Rewards Plan

Sign up Bonus

Our Rating

0% Intro

Annual Fee

APR

- No Annual Fee

- Payment Flexibility

- Foreign Transaction Fee

- Balance Transfer Fee

Rewards Plan

Sign up Bonus

Our Rating

PROS

- No Annual Fee

- Payment Flexibility

CONS

- Foreign Transaction Fee

- Balance Transfer Fee

APR

16.99% - 27.74% (Variable)

Annual Fee

$0

0% Intro

21 months on balance transfers and 12 months on purchases

Credit Requirements

Good - Excellent

- Our Verdict

- FAQ

If you have credit card debt or are looking to make an expensive purchase you might take a while to pay off, you should consider getting the Citi® Diamond Preferred® Card.

With an ultra-long 0% intro for 21 months on balance transfers and 12 months on purchases and no annual fee, it is the perfect card to buy you enough room to settle your debt comfortably. It allows you to transfer balances from high-interest credit cards and settle them at your own pace.

The Citi Entertainment feature gives you exclusive access to tickets for thousands of events, concerts, and unique experiences. It also includes a flexible payment plan, where you can set your own due date, along with standard credit card perks like purchase protection.

However, some of its cardholder benefits, such as Citi Flex Loan, Citi Entertainment, and Citi Easy Deals, are fairly typical and may not add significant long-term value to the card.

However, it lacks a rewards program, making it less appealing for long-term use beyond debt repayment or initial purchases. The balance transfer fee ($5 or 5% (the greater)) is higher than average.

Should you move to the Citi Diamond Preferred card?

Suppose you want to take advantage of a long intro with 0% APR. Unfortunately, no cashback rewards are on offer that allows you to earn rewards when you make purchases.

Does Citi Diamond Preferred Card have a cash-back/point rewards limit?

You are not able to earn any cashback rewards with the Citi Diamond Preferred Card. Therefore, you are not dealing with any types of purchases you can earn cashback or any limits on rewards

How do I redeem cash back on my Citi Diamond Preferred Card?

You are not able to earn any cashback rewards with the Citi Diamond Preferred Card. Therefore, you are not dealing with any type of purchase. You can earn cashback or any limits on rewards.

How hard is it to get Citi Diamond Preferred Card?

It is not very hard to get one of these credit cards. This is because there are not too many requirements that you have to meet first.

Top reasons NOT to get the Citi Diamond Preferred Card?

You will not be able to earn any cashback rewards when you use this type of card. Many people prefer having a credit card that gives them some return.

Table of Contents

Pros & Cons

Let’s take a closer look at the pros and cons of the Citi Diamond Preferred Card:

Pros | Cons |

|---|---|

Long 0% Introductory Rate Period | No Rewards Program Or Welcome Bonus |

Free FICO Score | Balance Transfer Fee |

No Annual Fee | Foreign Transaction Fee |

Citi Flex Loan | Limited Insurance Coverages and Protections |

Citi Entertainment |

- Long 0% Introductory Rate Period

The Citi Diamond Preferred Card gives you an ample amount of time to pay off debt on your credit card. The 0% intro APR which lasts 21 months on balance transfers and 12 months on purchases . Then, 16.99% – 27.74% (Variable) .

Balance transfers have to be completed within four months from the date you open an account.

- Free FICO Score

Citi Diamond Preferred Card partners with FICO and Equifax to give you free monthly access to your FICO score online.

You can use this feature to see how you’re doing and make better financial decisions which might improve your credit standing with time.

- No Annual Fee

This card does not charge annual fees. While it is not the only card that doesn’t, this feature is certainly good value for the benefit the card offers.

- Citi Flex Loan

The option for a Citi Flex Loan, though available by invitation only, allows cardholders to borrow against their credit card limit at a fixed rate with no additional fees, providing flexibility in managing unexpected financial needs.

- Citi Entertainment

This feature gives you special access to numerous events, concerts, dining, and exclusive VIP packages. You are required to pay for the tickets and experiences, but having access to early, sometimes presale tickets is a perk by itself.

- No Rewards Program Or Welcome Bonus

No Rewards Program: One significant drawback is the absence of a rewards program and a welcome bonus, limiting the card's long-term value for users seeking ongoing benefits.

- Balance Transfer Fee

If the balance transfer completed within the first four months of account opening, the fee is 3% or $5, the greater.

After that, the fee is $5 or 5% (the greater).

- Foreign Transaction Fee

The card imposes a3% foreign transaction fee, making it less suitable for international use where other cards may offer more favorable terms.

- Limited Insurance Coverages and Purchase Protections

The Citi Diamond Preferred Card lacks comprehensive insurance coverages and purchase protections commonly found in other credit cards, potentially leaving cardholders with fewer safeguards for their purchases and travels.

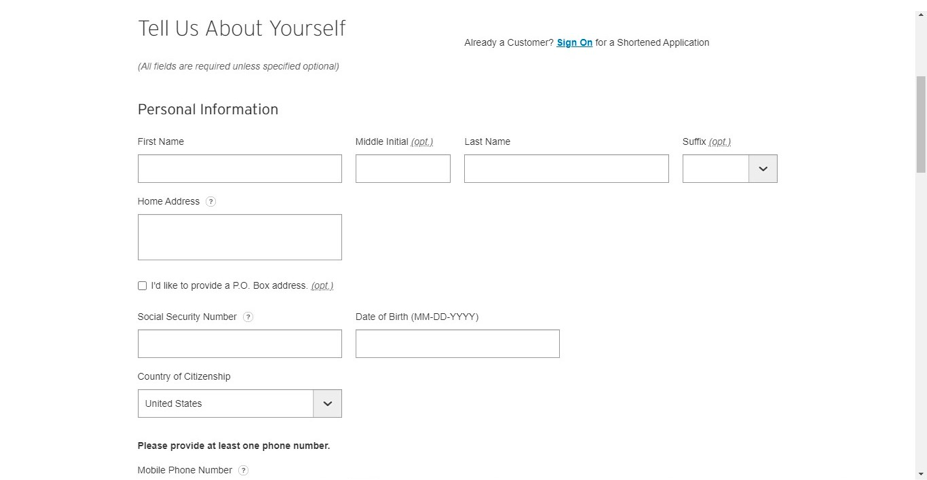

How To Apply For Citi Diamond Preferred Card?

- 1.

Start your application by visiting the homepage of Citi’s website. Click on “Credit Cards” from the top of the page and navigate to Citi Diamond Preferred Card. Click on “Apply Now” to begin.

- 2.

You can fill out the required information in the form below.

You'll need to provide your personal details, including your full name, home address, date of birth, social security number, country of citizenship, email address, and a phone number. Additionally, you’ll need to set up a security word for added protection on your account.

- 3.

The next step is to enter your financial information. This covers your total annual income, monthly mortgage payment, and your bank account type. Please ensure to state if part of your income is exempt from US federal taxes. You may choose to add an authorized user if you wish.

- 4.

The final step requires you to read and agree to the terms and conditions associated with owning a Citi Diamond Preferred Card. You are at liberty to print this out. Once you have agreed to Citi’s terms, tick the box below the terms the click on “Agree & Submit” to finish. Now, all you have to do is wait for their verdict.

- 5.

Then click on “continue” to complete the process.

How It Compared To Other Cards With 0% Intro APR?

When comparing the Citi Diamond Preferred Card to other 0% introductory APR options, it becomes evident that there are superior alternatives, especially for individuals with a good credit score.

Consider exploring alternative balance transfer cards like the Chase Slate Card, Wells Fargo Reflect® Card, and the Citi Simplicity® Card, all of which provide more extended introductory APR periods on balance transfers. Additionally, the U.S. Bank Platinum Card and the Bank Americard are noteworthy options for 0% introductory APR, albeit without offering any rewards.

For those open to shorter 0% intro APR periods but still seeking rewards and a welcome bonus, the Chase Freedom Unlimited Card stands out. With offering an 0% intro APR , the Chase Freedom Unlimited distinguishes itself with a higher cash back rate of 5% cash back on travel booked through Chase Ultimate Rewards, 3% on dining (including takeout and eligible delivery), 3% on drugstore purchases, and 1.5% on all other purchases. This makes it a potentially more rewarding choice.

Another noteworthy card is the Capital One SavorOne, offering a 0% intro APR for 15 months. The card boasts a higher cash back rate of unlimited 3% cash back on dining, entertainment, popular streaming services, and grocery store purchases (excluding superstores like Walmart® and Target®). You’ll also earn 1% on all other purchases. Plus, you get 10% cash back on purchases through Uber and Uber Eats, 8% on Capital One Entertainment purchases, and 5% on hotels and rental cars booked through Capital One Travel, making it an attractive option for individuals who prioritize earning rewards on their expenses.

The American Express Cash Magnet® Card is a straightforward rewards credit card that appeals to those seeking cashback as well as enticing 0% intro APR.

Compare The Alternatives

There are several other great options out there – let’s review a few of our top choices as alternative options to the Citi Diamond:

|

|

| |

|---|---|---|---|

Capital One Savor card | Chase Freedom Unlimited® card | Citi Simplicity® Card | |

Annual Fee | $0

| $0

| $0

|

Rewards |

1% – 8%

unlimited 3% cash back on dining, entertainment, popular streaming services, and grocery store purchases (excluding superstores like Walmart® and Target®). You’ll also earn 1% on all other purchases. Plus, you get 10% cash back on purchases through Uber and Uber Eats, 8% on Capital One Entertainment purchases, and 5% on hotels and rental cars booked through Capital One Travel

|

1.5% – 5%

5% cash back on travel booked through Chase Ultimate Rewards, 3% on dining (including takeout and eligible delivery), 3% on drugstore purchases, and 1.5% on all other purchases

|

N/A

None

|

Welcome bonus |

Earn $300 in welcome bonuses. Enjoy a $100 credit to use towards flights, stays and rental cars booked through Capital One Travel during your first cardholder year. Plus, earn a $200 cash bonus once you spend $500 on purchases within the first 3 months from account opening

Earn $300 in welcome bonuses. Enjoy a $100 credit to use towards flights, stays and rental cars booked through Capital One Travel during your first cardholder year. Plus, earn a $200 cash bonus once you spend $500 on purchases within the first 3 months from account opening

|

$200

Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening.

|

N/A

None

|

Foreign Transaction Fee | $0

| 3%

| 3%

|

Purchase APR | 18.99% – 28.99% (Variable)

| 18.74%–28.24% variable

| 17.99% – 28.74% (Variable)

|

FAQ

There are certain types of credit cards that will allow you to get free car rental insurance with them. However, this is not the case with this type of card.

You are able to get pre-approval for this type of card. This means that there will be no hard credit check needed if you are just looking to see if you are going to be eligible for this credit card.

The credit limit for the Citi Diamond Preferred Card is usually at least $500. The exact limit will depend on your personal financial situation that you have outlined in your application.

You are not able to earn any sort of cashback rewards with the Citi Diamond Preferred Card. Therefore, you are not dealing with any types of purchases you can earn cashback or any sort of limits on rewards.

Compare Citi Diamond Preferred Card

The Citi Diamond Preferred and Simplicity cards don't offer rewards or welcome bonuses – just a long 0% intro APR. Here's our winner:

Citi Simplicity vs. Citi Diamond Preferred: Which Is Better?

Each of these cards has its own goal – transferring your balance and use the long 0% intro APR, or getting decent rewards & sign up bonus

Citi® Diamond Preferred® vs Citi Rewards+® Card: Which Card Is Best?

In terms of 0% intro APR, the BankAmericard outshines the Diamond Preferred card. But what about other benefits? Here's our comparison

BankAmericard vs. Citi Diamond Preferred Card: How They Compare?

Both the Citi Diamond Preferred and the Wells Fargo Reflect card don't offer rewards or welcome bonuses, but a 0% intro APR. Which card wins?

Wells Fargo Reflect Card vs. Citi Diamond Preferred Card: Which Card Is Best?

Top Offers

Top Offers