Table Of Content

How Wells Fargo Monthly Maintenance Fees Work?

Wells Fargo's monthly service fee, also known as a monthly maintenance fee, is the amount of money banks charge their clients for providing banking services.

Wells Fargo's monthly service fee is automatically deducted from your checking account by the end of the statement period. So you do not have to make the payment to cover this fee. All you need to do is ensure that you have sufficient funds available in the account to cover this fee.

With most banks including Wells Fargo, in return for a monthly service fee, you typically get access to online and mobile banking features and a debit card alongside the checking account.

Here it is worth remembering that banks charge maintenance fees not only on checking accounts but also on savings accounts. However, some banks include those two types of accounts within the same package. This is convenient for customers since they only have to pay one fee, which covers all their accounts.

Finally, it is helpful to keep in mind that most banks agree to waive those monthly fees if you meet certain conditions, something we will discuss in greater detail below.

Wells Fargo Checking Account Fees

As of December 2025, Wells Fargo offers its customers four types of checking accounts. Each of them comes with its benefits and monthly maintenance fees. Here are the necessary details for each of those:

Wells Fargo Checking Account | Monthly Fee | Average Balance To Waive Fees |

|---|---|---|

Clear Access Banking | $5 | Only if you're under 24 |

Everyday Checking | $10 | $500 |

Prime Checking

| $25 | $20,000 (Combined with deposits) |

Premier Checking | $35 | $250,000 (Combined with deposits) |

- Clear Access Banking – This is the most basic and affordable checking account. You need to make an initial deposit of $25 or more to open this account. You get a debit card and access to online and mobile banking applications. However, with this account, you can not write checks, but you can deposit them in your account. You can withdraw money from Wells Fargo’s ATMs without paying any fees. The monthly service fee here is $5.

- Everyday Checking – This account includes all of the benefits of a Clear Access Banking account. In addition, you can write checks and take advantage of the optional overdraft protection. The minimum deposit to open this account is also $25. The monthly maintenance fee with this account is $10.

- Prime Checking – This account offers several benefits; for example, you get Wells Fargo personal wallet checks for free, and the bank will also pay interest on your balance on your checking account. You pay no fees for domestic and international incoming wire transfers or withdrawal money from Wells Fargo ATMs. You need to make an initial deposit of $25 to open this account. The monthly service fee for this account is $25.

- Premier Checking – This account for all of the benefits described above. In addition to that, you get priority customer service. Also, you pay 0% international debit card transaction fees instead of the standard 3%. You also get unlimited reimbursement for non-Wells Fargo ATM fees. Like all other accounts, you need to come up with an initial deposit of $25 or more. The monthly service fee for this account is $35.

Wells Fargo Savings Account Fees

Wells Fargo Savings Account | Monthly Fee |

|---|---|

Way2Save Savings | $5 |

Platinum Savings | $12 |

Wells Fargo offers two types of instant-access savings accounts:

- Way2Save Savings – This is the most basic savings account; you need to come up with a $25 initial deposit to open it. The current interest rate stands at 0.01% – 2.51%. The monthly service fee is $5. This account also offers a save-as-you-go function, where $1 will automatically be transferred to your savings account after each purchase and bill payment. Wells Fargo also provides an automatic transfer function, where $1 per day or $25 per month will automatically be transferred to your savings account.

- Platinum Savings – With this account, you can earn a slightly higher interest rate of if you link your platinum savings account to your checking account. You also have unlimited access to this account via online or mobile banking applications and ATM withdrawals. You need to make a $25 initial deposit to open this account. The monthly service fee here is $12.

How are Wells Fargo's Monthly Fees Compared to Other Banks?

Wells Fargo’s monthly service fees for Everyday checking accounts are broadly in line with what most of its direct competitors charge their clients. While Citi, Chase, and Bank of America's monthly fees are a bit higher, we can see that PNC and U.S. Bank monthly fees are a bit lower.

However, for the sake of fairness, it is crucial to point out that the monthly fees on its basic checking accounts, such as Clear Access Banking Account, are more affordable than some of its peers in the banking industry.

Another essential thing to note here is that regarding fees, Wells Fargo does not charge any monthly fees to people at 24 or younger for some accounts. This is not the case with some other banks. So this might make Wells Fargo more popular with younger people in the long term.

Bank/institution | Monthly Fee | |

|---|---|---|

| Wells Fargo Everyday Checking | $10

Related to Wells Fargo Everyday Checking. The fee can be waived if you maintain a minimum daily balance of $500 or receive at least $500 in qualifying direct deposits per month. The fee is also waived if you’re 17 to 24 and have a linked Wells Fargo Campus Debit Card or Campus ATM card linked to the checking account

|

| Bank of America Advantage Plus Checking | $12

can be waived by maintaining an account balance of $1,500, qualifying deposit of $250+ per month or enrol in Preferred Rewards

|

| Chase Total Checking® | $12 ($15, effective 8/24/2025)

Can be waived if you maintain a $1,500 minimum daily balance, making direct deposits or Associated SnapDeposits of $500 or more per statement cycle, or holding $5,000 in combined deposit accounts with the same statement cycle date or having a Health Savings Account or investment account

|

| Citi Checking Account | $12

Can be waived if you make one qualifying direct deposit and one qualifying bill payment per statement period, maintain a combined balance of $1,500 per month across your eligible accounts or if you’re aged 62

|

| PNC Standard Checking | $7 – $25 per month

can be waived if you maintain $500+/$2,000/$5,000 direct deposit per month, $500+/$2,000/$5,000 monthly balance in savings or age 62+/$10,000 in all PNC consumer deposit accounts/$25,000 in all PNC consumer deposit accounts/

|

| U.S. Bank Checking | $6.95

Can be waived by maintaining an average account balance of $1,500, have $1,000+ in direct deposits per month or be aged 65+

|

When it comes to traditional banks, Wells Fargo's fees are higher than most banks. If you compare Wells Fargo account fees to Chase, we can see they both charge the same fee. Also when comparing Bank of America with Wells Fargo, we can see the differences are minor – and they both offer multiple ways to waive it.

How to Avoid Wells Fargo Checking Account Fees?

One of the Wells Fargo benefits is that it allows its clients to avoid monthly service fees.

However, each checking account has to meet specific conditions for the bank to waive fees. Here are the terms for each of the four checking accounts:

Wells Fargo Checking Account | Monthly Fee | Average Balance To Waive Fees |

|---|---|---|

Clear Access Banking | $5 | Only if you're under 24 |

Everyday Checking | $10 | $500 |

Prime Checking

| $25 | $20,000 (Combined with deposits) |

Premier Checking | $35 | $250,000 (Combined with deposits) |

- Clear Access Banking – The only way the monthly service fee will be waived here is if you are 24 years old or younger. So if you are 25 or older, it might be better to move on to another checking account where you can avoid fees. In this account, you have to keep paying fees regardless of how much balance you maintain.

- Everyday Checking – You do not pay any fees if you are 24 or younger. However, unlike with the previous account, there are other ways to get rid of this fee. If you maintain the minimum daily balance of $500 or more, receive direct deposits worth $500 or more, or if you have a linked campus debit card or Fargo ATM card.

- Prime Checking – In this case, you have to maintain a combined minimum balance of $20,000 or more during the statement period. So, you do not have to keep all those funds in a checking account. Instead, the combined balance includes investment and retirement accounts, savings and money market accounts, and CDs.

- Premier Checking – To avoid paying monthly service fees here, you must maintain the combined minimum balance of $250,000 or more during each statement period. Like the previously discussed account, this combined balance includes all checking, savings, money market, investment retirement accounts, and certificates of deposit, also known as CDs.

How to Avoid Wells Fargo Savings Account Fees?

Like checking accounts, Wells Fargo also waives monthly service fees on savings accounts if clients meet certain requirements. Here are the full details for both accounts:

Wells Fargo Savings Account | Minimum Daily Balance To Waive Fees |

|---|---|

Way2Save Savings | $300 |

Platinum Savings | $500 |

- Way2Save Savings – With this account, you do not have to pay any monthly service if you are 24 or younger. You can also avoid paying fees if you make one save-as-you-go or automatic transfer during each statement period. Wells Fargo will also not charge you any monthly service fees if you keep a $300 minimum daily balance on this savings account.

- Premier Checking – The requirements are stricter in this account than in the Way2Save savings account. The only way to avoid paying monthly service fees is to maintain a minimum daily balance of $3,500 during each statement period.

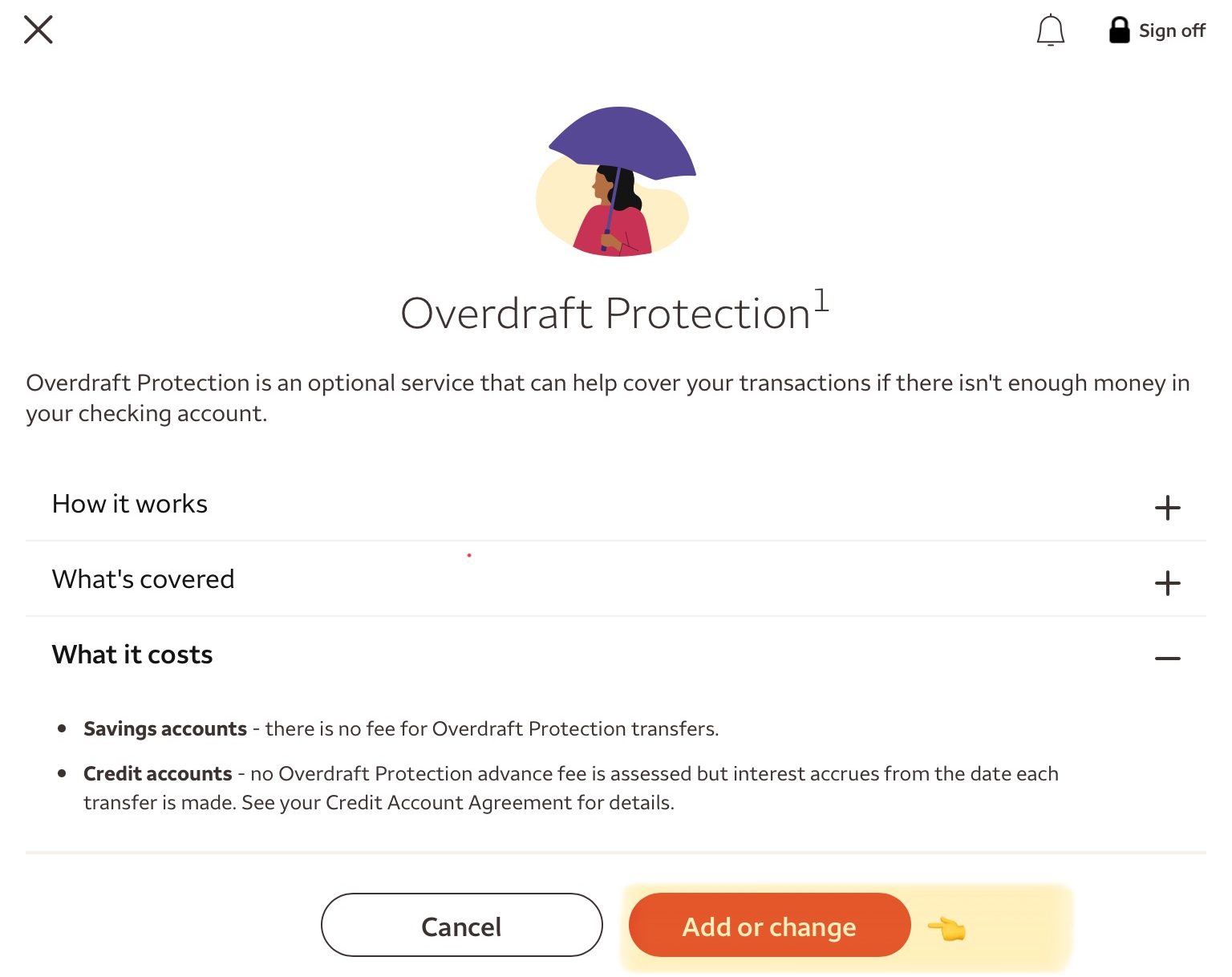

How to Avoid Wells Fargo Overdraft Fees?

According to the Wells Fargo website, the standard overdraft fee is $35 per item, whether the overdraft is by check, debit card transaction, or cash withdrawal from ATM.

One obvious way to avoid Wells Fargo overdraft fees is always to ensure that you have sufficient funds available in your account before proceeding with any transaction, whether writing a check, making a purchase by debit card, or withdrawing money from ATM.

In addition, Wells Fargo offers overdraft protection on some checking accounts, as described above. The main idea behind this is to link your checking account to other checking or savings accounts.

So if you have insufficient funds in the account to execute the transaction, then the necessary funds will be transferred from other accounts to avoid overdraft fees.

How to Avoid Wells Fargo ATM Fees?

If you have one of the four checking accounts at Wells Fargo, you can avoid paying fees when withdrawing money from Wells Fargo ATMs.

However, if you withdraw money from a non-Wells Fargo ATM, then you have to pay a fee not only to Wells Fargo, but also to the bank that owns that ATM.

One way to avoid that is to have a Prime Checking account. In this case, Wells Fargo will refund all fees associated with one withdrawal per statement period from a non-Wells Fargo ATM.

If you want unlimited refunds for withdrawing money from non-Wells Fargo ATMs, then the only way to achieve this is to get a Premier Checking account, the only account that offers that type of benefit.

How is Bank of America's Monthly Fees Compared to Online Banks?

Despite some of its advantages over its peers when it comes to fees, it is important to point out that Wells Fargo’s fees are still considerably higher compared to online banks.

Nowadays, one of the advantages of online banks is that they offer checking accounts without any monthly service fees. For example, with Discover checking account, you do not have to maintain a large minimum balance or conform to other requirements to avoid those fees.

This is not surprising since, unlike brick-and-mortar banks, online banks do not have to cover the cost of operating hundreds of branches or paying the salaries of tens of thousands of employees.

FAQs

Wells Fargo offers its clients innovative features such as save-as-you-go automatic transfers to savings accounts. The bank also provides significant discounts on wire transfers and non-Wells Fargo ATM fees to its Prime and Premier account clients.

The bank's two basic checking accounts have lower monthly fees than its competitors.

However, the interest rates on savings accounts are very low, and the overdraft fees are high and can quickly add up to a significant amount over time.

Here you can compare Wells Fargo with other banks.

Wells Fargo qualifying direct deposits are regular income deposits, such as salaries, pensions, social security benefits, rents, and dividend payments.

Some banks require a certain amount of qualifying deposits during the statement period on a checking account to waive monthly fees.

You can set up a direct deposit with Wells Fargo in a number of different ways. You need to add information about yourself and your account, regardless of the method you pick.

Daily balance refers to the amount of money available in checking, savings, or other types of accounts by the beginning or the end of the day.

On the other hand, combined balance represents the sum of all available funds across checking, savings, money market, investment, and retirement accounts, as well as CDs.

As of December 2025, Wells Fargo offers promotions for new customers. New clients have an opportunity to earn a $300 bonus. All you need to get this bonus is to open any checking account and receive at least $1,000 in direct deposits within 90 days.

Just like in the case of Bank of America, Wells Fargo has one of the lowest interest rates in the US banking industry. Receiving 0.01% – 2.51% interest on your savings account might not be the most attractive option when some online banks offer as much as Up to 3.85% on savings accounts.

Depends on the card.

Wells Fargo offers credit cards with no annual fee. For example, the Wells Fargo Active Cash® Card has no annual fee, and it offers 2% cash rewards on purchases (unlimited).