Looking for a savings account that offers a high interest rate and excellent customer service? You might have come across two popular options: Ally Bank and Discover Bank.

Both banks have gained a reputation for their competitive interest rates, user-friendly online platforms, and no-fee policies. But which one is better for your needs?

In this article, we'll take an in-depth look at Ally savings and Discover savings accounts, comparing their key features, pros, and cons, so you can make an informed decision on which one to choose.

Compare Savings Account Rates

Discover Online Savings | Ally High-Yield Savings | |

|---|---|---|

Savings Rate | 3.50% | 3.40%

|

Minimum Deposit | $0 | $0 |

Fees | $0 | $0 |

Promotion | None | None |

CD Range | 2.00% – 4.00%

| 2.90% – 3.90% |

The table shows a comparison between Discover Online Savings and Ally High-Yield Savings accounts. Both accounts offer the quite similar savings rate, have no minimum deposit or fees, and do not currently offer any promotions.

However, their CD ranges differ slightly, with Discover's range being 2.00% – 4.00% and Ally's range being 2.90% – 3.90%.

Top Offers From Our Partners

![]()

Savings Calculator: Visualize Your Savings Growth

Initial deposit

Monthly contribution

Period (years)

APY

-

Interest earned

-

Contributions

-

Initial deposit

Total savings

* Make sure to adjust APY and deposit

Breaking Down Savings Account Perks

Discover Online Savings | Ally High-Yield Savings |

|---|---|

No Monthly Balance Requirement Or Fees | No Monthly Fees or Account Minimum |

Access to 24/7 Customer Support | Savings Organization Tools |

Excellent Mobile App | Safe to Save Feature |

Automatic Saver Options | Round-Ups |

Ally Bank High Yield Savings is a popular savings account that offers a variety of features and benefits to its customers.

One of the most appealing aspects of Ally Savings is the absence of monthly maintenance fees or minimum balance requirements, making it a hassle-free option for people who want to save money.

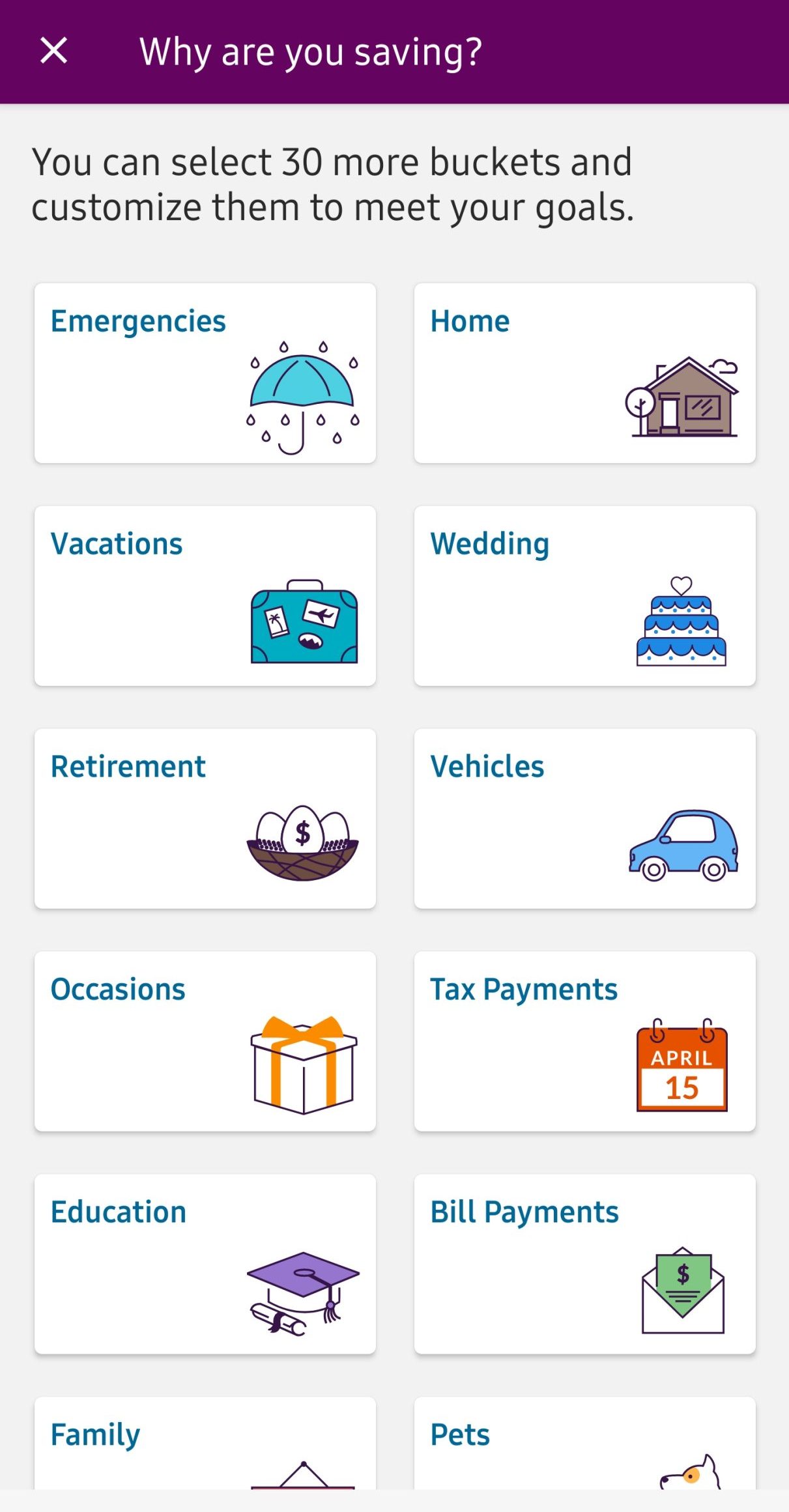

The account also comes with helpful savings organization tools, such as the “buckets” feature that allows customers to categorize their savings into different groups within the same account.

Ally Savings also has a unique Safe to Save feature, which analyzes a customer's linked checking account to identify areas where they can boost their savings balance. This feature makes it easier for customers to increase their savings without any effort.

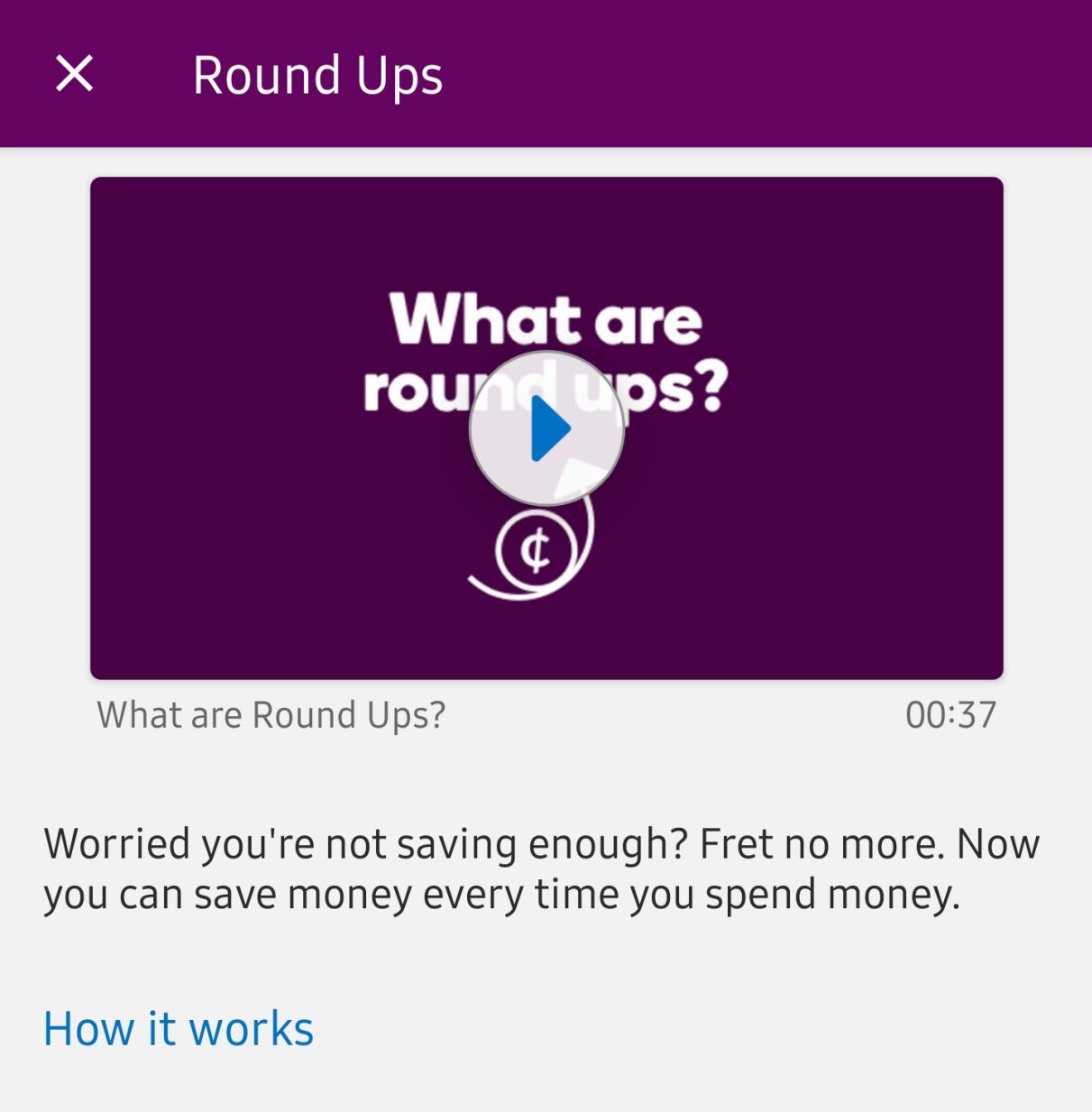

Additionally, the account includes a round-up feature that automatically transfers spare change from a customer's checking account to their savings account. This is a convenient way to save money without even thinking about it.

Discover Bank's online savings account is a great option for those looking to save money. The account comes with a mobile app that is considered one of the best among online banks, allowing customers to easily access all of their Discover accounts, view account activity, deposit checks electronically, and transfer money.

Discover also has no monthly balance requirement or fees for stop payment orders, excessive withdrawals, insufficient funds, or monthly maintenance, making it accessible to all account holders. Additionally, Discover provides a toll-free helpline that is available 24/7, with customer service representatives based entirely in the United States.

Alternative Savings Account : Better Rates Available?

Choosing the right savings account is an important decision when it comes to managing your finances. With so many options available, it can be overwhelming to compare and choose the right account for you.

If you would like to Ally and Discover savings account, we've created a table comparing savings accounts from traditional banks, online banks, and credit unions.

Bank/Institution | Savings APY | Min Deposit | Type |

|---|---|---|---|

Up to 3.85%

| $100 | Online Bank | |

4.00%

| $0 | Online Bank | |

3.50% | $0 | Online Bank | |

3.50% | $0 | Online Bank | |

0.03% – 1.18%

| $0 | Traditional Bank | |

3.42%

| $0 | Online Banking | |

3.65% | $0 | Online Banking | |

up to 4.10%

| $0 | Online Bank | |

4.20% | $100 | Online Banking | |

3.80% | $0 | Online Bank | |

3.06% – 3.10% | $0 | Credit Union | |

up to 4.50%

| $1,000 – $5,000 | Online Bank | |

2.80% | $5 | Credit Union |

Compare Ally Savings

Ally and Marcus Savings account offer competitive rates on savings with no monthly fees. Compare account features, benefits and drawbacks.

Ally Bank Savings Account vs Marcus Online Savings Account: Which Is Better?

Compare Ally and Capital One Savings account rates, features, benefits, and limitations to determine which one is the best option for you.

Ally Bank Savings Account vs. Capital One 360 Performance Savings: Which Is Best?

Ally and SoFi savings account rates are among the highest in the market and no monthly fees required. Compare account features and drawbacks.

SoFi High Yield Online Savings Account vs. Ally Bank Savings Account: Compare Side By Side

Compare Citi Accelerate Savings and Ally Savings rates, features, benefits, and limitations to determine which one is the best option for you.

Citi Accelerate Savings vs Ally High-Yield Savings: Comparison

Ally and Amex savings offers lucrative savings rates and many other benefits for savers. Here's our side by side savings account comparison: Ally Bank Savings Account vs American Express High Yield Savings Account

Ally and Amex savings offers lucrative savings rates and many other benefits for savers. Here's our side by side savings account comparison: Chase Savings vs Ally Bank Savings Account

Compare Discover Savings

The Discover Online Savings and the Capital One 360 Performance Savings rates are similar. Compare account features, benefits and drawbacks.

Discover Online Savings Account vs Capital One 360 Performance Savings: Compare Side By Side

Discover and American Express offer competitive savings rates and no monthly fees. Compare account features, benefits, and drawbacks.

Discover Online Savings Account vs. American Express High Yield Savings Account

There is no competition when it comes to savings rates – Discover wins Chase clearly. However, each of them has its own benefits and tools.

Chase Savings vs Discover Online Savings Account: Compare Side By Side

PNC offers higher savings rate than Discover, but the states are very limited. Here's our full savings account comparison: Discover Online Savings Account vs. PNC Standard Savings

The Smart Investor Savings Accounts Comparison Methodology

The Smart Investor team has conducted a comprehensive comparison of savings accounts, analyzing each based on these critical categories to help you decide where to entrust your savings.

- Savings Rates: The savings rates category delves into the interest rates offered by each account, assessing their competitiveness in the market. Higher interest rates mean greater returns on your savings over time, providing a crucial incentive for account holders to choose one account over another. Additionally, we explore any promotional rates or conditions that may affect the account's overall value.

- Savings Features: We examine the features and benefits accompanying each savings account. From account minimums and fees to accessibility through online and mobile banking platforms, these features can significantly impact the convenience and utility of the account for account holders. We also consider perks like overdraft protection, automatic savings plans, and rewards programs.

- Customer Experience: A positive customer experience is paramount in banking, and we evaluate each institution's performance in this area. This includes aspects such as the ease of account opening, quality of customer service, availability of support channels, and overall user satisfaction on platforms such as Trust Pilot and JD Power ranking.

- Bank Reputation: The bank's reputation carries weight in the decision-making process. Factors such as financial stability, regulatory compliance, and public perception contribute to the overall trustworthiness and reliability of the institution.