Table Of Content

Probably one of the best fool-proof ways to preserve your capital is by investing in Treasury securities. Most veteran investors know this and have made this a part of their financial investing strategy.

From T-bills to notes, bonds, and bond funds, investors can find the stability they want from their investments. Of course, one can’t discount the reasonable returns they can get to help them stay ahead or at least, at par with the inflation growth.

How are these bills, notes, and bonds different in terms of their lengths until maturity? Take note:

- Treasury bills have a term of less than a year.

- Treasury notes have a term of 2, 3, 5, and 10 years.

- Treasury bonds have a term of 30 years.

Key Takeaways

- Treasury notes have a maturity term ranging from 2 to 10 years. They typically pay interest to investors every six months.

- Investors can buy treasury notes through the Treasury Direct website. At the same time, individuals can purchase treasuries through brokerage firms or banks on the secondary market. Finally, investors can also invest in treasuries through mutual funds.

- One of the benefits of investing in treasury notes is that those types of securities are exempted from the state and local income tax. However, it is important to note that this benefit does not extend to federal income tax.

- Treasury notes are exposed to the inflation risk. If the inflation rate is higher than the interest rate paid to investors, then their investment will lose some of its purchasing power.

What is a Treasury Note or T-Note?

U.S. Treasury notes (T-notes) are certificates of indebtedness that the U.S. Department of Treasury issues and carries an intermediate maturity of usually one to ten years.

They have a minimum denomination of $1,000. The Treasury Department issues T-notes and bonds in book-entry form – which means that whoever wants to buy them should set up an account with the Treasury.

The selling system for the Treasury notes is through an auction where they accept both competitive and non-competitive bids.

How Does the Auction Work?

Non-competitive bids apply identically to Treasury bills auctions and should not go over $5 million from a single bidder. A non-competitive bidder can use the Internet, phone, or paper forms to make a bid.

In a bill auction, the Treasury Department indicates a rate of discount ahead. For a T-note auction, bidders must indicate a yield to maturity.

Keep in mind that the Department of the Treasury sells all Treasury securities, including T-notes, at a single price auction because they have already stopped the practice of awarding winning bids at multiple prices.

They will award the successful competitive and non-competitive bidder with securities at the price equivalent to the highest accepted rate or yield (that is, the lowest price) of the competitive tenders that came in.

Treasury Notes Vs Treasury Bills

Treasury notes and bonds carry stated rates that the Treasury Department has set at the time of sale – this is what differs them from U.S. Treasury bill (T-bills).

T-bills do not have stated rate of interest or coupons. T-notes and bonds also pay interest two times a year. While T-bills, by design, sell at a discount, the market will dictate the prices of T-notes such that it fluctuates the same way as corporate bonds do.

So, it happens that T-notes will sometime sell at a discount or a premium, according to how the market interest rates move up or down the note’s stated rate.

T-note futures now ranks among the most sought-after forms of interest rate futures. Investors find them a good option to hedge against adverse interest rate trends.

How to Buy a Treasury Notes

You can purchase Treasury notes through a private securities broker, government securities dealer, a bank, or other financial institutions.

TreasuryDirect

One current popular option is to get them online via TreasuryDirect. The Treasury Department uses the book-entry method for the sale of the instruments, where they record the entries in a central ledger.

You can conduct these entries through commercial bank form with your bank or broker.

It is actually a multitier system that involves the Treasury Department, the Federal Reserve, banks, brokers and other financial intermediaries.

TreasuryDirect is the government’s online dealer where investors can buy Treasuries. Investors can check the different auction dates through various outlets, including lenders, brokers, dealers, TreasuryDirect, and the Federal Reserve.

Banks and Brokers

Institutional investors make up the majority of the market for Treasuries, but this does not preclude individual investors from buying and trading the notes as well.

If you are interested in purchasing Treasuries, you may do so directly from the Treasury Department’s TreasuryDirect website or through your banks and brokers.

Many investors also hold Treasuries using mutual funds.

Although this costs them to pay fund-management fees and sacrifice part of their returns, they love the benefit of diversification among all the types and maturities of Treasuries.

If an individual investor would try to achieve this diversification on his own, it will be particularly difficult if he does not have sufficient cash reserves to buy more varied instruments.

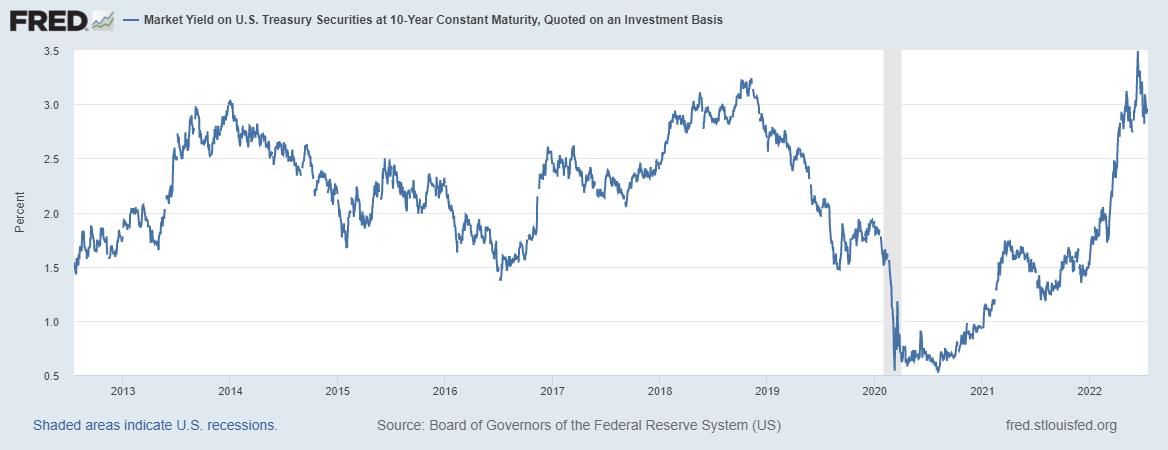

T-Notes Interest Rates

You will notice that Treasury notes will have future maturity dates of two, three, five, seven and 10 years during their sale and Treasury Department issues them in increments of $100.

The auction process will determine their purchase prices and interest rates so the actual price can be more than, less than, or just equal to the face value or pay amount of the note.

Since it is fixed-rate security, the Treasury note’s price will be dependent on its

Always remember that the longer a note’s or bond’s maturity is, the higher your exposure to interest rate risks becomes. A note/bond’s investment value depends on its credit strength and how much it reacts to changes in interest rates.

In most cases, a rate change happens at the absolute level beyond the control of a central bank or within the shape of the yield curve.

Yield to Maturity Ratio is a Key

If the yield-to-maturity ratio is lower than the interest rate, the purchase price will be more than par value.

If the yield-to-maturity ratio is higher than the interest rate, the purchase price will be less than face value. If the yield-to-maturity ratio is equal to the interest rate, the purchase price will be equal to par.

TreasuryDirect provides this actual formula: A = P x r [(d/t)/2].

In this formula, A means accrued interest, P means par or face value, r means the interest rate of a T-note, d means the number of day since the last coupon payment, and t means the number of days in the current coupon period.

T-Notes Example

Let’s say you have a $1,000 ten-year treasury note with a coupon rate of 5%. Every six months, you’ll receive a payment of $25 from the government.

When the note matures, you can redeem it for $1,000. Such bonds can sometimes sell below their face value and at other times above their face value depending on the market at the time of redemption.

T-Notes Pros & Cons

Many investors turn to Treasury notes not only for their stability but also because there is a large secondary market of T-notes that help bolster their liquidity.

Interest payments on the notes come every six months like clockwork until maturity. The income for interest payments is tax-free on a municipal or state level but not on the federal level where it remains subject to tax like the Treasury bond.

Benefits of T- Notes

Investors opt for Treasuries because of these advantages:

- Good Credit Quality

Let’s face it: the risk of default is almost non-existent so investors gobble up Treasuries to preserve their capital while earning from a reliable income stream.

Admittedly, Treasury securities do not pay as high as other taxable fixed-income securities but conservative investors would rather accept lower rates but with more security in their investments.

When you dissect a common diversified portfolio, you will see that U.S. Treasury securities normally represent that part of an investor’s money that he wants to protect from risk.

- Liquidity

Aside from having a very large market, Treasuries also exist on an incredibly liquid one.

Buyers and dealers don’t have to worry about timing because they can buy or sell at any time. It has now even become easier in electronic or digital format because it has eliminated the need for transfer of paper certificates.

The U.S. government maintains such transparency on these instruments that investors can compute for the value of a bond at any time.

Armed with an updated and accurate information, buyers and sellers are more confident in their transactions because they what how much these instruments are really worth.

- Timeline Predictability

Treasuries do not carry call provisions. A call provision is a bond feature that gives the issuer the option to repay a bond before its actual maturity date.

Many municipal and corporate bonds carry this feature. Issuers often resort to this option when interest rates go down in order to save on interest expense – to the detriment of the investors.

The bond issuer can avail of refinancing for their debt at a lower cost during this time but the holder of the bonds would not benefit from the decreased interest rate.

When they reinvest their money, they would most probably find that most options would give them a much lower income stream.

Since Treasuries do not have this provision and the U.S. Treasury will not call the bonds prematurely, investors know exactly how long they will be enjoying their income from each bond. The U.S. Treasury has stopped issuing callable securities beginning in 1985.

- A Wide Range of Maturities

Investors can make full use of the wide range of maturity dates available for Treasuries.

This helps investors to structure their portfolio time-wise by being able to plan exactly when each instrument should become due to meet their specific timetables.

- Preferred Tax Status

Treasury interest payments enjoy a tax-free privilege from state and local income taxes. They do not, however, enjoy the same status when it comes to federal tax laws.

Treasury Notes Risks

Investors and financial experts extol the many advantages of Treasury Notes but that doesn’t mean they are perfect and without any risk.

Here’s a snapshot of the risk implications of T-notes:

- Inflation Risk

Treasury notes rates of return cannot keep up with the rate of inflation.

The annual inflation rate in the US accelerated to 8.5% in March of 2022, the highest since December of 1981

The inflation rate grows much faster and usually stands higher than the T-notes rate.

- Low Yield

Treasury securities typically pay less interest than other securities because they carry lower default or credit risk.

- Opportunity Risk

Some Treasuries carry long maturities and the longer their term, the greater the chance you may miss out on a better investment deal that comes along.

When you tie up your cash in Treasuries, you can’t always just pre-terminate so you can invest your money in something else.

That is not too much of a problem though with T-bills, which has shorter maturities.

Summary

Treasury notes are excellent investment instruments because of their many advantages.

Investors, hedgers, and traders surely benefit from them by ably managing their risk and earn a reliable income stream over a period of time.

They are also very flexible, affording the investor the opportunity to trade from the short or long side while offering market access and liquidity at the same time.

FAQs

Can you lose money in treasury securities?

Since the U.S. government guarantees its payment, as long as the US government doesn't go bankrupt, it is unlikely that you will lose money in government bonds. In contrast to corporate bonds, however, government bonds have lower interest rates. You must keep a government bond until it matures in order to enjoy all of its benefits.

You risk losing money if you sell the government bond before it matures. This indicates that the issuer will only guarantee your principal if you wait until maturity. However, you should be aware that inflation and interest rate changes have a significant impact on the interest rates of government bonds.

How are Treasury securities with inflation protection (TIPS) taxed?

In general, TIPS interest income is taxed at the same federal income tax rates as any other nominal Treasury security. They also attract Phantom Income taxation, which is the tax levied against the growth in value of the premium during inflation.

However, by employing deflation adjustments to balance it, you can lessen the effect of this fee. Typically, deflation causes your principal value to decrease. The alternate strategy is to purchase your TIPs using a tax-deferred account, but you should speak with a tax professional to see whether this is a wise course of action.

Does the Risk versus return for Treasury bonds worth it?

You should be aware that risks have an impact on a treasury bond's return while investing in treasury bonds. Treasury bonds contain some risks, while being among the safest bonds on the market.

Inflation and interest rate risk are the two main dangers that government bonds encounter. The bond's interest rates are impacted by inflation.

For instance, if the bond's interest rate is 4 percent but inflation increases by 2 percent, the bond's interest rate will now be 2 percent. In contrast, the underlying intrinsic value of the issued bond is impacted by the interest rate risk. Its value decreases when the interest rate rises and vice versa is true.

What bond type is the riskiest?

Compared to other bonds, such as those issued by the government, corporate bonds are riskier, but they also yield higher returns as a result. Corporate bonds are among the riskiest forms of bonds due to a number of factors, including:

- Risk of inflation: When there is inflation, the corporate bond's rate of return may underperform interest rates, resulting in meager returns or a decreased principal amount. Therefore, lending your money will be worthless.

- Credit risk: In the event of insolvency or even a slowdown in the economy, the issuer can fail to make interest payments.

- Market risk: The corporation could lose value when the market swings.

Risks associated with interest rates: When interest rates increase, bond prices decline to reflect the equal coupon rate that was being given before to the fluctuation.

What happens if you hold a bond to maturity?

You will be given your bond's entire principal sum if you hold it until it matures. In accordance with the bond's conditions, interest payments will also be made to you.

For instance, if a bond has a face value of $1,000, a coupon rate of 5%, and a maturity of 3 years, you will receive $50 each year in addition to the bond's $1,000 face value when it matures. On the other hand, if you choose to sell your bond before it matures, you can do so for a discount (lower value) or a premium (higher value) to the principal sum.

Can bonds be sold before maturity?

You can sell your bond asset before maturity. However, liquidating your bond prematurely can lead to undesired costs. Some of the factors that can motivate the bondholder to sell the asset before maturity include:

- Emergency needs – If the holder is in a financial emergency, and the only available money is the cash tied to the bond, he can sell the bond prematurely. Depending on the market conditions, the bondholder can recover the principal amount or sell it at a discount.

- Speculative reasons – when the bond interest rates drop, investors pay high prices, which is an opportunity to sell your holding at a higher price. However, you will owe taxes on the capital gains.