Table Of Content

Closing a savings account can be a daunting task, especially if you're not familiar with the process. If you're a Chase Savings Account holder looking to close your account, you may be wondering how to do it and what to expect.

In this article, we'll guide you through the steps of closing a Chase Savings Account, highlight important considerations to keep in mind, and provide helpful tips to make the process as smooth as possible.

Ways to Close a Chase Savings Account

There are several ways to close a Chase Savings Account, including:

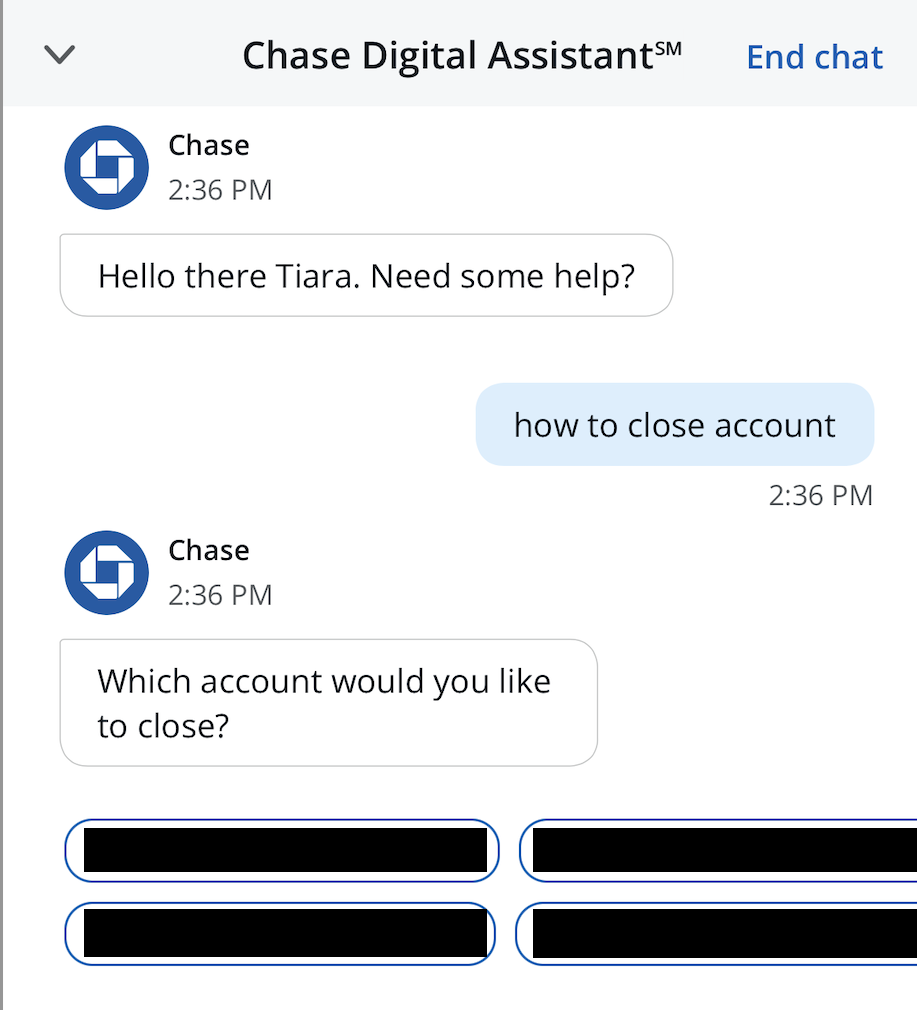

Online: If you have online access to your Chase account, you can log in and follow the prompts to close your savings account. Make sure you have transferred all funds out of the account before initiating the closure. However, you'll need to talk to Chase representative and the process can't be done online only.

Phone: You can call Chase customer service at 1-800-935-9935 to request the closure of your savings account. You'll need to provide your account information and answer some security questions to verify your identity.

In-person: You can also visit a Chase branch in person to close your savings account. Make sure to bring a valid photo ID and your account information with you.

By mail: If you prefer to close your savings account by mail, you can write a letter to Chase requesting the closure. Make sure to include your account information, signature, and a request to close the account.

Steps to Close a Chase Savings Account

Closing your Chase savings account can be quick and easy, but you should come prepared:

1. Have An Alternative Savings Account

It's important to have an alternative savings account set up before closing your Chase savings account. Having an alternative savings account set up before closing your Chase savings account can help ensure a smooth transition and prevent any unnecessary fees or missed payments. If you don't have one, it's time to compare savings rates and take a look at recommended savings accounts.

If you close your Chase savings account without having a new savings account set up, you won't have access to your funds until you've opened a new account and transferred your money.

Ensure that you have your new account information readily available and that any automated payments, if any, have been transferred to your new account.

Bank/Institution | Savings APY |

|---|---|

American Express | 3.50% |

Capital One | 3.50% |

Upgrade | 4.02% |

Marcus | 3.65% |

Discover Bank |

3.50%

|

Lending Club | 4.20% |

Quontic | 3.75% |

UFB Direct | Up to 4.01% |

Alliant Credit Union | 3.06% – 3.10% |

Ally Bank | 3.50% |

SoFi | up to 3.80% |

2. Transfer All Funds Out Of The Account

Before closing your Chase savings account, you should make sure to transfer all funds out of the account. You can do this in a few different ways:

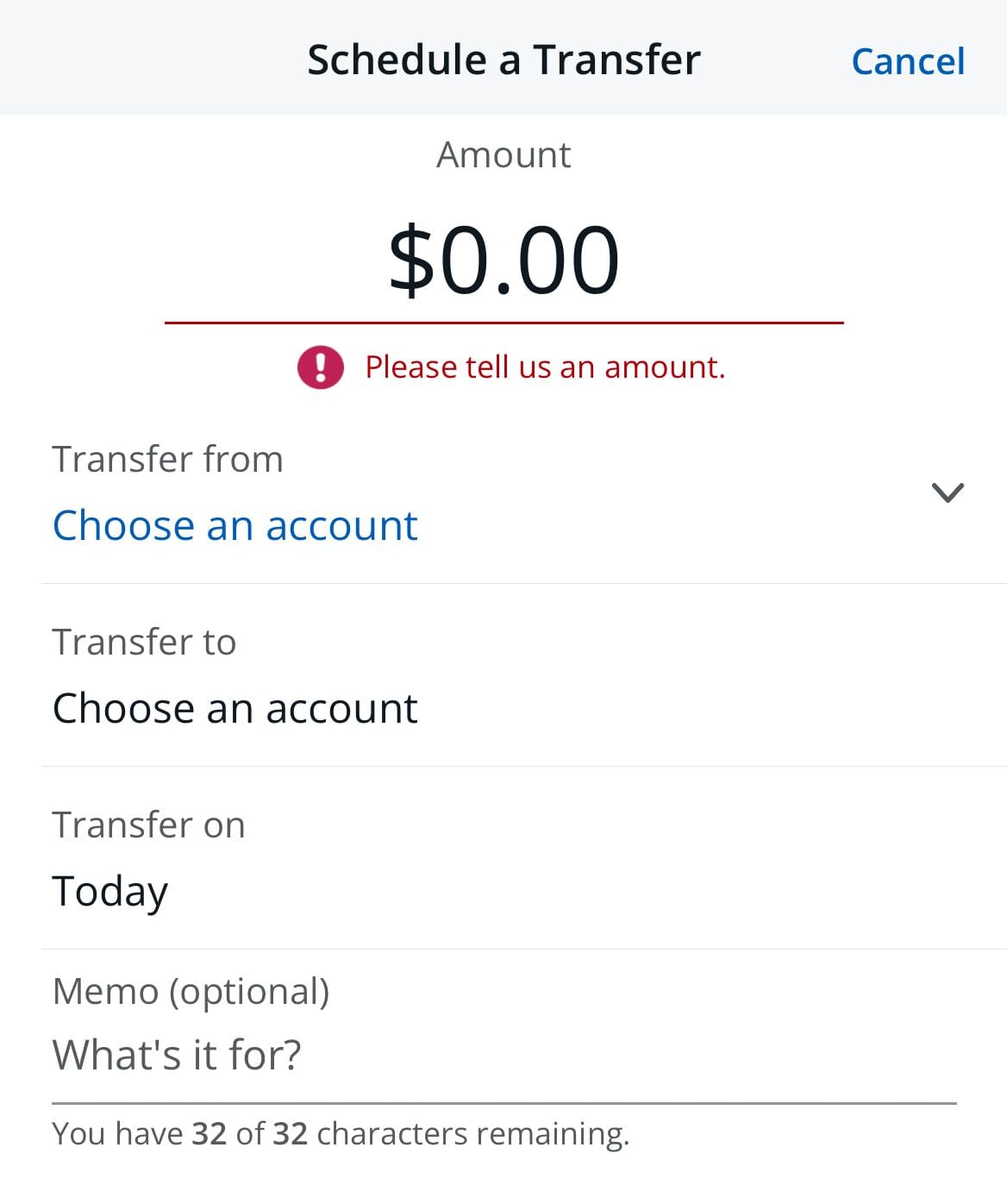

- Online transfer: If you have online access to your Chase account, you can log in and transfer funds from your savings account to another account, such as a checking account or an external account.

- Phone transfer: You can also call Chase customer service at 1-800-935-9935 and request a transfer of funds from your savings account to another account.

- In-person transfer: If you prefer to do the transfer in person, you can visit a Chase branch and request a transfer of funds.

It's important to transfer all funds out of the account before closing it to avoid any fees or penalties that may be incurred for maintaining a low balance. You should also make sure to transfer any interest that has accrued to another account before closing the savings account.

3. Initiate Closure Request

Once you have transferred all funds out of your Chase savings , you can initiate the closure request by following these steps:

- If you have online access to your account, log in to your account using your username and password.

- From the main account page, navigate to the “Account Services” menu and select “Close Account”.

- Follow the prompts to indicate that you want to close your Chase Savings Account.

- Depending on the type of account, you may be asked to provide a reason for closing the account. Choose the option that best reflects your reason for closing the account.

- Review the information you provided and make sure it's correct. Then, click the “Submit” button to proceed.

If you don't have online access to your account, you can also initiate the closure request by phone or in-person. In either case, you'll need to provide your account information and verify your identity before the closure request can be processed.

4. Talk To Chase And Clear Outstansing Items

The next step is to tell Chase why you would like to close the account and get prepared for a call with a Chase representative.

In addition, Chase would like you to make sure any outstanding items have cleared first, including checks, authorized ATM/debit card transactions, direct deposit etc. Once you've closed your account, anything outstanding would either be returned unpaid or could possible re-open your account.

5. Await Confirmation

After you've initiated the closure request and verified your identity, you'll need to await confirmation that your Chase savings account has been successfully closed.

This confirmation typically comes in the form of an email, phone call, or letter from Chase. The confirmation should include information about the account closure, such as the date of closure and any fees or interest owed.

It's important to keep a record of the confirmation for your records. This can serve as proof that the account has been closed and may be useful if you encounter any issues in the future.

Should I Close My Chase Savings Account?

There are several reasons why you may want to close a Chase savings account, including:

Poor interest rates: If your Chase savings account is earning a low interest rate, it may be worthwhile to shop around for better options that can help your money grow faster.

High fees: Some Chase savings accounts charge fees for maintenance, transactions, or other services. If these fees are eating into your savings, it may be a good idea to consider closing the account and finding a savings account with lower fees.

Consolidating accounts: If you have multiple savings accounts with different banks, it can be challenging to keep track of your finances. Closing some of these accounts and consolidating your savings into one account can help simplify your financial management.

Switching banks: If you're not happy with Chase or you've found a better savings account with a different bank, you may want to close your existing account and open a new one elsewhere.

FAQs

The time it takes to close a Chase Savings Account can vary, but typically it takes a few days to process the closure request and receive confirmation.

Yes, you can close your Chase Savings Account if you're outside the United States. However, you may need to follow different procedures depending on your location.

No, only the primary account holder can close a Chase Savings Account. If you're an authorized user, you'll need to contact the primary account holder to initiate the closure request.

Closing a savings account typically doesn't affect your credit score, but if you're also closing other accounts or loans, it's possible that the closure could have an impact.

Yes, you can reopen your Chase Savings Account at a later time if you choose to do so.

No, there's no fee to close your Chase Savings Account.