If you're living in North Carolina and searching for the best bank, you have numerous options to choose from. There are plenty of choices, ranging from small local banks to larger ones that serve wider areas, including national banks, and the convenience of online banks.

To find the perfect bank, we took a close look at several crucial factors. We considered the number of physical branches they have, the range of products they offer, the interest rates they provide for deposits, the quality of their online banking services, and the level of customer service and support they offer.

Best North Carolina Regional Banks

Here are our top picks for regional and community banks in North Carolina:

Truist Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

Truist Bank, formed from the merger of BB&T and SunTrust in 2019, is a leading financial institution offering a diverse range of financial solutions for both individuals and businesses. With over 270 branches spread across 165 cities in North Carolina, Truist ensures convenient accessibility to its customers nationwide.

Their services include various account options such as savings and checking accounts, CDs, and a money market account. Additionally, they provide around 3,000 ATMs with low fees that are easy to avoid.

However, it's important to note that while Truist Bank offers widespread accessibility and convenience, the interest rates on their savings and money market accounts may not be as competitive as other alternatives available in the market. Therefore, it may be prudent to explore other options when managing your savings.

First Citizen Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

At First Citizens Bank, you'll find a wide variety of checking and savings accounts tailored to suit your needs, with options ranging from free accounts to interest-earning ones, all accompanied by unique benefits.

Moreover, the bank offers an impressive array of banking products, including special CDs that come with flexible terms. Boasting an extensive network, they have over 190 branches spread across 120 cities in North Carolina, ensuring convenient access for their customers. The highly-rated mobile app available for iOS and Android has been praised by users for its functionality and ease of use.

However, some customers have noted that the yields on CDs, savings, and money market accounts are not as competitive as they would like. Additionally, certain account holders may encounter challenges in waiving monthly service fees, and those with savings accounts are limited to two free withdrawals or transfers per month.

First Horizon Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

First Horizon Bank is a regional bank that serves people in North Carolina through almost 20 branches in 10 cities. However, it has fewer branches compared to other banks in our list.

They have many personal banking products like checking, savings, money market accounts, and CDs. Some of these accounts have monthly fees, but there are ways to avoid them. They also offer other services like auto loans, mortgage loans, and credit cards.

If you live in North Carolina and want a bank with flexible checking options and don't need a lot of money to start, First Horizon could be a good choice. But if you want higher interest rates for your savings or prefer accounts without fees, you might want to look at other banks.

Best North Carolina National Banks

We conducted a thorough analysis of numerous top banks in North Carolina, meticulously comparing their critical attributes.

Our research commenced with an examination of the distribution and geographical reach of their branches. Additionally, we scrupulously scrutinized the wide array of products and services they provide.

Bank Of America

Checking Fees

Checking Promotion

Savings APY

CDs APY

Bank of America stands as a prominent American financial institutionץ. With a presence of over 100 branches spread across 50 cities in North Carolina, customers can easily access a nearby branch.

The bank presents the convenience of both in-person and online banking options, ensuring smooth transactions for its clientele. Moreover, it frequently offers attractive promotions for checking accounts and provides competitive rates on promotional CDs, making their credit card rewards program alluring to cardholders.

Despite these advantages, there are some aspects to consider. Bank of America imposes fees, including overdraft fees, which might not be ideal for those seeking fee-free alternatives. Additionally, the interest rates on their savings accounts and certain loans may not be as competitive as those offered by other institutions.

PNC Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

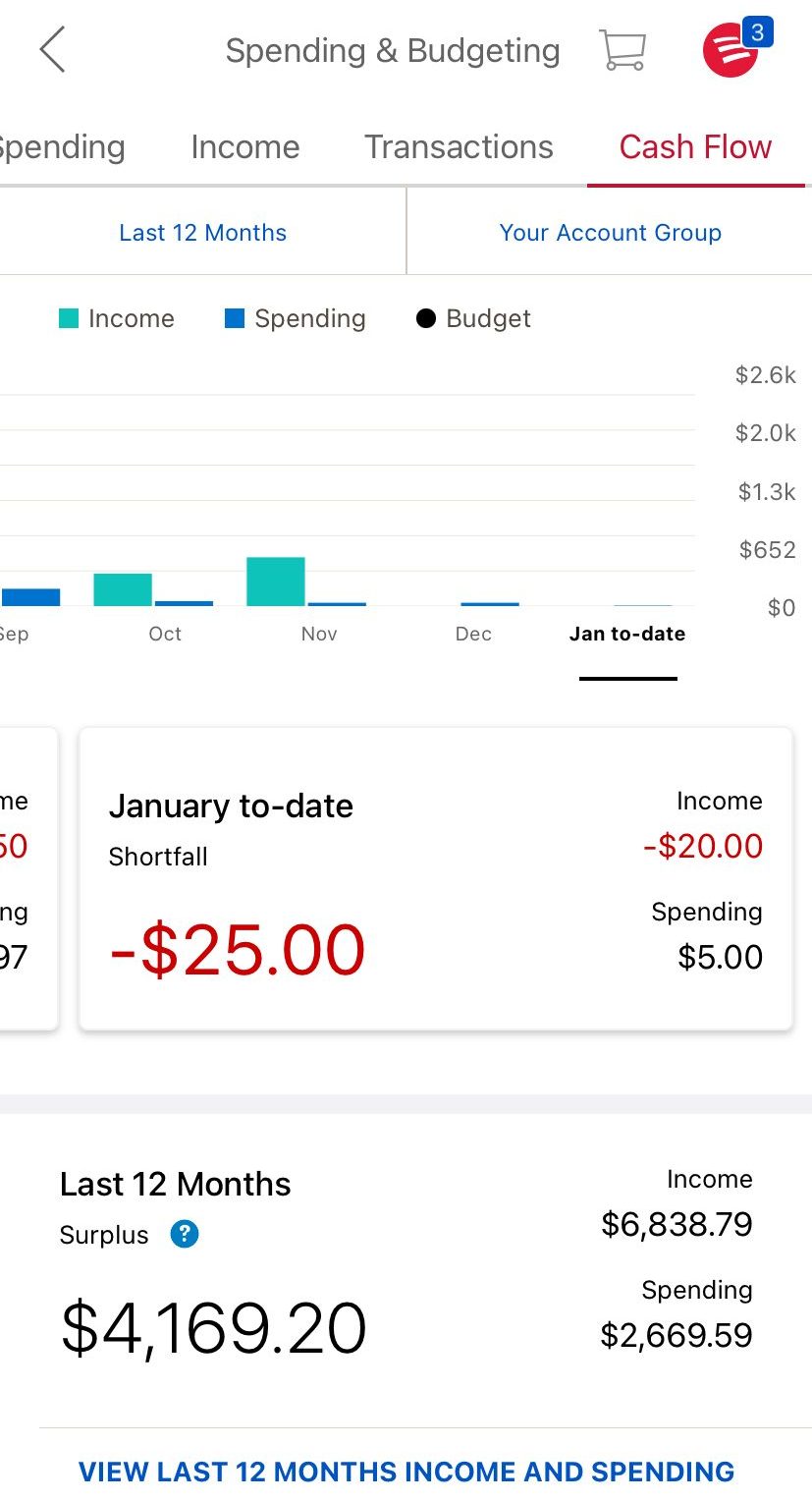

PNC Bank operates approximately 100 branches across 70 cities in North Carolina, providing accessible banking services through their Virtual Wallet Spend checking account, which offers convenient mobile and online banking with no bill payment fees. They also offer partial reimbursement for non-PNC ATM fees, although ATM owners may still impose separate charges.

The bank boasts several appealing features, such as a competitive interest rate for their online-only savings account, although availability may be restricted to specific states. Moreover, customers gain access to around 60,000 ATMs without incurring any fees.

However, there are some drawbacks to consider. PNC Bank imposes a relatively high overdraft fee of $36, one of the highest in the country. Opening a Certificate of Deposit (CD) mandates an in-person visit to a branch. Additionally, certain accounts may incur monthly fees, but these can be avoided by fulfilling specific requirements.

Wells Fargo Bank

Checking Fees

Promotion

Savings APY

CDs APY

Wells Fargo is one of the biggest bank in the US, with over 200 branches spread across 95 cities in North Carolina. They offer lots of different financial products and have ATMs all around for easy access.

People really like their checking account because they don't charge you if you don't have enough money, and their customer service is available 24/7 if you need help. They also have ATMs all over the country that you can use for free, and they can get your direct deposits to you early.

Best North Carolina Online Banks

When we were looking for online banks in North Carolina, we mainly focused on comparing how much interest they offer for savings accounts and CDs. We also wanted to find out if these banks offer other services like checking accounts, loans, credit cards, and mortgages.

Discover Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

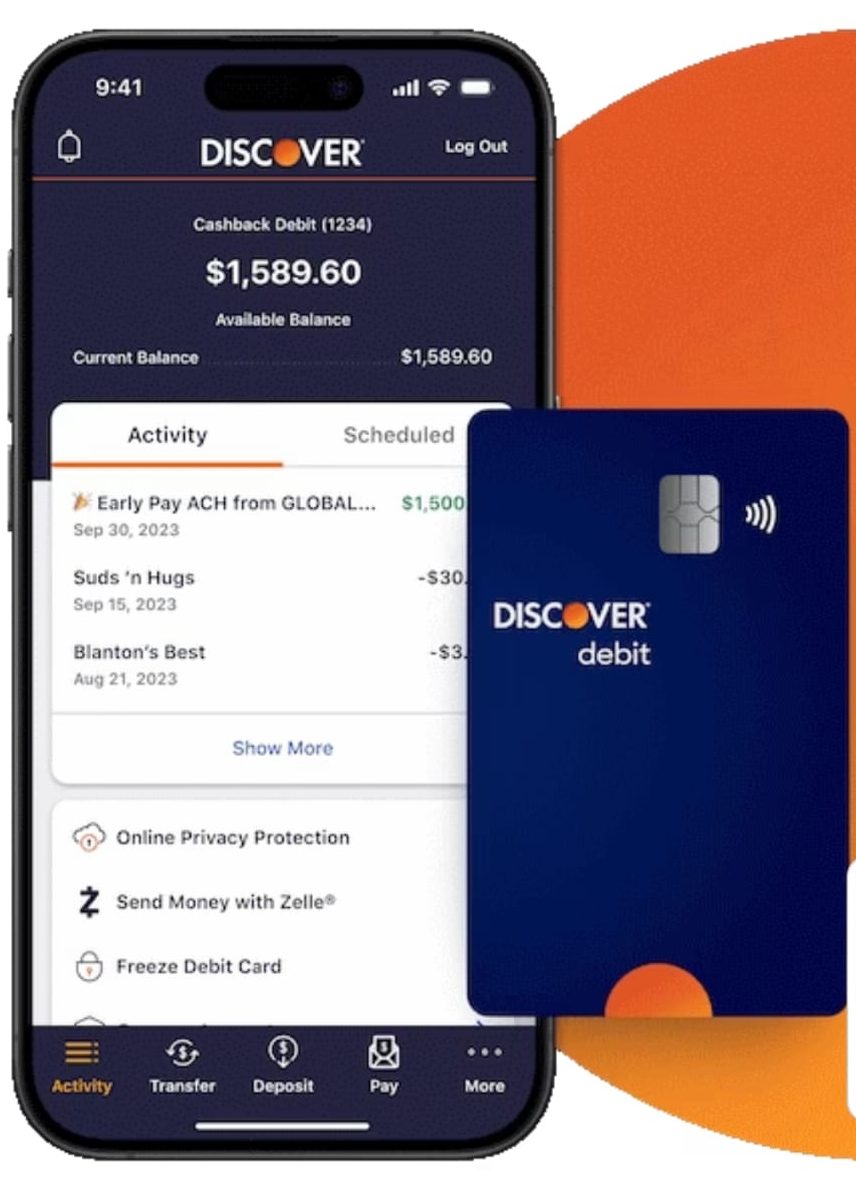

Discover Bank is a well-liked online bank that provides different financial services like savings accounts, credit cards, personal loans, and student loans. Unlike regular banks with physical branches, it operates entirely on the internet. To make up for this, they give customers access to a huge network of over 415,000 ATMs all over the country.

They have some awesome perks for their customers. You can use over 60,000 ATMs without paying extra fees, get money back on debit card purchases, apply to one of the Discover credit cards, and avoid monthly maintenance, insufficient funds, and overdraft fees. They also offer competitive interest rates on savings and CD accounts.

The downside is that they don't have physical branches for face-to-face banking. So, if you prefer dealing with bank staff in person, this might not be the best choice for you. Also, if you often use ATMs from other banks, Discover won't cover the fees, which could result in extra costs for you.

CIT Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

CIT Bank is an online bank that offers lots of financial products and services. They have different types of accounts like savings, checking, money market, and CDs. The best part is that they give really good interest rates on savings, and CIT CDs offer a variety of options, including no-penalty CDs.

Another great thing about CIT Bank is that they don't charge any monthly fees, so you won't have to pay extra just to keep your account. This makes it perfect for people who want to save money and do their banking without any hassles.

Keep in mind, though, that CIT Bank doesn't have physical branches, so you'll do all your banking online or at ATMs. If you like the idea of easy banking, earning more with high interest rates, and no fees, then CIT Bank is a great choice for you.

FAQs

What are the largest banks in North Carolina?

As of 2025, North Carolina is dominated by Truist Bank, Wells Fargo Bank, and First Citizens Bank, with each of them operating an extensive network of over 200 branches.

What's the top bank in North Carolina?

Picking the top bank in North Carolina depends on your needs – in-person service, high savings and CD rates, or no-fee checking accounts. Take a look at our suggested banks above, each with its specialty.

Which North Carolina bank has the best CD interest rates?

North Carolina's best CD rates change depending on the term. Some banks excel with 1-year rates, while others shine with 6-month rates. Explore our North Carolina top CD offers and compare them with credit unions.

Which bank has the best savings rates in North Carolina?

Finding the best savings rates may seem hard, but there are great options in North Carolina. Take a look at our list of some of the best performers for high savings rates in North Carolina in 2025.

Best Bank In North Carolina: Research Methodology

The Smart Investor team conducted an extensive review to identify the best banks in North Carolina. We assessed them based on four main categories, each with specific features:

- Financial Products and Services (40%): We evaluated the range and quality of financial products and services offered by each bank, including checking accounts, savings accounts, CDs, loans, credit cards, and investment options. Banks offering a diverse array of financial products with competitive rates and terms received higher ratings in this category.

- Banking Features and Tools (30%): This category assessed the availability and functionality of banking features and tools, such as transfer options, the ability to set savings goals, account linking capabilities, mobile app usability, check deposit options, and other features important for banks. Banks offering a comprehensive suite of features and user-friendly tools earned higher scores.

- Customer Experience (20%): We closely examined the overall customer experience, including the ease of account opening, communication with customer service representatives, the usability of online banking platforms and mobile apps, and the responsiveness of customer support. Banks with user-friendly interfaces, efficient digital banking tools, and responsive customer service received higher ratings.

- Bank Reputation (10%): Our team analyzed each bank's reputation based on factors such as customer satisfaction ratings, JD Power scores, TrustPilot reviews, and any notable awards or recognitions received. Banks with positive reputations and a history of providing excellent service to customers in North Carolina received higher ratings.

Within each category, we assigned weights to various features and qualities to ensure a comprehensive evaluation of each bank.