Table Of Content

For years, investors who wanted to preserve their capital have consistently turned to one instrument: Treasury Securities (or ‘Treasuries’).

Treasury instruments such as T-bills, bonds, notes, and bond funds have been offering investors not just the stability they are looking for from their investments but also the handsome returns to keep them afloat over inflation.

To understand them better, just remember that the difference between bills, notes, and bonds is the length until they mature.

- Treasury bills will mature in less than 12 months.

- Treasury notes carry terms of 2, 3, 5, and 10 years.

- Treasury bonds take the longest to mature at 30 years.

As you can see, bonds mature longer than notes (more than 10 years) and the government usually sells them in large increments from $100,000 or more to various financial institutions.

Key Takeaways

- Due to lengthy maturity dates, treasury bonds usually offer higher returns to investors, compared to shorter-term treasury bills and treasury notes. They also pay interest, also known as a coupon to investors every six months.

- Individual investors can buy treasury bonds directly from Treasury Direct website. Alternatively, they can purchase them on a secondary market through a brokerage firm or bank.

- One of the downsides of investing in Treasury bonds is that it still has a lower rate of return, compared to most municipal or corporate bonds. It is also exposed to inflation risk as well.

What is a 10-year Treasury Bond or a T-Bond?

By definition, Treasury Bonds (or T-Bonds) are long-term bonds that the U.S. Treasury Department issues. They typically mature in 10 to 30 years and have a $1,000 face value. The holder of T-Bonds can expect to receive interest payments semi-annually.

Their purpose is to help fill the gaps in the federal budget, regulate the nation’s money supply, and administer the country’s monetary policy.

10 years T-Bonds carry with them the backing of the full faith and credit of the U.S. government. This gives T-bonds a generally risk-free status in the investment market.

However, due to the absence of default risk and the presence of high liquidity, Treasuries can get away with offering the lowest yields among bonds their peer. T-Bonds are the benchmarks of the fixed income asset class.

Income from 10-year Treasury Bond is subject to federal taxes but they are normally exempt from most state and local taxes. This is a welcome relief for some investors, especially those who live in states with higher taxes.

Overall, Treasuries may provide slightly higher returns than other securities with higher coupons but are not federally tax-exempt.

How You Can Buy 10-year Treasury Bonds?

Nowadays, the Department of Treasury puts up 10-years bonds for auctions for four months of the year: February, May, August and November.

Buy thru TreasuryDirect

If you don’t want to go through the bidding process, you may still purchase 10-year Treasury Bond through a broker, dealer, bank, investment house, or thru TreasuryDirect.

The advantages of buying via TreasuryDirect is that you can do most of your bond transactions online, such as buying bonds, reinvesting them, and managing your account. The cool thing is that you don’t have to pay any maintenance fees on these bonds so you preserve your income as well.

This is how the selling goes. Initially, the buyer will participate in an auction for the bond issues. The maximum purchase amount is $5 million if the bid is noncompetitive.

If the bid is competitive, it’s set at 35% of the offering. A competitive bid will indicate the interest rate that the bidder is willing to accept in relation to how it compares to the specified rate of the bond issue.

For a non-competitive bid, the bidder gets the bond but he has to accept the set rate of the bond. After the auction, they can already sell the bonds in the secondary market.

Buy on Secondary Market

There is a very robust secondary market for 10-year Treasury Bond that makes the investment extraordinarily liquid. It is also the secondary market that causes the price of 10-year Treasury Bond to fluctuate considerably each trading day.

Because of this, the current auction and yield rates of 10-year Treasury Bond dictate how their prices will behave in the secondary market.

Similar to other types of bonds, the price of a 10-year Treasury Bond on the secondary market goes down when the auction rates increase because bidders discount the value of the bond’s future cash flow at the higher rate. Inversely, when prices increase, auction rate yields go down.

The 10-year Treasury Bond Formula

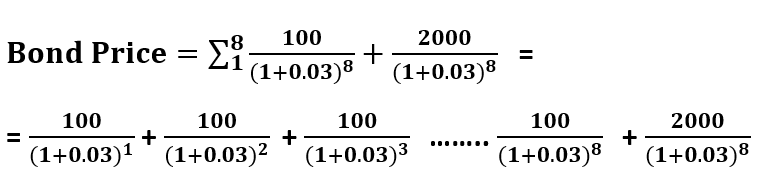

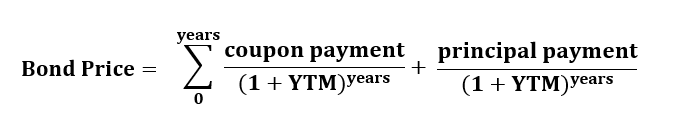

The 10-year Treasury Bond formula is much like the T-bill formula except that a T-bond has interest payment or coupons.

You can calculate the Treasury Bond rates, current price, coupons, as well as the face value by using these formulas:

Example Of 10-year Treasury Bond

Let’s say Baruch buys a 10-year, $2,000 T-Bond with a current YTM of 3%. The bond will mature in 8 years and pays a 5% coupon annually. Compute for the current price of the bond.

Using the formula above, this is how it will go:

The Pros and Cons of 10-year Treasury Bond Investment

Investing in treasury bonds can have a great option.

Like any other investment tool, it can fit for some types of investors profile, depends on their goals, level of risk and expected yield in the current market situation.

| Pros | Cons |

|---|---|

| High Credit Quality | Low Yield |

| Tax Advantages | Missing Alternatives |

| Liquidity | Interest Rate Risk |

| Inflation Risk |

- Safety

Treasury bonds are popular among investors because they are a safe investment even in a distressed economy. After all, the full credit of the United States guarantees the return on the bond.

Also, there is a very, very remote possibility that a revolution might overthrow the government in the near or far future.

The American economy remains to be one of the more stronger ones around the world because of its diversity: it is not reliant on a single resource like oil.

Another reason why it’s safe is that the Treasury Department does not have the option to call most bonds. This assures investors that they won’t have to mandatorily redeem the bonds before their maturity.

- Liquidity

The market for Treasuries boasts of two distinct characteristics: it is very huge and it’s exceedingly liquid.

Investors, buyers, dealers, traders, and brokers can buy or sell them at any time. And because the bonds are now electronic, it has all become easier and faster since there are no more paper certificates to transfer.

The government is quite transparent about the details of the bonds so both buyer and seller can determine the real value of a bond at any point in time.

This makes trading a lot more efficient since every party is aware of the value of the instrument they are dealing with.

- Tax Benefits

As we’ve said, you can enjoy tax exemption from state and local income taxes for your interest income from Treasury Bonds but not from federal taxes.

The other components, on the other hand, may still be subject to tax such as when you sell them or redeem them at maturity.

If you buy a bond on the secondary market at a market discount (buying it for less than face value) and you keep it until it matures or sells it for a margin, the profit will be taxable under both federal and state tax laws.

A market discount is different from an Original Issue Discount (OID).

When you sell a bond or let it mature, your gains when you’ve purchased it at market discount becomes capital gains while OID gains simply fall in the category of income.

- Inflation Risk

Inflation can overshadow your income from the bonds.

An investment should generate enough income for you to live decently, if not in total comfort.

However, the rates of returns of Treasuries somehow can fall below the rate of inflation.

For example, in August of 2018, the average returns of T-Notes and T-Bills stood at 2.0% while inflation was at 2.7% for the month.

Historically, Treasuries find it difficult to keep in step with, much less overtake the inflation rate.

- Lower Yield

Yes, they’re safe but they don’t exactly make you feel like you’ve won the lottery. While the rate is much higher compared to what you can get in the recent years, the returns remain comparatively low.

Other instruments that are riskier tend to offer higher returns.

If you’re aggressive and can comfortably put your money on instruments with a high-risk level or if you’re seeking a higher return on your investments, Treasury Bonds would be on the bottom of your list.

And one more thing: you need to wait at least 10 years to redeem your bonds.

- Interest Rate Risk

Inflation is here and interest rate is going up.

Should the interest rates rise, the value of the bonds on the secondary market may go down. This will affect your income if you are disposing of your bonds during this period.

- Missing Alternatives

Most Treasury instruments carry long maturities so when some great investment opportunities present themselves, it may not be too easy to grab them since you’ve tied up your cash to these instruments.

It may also take a while for you to cash in on your investments such that the window of opportunity might close on you or your urgent liquidation may deplete the amount you were hoping to realize.

The only exception to this is T-bills because they have shorter maturities.

From several points of view, 10-year Treasury Bonds are an excellent venue for investors, prospectors, hedgers, and traders to mitigate risk and trade according to the ups and downs of the economy.

They have great flexibility when you want to trade from the short side or long side while actively immersing themselves in the market and providing much-needed liquidity to their holders.