Wells Fargo Clear Access Banking

Fees

Minimum Deposit

Promotion

Our Rating

Wells Fargo Clear Access Banking

Fees

Minimum Deposit

Promotion

Our Rating

Wells Fargo is one of the oldest banks in the U.S, offering a wide variety of banking products via its branch network of over 8,000 locations. However, Wells Fargo has moved with the times and now offers a variety of online only products. A great example of this is the Wells Fargo Clear Access Banking account.

This is a digital checking account that is ideal for those who need some help managing their money or for students and teens, who may not have the maturity to handle all of the features of the more comprehensive Wells Fargo checking account options.

Wells Fargo Clear Access Banking Features

Wells Fargo Clear Access Banking comes with a variety of features and benefits that are designed to meet the needs of different types of customers. In this section, we will explore these features:

-

Monthly Service Fee

Like most Wells Fargo checking accounts, the Clear Access Banking does have a monthly fee, but this is a relatively low $5 per month. However, the fee is waived if the primary account holder is aged 13 to 24.

-

No Balance Requirements

While you'll need at least $25 to open the account, there are no daily balance requirements to maintain your account.

-

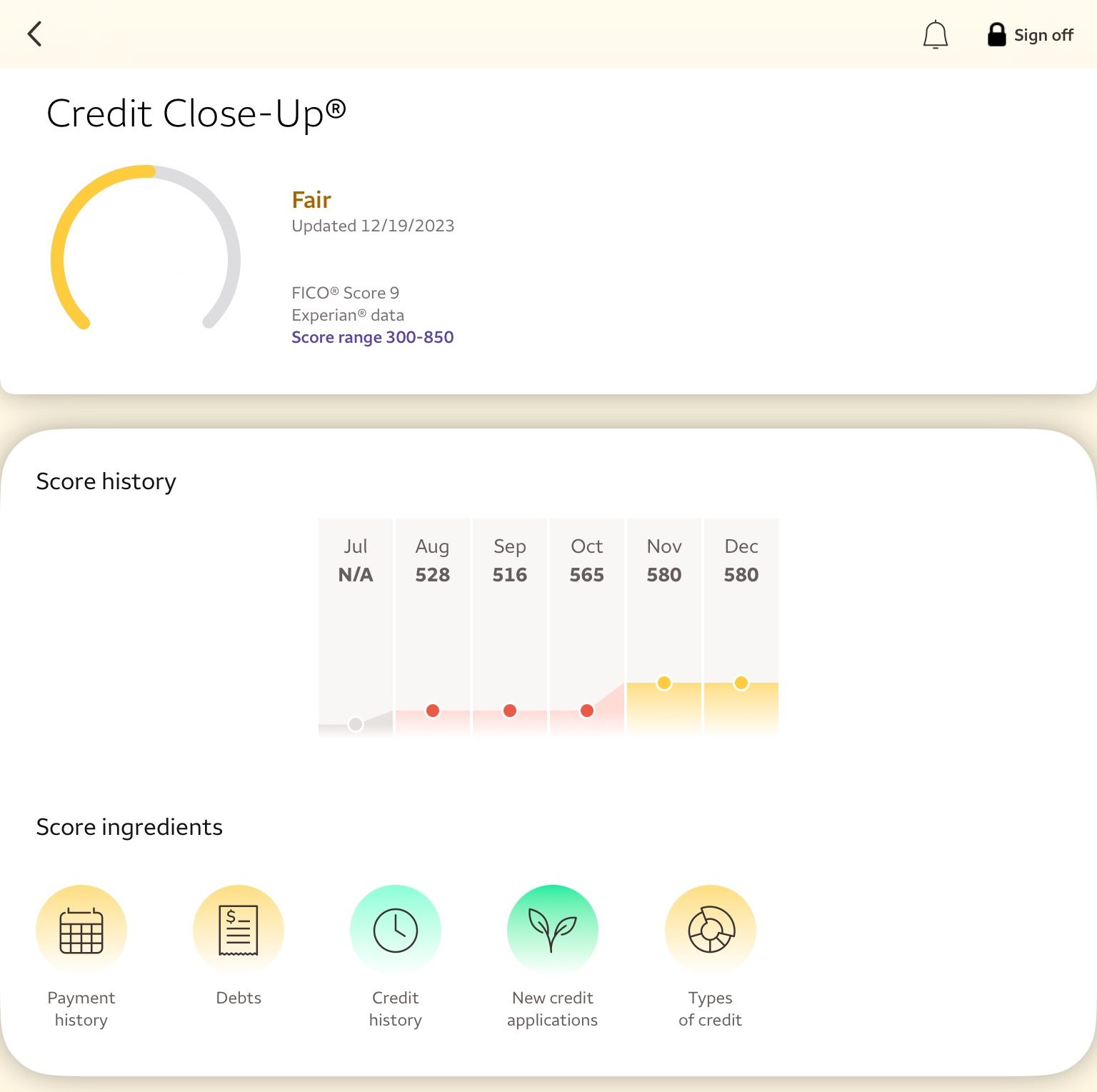

Credit Score

Gaining access to your credit score via the Wells Fargo app offers valuable insights into your financial well-being. Our interaction with this feature has been illuminating; the app prominently displays the credit score, accompanied by a detailed breakdown of the factors that impact it.

-

Access to the Wells Fargo App

This account can be managed using the Wells Fargo App. This is a highly rated app on both the Apple Store and Google Play. It incorporates a number of features including Zelle payments, card control, a digital wallet for tap and pay, and mobile check deposit.

-

ATM Access

You can also withdraw funds, perform account inquiries and deposit funds via the Wells Fargo ATM network. There are no fees for using Wells Fargo ATMs, but fees for using non network machines apply with no fee reimbursement.

-

Foreign Transaction Fees

Unlike some of the top tier Wells Fargo checking accounts such as Wells Fargo Prime or Premier accounts, if you use your account debit card abroad, you will incur foreign transaction fees. These are 3% of the transaction amount, which is fairly standard across the industry.

Top Offers From Our Partners

Top Offers From Our Partners

Is the Wells Fargo Clear Access Banking Account Good?

There is no straightforward answer to this question, since it will depend on your individual requirements and preferences. However, the account does have its own pros and cons, which may help you to determine if it could be a good fit for you.

Pros | Cons |

|---|---|

No Overdraft Fees | Limited Fee Waiver Criteria |

Access to a Massive ATM Network | Other Fees |

Biometric App Authorization | No Check Writing |

Low Monthly Maintenance Fee | Minimum Opening Deposit |

- No Overdraft Fees

This account is designed to offer simplicity, so there is no facility to go overdrawn. So, if you miscalculate and are about to slip into the red, Wells Fargo will decline any transactions.

While this may be potentially embarrassing if you’re trying to make a purchase, you won’t incur any costly overdraft fees.

- Access to a Massive ATM Network

Wells Fargo maintains an ATM network with over 12,000 machines, which should make it easy to find a fee free machine in your area. You can also use the ATM search feature on the app to find your nearest machine.

- Biometric App Authorization

The Wells Fargo app has some great features, but it also has superb security with biometric authorization to avoid the risk of fraudulent activity.

- Low Monthly Maintenance Fee

This account has the lowest monthly maintenance fee of all the Wells Fargo checking accounts, at a reasonable $5 per month.

- Limited Fee Waiver Criteria

Although the monthly fee is quite low, it can only be waived if the primary account holder is aged 13 to 24.

- Other Fees

The account is also not immune to other fees and charges. This includes incoming and outgoing wire transfers, stop payments, and money orders.

So, it is important to check the fees you can expect to incur on a typical month to determine if it is cost effective for you.

- No Check Writing

As is becoming more common, the Clear Access Banking account does not provide check writing capabilities.

This means that if you prefer to pay for purchases and services using paper checks, this is not the right account for you.

- Minimum Opening Deposit

Like other Wells Fargo checking accounts, you must deposit at least $25 to open a Clear Access Banking account.

Which Type of Customer is Best Suited To This Account?

The Wells Fargo Clear Access Banking account is primarily designed for teens and students. If the primary account holder is under 24, the monthly maintenance fee is waived. This makes it a good account choice for younger people, who need a simple account to manage day to day money and learn about financial responsibility.

The account does not permit an overdraft, so there is no way to go into the red and spiral into increasing fees and charges.

Also, the account could also be a good fit for those who are looking to get their finances under control with a simple account. However, if you’re looking for a feature packed checking account that includes check-writing capabilities, you may want consider the Everyday checking account.

Is Wells Fargo a Good Bank to Work With?

Wells Fargo has a comprehensive product line with a variety of options for each type of account. The Clear Access Banking is just one of several checking accounts. However, there are also various savings accounts such as the Way2save savings or the Platinum savings, credit cards, and lending products. This makes it easier to choose an account that best suits your needs.

However, one of the drawbacks of Wells Fargo is that the rates tend to be on the low side compared to many other banks. This is quite common with traditional banks, but when you compare the accounts with those offered from online banks, the rates do not compare favorably.

Additionally, Wells Fargo does not have a particularly great reputation. It has a poor rating on Trustpilot and other consumer websites, which highlight issues with bad customer service.

So, if you’re completely new to this bank, it is a good idea to read through some of the negative comments to see if there are any red flags for you. For example, since this is an online account, the comments about poor attitude in branch staff is not going to be a problem for you. But, if you intend on having a savings account that does offer branch access and you prefer in person support, you may be a little wary.

How to Open a Wells Fargo Clear Access Banking Account?

Since this is a digital account, the best way to open a Wells Fargo account is online, but those under 18s will need to visit a branch with a parent or guardian. The online method can be completed in a few simple steps.

- Navigate to the Clear Access Banking Page: On the official Wells Fargo website, you’ll find Clear Access Banking under the “Personal” tab on the top bar and then select “Checking.” After you have read through the account details, if you’re ready to proceed, click the “Open Account” red button.

- Confirm Customer Status: You’ll be directed to a screen to confirm if you’re an existing customer of Wells Fargo. If you already hold a Wells Fargo account, you can log in and the bank will pre-fill some of the application form using your profile details.

- Complete the Application Form: This is a standard account application form. You’ll need to fill in all of the mandatory fields including your name, postal address, email, date of birth and Social Security Number. You will also need to consent to a credit search.

- Review Details and Submit: Once you complete the application, you’ll be presented with a review summary. Read through it to check for any errors and then confirm the details by hitting “Submit.”

- Fund Your Account: Since this account requires at least $25 as an opening deposit, you can finish off the application process by providing the details for your initial deposit.

FAQs

Does Wells Fargo Clear Access Banking earn interest?

No, unfortunately, the Clear Access Banking account is not interest bearing. So, regardless of your balance, you’ll not earn anything on the funds you have in your account.

Does Wells Fargo Clear Access Banking offer a promotion?

Wells Fargo does periodically offer promotions for new customers, but there is not currently a promotione.

How do you close a Clear Access Banking account?

You can either visit a local Wells Fargo branch or call the customer support line and a Wells Fargo representative can guide you through the Wells Fargo account closure process.

How We Review Checking Accounts: Our Methodology

The Smart Investor team has conducted a comprehensive review of checking accounts offered by various banks, taking into account several key factors to provide a thorough evaluation. Here's how we rated them across four important categories:

-

Checking Account Features (60%): We meticulously assessed the features and benefits associated with each bank's checking accounts. Factors considered include account fees, minimum balance requirements, ATM access, overdraft protection, online and mobile banking functionalities, and additional perks such as rewards programs. Higher ratings were awarded to banks offering a wide range of features and benefits that cater to diverse customer needs, ensuring convenience and flexibility in managing finances.

-

Customer Experience (20%): A positive customer experience is essential in banking, so we evaluated each bank's performance in this area. This included assessing the ease of account opening, quality of customer service, availability of support channels, and overall user satisfaction. Ratings were based on factors such as responsiveness, efficiency, and the bank's commitment to meeting customer needs, ensuring a seamless and satisfactory banking experience.

-

Diversity of Other Financial Products (10%): We also considered the diversity of other financial products offered by each bank, such as savings accounts, loans, credit cards, and investment options. Higher ratings were given to banks with a comprehensive suite of financial products, allowing customers to meet their various banking and financial needs in one place.

-

Bank Reputation (10%): The reputation of a bank is a crucial factor in decision-making. We examined factors such as financial stability, regulatory compliance, and public perception to determine each institution's overall trustworthiness and reliability. Higher ratings were assigned to banks with strong reputations, reflecting their credibility and ability to inspire confidence among customers.

By considering these categories and assigning appropriate weights to each, our review aims to provide valuable insights to help individuals make informed decisions when selecting a checking account