TradingView Premium

Monthly Subscription

Promotion

Our Rating

Best For

- Overview

- Features

- Pros & Cons

The TradingView Premium Plan is a high-end solution designed for serious traders and investors who require real-time data, advanced charting, unlimited alerts, and full market access.

It enhances the platform’s already impressive technical analysis capabilities. Supercharts adds advanced charting features, making it a go-to option for day traders, swing traders, and algorithmic traders.

With eight charts per tab, 25 indicators per chart, and 20K historical bars, Premium allows users to conduct in-depth technical analysis, multi-timeframe comparisons, and advanced strategy backtesting.

Automation is another key advantage—Pine Script® enhancements, webhook alerts, and invite-only script publishing enable traders to build, test, and deploy custom trading strategies.

However, limitations remain: real-time stock data requires additional fees, portfolio management tools are absent, and fundamental analysis is not as deep as competing platforms.

- Supercharts & advanced charting

- Multi-timeframe & synced charts

- Indicators on indicators

- Auto chart patterns detection

- Second-based alerts & execution

- Webhook alerts & automation

- Premium stock & crypto screeners

- Expanded fundamental analysis

- Paper trading & trade simulation

- Social trading & script sharing

- Pine Script® strategy automation

- Dark & light mode themes

- Advanced charting & customization

- Unlimited alerts & automation

- Multi-timeframe & historical data

- Powerful technical analysis tools

- Social trading & community

- No stock picks or advisory

- Limited fundamental analysis

- Real-time data costs extra

- No portfolio management tools

- High cost for casual traders

TradingView Premium Pricing vs Other Plans

TradingView Premium is the top-tier plan (not including the expert and ultimate plans), providing unrestricted access to TradingView’s most advanced tools, making it the best choice for professional traders and serious investors.

Plan | Monthly Subscription | Promotion |

|---|---|---|

Trading View Essential | $14.95

$108 ($9 / month) if paid annually | 30-day free trial |

Trading View Plus | $29.95

$180 ($14.95 / month) if paid annually

| 30-day free trial |

Trading View Premium | $59.95

$432 ($23.98 / month) if paid annually | 30-day free trial |

Trading View Expert | $119.95

$1,199 ($99.95 / month) if paid annually | N/A |

Trading View Ultimate | $239.95

$2,399 ($199.95 / month) if paid annually | N/A |

TradingView Essential and Plus offer real-time data, additional alerts, and more indicators per chart, but they still have limitations on multi-chart layouts and advanced timeframes.

Plus expands these capabilities with more alerts and enhanced charting, but Premium removes nearly all restrictions, allowing for unlimited alerts.

Premium Takes Technical Analysis to the Next Level

With advanced Supercharts, over 400 indicators, and multi-timeframe analysis, we reviewed why TradingView is a top-tier tool. Here's what we found:

-

Supercharts: Advanced Charting & Technical Analysis

TradingView’s Premium Plan takes Supercharts to the next level, offering advanced customization, faster data access, and powerful technical tools for serious traders.

The charting experience is smoother and more responsive, even when switching between multiple timeframes, assets, and layouts.

Customization is more extensive than ever, with support for custom formulas, volume footprint charts, volume candles, and time price opportunity (TPO) analysis.

These features provide deeper market insights, helping traders understand price action in a more granular way.

Premium users also get access to intraday renko, kagi, line break, and point & figure charts, which are valuable for traders looking beyond traditional candlestick patterns.

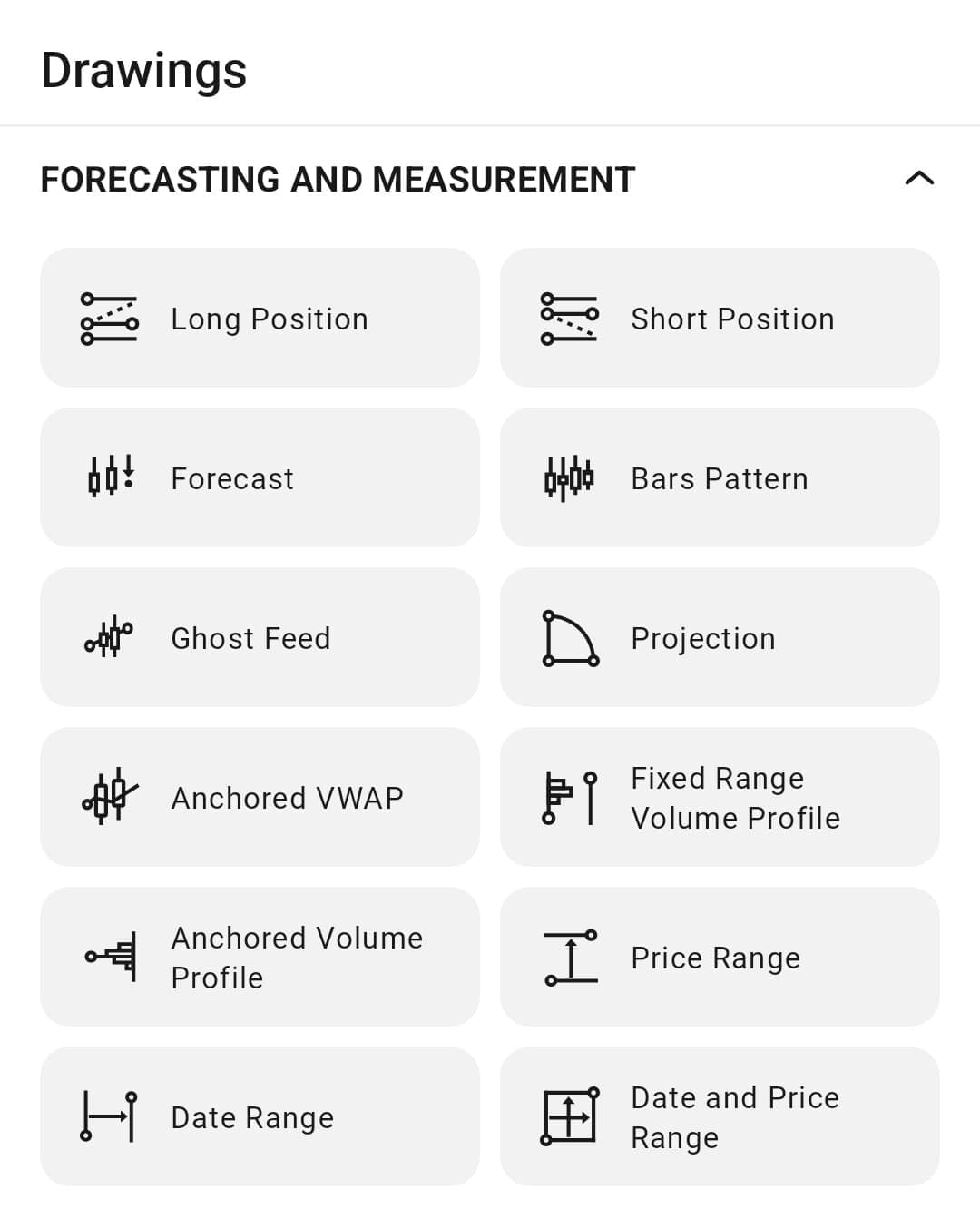

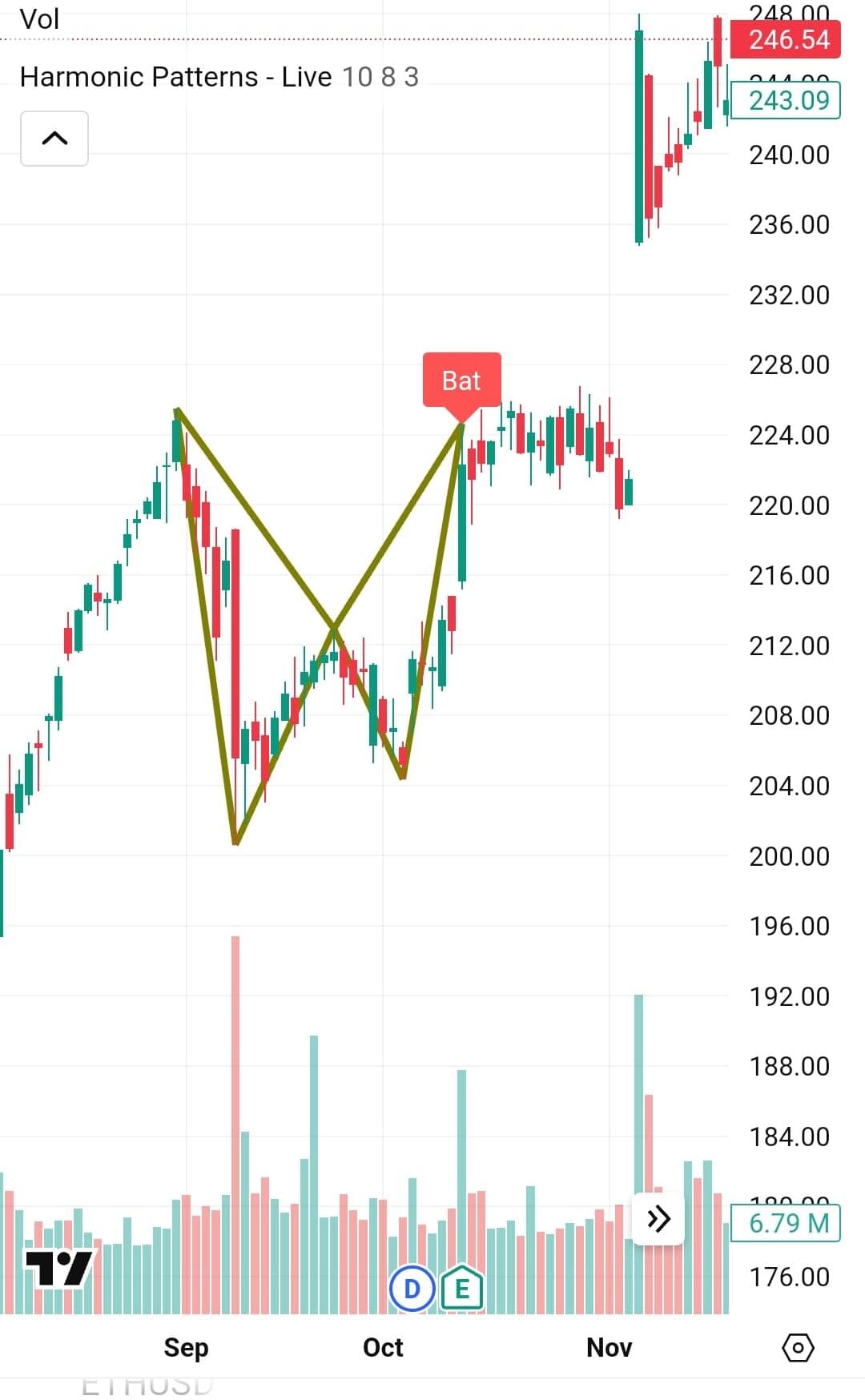

With over 400 built-in indicators and 110+ drawing tools, TradingView Premium offers even greater flexibility by allowing users to apply indicators on indicators, customize timeframes, and set second-based intervals for precise short-term analysis.

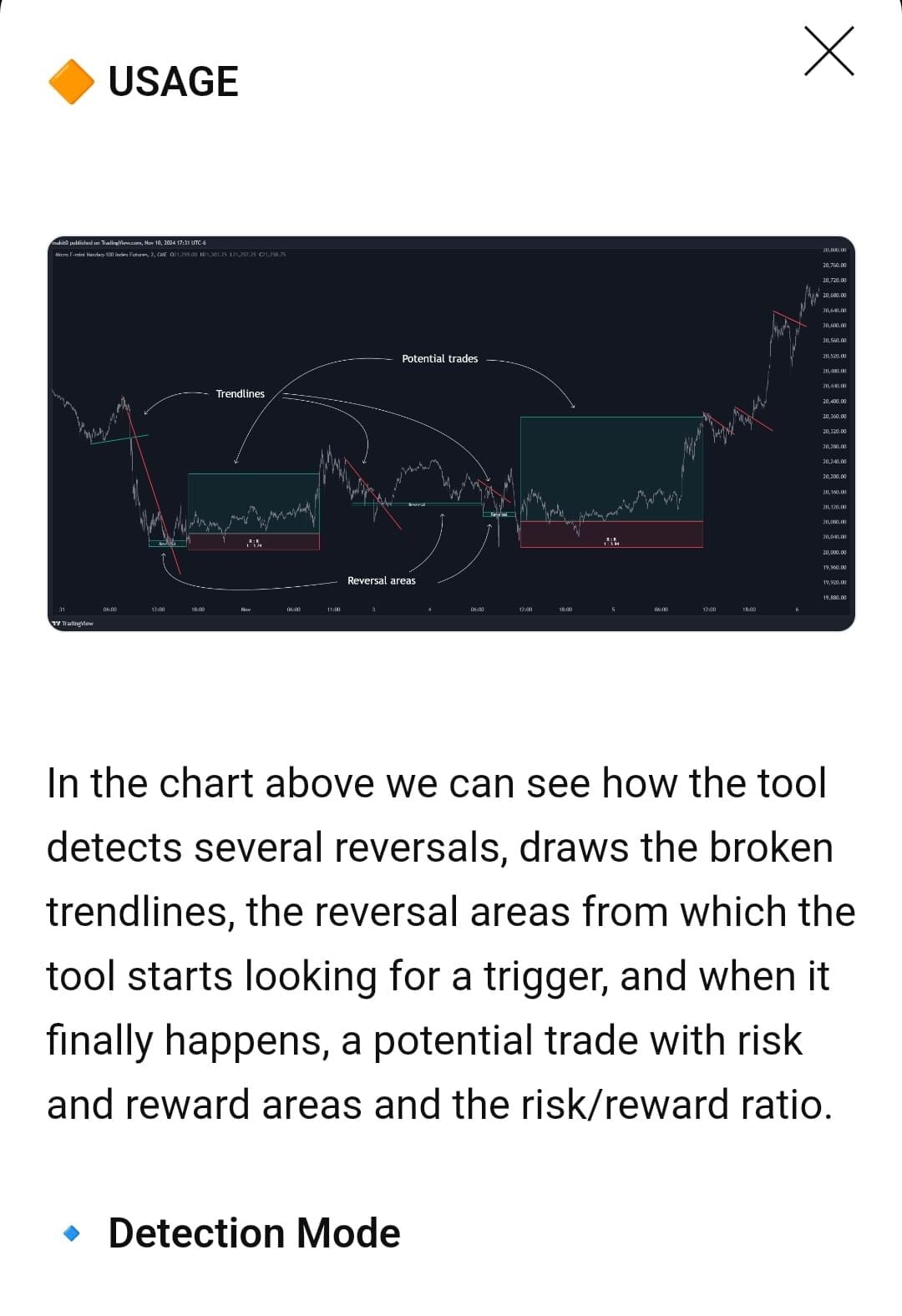

The auto chart patterns tool helps identify key market structures instantly, saving time for traders analyzing multiple assets.

-

Key Upgraded Features

The TradingView Premium Plan offers more credit use than the free and Essential plans in its top features:

Charts per Tab: Allows users to open multiple charts within a single tab, making it easier to compare different assets or timeframes without switching screens. This is essential for traders who track multiple markets at once.

Indicators per Chart: Expands the number of technical indicators that can be applied to a single chart, enabling deeper analysis and more complex strategies. This is crucial for traders who use multiple confirmations before making a trade.

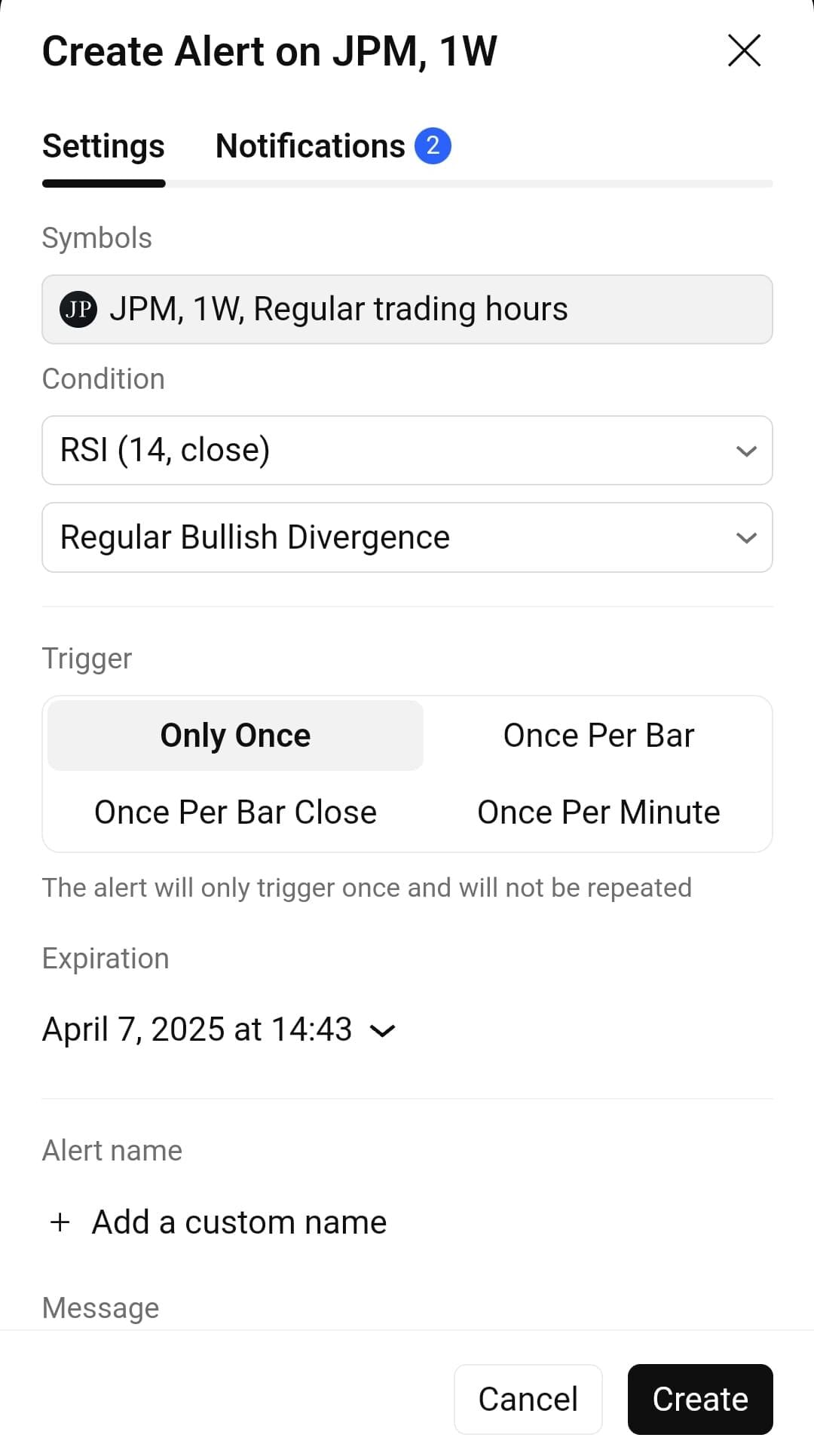

Price Alerts: Increases the number of active alerts that notify traders when an asset reaches a specific price, helping them react quickly to market changes. Essential for those who don’t monitor charts 24/7.

Technical Alerts: Triggers alerts based on technical indicator conditions like RSI overbought signals or moving average crossovers, automating trade monitoring. A must-have for traders who rely on technical setups.

- Historical Bars: Increases access to past price data, allowing traders to analyze longer-term trends and perform more effective backtesting. More historical bars provide a clearer picture of market cycles and past performance.

Parallel Chart Connections: Lets users sync multiple charts, making it easier to compare different assets, timeframes, or market conditions side by side. This is vital for traders using multi-timeframe analysis or correlating asset movements.

-

Premium Stock, ETF, Bonds & Crypto Screeners

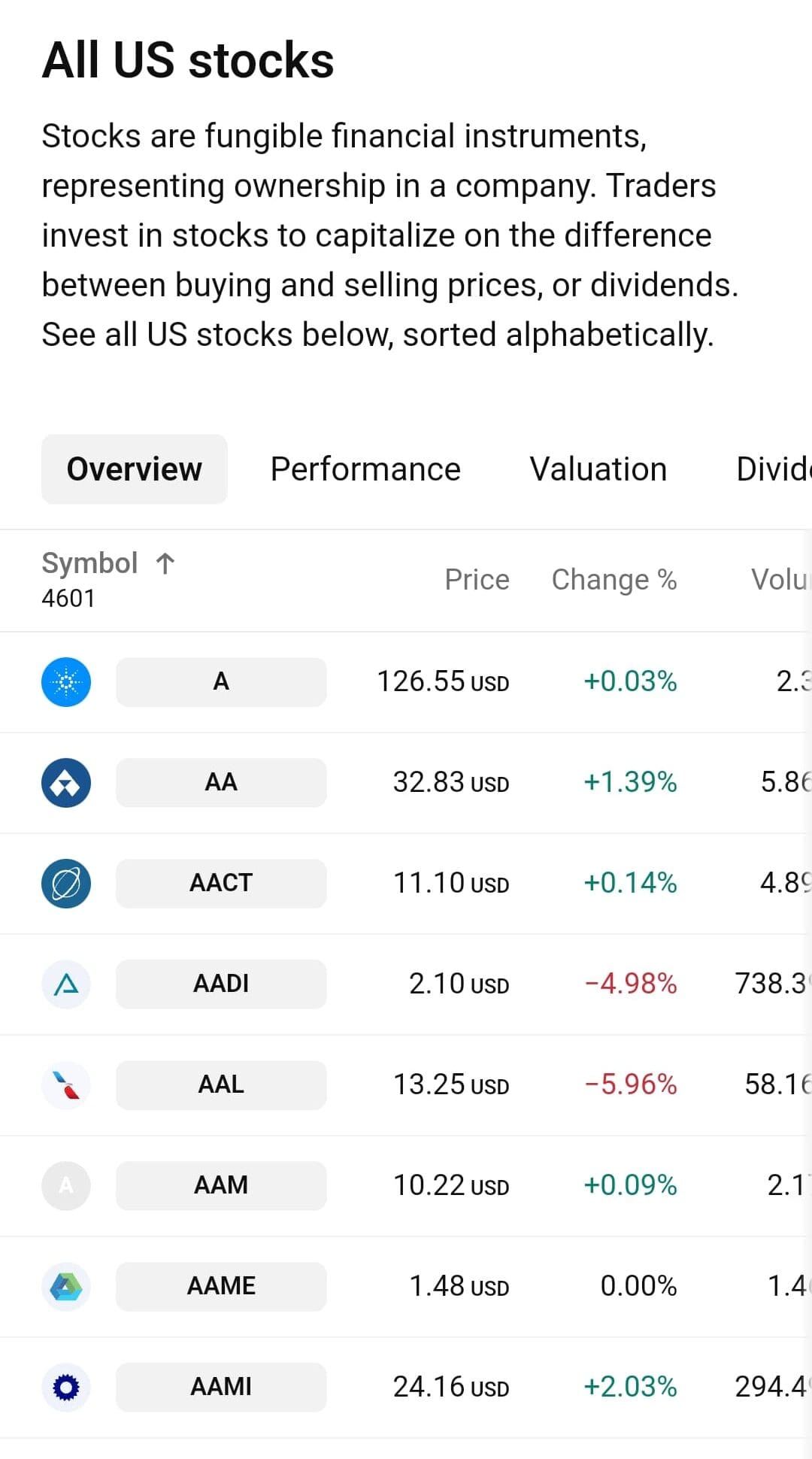

TradingView’s Premium Plan enhances its already powerful screeners by offering real-time data, advanced filtering, and custom screening options for stocks, ETFs, bonds, and cryptocurrencies:

-

Stock Screener

Premium users get real-time stock market data, eliminating the delays present in lower-tier plans.

Filters include market cap, valuation ratios, growth metrics, technical indicators, and analyst ratings.

Users can also apply custom screening formulas and combine fundamental and technical factors for deeper insights.

-

Bond Screener

With the Premium Plan, bond investors can screen bonds using issuer type, yield-to-maturity (YTM), coupon rates, and maturity dates, all with up-to-date pricing and performance tracking.

It also provides a more comprehensive list of corporate and government bonds, offering deeper insights into fixed-income opportunities.

-

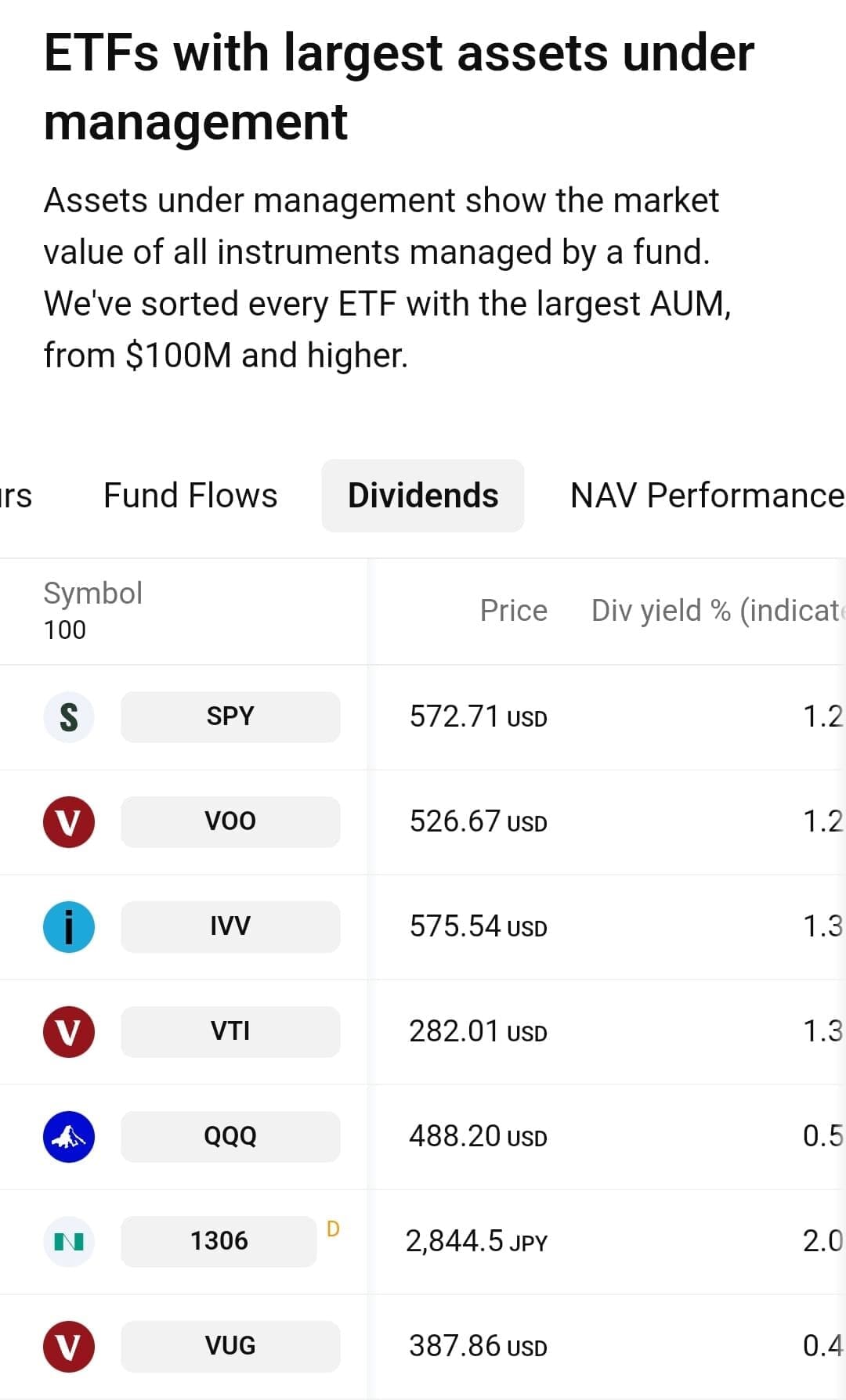

ETF Screener

The ETF Screener now includes enhanced performance tracking, expense ratio comparisons, and dividend breakdowns.

Premium users can sort ETFs by strategy, management style, and sector exposure, helping investors find optimal portfolio diversifiers with real-time NAV updates.

-

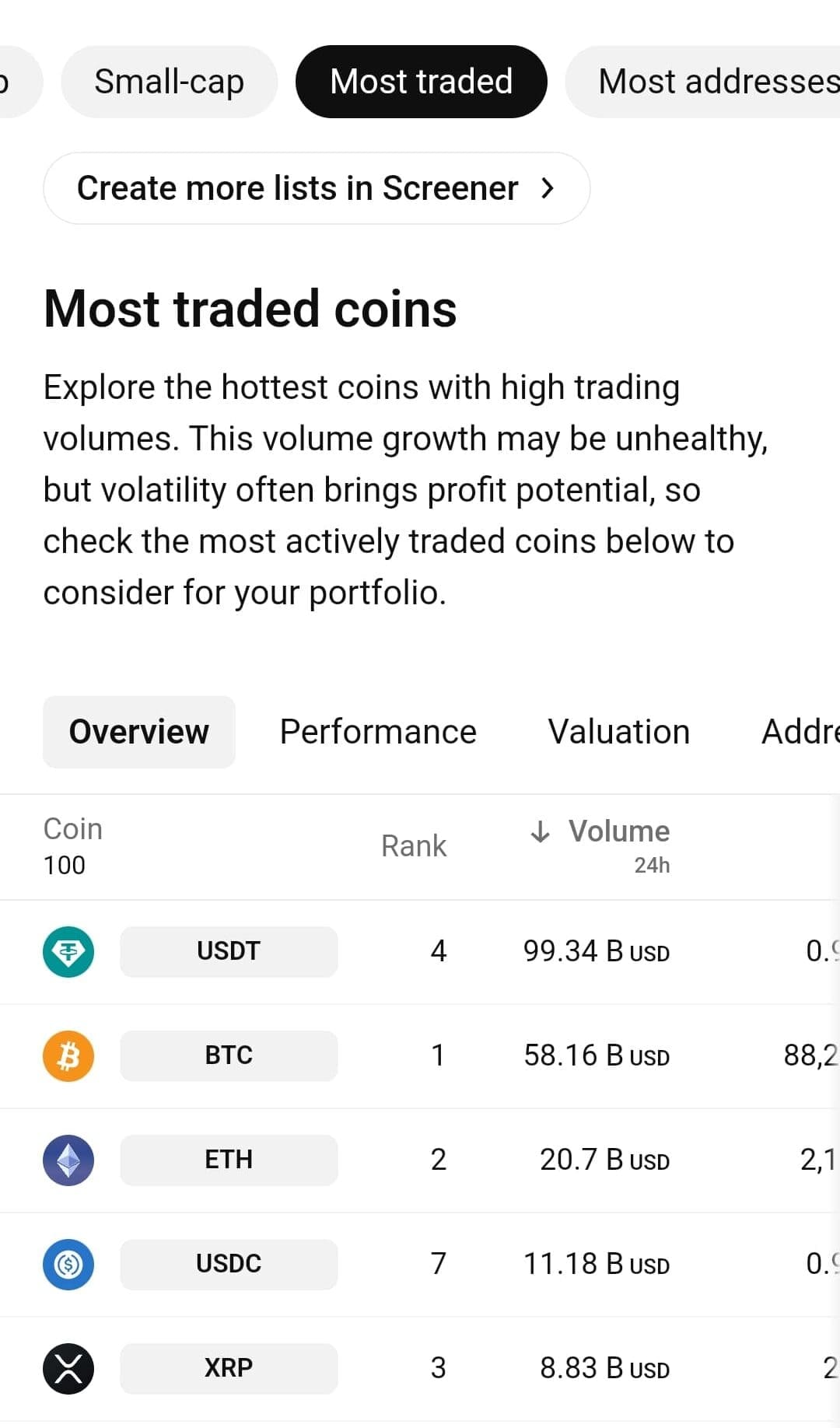

Crypto Screener

Crypto traders benefit from live market data, volume footprint analysis, and second-based updates.

New features like custom alerts on crypto pairs and sentiment tracking help users stay ahead of market trends, making the Premium Plan essential for active crypto traders.

-

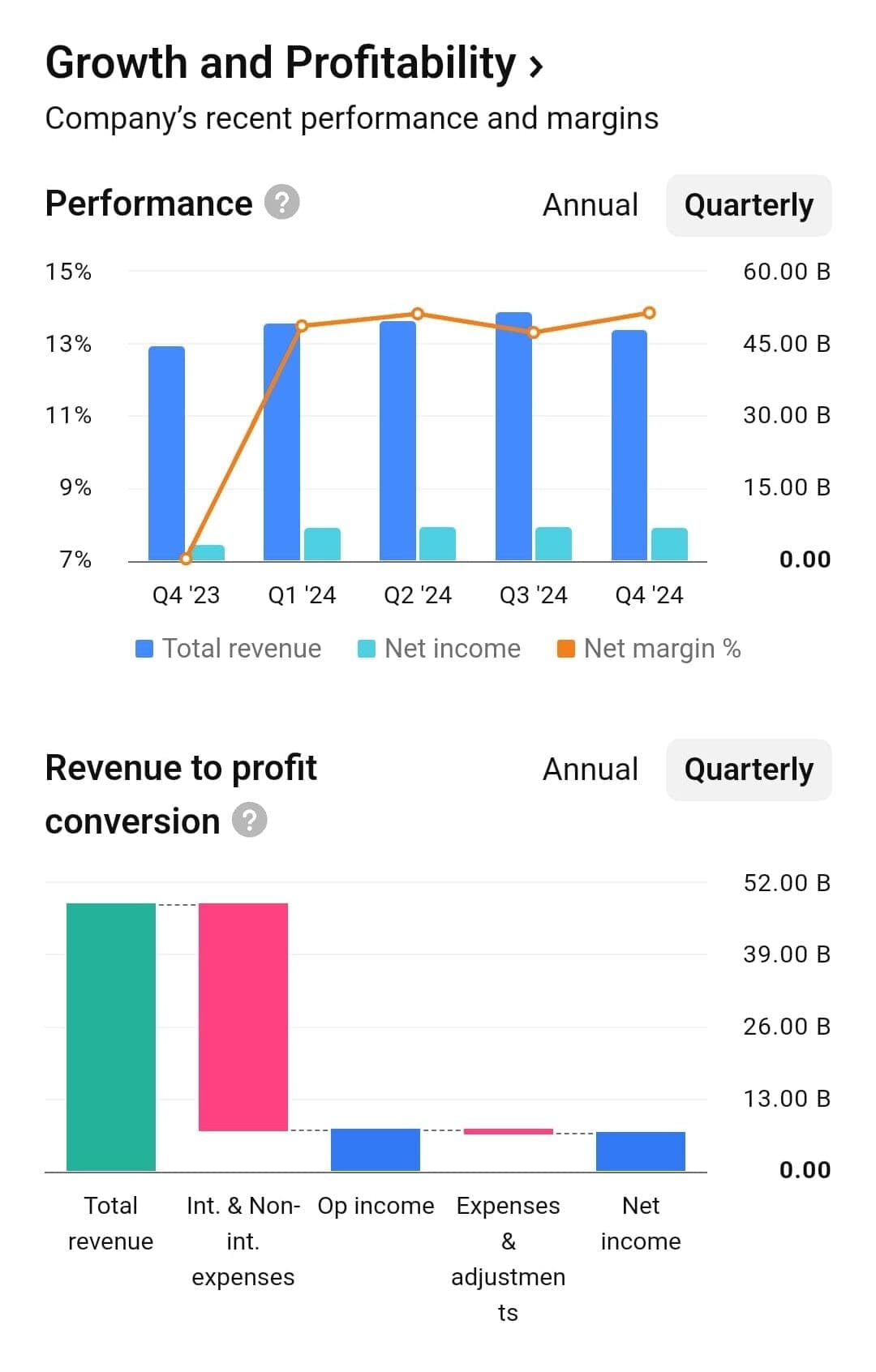

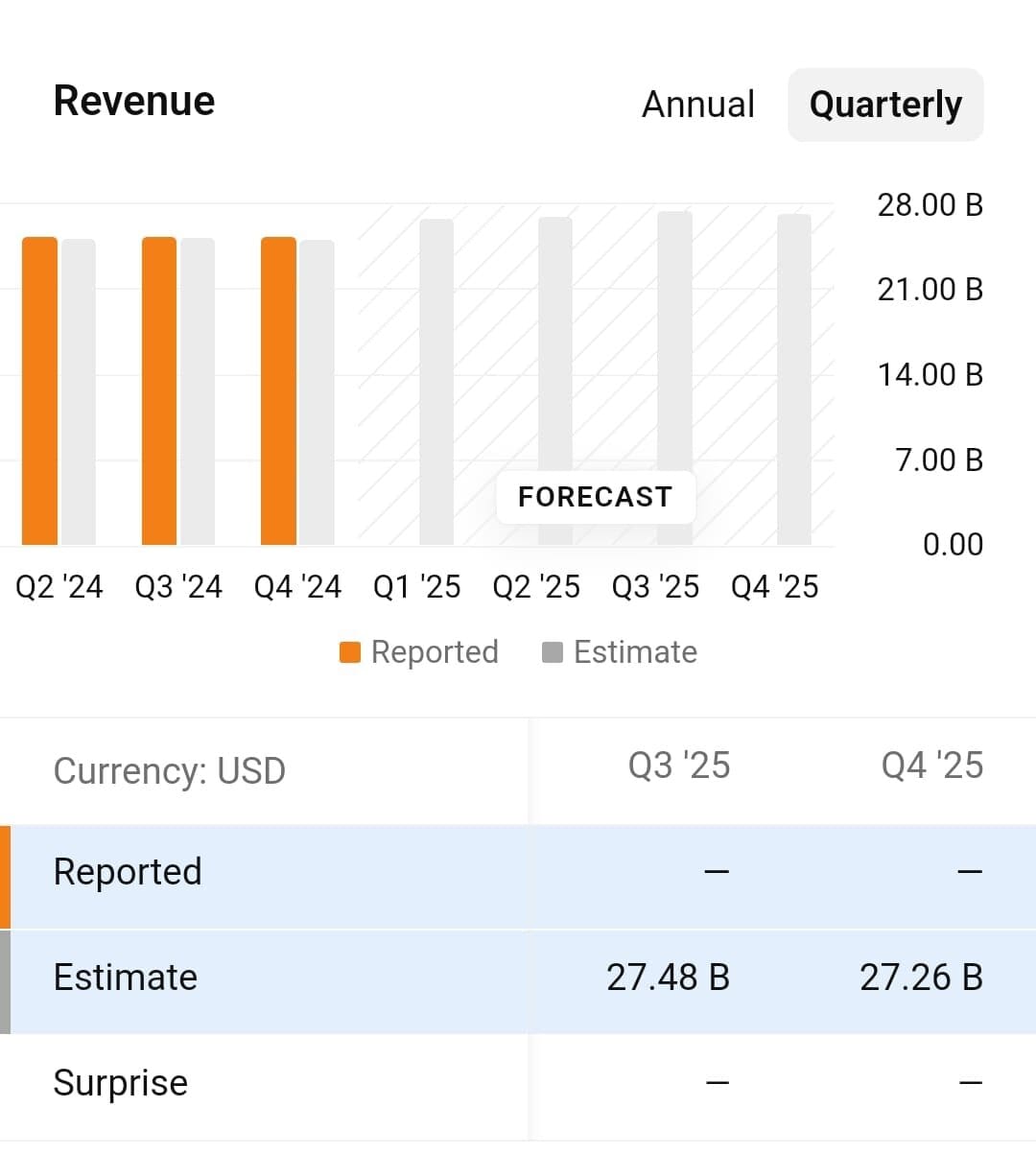

Advanced Fundamental Analysis Tools

While TradingView is known for technical analysis, the Premium Plan significantly enhances its fundamental analysis tools.

The Fundamentals Overview includes income statements, balance sheets, and cash flow reports, helping traders analyze profitability, revenue trends, and dividend history with live updates.

The Premium Plan also expands news coverage, integrating real-time press releases, analyst ratings, earnings forecasts, insider trading activity, and ESG data for a broader view of market sentiment.

The Technical Analysis Summary and Forecast Tools remain essential, offering an expanded view of market trends, sector performance, and analyst recommendations.

Bond investors benefit from real-time corporate bond listings and yield curve analysis, making it easier to identify fixed-income opportunities.

-

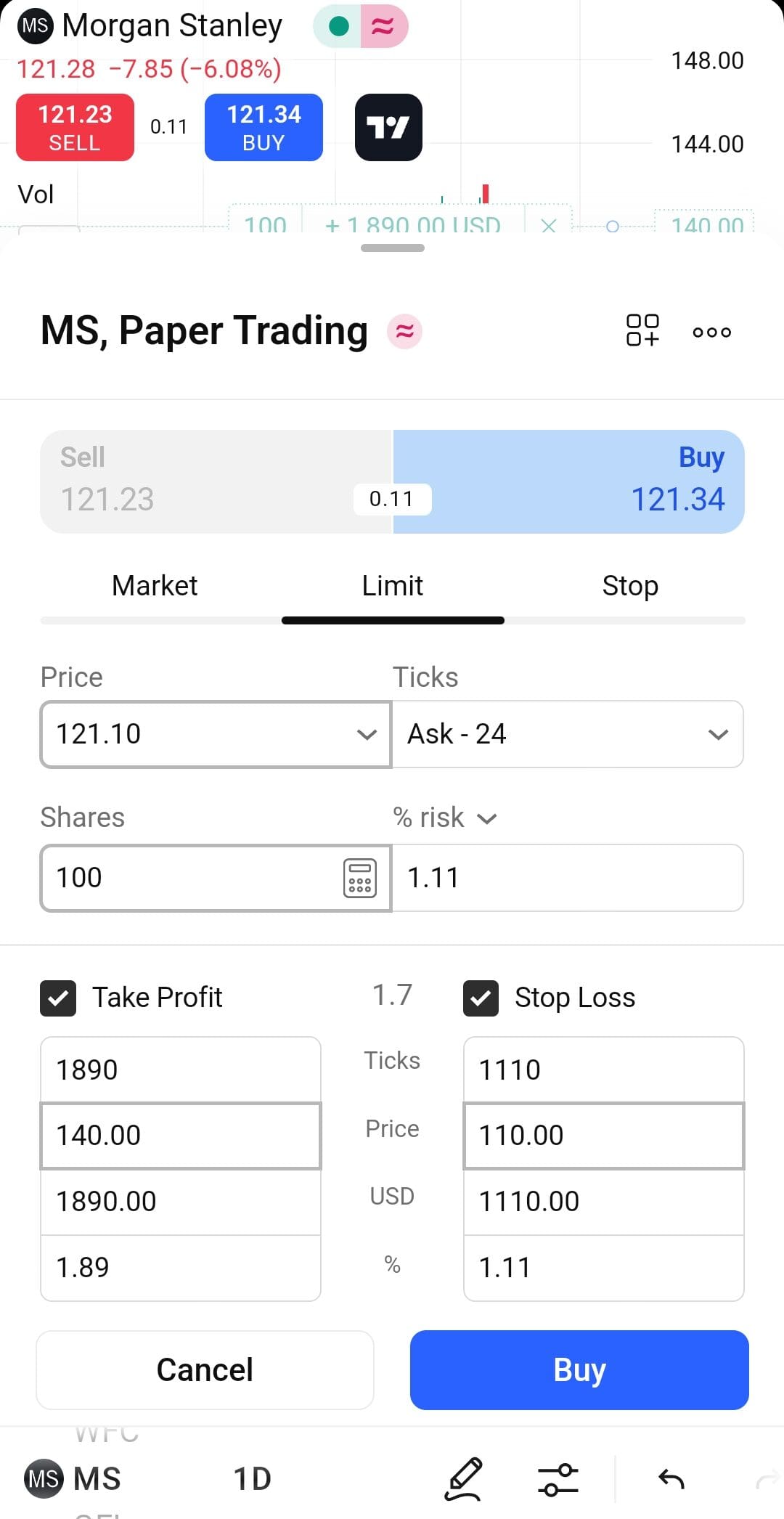

Trading & Paper Trading

TradingView Premium offers full broker integration, allowing traders to execute live trades directly from charts with supported brokers.

Unlike lower-tier plans, Premium users can set second-based trade execution alerts, improving reaction times.

The Paper Trading feature remains highly realistic, supporting market, limit, stop, and stop-limit orders, now with expanded historical data for better backtesting.

Traders can simulate trades with real-time market conditions, fine-tune strategies, and analyze performance with detailed trade reports.

This makes the Premium Plan ideal for both new traders practicing risk-free and experienced traders testing advanced strategies.

-

Social Trading & Community

TradingView’s social network for traders is even more powerful with the Premium Plan. Users can publish invite-only scripts, share private trade ideas, and engage with top-tier analysts.

The public scripts library is fully accessible, featuring over 100,000 Pine Script® indicators that Premium users can modify and enhance.

Additionally, the Premium community gets priority exposure, allowing traders to build a following and monetize strategies.

-

Pine Script® – Unlock More Automation & Customization

With TradingView Premium, Pine Script® reaches its full potential.

Users can publish invite-only scripts, create complex, multi-condition automated strategies, and access server-side script execution for faster performance.

The integrated editor now supports second-based intervals, allowing traders to code precise intraday strategies.

Whether modifying existing scripts or creating custom indicators, Premium users get deeper backtesting capabilities and exclusive script-sharing options.

-

Trading Alerts

Premium users benefit from alerts that never expire, second-based alerts, and unlimited active alerts, removing the restrictions found in lower-tier plans.

The ability to set alerts on auto chart patterns, volume profile, and custom Pine Script® indicators ensures traders stay ahead of key market movements.

Webhook alerts allow seamless integration with trading bots and automation tools.

Notifications via email, desktop, mobile, or SMS ensure traders are always informed, making this feature essential for day traders and algorithmic traders.

TradingView Premium’s Additional Features & Upgrades

The TradingView Premium Plan unlocks the platform’s full potential, offering additional features and tools for investors and traders:

- Chart Data Export: Lets traders export market data and custom analysis for external research, trading logs, or integration with other tools.

- More Historical Data: Premium unlocks the deepest historical market data, allowing for more accurate backtesting and long-term trend analysis.

- Faster Data Refresh Rates: Premium users receive the fastest market updates, reducing delays in chart movements compared to Free and Essential plans.

- Economic & Earnings Calendar: Available in all plans, but Premium users get faster updates and more filtering options to track critical financial events.

- Indicators on Indicators: Allows users to apply indicators to other indicators, such as a moving average on RSI, creating advanced trading strategies.

- Volume Footprint & Volume Candles: Offers a detailed breakdown of trading volume at each price level, essential for order flow and market sentiment analysis

- Auto Chart Patterns: Detects trendlines, channels, triangles, and other key market structures automatically, saving time for technical traders.

- Second-Based Alerts: Allows traders to set alerts on short-term price movements, perfect for scalpers and high-frequency traders.

- Webhook Alerts: Automates trading by sending alerts directly to trading bots, APIs, or external automation tools, enhancing algorithmic trading strategies.

- Dark & Light Mode Customization: Available in lower plans, but Premium users can fully personalize chart colors, themes, and layout settings for a tailored experience.

TradingView Premium Plan vs. Competitors: Worth the Price?

TradingView Premium competes with top-tier plans from Yahoo Finance Gold, Stock Analysis Pro, InvestingPro+, Finviz Elite, and Benzinga Pro.

Yahoo Finance Gold excels in fundamental research and stock ratings, while Finviz Elite provides powerful heatmaps and screening tools.

Plan | Subscription | Promotion |

|---|---|---|

Yahoo Finance Silver | $24.95

$239.40 ($19.95 / month) if paid annually | N/A |

TradingView Plus | $29.95

$180 ($14.95 / month) if paid annually

| 30-day free trial |

Zacks Premium | $249 ($20.75/month)

No monthly plan | 30-day free trial |

MarketBeat All Access | $39.99

$399 ($33.25 / month) if paid annually | $199/year or $19.99/month

30-day free trial + $19.99/month for the first year (billed monthly) OR $199/year ($16.58/month). New members only. |

InvestingPro | $15.99

$120 ($9.99 / month)

if paid annually | N/A |

TipRanks Premium | $359 ($30 / month)

No monthly plan | 30 day money-back guarantee |

Finviz Elite | $39.50

$299.5 ($24.96 / month) if paid annually | 30-day money-back guarantee |

Seeking Alpha Premium | $299 ($24.90 / month)

No monthly subscription | $4.95 for 1 month |

Benzinga Pro’s premium plan is best for real-time breaking news and options flow, making it a better fit for news-driven traders.

InvestingPro+ offers deep financial data and valuation models, whereas TradingView Premium stands out for advanced charting, real-time technical analysis, and unlimited alerts, making it the top choice for technical traders and active investors.

What's Missing in TradingView Premium

While TradingView Premium is the most advanced charting plan, offering real-time data, automation tools, and unlimited alerts, it still has some key limitations:

-

Limited Fundamental Analysis

TradingView focuses heavily on technical analysis, but its fundamental analysis tools still fall short of platforms like Morningstar, Zacks, and Yahoo Finance Gold.

While TradingView Premium offers financial statements, earnings reports, and valuation metrics, it lacks deep stock ratings, fair value estimates, analyst consensus scores, and sector-wide comparisons.

-

No Stock Picks, Stock Advisor, or Recommendations

Unlike platforms such as Motley Fool, Zacks, and TipRanks, TradingView does not offer curated stock picks, buy/sell recommendations, or expert-selected investment ideas.

While it provides screening tools and analyst ratings, users must interpret the data themselves rather than rely on model portfolios or expert-driven recommendations apps.

-

Real-Time Stock Data Requires Additional Fees

Even with the Premium Plan, users must still pay extra for real-time stock data from major exchanges like the NYSE, Nasdaq, and CME.

This can be frustrating, as competitors like Webull, ThinkorSwim, and Fidelity offer free real-time quotes.

-

No Built-In Portfolio Management Tools

Despite its advanced charting and analysis features, TradingView does not offer a dedicated portfolio management system.

Investors can track assets using watchlists, but there’s no real-time profit/loss tracking, asset allocation breakdowns, portfolio rebalancing tools, and personalized portfolio recommendations.

Who Should Use TradingView Premium?

The TradingView Premium Plan best suited for those who require full market access, automation, and in-depth charting. Here are the types of users who may benefit the most:

- Day Traders & Scalpers: Second-based timeframes, ultra-fast alerts, and volume footprint analysis make it ideal for traders who need precision and real-time execution insights.

- Swing Traders & Trend Followers: Multi-timeframe analysis, unlimited indicators, and advanced charting tools help traders identify strong trend signals and key reversal points.

- Algorithmic & Quant Traders: Premium unlocks full Pine Script® automation, webhook alerts, and invite-only script publishing, allowing traders to build and monetize custom trading strategies.

- Technical Analysis-Driven Investors: Advanced chart types, Auto Chart Patterns, and indicators on indicators make it perfect for investors who rely on technical signals for long-term positions.

Who Should Skip TradingView Premium?

The TradingView Premium Plan is packed with advanced technical analysis tools, real-time alerts, and automation features, but it’s not the best fit for everyone:

- Investors Looking for Stock Picks & Advisory Services: TradingView provides data and screeners, but doesn’t offer curated stock recommendations, model portfolios, or expert-guided investment strategies.

- Long-Term, Buy-and-Hold Investors: Premium focuses on short-term trading tools, but lacks advanced portfolio management, stock recommendations, and in-depth fundamental analysis needed by long-term investors.

- Fundamental-Driven Investors: While it provides financial statements, it doesn’t offer deep stock ratings, analyst history, or stock picks like platforms such as Morningstar or Zacks.

- Casual & Beginner Traders: The Premium Plan is expensive and includes many features that new traders may not need, making the Free or Essential plan a better starting point.

FAQ

No, even with Premium, you can only be logged in on one device at a time unless you purchase an additional seat.

TradingView allows webhook alerts and Pine Script® automation, but fully automated trading requires integration with external platforms or brokers.

No, it offers real-time earnings data and analyst ratings, but it doesn’t include full earnings call transcripts or CEO commentary like some financial platforms.

No, users cannot upload external financial datasets. However, Pine Script® allows for limited data customization.

Yes, Premium users get priority customer support, but there’s no 24/7 live chat or phone support—only email-based assistance.

No, while it supports options chain data, it doesn’t provide multi-leg options strategy backtesting or advanced options analytics.

No, while you can export chart data, you cannot download financial statements or stock screening results.

No, while most tools are available, some advanced features like second-based charts and Pine Script® coding work best on desktop.

Review Premium Stock Analysis & Charting Tools

How We Rated Premium Investing Analysis & Research Tools

At The Smart Investor, we evaluated premium investment research platforms based on their advanced features, data depth, and overall value compared to other paid alternatives. Each platform was rated based on the following key aspects:

- Advanced Fundamental Analysis Tools (20%): We assessed the depth of financial data, historical reports, earnings forecasts, and valuation models. Platforms that provided institutional-grade insights, DCF analysis, customizable financial models, and access to premium analyst reports scored higher.

- Advanced Technical Analysis Features (20%): We reviewed the availability of real-time charting, advanced indicators, custom scripting, and AI-driven pattern recognition. Platforms that offered backtesting tools, automated trading strategies, and integration with third-party software received better ratings.

- Stock Screener & Premium Filters (15%): A high-quality screener is essential for pro investors, so we evaluated customization depth, real-time filtering, and AI-driven stock discovery. Platforms offering pre-built expert screeners, backtesting capabilities, and sector-specific analytics scored the highest.

- Portfolio Tracking & Advanced Alerts (10%): We rated platforms on their ability to provide real-time performance tracking, portfolio rebalancing tools, and tax optimization insights. Platforms with smart alerts, AI-driven risk assessments, and brokerage integration ranked higher.

- Ease of Use & Customization (15%): We assessed how well premium platforms balance advanced capabilities with user-friendly interfaces. Those offering custom dashboards, API access, and seamless multi-device usability received better ratings.

- Pricing (20%): We considered how the plan's pricing compared to other premium plans and what benefits traders/investors get. Is it worth it overall?