In this article, we've compiled a list of the leading no-fee savings accounts that can help you grow your money hassle-free.

Whether you're saving up for a dream vacation, an emergency fund, or just want to have some extra cash for a rainy day, these accounts offer competitive interest rates and convenient features without charging any monthly maintenance fees or transaction costs.

Discover Online Savings Account

APY Savings

Minimum Deposit

Promotion

Fees

The first no fee savings account is the Discover Bank Online Savings account, which is a good choice if you want to earn a decent amount of money on your balance and don't mind not having access to a physical bank branch.

They calculate the interest you earn every day and add it to your account each month. Plus, you won't have to pay any fees for maintaining the account.

To make things even more convenient, they have a Discover Bank app that you can use on your Android or Apple device. With the app, you can easily transfer money, check your balance, see your recent account activity, and even deposit checks.

If you have a Discover checking account, you can set up regular transfers to your savings account to make the most of your savings.

However, it's worth noting that this account doesn't come with some of the extra features that other online savings accounts offer. For example, you won't get an ATM card, and the tools they provide are quite basic.

While the app is user-friendly and allows you to deposit checks on your mobile device, other banks might offer additional tools and calculators to help you save even more money.

CIT Bank Platinum Savings

APY Savings

Minimum Deposit

Promotion

Fees

The CIT Platinum Savings account has one of the highest APYs we've seen, but there's a catch. To get the high APY, you need to keep a balance of $5,000 or more. If your daily balance drops below that amount, the APY decreases to 0.25%.

That's still a good rate even compared to other top online savings accounts. And, of course, it doesn't have a monthly fee.

CIT has made things even more convenient with its app. They've added a feature that allows you to deposit checks remotely, so you can manage your account on the go and quickly deposit checks.

This account works best with the CIT e-checking account, giving you the benefits of a checking account and the high APY of Platinum Savings.

Not only can you access your CIT account from a computer, but you can also do so through the CIT Bank app. Using the mobile deposit feature, you can check your balance, move money around, and easily deposit checks.

Since CIT is an online bank, you can complete the entire account opening process online. It's a simple process you can finish in just a few steps.

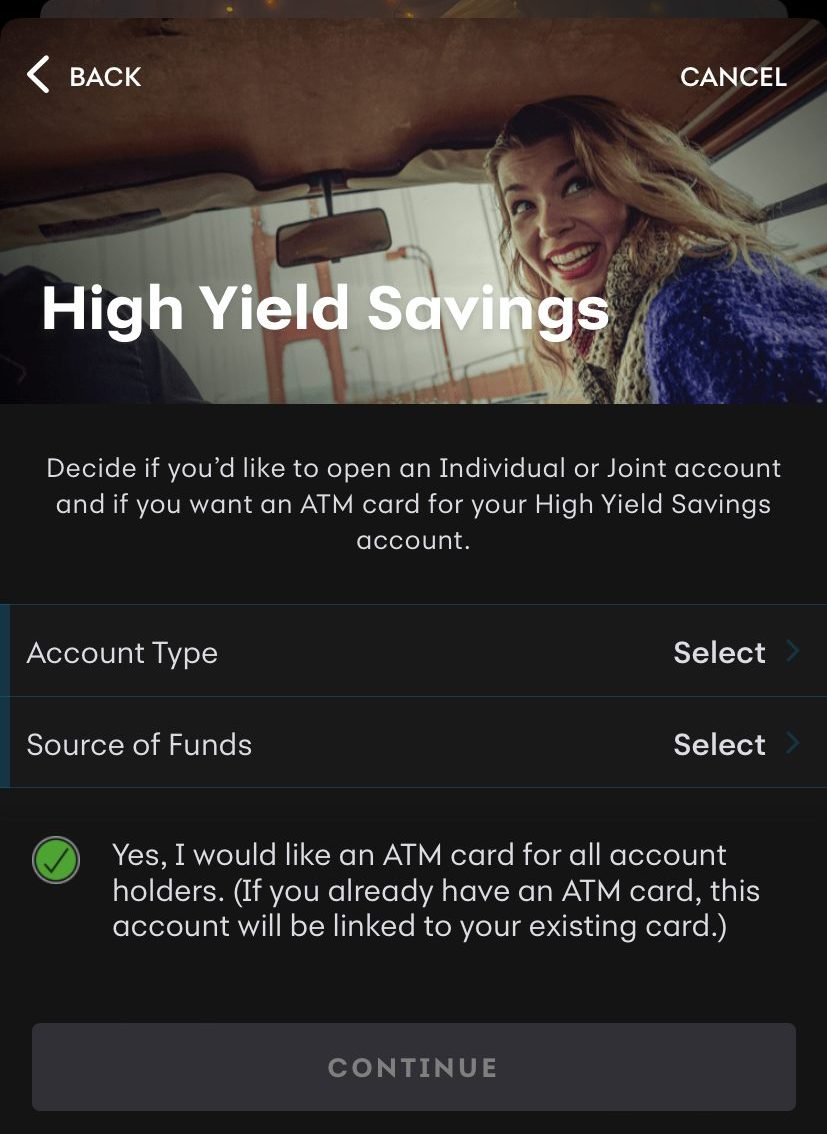

Synchrony High Yield Savings

APY Savings

Minimum Deposit

Promotion

Fees

The Synchrony online savings account is another no fee savings account choice if you want to earn decent returns and have easy access to your money.

One helpful feature that Synchrony provides is a savings goal calculator. This tool can assist you in planning your savings to achieve a specific goal, which can be really motivating.

However, Synchrony doesn't offer personalized savings tools like some of their competitors do.

Synchrony gives you various options for accessing your funds and making withdrawals from your savings account.

Synchrony offers an ATM card that you can request, and they'll reimburse you up to $5 per month for domestic ATM fees. However, there are no physical branches, so if you need help, you'll have to rely on their phone helpline and online support.

Barclays Online Savings

APY Savings

Minimum Deposit

Promotion

Fees

The Barclays Online Savings account is a free savings account for people who are comfortable using technology and want to earn decent returns on their savings.

To open the account, you'll need to visit the Barclays website and follow a few simple steps. You don't need to make an initial deposit or maintain a minimum balance to access the attractive interest rate.

One great feature of this account is the Barclays Savings Assistant. It's a helpful tool that lets you set a savings goal and experiment with different monthly savings amounts to see how long it will take you to reach your goal.

Unlike other savings accounts that provide an ATM card, the Barclays Online Savings Account doesn't offer one. If you need cash, you'll have to transfer funds to another account and then withdraw the cash from there.

Barclays is a highly trusted bank, serving nearly 50 million customers worldwide. It's one of the largest and oldest banks globally and has a strong reputation in over 50 countries.

Although it's based in the UK, it has expanded its operations and established a respected global presence.

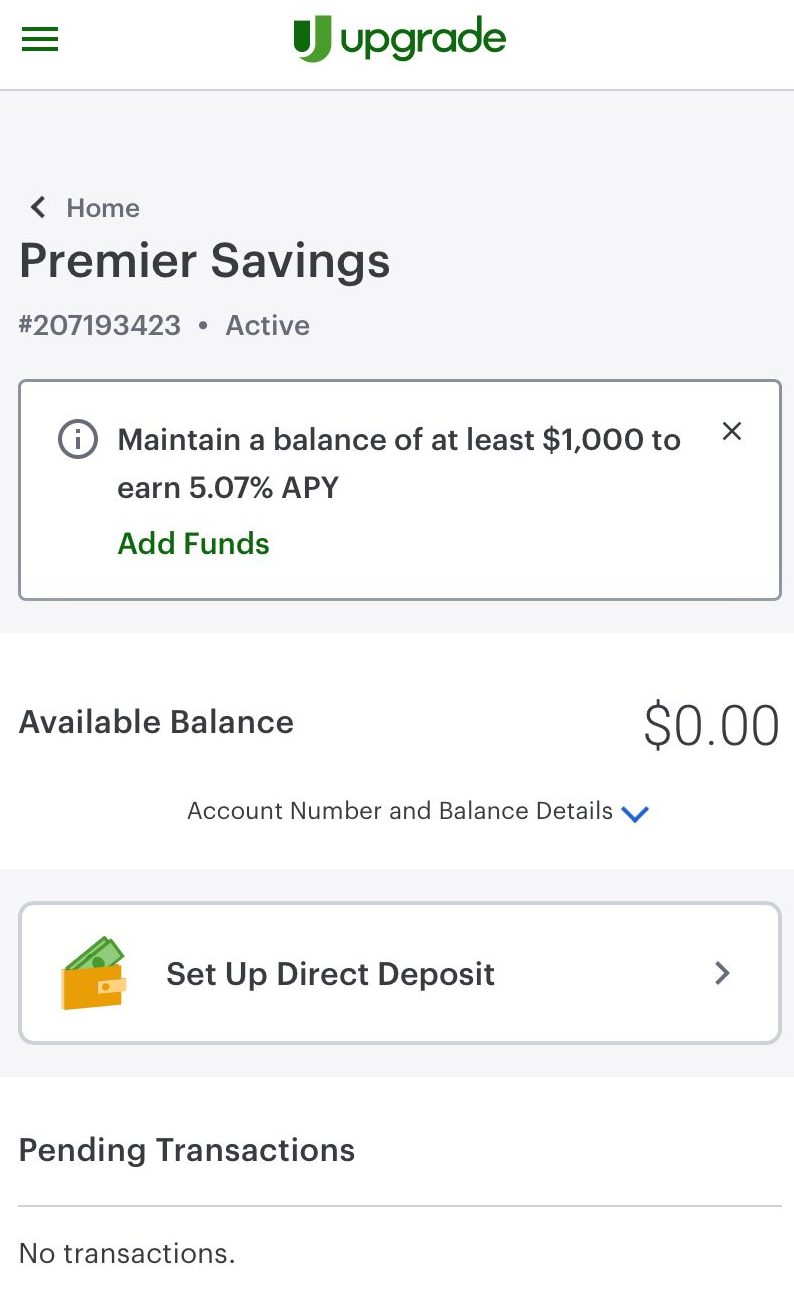

Upgrade

APY Savings

Minimum Deposit

Promotion

Fees

The Premier Savings account from Upgrade is a great choice for people who want to earn a competitive interest rate and are comfortable banking online.

Currently, the Premier Savings account offers one of the highest interest rates compared to other banks. Like all savings account here, it has no fees.

To access the money in your Upgrade Premier Savings account, you can transfer it to another bank account linked to your Upgrade account.

You can also transfer funds to an Upgrade Rewards Checking account if you have one. You can do all of this through the Upgrade website or mobile app.

Upgrade is a financial technology company that operates entirely online. It has partnered with Cross River Bank, which the FDIC insures.

Upgrade also offers a mobile rewards checking account to access through their website and mobile app.

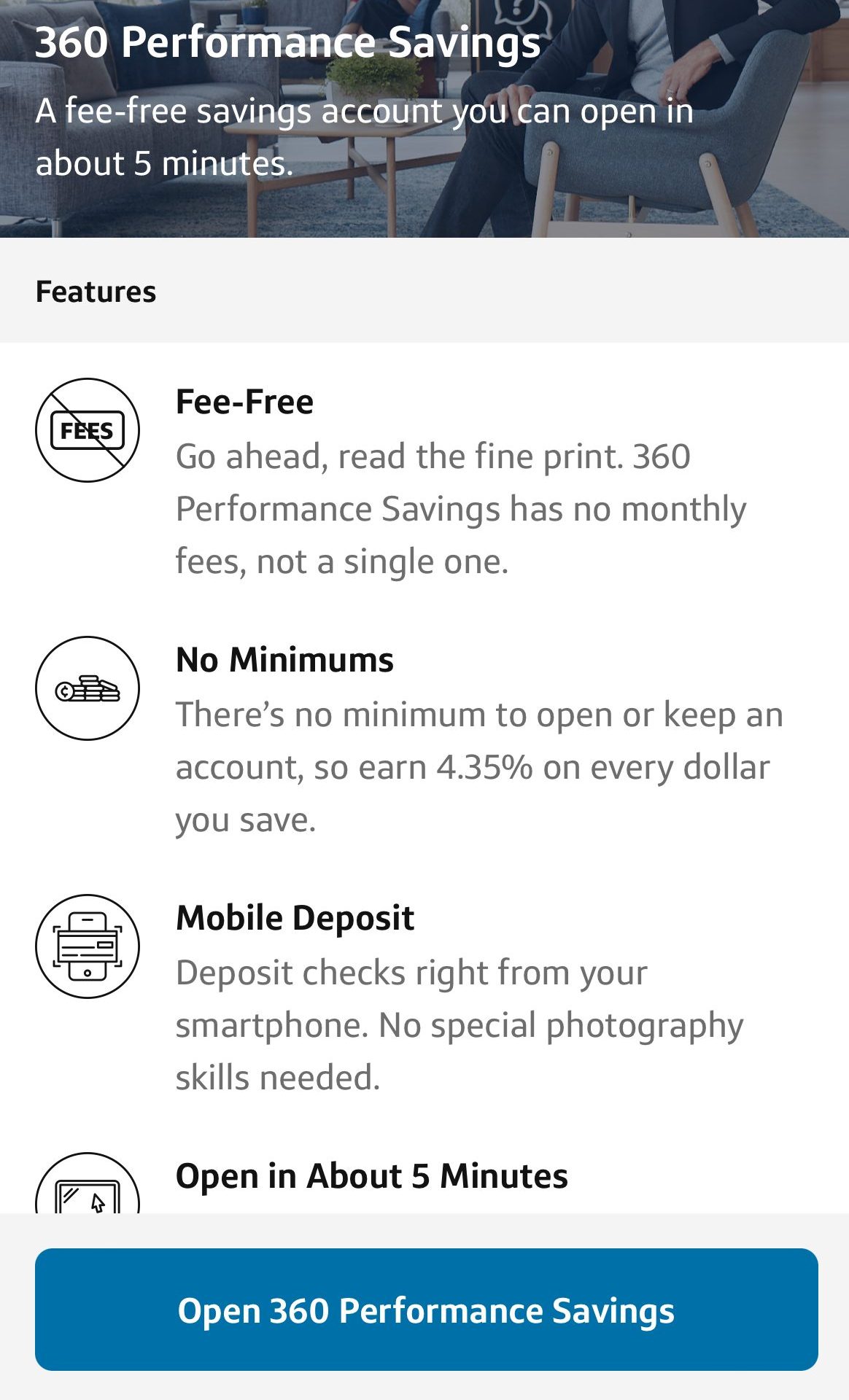

Capital One 360 Performance Savings

APY Savings

Minimum Deposit

Promotion

Fees

The Capital One 360 Performance Savings account is a great option for saving money. It offers a competitive interest rate and doesn't have any maintenance or monthly fees. You also don't need to maintain a minimum balance.

One of the major advantages of the Capital One 360 Performance Savings account is its mobile app. The app has received excellent reviews from users on different platforms.

It allows you to easily manage your savings account on your smartphone, and you can even deposit checks through the app.

The app also has helpful savings tools and lets you transfer money between your Capital One accounts and accounts with other banks.

Opening the Performance Savings account is a breeze. You can do it in person at a Capital One bank branch, online, or through the Capital One app.

Which No Fee Savings Account Is Best?

Choosing the best savings account for your needs involves considering several factors. Here are some steps to help you make an informed decision:

Determine your savings goals: Start by clarifying your savings goals. Are you saving for a specific purchase, an emergency fund, or long-term goals like retirement? Understanding your objectives will guide your selection process.

Assess interest rates: Look for savings accounts with competitive interest rates. Higher interest rates can help your savings grow faster over time. Compare the rates offered by different banks or financial institutions to find the best option.

Check for accessibility: Consider how easily you can access your funds. Some savings accounts may have limitations on withdrawals or impose penalties for excessive transactions. Ensure the account provides the flexibility you need while considering any trade-offs in terms of interest rates or fees.

Research account features: Look for additional features that may benefit you. For example, some savings accounts offer online banking, mobile apps, automatic transfers, or linked checking accounts. Evaluate these features based on your preferences and convenience.

Research the bank's reputation: Bank reputation is one of the most important factors for customers. Consider the reputation and stability of the bank or financial institution offering the savings account. Research their customer reviews, financial strength, and history to ensure they are reliable and trustworthy.

Seek recommendations and compare options: Seek recommendations from friends, family, or financial advisors who may have experience with different savings accounts. Compare multiple options, taking into account the factors mentioned above, to find the best fit for your needs.

By following these steps, you can narrow down your choices and find the best savings account that aligns with your financial goals, preferences, and circumstances.

How Much Will Your Savings Account Earn?

Initial deposit

Monthly contribution

Period (years)

APY

-

Interest earned

-

Contributions

-

Initial deposit

Total savings

* Make sure to adjust APY and deposit

FAQs

Are there minimum balance requirements for no fee savings accounts?

Some no-fee savings accounts have minimum balance requirements, while others may not. For example, CIT Bank Platinum savings required at least $5,000 to get the higher rate.

Can I make unlimited withdrawals from a no fee savings account?

Most no fee savings accounts allow you to make a certain number of withdrawals each month without incurring fees. However, there may be limitations on the number of transactions, so it's important to review the account details.

Are no fee savings accounts available for businesses?

Yes, some banks offer no fee savings accounts specifically designed for businesses. These accounts provide the same fee-free benefits and convenience for business savings.

Selecting The Best No Fee Savings Account: Methodology

The Smart Investor team thoroughly researched to find the best no-fee savings accounts. We assessed them based on four main categories:

Interest Rates and Terms (40%): We looked at the interest rates offered by each savings account and any conditions attached, like minimum balance requirements. Accounts with higher interest rates and more favorable terms received better ratings.

Account Features (30%): This category considered additional features such as whether the account offers automatic transfers, the ability to link to other accounts, and any perks like ATM access. Savings accounts with more features and flexibility earned higher scores.

Customer Experience (20%): We evaluated how easy it is to open a savings account, communicate with customer service, and use the bank's website or mobile app. Banks with user-friendly interfaces, responsive customer support, and convenient digital banking tools received higher ratings.

Financial Stability and Reputation (10%): We checked each bank's financial stability and reputation, including customer reviews, ratings from sources like JD Power, TrustPilot, and the Better Business Bureau (BBB). Banks with strong finances and positive reputations got higher ratings.

Our ratings considered various factors within each category to help you find the best no-fee savings account that meets your needs.