In this article, we will conduct a thorough comparison of various banking offerings from Chase and U.S. Bank, including savings accounts, checking accounts, CDs, credit cards, and lending products.

Checking Accounts

Chase and U.S. Bank offer comprehensive checking account options with unique features. Chase is our winner when it comes to checking accounts due to its varied account options and low requirements to waive the monthly fee.

-

Account Types

Chase Bank offers a variety of checking account types to suit the diverse needs of its customers. One notable option is the Total Checking account, which provides access to a widespread network of ATMs and a range of digital banking tools.

For customers with a premium banking preference, Chase presents the Sapphire Checking account, renowned for its exclusive benefits like enhanced travel rewards.

Account | Monthly Fee | Average Day Balance To Waive |

|---|---|---|

Chase Total Checking | $12 | $1,500 |

Chase Premier Plus Checking | $25 | $15,000 |

Chase Sapphire Checking | $25 | $75,000 |

Chase College Checking | $12 | $1,500 |

Chase Private Client Checking | $30 | $150,000 |

Chase Business Complete Banking | $15 | $2,000 |

Chase Performance Business Checking | $30 | $35,000 |

Chase Platinum Business Checking | $95 | $100,000 |

U.S. Bank also offers two main checking accounts for customers: the U.S. Bank Smartly Checking and the U.S. bank safe debit. Both have monthly maintenance fees, but the Safe Debit account fees can't be waived, unlike the U.S. Bank Smartly Checking:

U.S. Bank Account | Monthly Fee | Average Day Balance To Waive |

|---|---|---|

U.S. Bank Smartly Checking | $6.95 | $1,500 |

Safe Debit

| $4.95 | Cannot be waived |

Business Gold Checking | N/A | N/A |

Business Platinum Checking | N/A | N/A |

-

Features

Chase offers a comprehensive set of features with its checking accounts, catering to diverse financial needs:

Account | Main Features |

|---|---|

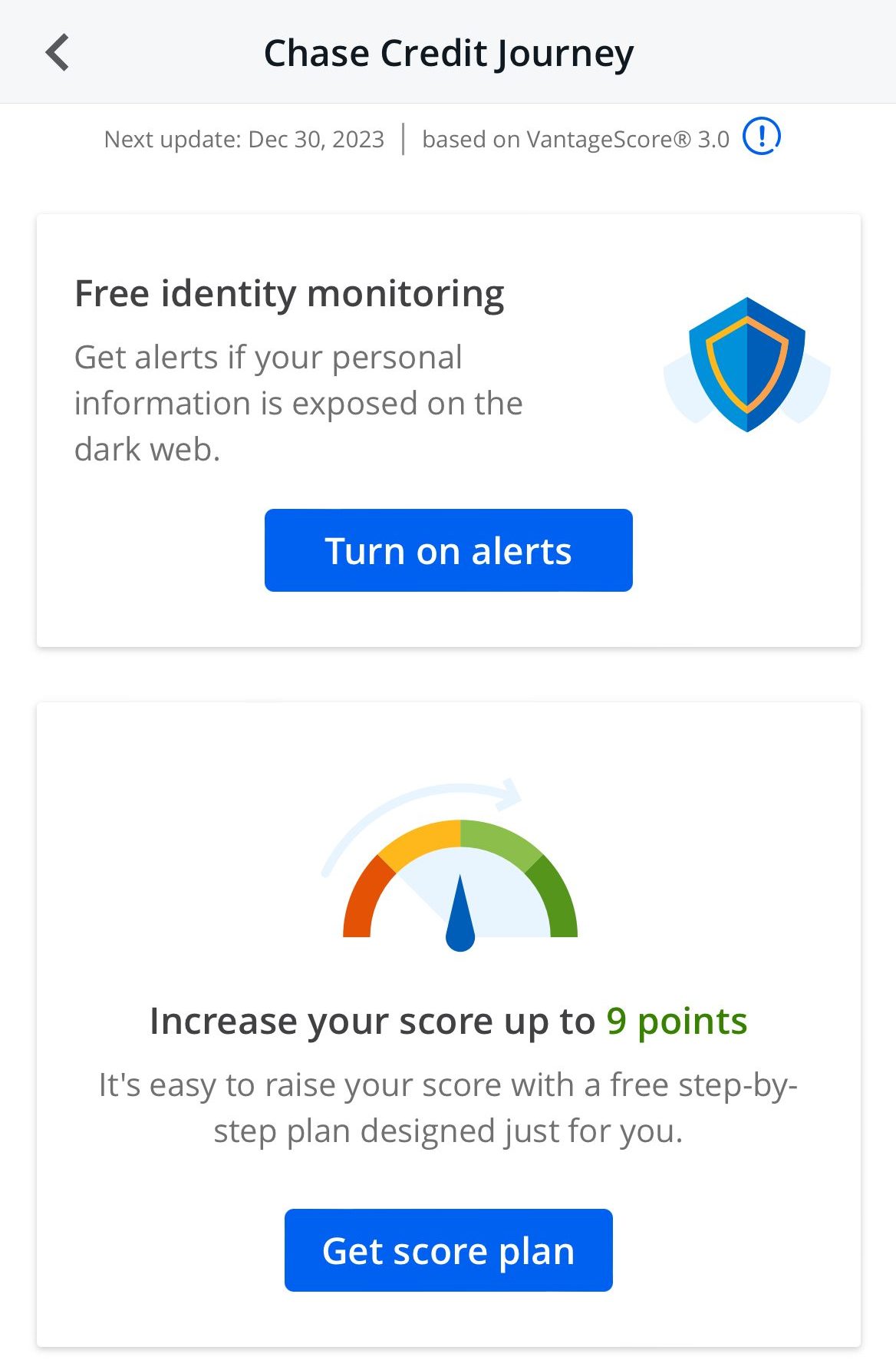

Chase Total Checking | Overdraft assist, chase credit journey, alerts |

Chase Premier Plus Checking | Interest on balance, free checks , free counter checks |

Chase Sapphire Checking | JPM wealth management, no ATM fees, no wire transfer |

Chase College Checking | No monthly fees, free credit score, new account promotion |

Chase Private Client Checking | Priority service, preferred rates, J.P. Morgan advisor |

Chase Business Complete Banking | Chase QuickAccept, fraud protection, chase business online |

Chase Performance Business Checking | No cost wires, unlimited electronic deposits, Chase business |

Chase Platinum Business Checking | No fee transactions, cash management support, platinum service |

Credit Journey is an invaluable tool for those wanting to keep tabs on their credit health. The app provides users with their credit score, credit report details, and personalized tips for improving their score.

The U.S. Bank checking account offers a range of features designed to meet the diverse needs of customers:

U.S. Bank Account | Main Features |

|---|---|

U.S. Bank Smartly Checking | Smart Rewards, transfer money, set alerts, $50 overdrawn available |

Safe Debit

| Directly deposit paychecks, pay bills for free, no overdraft fees |

Business Gold Checking | 300 free transactions, $10,000 of free cash deposits |

Business Platinum Checking | 500 free transactions, $20,000 of free cash deposits |

Savings Accounts

Chase Premier Savings and U.S. bank accounts offer relatively low interest rates on savings accounts, far below what you can find on other savings accounts. Their minimum deposit is relatively low, and while there are fees, they can be waived easily.

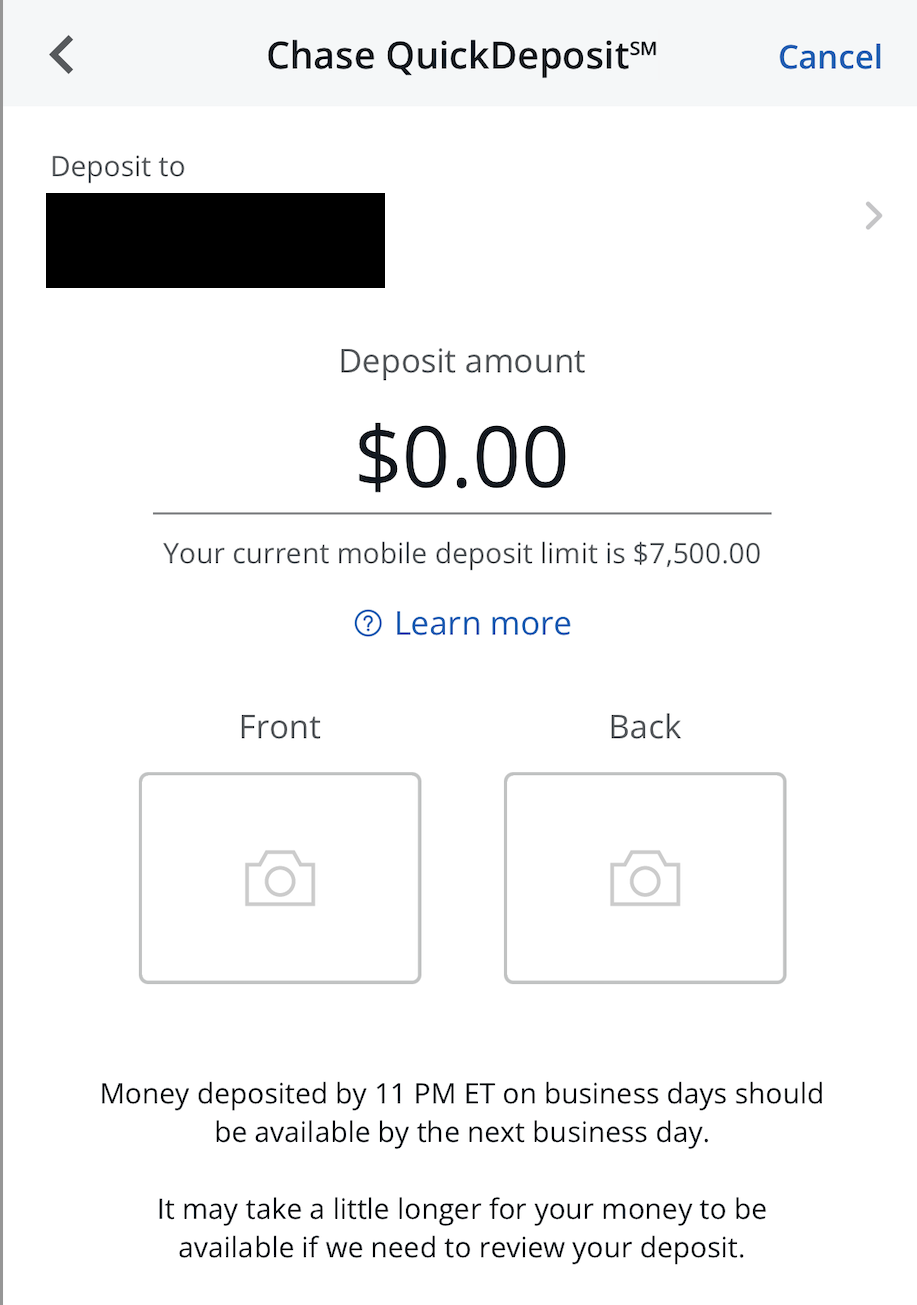

The Chase Premier Savings account provides the convenience of Autosave, facilitating easy online and mobile banking, including the quick deposit of checks using Chase QuickDeposit. Account holders also benefit from alerts, access to an extensive network of ATMs (over 15,000), and a substantial branch presence (over 4,700). The FDIC insurance protection ensures the safety of deposited funds.

Opening a U.S. Bank Standard Savings account presents several benefits. Users can enjoy fee-free ATM transactions and surcharge fees at U.S. Bank ATMs. Additionally, there are no overdraft protection transfer fees when initiated from an eligible linked U.S. Bank deposit account.

The account also provides convenient features such as account alerts, allowing customers to receive email or text reminders regarding low balances, transfers, and other important activities.

U.S Bank Savings Account | Chase Premier Savings | |

|---|---|---|

Savings Rate | up to 3.50% | 0.01% |

Minimum Deposit | $25 | $25 |

Fees | $4

can be waived by $300+ daily ledger balance or $1,000 average monthly balance

| $25 per month

Can be waived if you carry $300 account balance at the start of the month, $25+ autosave or linking a Chase checking account

|

Certificate Of Deposits (CDs)

Both U.S. Bank and Chase offer high CD rates only on specific terms. U.S. Bank rates tend to be a bit more competitive than Chase for these specific terms.

Both banks offer a diverse range of Certificate of Deposit (CD) terms, spanning from one month to ten years. These terms include options for shorter durations, such as one, two, three, six, and nine months, as well as one year.

-

Chase Bank CDs

CD Term | APY | Early Withdrawal Penalty |

|---|---|---|

3 Months | 2.25% | 90 days of interest |

6 Months | 1.01% | 180 days of interest |

9 Months | 1.01% | 180 days of interest |

12 Months | 2.00% | 180 days of interest |

18 Months | 2.00%

| 180 days of interest |

24 Months | 2.00% | 365 days interest |

30 Months | 2.00% | 365 days interest |

36 Months | 2.00% | 365 days interest |

48 Months | 2.00% | 365 days interest |

60 Months | 2.00% | 365 days interest |

120 Months | 2.00% | 365 days interest |

-

U.S. Bank CDs

CD Type | CD Term | APY |

|---|---|---|

Standard CD

| 6 Months | 0.05% |

Standard CD

| 12 Months | 0.05% |

Standard CD

| 24 Months | 0.05%

|

Standard CD

| 36 Months | 0.10%

|

CD Special | 7 Months | 4.00% |

CD Special | 11 Months | N/A |

CD Special | 13 Months | 3.20% |

CD Special | 19 Months | 4.95%

|

Step Up CD

| 28 Months | N/A |

Trade Up CD | 30 Months | 0.10% |

Trade Up CD | 60 Months | 0.25% |

Credit Cards

Chase credit cards offer a diverse range of options, each tailored to different lifestyles and preferences, making them a prominent choice in the credit card market. One notable feature of Chase credit cards is their robust rewards programs, offering cash back or travel points.

One of the standout features is the ability to redeem points for travel through the Chase Ultimate Rewards program. Cardholders can book flights, hotels, and rental cars directly through the Chase portal, often at enhanced values.

Card | Rewards | Bonus | Annual Fee | Chase Sapphire Preferred® Card | 2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

| 75,000 points

75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening

| $95

|

|---|---|---|---|---|

| Chase Freedom Flex℠ Card | 1-5%

5% cash back on up to $1,500 in combined purchases on selected categories each quarter and 5% cash back on travel purchased through Chase Ultimate Rewards®. Also, you can earn 3% cash back on dining at restaurants (including takeout and eligible delivery services), drugstore purchases , and 1% on all other purchases

| $200

$200 bonus after you spend $500 on purchases in the first 3 months from account opening

| $0 |

Chase Freedom Unlimited® | 1.5% – 5%

5% cash back on travel booked through Chase Ultimate Rewards, 3% on dining (including takeout and eligible delivery), 3% on drugstore purchases, and 1.5% on all other purchases

| $250

Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening.

| $0 | |

Chase Sapphire Reserve® | 1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

| 100,000 points + $500 Chase Travel℠ promo credit

100,000 points + $500 Chase Travel℠ promo credit After you spend $5,000 in purchases in the first 3 months from account opening

| $550 | |

Marriott Bonvoy Boundless Card | 1x – 6X

6X points for every $1 spent at over 7,000 hotels participating in Marriott Bonvoy® with the Marriott Bonvoy Boundless® credit card. Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy® member. Plus, earn up to 1X point from Marriott with Silver Elite Status. Earn 3X points for every $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining. Earn 2X points for every $1 you spend on all other purchases.

| 3 Free Night Awards after spending $3,000 on eligible purchases within 3 months of account opening.

Earn 3 Free Night Awards

after spending $3,000 on eligible purchases within 3 months of account opening.* Each Free Night Award valued up to 50,000 points – that's a total value of up to 150,000 points! Certain hotels have resort fees.

| $95 | |

United Explorer Card | 1X – 2X

2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases

| 50,000 miles

Earn 60,000 bonus miles after qualifying purchases

| $95 ($0 first year) |

While they may not be as widely recognized as some of the market's most popular cards, U.S. Bank's credit card lineup features options with appealing rewards that cater to a broad spectrum of consumers.

Card | Rewards | Bonus | Annual Fee | U.S. Bank Shopper Cash Rewards | 1.5% – 6%

6% cash back on your first $1,500 in combined eligible purchases each quarter at two retailers you choose, 3% back on your first $1,500 in eligible purchases each quarter on your choice of one everyday category, 1.5% back on all other qualifying purchases. Also, 5.5% back on reservations for hotels and prepaid car rentals when you book through the U.S. Bank Rewards Center.

| $250

$250 bonus after you spend $2,000 in eligible purchases within the first 120 days of account opening

| $95 ($0 on first year) |

|---|---|---|---|---|

U.S. Bank Cash+® Visa Signature® Card | 1% – 5%

5% cash back on purchases in two categories of your choice (up to $2,000 in combined purchases per quarter, then 1 percent). 5% back on prepaid air, hotel, and car reservations through the Rewards Center. 2% cash back on one choice everyday category. 1% back on all other purchases

| $200

Earn a $200 bonus after spending $1,000 within the first 90 days of account opening

| $0 | |

U.S. Bank Altitude® Go Visa Signature® Card | 1X – 4X

4x points at restaurants, take-outs & deliveries, 2x points at supermarkets, gas stations & streaming servicesm and 1 point for 1 dollar on all other purchases

| 20,000 points

Earn 20,000 bonus points after spending $1,000 in the first 90 days of card opening

| $0 | |

U.S. Bank Altitude Connect Visa Signature Card | 1X – 5X

5X points on prepaid hotels and car rentals booked directly in the Altitude Rewards Center; 4X points on travel, gas stations, and EV charging stations; 2X points on grocery stores, grocery delivery, dining, and streaming services; and 1X points on all other eligible purchases

| 60,000 points

60,000 points after spending $6,000 in eligible purchases on the account owner's card within the first 180 days from account opening.

| $95 (waived first year) | |

U.S Bank Altitude Reserve Visa Infinite Card | 1X – 5X

5 points per dollar on prepaid hotels and car rentals booked directly in the Altitude Rewards Center, 3 points per dollar on eligible travel purchases and mobile wallet spending and 1 point per dollar on all other eligible net purchases

| 50,000 points

50,000 bonus points after spending $4,500 on eligible purchases within the first 90 days.

| $400 |

Mortgage And Loans

Chase and U.S. Bank both offer a comprehensive suite of mortgage and loan products, providing a range of options to meet the diverse financial needs of their customers. Overall, the U.S. Bank offers more lending products for personal consumers.

Both banks stands out for its extensive mortgage offerings, including fixed-rate mortgages, adjustable-rate mortgages (ARMs), jumbo loans, and government-backed loans like FHA and VA loans.

In addition to mortgages, U.S. Bank offer a range of lending products, including personal loans, home equity lines of credit (HELOCs), and home equity loans which are not available through Chase.

Which Bank Is Our Winner?

While U.S. Bank offers some better conditions when it comes to CDs and lending options, Chase is our winner due to its extensive checking account options and various credit cards.

However, it is crucial to assess various factors, with a primary focus on those that are significant for your specific needs. This could include considerations such as banking services, overdraft assistance, frequent ATM usage, proximity to bank locations, and other elements that vary from person to person.

The Smart Investor Banking Comparison Methodology

In our detailed comparison, The Smart Investor team thoroughly looked in five main areas:

Checking Accounts (30%): We checked things like direct deposit, debit card availability, monthly fees, ATM and branch access, check deposit, bill pay options, and account alerts. We also considered any special offers for customers.

Savings Accounts including CDs (20%): We focused on important stuff like how much interest you can earn (APY), the smallest amount you need to open an account, how flexible the accounts are, and if they're insured by FDIC. We also looked at special savings offers, different types of CDs, and any fees for taking money out early.

Credit Cards (15%): We looked at what rewards you get, how much the card costs each year, any bonuses you get for signing up, perks for traveling, how much interest you pay on balances, and if you can transfer balances from other cards.

Lending Options (15%): We checked out the different kinds of loans they offer, like personal loans, student loans, mortgages, and loans where you use your home as collateral.

Customer Experience And Bank Reputation (20%): We looked into how easy it is to use their online and mobile banking, how helpful their customer support is, what people say about them online, any awards they've won, and how stable they are financially. This gave us a good idea of what it's like to be a customer and how much people trust them.

Compare Chase Versus Alternative Banks

Although Chase Bank has a modern, trendy image, it is one of the oldest banks in the United States. JP Morgan Chase's consumer division, Chase Bank, is one of the largest banks in the United States. Even though its interest rates aren't particularly competitive when compared to online banks and credit unions, loyal Chase customers who keep a significant amount of money with the bank can earn slightly better rates.

American Express is best known for its credit card business. The financial services firm, on the other hand, has a banking subsidiary that offers high-yield savings and CD accounts. For those looking to save money with a well-known financial institution, the American Express High Yield Savings Account is a popular option.

Read Full Comparison: American Express vs Chase Bank

Chase and Wells Fargo appear to offer very similar products at first glance, so we need to dig a little deeper. There is little to distinguish the savings accounts, and both banks provide a variety of checking accounts.

While Chase's account maintenance fee is slightly higher, it does have some more interesting features. Chase also has an advantage in terms of CDs, but Wells Fargo is a better option for loans and mortgages.

Read Full Comparison: Chase vs Wells Fargo: Where to Save Your Money?

The Chase and Citi checking accounts both have no minimum deposit and a monthly account maintenance fee of $12. This can also be waived with a balance of $1,500 or more, or with qualifying deposits.

Furthermore, both have a very impressive selection of more than credit card options.

Read Full Comparison: Chase vs Citi: Which Bank Account Wins?

The Discover checking account is more traditional. While the account does not pay interest, you can earn 1% cash back on debit card purchases. There are also no fees if you require a replacement debit card, have a deposit item returned, or have insufficient funds in your account.

Chase offers a wide range of banking products, including savings accounts, checking accounts, home loans, home equity options, auto loans, and a wide range of credit cards. In addition, Chase's customer service system is quite extensive.

Read Full Comparison: Discover vs Chase: Which Bank Account Suits You Best?

Chase has some great features including a massive selection of credit card options. Both banks also offer some great mortgage packages. PNC also has some innovative credit card options, and you can also access personal loans.

Read Full Comparison: Chase vs PNC Bank: Which Bank Account Is Better?

Because both Chase and TD Bank provide a comprehensive range of products, we'll need to summarize the benefits and drawbacks to determine which bank is superior.

Chase offers some novel features, including the possibility of comparable CD rates without the TD Bank's minimum deposit. However, there is little to distinguish the checking accounts, as TD Bank's savings rate is twice that of Chase.

Although Chase has more credit card options, don't discount TD Bank, which has some interesting options.

Read Full Comparison: Chase vs TD Bank: Which Bank Suits You Best?

Chase and Capital One both have banking product lines that compete with traditional high street banks.

Capital One also has a competitive advantage in terms of checking accounts. The Capital One checking account is not only fee-free, but you can also earn interest on your account balance. Chase's checking account does not pay interest, and you must meet certain requirements to have the $12 monthly fee waived.

However, when you open a qualifying account, Chase will give you a welcome bonus, and its checking account has some nice features such as paperless statements for up to seven years and checking account upgrade options.

Read Full Comparison: Chase vs Capital One: Compare Banking Options

Both banks have account maintenance fees that can be waived by meeting one of several requirements. The rates are also quite similar, so which bank is best will come down to what products you’re looking for.

While Truist is a full service bank where you can find almost any financial product, Chase is our winner. Here's why – and what else to know:

We'll explore Chase and BMO Bank savings accounts, checking accounts, CDs, credit cards, and lending products. Here's our winner:

In our opinion, Chase is the preferred option in this battle. But, there are significant differences between products. Here's our comparison:

In our opinion, Chase is the preferred option in this battle. But, there are significant differences between products. Here's our comparison.

We believe Chase is the preferred option in this battle. But, there are significant differences to know. Here's our comparison: Chase vs. Fifth Third Bank

While Huntington Bank offers some better conditions when it comes to CDs and lending options, Chase is our winner. Here's why: Chase vs. Huntington Bank

Even though Regions Bank has better terms for CDs and loans, we're leaning towards Chase. Here's why, and our complete banking comparison: Chase vs. Regions Bank

Chase is the largest brick-and-mortar bank, while Ally Bank is among the best online banks. Here's our comparison and our winner: Chase vs. Ally Bank

Chase Bank is our winner, while Amex and Chase offer great banking services and credit card portfolios. Here's our side-by-side comparison: American Express Bank vs. Chase Bank

Chase is our winner as it is a better fit for most consumers than HSBC bank. But, there are important things to consider when comparing them: Chase Bank vs. HSBC Bank

Both Chase and Barclays offer a significant portfolio of banking services for US-based customers, but Chase is our winner. Here's why: Chase Bank vs. Barclays Bank

Chase Bank is our winner with a complete package of banking services. SoFi is best for savings rates, online experience, and lending options.

Compare U.S. Bank With Other Banks

US Bank offers an even more impressive range of banking services. Savings and checking account options, investments, personal loans, mortgage products, and wealth management are all available.

Bank of America offers a wide range of banking services. There are numerous credit cards available, as well as various checking and savings accounts, home loans, investments, and auto loans.

Read Full Comparison: Bank of America vs US Bank: Which is Best For You?

Wells Fargo offers a diverse range of products, including checking accounts, savings accounts, loans, mortgages, and investments such as 401ks, IRAs, and wealth management options.

US Bank offers an even more impressive range of banking services. Savings and checking account options, investments, personal loans, mortgage products, and wealth management are all available.

Read Full Comparison: Wells Fargo vs US Bank: Which Bank Account Is Better?

While U.S. Bank offers some better conditions when it comes to lending options, Citibank is our winner in this comparison. Here's why.

Citibank vs. U.S. Bank: Which Bank Account Is Better?

There is no clear winner in this battle, as both banks offer similar bank account types. But what about the rest? Here's our winner: U.S. Bank vs. KeyBank

There is no clear winner when comparing Huntington and U.S. Bank , but if we have to pick one – Huntington is our first choice. Here's why.

U.S. Bank vs. Huntington Bank: Which Bank Account Is Better?

Picking the right bank account can be confusing, especially when looking at big banks like U.S. Bank and Capital One. Here's our winner: U.S. Bank vs. Capital One

While PNC offers better savings rates than U.S. Bank, the latter has better credit cards. Which is best for bank account? Here's our verdict: U.S. Bank vs. PNC Bank

Our winner is U.S. Bank as it offers better package banking than Fifth Bank, but there are cases when Fifth Bank wins. Here's our comparison: U.S. Bank vs. Fifth Third Bank

Both U.S. Bank and BMO Bank are active in various states, such as Illinois, Wisconsin, Montana, and Minnesota. Here's our winner: U.S. Bank vs. BMO Bank

While Regions offers better checking options, U.S. Bank offers better credit card options. Let's compare them and see which is our winner: Regions Bank vs. U.S. Bank

U.S. Bank is one of the largest brick-and-mortar banks, while Ally is among the best online banks. Let's compare them and find our winner: Ally Bank vs. U.S. Bank

U.S. Bank is one of the largest brick-and-mortar banks in the US, while Amex Bank is among the best online banks. Let's compare them: U.S. Bank vs. American Express Bank