As interest rates rises, CDs have garnered considerable attention for their reliability and predictable returns.

If you're looking for a secure and low-risk investment option with guaranteed returns, CD rates offered by traditional banks can be an excellent choice.

In this article, we will explore the leading traditional banks that offer competitive CD rates, highlighting their terms, rates, and any additional features they may provide.

Wells Fargo 7-Month CD

APY

Minimum Deposit

Early Withdrawal Penalty

Fees

Wells Fargo offers a range of Certificate of Deposit (CD) options, including Special Fixed Rate CDs for a duration of 5 months.

While the standard rates are moderate, customers have the opportunity to earn a higher rate through the relationship rate.

To open a Wells Fargo standard CD, a minimum opening balance of $2,500 is required. However, for the special five-month CD, a higher minimum opening balance of $5,000 is necessary.

Interest on CDs at Wells Fargo is compounded daily and paid out on a monthly basis. Alternatively, customers have the flexibility to choose quarterly, semiannual, annual, or maturity-based interest payments.

With over 5,200 bank branches and more than 13,000 ATMs across the United States, Wells Fargo stands as one of the largest national banks in the country.

Apart from CDs, the bank offers comprehensive banking solutions, including various checking and savings products, catering to the needs of both individuals and businesses.

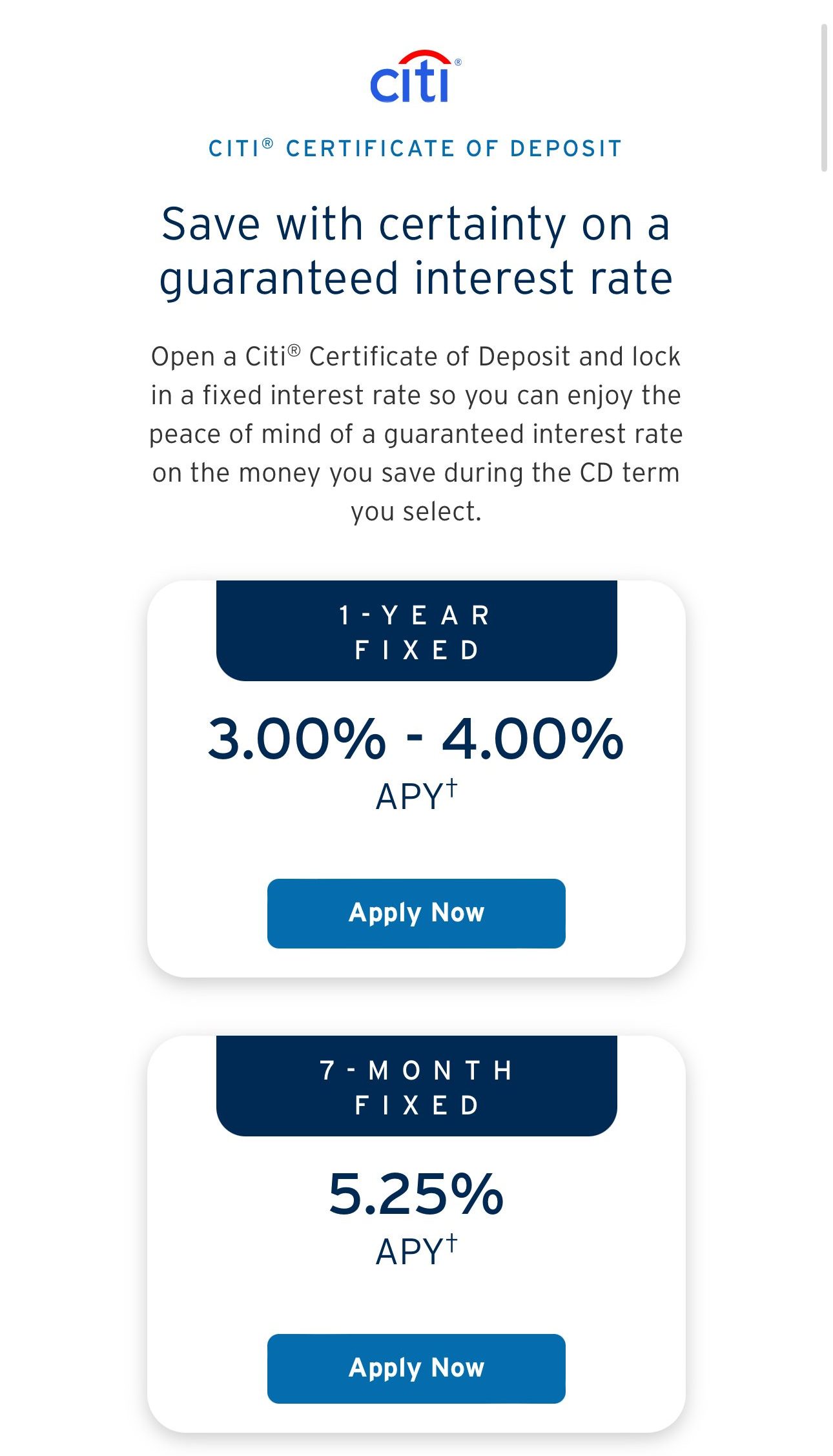

Citi 9-Month CD

APY Range

Minimum Deposit

Early Withdrawal Penalty

Fees

Citibank, one of the largest banks in the United States, provides its customers with a range of CD options, including fixed-rate and no-penalty CDs.

In a departure from the norm for brick-and-mortar banks, Citibank offers competitive rates on CDs spanning three months to five years.

In addition to these options, they offer two other types of CDs: Step Up and no penalty.

The step up CD offered by Citibank is a 30-month term CD that accrues interest at varying rates based on the specific period within the CD's duration. The interest rates are designed to increase over time.

Citibank employs a tiered approach to interest rates, where balances under $100,000 earn a lower Annual Percentage Yield (APY), while balances of $100,000 or more earn a higher APY.

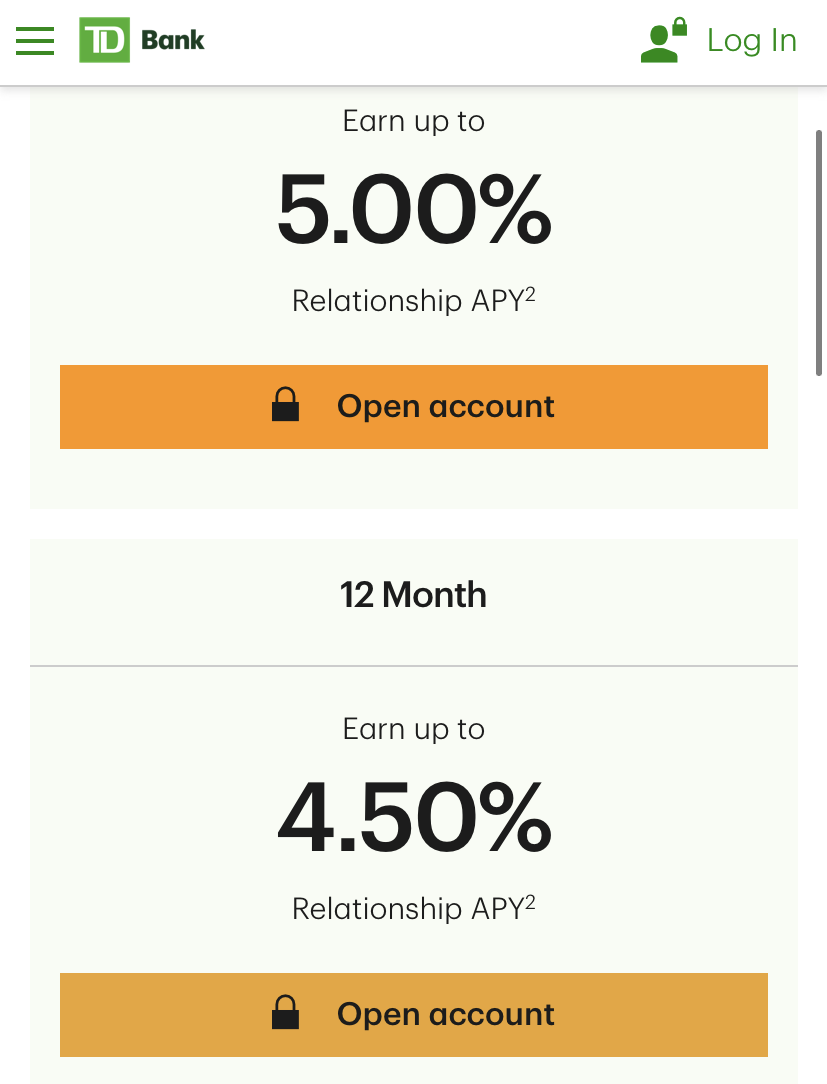

TD Bank 6-Month CD

APY Range

Minimum Deposit

Early Withdrawal Penalty

Fees

TD Bank offers a variety of CD options with different terms and interest rates, but only few of them offer high rates.

One of them is the 6-month CDs, which offers competitive rates for those who also have an eligible TD Checking account.

It's not required to have a TD Bank checking account to open one of the bank's CDs, but you do need a personal checking account to qualify for the highest APYs available with TD Bank’s Choice CD (to get the relationship bump rate).

TD Bank is a Canadian multinational banking and financial services corporation headquartered in Toronto, Ontario.

It is one of the largest banks in Canada and the United States, with operations in several other countries as well.

Bank of America 7-Month CD

APY Range

Minimum Deposit

Early Withdrawal Penalty

Fees

Bank of America is renowned for its wide range of banking services, encompassing checking, savings, and credit card accounts. In addition to these offerings, the institution also provides CDs.

However, it is important to note that Bank of America CD rates are typically not as enticing as other institutions offer.

Nevertheless, the rates can be quite competitive for specific durations like the 7-month term.

These particular CDs are referred to as “featured” CDs, tailored for individuals capable of making a higher initial deposit.

A minimum deposit of $1,000 is required to open an account, and various term options ranging from 7 to 37 months are available.

U.S. Bank 15-Month CD

APY Range

Minimum Deposit

Early Withdrawal Penalty

Fees

U.S. Bank provides a range of standard CD terms spanning from one month to 60 months, along with a reasonable minimum deposit requirement.

However, the returns on these standard CDs are comparatively low unless you opt for the CD Specials, which offer more favorable terms.

Additionally, US Bank offers CD Specials that necessitate a minimum deposit of $1,000 and feature shorter durations, such as 11, 15, and 19 months.

The interest rates for these promotional CDs significantly surpass those of the standard US Bank CDs and are among the highest in the nation.

Regrettably, US Bank's policy regarding early withdrawal penalties lacks transparency.

Although they state that a penalty is applicable for withdrawing funds before the maturity date, the official guidance from US Bank suggests contacting your local branch to obtain specific information regarding the fees and penalties that may apply to your account.

Chase 6-Month CD

APY Range

Minimum Deposit

Early Withdrawal Penalty

Fees

Chase, the largest bank in the United States, provides a diverse range of financial products, including CDs. Chase offers several CD terms, spanning from as short as one month to as long as ten years. CD accounts at Chase come with two types of rates: standard rates and relationship rates. The relationship rates are specifically designed for customers who have linked their Chase personal checking account.

Among the various CD terms offered by Chase, the 6-Month CDs provide the highest interest rate compared to others. A minimum deposit of $100,000 is required to avail of this highest rate. The interest on Chase CDs is compounded daily, and depending on the term of your CD, you have the option to have the interest applied to your account on a monthly, quarterly, semi-annual, annual, or at-maturity basis.

Is It A Good Idea To Deposit In Traditional Bank CDs?

In general, traditional banks tend to offer lower interest rates compared to those available at online banks. The higher rates offered by traditional banks are often limited to specific “special” terms rather than being consistently applicable across all CD terms.

Additionally, one potential drawback is that in many cases, you will be required to open a checking account at a traditional bank in order to deposit your funds into a CD account.

However, traditional bank CDs have some other benefits:

Physical Branches: Traditional banks have physical branch locations, which can be convenient for individuals who prefer in-person interactions and access to banking services.

Established Reputation: Traditional banks are typically well-known institutions with a track record of stability and reliability. As we saw in our banking survey, this is a very important factor for customers.

- Variety of terms: Traditional banks generally provide a wide range of CD terms.

Bottom line, if you already have an account – you may want to explore the CD options your bank offer. If you don't have one, you may want to take a look on online banks which usually offer higher rates on most terms

FAQs

Are the interest rates on traditional bank CDs fixed or variable?

Traditional bank CD rates are usually fixed for the duration of the term. This means the interest rate remains the same regardless of changes in the market.

What happens if the bank offering my traditional bank CD fails?

If the bank offering your traditional bank CD fails, your deposits are typically protected by FDIC insurance, up to the insurance limits.

What happens when a traditional bank CD matures?

When a traditional bank CD matures, you usually have a grace period during which you can withdraw the funds or roll over the CD into a new term. If no action is taken, the bank may automatically renew the CD.