Table Of Content

For those with sound financial stewardship, credit cards do not only provide comfort, but they also come with a lot of great perks. Some cards benefit cardholders with miles they can redeem for flights, cashback on their daily purchases, or rewards points they can exchange for merchandise.

Key Takeaways

Credit card companies offer perks because the goal is to incentivize cardholders to use their credit cards

If you have good credit, credit cards do not only provide comfort, but they also come with a lot of great perks – such as priority boarding, sign-up bonuses, rental car insurance, protections, free upgrades and concerige services are just part of them .

Credit cards can provide you with the utmost convenience, but they can also wreck your finances if you do not have the right discipline to use them

Why Credit Cards Offer Perks?

Credit card companies offer perks because the goal is to incentivize cardholders to use their credit cards when making payments rather than cash or debit cards. By giving perks, card issuers hope to build brand loyalty which would make holders patronize their services more often. This generates increased merchant fees for the credit card company.

Also, giving perks provides yet another source of revenue for the credit card company – interests charges on debt. credit card companies make money by charging interest rates on rolled-over balances, and issuing late fees for payments missed or made after the stated due date. These interest rates are usually high and provide credit card companies with significant cash flow.

We have compiled the most valuable unique credit card benefits you can get as long as you’re holding the right card.

1. Credit Card Rewards

Rewards on credit cards work by earning points, miles, or cash back for eligible purchases made with the card.

Here are some of the rewards you can get with a credit card:

-

Cashback Rewards

Cashback rewards are one of the most popular and lucrative credit card rewards offered by financial institutions. This type of reward program allows cardholders to earn a percentage of their purchases back in cash.

The percentage of cashback earned can vary depending on the type of card and the category of purchases made. For example, some cards offer higher cashback rates for purchases made at grocery stores, gas stations, or restaurants, while others offer a flat rate for all purchases.

The cash earned through cashback rewards can be redeemed for statement credits, deposited into a bank account, or used to offset future purchases. Some cards may also offer bonus cashback for reaching certain spending thresholds.

Cashback rewards are an excellent option for those who want to maximize their rewards earnings while keeping their finances in check.

-

Concerts, Wine And Sports Events

Credit card company experiences offer various special activities such as:

- Concerts and live events

- Dining experiences

- Culinary classes

- Sports events

- Adventure activities

- Wine tastings

- Cultural experiences

- Luxury travel packages

- Theatre shows and performances.

These are subject to availability and may vary by region.

-

Gift Cards

Some credit cards allow you to redeem your rewards points for merchandise or gift cards. This can be a good option if you don't travel frequently or if you prefer to use your rewards for other things.

The availability to redeem points for gift cards varies depending on the rewards program and its terms and conditions. You can usually redeem points for gift cards after reaching a certain threshold or through special promotions.

It's best to check the specific program's website or contact their customer service for more information.

-

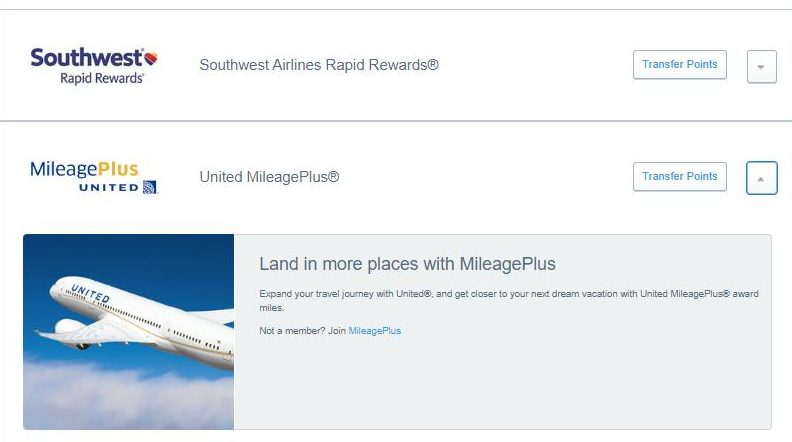

Transferring Credit Card Points To Airline Partners

Transferring credit card points to airline partners works by allowing cardholders to transfer their credit card rewards points to the frequent flyer programs of partnered airlines.

Typically, this is done at a set exchange rate, such as 1:1 or 2:1. The process usually involves logging into the credit card account and selecting the option to transfer points to the frequent flyer program. The transfer can take anywhere from a few hours to several days to complete.

Once the transfer is complete, the cardholder can then use the frequent flyer miles to book flights, upgrade seats, or redeem other benefits offered by the airline's loyalty program. The terms and conditions, transfer rates, and eligible airline partners can vary by credit card issuer.

-

Free Museum Visits

If you’re an art lover and hold a Bank of America or Merrill Lynch debit card, you can get one free general admission ticket to over 150 major museums and art institutions all over the country.

It’s valid on the first full weekend of every month and you only need to present your card and a picture ID to gain free entrance.

Some of the places you can visit for free are the Skirball Cultural Center in Los Angeles, the Art Institute of Chicago, and the Metropolitan Museum of Art in New York City (although they suggest that you donate for admission).

Card | Rewards | Annual Fee | Rewards Type | |

|---|---|---|---|---|

| Delta SkyMiles® Gold American Express Card | 1X – 2X

2X miles on delta purchases, at restaurants worldwide (including take-out and delivery in the U.S) and at U.S. supermarkets, and 1x miles on all other eligible purchases

| $150, $0 intro first year (Rates & Fees) | Miles |

| Chase Freedom Unlimited® | 1.5% – 5%

5% cash back on travel booked through Chase Ultimate Rewards, 3% on dining (including takeout and eligible delivery), 3% on drugstore purchases, and 1.5% on all other purchases

| $0 | Cash Back |

| American Express® Gold Card | 1X – 4X

4X points at restaurants (including Uber Eats purchases in the U.S.) and U.S. supermarkets (up to $25,000 per year in purchases, then 1X points), 3X points on flights booked directly with airlines or on amextravel.com, 2X points on rental cars through amextravel.com and 1X points on all other purchases

| $325 (Rates & Fees) | Points |

| Citi® Double Cash Card | 1% – 2%

2% cash back rewards rate – 1% every time you swipe and another 1% upon payment.

| $0 | Cash Back |

| Capital One Savor Cash Rewards Credit Card | 1% – 4%

unlimited 4% cash back on dining, entertainment, and popular streaming services, 3% at grocery stores and 1% on all other purchases.

| $95 | Cash Back |

2. Travel Perks

Credit cards offer a variety of travel perks. From lounge access to TSA PreCheck reimbursement, the options are extensive.

Here are some of the travel perks you can get with a credit card:

-

Hotel And Airline Upgrades

Credit card hotel and airline upgrades work by providing cardholders with perks and benefits for using their credit card to make purchases with partnered hotels and airlines. These benefits can include:

Hotel upgrades: Room upgrades to better rooms or suites, free nights, access to exclusive lounge, priority check-in, etc.

Airline upgrades: Access to premium seating (e.g. business or first class), priority boarding, checked baggage allowances, lounge access, etc.

To receive these benefits, cardholders must often use their credit card to book a flight or hotel stay and use the card to pay for it. The exact terms and conditions vary by credit card and program.

-

No Foreign Transaction Fees

No Foreign Transaction Fees is a feature offered by some credit card issuers, where the cardholder is not charged a fee for making purchases in a foreign currency.

When a cardholder uses their credit card abroad, the transaction is converted from the local currency to the cardholder's home currency. This conversion process usually incurs a fee, which is referred to as a foreign transaction fee.

With No Foreign Transaction Fees, the cardholder can make purchases in any currency without incurring any additional fees. This feature is especially useful for travelers, as it helps them avoid the extra costs that come with using their card abroad.

The transaction is still converted from the local currency to the cardholder's home currency, but the conversion rate will be the same as the rate charged by the credit card issuer.

To use No Foreign Transaction Fees, cardholders must have a credit card that offers this feature.

-

Concierge Service

Imagine what it would be like to have your own personal assistant just waiting for your instructions. Well, you might already have one and not know it. Your credit card’s concierge services work as a dedicated personal assistant without any costs to you.

Luxury Cards like Visa Signature and World MasterCard make concierge services available to their cardholders. They are there for almost everything, including getting reservations at a hard-to-book restaurant, to making travel arrangements, and even for unusual requests.

Your concierge service can save you time by helping you in booking theater or concert tickets (at times even before they go on public sale), sending flowers, locating special or unusual items for purchase, or even getting an emergency clothes delivery when you have a wardrobe malfunction.

-

Airport Lounge Access

Airport lounge access is a benefit offered by some credit card issuers, allowing cardholders to access airport lounges for free or at a discounted rate. The access is usually provided through the credit card issuer's membership program or through a partnership with an airport lounge network.

To access airport lounges through a credit card, cardholders must first be eligible for the benefit. Eligibility is usually determined by the type of card, with premium credit cards offering the best access. Cardholders can check with their credit card issuer to find out if they are eligible for airport lounge access and what lounges are available.

Once you’re eligible, you can access airport lounges by presenting your credit card and a valid photo ID at the lounge’s reception. The staff will verify your eligibility and grant you access. After that, you can relax and enjoy the lounge’s amenities, like comfortable seating, Wi-Fi, food, and drinks.

In some cases, cardholders may be required to pay a fee to access the lounge, even if they are eligible for the benefit. This fee is usually lower than the cost of a standard lounge access pass and is sometimes waived for premium cardholders.

-

Delayed/Lost Luggage Protection

Another reason travel credit cards are so lovable is baggage protection. If you lose your bags, some cards will reimburse you for the loss up to a certain amount. This will help you buy a new bag, clothes, shoes, and personal items you need during your stay. This reimbursement usually comes in after the airline reimburses you for the loss.

Some cards cover you for lost or damaged baggage, others for delayed baggage, and a handful of them offer both. If you have a choice, get one that covers all of the above. When your bag does not end up on the conveyor belt at your destination’s airport, you can’t always trust the airline company to run to your aid.

Some cards will give you a daily stipend for things like clothes, shoes, personal products, etc. if your flight becomes delayed by 6-12 hours or more. They usually have a maximum number of days for this (normally about 5 days) or a maximum dollar amount.

Card | Rewards | Annual Fee |

| 2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

| $95

|

|---|---|---|---|

| 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

| $395 | |

| 1X – 4X

4 Bonus Points per $1 spent on purchases at all Hyatt hotels. Plus, 5 Base Points from Hyatt per eligible $1 spent for being a World of Hyatt member. 2x Bonus Points per $1 spent at restaurants, on airline tickets purchased directly from the airline, local transit and commuting as well as fitness club and gym memberships. Plus, earn 1 Bonus Point per $1 spent on all other purchases.

| $95 | |

| 1X – 2X

2 AAdvantage miles per dollar on grocery stores and eligible American Airlines purchases, and 1 mile per dollar on other purchases

| $0 | |

| 1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

| $550 | |

| 1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

| $695 (Rates & Fees) |

3. Insurance & Protections

Lastly, besides rewards – one of the main credit card perks is the insurance options and protections cardholders get:

-

Extended Warranty Protection

Consumer Reports generally does not encourage consumers to pay for an expensive extended warranty when they purchase a product.

But, it if comes free with the purchase, why not get it? For example, the American Express Blue Cash Everyday card extends that benefit when you use it to buy some home appliances.

Just make sure that you use the same credit card when you’re paying for any repairs and secure all your receipts. Submit the necessary documents to your credit card issuer and after they’ve processed your claim, they will credit your statement with the appropriate amount.

Take note that credit cards that provide extended warranties do not cover all your purchases. Some items that do not fall within this offer are medical equipment and software. Check the details on the coverage before you make a big purchase.

-

Rental Car Insurance

When you’re renting a car, the car rental staff will ask if you’d like to purchase a Collision Damage Waiver or rental car insurance, on top of the cost of the rental. The additional $20 to $40 to your daily travel expenses can fracture your budget even if it’s just for a couple of days.

Many credit cards have built-in rental insurance that saves you money for car rentals and protects you in case of a car accident, theft, or towing charges. This is because the card issuers will shoulder these charges.

Most card providers, Visa, and Mastercard at the forefront, will insure your car for the first 15 days of a car rental, and up to 30 days for premium providers such as American Express and Discover.

Some cards also cover loss-of-use fees that rental agencies charge to customers who cause a vehicle to become out of commission because of repairs. You’ll have to first check if your current auto insurance policy offers rental car coverage.

However, if you’d like to take advantage of this credit card feature, make sure to use the card to pay for the car rental transaction in order to activate your coverage.

-

Credit Card Price Protection

You paid some big bucks for that smart TV you’ve always wanted, only to find out that the exact same item is selling at a substantial discount in another store two days later.

You may feel like a schmuck because you paid way too much, but don’t beat yourself up – there could be a recourse. First, check the store from where you bought your TV if they offer price matching. If they don’t, then look to your credit card.

If you have credit card price protection , you can file a claim and submit proof that the same item is now on sale for much less. When the card issuer says that your claim is okay, you can get a refund.

What’s even better is that you can request for price protection as many as 90 days after your purchase, which is a lot longer than most stores’ price-matching offers. With the right card, your card company will even search the lowest prices for you in the next few months.

Of course, there are exclusions and the list of items differ for each provider.

-

Emergency Travel Assistance

One of the worst problems you can have is running into trouble while traveling abroad.

If you have a high-end card, you don’t need an emergency for them to provide extra service to you, like giving lost luggage assistance.

Say you’ve landed in Oakland, but your baggage is somewhere in Shanghai; your credit card might give you an allowance to buy enough clothes until your luggage catches up with you.

Every card’s travel assistance is different when it comes to missing baggage. Some cards will help locate your luggage and get it back to you, while others will offer funds to keep you afloat.

Some other cards will replace your luggage if you’re a victim of theft while traveling.

-

Trip Cancellation Coverage

A travel cancellation insurance will reimburse the cost of nonrefundable flights in case an emergency or illness messes up your travel plans. Some cards also provide protection against flight delays.

It depends on your card, of course. Some cards will allow you to get back up to $2,500 if illness forces you to cancel your trip and up to $125 for delayed flights.

American Express, on the other hand, offers up to $250 to cover meals and accommodation if a snowstorm leaves you stranded, with a $9.95 fee per person, per trip. Just keep in mind, there are only a few valid reasons to cancel your trip, such as the death of an immediate family member, a serious illness, or an injury.

They won’t cover you if a pre-existing condition flares up or if you’re flying into a war zone. Normally, they will require you to provide a doctor’s certificate to prove your case.

-

Free Credit Score

Another helpful benefit of credit cards in improving your credit profile is getting a free FICO score straight from the card you’re using to give your credit a boost. For example, Discover offers a no-charge credit score card (even if you’re not a cardholder), that they update monthly on your card statement.

American Express offers the MyCredit Guide tool, Chase customers can use the Chase Credit Journey, and capital One offers its one service as well – the CreditWise.

This is very handy because you don’t have to wait for the credit bureau’s reports and it keeps you on top of any movement to your credit activity from month to month.

-

Fraud Protection

If someone steals your credit card and uses it to make purchases, generally, the card company can’t make you pay for them. According to a Chapman University survey, identity theft ranks 3rd among Americans’ biggest financial fears.

Identity-theft insurance aims to protect you if someone steals your personal information and uses them for illegal purposes. But experts do not agree with each other on whether it is worth paying for, even if it does include credit monitoring and help in repairing credit after a theft.

If a thief takes your card and uses it for a shopping spree, he probably won’t get away with it for an extended time.

Federal laws generally protect your liability for unauthorized credit card use up to $50 only, but many companies won’t expect you to pay for any fraudulent charges on your card.

-

Roadside Assistance

Some perks kick in even if you don’t purchase anything.

If your car suddenly breaks down, your credit card may provide roadside assistance. But don’t cancel your current roadside assistance contract without reading the terms of your credit card benefits. In most cases, after you call the credit card company, they would just call in a local tow truck for you.

Then, you’ll pay for the cost of towing with your own credit card. Note that some premium cards come with free roadside assistance. You may frown at this benefit, but you will thank the card company if you should need it on an unfamiliar country road on a dark night.

-

Cell-Phone Replacement

What does a phone have to do with a credit card? Well, your credit card can help cover the cost of a new cell phone in case somebody steals your phone, or it sustains some damage. However, for that insurance feature to be in effect, you need to pay your monthly cell-phone bill with a qualifying credit card.

Wells Fargo includes this benefit in many of their card products. In case of theft, you need to prove that someone stole your phone by presenting a police report or other relevant documents.

But, simply losing your phone (like leaving it in a cab) doesn’t count so the card company won’t cover the loss.

Perks Come With a Price

Additional credit card perks cost the card companies money and they would naturally get it from the cardholders who must pay more for these cards. The simple fact is, the more premium the card, usually the higher the fee that the issuer charges. So, think it through if you want to pay more.

So, when looking for a credit card, look for one whose benefits are relevant to you and redeem as often as possible to maximize the annual fee you may be paying for it.

Many reward cards with added bonuses usually charge a higher interest rate or require you to have a very good or excellent credit score before you can qualify. Check with the card provider for details before you apply.

If you get a perk-filled credit card, treat it responsibly the same way you would any other credit card. Use it intelligently, keep your debt to within 30% of your credit limit, and pay off your total balance in full every month.

Staying debt-free but still enjoying rewards, bonuses, and perks is the mark of a truly successful credit card handling.

FAQs

how do credit card rewards work?

Credit card rewards are incentives that card issuers give their holders to encourage them to use their credit cards. The rewards may be in the form of cashback, points, or travel miles for every dollar you spend. They can be redeemed for checks, a statement credit, merchandise purchased through the card company, gift cards, and/or travel perks

To entice new clients to sign up, credit card companies offer introductory bonus rewards along with an introductory 0% APR for the first several months. These rewards may reach hundreds of dollars in incentives if the user reaches a spending threshold.

Cardholders get to see their rewards on their credit card statement at the end of each billing cycle. For holders that pay their full balance every month, rewards would make the most sense. However, if you roll over your credit card debt, interest charges would erode the benefits of rewards. There is no clear-cut ‘best rewards’ card as it all boils down to your spending habits and how you redeem your rewards.

Are credit card rewards worth it?

Choosing a credit card that offers no rewards is analogous to leaving money on the table. When used responsibly, credit card rewards are worth it. They can be used to save money on expenses which can be channeled to other productive uses.

Optimizing the gains from credit card rewards comes down to your fiscal discipline. Rewards are better utilized if you pay off all your existing debt.

However, rewards can also be deceitful, as they encourage you to spend and rack up more debt. If rolled over, you incur high-interest charges on your loan, thereby allowing the credit company to make more money from you.

Top Offers