A credit score of over 700 puts you in the good to excellent credit score range. Credit cards for good credit have attractive features and benefits such as 0% APR for the first few months, higher rewards, $0 annual fees, and higher credit limits.

If you have good credit, you will be spoilt for choice with the number of credit card issuers who want your business. With the different options to consider, you should take some time to find the card that suits your needs.

Here are The Smart Investor Select’s picks for the best credit cards for good credit in 2025:

Card | Rewards | Bonus | Annual Fee | Best For | 1X – 2X

2X points at U.S. supermarkets (up to $6,000 per year, then 1X), 2X points on prepaid rental cars booked through American Express Travel and 1X points on all other purchases

| 10,000 points

10,000 points after you spend $2,000 in purchases on your new card within the first 6 months

| $0 | Everyday Spending |

|---|---|---|---|---|---|

1-5%

5% cashback on up to $1,500 in rotating category purchases each quarter when you activate the bonus category (then 1%), as well 1% percent cash back on all other purchases

| Cashback Match | $0

| Cashback | ||

1X – 4X

4x points at restaurants, take-outs & deliveries, 2x points at supermarkets, gas stations & streaming servicesm and 1 point for 1 dollar on all other purchases

| 20,000 points

20,000 bonus points when you spend $1,000 in eligible purchases within the first 90 days of account opening

| $0 | Point Rewards | ||

1-3%

3% cash back rewards on trips booked through SoFi Travel. After that, earn 2% unlimited cash back on purchases when redeemed toward investing, saving, or paying down an eligible loan with SoFi

| N/A

N/A

| $0 | Youngers | ||

| 1.5% – 5%

5% percent cash back on hotels and rental cars booked through Capital One Travel and 1.5% cash back on all purchases everyday.

| $200

$200 cash bonus once you spend $500 on purchases within 3 months from account opening

| $0 | 0% Intro | |

| 1-5%

5% cash back on up to $1,500 in combined purchases on selected categories each quarter and 5% cash back on travel purchased through Chase Ultimate Rewards®. Also, you can earn 3% cash back on dining at restaurants (including takeout and eligible delivery services), drugstore purchases , and 1% on all other purchases

| $200

$200 bonus after you spend $500 on purchases in the first 3 months from account opening

| $0 | Rotating Categorie |

Blue Cash Everyday® Card from American Express

Rates & Fees, Terms Apply

Blue Cash Everyday® Card from American Express

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

Rates & Fees, Terms Apply

- Overview

- Features

- Pros & Cons

- FAQ

The Blue Cash Everyday® Card from American Express is a no-annual-fee credit card that excels in providing rewards for everyday spending. With a focus on U.S. supermarkets, gas stations, and online retailers, it offers a competitive 3% Cash Back at U.S. supermarkets / U.S. online retail purchases/ U.S. gas stations on up to $6,000 per year in purchases, then 1%.

The card provides a $200 statement credit after you spend $2,000 in purchases on your new Card within the first 6 months. Additionally, it features a 0% introductory APR for 15 months on purchases and balance transfers from the date of account opening , followed by a variable APR of 18.49% – 29.49% Variable. This card pairs this introductory APR with the Pay It Plan It program, allowing users to manage their payments efficiently.

While it stands out for its unique U.S. online retail reward category, it may not be the most lucrative option for those who spend heavily outside these specified areas.

- APR: 18.49% – 29.49% Variable

- Annual fee: $0

- Balance Transfer Fee: 3% or $5, whichever is greater

- Foreign Transaction Fee: 2.7%

- Rewards Plan: 3% Cash Back at U.S. supermarkets / U.S. online retail purchases/ U.S. gas stations on up to $6,000 per year in purchases, then 1%. Terms Apply.

- Welcome Bonus: $200 statement credit after you spend $2,000 in purchases on your new Card within the first 6 months

- 0% APR Introductory Rate period: 15 months on purchases and balance transfers from the date of account opening

- Competitive Rewards And Welcome Bonus

- No Annual Fee

- 0% Intro APR

- Foreign Transaction Fee

- Spending Caps

Are there any restrictions on redeeming cash back for direct deposits or checks?

Yes, unlike some other cards, the Blue Cash Everyday card doesn't allow for direct deposit or check redemptions.

What is the Pay It Plan It program?

The Pay It Plan It program allows cardholders to manage payments effectively, offering upfront payment options for qualifying purchases.

Does the Blue Cash Everyday Card have any exclusive perks?

Yes, cardholders enjoy exclusive access to American Express Experiences, providing special ticket presale access and event invitations.

Does the card offer any travel-related benefits?

Yes, cardholders have access to the Global Assist Hotline for emergency assistance when traveling more than 100 miles from home.

How can I redeem the cash back rewards?

Cash back rewards, earned as Reward Dollars, can be redeemed for statement credits with no minimum redemption amount.

Discover it® Cash Back

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

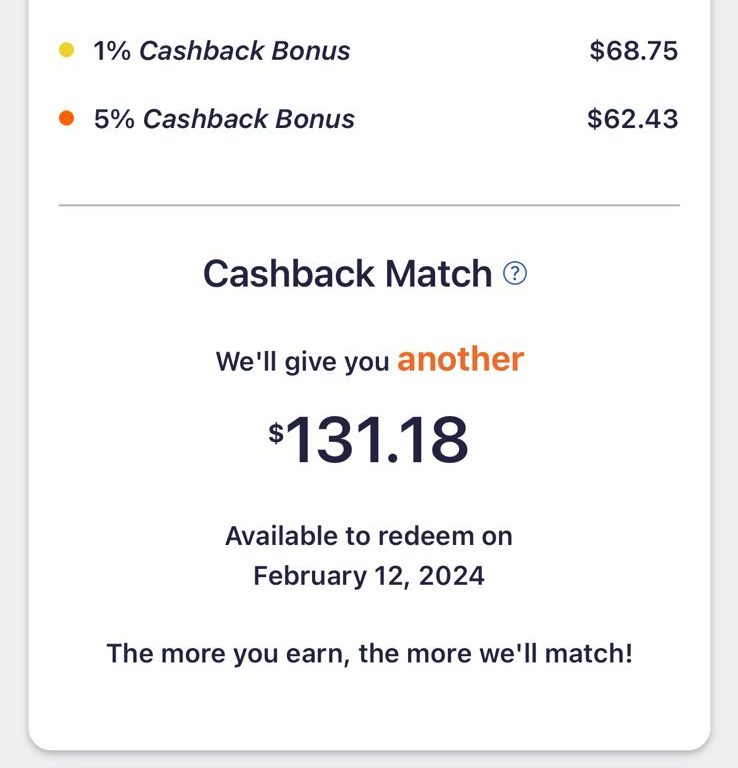

The Discover it® Cash Back is one of our favorites and another great option for good credit customers, mainly due to its high flexibility. This card offers a very high rewards rate on some categories that rotate every few months.

The card gives a 5% cashback on up to $1,500 in rotating category purchases each quarter when you activate the bonus category (then 1%), as well 1% percent cash back on all other purchases.

Some of the categories include; restaurant, gas station, online shopping and many more each time you activate them. However, on all other purchases, excluding the ones in the category selected, you will only receive a 1% cashback.

The Discover it® Cash Back also offers 15 months on purchases and balance transfers and a great sign up bonus. This card is best for individuals who understand their spending habits and want to leverage the high reward rate the card offers, or those who plan a big purchase in the next couple of months.

- Rewards Plan: 5% cashback on up to $1,500 in rotating category purchases each quarter when you activate the bonus category (then 1%), as well 1% percent cash back on all other purchases

- APR: 18.74% – 27.74% Variable APR

- Annual fee: $0

- Balance Transfer Fee: 5%

- Foreign Transaction Fee: $0

- Sign Up bonus: All cash back earned at the end of the first 12 months is matched.

- 0% APR Introductory Rate period: 15 months on purchases and balance transfers

- 0% Intro APR Period

- High Cash Back for Select Spending Categories

- Matches Cash Back in the First 12 Months

- No Annual Fee

- Limit on Cash Back Spending Per Quarter

- Keeping Track of Bonus Categories

- Less Merchant Acceptance

- Balance Transfer Fee

- What are the cash-back rewards limit? There is a $1,500 cap on purchases each quarter that allows you to get the bonus cashback rates. Otherwise, no cap.

- Does Discover it Cash Back ask for proof of income? No out and out request for proof of income and no transparent income requirements.

- Does card rewards points expire? No expiry date for these points.

- Can I get pre-approved on card Discover it Cash Back? Yes, you can get pre-approval.

- What is the initial credit limit of card Discover it Cash Back Card? The minimum credit limit will be $300.

- How do I redeem cash back? You can get the rewards in the form of cash, statement credit, or gift cards.

- What purchases don't earn cash back ? All purchases will earn cashback.

- Should You Move to Discover it Cash Back Card? If you want to get good rewards from bonus categories and want access to a good signup offer.

- Why did Discover deny me? What to Do Next? You might not have met all of the requirements. You can enquire as to where your application fell short. If you cannot proceed, you can look at some of the other available options.

PayPal Cashback Mastercard

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The PayPal Cashback Mastercard, issued by Synchrony Bank, stands out as a no-annual-fee cash-back credit card, offering simplicity and strong rewards for users who frequently utilize PayPal. With a competitive 3% cashback when you shop with PayPal, 2% cashback on all other purchases, the card eliminates the hassle of category restrictions and annual earnings caps.

To apply for this card, you'll need a free PayPal account and a good to excellent credit score. While it doesn't offer a welcome bonus or introductory APR, the cash rewards never expire, and there's no minimum redemption requirement. The process is simple—just transfer your cash rewards straight to your PayPal balance.

- Rewards Plan: 3% cashback when you shop with PayPal, 2% cashback on all other purchases

- APR: 20.24% – 32.24% Variable

- Annual fee: $0

- Balance Transfer Fee: N/A

- Foreign Transaction Fee: 3%

- Sign Up bonus: N/A

- 0% APR Introductory Rate period: N/A

- Cash Rewards Never Expire

- Simplicity and Flexibility

- Cash Rewards Integration with PayPal

- No Minimum Redemption Threshold

- Requirement of a PayPal Account

- Limited Perks

- High APR

Does the card have an introductory APR offer?

No, the card does not offer introductory APR rates for purchases or balance transfers.

How can I redeem cash rewards from the PayPal Cashback Mastercard?

Cash rewards can be redeemed by transferring them to a PayPal account, where they can be used for PayPal purchases or transferred to a linked bank account.

Can authorized users earn the same cash back rates?

No, authorized users can earn up to 2% cash back on all purchases, less than the primary cardholder.

What credit score is required to apply for the card?

The card typically requires a good to excellent credit score for approval.

Can I redeem cash rewards for statement credits or gift cards?

No, the redemption options are limited to transferring cash rewards to a PayPal account or linked bank account.

Are there category restrictions for earning cash back?

No, the card eliminates category restrictions, offering a flat 2% cash back on all other purchases.

Capital One Quicksilver

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The capital one quicksilver card is a good choice for individuals who have good credit score and either don’t like to spend too much in just one budget category or individuals that prefer one reward rate than multiple rates. The Capital One Quicksilver offers 5% percent cash back on hotels and rental cars booked through Capital One Travel and 1.5% cash back on all purchases everyday.. This cashback rate is not the highest in the market, but card do not charge any annual fee, and it has a nice welcome bonus of $200 cash bonus once you spend $500 on purchases within 3 months from account opening.

Lastly, the card offers 0% intro APR for 15 months on balance transfers and purchases (19.74% – 29.74% (Variable) after that). Some of the benefits individuals can derive from using this card include; no foreign transaction fees, travel accident insurance, secondary car rental insurance and 24-hour travel assistance services.

- Rewards Plan: 5% percent cash back on hotels and rental cars booked through Capital One Travel and 1.5% cash back on all purchases everyday.

- APR: 19.74% – 29.74% (Variable)

- Annual fee: $0

- Balance Transfer Fee: 3%

- Foreign Transaction Fee: $0

- Sign Up bonus: $200 cash bonus once you spend $500 on purchases within 3 months from account opening

- 0% APR Introductory Rate period: 15 months on balance transfers and purchases

- Sign-Up Bonus

- Flat Cashback Rewards Rate

- No Annual Fee or Foreign Transaction fee

- Intro APR on Purchases & Balance Transfers

- No Bonus Rewards Categories

- Cashback Rate Could Be Better

- Requires Good/Excellent Credit

- Can I get car rental insurance with Quicksilver Card? Yes, once you refuse the insurance offered by the rental company you will automatically get coverage if you fund the entire purchase through this card.

- What are Quicksilver Card income requirements? Capital One often required monthly income to be at least $800. Sometimes, you will need to show some proof of income.

- Can I get pre-approved? Yes, you can get pre-approval.

- What is the initial credit limit? You will normally get a credit limit of at least $5,000.

- How do I redeem cash back? For the Quicksilver cashback rewards, you are able to get a check, as statement credit, or redeem them with certain retailers.

- What purchases don't earn cash back? All purchases are covered.

- Should You Move to Quicksilver Card? If you want consistency across all types of purchases or need to fill some gaps thrown up by other cards.

- How to Use Quicksilver card Benefits? Use it to fill the gap where your other credit cards fall short. If you want to have ultimate ease of use thanks to the consistency across all types of purchases.

- What are the top Reasons NOT to get the Quicksilver Card? If you are looking to get higher cashback rewards for certain categories.

Wells Fargo Autograph Card

Reward details

3X points on restaurants, travel, gas stations, transit, popular streaming services, and phone plans. Also, earn 1X points on other purchases

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Wells Fargo Autograph Card offers a compelling option for those seeking a no-annual-fee rewards card with a diverse range of bonus categories

The card offers 3X points on restaurants, travel, gas stations, transit, popular streaming services, and phone plans. Also, earn 1X points on other purchasess. However, it lacks travel perks compared to traditional travel rewards cards, and its travel redemption options are limited.

Cellphone protection, My Wells Fargo Deals, and Auto Rental Collision Damage Waiver coverage are among the card's notable perks. Despite not offering transfer partners, the card's flexibility in redeeming points for cash rewards or travel, along with the ability to withdraw rewards from an ATM, adds to its appeal.

- Rewards Plan: 3X points on restaurants, travel, gas stations, transit, popular streaming services, and phone plans. Also, earn 1X points on other purchases

- APR: 21.49%–28.49% variable

- Annual fee: 19.49% – 29.49% Variable APR

- Balance Transfer Fee: $5 or 3% (the greater)

- Foreign Transaction Fee: $0

- Sign Up bonus: 20,000 bonus points when you spend $1,000 in purchases in the first 3 months

- 0% APR Introductory Rate: 12 months on purchases

- Everyday & Travel Rewards

- My Wells Fargo Deals

- 0% Intro APR

- No Foreign Transaction Fee

- Wells Fargo Credit Close-Up

- Basic Card

- No Transfer Partners

- No 0% APR On Balance Transfer

What makes the Wells Fargo Autograph Card stand out?

The Autograph Card stands out with its broad range of reward categories, including restaurants, gas stations, transit, travel, and more, making it suitable for those with diverse spending patterns.

What perks come with the Autograph Card?

The card offers cellphone protection, My Wells Fargo Deals reward opportunities, auto rental collision damage waiver, and Visa Signature perks such as concierge service and Luxury Hotel Collection privileges.

Can you redeem Wells Fargo Autograph points for travel?

While the card offers various redemption options, including travel, the value of points for travel is limited to 1 cent per point.

Can I use the Autograph Card's points for cash back?

Yes, you can redeem your points for cash back as a statement credit or a deposit to your Wells Fargo savings, checking, or money market account at a value of 1 cent per point.

What makes the Autograph Card's redemption options flexible?

The card provides flexibility in redemption, allowing points to be redeemed for various options, including cash rewards, travel, or withdrawal from an ATM, making it convenient for cardholders with different preferences.

Hilton Honors American Express Surpass Card

Hilton Honors American Express Surpass Card

Reward details

Earn 12x Points on hotels & resorts at eligible purchases at hotels and resorts in the Hilton portfolio. Earn 6x Points on dining at U.S. restaurants , and for takeout and delivery in the U.S, on groceries at U.S. supermarkets and at U.S. gas stations. Earn 4X Points for each dollar on U.S. Online Retail Purchases and 3X Points on all other purchases

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Hilton Honors American Express Surpass® Card is a co-branded credit card tailored for regular Hilton guests seeking valuable perks without the high annual fee of the premium Aspire Card. The Surpadd card earns Earn 12x Points on hotels & resorts at eligible purchases at hotels and resorts in the Hilton portfolio. Earn 6x Points on dining at U.S. restaurants , and for takeout and delivery in the U.S, on groceries at U.S. supermarkets and at U.S. gas stations. Earn 4X Points for each dollar on U.S. Online Retail Purchases and 3X Points on all other purchases.

The ongoing benefits include automatic Hilton Gold elite status, providing perks such as complimentary breakfast, increased points earnings, and space-available upgrades at Hilton properties. The annual fee of $150 is justified by these benefits, including up to $200 in Hilton statement credits, a free night reward for $15,000 in annual spending, and complimentary National Car Rental Emerald Club Executive status.

While the card has advantages like automatic Gold elite status and a solid earning rate, its drawbacks include the lower value of Hilton points, an annual fee, and limited travel protections.

- APR: 20.24% – 29.24% variable APR

- Annual fee: $150

- Balance Transfer Fee: N/A

- Foreign Transaction Fee: $0

- Rewards Plan: Earn 12x Points on hotels & resorts at eligible purchases at hotels and resorts in the Hilton portfolio. Earn 6x Points on dining at U.S. restaurants , and for takeout and delivery in the U.S, on groceries at U.S. supermarkets and at U.S. gas stations. Earn 4X Points for each dollar on U.S. Online Retail Purchases and 3X Points on all other purchases

- Welcome Bonus: 165,000 Hilton Honors Bonus Points after you spend $3,000 in purchases on the Hilton Honors American Express Surpass® Card in your first 6 months of Card Membership

- 0% APR Introductory Rate period: N/A

- Automatic Hilton Gold Elite Status

- Statement Credits

- No Foreign Transaction Fees

- Hilton Points Value Is Low

- Annual Fee

- Low Ratio When Tranferring To Airline

Who is the ideal candidate for the Hilton Honors American Express Surpass Card?

The card is best suited for regular Hilton guests seeking a balance of benefits and rewards without the high annual fee of premium cards.

What is the spending requirement for earning Hilton Diamond status with this card?

Cardholders can achieve Hilton Diamond status by spending $40,000 on the Hilton Surpass card within a calendar year.

What is the primary drawback of the Hilton Surpass card?

The perceived lower value of Hilton Honors points compared to other loyalty programs is a notable drawback.

Can I pool Hilton Honors points with other members?

Yes, Hilton allows cardholders to pool points with up to 10 other members, providing flexibility for combining points for award stays.

How can I earn a free night reward with the Hilton Surpass card?

Spending $15,000 on eligible purchases in a calendar year qualifies cardholders for a free night reward that can be used at any Hilton property.

Capital One Savor Cash Rewards Credit Card

Reward Details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Capital One Savor credit card offers unlimited 4% cash back on dining, entertainment, and popular streaming services, 3% at grocery stores and 1% on all other purchases.. Rewards don’t expire for the life of the account, and you can redeem cash back for any amount.

In addition, there is a significant sign up bonus of $300 cash bonus once you spend $3,000 on purchases within 3 months from account opening, as well as no foreign transaction fee.

However, if you don’t spend enough on these types of activities then you won’t get ahead much on the rewards due to the $95 annual fee.

- Rewards Plan: unlimited 4% cash back on dining, entertainment, and popular streaming services, 3% at grocery stores and 1% on all other purchases.

- APR: 19.99% – 29.99% Variable

- Annual fee: $95

- Balance Transfer Fee: 3%

- Foreign Transaction Fee: $0

- Sign Up bonus: $300 cash bonus once you spend $3,000 on purchases within 3 months from account opening

- 0% APR Introductory Rate period: None

- Sign Up Bonus

- High Cash Back

- No Rotating Categories

- $95 Annual Fee

- Approval Can Be Strict

- No 0% Intro APR

- Can I get car rental insurance with Capital One Savor? Yes, once you refuse the insurance offered by the rental company you will automatically get coverage if you fund the entire purchase through this card.

- Does it have a cash-back rewards limit? There is no limit.

- Does Capital One ask for proof of income? No out and out request for proof of income and no transparent income requirements.

- Does Capital One Savor Card offer pre approval? Yes, you can get pre-approval.

- What is the initial credit limit? The minimum credit limit is set at $5,000.

- How do I redeem cash back? You can get them sent to you in the form of a check, as a statement credit, or get them given to you through gift cards.

- What purchases don't earn cash back? All types of purchases are eligible for cashback with this card.

- Should You Move to Capital One Savor Card? If you spend enough on the premium cashback categories to justify the annual fee.

- Why did Capital One Savor Card deny me? What to Do Next? You might not have met all of the requirements. You can enquire as to where your application fell short. If you cannot proceed, you can look at some of the other available options.

- How to maximize rewards on Capital One Savor Card? Make the most out of the signup offer and use this card for the premium cashback categories to get the best bang for your buck.

- Top reasons NOT to get the Capital One Savor Card? If you will not reap enough rewards to justify the $95 annual fee.

U.S. Bank Shopper Cash Rewards

U.S. Bank Shopper Cash Rewards Review

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The U.S. Bank Shopper Cash Rewards Visa Signature Card offers an enticing rewards program for cardholders – 6% cash back on your first $1,500 in combined eligible purchases each quarter at two retailers you choose, 3% back on your first $1,500 in eligible purchases each quarter on your choice of one everyday category, 1.5% back on all other qualifying purchases. Also, 5.5% back on reservations for hotels and prepaid car rentals when you book through the U.S. Bank Rewards Center.

Also, this card provides a $250 bonus after you spend $2,000 in eligible purchases within the first 120 days of account opening. The first year comes with no annual fee.

The application process is swift, with decisions made in as little as 60 seconds. Flexible redemption options allow for cash back as a statement credit, rewards card, merchant gift cards, or direct deposits into U.S. Bank accounts.

- Rewards Plan: 6% cash back on your first $1,500 in combined eligible purchases each quarter at two retailers you choose, 3% back on your first $1,500 in eligible purchases each quarter on your choice of one everyday category, 1.5% back on all other qualifying purchases. Also, 5.5% back on reservations for hotels and prepaid car rentals when you book through the U.S. Bank Rewards Center.

- APR: 18.74% – 28.99%

- Annual fee: $95 ($0 on first year)

- Balance Transfer Fee: 3%, $5 minimum

- Foreign Transaction Fee: 3%

- Sign Up bonus: $250 bonus after you spend $2,000 in eligible purchases within the first 120 days of account opening

- 0% APR Introductory Rate period: 15 billing cycles if you transfer a balance in the first 60 days of opening your account

- High rewards rate

- High Welcome Bonus

- Bonus categories

- Annual fee

- Must enroll each quarter

- Foreign transaction fee

What are the eligible 6% bonus categories for this card?

The card offers 6% cash back at retailers like Apple, Amazon.com, Best Buy, Home Depot, Target, and more. The list is subject to change

How quickly can I get a decision on my card application?

You can receive a decision in as little as 60 seconds when applying for the U.S. Bank Shopper Cash Rewards Visa Signature Card.

What are some additional benefits of the U.S. Bank Shopper Cash Rewards Visa Signature Card?

Card benefits include purchase security, extended warranty protection, return protection, ID Navigator identity theft protections, and special guest status at 900+ Visa Signature Luxury Hotel properties worldwide.

Can cash back be redeemed for travel rewards with this card?

The redemption options are primarily cash-based, and travel transfer partners are not available.

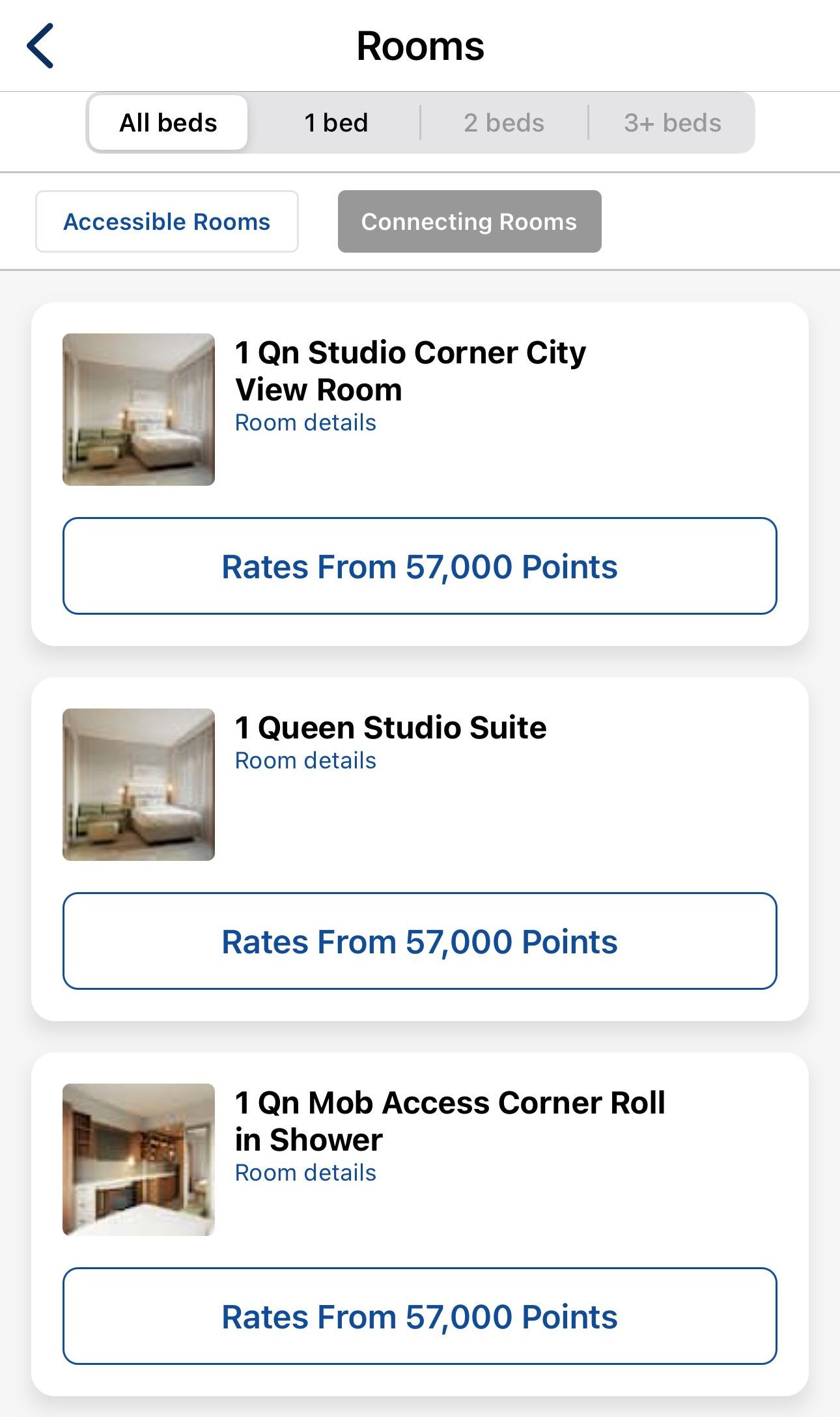

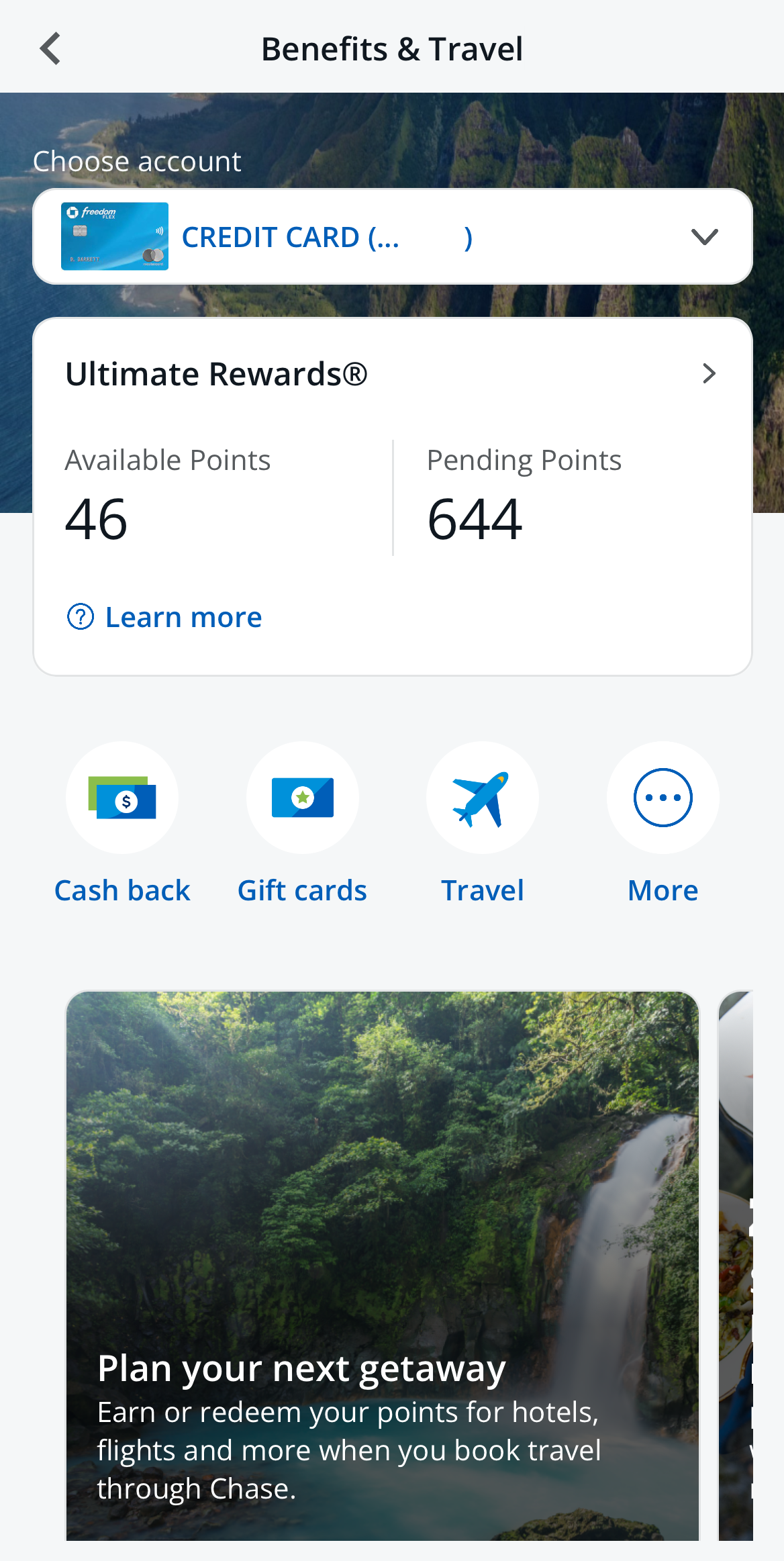

Chase Freedom Flex℠ Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

If you have a high credit score and want a card to capture your spending habits with no extra cost. The Chase Freedom Flex℠ Card has a $0 annual fee, and you can earn .

The sign up bonus includes .

- Rewards Plan: 5% cash back on up to $1,500 in combined purchases on selected categories each quarter and 5% cash back on travel purchased through Chase Ultimate Rewards®. Also, you can earn 3% cash back on dining at restaurants (including takeout and eligible delivery services), drugstore purchases , and 1% on all other purchases

- APR: 19.99% – 28.74% variable

- Annual fee: $0

- Balance Transfer Fee: $5 or 5% (the greater)

- Foreign Transaction Fee: 3%

- Sign Up bonus: $200 bonus after you spend $500 on purchases in the first 3 months from account opening

- 0% APR Introductory Rate period: 15 months on purchases and balance transfers

- Sign Up Bonus

- No Annual Fee

- 0% Intro APR

- Protection & Free Credit Score

- Higher cashback Bonuses has a Cap

- Balance Transfer Fee

- Foreign Transaction Fee

- Is there a limit to cashback? There is a cap on the bonus categories whereby it will cover up to $1,500 of relevant purchases per quarter.

- Can I get car rental insurance with a Chase Freedom Flex card? Yes, when you rent the car and pay for all of it with this card and do not accept coverage from the rental company.

- What are Chase Freedom Flex card income requirements? No specific income requirements and it does not usually ask for proof of income requirements.

- Does card Chase Freedom Flex offer pre approval? Yes, you can get pre-approval.

- What is the initial credit limit of the Freedom Flex? The initial credit limit varies, but can often be between $300 and $1,000. The average limit for this card is $3,000.

- How do I redeem cashback? You go to the Ultimate Rewards section that Chase offers and you can choose between the options as to how you utilize the rewards.

- What purchases don't earn cashback? All purchases earn cashback with this card.

- Should You Move to Chase Freedom Flex card? This is a good fit for people who are looking for good cashback rates, as well as getting access to quarterly bonus categories for enhanced rates.

- How hard is it to get it? It is not very hard to get this type of card once you meet all of the straightforward requirements.

- How to maximize rewards on Chase Freedom Flex card? You go to the Ultimate Rewards section that Chase offers and you can choose between the options as to how you utilize the rewards. To maximize rewards, you should make sure that you take advantage of the bonus categories and leave the other types of purchases that are not covered by an enhanced rate to another card. This is because you will only get 1% cashback on non-covered purchases.

- Top Reasons NOT to get the Chase Freedom Flex card? If you make a lot of purchases not covered by the respective categories and will only get 1% cashback on them. You may also travel a lot and not want to pay the 3% foreign exchange transaction charge that comes with this card.

What Does Good Credit Mean?

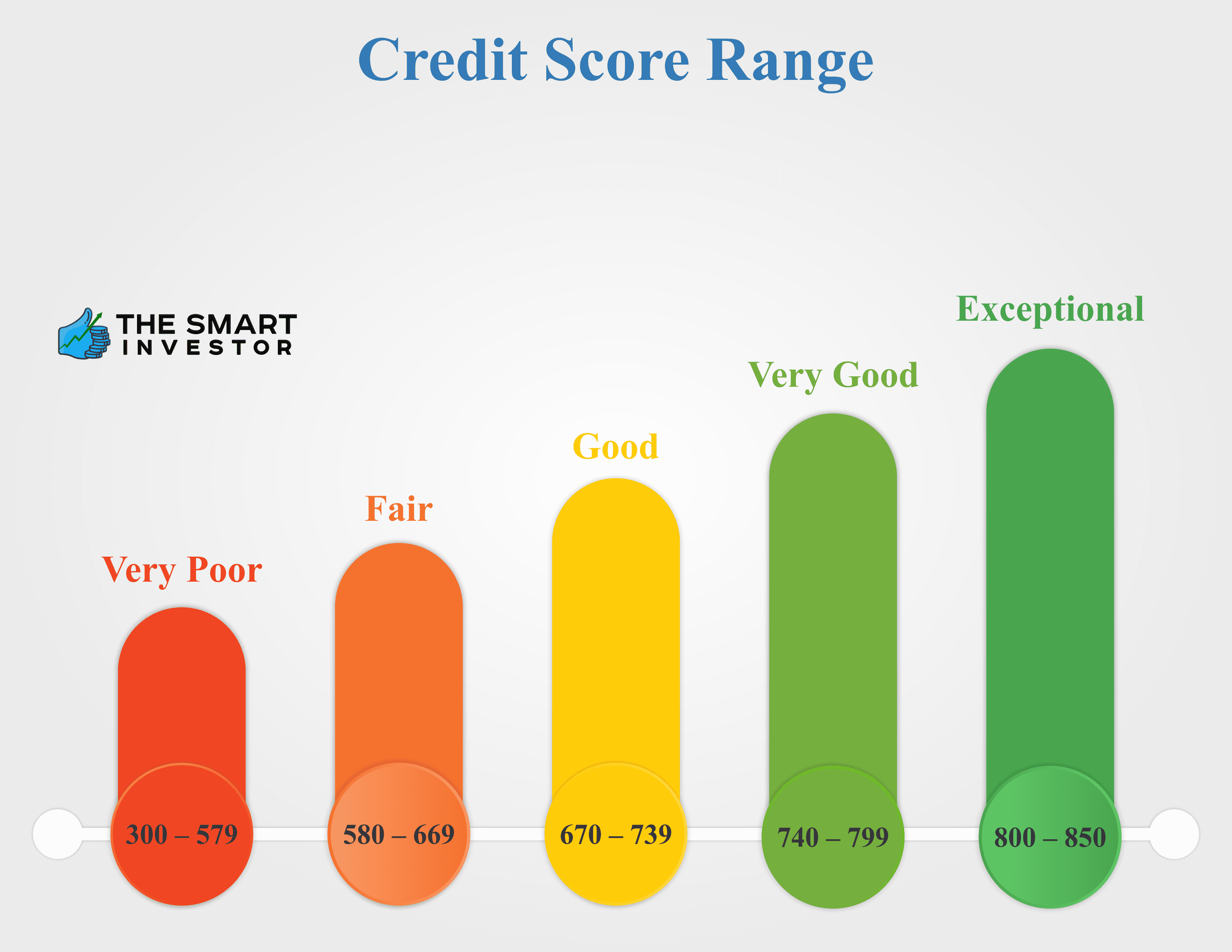

Good credit is an indication that a borrower has a relatively high credit score, and lenders prefer such borrowers due to their low credit risk. Usually, when

Borrowers with good credit starting from 670 or higher have the best chance of getting credit approval from a lender. They are also likely to get favorable loan terms such as attractive interest rates, 0% APR on balance transfers, longer repayment period, etc.

Apart from the credit scores, lenders also consider other factors such as recent credit inquiries, length of credit history, recent credit lines used, etc. to determine the ability of a potential borrower to meet their debt obligations.

Benefits and Limitations of Credit Cards for Good Credit

Credit cards have become an important life tool for consumers looking for convenience when making daily purchases, but they also have a bad reputation if used inappropriately.

If you are planning to get a credit card for good credit, here are the benefits and limitations you should know about:

Pros | Cons |

|---|---|

Rewards Programs | Temptation to Overspend |

Travel Benefits | High Annual Fees |

Introductory 0% APR Periods | Potential for Debt Accumulation |

Rental Car Insurance | |

Cashback and Statement Credits |

- Rewards Programs

Credit cards for individuals with good credit often come with robust rewards programs.

Cardholders can earn points, cash back, or travel miles on their purchases, providing an opportunity to save money or enjoy perks like free flights, hotel stays, or merchandise.

- Travel Benefits

Credit cards for good credit frequently come with travel-related perks, including travel insurance, airport lounge access, and waived foreign transaction fees.

These features enhance the overall travel experience for cardholders.

- Introductory 0% APR Periods

Some credit cards offer introductory periods with 0% APR on purchases or balance transfers.

This can be advantageous for individuals looking to make large purchases or consolidate existing high-interest debt without incurring immediate interest charges.

- Rental Car Insurance

Credit cards often provide rental car insurance coverage, offering protection against collision damage or theft when the rental is paid with the credit card.

This can save cardholders money on purchasing additional insurance from the rental car company.

- Cashback and Statement Credits

Many credit cards offer cashback rewards or statement credits, allowing cardholders to get a percentage of their purchases back in cash or applied directly to their statement.

- Temptation to Overspend

The availability of credit may tempt individuals to overspend beyond their means, leading to financial difficulties and accumulating debt.

- High Annual Fees

Some credit cards for good credit come with high annual fees.

While the benefits may outweigh the cost for frequent users, individuals should assess whether the fees align with their spending habits and lifestyle.

- Potential for Debt Accumulation

While having good credit opens the door to favorable credit terms, it also increases the potential for accumulating debt.

Responsible credit management is crucial to avoid financial pitfalls.

Credit Cards Types For Good Credit

A credit score of over 700 puts you in the good to excellent credit score range. Credit cards for good credit have attractive features and benefits such as 0% APR for the first few months, higher rewards, $0 annual fees, and higher credit limits.

Here are the main types of credit cards for good credit:

Balance Transfer

A balance transfer credit card lets you finance credit card debts at a 0% APR for about 6 to 18 months, depending on the credit card issuer. Usually, you can find a credit card with a 0% APR introductory offer or a low ongoing rate for the first few months.

A good balance transfer credit card is the Citi Double Cash Card that offers a 0% APR for 18 months from the date of account opening. When the promotional period ends, the APR increases to a variable interest rate of 13.99% to 23.99%. However, this credit card charges a 3% to 5% balance transfer fee of the transfer amount.

Travel Rewards

If you are always on the go, a travel credit card can help you save money through discounts and cash back on your travel purchases. Most of the time, travel rewards credit cards let you collect points that you can redeem for airline miles or hotel stays.

If you want to maximize travel rewards, the Chase Sapphire Preferred Card offers generous perks for travelers. Once you spend $4000 in purchases in the first 90 days, Chase Sapphire Preferred Card rewards you with a 60,000 sign-up bonus. You also earn 2x point on restaurant dining and travel purchases, and additional 1x point on other purchase categories. There are no foreign transaction fees.

Cash Back Rewards

Looking to collect cash backs on every eligible purchase you make? Get a cash back rewards credit card. A cash back credit card is a good option for regular shoppers looking to earn points on every purchase.

A good cash back rewards card is the Blue Cash Everyday® Card from American Express. This card is one of the better options for families and people who mostly stay at home instead of traveling. It’s highest cashback rates are for grocery store purchases, with the next two highest rewards tiers being gas purchases and department store purchases. That makes this an excellent option for anyone who doesn’t need a more specialized kind of card.

Business Credit Cards

Business credit cards provide small business owners with solutions for separating personal transactions and business finances. These cards come with tracking and reporting features that business owners can use to track payments.

For businesses managing large transactions, business credit card can earn significant cash back and reward points that can be redeemed for a statement credit and cash rewards.

Low Interest Credit Card

If you are looking for a credit card with the lowest charges, go for a low-interest credit card. This type of credit has a low annual percentage rate, and users accrue lower finance charges than high-interest cards charge.

No Annual Fee Credit Card

A no-annual-fee credit card is a good option if you plan to keep the credit card open for a long time at no cost. These cards do not have a recurring fee, and they can help you increase the average age of credit accounts.

Wells Fargo Propel America Express card offers the best deal for a no-annual-fee credit card. This card has a $0 annual fee, and it does not charge foreign currency conversion fee.

Which Cards Have The Highest Fees?

For many consumers, a lack of an annual fee is an attractive feature of any credit card. Lenders have recognized this trend, and today, most cards do not have an annual fee. However, savvy consumers want more from their credit cards. In this chart created with US news data, you can see the percentage of no-annual fee cards by card type.

What's the Best Credit Card Company?

The JD Power 2020 US Credit card satisfaction study ranked American Express as the best credit company in 2020. Based on a customer survey conducted during the COVID-19 period, American Express scored the highest score of 838 among national issuers. A higher percentage of customers gave a favorable impression of American Express response during the pandemic.

American Express was followed by Discover at 837 points and Bank of America at 812 points. Among regional issuers, Regions Bank scored the highest score at 816, while BB&T (now Truist) and PNC bank tied in the second position with a score of 815.

Overall, the JP Power study 2020 showed there was a decline in customer satisfaction metrics during the COVID-19 pandemic, and credit card customers were losing faith in credit card issuers. This decline was unique to the credit card industry, with other sectors in the consumer financial services industry such as retail banks and primary mortgages recording an increase in customer satisfaction.

The student assessed customer satisfaction based on six key factors. These factors include communication, credit card terms, interaction, rewards, benefits, and services, as well as key moments. The study, which started in September 2019 and ended in June 2020, received responses from 29,106 credit card customers.

Top Offers

Top Offers

Top Offers From Our Partners

What Should I Look For in a Credit Card if I Have Good Credit?

If you have good credit, you will be spoilt for choice with the number of credit card issuers who want your business. With the different options to consider, you should take some time to find the card that suits your needs. Here is what you should look for in your credit card:

- Annual Fee

If you are applying for your first credit card, you should consider getting a credit card that does not charge an annual fee. Without a recurring annual fee, you can keep the credit card open for a long time to help build your credit.

However, if you are looking for a rewards card, you can get a credit card with an annual fee where the potential rewards outweigh the annual fee.

- Interest Rate

Credit cards charge a higher interest rate, compared to other credit products in the financial services sector. You can expect to pay 15% to 25% APR on the outstanding balance. Also, some cards offer a 0% APR for a period of 6 to 18 months.

You can take advantage of these offers to consolidate your credit card debts or make a large purchase that you can repay within the promotional period. Once this offer expires, the interest rates jump to about 15% to 25%, which can be expensive if you have a large balance.

- Rewards

Credit cards can help you collect maximum rewards on your everyday shopping. Pick a rewards card that aligns with your interests or lifestyle such as travel rewards, gas & fuel, supermarket rewards, etc.

Choose between credit cards that offer cash backs, travel rewards or even airline miles.

- Credit Limit

If you are using a specific credit card for the first time, your initial credit limit might be below the expected credit score. In this case, find a card with a low limit, and use it to establish credit reputation.

However, if you are looking for a credit card that allows large purchases, you should find credit card issuers that are willing to increase your credit limit based on your good credit and financial needs.

- Fees and Penalties

Before signing up for a credit card, check the issuer’s terms and conditions to know all the account fees associated with the credit card.

Additional fees such as foreign transaction fees, over-limit fees, balance transfer fees, and late payment fees can add up to the cost of using the credit card. Knowing these fees can help you make the most of your card without incurring additional fees.

How Long Does it Take to Build Good Credit?

Building good credit from zero requires patience, time, and dedication. Generally, you need at least one credit account that has been active for six months to get a credit score, and at least six months of on-time payments and reporting to credit agencies to build a good score.

A FICO credit score requires at least 6 months of on time payments and account activity to accumulate enough credit history and a decent credit score. In comparison, a vantage score requires at least two months of credit history to establish good credit. FICO is the most common credit scoring system, and it is used in at least 90% of the market lenders.

How to Get a Good Credit Score

If you are struggling with a poor credit score, there are things you can do to add an extra 100 or more points. Here are quick strategies to help you get a good credit score:

- Pay Bills on Time

Payment history is one of the main factors that determine your credit score. Always pay your utility bills and credit card bills on time to help you build your credit. If you foresee a delay in making bill payments, you can ask the utility company to delay submitting the information to credit bureaus as you work on paying the bills.

- Don’t Close Old Credit Cards

Keep your credit cards open for a long time as long it does not cost you money in annual fees. By closing your old credit card accounts, you risk losing the accumulated credit history and cause your credit score to drop. Also, closing aged credit accounts increases your credit utilization ratio.

This chart created with Experian data shows that those with an average to good credit score have an average credit utilization ratio of the optimum 33%. This ratio drops significantly for those with very good and excellent scores.

At the other end of the scale, the chart shows that those with poor credit scores typically have a very high credit utilization ratio, with an average of 73%. This will be a massive factor in lending decisions for those in this group.

- Limit New Credit Applications

When you apply for new credit, the lender checks your information with credit agencies, which results in a hard inquiry on your credit report. While hard inquiries typically fade after a few years, they can lower your chances of getting approved for a loan, as lenders may view you as a higher-risk borrower.

- Become an Authorized User

An easy way of getting a good credit score is becoming an authorized user in another person’s credit account. The person can be a friend or relative, and they must have an impeccable credit history and excellent credit scores. This option lets you get credit for their good record of paying credit on time. As an authorized user, you get a longer credit history on your report without having to use the credit card.

- Use a Secured Credit Card

Secured credit cards provide a solution to cardholders looking to build or boost their credit scores. This card requires cardholders to make a deposit, which is equivalent to the allowed credit limit. Payments made to the secured credit card are reported to credit bureaus, and this helps build credit over time.

What are the Expected Credit Card Rates for Good Credit?

The expected APR for good credit varies depending on the type of credit card, borrower's creditworthiness, and the current average interest rates. Ideally, a borrower with good credit can get an APR that is below the current average interest rate. Federal Reserve data from the third quarter of 2020 shows the average interest rate was 16.43%. A good credit score above 700 can qualify you for an interest rate below the average APR of 16.43%. However, the lowest APR is given to cardholders with excellent credit scores due to their low credit risk.

The different types of credit cards in the market have different APRs. For example, reward cards and business credit cards carry higher APRs than balance transfer credit cards due to the benefits and perks that they offer. Generally, issuers have a variable APR that ranges from 13% to 25%, and it changes over time depending on the prevailing interest rates.

Good vs Excellent Credit Score

Lenders use credit scores as one of the main factors to determine whether or not to approve a loan.

Generally, credit scores range between 300 to 850, and a credit score above 700 is considered to be in the good credit score range, while a credit score above 800 is in the excellent credit score range. A credit score in the good and excellent credit score range gives you access to more credit card options and better credit terms.

The two leading credit scoring systems are FICO and VantageScore. FICO is the most common credit score, and it is used in at least 90% of lending decisions. A FICO credit score of 670 to 739 is considered good, while a score in the 800 to 850 range is considered excellent, and it is the highest credit score a person can have.

In comparison, a good vantage score should be in the 661 to 780 range, while an excellent vantage score is in the 781 to 850 range.

UltraFICO and Experian Boost: The New Scoring Models

UltraFICO and Experian Boost are the newest credit scoring tools in the market. These tools are aimed at two categories of consumers i.e. people starting out with credit and consumers with subprime scores. The two scoring models bridge the existing market gap by including data previously excluded from old scoring models when calculating credit scores.

- Experience Boost

Experian Boost allows users to add points to their credit score, by linking this tool to their bank account. The tool scans bank account information for utility bill and cellphone payments.

You can choose only the bill payments with a positive record to be added to the Experian Boost report to help improve your score. The boost factors in the new information in your credit report and this can immediately increase your FICO score.

- UltraFICO

UltraFICO is a new product by FICO, and it collects information from savings, checking, and money market accounts. You can opt-in by registering on FICO and linking your bank account. This tool scans your bank account to check the consistency in the cash on hand, the duration accounts have been open, account activity, and if the accounts carry a negative balance.

A decent savings balance and zero instances of negative balance can quickly improve your UltraFICO and FICO scores. This tool currently works only with data captured in your Experian Credit report.

Top Offers

Top Offers

Top Offers From Our Partners

How We Picked The Best Cards For Good Credit: Methodology

To identify the best credit cards for individuals with good credit, our team thoroughly researched offerings from various issuers, focusing on major banks and financial institutions. We rated these cards based on four key categories tailored for consumers with good credit:

Rewards & Benefits (40%): We evaluate the rewards program, including cash back percentage, points, or miles earned per dollar spent, bonus categories for accelerated rewards, and redemption options. Cards with competitive rewards rates, versatile redemption choices, and valuable perks like sign-up bonuses or statement credits score higher in this category.

Features & Offers (30%): This category assesses additional features that enhance the overall value of the card, such as introductory APR offers, absence of foreign transaction fees, balance transfer options, and basic benefits like purchase protection or extended warranty coverage. Cards offering a variety of benefits without excessive fees earn higher scores.

Cardholder Experience (20%): We examine the ease of application, customer service quality, and online account management tools. Cards with straightforward application processes, responsive customer support, and user-friendly mobile apps or online portals receive higher ratings, ensuring a positive experience for cardholders with good credit.

Issuer Reputation (10%): We scrutinize each issuer's reputation, considering customer feedback, financial stability, and regulatory standing. Issuers with positive reviews from cardholders and a track record of providing excellent products and customer service to individuals with good credit receive higher ratings in this category.

This comprehensive evaluation ensures that the best credit cards for good credit offer attractive rewards, benefits, and a seamless user experience, while maintaining a positive reputation in the industry.