Table Of Content

If you have a bank account you no longer need, you may want to simplify your finances by closing the account. But can you close your bank account online?

Here we’ll explore how to close a bank account in more detail and whether you can complete the process online.

Key Takeaways

- There are some sensible reasons why you might decide to close your bank account. This includes high-interest rates on loans, large fees, poor internet banking, or bad customer service.

- Closing the bank account does not always hurt your credit score. However, it is worth keeping in mind that closing the account does erase the payment history as well, which in some cases might hurt your credit score.

- In most cases, closing the bank account is free. However, some banks might charge around $25 if you close your bank account within 180 days of operating it.

- Before closing the account, it is important to transfer all of the funds to the new account. Alternatively, you can withdraw all of the available funds in cash at the branch.

Can I Close Your Bank Account Online?

It is possible to close your bank account using an online platform. However, some banks will require you to follow up by a phone call to their customer service or you physically visit your branch. Some banks may make it mandatory to fill out an account closure form or make a formal written request.

If you have nothing pending with the bank, the process will go through. However, Consumer Financial Protection Bureau advises you to get a written confirmation letter. If there will be some complications down the line, the document will help you resolve those issues.

Ways to Close Your Account

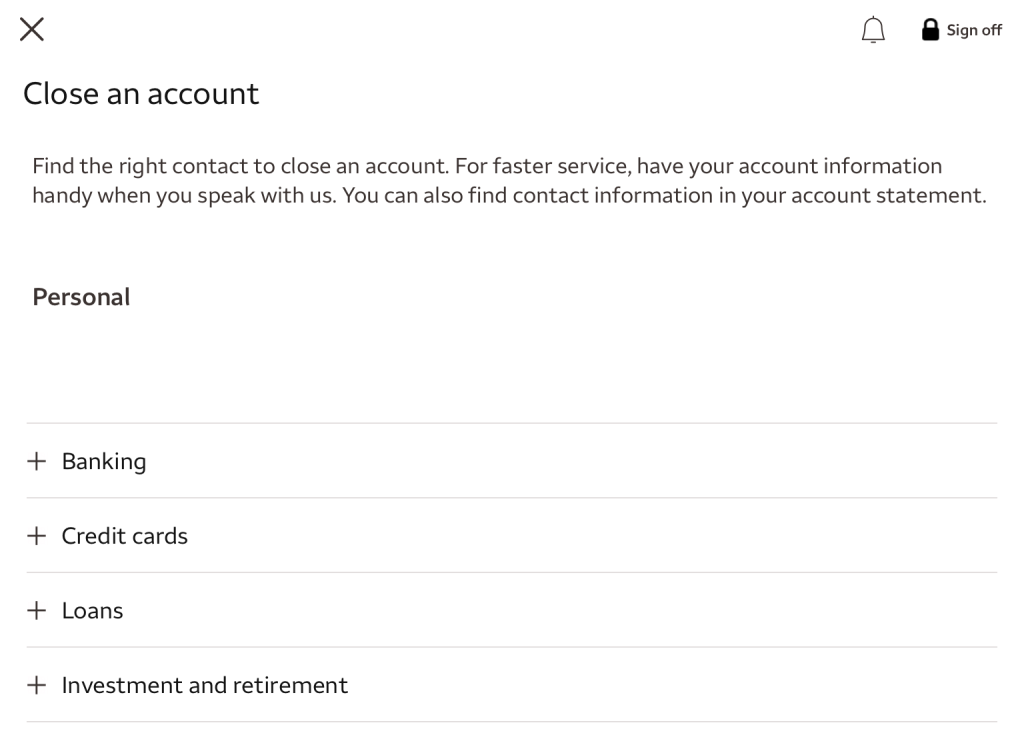

Banks today appreciate that customers have busy lives and want to manage their accounts in a variety of ways. This also applies to account closures, so there are a number of ways that you can close your account. These include:

- At a Branch: This is the go to way to close your account if you prefer face to face service and want to move funds around as a consequence of closing your account. You can visit your local branch and the support team will walk you through the process.

- Over the Phone: Most banks have a phone helpline available outside standard business hours. You can initiate the account closure process, but depending on the bank’s policies, you may need to follow up on the closure request in writing.

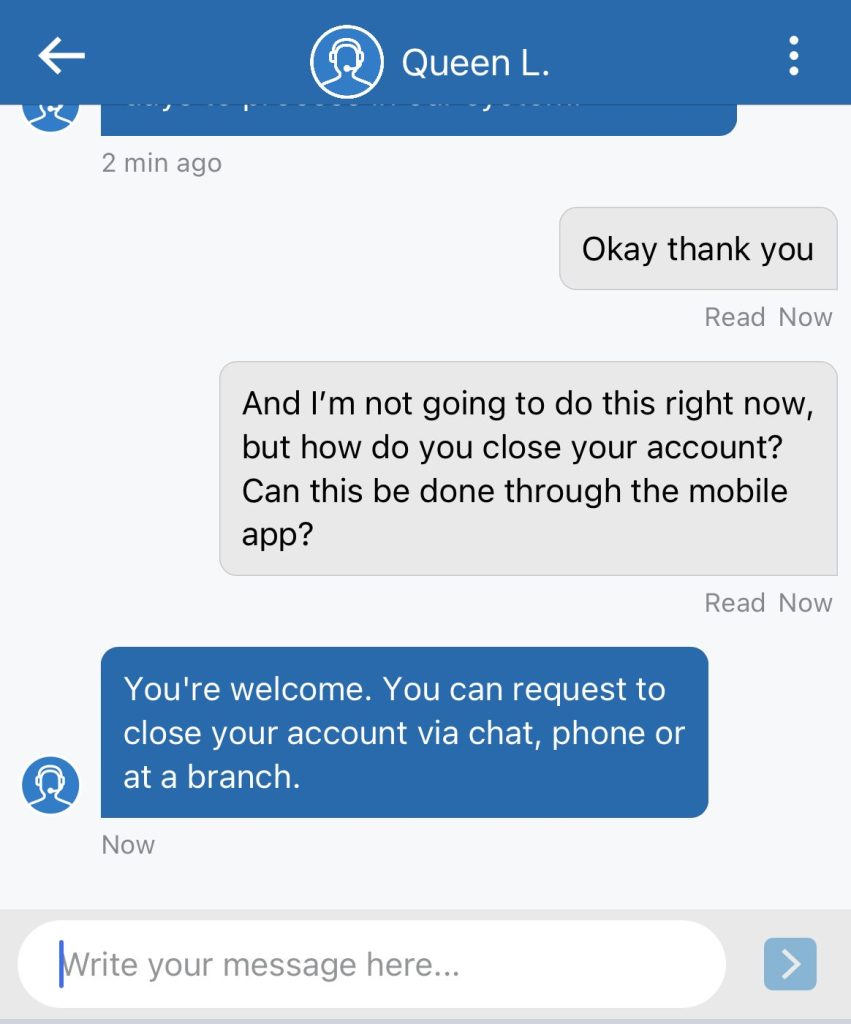

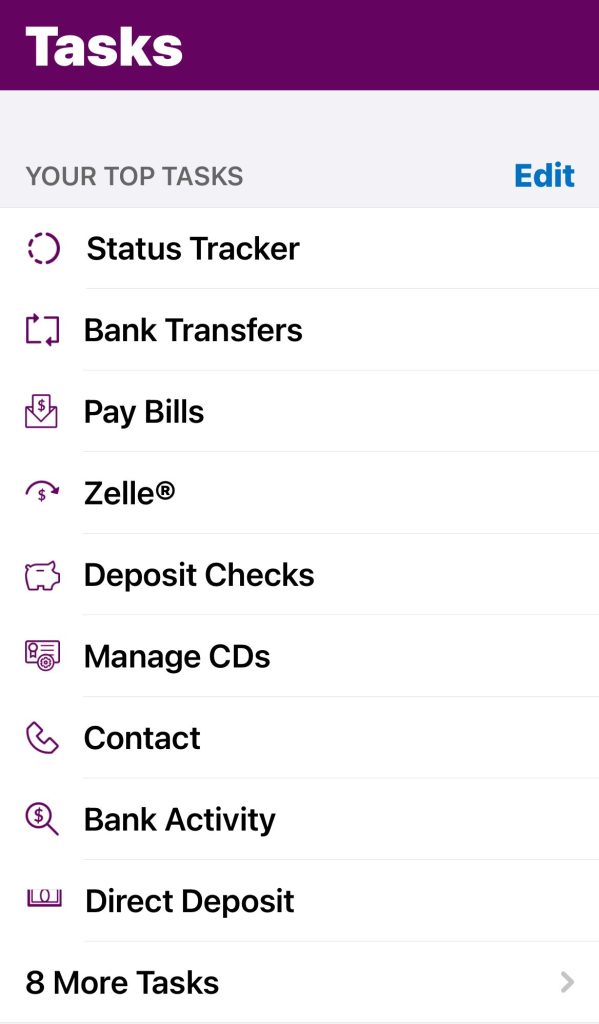

- Online: Some banks now allow you to close your bank account online, particularly if you use an online bank. Some banks allow you to close the account via email or online message, while others have account closure options via the chat feature. However, most banks still require you to contact a customer service to close your account.

- In Writing: This is the least efficient way to close your account, as you’ll need to wait until the bank receives your written request and then await their confirmation. However, as a last resort, if you cannot use other closure methods, you can send a written request.

What Do I Need to Close a Bank Account?

If you want to close your bank account there are several things that you will need. These include:

- An Active Account

To close your account, you will need an active account. If the account has lapsed into inactive status, you will need to contact the bank to reactivate the account before you initiate the closure process.

You may be able to reactivate your account using your online banking or mobile banking platform

- Your Account Details

To initiate the closure process, you will need to have your account details including your account number and if you’re speaking to the customer support team, you are likely to have to verify your identity by answering some security questions.

If the account is a joint account, your bank may require both account holders request account closure.

- A Positive or Zero Balance

Finally, you will need the account to not have a negative balance. If your account is overdrawn, you will need to bring the account balance back into the black before your bank will authorize the closure.

Just remember that if you’re withdrawing funds, you will need to leave sufficient money in the account to cover any pending transactions or charges.

Close Your Bank Account In 5 Steps

By doing the right steps when you switch banks, you could have a better transition from your old bank to the new one and spare yourself a lot of headaches.

1. Open Your New Account Before Closing The Old One

Make sure that before you close your old bank accounts, your new account is in place in your new bank to receive your money. If you close your bank accounts before you start looking for a new bank, you could have a problem in case you need to write a check, transfer funds, or pay your bills.

You can start by scouting for the best checking accounts in the market. That way, your shortlist will be about the best the market can offer. Then, once you've narrowed down your choices, find out if they provide a “switch kit.”

A good “switch kit” includes checklists and forms to instruct depositors and inform billers about your accounts' changes. These will help for a more seamless account transfer process.

What Do You Do If I Was Denied?

If a bank declines your request to open an account with them, you might want to explore other avenues available. One of them is to use a prepaid card, which is your credit card. However, a prepaid card only allows you to use your deposited amount.

You must also seek clarification from the bank on why they rejected your request. If one of the problems is a tainted history by ChexSystems report, fix it before reapplying.

Besides, you can always try an alternative bank. If that does not solve your problem because you are in big financial trouble, such as being blacklisted, enroll in a financial education program.

Bank/Institution | Minimum Deposit |

|---|---|

Chase | $0 |

PNC Bank | $0 |

Bank of America | $25 – $100 |

Capital One | $0 |

Wells Fargo | $25 |

Discover | $0 |

Citibank | $0 |

US Bank | $25 |

TD Bank | $0 |

2. Transfer Automatic Payments and Recurring Transactions

Many consumers have already automated much of their finances such that many of their bank transactions happen automatically. However, those who switch banks often find that such a move affects the flow of their money and that they need to re-establish the links to continue the efficient cycles of their transactions.

Refrain from paying your bills with your old checks and allow all outstanding checks to clear completely before you close your account.

Check online for your issued checks that remain outstanding and do a bank reconciliation, so you'll know what has cleared and what has not. Remember to remove all automatic payments you have set up through your old account.

Go through your bank statements for the past six to twelve months to identify which automated transactions you should reroute to your new bank.

Which Bank Activities Should I Look For?

These could include rent, utility bills, direct deposits, and automatic fund transfers. You may also discover recurring transactions that draw money from your old accounts.

- Payments you set up in your bank's online bill pay system. Rerouting your automated payments consists of two steps. As soon as you're done scheduling the payments in your new account, you must turn them off in your old account. You might pay twice the same bill if you don't do that.

- Payments that you've set up elsewhere automatically withdraw from your account. Maybe you have an auto loan or home mortgage whose payments go through the ACH. Don't ignore the minimal payments, such as a Netflix subscription, or those transit passes that automatically reload once their balance dips below a certain threshold level. For these accounts, supply the biller with your new account details.

- Deposits such as direct deposit from your paycheck or Social Security benefits. Sometimes, you may need to complete new paperwork and provide a voided check to change them to your new account.

Some billers will require substantially advanced notice (e.g., 30 days) to process your transfer or application. In addition, some may consume a full billing cycle or even two, so you may have to pay your bills manually for the time being.

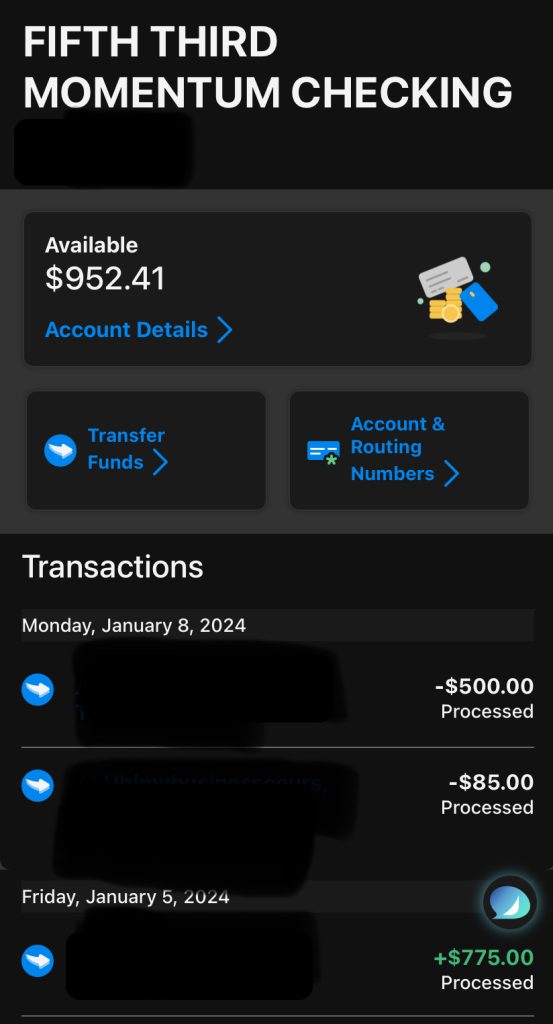

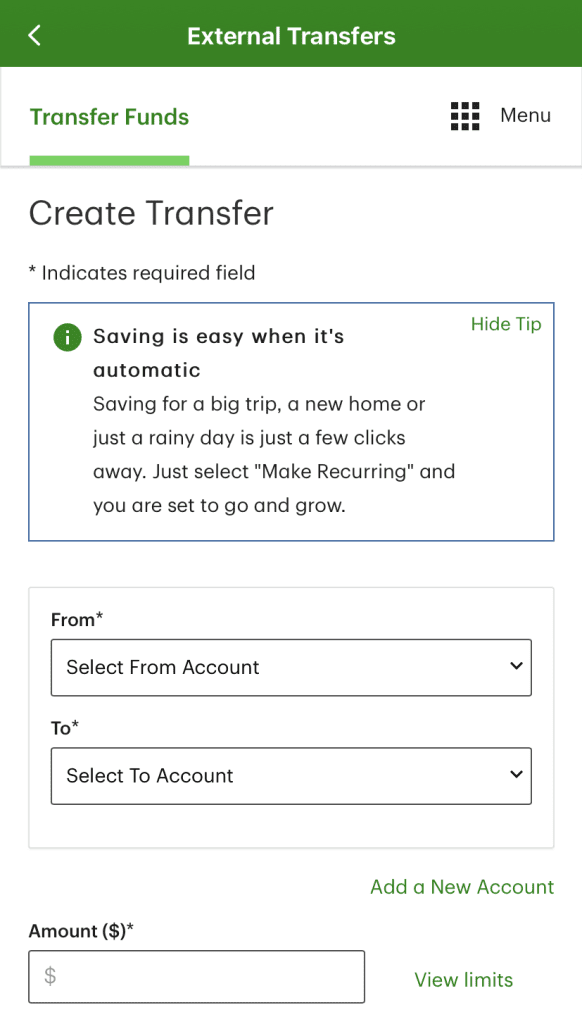

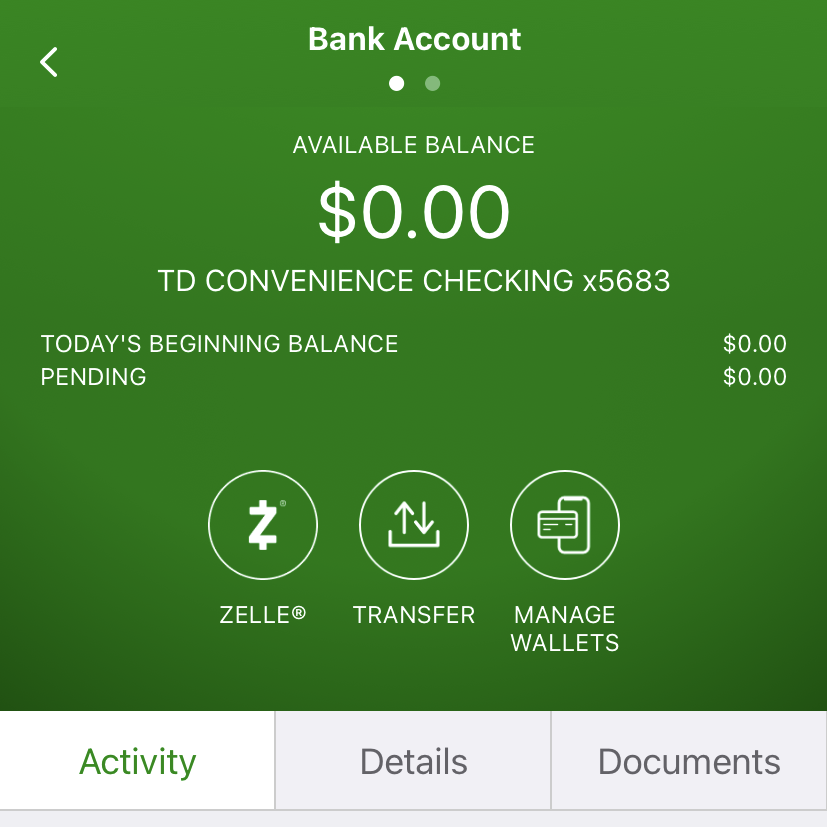

3. Transfer Your Money

After you’ve updated your payments and deposits, you can transfer funds to your new account.

It is unnecessary to inform your old bank that you plan to close your account. However, pay attention to any transfer limits because they may prevent you from transferring your whole balance simultaneously. If that is the case, you will have to transfer your balance on a staggered basis. Don’t forget to leave the minimum maintaining balance in your account should the bank imposes that requirement.

You can transfer your money without paying fees by using these three methods:

- Wire transfer. This is the easiest and safest way to move your money from your old account to your new account.

- Cash-out. If you have the time, you can make an in-person visit, withdraw all of your funds over-the-counter and deposit them in your new account. Having cash in your new account gives you immediate access to the money.

- Write a check. If you don’t want to carry a large amount of cash, you can issue a check to yourself from your old account and deposit it in the new one. The only downside is the check will take a few days to clear, so that you won’t have access to it immediately.

Once everything has cleared your account, you can already close your account. If you don’t want to do it face-to-face, you can just write a letter requesting that your bank close your account. Provide them your name, address, and account number, then sign it with the same signature you used when you opened the account.

Check if you’ve switched over everything and if things are running smoothly in your new account. Confirm that the cheques you wrote on your old account have cleared the bank. You can do this yourself by reviewing your statements or viewing your online statements.

4. Close The Account

Finally, go to the bank and ask them to close your account. If you have not moved everything out, the bank will return to you the balances in your bank by issuing a check.

Many depositors have complained about “zombie” accounts, which happen when a bank re-opens an account because a company has attempted to take money from it. They often reactivate closed accounts because of billing errors or there is an open automated bill payment that the owner forgot.

There are not too many ways you can close your account. You can close it with a bank representative by heading to your bank’s nearest branch to do it. This is the most traditional and straightforward way and you can ask the representative any question you might want to ask.

If you don’t’ want to speak person-to-person to a bank employee, you can close your account online. There’s no uniform process for all banks in doing this.

Normally, you’ll have to contact customer service through your secure messaging system and request for account closure. Some banks may require that you call customer service or submit a form to properly close the account.

Bank/Institution | Customer Service Number |

|---|---|

Chase | 1-800-935-9935 |

Capital One | 1-877-383-4802

|

Bank of America | 1-800-432-1000 |

PNC Bank | 1-888-762-2265

|

Wells Fargo | 1-800-869-3557 |

Citibank | 1-800-374-9700

|

Discover | 1-800-347-2683 |

US Bank | 1-800-872-2657 |

TD Bank | 1-888-751-9000 |

PenFED | 1-800-247-5626 |

Alliant Credit Union | 1-800-328-1935 |

Citizens Bank | 1-800-922-9999 |

Ally Bank | 1-877-247-2559 |

5. Get a Confirmation

Secure a written letter from your bank that documents all the details of your account closure. A paper trail is essential to an orderly financial life and could help you in the future should you need the letter to settle a dispute.

Although you’ve closed the account, save all your bank statements. They are part of your financial records and good pieces of evidence for future tax reconciliation.

Is There a Fee to Close a Bank Account?

Generally speaking, it should not cost you anything to close your bank account. There should be no fee to close a checking, money market, or savings account. However, you may incur a penalty if you want to close a time deposit account, such as a CD. Most banks will impose an early redemption penalty if you want to close a CD before it matures.

Another scenario where you may incur a fee or penalty for closing your account is if you received a welcome bonus. Most welcome bonus promotions require that you keep the account open for a minimum period.

If you close the account before the end of the promotional period, the terms and conditions of the bonus will typically require that you repay some or all of the bonus you received.

When You May Want To Close Your Bank Account?

Here are the most common reasons to close your bank account:

1. High Fees

You may need to leave your bank if the minimum requirements or fees are too difficult for you to meet. If you can't manage the minimum required amounts for your bank account, as well as the frequent fees to keep and maintain it, it's time to say goodbye.

Bank account fees can be exorbitant and unpredictable. Some banks charge fees for doing a few transactions per day, opening an account, overdrafts, and even just keeping an account with them.

Many people are simply tired of spending extra money on bank account fees, and others simply cannot afford to have any unexpected, extra expenses like that.

2. Bad Online/Digital Experience

Technology is advancing at a breakneck pace. Many banks now provide free apps that allow you to check balances, transfer money, accept payments, and even deposit checks.

If your bank's online setup makes it difficult to access your account or conduct transactions, it's time to switch. If you have any online security concerns, you should close your account and move your money somewhere else.

3. Low Savings And CDs Interest Rates

Due to the recent increases in FED rates, there is real competition in terms of savings account interest rates these days.

since It does, however, pay to shop around for the best rates. If your bank only pays a small amount of interest, you should close that savings account and look for one that will pay you more.

The same can be said of a certificate of deposit. If there are better deals available, consider closing your CD when it matures and opening one at a different institution.

However, keep in mind you can open a savings account in a different bank without closing your current bank account.

4. Poor Customer Service

Poor customer service is something you should not tolerate in general, let alone from your bank. When considering customer service, consider factors such as how long it takes to speak with a representative and how knowledgeable those representatives are.

It's not good if you have to wait on hold for a long time only to reach someone who can't help you.

The use of mobile banking as the primary banking method is more popular among younger households than older households, according to a 2019 FDIC report. At least 62% of young adults in the 15 to 24 years age bracket use mobile banking as the primary method to access bank account compared to only 8% of seniors in age 55 to 64 years who use mobile banking as the primary tool to access bank accounts.

Does Closing a Bank Account Hurt Your Credit?

Luckily, closing a bank account does not necessarily hurt your credit score, unlike when you intend to terminate your credit card account.

Before starting the process, you must first clear all the pending debts. If you have an outstanding debt in the account, the bank could send the debt to a collection agency to enforce collection. When this happens, it could be reported to credit bureaus, and the information will appear in your credit report.

One of the main reasons you should not close your checking account is that you can potentially harm your credit score. Your credit score usually comes from the information gathered from this account.

As a result, if by any chance you close one of those active accounts, you are likely to wipe out your credit history. However, if it has been dormant for a long time, for whatever reason, you might want to shut it down to prevent accumulating fees.

Tips When Closing a Bank Account

Closing a bank account need not be complicated, but some tips can make the process go a little smoother.

- Verify your new account is fully set up before closure: If you need a replacement bank account, be sure that your new account is fully set up with all your bills and your salary payments updated with your new account details. It is a good idea to overlap the accounts for at least a few weeks to make sure the new account is running smoothly before you start closing your old account.

- Keep a record of everything: While closing a bank account should be fairly routine, it is wise to keep a record of all communications that you have with the bank staff and save all letters and emails you receive from the bank. Keep hold of these records until you are confident that the account closure is permanent.

- Destroy or surrender old account remnants: If you have any debit cards or checkbooks associated with the old account, destroy them or surrender them to the bank. This will prevent them from being accidentally used, lost or stolen.

What Happens When You Close a Bank Account?

When you submit an account closure request, the bank will have its own procedure for what happens next. Generally, there will be several things that happen.

- Verify the validity of your request: The first thing the bank will do is verify the validity of the closure request. They will need to confirm your identity and that you have authority to close the account. If you hold a joint account, the bank may require permission from both account holders. So, the bank may contact the other party to confirm the request.

- Applying any outstanding fees: If your account has fees or charges pending, these will be applied to your account. This could include monthly maintenance fees, overdraft charges and other expenses.

- Transferring credit balance: Once the outstanding transactions have been applied, the bank will transfer any remaining funds left in the account to your designated account.

- Canceling any debit cards and checks: The final stage of the account closure will be to block the debit cards on the account and cancel any checkbooks.

- Checking the account balance: The bank will also need to check the account balance to make sure that there is no outstanding debt on the account. If the account had an overdraft facility, you will need to make sure that it has been repaid.

Can My Bank Close My Account?

A bank will close your account for one of two reasons: it does not expect to make money on it, or it is afraid of being held liable for any fraud or money laundering you may be committing.

The bank requires no proof or even evidence. JPM Chase, for example, decided a few years ago to close all personal accounts of porn stars.

They were given notice but were not told why. People figured it out based on who received the letters, but the bank never publicly stated the reason. In a similar case, companies involved in the legal marijuana industry have reported that their accounts have been closed.

What To Do If The Bank Close My Account?

Make an effort to find a reason. It could be as simple as providing your correct address or correcting your social security number. If you fail, I won't bother fighting it unless you believe there is illegal discrimination associated and want to fight back in the name of justice. You're not going to make any money or even get anywhere if you fight.

There are two critical actions you can take. If you don't pay off any negative balances, you'll have trouble opening bank accounts for the rest of your life. Even a payment delay can be detrimental. Unless you can't pay right away, try to work out a payment plan and stick to it

Second, as discussed, before – obtain a duplicate of your ChexSystems report. It's completely free. If the bank has posted incorrect information on it, file a dispute with ChexSystems and attempt to have it corrected.

FAQs

What's the easiest way to close a bank account?

The simplest method of closing a bank account is through using an online app. You do not have to travel to the bank or make any other written follow-ups that might complicate the process. All you have to do is use one of your bank’s online platforms like a mobile app or desktop app at the comfort of your home and follow the on-screen procedures.

However, some banks will make a follow-up call to ensure you are indeed initiating the process. Other banks may not allow it at all. As a result, ensure you know these procedures beforehand to avoid any complications.

What are the most important things to know when closing a bank account?

Once you decide to close your bank account, first ensure you have opened a new bank account to transfer all the balances and transactions held in the previous bank account.

After completing all the transfers, ensure you know the procedures your bank uses to close the account. With all information at hand, initiate the process.

The best method to close an account is to write a formal letter to your bank manager then present it yourself to the bank to finalize the process. By following this step, you ensure you are physically available to ask all the relevant questions you may require.

Once the bank closes your account, ensure they give you a written confirmation letter declaring that your account is no longer active. If any issues relating to the account crop up, you will use the confirmation letter to back up your evidence.

In addition, ensure there are no pending balances. Those overdrafts can harm your credit score if you do not settle them earlier in the process.

Can you close the bank account over the phone?

Most banks in the United States allow you to close your banks account over the phone. The process is typically simple. All you have to do is call their customer service, who will take you through the procedure after verifying your identity. You can also ask relevant questions during the call.

Also, you can cancel all the pending transactions, the interest owing and transfer the funds to your new account. However, some banks will have additional steps to complete the process. Before closing your bank account, always check out with your bank to know the correct procedure to follow.

Can one person close a joint bank account?

Yes, it is possible to close a joint bank account by one of the co-owners without the presence of the other. Apparently, the parties involved have equal rights to carry out all the transactions on that account.

It is why it requires a lot of honesty and trust to co-own a bank account with someone. However, many banks have rules that ensure none of the partners does a sensitive transaction alone.

Should I Write a Letter When Closing?

Before you close your bank account with money in it or other transactional elements like mortgages or insurance, ensure you have transferred them to your new bank account. Once done, draft a simple letter addressing your bank manager. State the address and the branch name.

In the letter, mention the reason for closing it and request the balances to be transferred to your new account. Also, ensure you have indicated your name in full as in the account details, your old account number in the reference, and end the letter with your official signature.

Can I Close a Bank Account From Any Branch?

It depends on the rules your bank has. Most banks allow their clients to close their accounts from their nearest branch. It is good customer service, especially for someone whose branch is far from their current location.

Also, by going physically to the local branch of your bank, you have an opportunity to ask all pertinent questions. Check with your bank to know if it allows this option.

Can you close a negative bank account?

Generally, no. Banks will require that you bring the account balance back to zero before a closure can be initiated.

Can my bank close my account without notice?

There are some circumstances where your bank may close your account without notice. For example, if you have consistently been overdrawn, have prolonged debt or are suspected of fraudulent activity, your bank may close the account.

Can a power of attorney close a bank account?

If the power of attorney agreement is general, it will authorize the person to open, operate and even close a bank account.

What should I do if a tax refund is sent to a closed bank account?

If your tax refund is sent to a bank account you’ve closed, the bank is likely to reject the refund and send it back to the IRS. At this point, the IRS may issue a paper check and send it to you in the mail.

However, if the refund has yet to be issued, you may be able to change the bank details by contacting the IRS.

Can you close a frozen bank account?

Most banks require bank accounts to be active to initiate closure. So, if the account is frozen or inactive, you will need to rectify this before you start to close the account.