Table Of Content

What Is A Direct Deposit?

When someone transfers money electronically into a bank or savings account, it is called a direct deposit. Over 25,000 financial institutions are connected by the Automated Clearing House (ACH) network. They use direct deposit to send money from one bank account to another. It is quick, easy to use, and secure as an alternative to check deposits.

Direct deposits include things like paychecks. For example, employers can deposit money into their workers’ bank accounts without waiting or losing cheques in the mail. Direct deposits are also helpful for recipients because the money is added to their account balance without their involvement.

Compared with other transfer methods, direct deposits have several benefits.

- The bank will put the money into your account when you get a direct deposit.

- The recipient is not required to take any action, such as accepting the payment or going in person.

- They can withdraw the money right away and receive them more quickly.

- The sender will automatically see a decline in their checking account amount.

How Does Bank of America Direct Deposit Work?

Payroll and direct deposit are frequently associated. Using an automated system for payment transfers saves a lot of resources in terms of money and time.

So, most people first encounter direct deposit services in this context. You have the option of signing up for direct deposit payouts from different sources aside from your job.

The U.S. government prefers using direct deposit to pay citizens rather than paper cheques. Since 2013, they have accepted only prepaid debit cards or direct deposits of Social Security benefits. Similarly, you can choose your tax refund automatically transferred into your bank account instead of waiting for a paper check to arrive, which can take up to six weeks.

The bank of America's direct deposit follows this procedure to work:

- An employer begins by gathering the banking details, such as bank account and routing numbers, from its suppliers and staff.

Note: This is a portion of the data employer collected throughout the onboarding procedure after you were employed.

- The company typically sends bank and payroll instructions some days before payday.

- The bank subsequently sends that notice to the Automated Clearing House (ACH).

- The ACH operator organizes the ACH entries for each employee's paycheck and guarantees they send each direction to the banking institution.

What Do You Need To Set Up A BOA Direct Deposit?

There are several ways to set up a direct deposit with Bank of America. Whatever method you choose, you must provide information regarding yourself and your account. Here are some information and documents required to set up a bank of America direct deposit:

- Bank Direct deposit Form: You can download the direct deposit form of bank of America from here. You can also log into Online Banking and get a printable Bank of America direct deposit form.

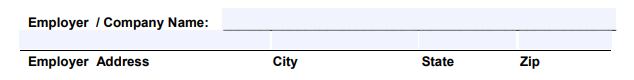

- Correct Employer’s Name and Address: You must mention the employer’s name and address the same as the ID number. If you don’t have an ID certificate, you can use your driving license or any other US-approved certificate to cross-check your information.

- Bank or credit union routing number and account number: A routing number is a nine-digit number that identifies a financial institution. Don’t get confused if you see an ABA number, ABA routing number, bank ABA number, or transit ABA number. These all refer to the same routing number we are talking about. If you cannot locate the routing number, then use your bank account number. The bank assigns a unique number to each of your accounts.

- Voided check or deposit slip: No one needs to pay for a void check. A check must be marked “void” on the front to be voided. Usually, the void check has the following details on it:

- Name of your bank

- Routing Number for your bank

- Your bank account number

- Your check number.

Above mentioned is the mandatory information you need to submit the direct deposit form. Ensure every document is legally approved and the information is correct.

5 Steps For Setting Up A Bank Of America Direct Deposit

You can follow these 5 simple steps for setting up a bank of America direct deposit:

Step 1: Ask Your Workplace For A Direct Deposit Form

Request a printed or digital direct deposit form from your employer. In the absence of that, appeal one from your bank or credit union. Employer details should be filled on this section:

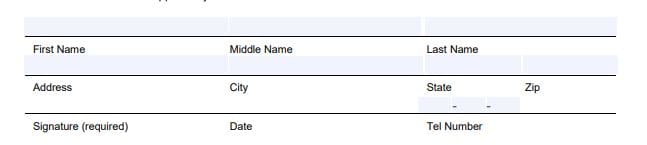

Step 2: Add Personal Information

The following private and financial information is often required:

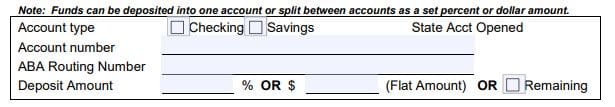

Step 3: Add Bank Account Information And How to Divide

- Postal address of the bank: Usually, bank statements have their postal address, or you can check the address on your bank’s website.

- Account and routing numbers for the bank: Your bank statement or the left-hand bottom of your cheques will have an ABA and account number printed there.

- Account category: Your checking or savings account mainly serves as this. You can deposit money they’re using direct deposit.

Although you can deposit the entire check into your checking account. You can choose to deposit a specific amount or % from your deposit to a savings account or another account you manage.

Step 4: Include A Void Check Or Deposit Receipt

To confirm the account and routing data, some employers use a canceled check or deposit receipt.

If you do so, attach a blank check to the deposit form. The voided check should have VOID written on the front.

Step 5: Submit The Form

Send the form to your employer, then monitor for direct transfer. Although it can take several weeks, check your bank account frequently for direct deposit.

What Time Does Direct Deposit Hit The Bank of America?

Bank of America accepts direct deposits from Monday through Friday during regular business hours.

You should know Bank of America asks you to wait till the first working day for your direct deposit to arrive if you were expecting it to come on a Sunday because the vast number of banks in the United States are closed on weekends.

Direct Government Payments on Wednesday

Direct government payments, including welfare payments, come every Wednesday except the first one. When a national holiday falls on Wednesday, it will make the direct transfer on the last business day preceding the holiday.

You receive your payment the same day the payer sends it because direct deposits are supposed to be instant. However, the sender and source of the money impact how quickly you receive it. The bank rarely holds direct deposits.

Every workplace has a procedure to ensure employees' payment under the payroll schedule. You can expect to get the direct transfer, in this case, at midnight on payday.

How Long Does Bank Of America Direct Deposit Take?

One of the quickest methods of money transfer is through direct deposits. Direct deposit typically clears in 2 to 7 working days on average. For deposits made on weekends, funds are considered deposited on Monday (the first business day), so the hold will go into effect the next business day (Tuesday).

Although the process is quick, the time it takes for the money to appear in your account varies on the date the issuer starts the payment.

Other elements may also contribute to delays. Government help and paychecks are accessible immediately, but they have the potential to delay the payments until the following business day.

If you use your bank’s bill-pay service for direct deposit, it can leave your account right away. It can take one to three days for a service provided by a third party to transfer.

For instance, payroll software guarantees that employees are paid on time. You can expect your company will process your paycheck and deposit at midnight on the day before it is due.

Bank of America doesn't offer early direct deposit. When it comes to the largest banks, only Chase offers early direct deposit (currently on Chase Secure Banking only).

FAQs

Bank of America does not provide early direct deposit. Direct deposits are processed on the first available banking day.

The delay occurs only because of the weekends or any national holidays; otherwise, it processes payments on the same day.

Bank of America is one of the most popular banks in the US. While it offers a variety of products, the interest rate Bank of America offers on deposit accounts is low.

Fill out an Enrollment Request Form for Non-Federal Direct Deposit. This form is available on the Bank of America’s website.

You can also access Online Banking and obtain a printable direct deposit form. You can download this form using this link.

This usually occurs when information is incorrect. The employee should call their bank to ensure that the information is valid. Another possibility is that payroll put the worker on wait.

In this situation, a notification will show informing the employee that they must contact Payroll for further information.

Employees who use direct deposit can also obtain pay stubs from their company. Employers can produce paystubs using your direct deposit information.

Many companies will provide their staff with access to a digital payment page. You can view any direct deposit payments you've received by using your personal login information.

Bank of America sends a direct deposit every Friday. If your company paid your invoice by 9 a.m. on a Friday, you should have it by the end of the day.

Otherwise, your payment may not receive until the next working day.

Bank of America does not charge for direct deposit, but you may need to pay a monthly maintenance fee.

Yes, Bank of America offers direct deposit cash advance which you can deposit from your credit card to your checking account.