Table Of Content

When Discover Bank Wins?

Discover Bank is both a full-service online bank and a payment services provider. Individuals can use Discover for banking and retirement planning. Discover is best known for its rewards credit cards, but it also offers personal, student, and home equity loans.

Discover makes use of a mobile app that is available for both iOS and Android devices. You can use this app to access all of your Discover accounts and use their mobile check deposit by taking a photo with your phone or tablet.

Discover can be a better choice than Citibank if:

- You’re looking for great savings rates

- You want fee free accounts

- You arer ready for an online bank

When Citi Bank Wins?

Citibank is a global financial services company with over 100 million customers in 98 countries. If you're looking for a dependable financial service where you can open a checking and savings account with no minimum deposit, Citibank is a great option.

However, Citibank requires you to meet certain criteria in order to waive monthly fees on checking accounts. This may be a disservice to users who are not yet financially secure.

Citibank can be a better choice than Discover if:

- You want a massive choice of credit card options

You can easily meet the fee waiver criteria

- You need a personal service

Banking Options

Discover Bank | Citi Bank | |

|---|---|---|

Savings Accounts | ||

Checking Accounts | ||

CDs | ||

Money Market Account | ||

Debit Card | ||

Credit Cards | ||

Personal Loans | ||

Mortgage | ||

Government Mortgage | ||

Business Loans | ||

Investing Capabilities |

Compare Savings Account

When it comes to savings rates, both Discover and Citi offer competitive rates. Additionally, Discover is fee free, so you don’t need to worry about maintaining a particular balance to avoid a monthly fee.

Citi accounts also come as a package, so you do need to open a checking account for using a savings account.

Discover Bank | Citi Bank | |

|---|---|---|

APY | 3.50% | 0.03% – 1.13% |

Fees | $0 | $4.50/$10 per month

Can be waived if you maintain an average combined monthly balance of $500/$1,500 in your eligible accounts, make one enhanced direct deposit or one qualifying bill payment per statement period

|

Minimum Deposit | $0 | $0 |

Checking Needed? | No | Yes |

Main Benefits |

|

|

Checking Account

Discover also has the edge in the checking account comparison. In addition to being fee free, you can even earn 1% cash back on your debit card purchases.

Citi requires that you make a qualified bill payment, receive a qualifying deposit or maintain an account balance to ensure the $12 account management fee is waived each month.

Both banks have a similar size ATM network, but Citi’s is a little larger, so the only real advantage Citi has is its overdraft protection, which automatically transfers funds from your savings account to avoid overdraft fees if you have insufficient funds.

Discover Bank | Citi Bank | |

|---|---|---|

APY | 0% (1% cash back on up to $3,000 in debit card purchases each month) | 0.01% |

Fees | $0 | $12

Can be waived if you make one qualifying direct deposit and one qualifying bill payment per statement period, maintain a combined balance of $1,500 per month across your eligible accounts or if you’re aged 62

|

Minimum Deposit | $0 | $0 |

Main Benefits |

|

|

Compare CDs

Similar to savings account, also in terms of CDs you can earn higher rates with Discover. However, the minimum deposit ia a big higher compared to Citi.

Discover | Citi | |

|---|---|---|

Minimum Deposit | $2,500 |

$500 – $2,500 |

APY Range | 2.00% – 4.20% | 0.05% – 4.16% |

APY 6 months | 4.20%

| 2.25% |

APY 12 months | 4.00% | 3.25% |

APY 24 months | 4.10% | 0.50% – 1.01% |

APY 36 months | 3.60%

| 2.00% |

No Penalty CD | / | 12 months, 0.05% APY |

Top Offers From Our Partners

Credit Cards

Discover is a leading credit card issuer, so it stands to reason that it would offer a great selection of card options.

All the Discover cards offer rewards and the bank also has the Unlimited Cashback Match. This means that Discover will match, dollar for dollar, your first year’s cash back automatically with no maximum reward cap or minimum spends.

Citi has a massive selection of credit card options. You can browse the card options by category including Travel, Rewards, Cash Back, 0% intro rate and Balance Transfer.

Many of these cards have no annual fee and allow you to earn up to 5% cash back.

Card | Rewards | Bonus | Annual Fee | Citi® Double Cash Card | 1% – 2%

2% cash back rewards rate – 1% every time you swipe and another 1% upon payment.

| N/A

$200 cash back after spending $1,500 on purchases in the first 6 months

| $0 |

|---|---|---|---|---|

Citi Premier® Card | 1X – 10X

10X per dollar on hotel, car rentals and attractions booked through CitiTravel.com, 3X points on restaurant, supermarket, gas station, and air travel and other hotels purchases, and 1X points per dollar on all other purchases

| 75,000 points

75,000 bonus points after spending $4,000 in the first 3 months of account opening, redeemable for $750 in gift cards or travel rewards on thankyou.com

| $95 | |

Citi Simplicity® Card | None | None | $0 | |

Citi® Secured Mastercard® | None | None | $0 | |

| Citi Custom Cash℠ Card | 1-5%

5% cash back on your highest eligible spend category each billing cycle up to the first $500 spent and 1% cash back thereafter

| $200

$200 cash back after you spend $1,500 on purchases in the first 6 months of account opening (20,000 ThankYou® Points, which can be redeemed for $200 cash back)

| $0 |

Citi also has partner cards with popular brands including American Airlines, AT&T, Expedia and even Costco, so you can tailor your rewards with your preferred brands.

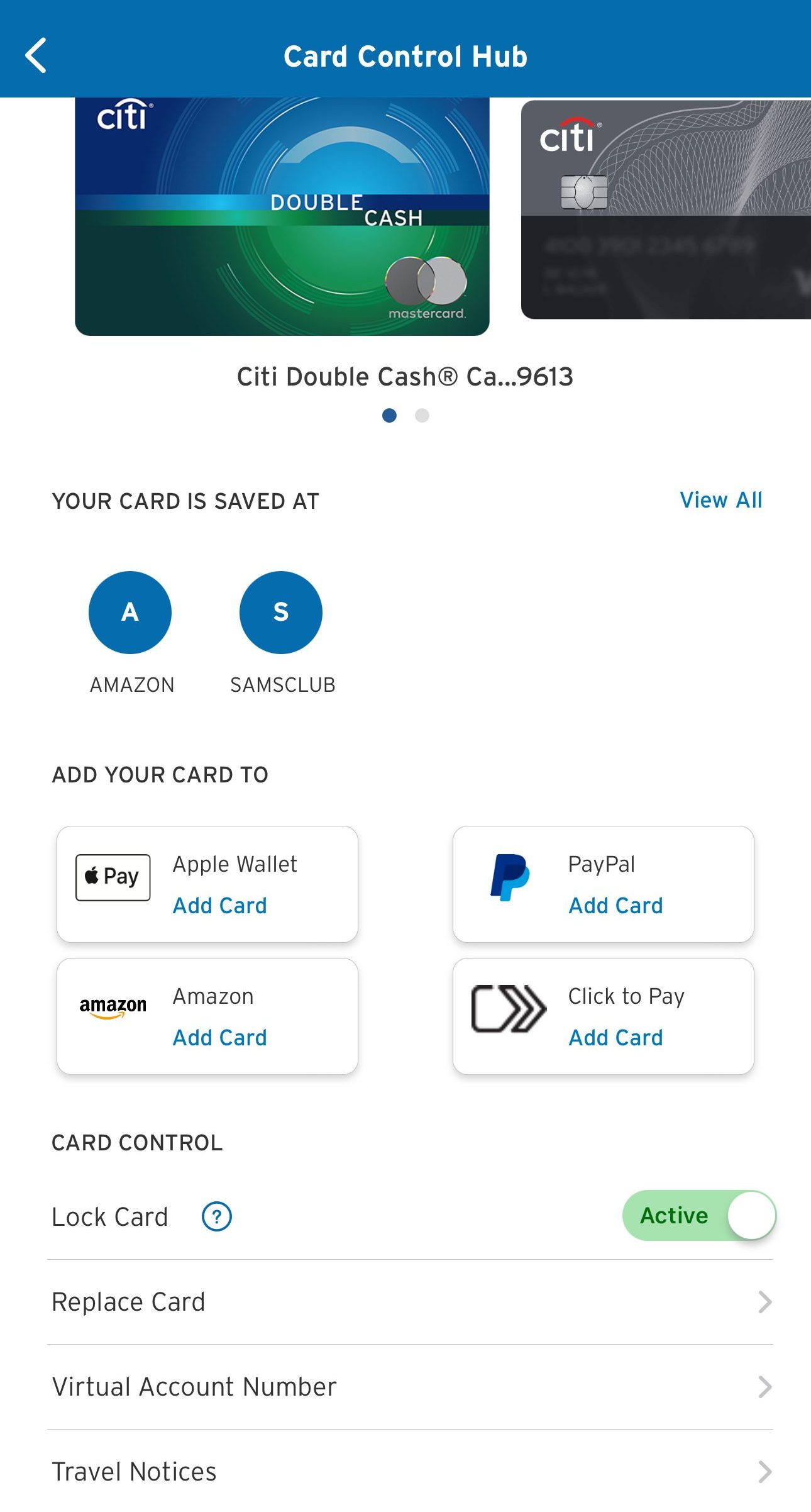

One of Citi’s most popular cards is Double Cash. This is an innovative card offering 1% cash back on your purchase and then another 1% when you pay for those purchases:

Personal Loans

Discover only conducts a soft pull inquiry when you apply for a personal loan, but you must have a minimum yearly income of $25,000. In order to be accepted, your credit score cannot be lower than 660.

Discover is a good option because their rates are competitive, and borrowing from them means you're making payments directly to the creditor.

Discover Bank | Citi Bank | |

|---|---|---|

APR | 7.99% – 24.99%

| 10.49% – 19.49% APR

|

Loan Amount | $2,500 – $40,000

| $2,000 – $30,000 |

Terms | 36 to 84 months

| 12-60 months

|

Citibank personal loans are ideal for current bank customers. Customers who are already customers get better terms, options, and rewards.

There are no origination or late fees with Citibank personal loans. They also do not have a prepayment penalty, so the loan can be paid off early without incurring any additional fees.

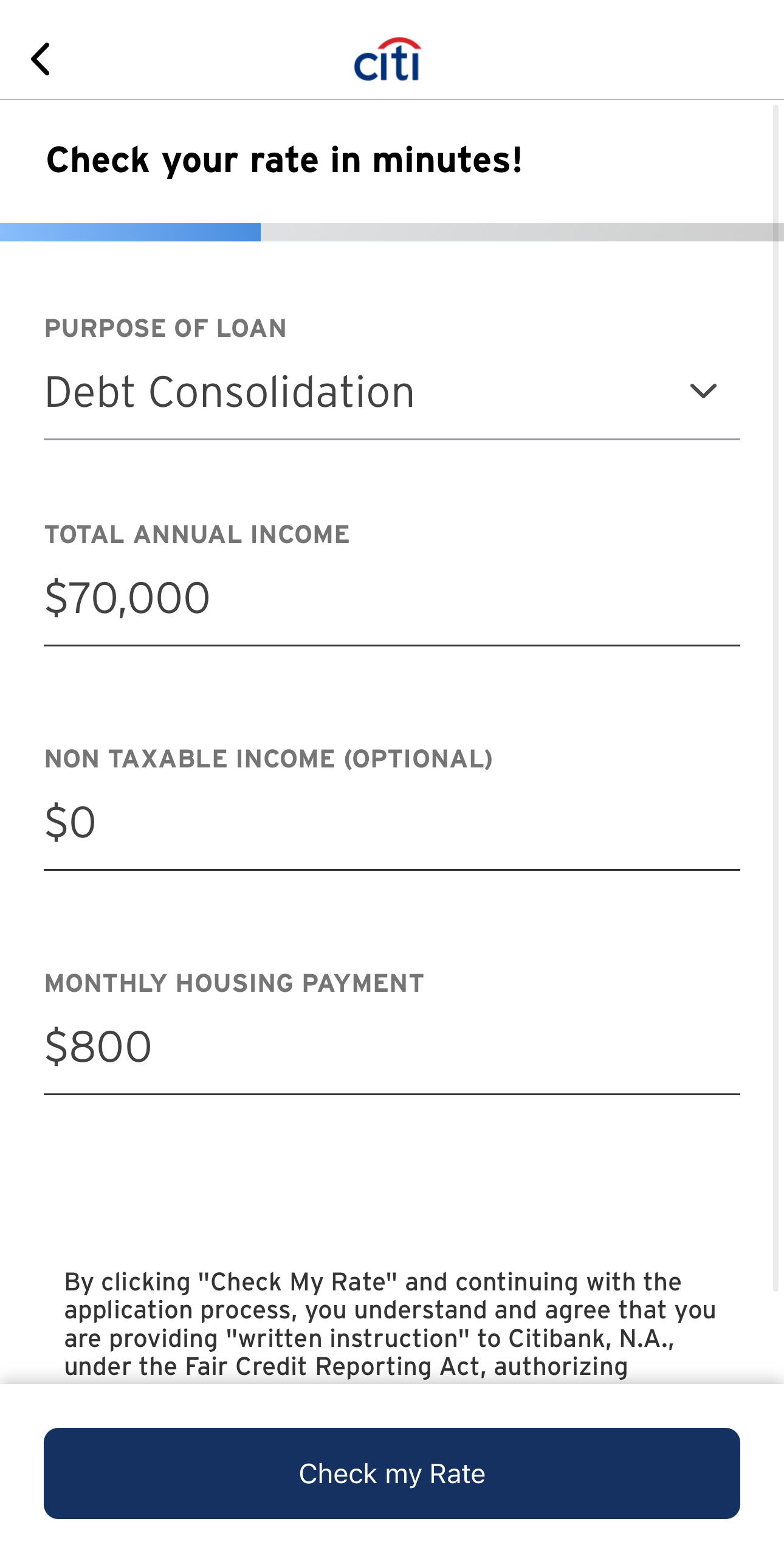

All online eligible candidates can apply through a registered Citibank account, and applicants who do not already have one must create one before submitting the online application. Borrowers can apply for loans with Citibank in three ways: online, by phone, or in person at a local branch.

Customer Service

Discover offers access to its customer service team 24/7 online or via phone, so if you need urgent help or have an account query, you can easily access support.

Citi’s customer support is more complex. The bank has different phone lines to access customer service according to the product or query. So, if you have a question about Citi savings accounts, you’ll need a different number than if you had a credit card query.

Citi also has a comprehensive help page, where you can type in an inquiry or keyword and receive an answer. You can also use the website or app to message the customer service team. You can even use your smartphone to scan the QR code to message the team.

Online/Digital Experience

Both Discover and Citi have an app. Discover’s app is rated 4.9/5 and 4.5/5 on the Apple Store and Google Play respectively. This is an intuitive and easy to use app that allows you to manage your account, move money around and even put a hold on your debit card if necessary.

The Citi app has a 4.9/5 rating on the Apple Store and 4.7/5 on Google Play. This also allows you to manage your account, contact the customer service team and receive notifications.

Both websites are very helpful to enhance the digital experience. You can browse products and compare options if you’re unsure about which product would be best for you.

Which Bank is The Winner?

Both Discover and Citi established their reputations as credit card companies and both have expanded their services over the years. This allows you to access some great products that can fit your specific needs. But how do they really stack up against each other?

If you’re looking for the best rates with no fees and some nice features, like 1% cash back on debit card purchases, Discover is the better bank. Discover offers great rates on savings and CDs, but there is the $2,500 minimum deposit on CDs, which may be a barrier to entry.

Although Discover does have ample credit card options, if this is more your area of concern, the sheer volume of Citi cards is likely to make Citi a better choice for you. While it may not offer the same fee free accounts, the waiver requirements are fairly basic and easy to manage.

FAQs

Does Discover offers a bonus promotion?

Yes, Discover offers bank promotions for new accounts as well as on a variety of credit cards. As of October 2025 , Discover Cashback Debit account offers Up to $360 bonus promotion based monthly debit card activity.

How's Citi promotion?

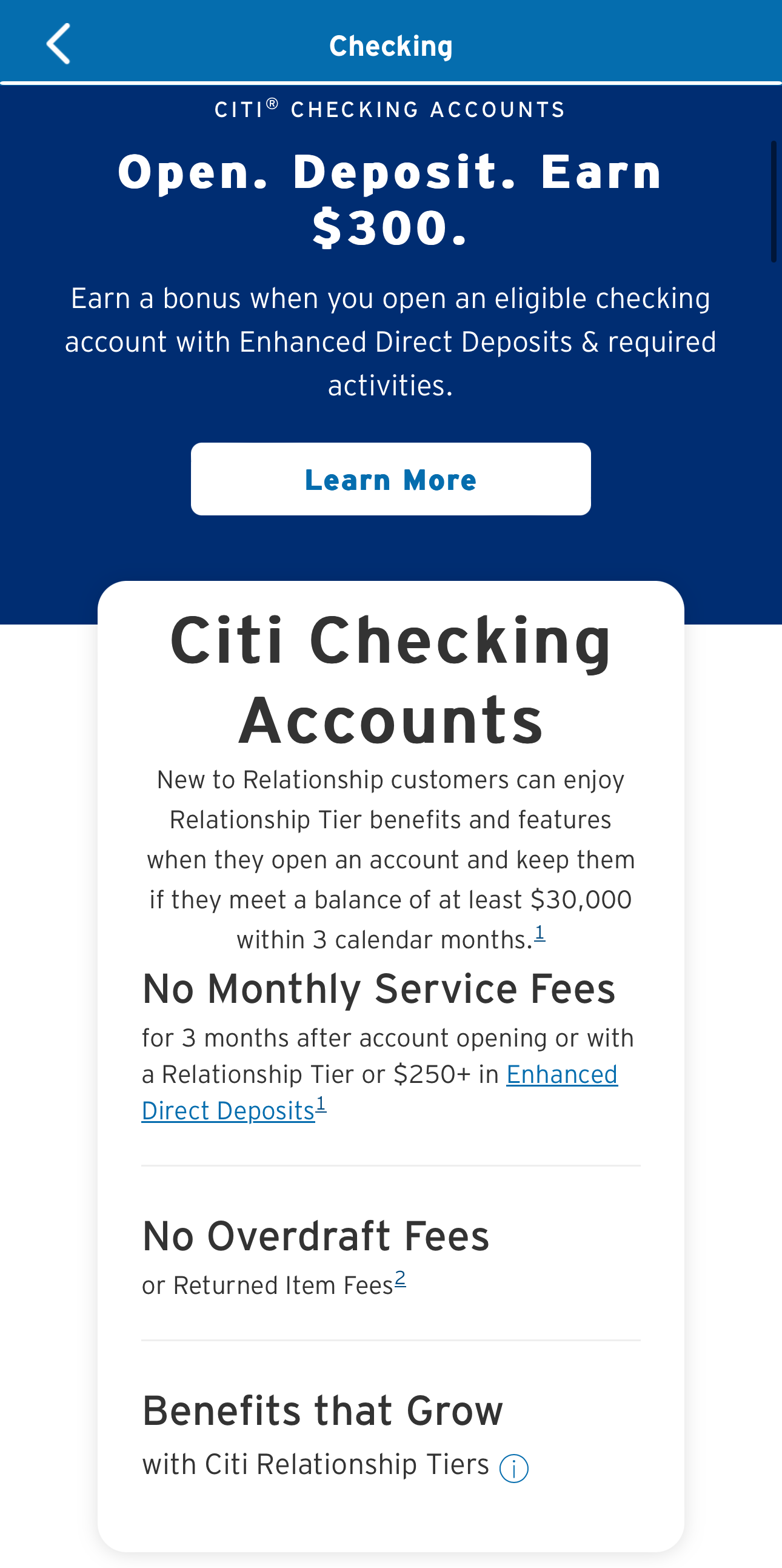

Citi checking and savings promotion is usually relevant for both new business and personal customers. For example, the Citi Personal Checking offers new accounts a $325 bonus, based on your minimum deposit and as long as you meet Citi terms and conditions.

Does Discover offers secured credit cards?

Yes, Discover has excellent options for students and those looking to build credit. The Discover It Secured credit card is a good option for people who want to rebuild or establish their credit. You must make a refundable security deposit to open your account. This deposit amount will have an impact on your approved credit line.

In addition to this option for a genuine credit card, you can earn 2% cash back on restaurant and gas station purchases up to $1,000 per quarter and 1% cash back on all other purchases.

How's Citibank reputation?

- F on BBB – BBB assigns ratings ranging from A+ (highest) to F (lowest) (lowest). BB ratings are based on information in BBB files about factors such as the business's complaint history with the BBB, the type of business, the length of time in business, transparent business practices, and more.

- 1.04/5 on BBB customer reviews (248 reviews) – BBB customer reviews allow customers to leave positive, negative, or neutral feedback about their marketplace experiences.

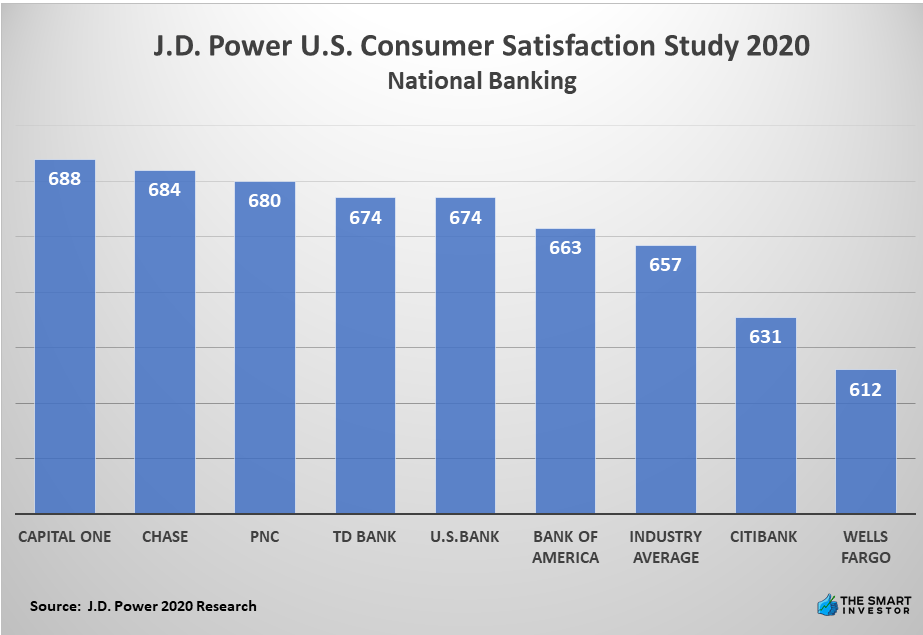

- On JD Power national banking 2020 research, Citi rates under the industry average with 631 points only, while Capital One on top with 688 points.

What are the drawbacks of Citi Savings Account?

Citi's top APY is only available in a few markets, so some customers will be denied high-quality interest rates.

There is also the risk of misunderstanding due to the labeling of various savings account packages. Because of how these are operated, the confusion over rate versus APY makes the banking experience a little more complicated than in other places.

Does Discover worth it?

Discover Bank is a high-end online banking service that provides competitive rates on accounts with no minimum balances or fees. You can earn 1% cash back on your checking accounts, which is unusual in the banking industry.

Discover banking prioritizes their accounts by providing comparisons to other banks, absolute transparency, and flexibility. Because of their user-friendly banking products, you can use their services with confidence, knowing that your account is secure.

Discover Bank's online bank is an excellent example of a company that provides services for the adult with a hectic schedule while also providing dependable software that you can rely on. This is a high-yielding earning opportunity that you should take advantage of if you use Discover Bank.

Discover vs Citibank: Comparison Methodology

In our detailed comparison, The Smart Investor team thoroughly looked at Citibank and Discover in five main areas:

Checking Accounts (30%): We checked things like direct deposit, debit card availability, monthly fees, ATM and branch access, check deposit, bill pay options, and account alerts. We also considered any special offers for customers.

Savings Accounts including CDs (20%): We focused on important stuff like how much interest you can earn (APY), the smallest amount you need to open an account, how flexible the accounts are, and if they're insured by FDIC. We also looked at special savings offers, different types of CDs, and any fees for taking money out early.

Credit Cards (15%): We looked at what rewards you get, how much the card costs each year, any bonuses you get for signing up, perks for traveling, how much interest you pay on balances, and if you can transfer balances from other cards.

Lending Options (15%): We checked out the different kinds of loans they offer, like personal loans, student loans, mortgages, and loans where you use your home as collateral.

Customer Experience And Bank Reputation (20%): We looked into how easy it is to use their online and mobile banking, how helpful their customer support is, what people say about them online, any awards they've won, and how stable they are financially. This gave us a good idea of what it's like to be a customer and how much people trust them.

Compare Citibank Versus Other Banks

The Chase and Citi checking accounts both have no minimum deposit and a monthly account maintenance fee of $12. This can also be waived with a balance of $1,500 or more, or with qualifying deposits.

Furthermore, both have a very impressive selection of more than credit card options.

Read Full Comparison: Chase vs Citi: Which Bank Account Wins?

Capital One began as a credit card company, but it has recently expanded its banking product line. Capital One offers checking and savings accounts, children's accounts, auto finance and refinancing, in addition to an impressive selection of credit cards.

Citi offers a diverse range of banking products, including checking and savings accounts, CDs, credit card options, mortgages, personal loans, wealth management plans, IRAs, and investment options.

Read Full Comparison: Citi vs Capital One: Which Bank is Best For You?

CIT Bank has a banking product line that rivals that of traditional banks. Savings accounts, CDs, an eChecking account, home loans, and mortgages are all available. The main shortfalls in this lineup are the lack of personal loans and a credit card option.

Citibank has a credit card background, but that doesn't mean it has a limited banking product line. Citi offers home loans, personal loans, lines of credit, wealth management options, and investments, as well as everyday and premium banking services.

Read Full Comparison: CIT Bank vs Citi: Which Bank Account Suits You Best?

The Citi checking account is a fairly standard product. The account does have a $12 monthly fee, but it is waived if you make a qualifying deposit or make a qualifying bill payment. Overdraft protection is also available, which automatically transfers funds from your savings account to avoid overdraft fees.

Because the American Express savings account has a high yield, the number of withdrawals or transfers you can make each month is limited to nine. It's also a nice touch that American Express allows you to choose paper statements if you prefer the old-fashioned way.

Read Full Comparison: American Express vs Citi: Where to Save Your Money?

Citi offers an excellent range of banking products that cover the majority of your financial needs.

Personal loans, mortgages, credit cards, investment options, IRAs, and wealth management plans are available in addition to savings and checking accounts. Barclays' product line is more streamlined. This bank offers credit cards, savings accounts, credit cards, and personal loans.

The most obvious product gap is the absence of a checking account. As a result, Barclays becomes more of a supplementary bank rather than your primary day-to-day financial institution.

Read Full Comparison: Citi vs Barclays: Which Bank Account Is Better?

Bank of America is a large banking institution, and its impressive banking product line reflects this. Aside from savings and checking accounts, there are home loans, auto loans, investment options, and a variety of credit cards. Citi also has a diverse product offering. Credit cards, CDs, personal loans, mortgages, IRAs, investment options, wealth management plans, and checking and savings accounts are all available.

As a result, if you want to switch from your current bank, either bank is a viable option because you won't have to make any compromises in terms of banking products.

Read Full Comparison: Bank of America vs Citi: Which Bank Suits You Best?

Both banks offer a good selection of banking products, making it easier to switch from your current bank.

Citi offers CDs, personal loans, mortgages, IRAs, investment options, wealth management plans, and a variety of credit card options in addition to checking and savings accounts.

Wells Fargo provides savings and checking accounts, but it also provides mortgages, loans, and investment options such as IRAs, 401ks, and wealth management products.

Read Full Comparison: Citi vs Wells Fargo: Which Bank Account Is Better?

While U.S. Bank offers some better conditions when it comes to lending options, Citibank is our winner in this comparison. Here's why.

Citibank is our winner due to its checking account options, various credit cards, and better savings account rates than Truist Bank.

PNC Bank and Citibank are two big players in brick-and-mortar banking. Let's compare them side by side and see which is our winner: PNC Bank vs. Citibank

Citibank leads in credit cards, and TD Bank options for borrowers are broader. But what about the rest? Here's our comparison and winner: Citibank vs. TD Bank

We'll explore Citibank and M&T Bank savings accounts, checking accounts, CDs, credit cards, and lending products. Here's our winner: Citibank vs. M&T Bank

Citi is our winner for most consumers, but Ally is also a great option if you are willing to manage your account online. Here's why.

Banking Reviews

Aspiration Review

Alliant Credit Union Review