Table Of Content

The American Express® Gold Card is one of the best Amex credit cards and offers various benefits which customers looking for rewards on everyday spending as well as travel.

It may be difficult to get a credit card that comes with a $325 annual fee (see rates and fees), which makes some people hesitant to look into this card.

What Credit Score Is Recommended To Get The Amex Gold Card?

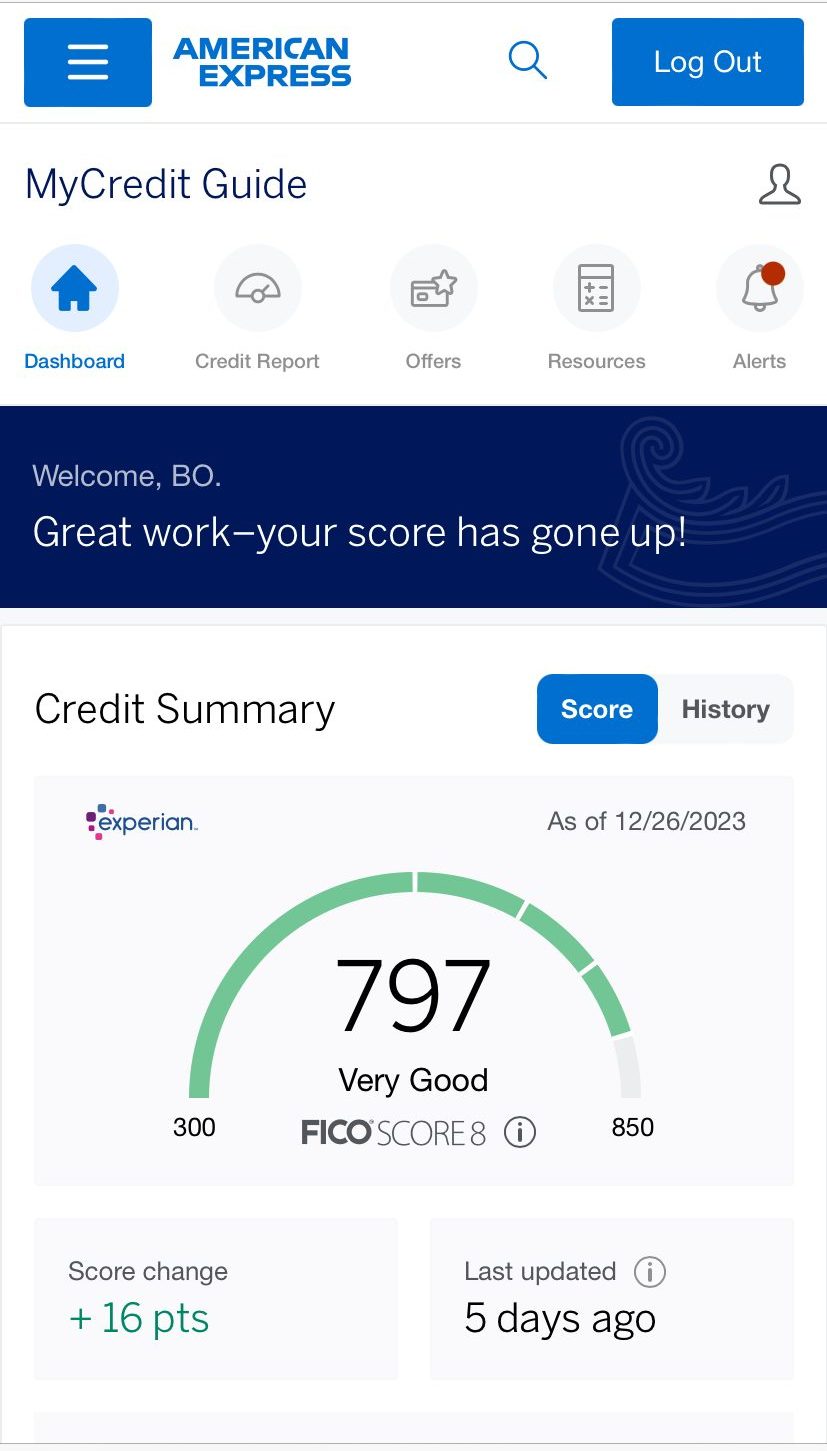

American Express cards do come with a credit score recommendation of at least 700. However, according to our research, you can get approved for the Amex Gold card with 680 and even 650 credit score, as long as you meet other Amex requirements.

There are some instances that you could qualify for the card with a slightly lower credit score, which is outlined in the following real life scenarios of applicants being approved in 2022.

- “GoHooterGo” reports being approved for the Amex Gold Card with a credit score of 633.

- “Had recently pulled my TU score up to a 706 and figured WTH might as well go for it.”, says TRJ87 on the FICO forum.

- One applicant was approved with a credit score of 736 Experian credit score. This applicant’s approval is important as they filed for bankruptcy in 2016, and they were still approved.

- Finally, an applicant was approved for the American Express Gold card with a 686 Experian credit score. Moreover, he got a pre approval email: “I received an email from AMEX over the weekend that I could be approved for the Gold Card. I didn't believe it! But I logged in, put in the quick application, and a few seconds later, APPROVED!”

Additional Requirements To Get The Amex Gold Card

Besides credit score, Amex look on more aspects to assess your financial situation and decide whether your eligible for the Amex gold card. Meeting these requirements can help you get the card also with lower score than stated on Amex website. Here are some of the parameters:

- Income – In addition to the credit score, American Express requires you to have a steady income. While it is not disclosed what the minimum income level is, you have to show that you are able to make payments on the card and you are able to afford the $325 annual fee.

- Debt-to-Income Ratio – Another requirement for applicants to consider would be your existing debt. If you have a number of credit cards, all with high amounts on them, it is unlikely that you will be able to qualify for the Amex Gold card. Because of this, it is beneficial to work on lowering your debt on the other cards before putting in an application as it will increase your chances of getting approval.

- Age – While this is not entirely exclusive to an American Express card, the Amex Gold card requires applicants to be at least 18 years of age in order to even be considered.

- Valid Email address – One of the basic requirements when applying for the credit card is a valid email address. This will help set up your account once you are approved. If you do not have one yet, you are able to create a free one through many different websites, but Google is the easiest.

What Documents Should I Provide When Applying For An Amex Gold Card?

Here are the documents you'll need when applying:

- Social Security Number – When applying for the credit card, you must provide your social security number. When applying online, you simply have to provide the numbers, not the physical card itself. If you are unsure what your social security number is, your are able to apply for a copy of your social security card through ssa.gov/ssnumber – you will be required to answer a few questions in order to find the best way to apply.

- Annual income – To show your income, you are able to either provide a W-2 or a recent pay stub. Providing the W-2 is the best option when showing your annual income, but to show you have a steady income, you could also provide the recent pay stub if a W-2 is unavailable.

- Individual Taxpayer Identification Number – If you do not have your social security number handy, you could also provide your individual taxpayer identification number, or your, ITIN. If you need to get your ITIN, you could complete the IRS Form W-7 application for your ITIN.

Amex Gold Vs Chase Sapphire Preferred Requirements: Which Is Harder To Get?

When comparing the requirements for both cards, we can see that Amex gold score needed is higher compared to the Chase Sapphire Preferred card. On the other hand, Chase states a minimum income , unlike American Express:

- Credit Score – The credit score recommeded for the Chase Sapphire Preferred card is at least 690, slightly lower than the American Express Gold card. Like Amex, it is possible to be approved with a credit score lower than 690 and rejected with a credit score over 690.

- Annual Income – Unlike the Amex Gold card, the Chase Sapphire Preferred does have a minimum amount for an applicant's annual income. In order to be considered for approval, applicants must have an annual income of at least $30,000 per year.

- Age – Applicants for both credit cards must be at least 18 years old.

- Annual Fee – The annual fee for the Chase Sapphire Preferred card is $95 per year, which is significantly lower than the Amex Gold card, which is $325 per year.

Amex Gold Vs Chase Sapphire Reserve Requirements: Which Is Harder To Get?

The Chase Sapphire Reserve is one of the most luxurious cards out there and recommended higher score and income compared to the Amex gold card:

- Credit Score – The Chase Reserve credit card comes with a recommendation of a credit score of 720 to be considered for approval. However, you may also get a card with a 690 credit score, and rarely even with a lower score.

- Annual Income – The Chase Reserve card is similar to the Amex Gold card in the sense that it does not have a set minimum annual income requirement. However, based on data compiled since the card was introduced (2016), the average income of a Chase Sapphire Reserve card member is $180,00.

- Age – Applicants for both credit cards must be at least 18 years old.

- Annual Fee – The Chase Reserve comes with a shocking $550 annual fee for card members. Because of this, not only must your credit score be excellent, but your annual income must be high to show you can afford the annual fee.

American Express® Gold Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

Rates & Fees, Terms Apply

Why Is My Amex Gold Card Application Rejected, And What Can I Do?

There are a number of different reasons that your application may have been rejected. The following are just a few of the reasons you could have been denied, and what you could do to remedy the situation.

- Too many lines of credit

One reason for a credit card rejection could be having too many open lines of credit, whether with companies like Discover, Visa, or even American Express itself. Many credit card issuers prefer that consumers don’t carry a large number of active credit accounts. To improve your chances of approval, try paying off debt on some of your other cards, closing those accounts, and then reapplying when you have fewer open credit lines.

- Low Credit Score

In some cases, your application may not be considered due to your credit score.

In order to build up your credit score, pay off outstanding debt, continue to pay your bills on time, avoid taking out more debt, and even disputing inaccurate Credit Report information.

In doing so, you could build your credit score within a month, but to truly build your credit score, it could take up to six months to a year.

- Call the Reconsideration Line

If you feel your application warrants another look, you are able to contact Amex at (800) 567 – 1083. When you call the number, you should be prepared to prove the denial was based on inaccurate or outdated information.

Also, you financial situation could have improved since you had applied. It is recommended that you wait at least 30 days from the date you received the decline letter before calling the reconsideration line.

Bottom Line

The American Express Gold card offers a mix of benefits and drawbacks. It’s not the easiest card to get approved for, as it typically requires a strong credit score and an income level that shows you can handle the high annual fee. To make the most of the card and offset the cost, cardholders should take full advantage of its various perks and rewards.

FAQs

Amex Gold card does offer pre-approval, applicants may find the pre-approval page online where potential card members could check their approval odds before they actually apply for the card.

Pre-approval for the Amex Gold will not impact your credit score, but applying for the card may have a small impact and will be show up on your credit bureau report.

While the American Express Gold card is not as beneficial compared to the Platinum Card From American Express, the Gold card offers travel insurance perks, hotel credit, and points back on flights booked through Amextravel.com.

There are many different perks that the Amex Gold card has, simply by possessing the card.

First of all, Card members may earn 4X points at restaurants (including Uber Eats purchases in the U.S.) and U.S. supermarkets (up to $25,000 per year in purchases, then 1X points), 3X points on flights booked directly with airlines or on amextravel.com, 2X points on rental cars through amextravel.com and 1X points on all other purchases (terms apply).

You will also earn a welcome bonus and get up to $120 in dining credits and up to $120 in Uber Cash. These credits are rolled out in $10 monthly increments and do not carry over.

mex Gold Card cardholders are eligible for membership rewards with many different ways to earn membership rewards points. When using the membership rewards points, users will receive the highest value when booking flights.

The membership points can be worth anywhere from 0.5 cents to 1 cent per point. An example of this would be 10,000 points at retailers like Amazon would be worth $70.

Unfortunately, Gold Card members are not eligible for the Amex Lounge, that is reserved for Amex Platinum card members.