Rewards Plan

Sign up Bonus

Credit Rating

0% Intro

Annual Fee

APR

- High Rewards Rate

- No Annual Fee

- No Sign-Up Bonus or 0% APR Introductory Rate

- Redemption Restrictions

Rewards Plan

Sign up Bonus

Our Rating

PROS

- High Rewards Rate

- No Annual Fee

CONS

- No Sign-Up Bonus or 0% APR Introductory Rate

- Redemption Restrictions

APR

19.99% - 27.99% (Variable)

Annual Fee

$0 ($60 Costco membership fee required)

0% Intro

N/A

Credit Requirements

Excellent

- Our Verdict

- FAQ

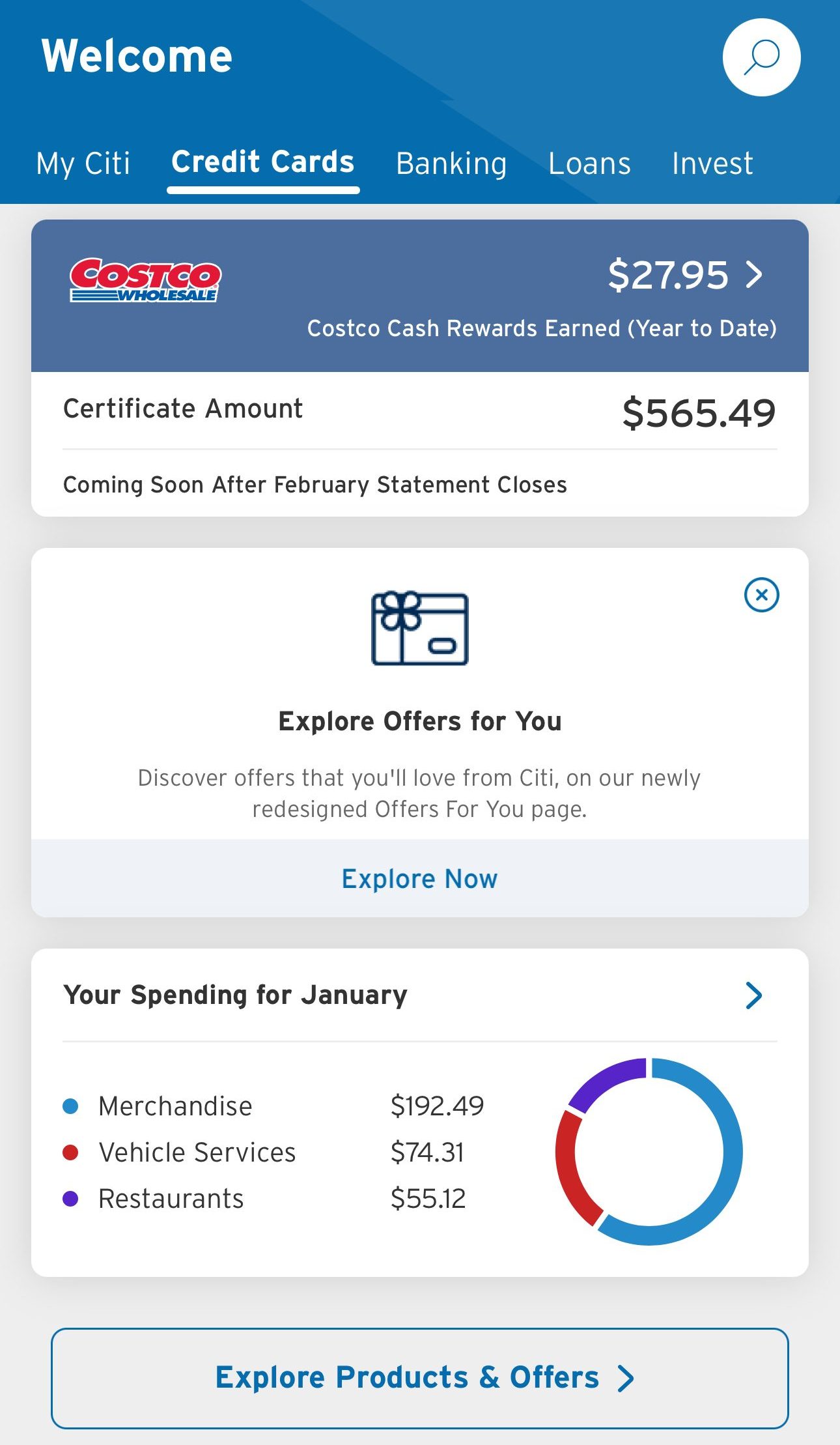

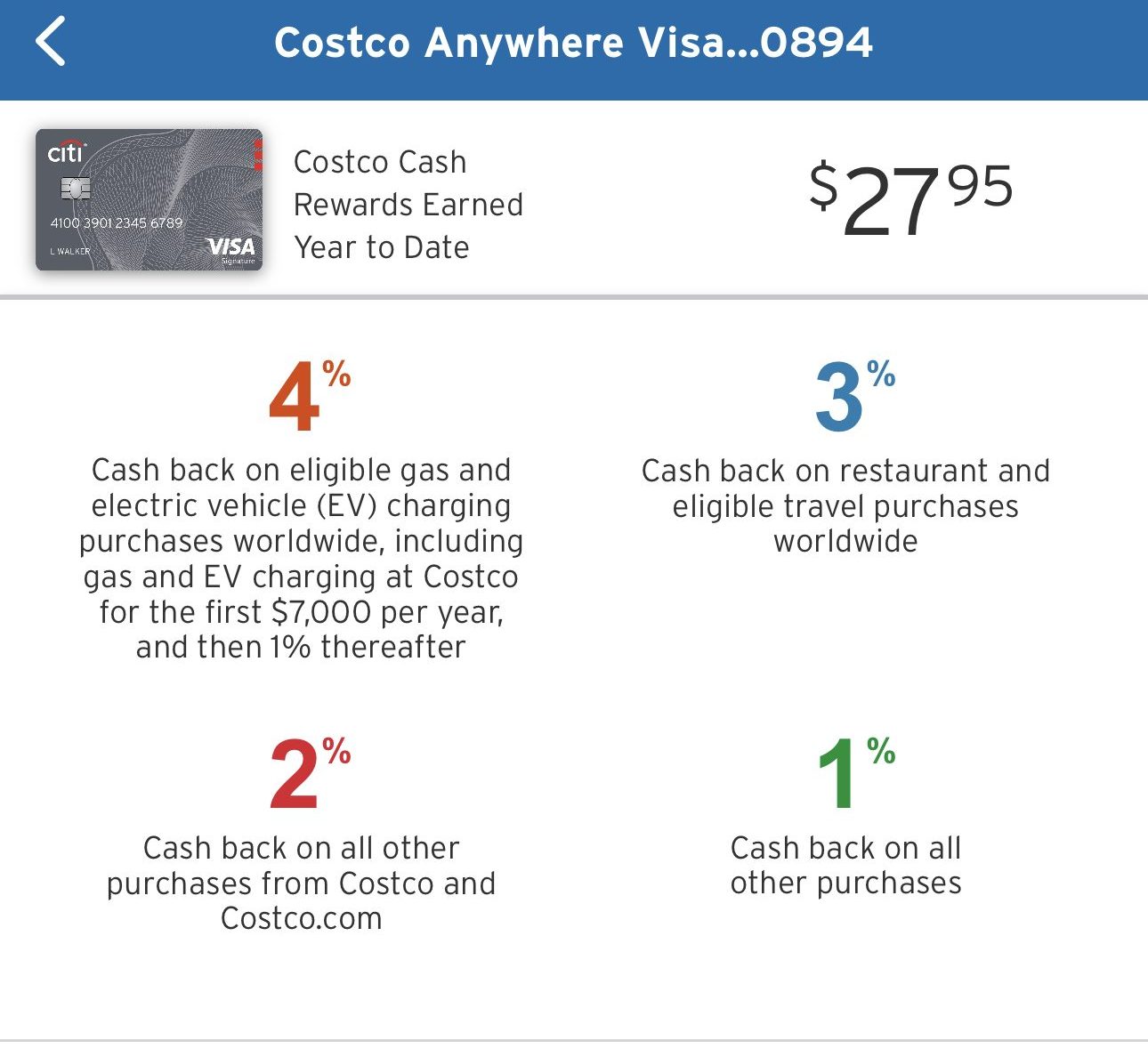

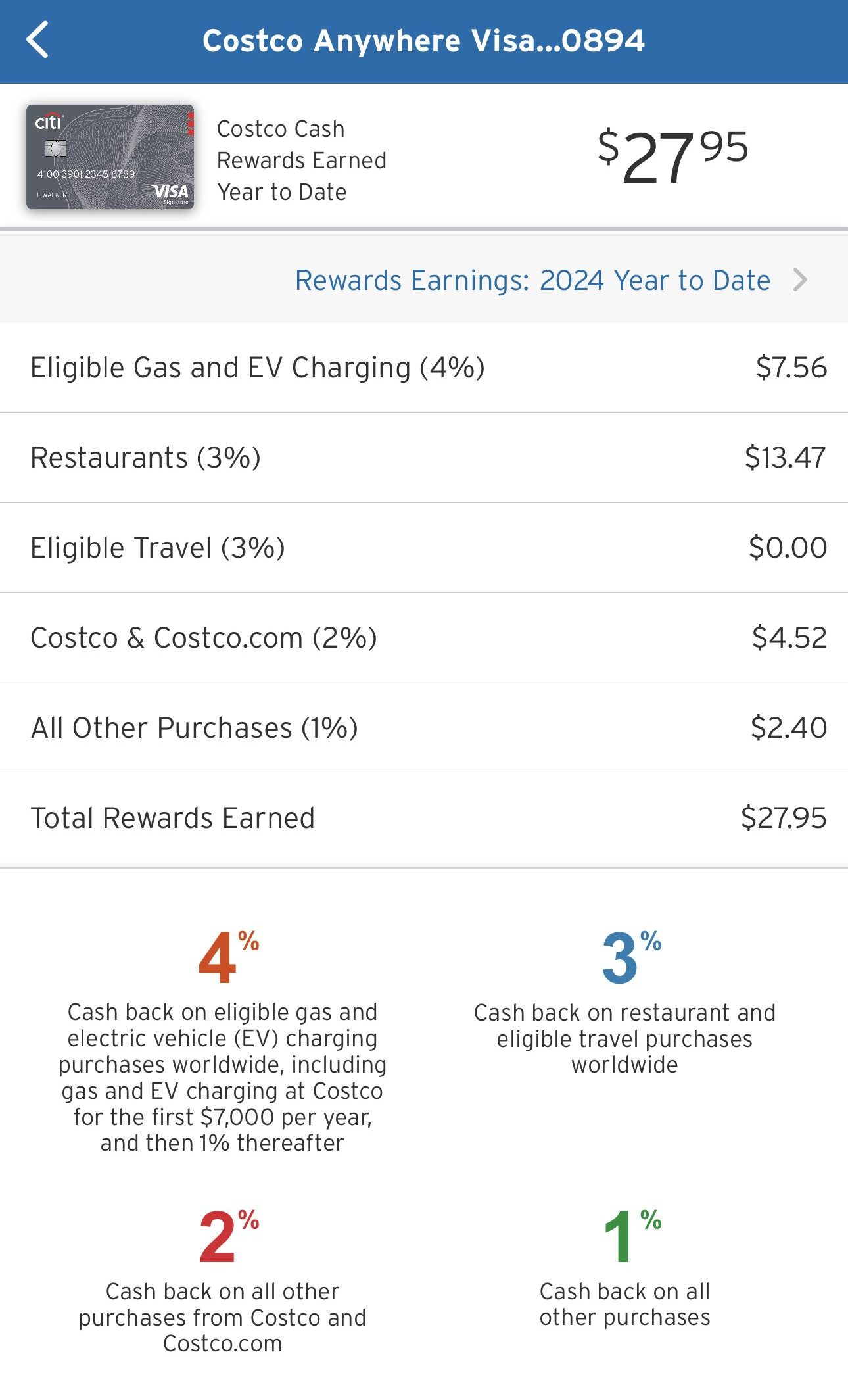

The Costco Anywhere Visa® Card by Citi is a top choice for earning gas rewards, offering 4% cash back on on eligible gas and EV charging purchases for the first $7,000 per year and then 1% thereafter, 3% cash back on restaurants and most travel purchases, 2% cash back at Costco and Costco.com, 1% cash back on all other purchases.

However, accessibility may be a drawback, as the card is exclusively available to Costco shoppers with good – excellent credit scores. In comparison to other shopping cards, the Costco Anywhere Visa® Card by Citi competes well in gas rewards but falls short in introductory offers and additional perks.

Cash back redemption is limited to once per year, with rewards issued as a “credit card reward certificate” valid for purchases, cash, or a combination, and the requirement of a Costco membership (at least $60 annually) further limits eligibility.

How long does card approval take?

Since Citi does not facilitate pre approval for the Costco Anywhere, the approval process is a little longer. You may be waiting up to 14 days to receive an approval decision by email or standard mail.

What’s the initial credit limit ?

The initial credit limit for the Costco Anywhere visa is $500, but some cardholders have been offered an initial limit as high as $10,000.

What are the top reasons not to get it?

The top reason to not get the Costco Anywhere card is if you can get better rewards on a different tier card. There are some cards out there that offer 5% on one or two categories, which provides greater flexibility.

In This Review..

Pros & Cons

Now, let's explore the pros and cons of the Costco Anywhere Visa card to determine if it's a good fit for your wallet.

Pros | Cons |

|---|---|

High Gas And Travel Cash Back

| Annual Cash Back Redemption Limit |

No Annual Fee | There are Better Cashback Cards |

Access to Citi Entertainment | No Sign-Up Bonus or 0% APR Introductory Rate |

No Foreign Transaction Fee | Limited Costco-Specific Benefits |

- High Gas And Travel Cash Back

The Costco Anywhere Visa Card provides 4% cash back on on eligible gas and EV charging purchases for the first $7,000 per year and then 1% thereafter, 3% cash back on restaurants and most travel purchases, 2% cash back at Costco and Costco.com, 1% cash back on all other purchases.

- No Annual Fee

Costco Anywhere Visa Card by Citi does not have an annual fee as long as you are a Costco member.

Costco membership starts at $60 a year. You can start earning cash back immediately.

- Access to Citi Entertainment

The Citi Entertainment platform provides access to once in a lifetime experiences. You can get special ticket purchase access to events including concerts, dining experiences, sporting events and more.

- No Foreign Transaction Fee

The Costco Anywhere Visa Card does not have a foreign transaction fee.

This is unusual for a non-travel rewards card. This is a great perk because you can earn cash back on your travels.

- Annual Cash Back Redemption Limit

Costco Anywhere Visa Card by Citi cash back can only be redeemed or spent at Costco. This redemption also only happens once a year in February. With other cards you can redeem rewards almost anytime.

- There are Better Cashback Cards

There are other cashback cards in the market that offer higher cashback rewards. Some have rotating categories, but depending on your spending habits and with a little planning, you can earn more cash back on your purchases.

If you are a big spender and don’t mind an annual fee, there are other cards with higher cashback rewards, but not my much.

- No Sign-Up Bonus or 0% APR Introductory Rate

The Costco Anywhere Visa Card by Citi does not have a sign-up bonus or any introductory rate like many cards on the market.

- Limited Costco-Specific Benefits

While the card offers general benefits like purchase protection, it lacks significant Costco-specific perks that could enhance its appeal to Costco shoppers.

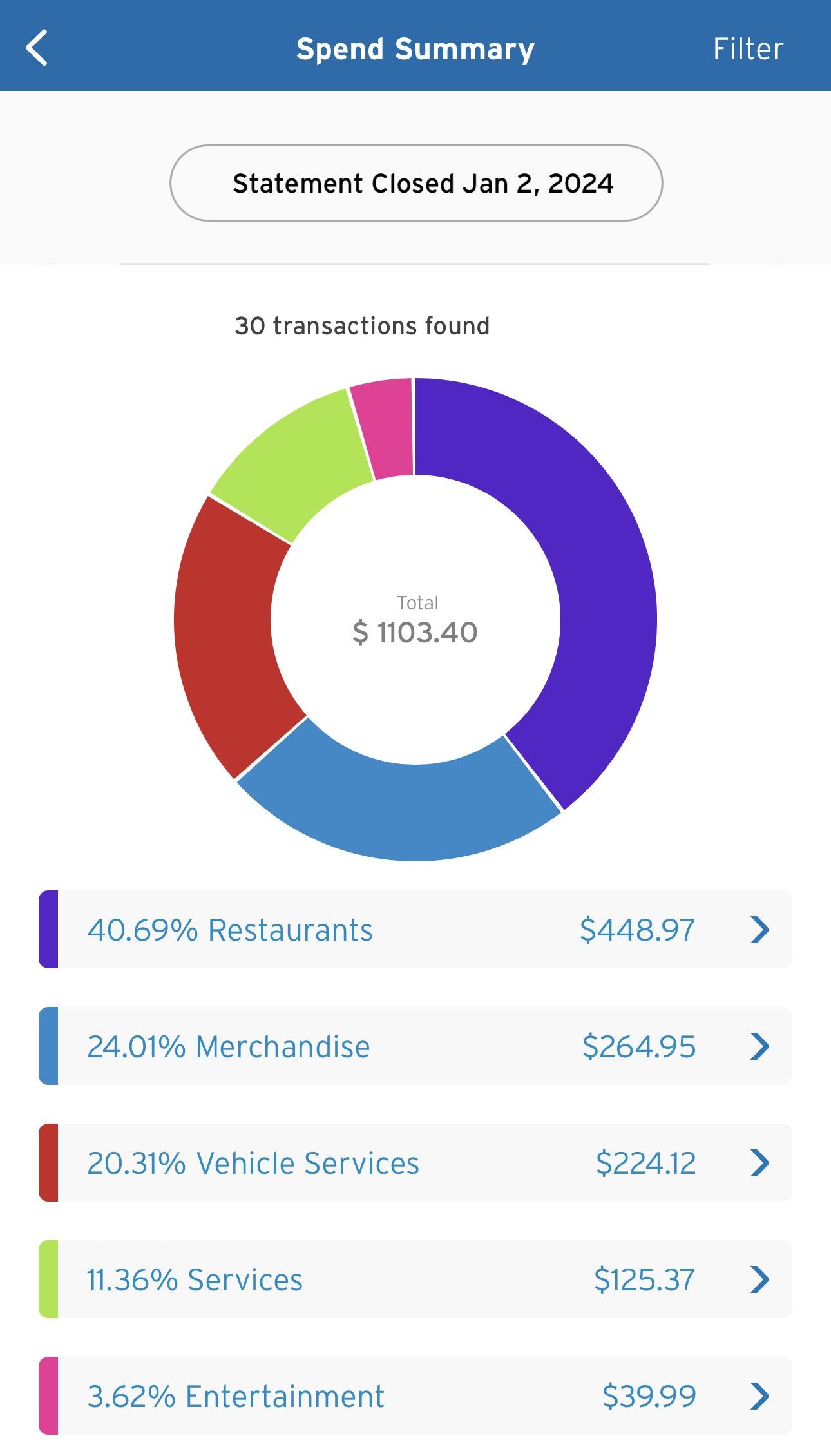

Simulation: How Much Rewards You Can Earn?

If you frequently shop online or visit the retail store regularly, the Costco card can definitely help you earn plenty of rewards, along with other benefits it offers. But how much can you really earn?

To figure that out, you'll need to calculate the rewards based on the card's terms and your spending in each category. Since everyone’s spending habits differ, it’s important to adjust the calculations to match your personal spending breakdown.

Spend Per Category | Costco Anywhere Visa Card |

$12,000 – U.S Supermarkets | $240 |

$5,000 – Restaurants | $150 |

$4,000 – Hotels | $120 |

$4,000 – Airline

| $120 |

$5,000 – Gas | $200 |

Estimated Annual Value | $830 |

* Assuming all supermarkets/gas purchases made via Costco

** Assuming 50% of supermarkets purchases are online

Unfortunately, Redeeming Rewards Is Challenging

The Costco Anywhere card, as previously mentioned, has limited redemption options. You cannot use your rewards at any time during the year. Citi will instead accumulate your rewards and send you a certificate in February.

You can then take this certificate to Costco and use it as store credit or cash. Your certificate will expire if you do not complete this by the end of the year.

To redeem your rewards, you must also have an active Costco membership. Some Costco locations may offer electronic reward transfer, but this is not guaranteed.

Top Offers

Top Offers From Our Partners

Best Ways to Maximize Miles Rewards

Here are some pointers to help you make the most of your Costco Anywhere Visa card:

- Set an alert to redeem your certificate: You'll receive your rewards certificate with your February statement, so make sure to set an alert on your phone to redeem it as soon as possible at your local Costco. It's all too easy to file the certificate away and forget about it, but if you don't cash it in by December 31, you'll forfeit your rewards.

- Check out Citi Entertainment: Before purchasing tickets to any event, make sure to look into the Citi Entertainment platform. This platform is available to all Citi credit card holders, and you can use it to gain access to presales and other benefits. You'll have access to the same features as other Citi cards.

- Make the most of your gas purchases: Whether you buy gas at Costco or elsewhere, this is the highest reward tier. So, make sure to use your card for all of your gas purchases, up to the $7,000 annual limit. This averages around $580 per month, so make sure everyone in your household uses this card to pay for gas until you reach the maximum.

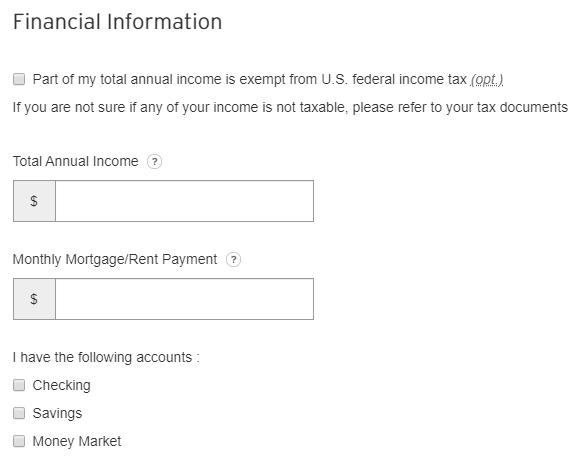

How To Apply For Costco Credit Card?

- 1.

Visit the Citi Costo Anywhere Visa Credit Card home page and then click “Apply Now”.

- 2.

A page comes up; just fill in your personal information correctly.

- 3.

Next, fill in your security number, date of birth and other information.

- 4.

Also fill in your financial information, and then take your time to read through the terms and conditions.

- 5.

After this, tick to agree and then click on “Agree and Submit.”

How It Compared To Other Store Credit Cards?

The Costco Anywhere Visa® Card by Citi distinguishes itself among other store credit cards through its unique rewards structure, notably excelling in gas rewards and travel.

While the Costco Anywhere Visa® Card provides solid rewards for travel and dining, it lacks the introductory bonus that many other store cards, such as the Target RedCard or the Amazon Prime Rewards Visa Signature Card, often offer.

The card's requirement of a Costco membership for eligibility is a unique aspect that may limit its accessibility compared to other store cards like the Walmart Capital One Rewards Card, Macy's Amex card or the Sam's club credit card, which is available to a broader audience without the necessity of a membership.

Despite its strengths, the Costco Anywhere Visa® Card is criticized for its annual cash back redemption limit and the fact that rewards can only be redeemed in a physical Costco store. In contrast, cards like the Walmart Capital One Rewards Card or Prime Visa card allow for more flexible redemption options, including online redemption.

Top Offers

Top Offers

Top Offers From Our Partners

Is the Costco Anywhere Visa Card Right for You?

The Costco Anywhere Visa Card by Citi is a great card for Costco members. It has very competitive cashback rewards and benefits. Those that are big Costco shoppers will benefit the most from this card. This card is also great for those who do a lot of traveling.

The high cashback on travel rewards is better than most travel reward credit cards on the market. The biggest drawback to the Costco Anywhere Visa Card by Citi is you have to wait a year for your rewards. Those rewards also have to be spent at Costco.

If you are not a Costco member, you would want to pass on this card. There are better cash back cards but you have to jump through hoops to get the rewards. The Costco Anywhere Visa Card by Citi rewards are clear, they do not change, and are very competitive in each of the cashback categories.

Compare The Alternatives

There are other credit cards that do offer comparable cash back rewards – we’ve summarized the most popular cards which can use as an alternative to the Costco Anywhere Visa Card:

| |||

|---|---|---|---|

Costco Anywhere Visa® Card by Citi | Best Buy Visa Card | Sam's Club® Mastercard® | |

Annual Fee | $0 ($60 Costco membership fee required)

| $0

| $0 ($50/$110 for Club/Plus membership – MUST)

|

Rewards |

1-4%

4% cash back on on eligible gas and EV charging purchases for the first $7,000 per year and then 1% thereafter, 3% cash back on restaurants and most travel purchases, 2% cash back at Costco and Costco.com, 1% cash back on all other purchases

|

1-5%

5% back in rewards on shopping at BestBuy, 3% back in rewards on gas purchases, 2% back in rewards on dining, takeout and grocery purchases, 1% back in rewards on everyday purchases

|

1-5%

5% cash back on gas anywhere Mastercard is accepted (on the first $6,000 per year, then 1% after), 3% cash back on Sam’s Club purchases for Plus members, 3% on dining and takeout and 1% on all other purchases

|

Welcome bonus |

None

None

|

None

10% back in rewards on your first day of purchase

|

None

$30 statement credit after making $30 in Sam’s Club purchases within the first 30 days

|

Foreign Transaction Fee | $0

| N/A

| N/A

|

Purchase APR | 19.99% – 27.99% (Variable)

| 15.99% – 31.49% variable

| 20.40% or 28.40% Variable

|

FAQ

The only rewards limit on the Costco Anywhere is in the top tier. You’re limited to up to $7,000 on your gas purchases per year.

The Costco Anywhere card requires excellent credit, which means that you will need to have a low income to debt ratio to qualify.

Citi does not support pre approval for the Costco Anywhere card. You’ll need to complete a full application and this will involve a hard credit pull.

Both these cards operate on cash back percentages, so you don’t need to worry about conversion rates and confusing redemption offers. This means that you’ll earn a dollar amount as a percentage of your purchases.

Compare Costco Anywhere Visa Card by Citi

Both can be a perfect choice if you're looking for a store card. What are the main things you should know before applying, and how much can you save? Here's our analysis.

Costco Anywhere Visa vs Capital One Walmart Rewards Card: Which Card Is Best?

The Costco card stands out with substantial cashback rewards on gas, dining, and Costco shopping. In which cases the Apple card may be better?

Costco Anywhere Visa Card by Citi vs Apple Card: Which Card Is Best?

Costco is a clear winner when it comes to rewards for everyday spending, but the Best Buy Card wins for gadget lovers. Here's our comparison.

My Best Buy Visa vs Costco Anywhere Visa Card: How They Compare?

The Amazon Prime Visa card offers high cashback for avid online shoppers. However, Costco is the winner when it comes to everyday spending.

In the realm of wholesale clubs, Sam's Club and Costco stand as titans. Which of them offers a better branded credit card? Here's our verdict.

Sam's Club Mastercard vs Costco Anywhere Visa Card: Which Card Is Best?

The Costco Card is a great for Costco shoppers, gas and grocery purchases, while the Freedom Unlimited stands out for its travel benefits.

Costco Anywhere Visa Card vs Chase Freedom Unlimited: Comparison

BJ's One+ Mastercard our winner when it comes to cashback, but Costco card offers flexibility and many categories with higher cashback ratio.

BJ's One+ Mastercard vs Costco Anywhere Visa Card: How They Compare?

If you focus on groceries – the Target RedCard wins, but if you focus on travel or gas – you may want the Costco credit card.

Target Red Card vs. Costco Anywhere Visa Card: How They Compare?