Table Of Content

How Citizen Bank Overdraft Works?

An overdraft occurs when you have insufficient funds to cover a transaction, but the bank pays it anyway. Citizen Bank pays overdrafts at its discretion, implying that the financial institution does not guarantee authorization or payment of transactions.

Citizen Bank will return or decline your transaction if it does not authorize or pay an overdraft.

The bank may pay an overdraft based on different factors, including:

- Account history

- Transaction amount

- Deposits

The overdrafts cover these forms of payment:

- Checks

- ACH

- recurring debit card transactions

Citizen Bank charges $35 per transaction during processing and charges a maximum of 5 fees per business day. The bank can help avoid overdraft fees through its Citizens Peace of Mind™

When Does Citizen Bank Charge Overdraft Fees?

The standard overdraft practice at Citizen Bank entails charging an overdraft fee per transaction during the bank’s nightly processing. It begins with your first transaction that overdraws your account. It charges a maximum of five overdraft fees per day.

How Can I Get Citizen Bank to Waive Overdraft Fees?

There are instances when Citizen Bank does not charge overdraft fees. First and foremost, you can avoid paying the overdraft fee if you have a linked savings account.

With the service, you will not pay overdraft fees if your account is linked to your savings account. The money will be withdrawn from your savings account to cover the overdraft on checking. This covers all transactions, including daily debit transactions such as groceries and gasoline. It does not cover any transaction when there are no funds in the linked account.

You will not incur overdraft fees if your debit card transaction or ATM cash withdrawal request is declined. Also, the bank waives the fees if the check is unpaid. However, the bank might charge an overdraft fee if a previously returned check is presented again and paid.

With Citizens Peace of Mind™, if your Citizen Bank waives the fees if your account is overdrawn and you bring the balance to $0 by 10 pm ET on the same day.

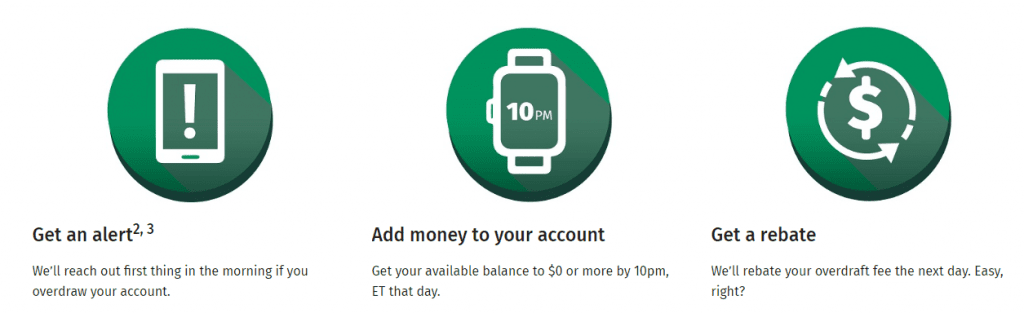

How Citizens Peace of Mind™ Work?

Citizens bank is promoting changes to eliminate the overdraft fee. With Citizens Peace of Mind™, you can avoid the costs of unexpected overdrafts by giving you additional time to fund your account and reverse overdraft fees. With this plan, you need to get the available balance to $0 or more by 10 pm, ET that day to avoid an overdraft fee.

Only the transactions that led to your overdraft and any new transactions that process on the same day as your deposit must be covered in your deposit amount; the overdraft fee is not included.

How Citizen Bank Debit Card Overdraft Works?

When you don't have enough money in the bank to pay debit card purchases and ATM withdrawals, you can decide how you want the bank to handle the situation.

If you want Citizen to approve (at their discretion) ATM withdrawals and debit card purchases that overdraw your account, you can enroll in debit card coverage. Transactions are completed if approved. There are overdraft costs.

Citizens may pay the overdraft fees associated with your withdrawals so that transactions can be processed even if your account does not have the required Available Balance.

Enrolling will prevent the bank from refusing ATM withdrawals and debit card purchases that overdraw your account, too. You will require another type of payment in order to complete the transaction. There are no overdraft costs.

How Citizens Overdraft Fees Compared To Other Banks?

Citizens Bank charges a high overdraft fee, and the maximum daily fees are higher than most banks.

While Citizen Bank checking and savings offers a variety of products compared to other banks, when it comes to overdraft fees, they are one of the most expensive banks in the industry.

Bank/institution | Overdraft Fee | Max Per Day | ||

|---|---|---|---|---|

| Bank of America | $10 | 2 per day | Learn More |

| TD Bank | $35 | 3 per business day | Learn More |

| PNC Bank | $36 | 4 per 24 hours | Learn More |

| Wells Fargo | $34 | 3 per business day | Learn More |

| US Bank | $36 | 4 times per day | Learn More |

| Chase Total Checking® | $35 | 3 per business day | Learn More |

Can You Call Citizen Bank to Refund Overdraft Fees?

You can discover if you have an overdraft fee on your account by checking your statement. If you are wondering how to get an overdraft fee refund, it may not be easy, but worth checking.

If you do not have a lot of overdraft fees on your account or have not taken a long time before paying the previous overdraft, the bank can waive or refund the fees.

Below are the tips that can help you get a refund of the fees.

- Call Citizen: You can call a Citizen Bank representative and discuss the possibility of a refund.

- State your case: When you call the bank representative, provide your account details and be ready to state your case. It is best if you explain to the representative the circumstances under which you lacked the fees politely and firmly.

- Positive Balance: The bank is more likely to refund the overdraft fees if deposits on your account were completed not long after the fees were charged. If you do not do anything about overdraft fees, the bank will likely not refund it. However, when you call and ask, there is a good chance of getting the fee refunded.

If calling is not your favorite mode of communication, you can ask Citizen Bank and argue your case by sending a secure message to the bank.

FAQs

Does Citizen Bank Have a Grace Period for an Overdraft?

Yes. With Citizen Bank Peace of Mind™, if your account is overdrawn, you can bring the balance to positive by 10 pm ET that day.

How Many Times Will Citizen Bank Let You Overdraft?

Citizen Bank charges a $35 fee if your account has insufficient funds per transaction, starting with the first transaction that overdraws the account. The bank charges a maximum of 5 fees per business day, totaling $175 every working day.

How Many Overdraft Fees Can Be Waived by Citizen Bank

The bank can waive five overdraft fees per day. Other than recurring payments and checks, Citizen Bank will not offer the service when you have an insufficient balance. The institution covers the overdraft transaction and charges an overdraft fee based on your account history, deposits, and transaction amount.

How Much Overdraft Does Citizen Bank Allow

There is no limit on the amount you can overdraw from your Citizen Bank account. Still, the amount is at the bank’s discretion and depends on different factors, including account history and the type of account you operate. The bank allows additional debit transactions or purchases.

Are Citizen Bank Overdraft Fees Charged Immediately?

It charges overdraft fees for transactions not covered by midnight Eastern time. The bank pays transactions during nightly processing on a business day when the account is overdrawn.

Will Citizen Bank Forgive Overdraft Fees?

Yes. With the Citizen Bank Peace of Mind™ program, you won't be charged an overdraft fee if you bring your balance to $0 until 10 pm the same day.

What Happens if My Citizen Bank Account Is Negative for Too Long?

Your account may be closed if it has a negative balance for more than 90 days. Also, you may face the consequences such as a negative item on your credit report and the costs of being referred to a recovery agency.

Sometimes, the bank may report you to a credit reporting bureau, making it impossible to open another account.