Table Of Content

How Does Interest On A Credit Card Work?

Credit card spending does not need to be immediately paid off, there is a grace period before at least part of the balance must be paid. Monthly credit card statements show you the following important information:

- Minimum payment – this is the least you can pay on the next due date and will incur interest on the outstanding (unpaid) balance.

- Full balance – this is the total of past spending you must pay to avoid interest charges.

- Payment due date – your payment must be received by this date to avoid penalty charges.

- Credit limit – the maximum you are allowed to borrow at any one time.

- APR – the Annual Percentage Rate or interest applicable to any unpaid balance.

Here’s a simple example:

Let’s say your full credit card balance is $1,000, of which you decide to pay the minimum of $50.

- Find the APR. This is listed as 24% on your statement but this is ‘per year’ so you divide by 12 to find the approximate monthly interest rate, 24% ÷ 12 [months in year] = 2%.

- Find your interest charge. For this you need your full balance and monthly APR from above: $1,000 × 2% = $20.

- Calculate your principal paid and the remaining balance. Since you paid $50 in total, $20 of which covered the interest charge, you paid [$50 – $20] = $30 of principal down. Your balance owing is now $1,000 – $30 = $970.

This calculation exposes the hidden danger of credit cards. If you pay just the minimum balance, you make very little impact on the balance owing and accumulate debt quicker than you may realize.

Something we haven’t explored are the penalties for late payments which add to this burden and, according to the Consumer Financial Protection Bureau, are on the rise nationally. These fees range based on the card provider, from low at community banks and credit unions to higher at large banks.

Does The Fed Raising Interest Rates Affect Credit Cards?

“Yes, the Federal Reserve, or Fed, plays a big role in influencing interest rates nationwide, especially variable rates. Since most credit cards have variable APRs, the interest rate on your card can change over time based on the formula in your card agreement.

Fixed-rate credit cards are quite rare, so unless you’re sure your card has a fixed rate, it’s safe to assume it’s variable.

But why do interest rates go up? This question takes us into how credit card companies operate. There are two main reasons for these increases:”

- Borrowing costs. When the Fed raises its policy rate, known as the Federal Funds Rate, companies face higher borrowing costs. To manage these increased expenses, companies can either pass them on to customers or accept lower profits, which often frustrates shareholders and can lead to actions like selling stock or pushing for changes in management. Credit card companies typically pass these higher costs to you through increased APR.

- Higher default risk. This one is a bit less direct but here is the logic: as the Fed, and all other, rates go up, there is a higher chance of recession and job losses. We frequently hear this in the news and sometimes it is explained as a “hard landing” caused by the Fed raising rates too fast. Credit card companies understand this well and know that customers without jobs prefer to keep making their mortgage payment over paying off their monthly credit card balance. To balance these potential losses and prepare for leaner times, credit card APRs increase.

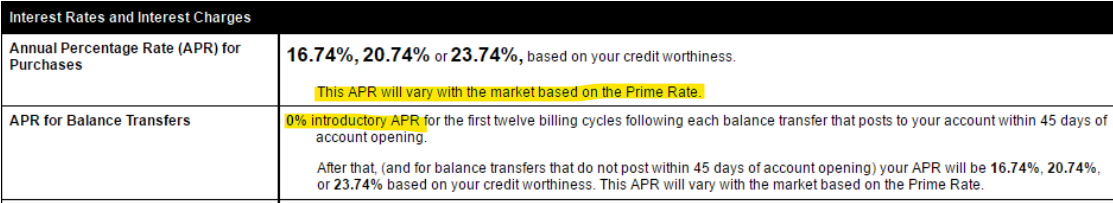

To know with certainty how your APR is impacted, it helps to see how rates are disclosed in your terms and conditions. Notice that APR is variable – in most cases, it varies with Prime, the lender’s key rate, and moves with Fed rate changes.

How Have Fed Rate Increases Impacted Credit Card APR?

First, let’s understand all factors that impact credit card interest rates:

Factors affecting everyone | Factors affecting only you |

|---|

Each company will vary in how it looks at these factors, trying to profit or benefit users in its own unique way. While the Fed is only a single factor it is an unavoidable one, we saw this in Figure 1 where APR is based on changes to Prime, which is directly linked to Fed rates.

More precisely, the Fed controls only a single, overnight interest rate: the Federal Funds Rate (FFR). The FFR has increased by 3% in the last year so we should expect credit card APRs to be up by roughly this amount. As predicted, the average rate, shown below, has gone up accordingly.

What Options Should Credit Card Users Who Carry Debt Consider?

So far, we know Fed rates clearly impact credit card APRs. The Fed, in its rate announcements and projections, tells us that future FFR hikes are needed to fight inflation, which is at 40-year highs. This leaves very little doubt about where credit card APRs are going next: up! So what can you do about it?

- Pay off your balance every month. Interest is only charged if you carry a balance to next month so make sure you pay the full balance by the due date to avoid interest and penalty charges.

- Keep an eye on expiring introductory offers. Credit cards are marketing geniuses who use short-term offers to lure you in. Many people simply sign up and forget. For example, if you have a 0% offer on balance transfers for 12 months, then in month 13 you will face interest charges on any remaining balance – this is despite controlling your new spending and paying it off monthly. You can put a reminder in your calendar or, better yet, pay it off early.

- Use balance transfers wisely and look into debt consolidation. Transferring your existing balance to a new credit card with a 0% introductory offer can benefit you, but only in the short run (see above). It’s easy to keep moving a balance around without noticing its growth over time. Instead, consider a lower-interest-rate debt consolidation loan to start chipping away at the balance and, in effect, change your habits.

- The dreaded B-word. Without knowing how much you spend and assigning part of your income to debt repayment, it’s impossible to balance your lifestyle. And, with technology’s help, there is no shortage of apps and websites to make budgeting simpler: EveryDollar, Mint. Knowing your numbers is highly motivating and that’s critical to actually taking action.

- Cut it up. We left the most extreme for last but there’s no denying that, for some people, physically disabling their credit card is the first step to recovering their financial health. Part of the population would admit they are addicted and are likely to rationalize their spending as “necessary” or “building credit.” Going without plastic can not only help reduce debt but also exercise greater control over life choices.

What Is A Good Credit Card Interest Rate These Days?

As we’ve seen above, credit card APRs are roughly 19% on average. . If you have good credit, as measured by your credit score, you will pay less and if you’re just starting out or have poor credit, you will pay more.

Everyone should expect to face higher APRs into 2023 because of coming Fed rate hikes. So, what should you consider a ‘good’ APR?

One mistake commonly made is to focus on the introductory interest rate, waived annual fee or potential rewards instead of the card’s typical APR. While those added benefits are attractive, consider yourself in 5 years once they have expired – is that annual fee still worth the rewards?

As you think it through, question how your lifestyle might change: will you still be jet-setting around the world every month? Once you have a reasonable, long-term understanding of your spending habits, you will be in a better position to judge a good credit card. For example:

- If you travel for work often and don’t plan to carry a balance, you may want a card for accumulating travel (or cash) rewards for your own vacations later

- If you plan to pay off your card and use it only at restaurants or grocery stores, find one with higher rewards at those places which also returns benefits you will definitely use (cash, in the form of statement credit, is the most flexible)

- If you’re just starting out, find a ‘credit builder’ card with low limit to practice with

Why Is The Fed Continuing To Increase Interest Rates?

The Fed has a ‘dual mandate’ as its purpose: maximum employment and price stability (low inflation). Motivating these targets are multiple historical periods of high inflation and devastating unemployment which eroded household wealth. During the Great Depression, for example, unemployment reached 25%.

What the Fed is trying, by maneuvering rates up and down, is to proactively stop the extreme growth (known as asset bubbles) and collapses of the past. It’s a tricky task, more “art than science” as many commentators have said.

Today, high inflation is the boogeyman the Fed wants to put a stop to with rate hikes. But where did this inflation come from?

Mostly from high demand for goods, partly funded by generous government benefits, and lower-than-normal supply, clogged by microchip and other shortages. You saw examples of this in runaway home price increases, used cars and lumber early on in the pandemic and now it’s clear in food prices, gasoline and wages.

It should also be noted that fast inflation (above 5% per year) can become “expected,” something the Fed is desperate to avoid with larger-than-usual rate hikes.

Does The Fed Raising Interest Rates Affect Debit Cards?

The interest rate on a checking account, which your debit card is linked to, is unlikely to increase with further Fed rate hikes.

This is because checking accounts are used for daily transactions (including utility payments, and paycheck deposits) and balances are kept low so earning interest is not the priority for account holders. Banks, rather than increase interest on checking accounts, will usually cut monthly fees or add features to compete.

Savings accounts, on the other hand, are sensitive to Fed hikes and competition from other banks. Savers want to earn as much as they can on the larger balances they hold in their savings accounts, triggering them to move banks if interest rates are better elsewhere.

From the bank’s perspective, customer savings are used to make loans and earn interest income, so paying higher interest rates makes sense to keep their funding secure.