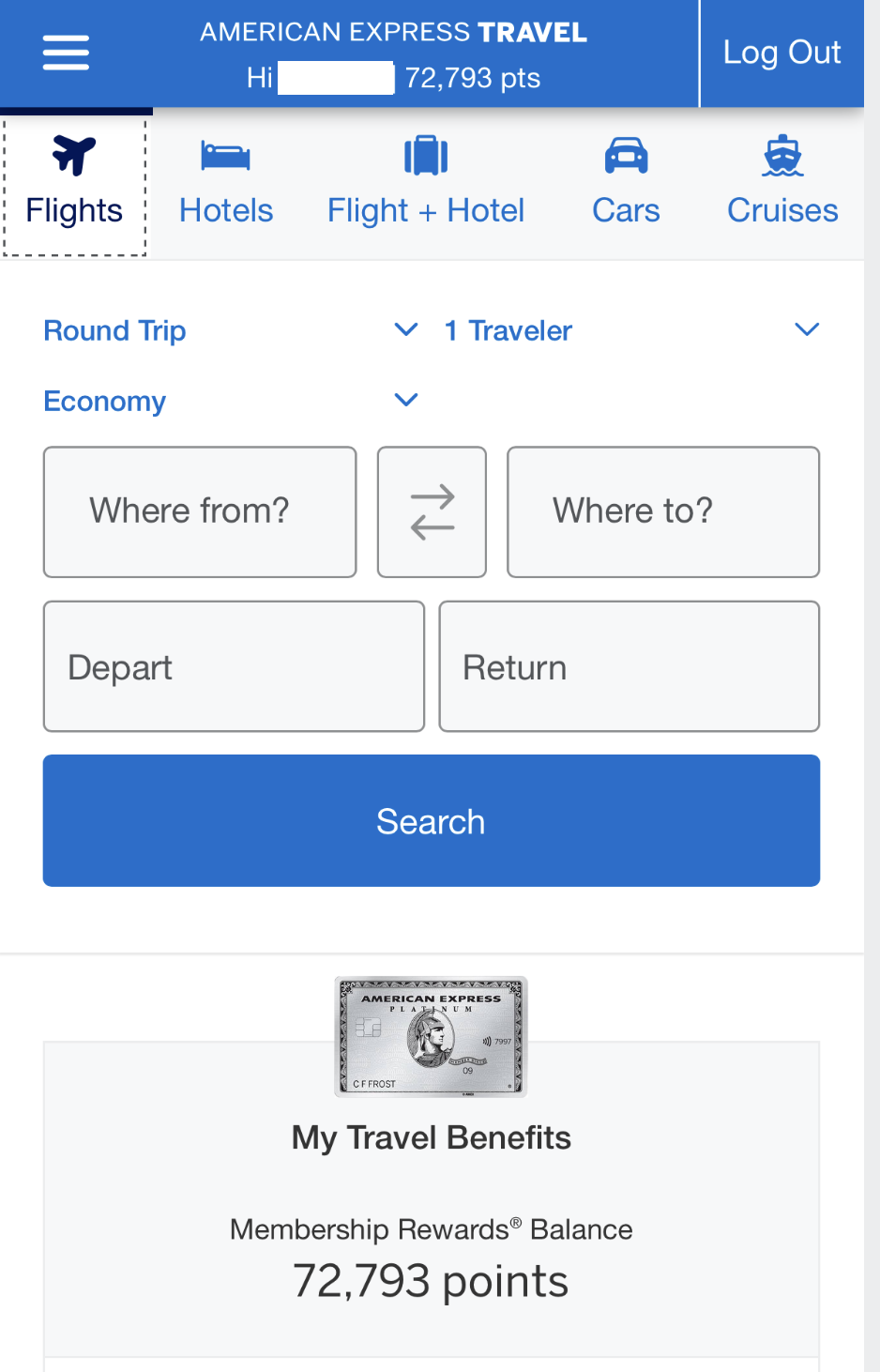

Platinum Card holders enjoy numerous exclusive benefits, such as Marriott Bonvoy Gold Elite status for hotel perks and a complimentary Priority Pass Select membership, providing access to over 1,400 lounges worldwide.

Additional perks include preferred event seating, a $100 experience credit for bookings through The Hotel Collection, up to $200 in annual hotel credits, $240 in digital entertainment credits, $155 in Walmart+ credits, $200 in airline fee credits, and $189 for CLEAR® Plus memberships.

The Chase Sapphire Reserve card comes with a $300 annual travel credit, access to over 1,300 airport lounges worldwide through Priority Pass Select, and a credit for Global Entry or TSA PreCheck fees. It also offers strong travel protections, and your points are worth 50% more when used for travel through the Chase Ultimate Rewards portal.

There is no clear winner here; choosing between them depends on your personal preferences, the other cards you carry, and the types of benefits you need the most.

The Platinum Card® from American Express | Chase Sapphire Reserve | |

Annual Fee | $695 | $550 |

Rewards | 1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

| 1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

|

Welcome bonus | 175,000 points

175,000 Membership Rewards® Points after spending $8,000 in eligible purchases on your new Card in your first 6 months of Membership

| 100,000 points + $500 Chase Travel℠ promo credit

100,000 points + $500 Chase Travel℠ promo credit After you spend $5,000 in purchases in the first 3 months from account opening

|

Foreign Transaction Fee | $0 | $0 |

Purchase APR | See Pay Over Time APR | 21.99% – 28.99% variable APR |

Read Review | Read Review |

0% Intro APR: Chase Slate Edge vs. Amex Eeveryday

If you're looking for a balance transfer card with a long 0% introductory APR, Amex and Chase offer several options. Two popular choices are the Amex Everyday card and the Chase Slate Edge.

When comparing these cards, the Chase Slate Edge offers the longest 0% introductory APR, making it ideal for those who need extra time to repay their balance.

On the other hand, the Amex Everyday card provides rewards not available through Chase and also has a lower balance transfer fee, offering additional benefits for those who value earning rewards while managing their balance transfers.

| ||

|---|---|---|

American Express EveryDay® Card | Chase Slate Edge | |

Annual Fee | $0 | $0 |

Rewards | 1X – 2X

2X points at U.S. supermarkets (up to $6,000 per year, then 1X), 2X points on prepaid rental cars booked through American Express Travel and 1X points on all other purchases

| None |

0% Intro APR | 15 months on purchases and balance transfers | 18 month on purchases and balance transfer |

Balance Transfer Fee | $5 or 3%, whichever is greater | $5 or 5% |

Foreign Transaction Fee | 2.7% | 3% |

Purchase APR | 17.74% – 28.74% Variable | 16.49% – 25.24% Variable |

Read Review | Read Review |

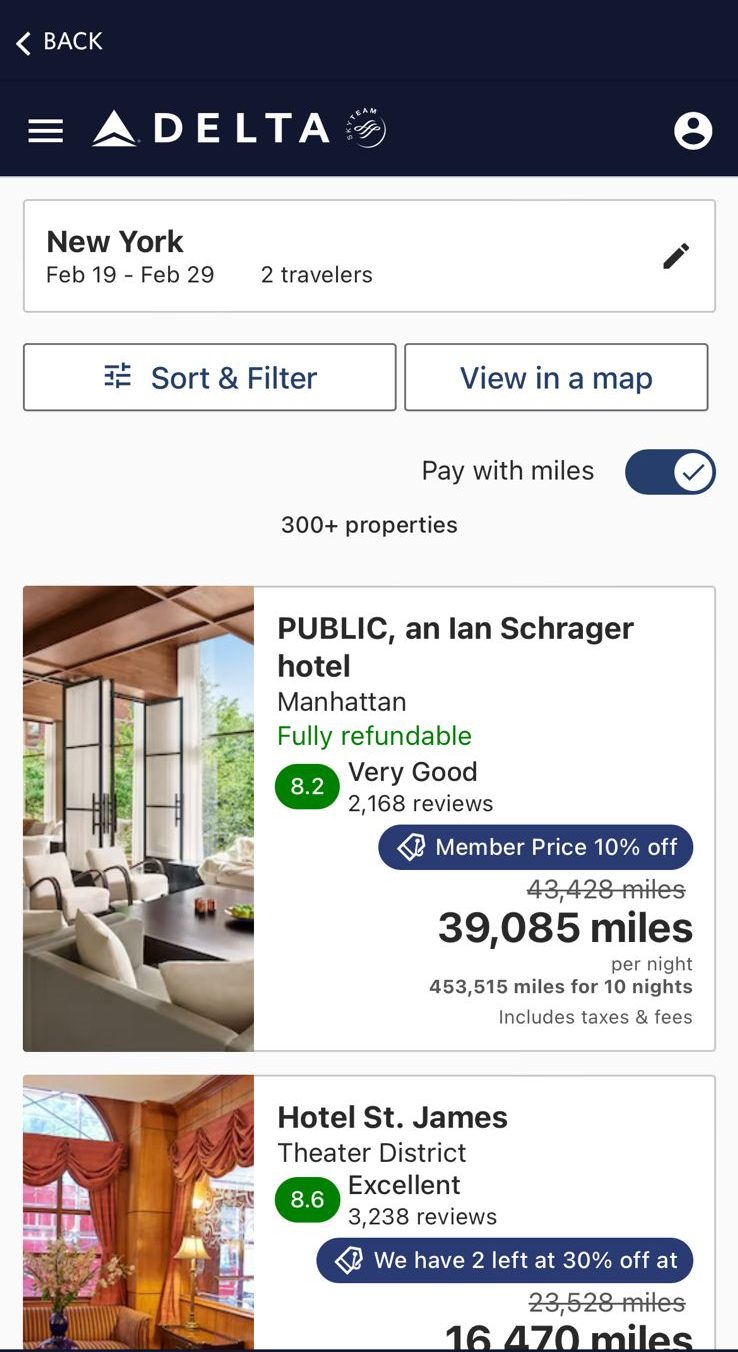

Co-Branded Airline Cards: Delta, United, Southwest And More

When it comes to co-branded airline cards, American Express partners with Delta, while Chase collaborates with various airlines. Beyond the cards listed here, both issuers offer options for low, mid, and high-tier users, with each tier providing increasing levels of benefits.

Chase offers a range of co-branded credit cards tailored to specific brands and loyal customers. For example, Chase partners with United Airlines and Southwest Airlines to offer several card tiers, including the United Explorer Card, United Club Infinite Card, Southwest Rapid Rewards Plus, Premier, and Priority.

Additionally, Chase partners with Air Canada, Iberia, British Airways, and Aer Lingus. These cards offer benefits such as free checked bags, priority boarding, and miles on purchases with United, dining, and hotels. The luxury cards may also provide lounge access or boost points towards elite status with these airlines.

American Express primarily partners with Delta. The Delta SkyMiles® Gold American Express Card offers mid-tier benefits, while the Delta SkyMiles® Reserve Amex Card provides premium perks such as complimentary access to Delta Sky Club® and Centurion® Lounges, an Annual Companion Certificate, a $150 Delta Stays Credit, a $120 Resy Credit, MQD boosts, advanced protections, and more.

United Explorer Card | Delta SkyMiles® Reserve American Express | Southwest Rapid Rewards Priority | British Airways Visa Signature Card

| |

Annual Fee | $95 ($0 first year) | $650 | $149 | $95 |

Rewards | 1X – 2X

2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases

| 1X – 3X

3X miles per dollar on eligible Delta flights and Delta Vacations® with 1X miles on all other purchases

| 1X – 3X

3X points on Southwest purchases, 2X points on Southwest’s Rapid Rewards hotel and car rental partners, local transit and commuting (including rideshares) and internet, cable phone and select streaming services; 1X points on all other purchases

| 1x – 5x

5x Avios for every $1 spent on gas, grocery stores and dining for the first 12 months of account opening. 3x Avios for every $1 spent on British Airways, Aer Lingus and Iberia purchases. 2x Avios for every $1 spent on hotel accommodations booked directly with the hotel.

|

Welcome bonus | 50,000 miles

Earn 60,000 bonus miles after qualifying purchases

| 70,000 miles

70,000 Bonus Miles after you spend $5,000 in eligible purchases on your new Card in your first 6 months of Card Membership

| 100,000 points

100,000 bonus points after you spend $4,000 in the first 5 months from account opening

| 75,000 Avios

Earn 75,000 Avios after you spend $5,000 on purchases within the first 3 months of account opening.

|

Foreign Transaction Fee | $0 | $0 | $0 | $0 |

Read Review | Read Review | Read Review | Read Review |

Co-Branded Hotel Cards: Marriot, Hilton, IHG & World Of Hyatt

When it comes to co-branded hotel cards, American Express partners with Marriot and Hilton, while Chase partners with various hotel companies including Marriot, IHG and World Of Hyatt.Hilton Honors cardholders enjoy complimentary Hilton Honors status, depending on the card, providing benefits such as bonus points on base earnings and late check-out.

Premium Hilton cards offer additional perks like free night awards, Hilton credit, enhanced travel protection, and various statement credits. Hilton Points can be redeemed for free nights at Hilton properties worldwide, as well as for experiences, car rentals, and more.

In contrast, Chase has partnerships with major hotel chains, offering a variety of co-branded credit cards. For instance, Chase provides the Marriott Bonvoy Boundless and Bonvoy Bold Credit Cards, as well as the IHG Rewards Club Premier and Traveler Credit Cards for IHG (InterContinental Hotels Group).

These cards earn points on hotel stays and other purchases, along with perks like annual free-night awards, room upgrades, hotel benefits, and elite status credits.

Hilton Honors American Express Card

| IHG One Rewards Premier Credit Card by Chase | Marriott Bonvoy Brilliant® American Express® Card | World of Hyatt Credit Card by Chase | |

Annual Fee | $0 | $99 | $650 | $95 |

Rewards | 3X – 7X

7X Hilton Honors Bonus Points for each dollar of eligible purchases charged directly with hotels and resorts within the Hilton portfolio, 5x points at U.S. restaurants (including takeout and delivery) U.S.supermarkets, U.S. gas stations and 3x points for each dollar on other eligible purchases

| 3X – 10X

Up to 10X points from IHG® on stays for being an IHG One Rewards member. Up to 6X points from IHG® on stays with Platinum Elite Status. 5X total points on travel, dining, and at gas stations and 3X points per $1 spent on all other purchases.

| 2X – 6X

6 Marriott Bonvoy points for each dollar of eligible purchases at hotels participating in the Marriott Bonvoy™ program, 3 points at Worldwide restaurants and on flights booked directly with airlines and 2 points on all other eligible purchases

| 1X – 4X

4 Bonus Points per $1 spent on purchases at all Hyatt hotels. Plus, 5 Base Points from Hyatt per eligible $1 spent for being a World of Hyatt member. 2x Bonus Points per $1 spent at restaurants, on airline tickets purchased directly from the airline, local transit and commuting as well as fitness club and gym memberships. Plus, earn 1 Bonus Point per $1 spent on all other purchases.

|

Welcome bonus | 100,000 points

100,000 Hilton Honors Bonus Points after you spend $2,000 in purchases on the Card in the first 6 months of Card Membership

| 140,000 Bonus Points

Earn 140,000 Bonus Points After you spend $3,000 on purchases in the first 3 months from account opening

| 180,000 points

185,000 Marriott Bonvoy® bonus points after you use your new Card to make $6,000 in purchases within the first 6 months of Card Membership

| 2 free nights + 25,000 Points

2 free nights at any Category 1–4 Hyatt hotel or resort after you spend $4,000 on purchases in the first 3 months from the account opening. Plus, 25,000 Bonus Points after you spend $12,000 on purchases in the first 6 months from account opening

|

Foreign Transaction Fee | $0 | $0 | $0 | $0 |

Purchase APR | 20.24% – 29.24% variable APR | 20.99% – 27.99% variable | 20.24% – 29.24% Variable | 21.49%–28.49% variable |

Read Review | Read Review | Read Review | Read Review |

Bottom Line

Ultimately, there is no question that Chase and Amex are the top credit card issuers in the nation.

Unlike other comparisons, there is no clear winner here as each offers various cards for each category, including super premium travel benefits and generous rewards.