Table Of Content

Can I Add An Authorized User To My Discover Card?

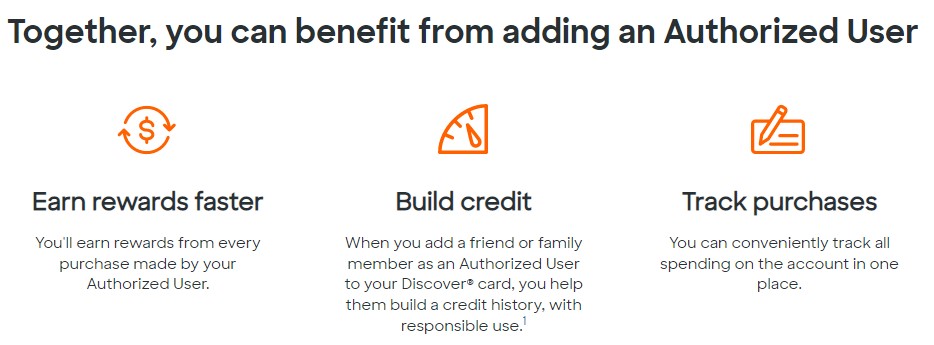

Discover, along with most major credit card issuers- no longer allow co-signers. Account owners can, however, add Authorized Users to their accounts. Discover allows up to five Authorized Users on each account and sometimes offers sign-on rewards to the owner and the added user.

The credit line allotted to the account is shared with the account holder and the Authorized User. Authorized Users with Discover have a mutual account with the account owner and can see all purchases and when they are paid.

How To Add An Authorized User To A Discover Card?

Once you have decided to add an Authorized User to your account, the process becomes simple. Just like opening a personal account, additional users are added by phone, website, or mobile app.

-

Discover Website

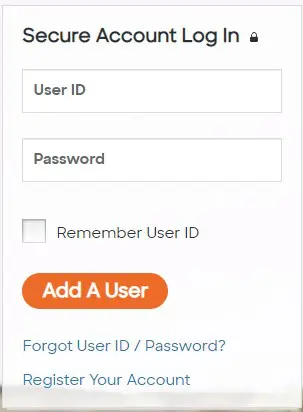

To add an Authorized User to your account via the website, start by visiting the Account Center page:

- Login

- Choose the “Manage” tab

- Click “Manage Authorized Users”

Cardholders can then add the Authorized User by entering the necessary information. This is the same process for adding a user through the mobile app.

The mobile app is generally an easier process because the account is accessible immediately upon opening the app; usually by PIN or face recognition.

Once an application is complete, you will click “submit.” When you apply online or through the mobile app, Users are added to the account instantly. Once the application is complete, the Authorized User will receive their card by mail.

-

Phone

Account holders can also add Authorized Users by phone:

- Call customer service

- Enter your card number

- Voice the requested information, or type it on the keypad

The information needed for an application is to ensure that Discover knows who the Authorized User is and what their credit history looks like.

- Name and Address

- Birth Date

- SSN

Sign Up for

Our Newsletter

and special member-only perks.

Sign Up for

Our Newsletter

and special member-only perks.

Are There Any Restrictions?

Anyone aged 15 or older can be added as an Authorized User, regardless of relationship. For example, if your 16-year-old daughter gets a weekly allowance for gas, you could add her as an Authorized User. This way, she can use the card for gas instead of you needing to send her money manually.

Account owners can also add friends or family members for various reasons. For instance, you might want to help a friend build or rebuild their credit.

Does Discover Report Authorized Users To Credit Bureaus?

Discover reports an Authorized User’s activity to all three credit bureaus: Equifax, Experian, and TransUnion.

However, not all credit bureaus will reflect that information to an Authorized User’s account. For example, it may not be within a credit bureau’s policy to report negative information to an account.

Some bureaus have age restrictions when it comes to credit reports as well. Discover card Authorized Users under the age of 15 will not have their card activity reflected on their credit history. The best way to set your Authorized User up for success, is to check all three credit bureau's policies when it comes to this information.

Discover Cards: How Do Authorized Users Work?

Authorized Users are added to an already existing account without needing a second credit check- meaning that most authorized users can apply to be added to an account without fear of being denied.

These users are given a Discover card and an account login. The authorized user will have the ability to add their own payment method. Usage and payments made through the authorized user’s selected payment method will appear on both users’ credit histories.

If payments are not made on time, this reflects negatively on the account owner, as all payments are their responsibility by default. This is why it is important to be selective of who you add as an authorized user.

There are many upsides to adding an authorized user to your Discover account if both parties spend responsibly and understand the benefits of their selected card.

- Having two users makes it easier to meet spending requirements

- More opportunities to earn points as more purchases are made

- Prevent account closures due to lack of use

When an Authorized User is approved for your Discover card, a new account will appear on your credit report. Just as their usage affects your credit, your usage even more so affects them.

If you, as the account owner, miss payments or misuse your card, you negatively impact the Authorized User’s credit history- preventing them from approval for loans or other credit cards down the road.

Card | Rewards | Bonus | Annual Fee |

| 1-5%

5% cashback on up to $1,500 in rotating category purchases each quarter when you activate the bonus category (then 1%), as well 1% percent cash back on all other purchases

| Cashback Match

All cash back earned at the end of the first 12 months is matched.

| $0 |

|---|---|---|---|---|

| 1-2%

2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter and 1% cash back on all your other purchases

| Cashback Match

Discover matches all cash back you earn at the end of your first year

| $0 | |

| 1.5X

unlimited 1.5x miles for every dollar spent on all purchases

| Discover Match®

Discover matches your first year miles automatically.

| $0 | |

| 1-2%

2% cashback at gas and restaurants (up to $1,000 every quarter) and 1% on groceries and other student related products

| Match Bonus

Discover will match all cash back earned at the end of your first year

| $0 | |

| 1-2%

2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter and unlimited 1% cash back on all other purchases

| Cashback Match™

Discover will match all the cash back you’ve earned at the end of your first year.

| $0 |

What Else Should I Take Into Account?

Another important aspect when it comes to adding an authorized user to Discover card is the process of deciding who to add to your account, and when:

- This person has proven to be trustworthy

- This person is reliable

- This person meets the minimum age requirement

- You communicate regularly with the potential user

- Adding an Authorized User to your account will benefit you

- Your credit score is stable (meaning a temporary drop in credit won’t hurt you in the meantime)

When adding an authorized user to your Discover account, it is necessary to be on the same page as one another. Important questions to ask yourself and the added user are:

- What are our mutual goals for the account?

- How often will payments be made?

- What percentage of the credit line will be utilized?

- Who is responsible for what payments?

If this person meets all of the requirements and passes the personal criteria you have set, you may begin adding them as an authorized user.

How To Remove An Authorized User From My Discover Card?

Removing yourself as an authorized user on Discover card could impact your credit score because the account owner’s credit history will be removed from your credit report.

If the account owner was responsible for paying most of the bills and had a higher credit score than you, your credit score may drop by a few points. If the account owner carried high balances or made payments late, being removed as an authorized user may improve your score.

You can remove authorized users or remove yourself as an authorized user by:

- Login to your Discover account

- Click the “Card Services” tab

- Select “Manage Cards”

You will see an authorized users section under the account owner's card. Select “Manage” and then “remove.” This can be done through the mobile app or by logging into your account via the Discover website.

The user will be removed from the account immediately. authorized users can also be removed by calling the number on the back of the Discover card.

What Benefits Are Not Available To Discover Authorized Users?

Unfortunately, Authorized Users don’t receive all of the same benefits and perks as the account owner.

Authorized Users have the opportunity to use Cashback rewards for payments, and the option to redeem their rewards in miles or gift cards, after gaining permission from the issuer or an agent. Generally, the account owner dictates who can use the rewards.

While some cards allow access to cashback rewards for the Authorized User, ultimately, they are collected by the account owner. It is their account, so they own rights to all benefits and perks.

Some Authorized Users have lower spending limits than the account owner- but that is determined by the type of card or per request by the account owner.

Top Offers

Top Offers

Top Offers From Our Partners

FAQs

Are Authorized Users liable for debt with Discover?

Authorized Users with Discover aren’t responsible for any outstanding debt or balances on the account. The account owner is solely accountable for payments and managing benefits.

This makes it especially important to weigh the pros and cons before deciding to add someone as an Authorized User.

Do you need an SSN to add an Authorized User to your Discover account?

Authorized Users are required to provide an SSN to be added to an account. Discover required an SSN, address, and date of birth to ensure they know the person and their identity before approving them as an Authorized User.

If they cannot provide an SSN, they are not eligible to be an Authorized User with Discover.

Does Discover deny Authorized Users?

The only reason why someone would be denied as an Authorized User with Discover is if they fail to provide the necessary information for application.

Discover does not require any prerequisites for Authorized Users, but failing to provide an SSN, address, or date of birth means you are not eligible to be an Authorized User.

Does Discover do a credit check for Authorized Users?

Discover does not do a credit check on Authorized Users. Authorized Users can be added to an account without fear of rejection, as Discover does not require added users to meet any prerequisites.