Table Of Content

When Bank of America Wins?

Bank of America has a comprehensive line of banking products. There are a variety of credit cards, different checking and savings accounts, home loans, investments, and auto loans.

Bank of America can be a better choice than US Bank if:

You want a massive choice of credit card options

You are happy to become a Preferred Rewards member to access higher savings rates

You want a discount on your mortgage fees

When US Bank Wins?

US Bank has an even more impressive banking product line. There is a variety of saving and checking account options, investments, personal loans, mortgage products, and wealth management.

This means that either bank will make it easier to switch from your current bank, as you should have access to all the products you would expect and need.

Open a bank account on US can be a better choice than Bank of America if:

You want better CD rates

You are looking for personal loans

You want lower account maintenance fees

Bank of America | US Bank | |

|---|---|---|

Savings Accounts | ||

Checking Accounts | ||

CDs | ||

Money Market Account | ||

Debit Card | ||

Credit Cards | ||

Personal Loans | ||

Mortgage | ||

Government Mortgage | ||

Business Loans | ||

Investing Capabilities |

Savings Account

Bank of America has a conventional savings account that pays 0.01% to 0.04% interest depending on your Preferred Rewards status. If you’re a Preferred Rewards member with a higher savings account balance, you’ll be able to access the higher rates.

Bank of America | US Bank | |

|---|---|---|

APY | 0.01% – 0.04% | up to 3.00 %

|

Fees | $8 per month

Can be waived by maintaining a balance of $500+, becoming a Preferred Rewards member or linking to your B of A Advantage Banking account. Fees are also waived for enrolled students aged under 24

| $4

can be waived by $300+ daily ledger balance or $1,000 average monthly balance

|

Minimum Deposit | $100 | $25 |

Checking Needed? | No | No |

Main Benefits |

|

|

While US Bank has several savings account options, if you’re purely looking at the base savings account, Bank of America has a far higher potential rate.

Both savings accounts have a maintenance fee that can be waived, but the US Bank’s fee is far lower, just in case you slip up and fail to meet the waiver requirements in the odd month or two. However, you do need a minimum deposit of $25 to open the account.

Checking Account

Neither bank’s checking account is interest bearing, but both accounts have a maintenance fee. While US Bank’s fee is far lower, you will need to receive more in direct deposits to have the fee waived.

Bank of America | US Bank | |

|---|---|---|

APY | 0.01% – 0.02% | 0.001% – 0.005% |

Fees | $12

can be waived by maintaining an account balance of $1,500, qualifying deposit of $250+ per month or enrol in Preferred Rewards

| $6.95

Can be waived by maintaining an average account balance of $1,500, have $1,000+ in direct deposits per month or be aged 65+

|

Minimum Deposit | $25 – $100 | $25 |

Main Benefits |

|

|

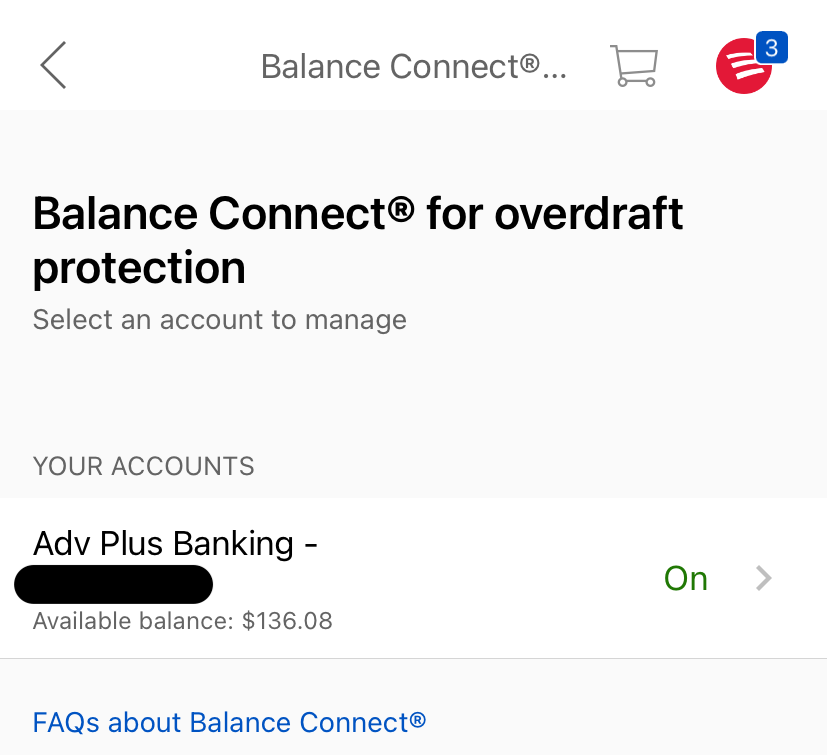

Both accounts have overdraft protection options.

However, while US Bank allows you to link a deposit account and have fee free transfers if you have insufficient funds, Bank of America has multiple options, so you can decide how the bank handles your transactions if you slip into a negative balance.

While it may lack features, US Bank does have a number of checking account options, so you can choose an account that suits your preferences and requirements.

CDs

Both Bank of America and US Bank have minimum deposit requirements of $1,000, but while Bank of America has a flat rate of 0.03%, US Bank has special CD rates with the potential to earn up to 0.75%. The rates are tiered, so you’ll gain access to better rates if you commit to a longer term CD.

Bank of America | US Bank | |

|---|---|---|

Minimum Deposit | $1,000 | $500 |

APY Range | 0.03% – 3.75%

| 0.05% – 3.75%

|

Credit Cards

Bank of America has a vast choice of credit cards. There are student cards for those in full time education and a secured card to build credit while earning rewards.

Card | Rewards | Bonus | Annual Fee |

| Bank of America® Customized Cash Rewards credit card

| 1-3%

3% cash back in the category of your choice: gas, online shopping, dining, travel, drug stores, or home improvement/furnishings, 2% cash back at grocery stores and wholesale clubs and 1% cash back on all other purchases. The 3% and 2% cash back available on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter (then 1%)

| $200

$200 cash rewards bonus after making at least $1,000 in purchases in the first 90 days of your account opening

| $0 |

|---|---|---|---|---|

| Bank of America® Travel Rewards credit card | 1.5X

1.5 points for every $1 you spend on all purchases everywhere, every time and no expiration on points

| 25,000 points

25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening – which can be redeemed for a $250 statement credit toward travel purchases

| $0 |

| BankAmericard® credit card | N/A |

N/A

N/A

| $0 |

| Bank of America® Premium Rewards® credit card | 1.5X – 2X

Unlimited 2X points on travel and dining purchases. Unlimited 1.5X points on all other purchases

|

60,000 points

60,000 online bonus points after spending $4,000 on purchases in the first 90 days. | $95 |

| Bank of America Unlimited Cash Rewards credit card | 1.5%

unlimited 1.5% cash back on all purchases

|

$200

$200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

| $95 |

| Bank of America® Premium Rewards® Elite | 1.5x – 2x

2 points for every dollar you spend on travel or dining purchases, with 1.5 points per dollar on all your other purchases | 75,000 points

75,000 bonus points if you spend $5,000 or more within 90 days of opening your account

| $550 |

The bank also has partnership cards with brands such as Amtrak, Always, Alaska Airlines, and Free Spirit.

US Bank also has a number of credit card options, which you can explore with search categories such as cash back, no annual fee, low intro rate, or credit building.

Mortgage

Bank of America has a selection of mortgage products including fixed rate and ARM packages, FHA and VA loans, and home equity lines of credit. You can explore the options on the Bank of America website with a variety of calculators and tools that will help you to estimate your costs.

Additionally, Preferred Rewards members can qualify for a discount of up to $600 towards mortgage origination fees.

US Bank has various home loan products. There are conventional fixed rate packages, FHA loans, and VA loans. Like Bank of America, US Bank has tools to guide you through the home buying process with payment calculators, blog posts, and FAQ support.

Loans

Bank of America does not have a conventional personal loan. However, you can access fee free auto loans. You can lock in your rate with a one minute application decision, making it easy to comparison shop.

US Bank has several loan options. There are conventional personal loans for up to $50,000, but you can also access home improvement loans. US Bank also offers simple loans for up to $1,000 if you have unexpected or unplanned expenses.

Customer Service

As a large bank, Bank of America does have a large customer service department. You can access live support 8 am to 9 pm ET Monday to Friday, at weekends 8 am to 8 pm on Saturday and 8 am to 5 pm on Sunday. You can also speak to the customer service team via the Bank of America website or social media channels.

US Bank has a toll free number to speak to a member of the customer service team. However, there is a comprehensive support section on the bank’s website to answer any common questions and access blog resources.

However, the ratings on Trustpilot are more of a mixed bag. While Bank of America has a fairly impressive 3.5 out of 5, US Bank has a poor 1.3/5.

Online/Digital Experience

Both banks have an app which allows you to manage your bank accounts at your convenience. The Bank of America’s app is rated 4.8/5 on the Apple Store and 4.6/5 on Google Play, while the US Bank App is rated 4.8/5 and 3.9/5 on Apple and Google respectively.

The bank’s websites are both easy to use, with some excellent learning resources. There is a comprehensive help section that allows you to explore all aspects of the bank’s products and finance in general, which creates an excellent digital experience.

Which Bank is The Winner?

To sum up, we’ll need to look at which bank is better, depending on what you’re looking for.

Both banks have some excellent products, but there are some differences. For example, Bank of America Preferred Rewards customers can gain access to higher savings rates, but US Bank does have more saving account options.

However, in terms of CDs, US Bank offers far better rates with its Special CDs. Additionally, US Bank allows access to personal loans, which are not available with Bank of America.

FAQs

What are US Bank promotions for new accounts?

US Bank promotions are focused on both bank accounts and credit cards. For example, as of {month_year], you can get up to

Does Bank of America offer Bonuses for new accounts?

Yes, Bank of America bonuses for new accounts are relevant for business and personal accounts. For example, the Advantage Banking Account offers new accounts a $300 bonus as of November 2025.

What Does Bank of America offer for Bad Credit?

At first glance, it doesn’t look like Bank of America has products designed for those with bad credit. While there are basic checking accounts and savings tools, one of the best products is the Customized Cash Rewards Secured credit card.

This card allows you to earn up to 3% cash back while strengthening or building your credit. You can use a refundable deposit of up to $4,900, along with your income and ability to pay to establish a credit line. Bank of America will review your account periodically and you may qualify for the return of your security deposit.

What US Bank products are inflation proof?

As with most banks, savings and deposit accounts are not particularly inflation proof.

However, US Bank does have a number of lending products that allow you to lock in your rate for the duration of your loan term. This means that your monthly repayments are set when you open your loan account, whether this is a mortgage, car loan or personal loan.

So, even if the rate of inflation, and consequently interest rates, go up, you don’t need to worry about your financing costs also increasing

How's US Bank physical coverage?

US Bank has decent coverage with over 3,100 branches across the USA. These branches are primarily in the Midwest and Western states. The bank also has an ATM network with 4,800 machines.

What is required to open a US Bank account?

As with most banks, you will need to provide personal and financial details to open a US Bank account. This will include a valid home address, your Social Security number, and contact information. It is important that you can verify your identity, as US Bank needs to comply with federal regulations.

The Smart Investor Banking Comparison Methodology

In our detailed comparison, The Smart Investor team thoroughly looked in five main areas:

Checking Accounts (30%): We checked things like direct deposit, debit card availability, monthly fees, ATM and branch access, check deposit, bill pay options, and account alerts. We also considered any special offers for customers.

Savings Accounts including CDs (20%): We focused on important stuff like how much interest you can earn (APY), the smallest amount you need to open an account, how flexible the accounts are, and if they're insured by FDIC. We also looked at special savings offers, different types of CDs, and any fees for taking money out early.

Credit Cards (15%): We looked at what rewards you get, how much the card costs each year, any bonuses you get for signing up, perks for traveling, how much interest you pay on balances, and if you can transfer balances from other cards.

Lending Options (15%): We checked out the different kinds of loans they offer, like personal loans, student loans, mortgages, and loans where you use your home as collateral.

Customer Experience And Bank Reputation (20%): We looked into how easy it is to use their online and mobile banking, how helpful their customer support is, what people say about them online, any awards they've won, and how stable they are financially. This gave us a good idea of what it's like to be a customer and how much people trust them.

Compare BofA With Alternative Banks

Since its inception as a credit card provider, Discover has come a long way.Of course, credit cards are available, but you can also get home loans, personal loans, and a variety of checking and savings products such as retirement accounts, CDs, and money market accounts.

Bank of America offers a far more comprehensive range of banking services. There are numerous credit card options, as well as various savings and checking accounts.

Bank of America also provides mortgages, auto loans, and investments. This makes switching from a traditional bank much easier because you won't have to compromise on your banking products.

Read Full Comparison: Discover vs Bank of America: Compare Bank

Bank of America is a nationwide network that offers deposit, loan, and credit card services. There are also increased daily limits on ATM and debit purchases, which is an excellent incentive to improve your financial situation. Aspiration's company was presented in a very different manner than their bank competitors.

One feature that sets them apart from their competitors is that they let their customers decide how much they want to pay for their services. The fee that the customer believes is fair or appropriate for the level of service they receive is set by the customer.

Wells Fargo's product offering is even more extensive. This bank offers checking accounts, a variety of savings accounts, mortgages, loans, and investment options such as IRAs, 401ks, and wealth management services. This makes switching from another bank even easier because you'll have access to all of your favorite banking products.

Bank of America offers a diverse range of banking services. Checking and savings accounts, auto loans, home loans, credit cards, and investment options are all available.

Read Full Comparison: Bank of America vs Wells Fargo: Which Bank Is Better?

Bank of America has an impressive line of banking products, as one would expect from a large banking institution. Aside from various checking and savings accounts, there are auto loans, home loans, a variety of credit cards, and investment options. This makes switching from your current bank easier because you'll find many familiar products.

Chase also has a good selection of banking products. There are checking and savings accounts, auto loans, home loans, and home equity options, as well as a fantastic selection of credit cards.

Read Full Comparison: Bank of America vs Chase: Where to Save Your Money?

Bank of America is a large banking institution, and its impressive banking product line reflects this. Aside from savings and checking accounts, there are home loans, auto loans, investment options, and a variety of credit cards. Citi also has a diverse product offering. Credit cards, CDs, personal loans, mortgages, IRAs, investment options, wealth management plans, and checking and savings accounts are all available.

As a result, if you want to switch from your current bank, either bank is a viable option because you won't have to make any compromises in terms of banking products.

Read Full Comparison: Bank of America vs Citi: Which Bank Suits You Best?

Spend and Save is a SoFi savings and checking account hybrid. For the purposes of this comparison, we'll look at the savings features, of which there are a few. The most visible are the savings vaults. These enable you to set up separate funds to work toward different savings goals without the need for multiple accounts. This helps you organize your money, and you can even designate a vault for your round-up funds.

Bank of America offers a more traditional savings account, but it pays far less interest, ranging from 0.01 percent to 0.04 percent depending on your Preferred Rewards status, compared to SoFi's 0.25 percent. In addition, there is a $8 monthly maintenance fee that can be waived by keeping a balance of $500 or more in the account or linking your checking account. By linking your accounts, you can avoid going overdrawn with Balance Connect.

Read Full Comparison: SoFi Money vs Bank of America: Which Is Better For Your Needs?

Both banks have a decent selection of banking products, but there are some gaps in each line up. If you’re looking for the best returns, Capital One does have the edge in terms of CD and savings rates.

There is no clear winner as to whether Truist Bank or Bank of America is a better choice, but we prefer the latter. Here's why.

Truist Bank vs. Bank Of America: Which Bank Account Is Better?

Bank of America and PNC Bank offer various banking products, but which is a better fit for you? Let's compare and see our winner: PNC Bank vs. Bank Of America

We'll explore Bank Of America and TD Bank savings accounts, checking accounts, CDs, credit cards, and lending products. Here's our winner: TD Bank vs. Bank Of America

BMO is the winner when it comes to savings products, while Bank Of America offers many more credit card options. Here's our winner: Bank of America vs. BMO Bank

There is no clear-cut winner, but we prefer Bank Of America. But, there are cases when Citizens is best. Here's our comparison: Bank of America vs. Citizens Bank

While Bank of America and Fifth Third Bank offer a range of banking services, Fifth Third is our winner in this competition. Here's why.

Bank of America vs. Fifth Third Bank: Which Bank Account Is Better?

We'll explore Bank of America and M&T Bank savings accounts, checking accounts, CDs, credit cards, and lending products. Here's our winner: Bank of America vs. M&T Bank

We believe Bank Of America is the preferred option in this battle. But, there are significant differences to know. Here's our comparison: Bank of America vs. KeyBank

While Regions Bank offers better checking accounts, Bank of America wins in credit cards and CDs. Here's our side by side comparison: Regions Bank vs. Bank of America

If you feel comfortable with online-only banking and depending on your needs – Ally may be a better option than Bank Of America. Here's why.

Ally Bank vs. Bank of America: Which Bank Account Is Better?

For most consumers, Bank of America may be a better option. American Express is a solid option for customers with higher wealth. Here's why.

American Express Bank vs. Bank of America: Which Bank Account Is Better?

Banking Reviews

Aspiration Review

Alliant Credit Union Review