Table Of Content

Capital One and Discover are some of the best choices when it comes to line banking.

In this article, we will compare the Discover Bank Online Savings and the Capital One 360 Performance Savings account in detail. We will examine their savings rates, minimum deposit requirements, and account features to help you determine which account best suits your financial needs.

Exploring Savings Rates and Minimum Deposits

Discover Online Savings | Capital One 360 Savings | |

|---|---|---|

Savings Rate | 3.70% | 3.70% |

Minimum Deposit | $0 | $0 |

Fees | $0 | $0 |

Promotion | N/A

Minimum deposit of N/A, expired on N/A

| None |

Comparing Discover Online Savings and Capital One 360 Savings, they offer quite similar rates. Both banks have no minimum deposit requirements and no monthly maintenance fees, making them accessible to a wide range of customers.

Compare Savings Account Perks: Capital One vs Discover

Discover Online Savings and Capital One 360 Performance Savings rates are similar and other features, such as no monthly fee and excellent mobile app support.

Here's a comparison of the benefits:

Discover Online Savings | Capital One 360 Savings |

|---|---|

High Rates | Highly Competitive APY |

No Minimum Balance Or Monthly Fees | No Minimum Balance or Monthly Fees |

24/7 US Based Customer Support | Mobile Check Deposit |

Excellent Mobile App | Free Credit Monitoring Services |

- No Minimum Balance Or Monthly Fees

The account has no monthly fees, initial deposit, or balance requirements, allowing you to earn the APY regardless of the amount in the account.

- Excellent Mobile App

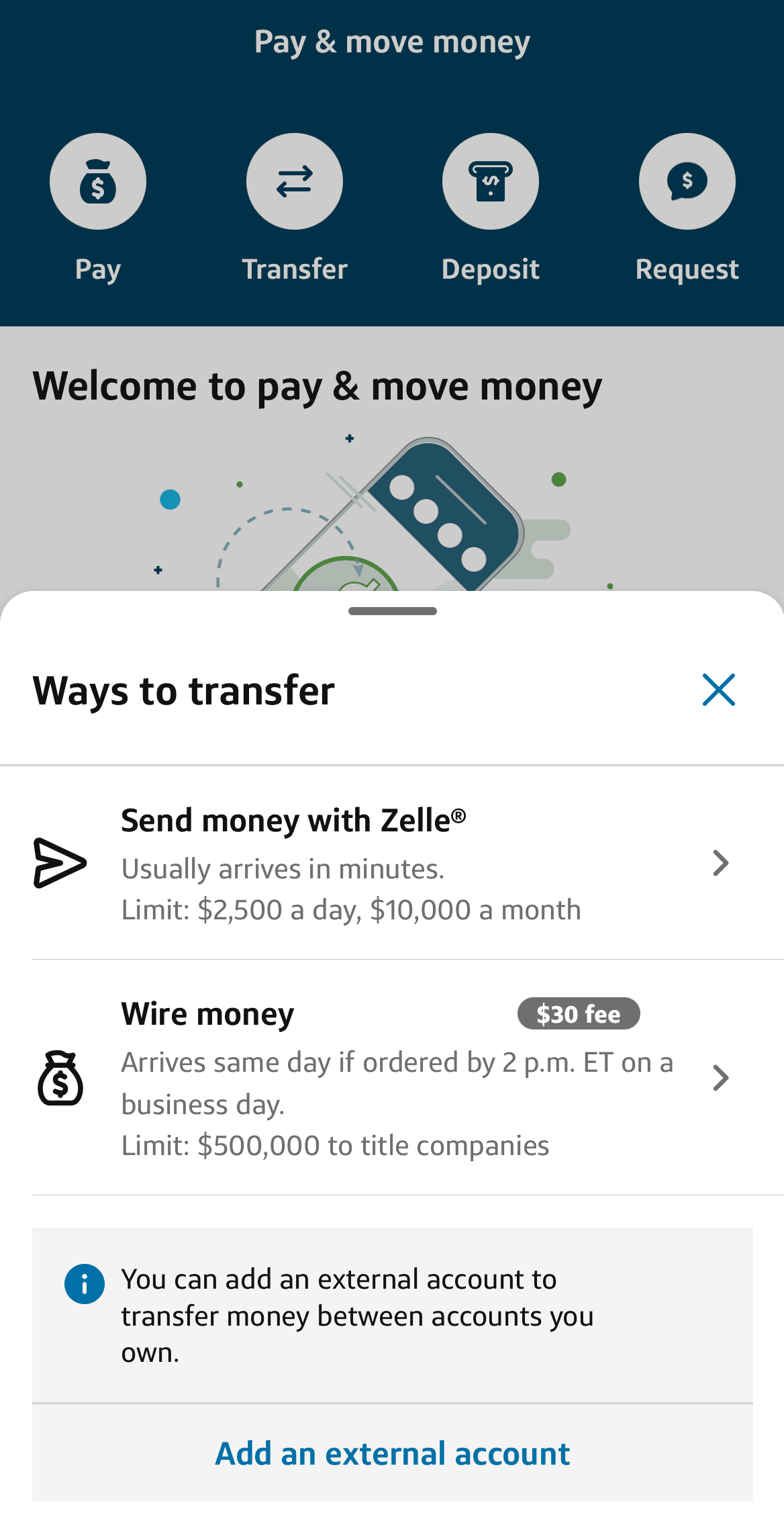

The Discover Bank app is available for Android and Apple devices, allowing you to manage your account, transfer funds, check balances, and deposit checks.

- Automatic Saver Options

You can schedule regular transfers from your Discover checking account to maximize returns and build your savings fund.

- Free Credit Monitoring Services

Access credit monitoring services without extra fees and improve your financial and credit health.

- No Minimum Balance or Monthly Fees

Open and maintain your account without any minimum balance requirements. Enjoy the benefits of no monthly maintenance fees

- Mobile Check Deposit

With mobile check deposit, you can conveniently deposit checks at any time and from almost any location. Simply take a picture of the check using your mobile phone.

Where They Can Improve?

Discover Online Savings | Capital One 360 Savings |

|---|---|

No ATM Access | No ATM Cards |

Online Only | Limited Withdrawals |

Transfer Delays |

When comparing Capital One 360 Performance Savings account and Discover Bank's online savings account, their limitations are also quite similar due to the nature of these accounts.

Capital One 360 Performance Savings account does not provide an ATM card, and there is a limit of six withdrawals or transfers out of the account per statement cycle, which may result in fees or account closure. In addition, transfers to or from external accounts may take a few days, which can be inconvenient if you need quick access to your funds.

On the other hand, Discover Bank's online savings account also does not come with an ATM card, and the lack of physical branches may be a drawback for those who prefer in-person customer support.

Moreover, depositing cash directly into the account is not possible, and it needs to be deposited into another account first, and then transferred.sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

How to Start Saving: Step-by-Step Comparison

Both savings accounts can be opened online quickly. Here are the steps for each account:

-

Discover Bank Online Savings

If you want to open a Discover Bank online savings account, you can follow these simple steps:

Visit the Discover Bank website: Head over to the Discover Bank website and browse the homepage to locate the savings tab. Click on “savings account” to proceed.

Click the orange button: Once you're on the product page for the online savings account, click on the “Open Account” orange button if you're satisfied with the details.

Confirm your customer status: Discover will prompt you to confirm whether you're an existing customer. You can speed up the account opening process with your customer credentials if you already have a Discover credit card, checking account, or any other Discover product.

Complete the application: If you're a new customer, you'll need to fill out all the mandatory fields, including your full name, Social Security Number, and date of birth. Discover will automatically populate many of the fields if you're an existing customer.

-

Capital One 360 Performance Savings

Here are the main steps to take when opening a Capital One savings account:

- Find the Product Page: Browse the Capital One website to find the Performance 360 Savings product page and confirm it is the right account for you.

- Click the “Apply” Button: Click the “apply” button to start the application process once you’re happy that you’d like to go ahead with opening the account.

- Fill in the Application Form: Provide some basic details including your full name, phone number, address, and social security number on a standard form.

- Verify Your ID: Provide a copy of your driver’s license, passport, or state-issued photo ID to verify your identity, which is required by federal regulations.

Top Offers From Our Partners

Compare Capital One Savings

While Citi Accelerate Savings account offers a slightly higher APY than Capital One 360 Performance Savings, it has drawbacks to consider.

Citi Accelerate Savings vs Capital One 360 Performance Savings: Which Is Better

Compare Ally and Capital One Savings account rates, features, benefits, and limitations to determine which one is the best option for you

Ally Bank Savings Account vs. Capital One 360 Performance Savings: Which Is Best?

Capital One and Amex savings rates are quite similar. However, each of them has its own benefits, features and tools. Here's our comparison: Capital One 360 Performance Savings vs. American Express High Yield Savings Account

Capital One Savings provides a significantly higher savings rate when compared to Chase. Let's explore the features and additional benefits.

Chase Savings vs Capital One 360 Performance Savings: Compare Side By Side

Compare Discover Savings

Discover and American Express offer competitive savings rates and no monthly fees. Compare account features, benefits, and drawbacks.

Discover Online Savings Account vs. American Express High Yield Savings Account

Discover and Ally offer online only savings accounts with several benefits, tools and sometimes even promotions. Here's our full comparison: Ally Bank Savings Account vs Discover Online Savings Account

There is no competition when it comes to savings rates – Discover wins Chase clearly. However, each of them has its own benefits and tools.

Chase Savings vs Discover Online Savings Account: Compare Side By Side

PNC offers higher savings rate than Discover, but the states are very limited. Here's our full savings account comparison: Discover Online Savings Account vs. PNC Standard Savings

Related Posts

How We Compare Savings Account: Methodology

The Smart Investor team has conducted a comprehensive comparison of savings accounts, analyzing each based on these critical categories to help you decide where to entrust your savings.

- Savings Rates: The savings rates category delves into the interest rates offered by each account, assessing their competitiveness in the market. Higher interest rates mean greater returns on your savings over time, providing a crucial incentive for account holders to choose one account over another. Additionally, we explore any promotional rates or conditions that may affect the account's overall value.

- Savings Features: We examine the features and benefits accompanying each savings account. From account minimums and fees to accessibility through online and mobile banking platforms, these features can significantly impact the convenience and utility of the account for account holders. We also consider perks like overdraft protection, automatic savings plans, and rewards programs.

- Customer Experience: A positive customer experience is paramount in banking, and we evaluate each institution's performance in this area. This includes aspects such as the ease of account opening, quality of customer service, availability of support channels, and overall user satisfaction on platforms such as Trust Pilot and JD Power ranking.

- Bank Reputation: The bank's reputation carries weight in the decision-making process. Factors such as financial stability, regulatory compliance, and public perception contribute to the overall trustworthiness and reliability of the institution.