Chase College Checking℠

Fees

Minimum Deposit

Our Rating

Promotion

To get it, customers need to complete 10 qualifying transactions within 60 days of coupon enrollment needed. Expired on 10/15/2025

Chase is the largest bank in America, so it is unsurprising that this bank has a comprehensive product line offering accounts for all stages of your life. A great example of this is the Chase College Checking account.

As a college student, managing your finances is an important aspect of your overall wellbeing. A good checking account can help you keep your money organized and make everyday transactions like paying for groceries or withdrawing cash more convenient.

As the name suggests, this account has been specifically designed for students, offering features and benefits that are tailored for the under 24s for up to five years while in college.

Chase College Checking℠: Account Features

The Chase College Checking℠ account is designed specifically for students and comes with a range of features that can help you manage your finances more effectively.

-

Monthly Maintenance Fee

The Chase College Checking account has a $12 monthly maintenance fee, but this is waived if you are enrolled in college (up to five years) for students 17-24 years old..

-

Access to a Large Branch Network

As we touched on above, Chase is one of the biggest banks in the U.S. It has more than 4,700 branch locations, which makes it easy to find a local branch and access in person support should you have a query or issue.

Chase also has an ATM network with over 15,000 machines, so you can withdraw or deposit funds for free.

-

Phone Support

In addition to the branch teams, Chase has a 24/7 phone support line. This means that should you run into an issue outside of the regular business hours, you can immediately get some help.

-

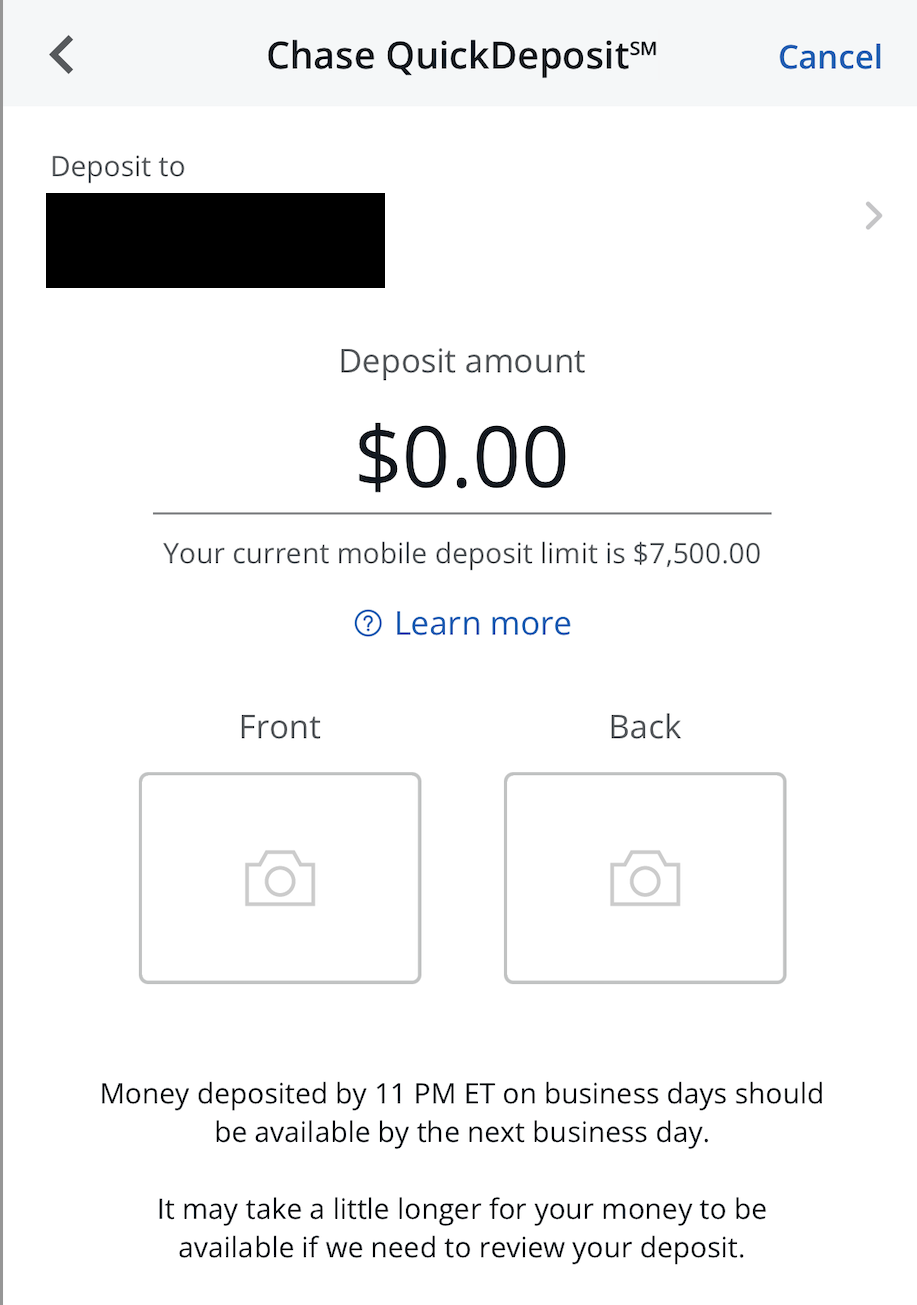

QuickDeposit

The Chase mobile app features QuickDeposit, which allows you to deposit checks using your device. This is a free service and you can avoid the hassle of visiting a branch or ATM.

-

Online Bill Payment

You can pay your bills through your Chase College Checking account, making it easier to stay on top of your financial obligations and minimize the risk of late fees.

-

Chase Quickpay

This is a Zelle integrated free service on the Chase app or online banking platform. Whether you’re out with friends and want to split the bill or need to receive some money from your parents, Zelle makes it easy to quickly send and receive money using only an email address or phone number.

-

Money Tips and Tools

Similar to Chase Secure Banking, this account also includes tailored content to help students to understand the financial basics. There are also savings tools that allow you to set and track savings goals to help you to reach your target.

Is the Chase College Checking Account Good?

There is no easy answer to this question, as whether you consider this account to be good will depend on your unique circumstances and needs.

However, as with any financial product, there are both pros and cons associated with the Chase College Checking account, which may help you to decide if it could be a good choice for you.

Pros | Cons |

|---|---|

No Minimum Deposit Requirements | May Not Be On All College Campuses |

Promotion | Out of Network ATM Fees |

Overdraft Protection | Not Interest Bearing |

Highly Rated App | Other Fees Apply

|

- No Minimum Deposit Requirements

Unlike many checking accounts, there is no minimum initial deposit or minimum balance requirements to maintain your account.

- Promotion

Chase typically offers new customers a welcome bonus if they complete the required qualifying transactions within a set time after account opening.

The current offer is a $125 bonus with complete 10 qualifying transactions within 60 days of coupon enrollment .

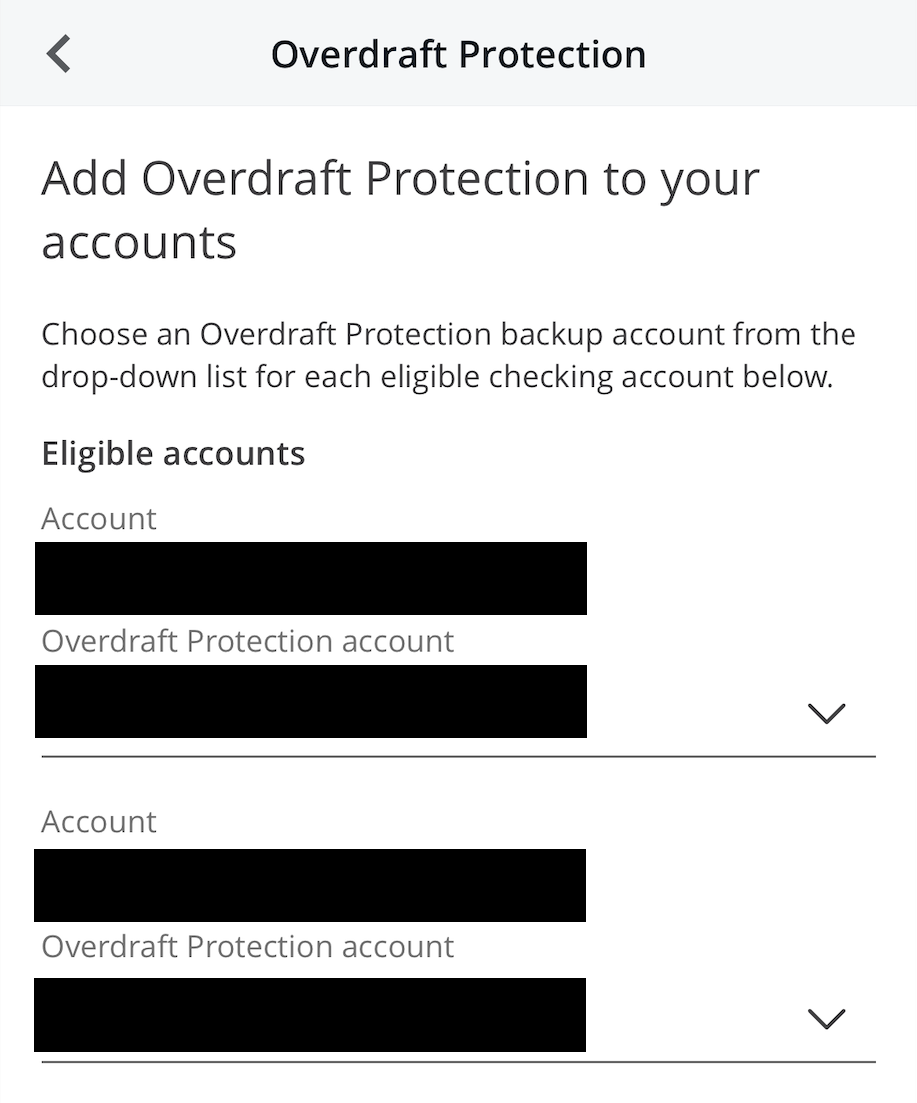

- Overdraft Protection

You can sign up for overdraft protection and the coverage extends to debit card transactions.

Chase will waive the overdraft fees if you make a deposit to bring your account back into the black by the end of the day or by 10pm/11pm if you deposit funds by Zelle or an ATM respectively.

- Highly Rated App

The Chase app is highly rated and offers an intuitive way to manage practically all aspects of your account at home or on the go.

- May Not Be On All College Campuses

While Chase does have a substantial branch network, it may not have a presence on all college campuses.

- Out of Network ATM Fees

Although Chase does have a large network, if you don’t have a Chase ATM nearby, you will incur out of network fees.

The current fee is $3 per transaction and unlike some of the other checking accounts offered by Chase, you will not receive reimbursement for any out of network fees you incur.

- Not Interest Bearing

Unlike some Chase checking accounts, you’ll not receive interest on your College Checking account regardless of your balance.

- Other Fees Apply

Although it is quite simple to have Chase monthly maintenance fee waived, you may incur other fees, some of which are a little on the high side. For example, the insufficient funds fee is currently $34.

When Chase College Checking May Be Relevant?

As its name suggests, the Chase College Checking account is best suited to college students. As a college student, you can have the monthly maintenance fees waived for up to five years. This account should appeal to students who want access to a large branch and ATM network, particularly if Chase has a presence on your college campus.

This account is also best suited to those who have a tendency to lose track and slip into the red. If you can bring your account balance back up to at least zero within the same business day, you won’t incur an overdraft fee.

However, there are also associated tools offered with this account that can help you to get to grips with your finances for a healthier financial future.

Is Chase a Good Bank to Work With?

As is typical for traditional banks, Chase doesn’t have a great reputation on the consumer review platforms including Trustpilot. There are a number of negative comments and reviews that relate to the customer support and fees.

However, the Chase app has a good rating on both the Apple Store and Google Play. So, you are likely to find that Chase is an average bank to work with and as it also offers 24/7 support, it may actually be a good option for you.

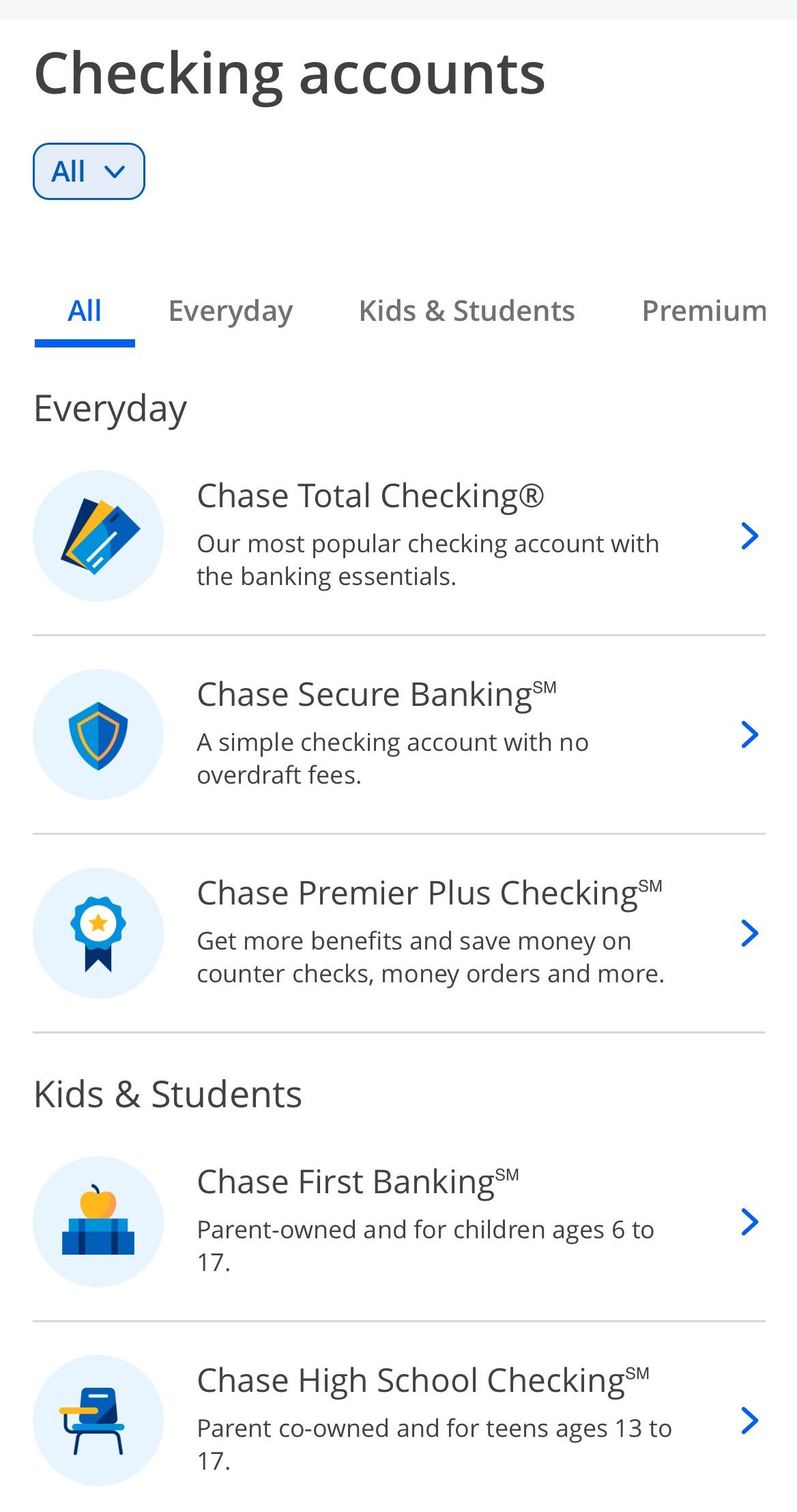

Additionally, although Chase doesn’t offer the highest deposit rates on the market, it does carry an impressive product line. There are different options in different account types including savings, CDs, checking and lending products. The leading checking product is Chase Total Checking, one of the most popular accounts in the nation.

This makes Chase a good option if you want to keep all of your finances under one roof. But, if you’re looking for the highest deposit rates and most favorable checking account terms, you may need to compromise on access to branch support and consider online banks.

How to Open a Chase College Checking Account

You can call into a local Chase branch to open an account, but Chase also makes it easy to open a College Checking account online in a few basic steps.

- Navigate to the College Checking Product Page: On the official Chase website, you will need to navigate to College Checking. You can find this page by clicking “Checking” on the top bar and then selecting “College Checking.” You can read through all of the details for this account and if you’re ready to start the account opening process, click on the green “Open Now” button.

- Complete the Form: If you don’t already have any Chase accounts, you will need to complete the mandatory fields including your full name, address, date of birth and Social Security Number.

- Fill in the Full Application: You’ll then be directed to the full application form. Be sure to complete all of the mandatory fields and then click “Submit.” Chase will process the application and then send you a confirmation email.

FAQs

Does the Chase College Checking account earn interest?

Unfortunately, the Chase College Checking account is not interest bearing, so you won’t earn anything regardless of your balance.

Does Chase College Checking offer a promotion?

Chase frequently offers promotions for new customers interested in the College Checking account. The current offer is a $100 bonus if you have 10 qualifying transactions within the first 60 days of opening an account.

How do you close a Chase College Checking account?

The easiest way to close your Chase College Checking account is to visit a Chase branch or call the customer support line. A Chase representative can walk you through the closure process.

How We Review Checking Accounts: Our Methodology

The Smart Investor team has conducted a comprehensive review of checking accounts offered by various banks, taking into account several key factors to provide a thorough evaluation. Here's how we rated them across four important categories:

-

Checking Account Features (60%): We meticulously assessed the features and benefits associated with each bank's checking accounts. Factors considered include account fees, minimum balance requirements, ATM access, overdraft protection, online and mobile banking functionalities, and additional perks such as rewards programs. Higher ratings were awarded to banks offering a wide range of features and benefits that cater to diverse customer needs, ensuring convenience and flexibility in managing finances.

-

Customer Experience (20%): A positive customer experience is essential in banking, so we evaluated each bank's performance in this area. This included assessing the ease of account opening, quality of customer service, availability of support channels, and overall user satisfaction. Ratings were based on factors such as responsiveness, efficiency, and the bank's commitment to meeting customer needs, ensuring a seamless and satisfactory banking experience.

-

Diversity of Other Financial Products (10%): We also considered the diversity of other financial products offered by each bank, such as savings accounts, loans, credit cards, and investment options. Higher ratings were given to banks with a comprehensive suite of financial products, allowing customers to meet their various banking and financial needs in one place.

-

Bank Reputation (10%): The reputation of a bank is a crucial factor in decision-making. We examined factors such as financial stability, regulatory compliance, and public perception to determine each institution's overall trustworthiness and reliability. Higher ratings were assigned to banks with strong reputations, reflecting their credibility and ability to inspire confidence among customers.

By considering these categories and assigning appropriate weights to each, our review aims to provide valuable insights to help individuals make informed decisions when selecting a checking account