Table Of Content

Capital One miles are the simplest option for free travel, simply swipe your card and make the travel purchase. You then have up to 90 days to “remove” the purchase with the miles in your account.

However, you can also transfer the Capital One miles between airline partners and combine the miles between your cards or other Capital One mile account holders.

So, here we’ll delve into how to transfer and combine Capital One Miles.

How Does the Capital One Travel Portal Work?

The Capital One Travel Portal is a well-designed booking platform that is accessible to certain cardholders. Some Capital One cards don’t have access to this platform, but many other rewards cards do, they include VentureOne, Spark Miles, Venture Rewards, Venture X, and Walmart Rewards.

The travel portal is an Online Travel Agent (OTA) where users can log in and look for great deals on flights, rental cars, hotels, and travel options for their destination. But, the Capital One Travel Portal differs from other OTAs, such as Expedia, Booking.com, Agoda, and others.

The main difference is that you can use cash or rewards to fund your travel purchases. Travel is typically the highest redemption value for a credit card reward program.

So, you can get better prices” when you use your accumulated rewards for travel purchases. There is no need to worry about point transfers between programs or point swapping to get the miles.

Simply browse the offered travel options and then make your plans within the Capital One Travel Portal. This is an excellent feature for eligible Capital One cardholders that want to spend their rewards on trips and other related leisure activities.

Which Capital One Cards Have Transferable Points?

There are four Capital One cards that have transferable points:

- Capital One Venture Rewards Credit Card – This is a general-purpose travel card, the rewards are generous when you make travel purchases through the Capital One Travel Portal. Regular travelers that use the Travel Portal can take full advantage of these deals without paying a large annual fee.

- Capital One VentureOne Rewards Credit Card – The VentureOne Rewards card has a tiered reward structure weighted towards travel purchases. But, this card has no annual fees and there is no need to offset those costs each year to get access to good deals. This card is a great option for frequent travelers that want to keep their costs low with a lower reward rate.

- Capital One Spark Miles – This card has no annual fee for the first year and after that the fee is set at a reasonable level to cover the access to the card benefits. But, the benefits package is pretty limited with the miles rate set lower than you would find on many other cards. This card is best suited to people that only travel occasionally and those that want to earn rewards on all their purchases.

Capital One Venture X: The Capital One Venture X is the ultimate traveler's card. It provides a variety of travel-related perks including Priority Pass, Global Entry/TSA PreCheck reimbursement, insurances, Hertz President’s Circle status, annual travel credit, vacation rental credit and an anniversary miles bonus. This makes it easy to boost your miles balance and combine them for maximum rewards.

Card | Rewards | Bonus | Annual Fee | Capital One Venture Rewards Credit Card | 2X – 5X

2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel

| 75,000 miles

75,000 miles once they spend $4,000 on purchases within 3 months from account opening

| $95 |

|---|---|---|---|---|

Capital One VentureOne Rewards Credit Card | 1.25X – 5X

unlimited 5X miles on hotels and rental cars booked through Capital One Travel and 1.25X miles on all other purchases

| 20,000 miles

20,000 bonus miles once you spend $500 on purchases within the first 3 months from account opening

| $0 | |

Capital One Venture X Rewards Credit Card | 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

|

75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

| $395 | |

Capital One Spark Miles For Business |

2X – 5X

Unlimited 2X miles per dollar on all purchases, 5X miles on hotels and rental cars booked through Capital One Travel

| 50,000 miles

50,000 miles once you spend $4,500 on purchases within the first 3 months from account opening

| $95 ($0 first year) |

How to Transfer Capital One Miles to Airline And Hotel Partners

There are many ways to redeem Capital one miles. Your Capital One miles can be transferred between 18 different travel partners, including three hotels and 15 airline loyalty programs. Huge value can be derived from Capital One miles transfers to get business or even first-class redemptions.

Let’s take a look at the three steps to transfer Capital One miles to participating partners:

Step 1: Access Your Capital One Account

Simply log into your Capital One account, in the dashboard you will find the “Rewards Miles” button. Press this and you will be directed to the “Rewards” page and here you will find the “Convert Rewards” section.

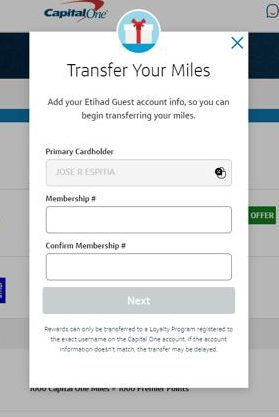

Click this link and you can review all the transfer program partners where you can transfer your Capital One miles. Here's an example of transferring to Etihad:

Step 2: Select a Program

When you’ve found a program where you want to transfer your Capital One miles, simply click the “Transfer Miles” button.

This will display the cardholder name; it’s pre-populated because you can only transfer your miles to accounts that are registered to the primary Capital One card member.

Enter the membership number with your selected partner loyalty program.

Step 3: Choose the Transfer Amount

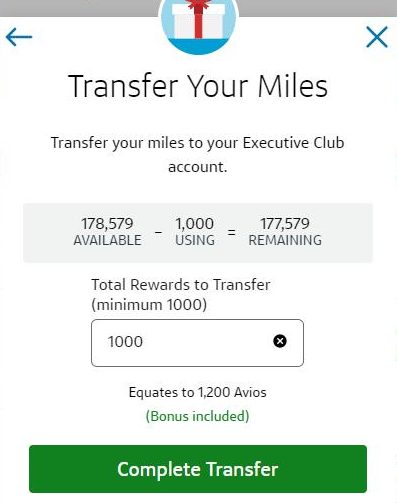

The next page will prompt you to enter the number of Capital One miles that you want to transfer to your selected partner program.

Input the amount, confirm the transfer and the miles will be sent to the chosen partner account. You will get an email confirmation that the transfer transaction has been completed and then you can use the miles.

The specific value of your Capital One Miles can vary according to the partner program you choose. Most partners have a 1:1 transfer ratio, which means that for every Capital One mile, you’ll get one mile or point within the partner program. This means that you can expect a mile value of $0.014 to $0.0185.

Let’s take a look at some well known Capital One transfer partners in more detail to help you to understand the potential of transferring miles to partner programs.

Sign Up for

Our Newsletter

and special member-only perks.

Sign Up for

Our Newsletter

and special member-only perks.

Transferring Capital One Miles to Air Canada Aeroplan

Aeroplan is the loyalty program for Air Canada and there is significant value to be found in the award routing and stopovers. Air Canada flights have variable pricing, but there are caps in place for the award costs and the program has no carrier surcharges.

So, you can book a Star Alliance award ticket with low fees and taxes. The partner awards have a fixed price and they offer excellent value on Canadian short-haul flights and international flights with premium cabins.

You can add stopovers on one-way tickets and a flight within the U.S. that’s less than 500 miles only costs 6,000 points each way.

Aeroplan is also a transfer partner with American Express Membership Rewards at a 1:1 ratio.

Transferring Capital One Miles to British Airways Executive Club

The British Airways Executive Club or Avios is well worth your consideration for points transfers. There is significant value to be found when you’re booking short-haul and medium-haul American Award flights through Avios.

The British Airways distance-based award chart is essential if you want to maximize the value of transferred points. You can get access to the Iberia Plus Avios through the Combine My Avios feature.

But, this is only possible if you’ve had the account for at least 90 days. There are many ways to redeem Iberia Plus Avios points, including off-peak one-way business flights to Madrid which only cost 34,000 points at the time of writing.

If you need more miles and have a Chase card, so Chase Ultimate Rewards points can also be transferred to British Airways Executive Club at a 1:1 ratio, but you must transfer at least 1,000 Ultimate Rewards points to Chase.

Transferring Capital One Miles to Choice Privileges

The Choice Privileges program offers a lot of value, but the award rates are changeable and you can only book any awards within 100 days of the stay. This can make planning a real challenge and yet it is possible to get some excellent rewards when you redeem.

The redemption of Choice Privileges points offer great value for popular domestic destinations, but this isn’t a hard and fast rule. It’s a good idea to actively look for the high-value redemptions because they don’t tend to fall in your lap.

Choice points are valued at approximately $0.06 per point at this time, but this is set to rise to a 1:1 transfer ratio soon. Choice Privileges is a transfer partner with Citi ThankYou Rewards at an improved 1:2 ratio as well as American Express Membership Rewards at a 1:1 ratio.

Transferring Capital One Miles to Turkish Airlines

The Turkish Airlines Miles&Smiles program is well regarded for some very good reasons. The program hits the sweet spot for many users and the award charges are worthy of closer consideration.

One popular option is the United flights that depart from most U.S. states to Hawaii for only 7,500 miles for an economy flight. There are some problematic fuel surcharges to consider if you choose to fly with certain Star Alliance carriers.

But, you can avoid these surcharges if you choose United flights and they are reasonable on any Turkish carriers that operate between Europe and the U.S..

How To Combine Points Between Capital One Cards

The Capital One point ecosystem uses two “currencies”: Capital One Venture Miles and Capital One Spark Miles.

- Venture Miles: These are earned from personal credit cards, including: the Capital One Venture X Rewards Credit Card, the Capital One Venture Rewards Credit Card and the Capital One VentureOne Rewards Credit Card.

- Spark Miles: They are earned from Capital One business cards, including: the Capital One Spark Miles for Business Card and the Capital One Spark Miles Select for Business.

Once you've earned these miles, they are essentially the same. Their value is identical, and you can redeem them through the Capital One Travel Portal in the same way. They can be used with Capital One’s hotel and airline partners, and the Capital One Purchase Eraser works the same way for both.

So, you can combine your earned Venture and Spark Miles into one balance and this is equally true if you are moving Spark to Venture Miles and vice versa. This even works if you want to move Capital Miles from an old Venture to a newer Venture X account.

4 Steps To Combine Points

The Capital One mile transfer between accounts is simple:

- Log In To Your Account: Open your Capital One account, find the “Explore Rewards” block and click “Redeem”.

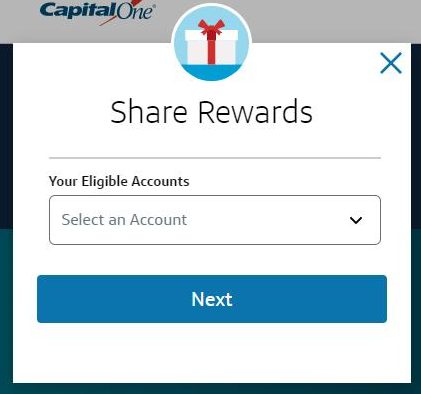

- Choose Account And Destination: Select the “Move Rewards” option and you can transfer Capital One miles. If you have more than one Capital One Venture and/or Spark card you will get a drop-down account list to select the transfer destination.

- Choose How Much to Transfer: When you have selected your accounts, you will be prompted to enter the number of miles that you want to transfer. You can transfer all or some of the earned miles from your Capital One account.

- Validate: When the transfer is initiated the miles will arrive at the destination account immediately.

Top Offers

Top Offers From Our Partners

Transferring Capital One Miles to Another Person’s Account

One of the most attractive features of Capital One Miles is their flexibility. They can be transferred, exchanged and shared with other Venture or Spark Miles card holders as desired. Let’s take a look at the transfer basics:

- Capital One Miles can be transferred to other members if they have a credit card that can earn Venture or Spark Miles.

- The person that may be receiving or sharing their miles doesn’t need to be related to the sender or live at the same address.

- There is no transfer cap limit on the Capital One Venture or Spark Miles that can be shared with other cardholders.

- There are no expiration dates on miles and no major restrictions on transfers between other cardholders.

To make the transfers, call the number on the back of the Capital One card. There is no way to do this with your online account at this time. All you need is the name and the card number of the account where you want to transfer the miles.

Should You Transfer Capital One Miles or Use the Capital One Travel Portal?

The Capital One Travel Portal is a great option when you’re searching for flights, car rentals, hotels and other travel options. It’s easy to book your trip using your points and the flight-booking engine is powered by Hopper, which is a popular travel app.

So, you tend to find great deals via Google Flights or your chosen airline. Simply tap in your flights, hotel or other trip details that you want to book with your Venture Miles and search the results for something that meets your needs.

Unlike the Chase cards, such as: the Chase Sapphire Reserve and the Chase Sapphire Preferred, you won’t get the bonus when you’re using miles via the Capital One Travel Portal. Like the Purchase Eraser, each mile is worth $0.01. So, you can still book a $200 flight for 20,000 Venture Miles and if you don’t have enough, you can apply those miles to reduce the flight cost.

Benefits of Using the Capital One Travel Portal

Although you may not get the maximum bang for your buck when you use your Venture Miles through the Capital One Travel Portal there are some compelling reasons to consider using it:

- Capital One automatically refunds you if the flight price drops after you booked it with a flight that Hopper predicted would maintain its price. The refunds are capped at $50 which is 5,000 Venture Miles in total.

- If you pay with cash rather than miles, you can earn up to 5x the miles per dollar spent on any flights that are booked through the portal. This rises to 10x the point per dollar on hotel and rental car bookings if you’re using a Venture X card and 5x if you’re using a regular Venture card.

- Capital One has a “cancel for any reason” travel insurance policy that is a useful and reasonably priced add-on for any trip.

- It’s possible to set price alerts for flights that you want to book via the portal. You will get an email alert when a flight you’re considering increases or drops in price.

- When you use the portal, you can freeze a fare for up to 14 days and then purchase it later at the frozen price. Capital One will charge a small fee for this feature, but it can be a useful way to secure a flight if you have some uncertainty in your schedule.

Benefits of Transfering

Transferring your points can be a smart move, depending on what you’re looking for. Here are the main benefits:

- You can earn extra bonuses when using your miles, which isn’t an option when booking through the Travel Portal.

- Access to a wider range of flights through additional partnerships.

- The potential for better redemption rates; even if you transfer at a 1:1 ratio, the flight cost could end up being lower.

FAQs

Capital One Venture Miles can be used to book Delta flights through Capital One directly. Alternatively, you can redeem your miles to pay for a previously charged airfare on the card up to 90 days from the ticket purchase date.

You can book with United directly and then remove the charge from your Capital One card later, and every mile gets you $0.01 towards your travel costs. However, using cash instead miles can be a better idea.

Yes, but there is a caveat, you can only transfer to other members that have a credit card that earns Venture or Spark Miles.

The person that you’re transferring the miles to doesn’t need to be related to you or living at the same address.

Yes, you can transfer your Capital One points to any other member that earns Venture Miles or Spark Miles with their credit card, and this includes your spouse if they meet these requirements.

There is no need for your spouse to be living with you at the same address at the time of the transfer.