Table Of Content

Savings accounts are a popular way for individuals to save money and earn interest on their deposits. However, when it comes to making payments or transactions, many people wonder if they can write checks from a savings account.

In this article, we'll explore the question of whether or not you can write checks from a savings account, and look at some of the options available for making payments from savings accounts.

Why Check Writing Isn't Allowed On Savings Accounts?

Savings accounts are designed to earn interest on the money you deposit and are not intended for making transactions such as writing checks. This is due to federal regulations that prohibit check-writing from these accounts and may impose restrictions on the number of transfers allowed.

In addition, although savings accounts can be managed through ATM or debit card transactions, it's important to note that debit cards linked to savings accounts, also called ATM cards, cannot be used to purchase directly from the account balance.

Banks use the funds in savings accounts to make loans and generate revenue, while account holders earn an annual percentage yield (APY) on their deposits. Therefore, financial institutions rely on some portion of savings account funds to remain untouched and not regularly withdrawn through check transactions.

What Accounts Can You Write a Check From?

You can write a check from a checking account. Checking accounts are specifically designed to facilitate transactions such as writing checks, making payments, and withdrawing cash.

Some banks may also allow you to write checks from a money market account, which is a type of savings account that typically offers higher interest rates but also has some checking account features such as check writing privileges.

However, you typically cannot write a check from a savings account or a certificate of deposit (CD) account, as these types of accounts are designed to be used for saving money and earning interest, rather than for making payments or transactions.

How To Make a Payment From a Savings Account?

While savings accounts are not typically used for making payments or transactions, there are still some ways to access the funds in a savings account to make a payment:

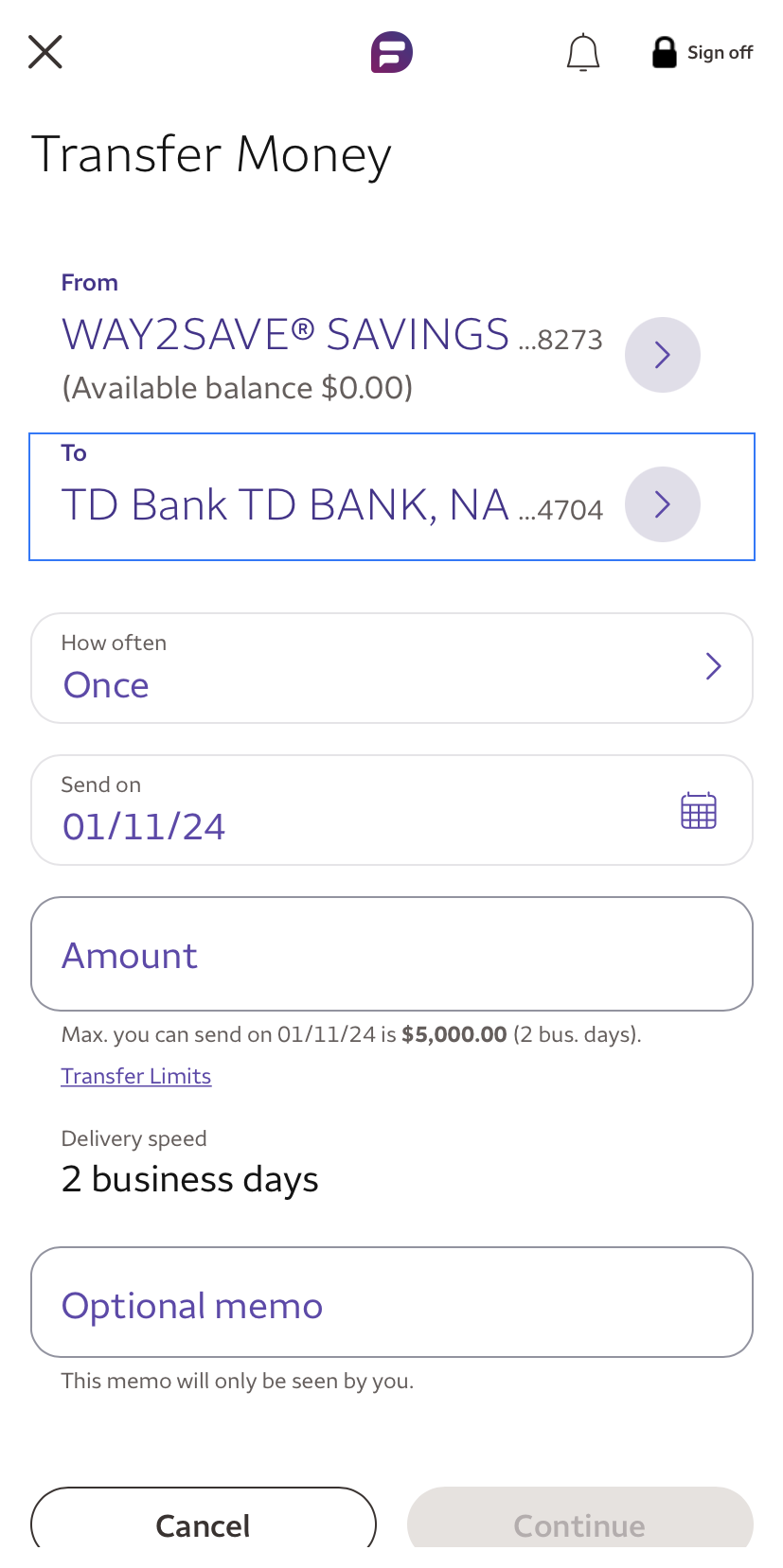

Transfer funds to a checking account: If you have a checking account linked to your savings account, you can transfer funds from your savings account to your checking account and use the checking account to make payments by writing checks, using a debit card, or setting up online bill payments.

ATM withdrawals: If your savings account comes with an ATM card, you can withdraw funds from an ATM and use the cash to make a payment.

Wire transfer: Some banks may allow you to initiate a wire transfer from your savings account to make a payment to another person or business.

It's important to note that many of these transactions may be subject to fees or limitations, such as minimum balance requirements or withdrawal restrictions, so be sure to check with your bank to understand the terms and conditions of your savings account before making any transactions.

What Are The Main Features Of A Savings Account?

The main features of a savings account include:

Interest: Savings accounts offer a variable or fixed interest rate on the balance in the account, which allows you to earn money on your savings over time. The interest rate can vary depending on the bank and the account balance, and it's important to note that interest earned on a savings account is usually taxable.

FDIC or NCUA insurance: Most savings accounts are FDIC or NCUA insured up to a certain amount, which means that your deposits are protected by the government in case the bank fails.

Minimum balance requirement: Some savings accounts may require you to maintain a minimum balance in order to avoid fees or earn a higher interest rate.

Withdrawal limitations: Federal regulations limit the number of withdrawals or transfers you can make from a savings account to six per month. This includes electronic transfers, withdrawals made through ATMs, or checks written against the account.

Fees: Some savings accounts may have fees associated with them, such as monthly maintenance fees, transaction fees, or overdraft fees.

Online banking: Many banks offer online banking services for savings accounts, which allow you to view your account balance, transfer funds, and set up automatic savings plans.

FAQs

Can you make automatic deposits into a savings account?

Yes, many banks offer automatic savings plans that allow you to schedule regular deposits into your savings account.

Can you withdraw money from a savings account at any time?

Yes, you can withdraw money from a savings account at any time, but be aware that there may be restrictions on the number of withdrawals or transfers allowed per month.

Can you use a debit card with a savings account?

Yes, some savings accounts may come with an ATM card, but these cards cannot be used to make purchases directly from the savings account balance.

How is a savings account different from a checking account?

While a checking account is designed for making transactions and payments, a savings account is intended for saving money and earning interest.

Can you have more than one savings account?

Yes, you can have multiple savings accounts, which can be useful for organizing your finances or saving for different goals.