Are you looking to grow your savings with a secure and reliable investment option? Certificate of Deposit (CD) accounts can be an excellent choice, providing a higher yield compared to traditional savings accounts.

However, some financial institutions often require a minimum deposit to open a CD, making it challenging for individuals with limited funds to access these lucrative options.

In this article, we unveil the best CD accounts that waive the minimum deposit requirement.

American Express National Bank

APY Range

Minimum Deposit

Terms

Fees

American Express strives to simplify the process of setting up a CD. Opening a new CD account with American Express is a quick and effortless task, taking only a few minutes. During the account setup, American Express will utilize public records to verify your personal information. There is no requirement for a minimum deposit, allowing you to open a CD with any amount you choose.

However, American Express does not offer Jumbo CDs or exclusive benefits for larger deposits. The interest rates for your CD are determined based on the chosen term. Also, Amex early withdrawal penalties are quite high compared to other CD accounts.

CD Term | APY | Early Withdrawal Penalty |

|---|---|---|

12 Months | 4.00% | 270 days interest |

18 Months | 3.25%

| 270 days interest |

24 Months | 4.00% | 270 days interest |

36 Months | 3.00% | 270 days interest |

48 Months | 3.00% | 365 days interest |

60 Months | 3.00% | 540 days interest |

If you are interested in CD laddering, American Express may not be the most suitable choice. The variations in interest rates between different CD terms are significant, and you may find higher rates on a limited number of terms compared to what other banks offer.

Barclays Bank

APY Range

Minimum Deposit

Terms

Fees

Barclays CDs consistently outperform many competitors, establishing themselves as top performers within the industry.

Interest on Barclays CDs is compounded daily and credited monthly, enhancing the growth potential of account holders' savings. Customers have the flexibility to withdraw their earned interest on a monthly basis, either to a Barclays savings account or an external bank account. Alternatively, they can choose to leave their CD's interest, further compounding it.

CD Term | APY |

|---|---|

12 Months | 5.00% |

18 Months | 4.50%

|

24 Months | 4.00% |

36 Months | 3.50% |

48 Months | 3.50% |

60 Months | 3.75% |

Upon maturity of a CD, a generous 14-day grace period is provided to customers. During this period, they can opt to close their Barclays CD and withdraw the funds, renew it with a different term, or simply take no action and have it automatically renewed.

Barclays also facilitates the creation of a CD ladder, a strategy where multiple CDs are opened simultaneously with different maturity dates. This approach ensures a steady flow of funds over time.

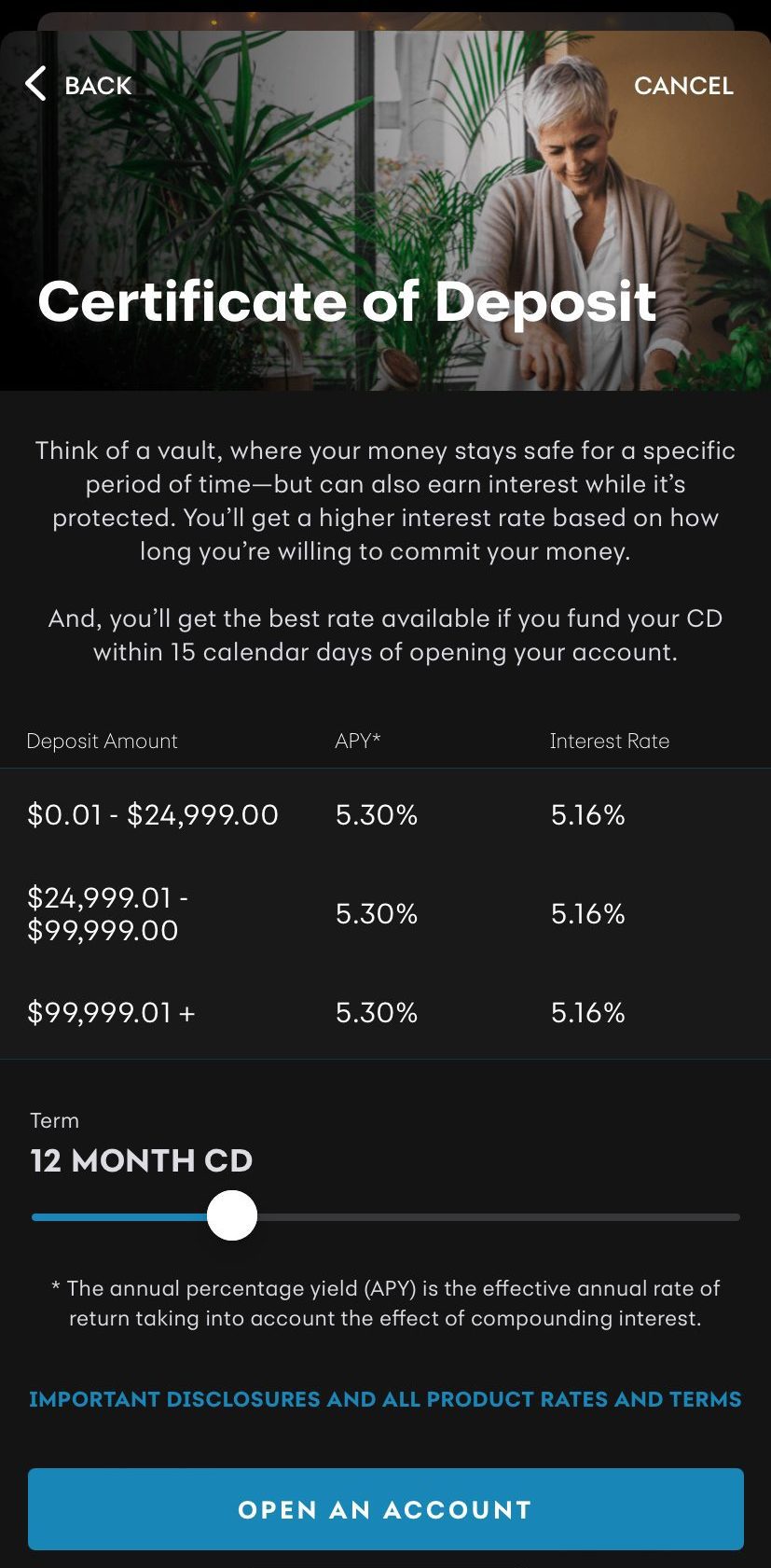

Capital One

APY Range

Minimum Deposit

Terms

Fees

Capital One provides a range of nine CD options, varying from six months to 60 months in duration. While they don't offer specialized CDs like no-penalty or bump-up CDs found with some online competitors, Capital One boasts highly competitive yields for an online bank.

After the maturity date of the CD, there is a 10-day grace period during which you can make withdrawals without incurring penalties.

CD Term | APY | Early Withdrawal Penalty |

|---|---|---|

6 Months | 4.35% | 3 months interest |

9 Months | 4.35% | 3 months interest |

12 Months | 4.90% | 3 months interest |

18 Months | 4.50%

| 6 months interest |

24 Months | 4.20% | 6 months interest |

30 Months | 4.10% | 6 months interest |

36 Months | 4.10% | 6 months interest |

48 Months | 4.05% | 6 months interest |

60 Months | 4.00% | 6 months interest |

Opening a Capital One CD can be done online, with the flexibility to deposit any desired amount.

Capital One offers a unique blend of physical branches (including cafés) available in select states, an extensive fee-free ATM network across the country, and a robust online platform complemented by top-rated mobile apps and dedicated Twitter assistance.

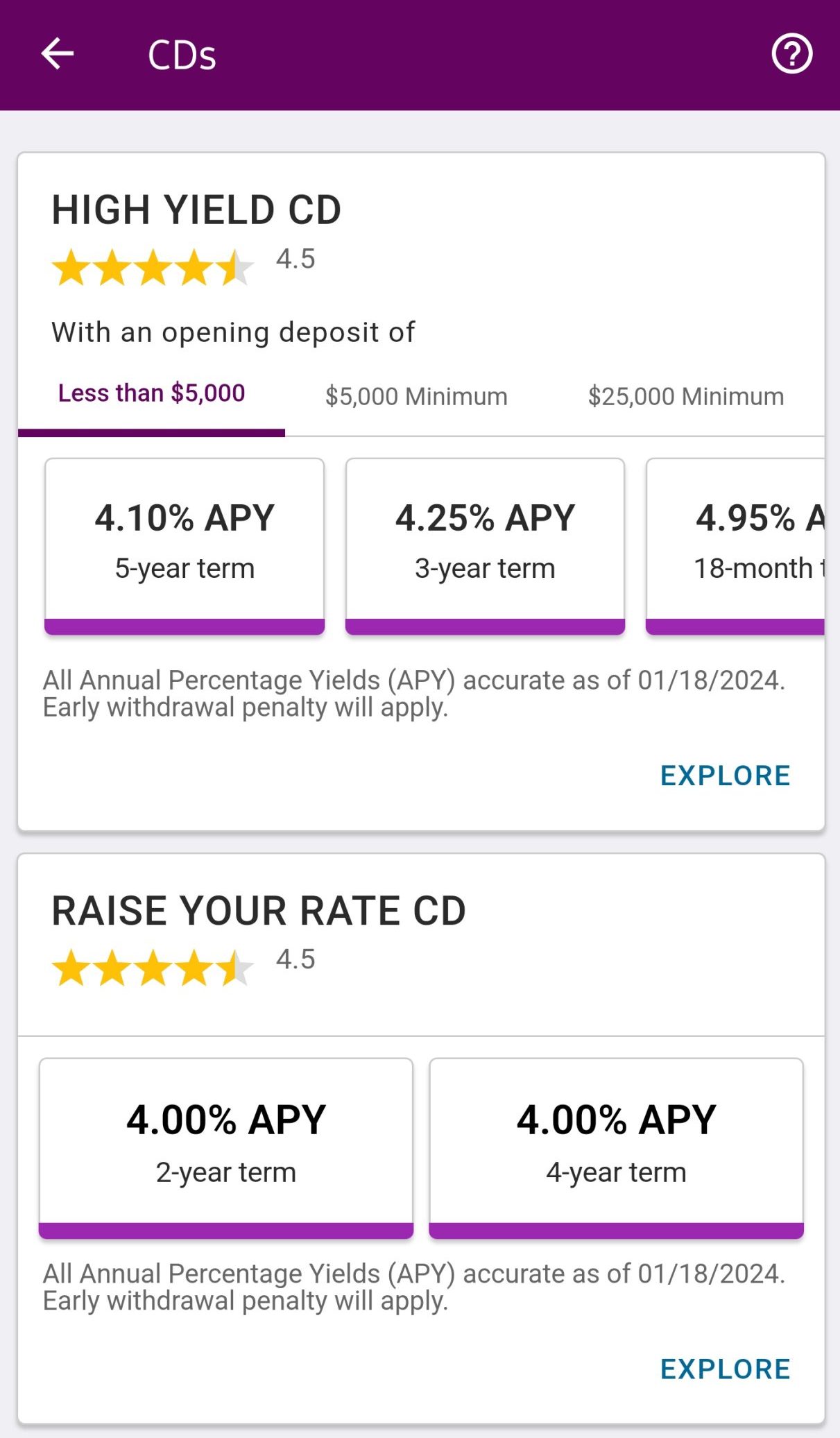

Ally Bank

APY Range

Minimum Deposit

Terms

Fees

Ally Bank provides an opportunity to invest in high-yield CDs that come with competitive rates and no minimum deposit requirement. The interest on these CDs compounds on a daily basis and can either be credited to your account annually or at the time of maturity, depending on the length of your chosen term.

Ally offers a range of CDs, each with its own distinctive features. The High Yield CD guarantees fixed rates but incurs penalties for early withdrawals. With the “Raise Your Rate CD,” you have the flexibility to increase your interest rate if Ally decides to raise rates for new CDs of the same term. The No-penalty CDs allow you to withdraw the full amount without any penalties after a six-day period. You can open an Ally CD account online.

CD Term | APY |

|---|---|

3 Months | 3.00% |

6 Months | 4.40% |

9 Months | 4.45% |

12 Months | 4.50% |

11 Months – No Penalty | 4.00%

|

36 Months | 4.00% |

60 Months | 3.90% |

When your Ally Bank High Yield CD matures, you have a 10-day grace period to withdraw your funds without any charges. To plan ahead, you can schedule a transfer before maturity to move your funds to another Ally account or an external bank account. Ally will automatically renew the CD at the current APY if no action is taken.

It's important to note that, like most banks, Ally Bank applies penalties for early withdrawals before the CD reaches maturity. The early withdrawal penalties for Ally CDs range from 60 days' interest to 150 days' interest, depending on the specific term of your CD.

Synchrony Bank

APY Range

Minimum Deposit

Terms

Fees

Synchrony Bank is an exclusively online financial institution that offers competitive rates on certificates of deposit (CDs). In addition to traditional CDs, Synchrony Bank provides two specialized CD options for savers seeking flexibility: bump-up CDs and no-penalty CDs.

By operating solely online, Synchrony Bank minimizes overhead costs associated with physical branches, allowing them to offer higher interest rates on savings and CD accounts.

CD Term | APY |

|---|---|

3 Months | 0.25% |

6 Months | 5.15% |

9 Months | 4.90% |

12 Months | 4.80% |

11 Months – No Penalty | 0.25% |

18 Months | 4.50% |

24 Months | 4.20% |

36 Months | 4.15% |

48 Months | 4.00% |

60 Months | 4.00% |

When it comes to maturity dates, Synchrony Bank offers a grace period of only 10 days. Within this timeframe, you have several options: you can add more funds to your account, renew your CD, transfer the funds to another account, or withdraw your money.

If no action is taken, Synchrony Bank will automatically renew the CD on your behalf at the end of the 10-day grace period and send you a renewal notice by mail.

Which One Is Best For My Needs?

To find the best CD account that suits your needs, you can follow these steps:

Determine Your Goals: Clarify your financial goals and needs. Consider factors such as the amount of money you want to invest, the length of time you can leave the funds untouched, and your expected returns. Understanding your goals will help you make a more targeted search.

Research Different Banks: Explore various banks and financial institutions that offer CD accounts. Look for well-established banks, credit unions, or online banks with good reputations and FDIC insured. Consider both local and national options.

Compare Interest Rates: Compare the interest rates offered by different banks for the specific CD term you are interested in. Look for the highest APY (annual percentage yield) as it indicates the effective interest rate considering compounding. Remember that longer-term CDs often have higher rates, but make sure the term aligns with your needs.

Assess Fees and Penalties: Review the fees associated with each CD account, including any maintenance fees or penalties for early withdrawal. Some banks may charge higher fees, which can impact your earnings or flexibility if you need to access the funds before maturity. Choose an account with reasonable fees or penalties.

Evaluate Customer Service: Consider the quality of customer service provided by the banks you are considering. Look for reviews, ratings, and feedback from existing customers to assess the bank's responsiveness, helpfulness, and overall customer satisfaction. Good customer service can be valuable when you have inquiries or need assistance.

Consider Special Features: Some banks offer additional features or benefits with their CD accounts. For example, they may provide a relationship bonus, or offer flexible renewal options. Evaluate these features and see if they align with your needs and preferences.

Sign Up for

Our Newsletter

FAQs

How can I maximize my earnings with CDs?

To maximize your earnings, compare interest rates, choose a suitable term length, reinvest the interest

How do I find more banks offering CDs with no minimum deposit?

The best thing to do is to search online, usually bank advertise this on their website. You can also use other comparison websites or CD comparison tool, or contact local banks and credit unions to inquire about their CD offerings without minimum deposit requirements.

Can I open multiple CDs with no minimum deposit?

Yes, you can open multiple CDs with no minimum deposit, allowing you to diversify your investments across different terms or banks based on your financial strategy.

What does "no minimum deposit" mean?

“No minimum deposit” indicates that you can open a CD account without being required to deposit a specific minimum amount of money. This enables you to open an account even if you have $200 or $300, which is less than required on most banks.