Table Of Content

When Chase Bank Wins?

Chase has a fairly comprehensive banking product line to compete with conventional high street banks.

There are savings and checking accounts, home loans, auto loans, home equity options, and an impressive choice of credit card options.

Chase can be a better choice than PNC bank if:

You want a massive choice of credit card options

You want a welcome bonus

When PNC Bank Wins?

PNC has even more banking products. In addition to its PNC checking and saving accounts, you can access credit card options, home loans, mortgages, student loan refinancing and investment options.

PNC bank can be a better choice than Chase if:

You need a personal loan, line of credit or student loan refinancing

You want personal service

Chase Bank | PNC Bank | |

|---|---|---|

Savings Accounts | ||

Checking Accounts | ||

CDs | ||

Money Market Account | ||

Debit Card | ||

Credit Cards | ||

Personal Loans | ||

Mortgage | ||

Government Mortgage | ||

Business Loans | ||

Investing Capabilities |

Chase vs. PNC Bank: Savings Account

On the surface, the Chase and PNC savings accounts are quite similar. Both have a $5 maintenance fee that can be waived with similar criteria. Both accounts also have auto save features.

However, PNC does allow customers to earn higher rates according to their account balance and whether they link their savings account to a qualified PNC account.

Overall, both banks offers low rates compared to national average.

Chase Bank | PNC bank | |

|---|---|---|

APY | 0.01% | 0.01% – 0.03% |

Fees | $5 per month

Can be waived if you carry $300 account balance at the start of the month, $25+ autosave or linking a Chase checking account

| $0 |

Minimum Deposit | $25 | $0 |

Checking Needed? | No | No |

Main Benefits |

|

|

Chase vs. PNC Bank: Checking Account

Again, superficially, the Chase and PNC checking accounts appear similar. While the PNC monthly fee is lower at $7 compared to Chase’s $12, the waiver requirements are similar. However, Chase does have several checking account options, while PNC has just the one.

Chase Bank | PNC bank | |

|---|---|---|

APY | None | 2.25% – 2.55% |

Fees | $12 ($15, effective 8/24/2025)

Can be waived if you maintain a $1,500 minimum daily balance, making direct deposits or Associated SnapDeposits of $500 or more per statement cycle, or holding $5,000 in combined deposit accounts with the same statement cycle date or having a Health Savings Account or investment account

| $7 – $25 per month

can be waived if you maintain $500+/$2,000/$5,000 direct deposit per month, $500+/$2,000/$5,000 monthly balance in savings or age 62+/$10,000 in all PNC consumer deposit accounts/$25,000 in all PNC consumer deposit accounts/

|

Minimum Deposit | $0 | $0 |

Main Benefits |

|

|

While Chase offers new customers a welcome bonus, PNC has added some nice features to its checking account.

For example, you can select whether you want to pay or return an item if you have insufficient funds, and PNC allows you 24 hours to bring your account balance up to the required amount to avoid an overdrawn fee.

Chase vs. PNC Bank: CDs

This is an area where Chase has a clear edge. In addition to having no minimum deposit compared to PNC’s $1,000, Chase offers a bit better rates.

Chase Bank | PNC bank | |

|---|---|---|

Minimum Deposit | $1000 | $1 |

APY Range | 0.02% – 3.80%

| 0.01% – 3.90%

|

PNC vs. Chase Bank: Mortgage Options

Chase has a variety of mortgage products including fixed rate, ARM loans, FHA, and Jumbo loans. The bank allows prequalification to help speed up your home purchase. You can also purchase discount points whether you’re purchasing a home or refinancing.

PNC has packages for home purchase and refinancing. These include fixed rate, adjustable rate, FHA loans, VA loans, and Jumbo loans. You can also access specialized loans for situations such as 80-10-10. You can apply online and lock in your rate and save time by electronically verifying your financial details.

Loan Options

Chase does not have conventional personal loans. While you can access auto loans to finance a new or used vehicle, there are no unsecured loans.

PNC has lines of credit, auto loans, and personal loans of up to $20,000 with a fixed rate and no prepayment penalties.

PNC vs. Chase Bank: Credit Cards

Chase has a massive choice of 30+ credit card options. This includes 20+ Travel cards, 7 hotel cards, and 7 business cards.

Chase has partnered with United, Southwest, Avios, Hyatt, Amazon, Disney and Starbucks, so you can tailor your card rewards to your preferred brands.

The Chase Sapphire Preferred card has a $95 annual fee, but it offers 5x points on travel purchases and 25% more value when redeeming for airfare, hotels, car rentals, and cruises through Chase.

Chase also offers some intriguing cards, such as the Chase Freedom Flex. Each quarter you activate this card, you can earn .

Card | Rewards | Bonus | Annual Fee |

| Chase Sapphire Preferred® Card | 2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

| 75,000 points

75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening

| $95

|

|---|---|---|---|---|

| Chase Freedom Flex℠ Card | 1-5%

5% cash back on up to $1,500 in combined purchases on selected categories each quarter and 5% cash back on travel purchased through Chase Ultimate Rewards®. Also, you can earn 3% cash back on dining at restaurants (including takeout and eligible delivery services), drugstore purchases , and 1% on all other purchases

| $200

$200 bonus after you spend $500 on purchases in the first 3 months from account opening

| $0 |

| Chase Freedom Unlimited® | 1.5% – 5%

5% cash back on travel booked through Chase Ultimate Rewards, 3% on dining (including takeout and eligible delivery), 3% on drugstore purchases, and 1.5% on all other purchases

| $200

Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening.

| $0 |

| Chase Sapphire Reserve® | 1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

| Earn 125,000 points after you spend $6,000 in purchases in the first 3 months from account opening

Earn 125,000 points after you spend $6,000 in purchases in the first 3 months from account opening

| $550 |

| Marriott Bonvoy Boundless® Credit Card | 1x – 6X

6X points for every $1 spent at over 7,000 hotels participating in Marriott Bonvoy® with the Marriott Bonvoy Boundless® credit card. Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy® member. Plus, earn up to 1X point from Marriott with Silver Elite Status. Earn 3X points for every $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining. Earn 2X points for every $1 you spend on all other purchases.

| 125,000 Bonus Points

“Earn 125,000 Bonus Points + 1 Free Night Award

after spending $3,000 on eligible purchases within 3 months of account opening.* Each Free Night Award valued up to 50,000 points. Certain hotels have resort fees.”

| $95 |

| United Explorer Card | 1X – 2X

2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases

| 50,000 miles

Earn 60,000 bonus miles after qualifying purchases

| $95 ($0 first year) |

Card | Rewards | Bonus | Annual Fee | Chase Sapphire Preferred® | 2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

| 75,000 points

75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening

| $95

|

|---|---|---|---|

Chase Freedom Flex | 1-5%

5% cash back on up to $1,500 in combined purchases on selected categories each quarter and 5% cash back on travel purchased through Chase Ultimate Rewards®. Also, you can earn 3% cash back on dining at restaurants (including takeout and eligible delivery services), drugstore purchases , and 1% on all other purchases

| $200

$200 bonus after you spend $500 on purchases in the first 3 months from account opening

| $0 |

Chase Freedom Unlimited® | 1.5% – 5%

5% cash back on travel booked through Chase Ultimate Rewards, 3% on dining (including takeout and eligible delivery), 3% on drugstore purchases, and 1.5% on all other purchases

| $200

Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening.

| $0 |

Chase Sapphire Reserve® | 1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

| Earn 125,000 points after you spend $6,000 in purchases in the first 3 months from account opening

Earn 125,000 points after you spend $6,000 in purchases in the first 3 months from account opening

| $550 |

Marriott Bonvoy Boundless® | 1x – 6X

6X points for every $1 spent at over 7,000 hotels participating in Marriott Bonvoy® with the Marriott Bonvoy Boundless® credit card. Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy® member. Plus, earn up to 1X point from Marriott with Silver Elite Status. Earn 3X points for every $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining. Earn 2X points for every $1 you spend on all other purchases.

| 125,000 Bonus Points

“Earn 125,000 Bonus Points + 1 Free Night Award

after spending $3,000 on eligible purchases within 3 months of account opening.* Each Free Night Award valued up to 50,000 points. Certain hotels have resort fees.”

| $95 |

United Explorer Card | 1X – 2X

2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases

| 50,000 miles

Earn 60,000 bonus miles after qualifying purchases

| $95 ($0 first year) |

PNC has a decent choice of credit cards and currently, you can receive a $100 or 50,000 point bonus points if you sign up for a qualified card.

Card | Rewards | Bonus | Annual Fee |

| PNC Cash Unlimited Visa Signature Credit Card | 2%

unlimited 2% cash back on every purchase | 0% Intro APR: 12 billing cycles on purchases and balance transfers | $0 |

|---|---|---|---|---|

| PNC Cash Rewards Visa Credit Card | 1% – 4%

4% on Gas station purchases, 3% on Restaurant and 2% on Grocery store (for the first $8,000 in combined purchases in these three categories) and 1% cash back on all other purchases | $250

$200 cash back after you make $1,000 or more in purchases during the first 3 billing cycles following account opening | $0 |

| PNC points Visa Credit Card | 4x – 7x

4 points per $1 on purchases + 25% / 50% /75% bonus on all base points for PNC customers | 100,000 bonus points

Earn 100,000 bonus points after you have made at least $1,000 in purchases during the first 3 months following account opening. | $0 |

| PNC Core Visa Credit Card | N/A | 0% Intro APR: 15 billing cycles on purchases and balance transfers | $0 |

| PNC Secured Visa credit card | N/A | N/A | $0 |

One of the most popular PNC cards is the Cash Rewards Visa that has a tiered reward structure offering up to 4% cash back. There is also the Core card that offers 0% on purchases and balance transfers for the first 15 billing cycles.

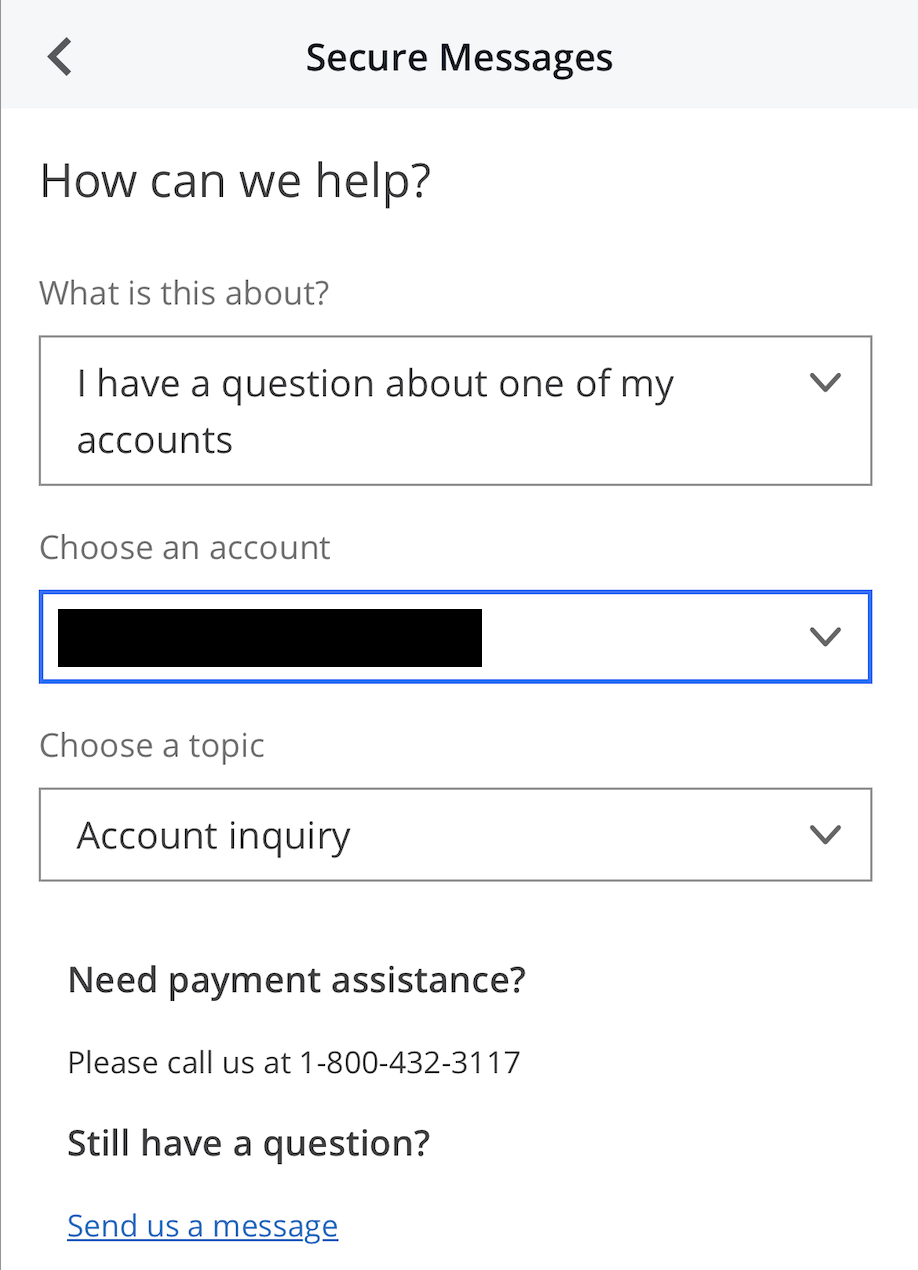

PNC vs. Chase Bank: Customer Service

Chase’s customer service system is quite comprehensive.

In addition to an in-depth help website page, there are customer service lines, Twitter and Facebook support 7 am to 11 pm ET on weekdays and 10 am to 7 pm ET on the weekends, or you can schedule a meeting with an agent in your local branch.

PNC also has a comprehensive customer service section on its website, with FAQs, how to videos, and product help. If you want to speak to an agent, there are toll free numbers that are typically available 7 am to 10 pm on weekdays and 8 am to 5 pm on the weekends.

Unfortunately, the levels of service are not confirmed by consumer ratings. Chase has a poor rating of 1.3 out of 5 on Trustpilot, while PNC has a bad 1.5 out of 5 rating.

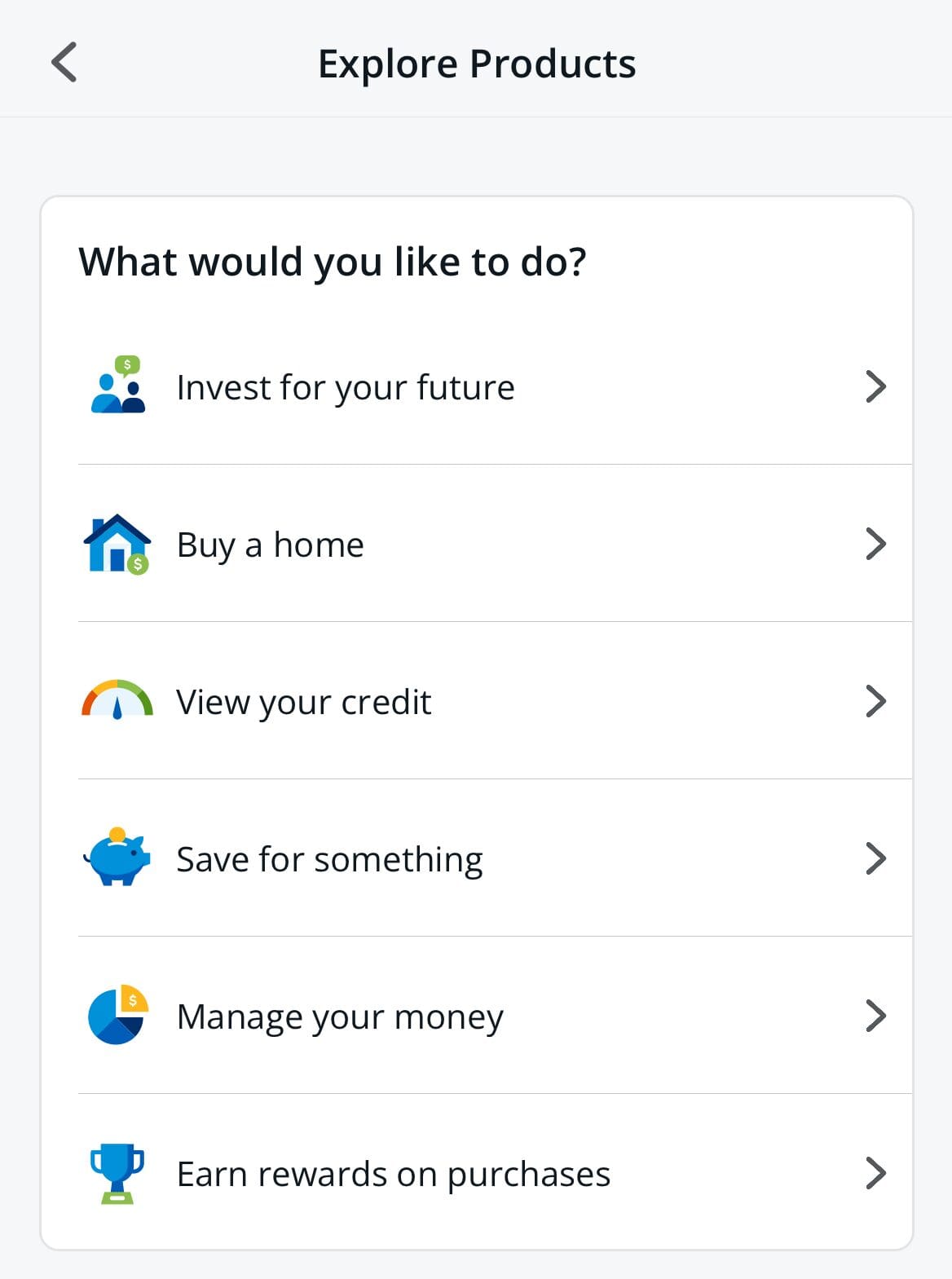

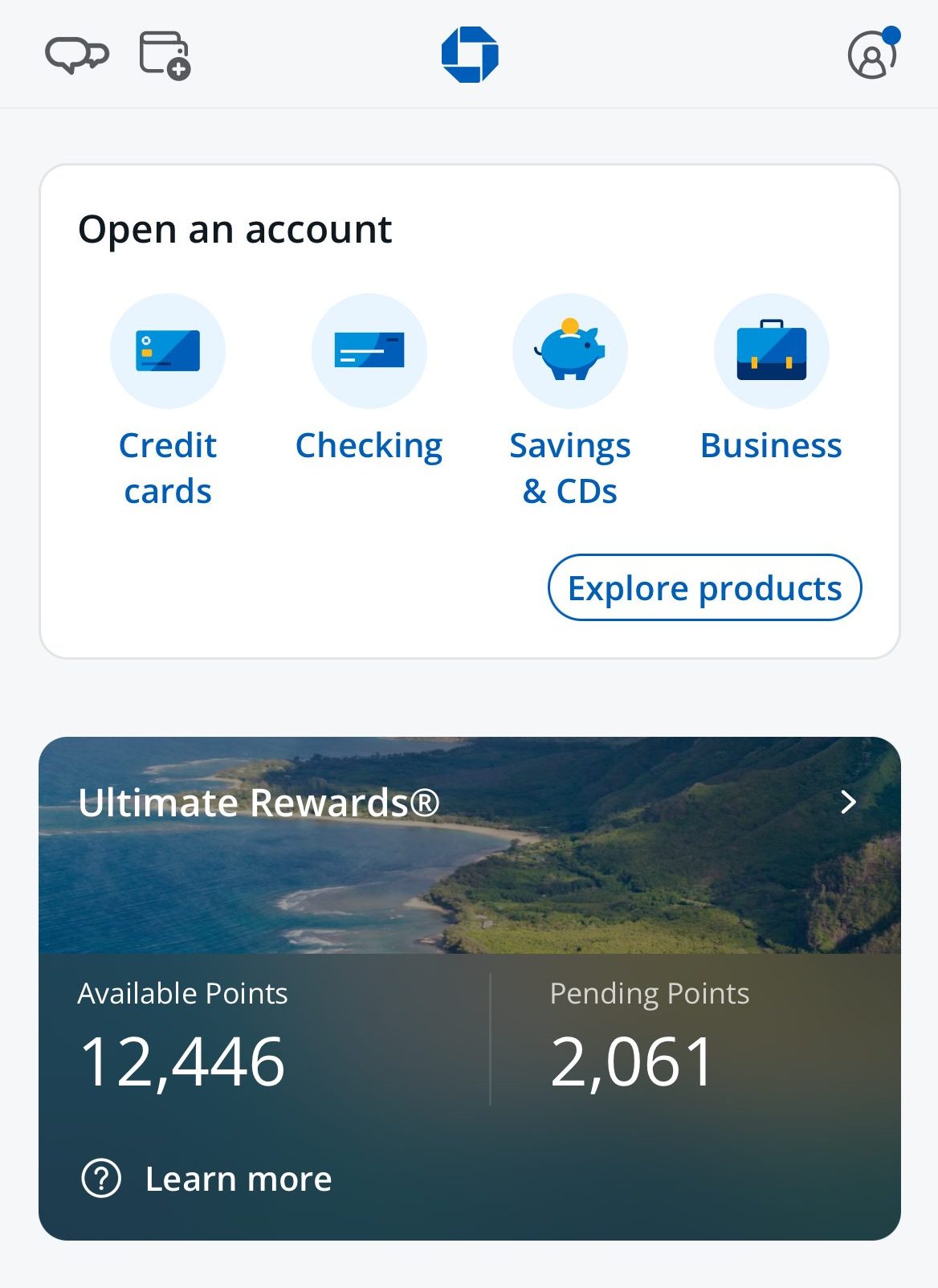

Online/Digital Experience

Both Chase and PNC have an app for iOS and Android devices. Chase’s app has similar ratings with 4.8/5 on the Apple Store and 4.4 out of 5 on Google Play. The PNC Bank app is rated 4.8/5 on Apple and 4.3/5 on Google respectively.

Both sites have a clean design and are easy to use that offering a great user experience. You can fully explore and compare products and access how to videos and other support materials.

Which Bank is The Winner?

Chase has some great features including a massive selection of credit card options and better CD rates. However, the waiver requirements for Chase and PNC are similar. Both banks also offer some great mortgage packages. PNC also has some innovative credit card options, and you can also access personal loans.

So, which bank is better will depend on your needs.

FAQs

What promotion does Chase offer?

As of December 2025, new Chase total checking customers can currently qualify for a $300 bonus. You’ll need to open a Chase Total Checking account and set up at least one direct deposit to receive your bonus. Chase also offers $100 if you set up a new Chase Secure Banking account.

All of these promotional offers do have qualification criteria, so it is important to check the small print, but these products can be a great way to get your hands on some free cash.

What promotion does PNC Bank offer?

PNC Virtual Wallet offers a promotion based on direct deposit you make to the new account. Learn more about the best new account bonus promotions.

Does PNC offer a free checking account?

PNC checking accounts have a monthly maintenance cost, but if you maintain a minimum balance in your linked savings account or receive a minimum amount in direct deposits each month, you may be eligible to have the price waived.

These minimums are $500 each for the fundamental Spend checking account, but they are higher for the Performance checking accounts.

Is Chase a good bank for teens?

Chase is actually a great option for kids and teens. There are several checking account options including the Chase First Bank account which is designed for kids aged 6 to 17, with no fees and parental controls. Parents can set up recurring allowance and even assign chores, so children can start learning more about financial responsibilities and managing money.

Under 18s can also enjoy a Chase savings account with no fees.

Is Chase worth it if I have bad credit?

Although Chase does not have any specific bad credit products, it could be a good choice if you want to work on your credit score. The bank has a basic checking account that has minimal frills, so you can concentrate on establishing good financial habits.

The bank also offers the Slate Edge credit card that has an automatic review to increase your credit limit if you pay on time and spend $500+ in your first six months. There is the potential to lower your rate by 2% each year. So, even if you qualify for a high rate initially, due to your current credit score, you can decrease your rate and work on your credit score with responsible card use.

How's PNC physical coverage?

Although there are reports of PNC closing branches across the USA to increase focus on digital services, the bank does still have almost 3,000 locations across 27 states. The bank also has an ATM network with almost 10,000 machines.

Can I open a PNC checking account online?

Yes, it is possible to open up a PNC Wallet checking account without visiting a branch. There is an online application form that will guide you through the process. After you submit your application, the PNC team will review and contact you with their approval decision.

Is PNC a good bank for teens?

PNC has a fantastic savings account for minors. You can open the account with just $25, but there are no account fees if the account holder is under 18. There is also a learning center with “jars” to help your teens learn about finances. They can add funds into “spending” “saving” or “sharing” jars. This allows kids to see what money is available to use.

Chase vs PNC Bank: Comparison Methodology

In our detailed comparison, The Smart Investor team thoroughly looked at Chase and PNC Bank in five main areas:

Checking Accounts (30%): We checked things like direct deposit, debit card availability, monthly fees, ATM and branch access, check deposit, bill pay options, and account alerts. We also considered any special offers for customers.

Savings Accounts including CDs (20%): We focused on important stuff like how much interest you can earn (APY), the smallest amount you need to open an account, how flexible the accounts are, and if they're insured by FDIC. We also looked at special savings offers, different types of CDs, and any fees for taking money out early.

Credit Cards (15%): We looked at what rewards you get, how much the card costs each year, any bonuses you get for signing up, perks for traveling, how much interest you pay on balances, and if you can transfer balances from other cards.

Lending Options (15%): We checked out the different kinds of loans they offer, like personal loans, student loans, mortgages, and loans where you use your home as collateral.

Customer Experience And Bank Reputation (20%): We looked into how easy it is to use their online and mobile banking, how helpful their customer support is, what people say about them online, any awards they've won, and how stable they are financially. This gave us a good idea of what it's like to be a customer and how much people trust them.

Compare Chase Versus Alternative Banks

Although Chase Bank has a modern, trendy image, it is one of the oldest banks in the United States. JP Morgan Chase's consumer division, Chase Bank, is one of the largest banks in the United States. Even though its interest rates aren't particularly competitive when compared to online banks and credit unions, loyal Chase customers who keep a significant amount of money with the bank can earn slightly better rates.

American Express is best known for its credit card business. The financial services firm, on the other hand, has a banking subsidiary that offers high-yield savings and CD accounts. For those looking to save money with a well-known financial institution, the American Express High Yield Savings Account is a popular option.

Read Full Comparison: American Express vs Chase Bank

Chase and Wells Fargo appear to offer very similar products at first glance, so we need to dig a little deeper. There is little to distinguish the savings accounts, and both banks provide a variety of checking accounts.

While Chase's account maintenance fee is slightly higher, it does have some more interesting features. Chase also has an advantage in terms of CDs, but Wells Fargo is a better option for loans and mortgages.

Read Full Comparison: Chase vs Wells Fargo: Where to Save Your Money?

The Chase and Citi checking accounts both have no minimum deposit and a monthly account maintenance fee of $12. This can also be waived with a balance of $1,500 or more, or with qualifying deposits.

Furthermore, both have a very impressive selection of more than credit card options.

Read Full Comparison: Chase vs Citi: Which Bank Account Wins?

The Discover checking account is more traditional. While the account does not pay interest, you can earn 1% cash back on debit card purchases. There are also no fees if you require a replacement debit card, have a deposit item returned, or have insufficient funds in your account.

Chase offers a wide range of banking products, including savings accounts, checking accounts, home loans, home equity options, auto loans, and a wide range of credit cards. In addition, Chase's customer service system is quite extensive.

Read Full Comparison: Discover vs Chase: Which Bank Account Suits You Best?

Because both Chase and TD Bank provide a comprehensive range of products, we'll need to summarize the benefits and drawbacks to determine which bank is superior.

Chase offers some novel features, including the possibility of comparable CD rates without the TD Bank's minimum deposit. However, there is little to distinguish the checking accounts, as TD Bank's savings rate is twice that of Chase.

Although Chase has more credit card options, don't discount TD Bank, which has some interesting options.

Read Full Comparison: Chase vs TD Bank: Which Bank Suits You Best?

Chase and Capital One both have banking product lines that compete with traditional high street banks.

Capital One also has a competitive advantage in terms of checking accounts. The Capital One checking account is not only fee-free, but you can also earn interest on your account balance. Chase's checking account does not pay interest, and you must meet certain requirements to have the $12 monthly fee waived.

However, when you open a qualifying account, Chase will give you a welcome bonus, and its checking account has some nice features such as paperless statements for up to seven years and checking account upgrade options.

Read Full Comparison: Chase vs Capital One: Compare Banking Options

Both banks have account maintenance fees that can be waived by meeting one of several requirements. The rates are also quite similar, so which bank is best will come down to what products you’re looking for.

While Chase and U.S. Bank offer many banking services, Chase Bank is our winner in this competition. Here's why – and what else to know:

While Truist is a full service bank where you can find almost any financial product, Chase is our winner. Here's why – and what else to know:

We'll explore Chase and BMO Bank savings accounts, checking accounts, CDs, credit cards, and lending products. Here's our winner:

In our opinion, Chase is the preferred option in this battle. But, there are significant differences between products. Here's our comparison:

In our opinion, Chase is the preferred option in this battle. But, there are significant differences between products. Here's our comparison.

We believe Chase is the preferred option in this battle. But, there are significant differences to know. Here's our comparison: Chase vs. Fifth Third Bank

While Huntington Bank offers some better conditions when it comes to CDs and lending options, Chase is our winner. Here's why: Chase vs. Huntington Bank

Even though Regions Bank has better terms for CDs and loans, we're leaning towards Chase. Here's why, and our complete banking comparison: Chase vs. Regions Bank

Chase is the largest brick-and-mortar bank, while Ally Bank is among the best online banks. Here's our comparison and our winner: Chase vs. Ally Bank

Chase Bank is our winner, while Amex and Chase offer great banking services and credit card portfolios. Here's our side-by-side comparison: American Express Bank vs. Chase Bank

Chase is our winner as it is a better fit for most consumers than HSBC bank. But, there are important things to consider when comparing them: Chase Bank vs. HSBC Bank

Both Chase and Barclays offer a significant portfolio of banking services for US-based customers, but Chase is our winner. Here's why: Chase Bank vs. Barclays Bank

Chase Bank is our winner with a complete package of banking services. SoFi is best for savings rates, online experience, and lending options.

Compare PNC With Other Banks

The Wells Fargo service is even more extensive. Checking accounts, various savings accounts, mortgages, loans, and investment options such as IRAs, 401ks, and wealth management solutions are all available.

PNC offers checking and savings accounts, home loans, mortgages, investments, student loan refinancing, and a variety of credit cards.

Read full comparison: Wells Fargo vs PNC: Which Bank Account Wins?

Bank of America and PNC Bank offer various banking products, but which is a better fit for you? Let's compare and see our winner: PNC Bank vs. Bank Of America

PNC Bank and Citibank are two big players in brick-and-mortar banking. Let's compare them side by side and see which is our winner: PNC Bank vs. Citibank

PNC is our winner in this competition with a better banking package than Huntington Bank. But there are more things to consider: PNC Bank vs. Huntington Bank

While PNC offers better savings rates than U.S. Bank, the latter has better credit cards. Which is best for bank account? Here's our verdict: U.S. Bank vs. PNC Bank

PNC Bank and Fifth Third Bank are two big players when it comes to brick-and-mortar banking. Let's compare them and see which is our winner: PNC Bank vs. Fifth Third Bank

We prefer PNC Bank over M&T, mainly due to higher savings and money market account rates and better credit cards. Here's our comparison: PNC Bank vs. M&T Bank

Our winner is PNC Bank as it offers more options for checking and higher savings rates than Truist bank. Here's our comparison: Truist Bank vs. PNC Bank

Both KeyBank and PNC Bank are active in various states, such as Pennsylvania, Indiana, Ohio, and more. Let's compare their banking products.

While the differences are insignificant, our winner is PNC Bank, which has better options than BMO Bank. Here's our complete comparison: PNC Bank vs. BMO Bank

PNC and Regions Bank operate in several states, including Florida, Georgia, Kentucky, and South Carolina. Let's compare them side by side: Regions Bank vs. PNC Bank

While PNC Bank is a brick-and-mortar bank, Capital One's presence is mainly online. Let's compare them and see which is our winner: Capital One vs. PNC Bank

While PNC Bank is a brick-and-mortar bank, American Express Bank's is an online bank. Let's compare their banking products side by side: American Express Bank vs. PNC Bank

PNC Bank is our winner with a complete package of banking services. SoFi is best for savings rates, online experience, and lending options.

Banking Reviews

Aspiration Review

Alliant Credit Union Review